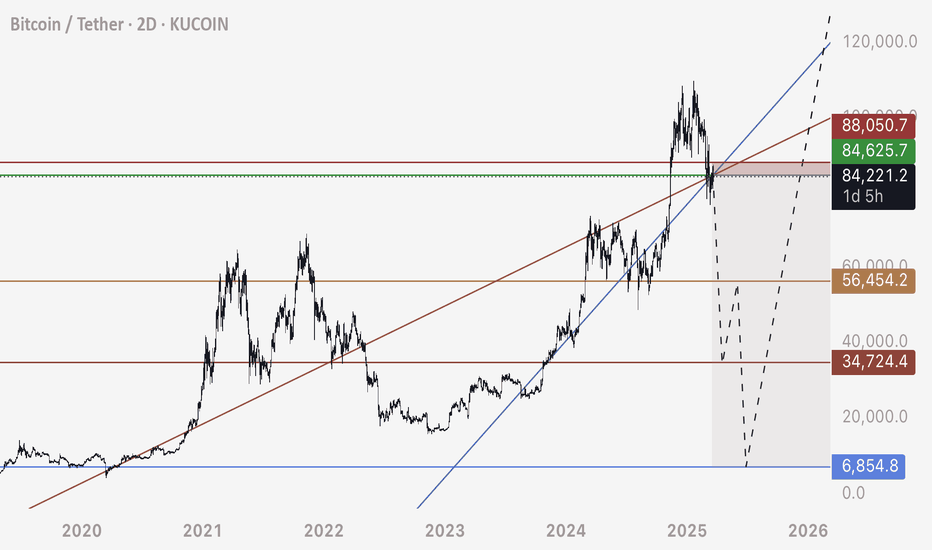

Reminder - Bitcoin back below these trendlinesI encourage you guys to draw these trendlines on your chart and experiment by doing some exercises.

1. Draw the main two trendlines.

2. Spend time on each by duplicating it, keeping the angle the same, and moving it to different spots on the chart. Notice how Bitcoin works on this ascending diagonal support resistance structure. You’ll find that the correct trendline can be duplicated infinitely and the price respects it at any point you place it.

3. Notice that price consolidates on these ascending lines. We see breaks above or below depending on the stop losses from futures positions and liquidity that’s collected. In other words, a break above doesn’t invalidate it.

4. Notice that Bitcoin moves above and below these trendlines.

5. It’s in my opinion that THIS is the structure that explains why Bitcoin isn’t moving higher, telling me the market wants to keep price below these trendlines and take back the liquidity in these zones (look at my previous posts for liquidity maps)

Personally this is still my trade.

God bless and may you live to trade another day!

Experimental

New Strategy Testing Consolidation HypothesisIf you see previous trades in this account, you'll notice this strategy has never been used before. This strategy consists of new indicators I created through my own research and back tested it using Yahoo Finance Data. Today I finally coded the indicators into tradingview, however I will not be sharing the code.

Basically, the indicator is reading the trend as it currently is. Determining it's a bullish trend if the blue line is above 0 and the opposite is true. Once the blue line reaches the limits, then it's considered a local minimum or maximum. These however are not always activated, so it's up to the user to determine if the movement is way too close to the limit and therefore should close the position.

However, it can also be possible that a strong trend causes many consecutive maximums to appear. It's up to the user to determine if the maximums are just part of a strong trend or actually a maximum. This exception happens more on the upside than the downside, making minimum signals more reliable.

Looking at how the SPX has behaved and seeing it come out of a slump and with the elections coming up it would seem reasonable to see investors skeptical about the future. Whoever wins the election will have a heavy impact on the price action, however, I doubt investors will make up their mind until then. Therefore, it's reasonable to assume the market may stall before continuing its growth. Also allowing the technicals to reset for a healthy bullish setup for the long term.

Warning: This is the first live test of this strategy!!

Estimate time for price to increase :

1months-6 months

Expect price to stall within the drawn range. For the following weeks

I don't expect any mayor price movements until the elections, unless a sudden international event happens.

NASDAQ 100 (NDQ100 Eightcap) BUY SIGNAL 7am 7-28-2023

Candle close SIGNAL BUY. EVERY INDICATOR IS BULLISH WITH STRAGETY SIGNAL.

price targets are 15702 21 hrs avg trade

15748 30 hrs avg trade

THIS A TEST TO SEE HOW THE STRAGETY PLAYS OUT.

1.66 LOTS.

stop loss at sell signal(candle close)/g-trend line

Dangerous ETH Long for a swing hughI am hoping to catch a bounce but am still in an active short. Wish KuCoin offered Hedge mode but have to use Okx for that. This is risky and I will add to my short if it does because this correction doesn't seem over as of yet. This is the new MM Matrix I am working on. Right now it is a combination of available indicators I have customized but I full intend of creating a better one. If anyone knows one or a way to get the supply of the market maker please DM me or comment. If we know what the market maker has on hand we know where the market would be headed to fill institutional orders. I am sure someone way smarter then myself has already figured this out and made something. I can get the data from one of my other software MM Balances but no way to port it in. This is more a test then anything. I think it is still going to go down from here, however the supply of the MM I believe will need to be replenished. This is all a theory, nothing more. I am experimenting basically. If someone already knows more about this please let me know as well. I am trying to learn this the best I can but don't trust many sources t provide accurate information so I have to research it all myself. This is going to be a part of a strategy one I get it working properly. Anyone wanting to assist that has more knowledge on it or is a coder please contract me as well.

Thanks for following and sorry this is probably late into the trade. Longing SOL also will try to post trade.

-Trade Experiment

Ichimouku as s/r confirmation. Newbie.So, i really like the cloud. it has everything kind of built in and i think it's great. i have not been successful EVER at trying to use it for buy sell signals. so i am now experimenting with it for a secondary confirmation of s/r levels. i haven't tested it as i am currently doing now. live trading.

It seem on the settings 20 60 120 30 it truly verifies s/r which is my main strat. Newbie!

so this is my idea. it's on jasmy because that's what i've been trading for some reason. i like the random action and s/r can hit and bounce very nicely at times.

it's just my ichimoku settings with my s/r levels that i used around the info it gave. I removed the fill of the cloud as the 2 lines also work as s/r at times.

suppose i should have zoomed out to show my point lol. next time. it's just an idea.

geometrical metodology used on CTII've decided to experiment with geometrical shapes on CTI token as it's chart has some interesting harmonics. Basic technical analysis shows us a point where trend changes, but it's curiosity that asks us to predict how exactly this will influence price change. It's experimental method, but there is a tendency for corellating with RSI data and Trend Ribbon. This could be used in a number of ways, including pattern harmonics and long-term planning. We will see in a couple of weeks if it's working. Here and now it's pretty obvious that that's a buy price for CTi in a long-term perspective.

Newton's 2nd Law and the MarketThis is my first pine script and is (probably) of no practical value whatsoever; however, it is interesting. The idea was to apply Newton's 2nd Law of motion (force = mass x acceleration) to the market and see what pops up. To do this, I applied Ohm's Law, the electrical version of Newton's 2nd, in the following manner; Voltage (V), or potential, is defined as the delta of the high and low (or open and close) of a bar. Amperage (I), or current, is defined as the volume of trades within the bar. Resistance (R) is then calculated using the Ohm's Law formula of R=V/I, and Power (P) is then defined as P=V*I. The plotted values are normalized EMA of the RSI of these series.

The implication is that Resistance (R) *should* be the price, and you can see how when using a "voltage" of open/close (vs. low/high), the R line always moves in the opposite directions of the price. When using low/high, it tends to move in the same direction as the price.

//@version=4

study(title="Tholonic Pattern", shorttitle="Tholonic", overlay=false)

proc(_src,len) =>

a=rsi(_src, len)

a:=ema(a,len) // the EMA is taken 3 times here because three EMAs of 4 is a lot smoother and tighter than one EMA of 16

a:=ema(a,len)

a:=ema(a,len)

// —————

len = input(title="EMA and RSI Length", type=input.integer, defval=5)

showBlu_V= input(title="Show V (blue - hi/lo delta)?", type=input.bool, defval=true)

showRed_I= input(title="Show I (red - volume)?", type=input.bool, defval=true)

showGre_R= input(title="Show R (green - balanced price)?", type=input.bool, defval=true)

showYel_P= input(title="Show P (yellow - 'power')?", type=input.bool, defval=true)

showClose= input(title="RSI/EMA of close?", type=input.bool, defval=false)

hloc= input(title="Use High/Low (vs Open/Close)?", type=input.bool, defval=true)

// using hi-lo vs. close-open has a significent effect

pole1 = low

pole2 = high

if hloc

pole1 := open

pole2 := close

V=pole2-pole1 // Price range defines the range and equates to Voltage, or potential (which equates to FORCE)

I=volume // Volume defines the movement and equates to Amperage, or current (which equates to ACCELERATION)

R=V/I // Price defines the agreement between two opposing forces and equates to Resistance (which equates to MASS)

P=V*I // In the electrical world, this is POWER... no idea what is means here

C=close

mV=proc(V,len)

mI=proc(I,len)

mR=proc(R,len)

mP=proc(P,len)

mC=proc(C,len) // Don't know why this has a differenmt scale than the others

lw=1

plot(series=mV,style=plot.style_line, linewidth=lw, color=iff(showBlu_V,color.blue,na))

plot(series=mR,style=plot.style_line, linewidth=lw, color=iff(showGre_R,color.green,na))

plot(series=mI,style=plot.style_line, linewidth=lw, color=iff(showRed_I,color.red,na))

plot(series=mP,style=plot.style_line, linewidth=lw, color=iff(showYel_P,color.yellow,na))

plot(series=mC,style=plot.style_line, linewidth=lw*2,color=iff(showClose,color.aqua,na))

hline(50)

var label V_lbl = na

var label I_lbl = na

var label R_lbl = na

var label P_lbl = na

var label C_lbl = na

var label notice = na

label.delete(V_lbl)

label.delete(I_lbl)

label.delete(R_lbl)

label.delete(P_lbl)

label.delete(C_lbl)

label.delete(notice)

spacer =" " // I don't know how to set the x position to teh right of the last bar :/

sadd=" "

V_lbl := label.new(bar_index, high, text = spacer+"V", style = label.style_none, size = size.normal)

label.set_xy(V_lbl, bar_index, mV)

label.set_textcolor(id=V_lbl, textcolor=color.blue)

R_lbl := label.new(bar_index, high, text = spacer+sadd+"R", style = label.style_none, size = size.normal)

label.set_xy(R_lbl, bar_index, mR)

label.set_textcolor(id=R_lbl, textcolor=color.green)

I_lbl := label.new(bar_index, high, text = spacer+sadd+sadd+"I", style = label.style_none, size = size.normal)

label.set_xy(I_lbl, bar_index, mI)

label.set_textcolor(id=I_lbl, textcolor=color.red)

P_lbl := label.new(bar_index, high, text = spacer+sadd+sadd+sadd+"P", style = label.style_none, size = size.normal)

label.set_xy(P_lbl, bar_index, mP)

label.set_textcolor(id=P_lbl, textcolor=color.yellow)

if showClose

C_lbl := label.new(bar_index, high, text = spacer+sadd+sadd+sadd+sadd+sadd+sadd+"CLOSE", style = label.style_none, size = size.normal)

label.set_xy(C_lbl, bar_index, mC)

label.set_textcolor(id=C_lbl, textcolor=color.aqua)

noticeTxt = hloc ? "Using High/Low" : "Using Open/Close"

notice := label.new(bar_index,90, text = noticeTxt, style = label.style_none, size = size.large)

label.set_textcolor(id=P_lbl, textcolor=color.white)

Evolution of MACDMoving Average Convergence Divergence – MACD

The most popular indicator used in technical analysis, the moving average convergence divergence (MACD), created by Gerald Appel. MACD is a trend-following momentum indicator, designed to reveal changes in the strength, direction, momentum, and duration of a trend in a financial instrument’s price

Historical evolution of MACD,

- Gerald Appel created the MACD line,

- Thomas Aspray added the histogram feature to MACD

- Giorgos E. Siligardos created a leader of MACD

MACD employs two Moving Averages of varying lengths (which are lagging indicators) to identify trend direction and duration. Then, MACD takes the difference in values between those two Moving Averages (MACD Line) and an EMA of those Moving Averages (Signal Line) and plots that difference between the two lines as a histogram which oscillates above and below a center Zero Line. The histogram is used as a good indication of a security's momentum.

Mathematically expressed as;

macd = ma(source, fast_length) – ma(source, slow_length)

signal = ma(macd, signal_length)

histogram = macd – signal

where exponential moving average (ema) is in common use as a moving average (ma)

fast_length = 12

slow_length = 26

signal_length = 9

The MACD indicator is typically good for identifying three types of basic signals;

Signal Line Crossovers

A Signal Line Crossover is the most common signal produced by the MACD. On the occasions where the MACD Line crosses above or below the Signal Line, that can signify a potentially strong move. The standard interpretation of such an event is a recommendation to buy if the MACD line crosses up through the Signal Line (a "bullish" crossover), or to sell if it crosses down through the Signal Line (a "bearish" crossover). These events are taken as indications that the trend in the financial instrument is about to accelerate in the direction of the crossover.

Zero Line Crossovers

Zero Line Crossovers occur when the MACD Line crossed the Zero Line and either becomes positive (above 0) or negative (below 0). A change from positive to negative MACD is interpreted as "bearish", and from negative to positive as "bullish". Zero crossovers provide evidence of a change in the direction of a trend but less confirmation of its momentum than a signal line crossover

Divergence

Divergence is another signal created by the MACD. Simply, divergence occurs when the MACD and actual price are not in agreement. A "positive divergence" or "bullish divergence" occurs when the price makes a new low but the MACD does not confirm with a new low of its own. A "negative divergence" or "bearish divergence" occurs when the price makes a new high but the MACD does not confirm with a new high of its own. A divergence with respect to price may occur on the MACD line and/or the MACD Histogram

Moving Average Crossovers , another hidden signal that MACD Indicator identifies

Many traders will watch for a short-term moving average to cross above a longer-term moving average and use this to signal increasing upward momentum. This bullish crossover suggests that the price has recently been rising at a faster rate than it has in the past, so it is a common technical buy sign. Conversely, a short-term moving average crossing below a longer-term average is used to illustrate that the asset's price has been moving downward at a faster rate and that it may be a good time to sell.

Moving Average Crossovers in reality is Zero Line Crossovers, the value of the MACD indicator is equal to zero each time the two moving averages cross over each other. For easy interpretation by trades, Zero Line Crossovers are simply described as positive or negative MACD

False signals

Like any forecasting algorithm, the MACD can generate false signals. A false positive, for example, would be a bullish crossover followed by a sudden decline in a financial instrument. A false negative would be a situation where there is bearish crossover, yet the financial instrument accelerated suddenly upwards

What is “MACD-X” and Why it is “More Than MACD”

In its simples form, MACD-X implements variety of different calculation techniques applied to obtain MACD Line, ability to use of variety of different sources, including Volume related sources, and can be plotted along with MACD in the same window and all those features are available and presented within a single indicator, MACD-X

Different calculation techniques lead to different values for MACD Line, as will further discuss below, and as a consequence the signal line and the histogram values will differentiate accordingly. Mathematical calculation of both signal line and the histogram remain the same.

Main features of MACD-X ;

1- Introduces different proven techniques applied on MACD calculation, such as MACD-Histogram, MACD-Leader and MACD-Source, besides the traditional MACD (MACD-TRADITIONAL)

• MACD-Traditional, by Gerald Appel

It is the MACD that we know, stated as traditional just to avoid confusion with other techniques used with this study

• MACD-Histogram, by Thomas Aspray

The MACD-Histogram measures the distance between MACD and its signal line (the 9-day EMA of MACD). Aspray developed the MACD-Histogram to anticipate signal line crossovers in MACD. Because MACD uses moving averages and moving averages lag price, signal line crossovers can come late and affect the reward-to-risk ratio of a trade. Bullish or bearish divergences in the MACD-Histogram can alert chartists to an imminent signal line crossover in MACD

The MACD-Histogram represents the difference between MACD and its 9-day EMA, the signal line. Mathematically,

macdx = macd - ma(macd, signal_length)

Aspray's contribution served as a way to anticipate (and therefore cut down on lag) possible MACD crossovers which are a fundamental part of the indicator.

Here come a question, what if repeat the same calculations once more (macdh2 = macdh - ma(macdh, signal_length), will it be even better, this question will remain to be tested

• MACD-Leader, by Giorgos E. Siligardos, PhD

MACD Leader has the ability to lead MACD at critical situations. Almost all smoothing methods encounter in technical analysis are based on a relative-weighted sum of past prices, and the Leader is no exception. The concealed weights of MACD Leader are such that more relative weight is used in the more recent prices than the respective weights used by the components of MACD. In effect, the Leader expresses more changes in average price dynamics for the recent price movement than MACD, thus eventually leading MACD, especially when significant trend changes are about to take place.

Siligardos creates two less-laggard moving averages indicators in its formula using the same periods as follows

Indicator1 = ma(source, fast_length) + ma(source - ma(source, fast_length), fast_length)

Indicator2 = ma(source, slow_length) + ma(source - ma(source, slow_length), slow_length)

and then take the difference:

Indicator1 - Indicator2

The result is a new MACD Leader indicator

macdx = macd + ma(source - fast_ma, fast_length) - ma(source - slow_ma, slow_length)

• MACD-Source, a custom experimental interpretation of mine,

MACD Source, presents an application of MACD that evaluates Source/MA Ratio, relatively with less lag, as a basis for MACD Line, also can be expressed as source convergence/divergence to its moving average. Among the various techniques for removing the lag between price and moving average (MA) of the price, one in particular stands out: the addition to the moving average of a portion of the difference between the price and MA. MACD Source, is based on signal length mean of the difference between Source and average value of shot length and long length moving average of the source (Source/MA Ratio), where the source is actual value and hence no lag and relatively less lag with the average value of moving average of the source . Mathematically expressed as,

macdx = ma(source - avg( ma(source, fast_length), ma(source, slow_length) ), signal_length)

MACD Source provides relatively early crossovers comparing to MACD and better momentum direction indications, assuming the lengths are set to same values

For further details, you are invited to check the following two studies, where the first seeds were sown of the MACD-Source idea

Price Distance to its Moving Averages study, adapts the idea of “Prices high above the moving average (MA) or low below it are likely to be remedied in the future by a reverse price movement", presented in an article by Denis Alajbeg, Zoran Bubas and Dina Vasic published in International Journal of Economics, Commerce and Management

First MACD like interpretation comes with the second study named as “P-MACD”, where P stands for price, P-MACD study attempts to display relationship between Price and its 20 and 200-period moving average. Calculations with P-MACD were based on price distance (convergence/divergence) to its 200-period moving average, and moving average convergence/divergence of 20-period moving average to 200-period moving average of price.

Now as explained above, MACD Source is a one adapted with traditional MACD, where Source stands for Price, Volume Indicator etc, any source applicable with MACD concept

2- Allows usage of variety of different sources, including Volume related indicators

The most common usage of Source for MACD calculation is close value of the financial instruments price. As an experimental approach, this study will allow source to be selected as one of the following series;

• Current Close Price (close)

• Average of High, Low, and Close Price (hlc3)

• On Balance Volume (obv)

• Accumulation Distribution (accdist)

• Price Volume Trend (pvt)

Where,

-Current Close Price and Average of High, Low, and Close Price are price actions of the financial instrument

-Accumulation Distribution is a volume based indicator designed to measure underlying supply and demand

-On Balance Volume (OBV), is a momentum indicator that measures positive and negative volume flow

-Price Volume Trend (PVT) is a momentum based indicator used to measure money flow

3- Can be plotted along with MACD in the same window using the same scaling

Default setting of MACD-X will display MACD-Source with Current Close Price as a source and traditional MACD can be plotted eighter as a companion of MACD-X or can be selected to be plotted alone.

Applying both will add ability to compare, or use as a confirmation of one other

In case, traditional MACD Is plotted along with MACD-X to avoid misinterpreting, the lines plotted, the area between MACD-X Line and Signal-X Line is highlighted automatically, even if the highlight option not selected. Otherwise highlight will be applied only if that option selected

4- 4C Histogram

Histogram is plotted with four colors to emphasize the momentum and direction

5- Customizable

Additional to ability of selecting Calculation Method, Source, plotting along with MACD, there are few other option that allows users to customize the MACD-X indicator

Lengths are configurable, default values are set as 12, 26, 9 respectively for fast, slow and smoothing length. Setting lengths to 8,21,5 respectively Is worth checking, slower length moving averages will lead to less lag and earlier reaction to price actions but yet requires a caution and back testing before applying

Highlight the area between MACD-X Line and Signal-X Line, with colors emphasising the direction

Label can be added to display Calculation Method, Source and Length settings, the aim of this label is to server only as a reminder to trades to be aware of settings while they are occupied with charts, analysis etc.

Here comes another question, which is of more importance having the reminder or having the indicators with multi timeframe feature? Build-in Multi Time Frame features of Pine is not supported when labels and lines introduced in the script, there are other methods but brings complexity. To be studied further, this version will be with labels for time being.

EPILOGUE

MACD-X is an alternative variant of MACD, the insight/signals provided by MACD are also applicable to MACD-X with early and clear warnings for the changes in the trend.

If MACD is essential to your analysis, then it is my guess that after using the MACD-X for a while and familiarizing yourself with its unique character and personality, you will make it an inseparable companion to other indicators in your charts.

The various signals generated by MACD/MACD-X are easily interpreted and very few indicators in technical analysis have proved to be more reliable than the MACD, and this relatively simple indicator can quickly be incorporated into any short-term trading strategy

MaMA : Momentum adjusted Moving AverageA brand new Moving Average , calculated using Momentum, Acceleration and Probability (Psychological Effect).

Momentum adjusted Moving Average( MaMA ) is an indicator that measures Price Action by taking into consideration not only Price movements but also its Momentum, Acceleration and Probability. MaMA , provides faster responses comparing to the regular Moving Average

Here is the math of the MaMA idea

Momentum measures change in price over a specified time period

momentum = source – source(length)

where,

source, indicates current bar’s price value

source(length), indicates historical price value of length bars earlier

Lets play with this formula and rewrite it by moving source(length) to other side of the equation

source = source(length) + momentum

to avoid confusion let’s call the source that we aim to predict as adjustedSource

adjustedSource = source(length) + momentum

looks nice the next value of source simply can be calculated by summing of historical value of the source value and value of the momentum. I wish it was so easy, the formula holds true only when the momentum is conserved/constant/steady but momentum move up or down with the price fluctuations (accelerating or decelerating)

Let’s add acceleration effects on our formula, where acceleration is change in momentum for a given length. Then the formula will become as (skipped proof part of acceleration effects, you may google for further details)

adjustedSource = source(length) + momentum + 1/2 * acceleration

here again the formula holds true when the acceleration is constant and once again it is not the case for trading, acceleration also changes with the price fluctuations

Then, how we can benefit from all of this, it has value yet requires additional approaches for better outcome

Let’s simulate behaviour with some predictive approach such as using probability (also known as psychological effect), where probability is a measure for calculating the chances or the possibilities of the occurrence of a random event. As stated earlier above momentum and acceleration are changing with the price fluctuations, by using the probability approach we can add a predictive skill to determine the likelihood of momentum and acceleration changes (remember it is a predictive approach). With this approach, our equations can be expresses as follows

adjustedSource = source(length) + momentum * probability

adjustedSource = source(length) + ( momentum + 1/2 * acceleration ) * probability , with acceleration effect

Finally, we plot MaMA with the new predicted source adjustedSource, applying acceleration effect is made settable by the used from the dialog box, default value is true.

What to look for:

• Trend Identification

• Support and Resistance

• Price Crossovers

Recommended settings are applied as default settings, if you wish to change the length of the MaMA then you should also adjust length of Momentum (and/or Probability). For example for faster moving average such as 21 period it would be suggested to set momentum length to 13

Alternative usage, set moving average length to 1 and keep rest lengths with default values, it will produce a predictive price line based on momentum and probability. Experience acceleration factor by enabling and disabling it

Conclusion

MaMA provide an added level of confidence to a trading strategy and yet it is important to always be aware that it implements a predictive approach in a chaotic market use with caution just like with any indicator

Trading success is all about following your trading strategy and the indicators should fit within your trading strategy, and not to be traded upon solely

Disclaimer : The script is for informational and educational purposes only. Use of the script does not constitutes professional and/or financial advice. You alone the sole responsibility of evaluating the script output and risks associated with the use of the script. In exchange for using the script, you agree not to hold dgtrd TradingView user liable for any possible claim for damages arising from any decision you make based on use of the script

This is my look at Bitcoin Vs USD on 05.26.2020 I'm not a financial advisor, Don't buy or sell bass on what I'm saying... I do own some Bitcoin and I think it has a great future, this future may or may not be that great so PLEASE DO YOUR OWN HOMEWORK. THIS POST IS JUST FOR INFO ONLY...

This is my look at Bitcoin Vs USD on 05.26.2020

This is an experimental indicator that I have made and testing it out... It is using the EMAs the white line is 13 EMA, the green line is 55 EMA and the yellow line is 89 EMA...

The points going pass is a future guess by the experimental indicator and the way it works is if it's pointing up like the white one is on this chart, to me it's suggesting that Bitcoin is going to head lower in the next couple of hours and using the RSI, has helped to confirm that for me...

What do you think about this, a good idea or a bad idea?

Chart and Fib ExperimentationWith this I am not saying anything is going in one way or another. I just wanted to plot some fib spirals on some key points along the upward implus, draw a fib retracement over it, and just watch what happens.

I am curious to see what the price does with the different levels and marking on the chart and thought some of you may also be interested in it.

Stay safe and healthy everyone.

Demo TraderIs paper trading worth to do before actaully trading real funds? I would say yes it’s a great way to get started.Paper trading is great to test out strategies as well. The only thing wrong with this is that if you start making money on a demo account it doesn’t mean you will make money in a live account.The reason behind this is that when you’re a demo trader you have no emotions at all compare to when you have hard earned money in your live account.Thinking of it like this you can read all you want on how to ride a bike from there you will have an idea on how to do it. This does’t mean that when you do get on the bike you will be an expert.At this point when you start practicing is when you will really start to get expierence. Another great example is when you’re going to get your drivers license. You usually start by going to driving school to learn about what you will do on the road.Once you have been in class for a while you then start getting on the road and that’s when you actually start getting real experience.When you’re on the road this when you get a different feeling being behind the wheel compared to what you were doing in the classroom.At this point you start to learn how to get on the highway, how to park, and all around how to actually drive. At this point it all comes down to how you handle yourself behind that wheel.For example you may have someone with 5 years of experience that drives better than someone with 15 years of experience. Why is that? Well it could be emotional factor in which they are never calm and always scared to drive not allowing them to unlock full potiental. Compared to the guy that is always calm and always driving.This all corrolates to trading because you requires a few moving parts but it all comes down to emotion. So I would say demo trading is good only to test out strategies.I wouldn’t recommend demo trading for too long.

Quote: “I learned early that there is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again. I’ve never forgotten that.” – Jesse Livermore

Trader essential from Amazon

1. amzn.to -Tylenol Extra Strength Rapid Release (LOL)

2. amzn.to -Encyclopedia of Chart Patterns

3. amzn.to -Apple MacBook Pro

4. amzn.to -OLLY Goodbye Stress Gummy,

5. amzn.to - Lenovo Ideacentre AIO 520S 23-Inch Desktop Computer (Intel Core i5-7200U, 16GB DDR4, 1TB HDD, Intel HD Graphics 620, Windows 10), F0CU0001US

6. amzn.to Apple iMac (21.5" Retina 4K display, 3.0GHz quad-core Intel Core i5, 8GB RAM, 1TB) - Silver

7. amzn.to -Dell i5680-7813BLU-PUS Inspiron Gaming PC Desktop 5680, Intel Core i7-8700, 16GB DDR4 Memory, 128GB SSD+2TB SATA HDD, NVIDIA GeForce GTX 1060, Recon Blue, Windows 10 64-bit

Possible Trade on GME? What do you guys think?GME broke out of a beautiful symmetrical triangle. I can buy on the break above the upper supply area. However, it has recently been downgraded to a zacks rank of 4 (sell). There is however a possibility of a buy out which would result in significant move to the upside. Also, zacks analysts do not expect GME to meet earnings estimates which is not too far away. I will go long in my paper trading account to learn from such a situation.

EOSUSD 3-4 days expectationFirst of all, I am not a pro Trader (I am a mathmatician / Computer Science student) and this is an experiment that I analyze and set up.So this is not a financial advice.

Example 1 and 2 are two situation that have the same indicator(S-RSI, RSI and MACD) levels as the experiment point ( which all are shown on the graph)

After 3-4 days prices of Example 1 and 2 have raised .

My Expectation here is

Finding an answer to "If I can find examples (with the same indicator levels) of present time in the past then I can predict the future" phrase is true or not?

So in this specific case, the experiment is successifull if in 3-4 days time period price will be a number between $8.04 and $8.36

--Thank you for stoping by and reading my first noob post :) and showing patiance to my writings--