KCS left behindKucoin token is the only token which has not gained enough attraction during this bullish market. This exchange is now 8th in top exchanges by volume (according to coinmarketcap). And it provides decent returns as by holding it you have the right to have a part of fees received by the platform. According to my calculations, its APY is around 18%.

Also, despite being sceptical of TA, I can say, this is a huge falling wedge (or whatever) and as soon as price breaks out of it, we can expect an upside movement.

I would advice you to look for a breakout and enter then (KCS/USD looks better from the point of volume and price movement).

Exchange

selby_exchange - BraveNewCoin Liquid Index for Bitcoin BNC:BLXBraveNewCoin Liquid Index for Bitcoin (BNC:BLX)

BLX price/time forecast:

$93759

2021-05-10

Please check this original BLX price/time forecast from Feb. 1st, 2019 when bitcoin was $3448 linked below.

Here is a snapshot of this chart back in Dec 2019 when price was $7320

Selby finding creative patterns in charts on Tradingview

Not advice for investing, but I am one to watch

Rebellion=Change=Future

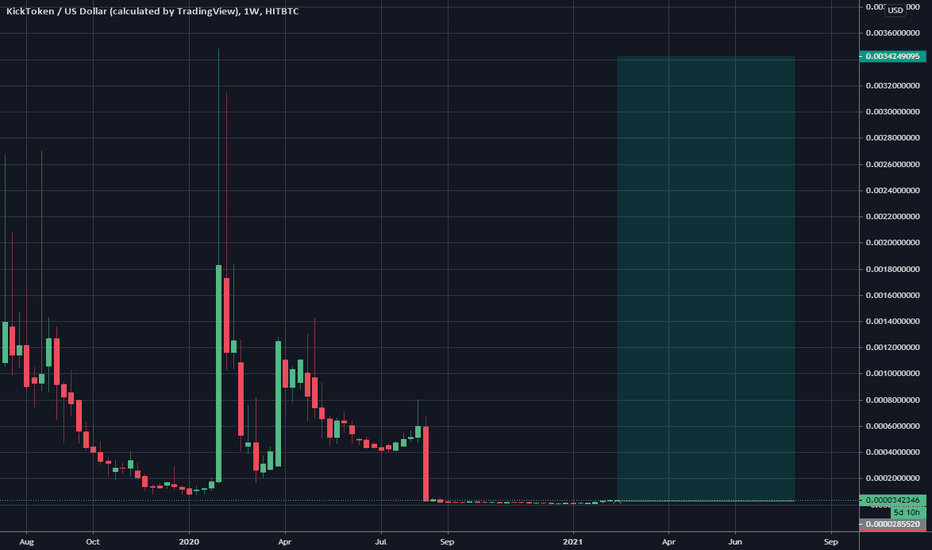

🚀Kick Ecosystem. The beginning of the lunar program?Part 1

Background, fundamental and some TA.

This is not the first year, or rather, since 2017, I have been watching the Kick Ecosystem project, formerly called KICKICO. During the last crypto season, the KICKICO project has carried out many successful ICO campaigns, and the site token itself has repeatedly hit the top cryptocurrencies. But then crypto winter came ... disappointment came and it seemed like the end ... but no, bitcoin rubbed the bottom around 3k and took off with renewed vigor. During this crypto winter, KICKICO transformed into a Kick ecosystem, losing the price tag, but methodically and successfully following their whitepaper, the project team created its own KickEx exchange, ran a unique referral program and is now preparing to release the new KICKICO. v4.0 for the whole world. The key feature of the new platform will be the ability to conduct IEO startups, which are a safer ICO option with mechanisms for organically forming the starting price of campaign tokens, which protects investors from a possible sharp drop in the price of tokens after the campaign. And the ecosystem token KickToken will play a central and pivotal role in settlements between the ecosystem and hosted campaigns, ensuring continued demand for the token.

Also, mobile applications will be released day after day - a wallet, into which trading functionality will be added a little later.

If you look at the chart, you will see a colossal drop on the powerful primary trend and then accumulation since about the spring of last year. The charts here are slightly different from the native ones on KickEx, and it's better to look there.

There is a triple bottom reversal pattern.

In addition, starting in the new year 2021, the token began to grow, and now on that day you can observe that

he is preparing to exit the symmetrical triangle upwards, the nearest target in the usdt is 0.00006.

Given the upcoming release of KICKICO v4.0, the current token price, the successful and systematic development of the platform, and an extremely bull market, it is difficult to imagine possible long-term goals.

The first ten new trading pairs were added to the KickEx exchange yestoday, which will become a permanent practice in the future.

Also this fall, the project plans to significantly reduce the emission of the token, so this year should be really bulish.

All information about the token, support groups and active community can be found through etherscan or coinmarketcap in the KickToken search, the main volumes are now going through the native KickEx exchange, as well as through Uniswap.

Good luck!

[$WAVES] First wave was crazy but the second will be savage ! Hello ,

$WAVES is doing a classic reversal pattern printing HL and pushing into resistance.

WAVES have developped a solid ecosystem , and can pretend doing more in the DeFi space

It could be a huge contender for a huge growth , place your bets.

GateChain Token allTime breakout - $GT $GTXHey frens

I just wanted to show u my fav chart of my fav native exchange token. I watch BNB, HT, LEO and GT, which all are about to breakout any moment or really sewn.

This one $GT is my winner of them also I have the feeling there is something incoming for all crypto exchanges and their assets.

Suprisingly even $HT performed better to me, then the notorious one $BNB, but for sure I have no idea for what $LEO is doing there.

Good luck for this coming event

selby_exchange - Ethereum ETHUSD - Selby Geometric ExtrapolationSelby Geometric Extrapolation Structure

ETHUSD Mar 2020 - Jan 2022

With fibonacci extension levels for new ATH

Price/time forecast:

$2,001.32 04-26-2021

52% in 89 Days.

Selby finding creative patterns in charts on Tradingview

Not advice for investing, but I am one to watch

Rebellion=Change=Future

Serum the future of exchangesSerum is one of my favorites coin with Polkadot and Synthetix in the DEFI space. Very strong potential and Governed by peoples votes.

What is Serum ?

The Team Behind Project Serum Project Serum is coined to be the new DEX to be launched by FTX Exchange- a cryptocurrency exchange and derivatives platform. Check out our review of FTX Exchange. The founders of Project Serum are also behind FTX exchange and they have also partnered with titans in the industry who have successful projects including the founders of Multicoin Capital, TomoChain, Compound, and Kyber Network

Serum is the first DEX built on Solana. Solana is a web-scale blockchain that can potentially reach 710,000 transactions per second (tps). This is possible with a verifiable delay function called SHA 256 hash chain that enables Optimistic Concurrency Control. At present, it can handle around 50,000 tps, which is exponentially faster than Ethereum’s 15 tps. The Team Behind Project Serum Project Serum is coined to be the new DEX to be launched by FTX Exchange.

Short Term Targets :

TP1 : ATH 3.8$

TP2 : 5.7$

Happy T4ding !

Uniswap (UNI) to $20? In Price Discovery Phase Good morning everybody!

Congratulations to all the Uniswap Hodlers and Investors. We've sailed through our previous all time high of $8.70 and now it's forming to be a solid zone for support. Resistance becomes support, that's always a good sign.

As of now Uniswap is in price discovery phase so I heavily caution people taking positions at these levels. I'm just not the kind of person that buys at the top especially at new all time highs. Uniswap has a lot of steam but please always bare in mind that it is overbought and past 70 on the Relative Strength Index (RSI). But that's just my personal preference.

I'm calling for a $20.00 Uniswap by March if we continue to grow at this pace. Another 100% increase from $10.00 will put Uniswap at $20.00 which is not a farfetched price target at all. This will put Uniswap at a total market capitalization of $6,000,000,000 doubling from where it is currently. These are reasonable goals considering what Uniswap is.

Uniswap is a Decentralized Exchange (DEX) meant to easily trade coins and create liquidity without any human involvement or corporate hierarchy. Meaning you will never need to divulge your personal information or identity to start using the platform. This is extremely powerful and attractive to many investors and traders alike. With this being said it is already a function product and platform being heavily utilized every second.

Decentralzied Finance (DeFi) is the future and as DeFi grows so will Uniswap. Uniswap is becoming the Binance equivalent of the DeFi ecosystem and is the current leader of Decentralized Exchanges (DEX's). It is already listed on Coinbase as well. I see Uniswap continuing to perform extremely well in the months to come.

Cheers! Much Love and Peace!

selby_exchange - Bitcoin BTCUSD - Selby Geometric ExtrapolationSelby Geometric Extrapolation Structure

BTCUSD

Feb - Jul 2021

With fibonacci extension levels for new ATH

Price/time forecast:

$51,244.71

07-01-2021

52% in 151 Days.

Selby finding creative patterns in charts on Tradingview

Not advice for investing, but I am one to watch

Rebellion=Change=Future

selby_exchange - Selby Margin Trading Rules 1.0 Selby Margin Trading Rules 1.0

1. Read these rules everyday without exception. Only begin margin trading after 30 minutes of reviewing all instruments and timeframes.

2. Charting: Midterm forecasting (months) charts built in 9,12hr and 1day. - Margin forecast charts built in 11,33min. using data from Heikin Ashi candle wicks. - Margin trade on 1min. follow the 3,6min. (use 2,3,4,5,6,9,11,15min. for in/out).

3. 3% RULE: Always close negative positions. Look for a retrace opportunity to exit but if trade falls below -3% for more then 30min set a stop loss limit order. This is the most important rule to prevent loss of time and a potential liquidation.

4. Enter limit order long/short and then set limit exit to take profit (TP) at the next short term Fibonacci level. Moving averages in higher timeframes 21,29,33,42,48,52,96min the 1-6,9,16hr and 1day will confirm market direction for successful trade.

5. "THINGS TO AVOID" Greed - Bragging - FOMO

6. "60/40 Split" to maximize margin profit, stay in fiat while awaiting confirmation of market direction (do not trade reversal chop washes; the 6,11min. must show a clear direction). Work as long as you like if you are in rhythm, but remember not every day is a trading day.

7. Think and chart 3-steps ahead, do not rush yourself into a position. Wait 11min at a minimum between entry/exit. Stay alert (Matcha tea) do not fall asleep. No trades 48hrs after (alcohol or drug use). "3-Strikes" If you have three bad trades during the workday stop for 24hrs.

8. (TP) TAKE PROFIT: Cash-out at the end of the day and pull 10% of daily net gains out of cyberspace. Always sleep in fiat (stable coin) without exception.

Selby finding creative patterns in charts on Tradingview

Not advice for investing, but I am one to watch

Rebellion=Change=Future

KCS: 50%+ DIVIDENDS! + HUGE UPSIDE - Crypto InvestmentKucoin is a full-service exchange which does NOT require KYC and is open to US residents, sporting 0.1% trading fees and lower--(compared to CoinbasePro's 0.5% fees, or regular Coinbase's 1.5% fees!). It supports 10x margin spot trading, using the dollar value of any assets placed in the margin account as collateral. It offers perpetual contract future trading, and ranks #12 / 249 exchanges (#5 of reputable exchanges via coinmarketcap) in terms of coin offerings, with 260 coins/currencies currently listed.

It also distributes 50% of exchange profits daily to KCS (ERC20) token holders. Based on the 24hr volume on 1/19/2021 and a fee base rate of 0.1% (the mode), that's about ~$20 PER DAY in BTC, ETH, etc. to someone owning 10K KCS!! ~.3BTC I could live on that!

The company also allocates >10% of quarterly profits to token buyback and burn. There used to be 200 million outstanding, now there are 180M outstanding.

Given the bull cycle is just getting started and Kucoin is a reputable global exchange, it will likely continue to attract new users and trading volume will likely increase!

Last but not least, the price of KCS. After a severe slump in the crypto bear market, KCS:BTC would have to appreciate 49X to reach its ATH.

Here's something that will return >50% of your money in yearly dividends which has tremendous upside potential, plus the technicals are screaming, buy NOW! It's also a great exchange due to its KYC status, offerings, reputability. And I might add if you buy KCS and leave it on exchange to collect your dividends, you can borrow against it to trade other cryptocurrencies and still get the dividend? Margin that pays you! But hurry, only at this limited time price offer, lol. The symmetrical triangle is about to be broken to the upside!

>>> When you open an account, do me a favor!--reward me for bringing this great investment to your attention and use my referral link. Won't cost you anything, and your experience will be no different than if you navigated to their site directly: www.kucoin.com

Disclosure: I use this exchange and enthusiastically own KCS at these prices!

Some additional reading:

coincentral.com

cryptonews.com

coincentral.com

FTT - Parabolic ModeFtt becomes parabolic, volume is still growing steadily (about $400 million atm), and it shows no signs of weakening. I think this trend will continue for some time.

The trend is still clearly bullish, and we shouldn't forget Maps Me IEO is ahead.

12-15 dollars is quite a possible target for me.

Information is just for educational purposes, never financial advice. Always do your own research.

Hit the "LIKE" button and follow to support, thanks!

XRP - Reality Over 350 financial institutions use Ripple's payment network, RippleNet, to receive payouts in more than 40 currencies across 55-plus countries. The present RippleNet members settle transactions in three to five seconds, compared to the hours or days it could take traditional services.

Ripple has the $ and resources to hire the best lawyers on the planet... that will happen. Combine this all with the fairly WEAK accusation that the SEC has brought forward... we will see short-term volatility YES - but I believe that XRP will prevail in the long term... especially if they win their case. XRP is a utility token, if you acknowledge XRP as a utility token for network usage, it’s nearly impossible to classify it as a security. The SEC's entire case is paper thin. I believe that the SEC is using XRP to place fear into the crypto community.

selby_exchange - Bitcoin BTCUSD - Selby Geometric ExtrapolationSelby Geometric Extrapolation Structure

With fibonacci extension levels for new ATH

BTCUSD Nov 2020 - May 2021

Selby finding creative patterns in charts on Tradingview

Not advice for investing, but I am one to watch

Rebellion=Change=Future