Expensive

Holding Tesla into EarningsI am thrilled to see Musk capture the title of richest man recently. He is a class act & I respect his entrepreneurial attitude/life style. His book by Vance is an absolute must read.

Tesla I think is a company that is a wonderful example of investors putting their capital where their values are. I know that Tsla is 1078% away from it's 52W low & appears to be in a bubble and is fundamentally extraordinarily overbought. I also read this week that the one famous character from the "the big short" is likewise shorting TSLA. I understand the logic. I think however that there is a fundamental mindsight many do not realize with the new entrants of investors who often invest with their heart, not their academia bullet points.

I am holding TSLA, and while controversial I am seeking to target $950...even then I would most likely continue to hold. This is in-line with the latest target from Wedbush on 1/15 with a target of $950. Bank of America updated their target on 1/11 to $900.

Good luck Tesla bulls.

Is it cheap? Why "dilution" is a concept you NEED to understandMany newbie investors get in trouble because they don't understand the relationship between share price and share count. If you're new to investing and you've never heard of "dilution," it's very important that you keep reading this post.

If I look at a standard chart of Spirit Airlines's share price, such as a upper chart above, I might conclude that the stock is cheap right now. Spirit shares are trading well below the price they've traded at for the last five years.

This is an illusion. The valuation of a company is its share price times the number of shares outstanding. When a company runs low on cash, it sometimes issues and sells new shares. This "dilutes" the ownership percentage of existing shares.

Imagine I have a pie, and I've invited you and two other people over for a piece. We're each going to get a quarter of a pie-- a really big slice! But then you decide to invite a friend. The size of the pie doesn't change, so now we have to cut it in fifths so your friend can have a slice. Each of us will get a smaller piece.

Issuing new shares works the same way. Since the beginning of the Covid-19 pandemic, Spirit Airlines has issued 29.14 million new shares, increasing its share count by 42.5%. That means that each share now represents a much smaller proportion of the company than it used to. The shares have been "diluted."

Because of dilution, looking at a chart of the price of a single share doesn't tell you how "cheap" or "expensive" a company is compared to its historical valuations. Fortunately, there's a quick and easy way to chart a company's actual valuation.

Share price multiplied by shares outstanding equals the company's total price tag, its "market capitalization" or "market cap." To chart market cap on TradingView, find and click the button labeled "fundamental metrics for stocks" at the top of the chart. Type "market" in the search box, and TradingView will narrow the list of metrics down to the one you want. Clicking on "market capitalization" will add a time series of the stock's market cap to your chart.

When we look at market cap for Spirit Airlines, it doesn't look cheap anymore. Spirit is trading within its price range of the last four years, even though the company is now financially worse off in every way. With earnings negative and sales nearly cut in half, Spirit is priced as if the pandemic had never happened. By charting market cap, you've adjusted for dilution and gained a much better understanding of the asking price.

YFI's Move To Horizontal Support Gives Us A 52% Opportunity!In this technical analysis you can see how YFI is moving in on the strong horizontal support area we have observed before. I show you how you can make use of this area to enter a 52% return trade opportunity.

Now, we see that the price is getting close to the support zone again. I suggest going in for a long position near the $21,500 level for a trade set-up with fantastic risk reward.

Essentially we want to bet on the horizontal level to hold strongly like it did in the past. Enter with small positions since even when your stop loss hits by breaking through the support you can suffer a pretty big loss given the volatility of YFI.

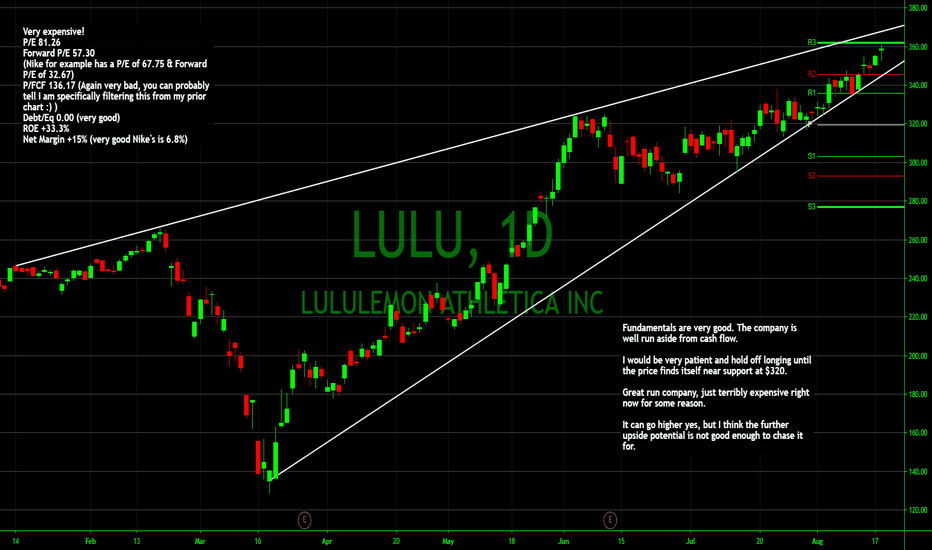

Analysis on Lululemon Athletica - a Canadian Retail CoFundamentals are very good. The company is well run aside from cash flow.

I would be very patient and hold off longing until the price finds itself near support at $320.

Great run company, just terribly expensive right now for some reason.

It can go higher yes, but I think the further upside potential is not good enough to chase it for.

PLATINUM (XPT/USD) SHORTCharts rarely come as crystal clear as this one. The price for Platinum has been range-bound on the weekly and daily timeframe, however downtrend from the monthly is still there. Going to the immediate now, the daily timeframe and four hour timeframe both show that price rejected the resistance level at 871.73, and is now southbound towards the 779.91 support level. The short-term trendline on the four hour timeframe has also been broken to the downside, giving more confluence and confidence.Therefore, traders must be lookout for a downside-break of the 844.71 level in order enter short positions. Happy selling!

Delta Airlines -DAL - Weekly -Touched 1x's sales in 2014Delta is just off of an extreme level of valuation as it backs down to $43.36 today, May 22, 2015.

If you look at the Total Revenue chart, you can see that revenue gains were steady and have increased by 42% since 5 years ago in May. Over the same time frame, however, the stock price has risen by 267%. After-tax margins went from losses to profits and margins briefly climbed over 20% (after-tax).

Next questions: Did DAL use up all of their tax-loss carry forwards? Will the drop in oil prices lead consumers to spend more on travel? Will people fly on vacations more or will driving still be the best choice.

DAL has been a monster winner for any portfolio up until now, but Airlines are a cyclical business and the business cycle hasn't been outlawed. Consolidation and efficiencies have driven up profitability, and shareholders have been richly rewarded. It looks like there are more "shareholders" than "share-buyers" at this level and the recent price action is alerting us to sellers unloading shares. $46 seems to be the common price where the sellers are unloading shares and the strong buyers are down at $34-$30. So, from $43.30 here, the upside seems less than the risk to the downside.

Here's hoping you look at the fundamentals too when you examine a chart and not just the "technimentals"....

Cheers,

Tim 5/22/2015 2:02 PM EST 43.31 last DAL

PS - Note - I have been picking a top in DAL over the past year +. Check out my charts.