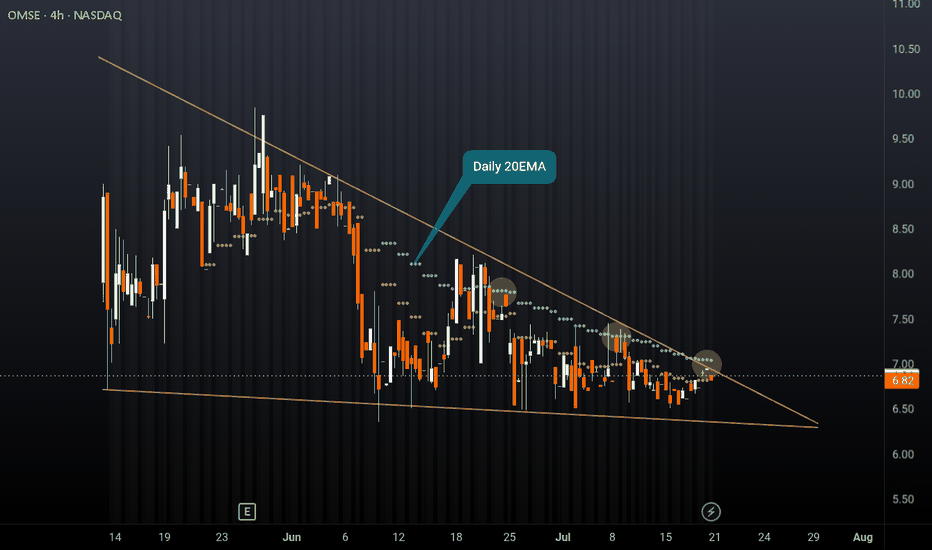

OMSE falling wedge after IPONeutral on OMSE, another relatively new ticker. Similar to my previous post on DVLT, this ticker is fundamentally strong but stuck in a falling wedge after IPO. Price is struggling to break the daily 20EMA (overlayed on this 4H chart) and has rejected multiple times. The company has strong financials, take the time to do some DD, however this pattern could break to the downside and hit new lows before we see any type of rally given the weakness in this sector at the moment. Set alerts and watch the price action play out, or don't bet your rent money on any direction if entering a position.

I'm just a cat not a financial advisor.

Falling

BTC Potential Short-Term PullbackBINANCE:BTCUSDT could be setting itself up for a short-term pullback.

It might be forming a Daily RSI Bear Divergence, with the latest retest of the the main supply zone, and RSI Divs/Breakouts have been reliable leading signals for recent CRYPTOCAP:BTC PA.

Key Levels to Watch

• $119k - Measured wedge target, confirmed with last month's breakout.

• $106.2k-$109.5k - Main supply and ATH, a sustained break above it would invalidate any bearish PA.

• $89.6k-$91.9k - Lots of confluence here:

- Unmitigated daily FVG

- The 200-day EMA is sitting there

- A move here would be between 0.5 and 0.618 Fib retracement of the last leg up, consistent with the typical pullback length of Wave 2 (Elliott Waves theory)

- It has also been an important S/R since November 2024, and a retracement here could form an Inverse Head and Shoulders pattern.

I would be patient with it, as I still see a lot of uncertainty short-term, but I think a pullback to ~$90k could offer a great long entry. Worth keeping a close eye on it.

Optimism (OP) Falling WedgeBINANCE:OPUSDT is attempting a breakout from a 14 months long falling wedge.

A sustained break above the resistance in the near term would set the target at $3.80, just shy of the main $4.00-$4.80 supply zone.

Key Levels to Watch

• $0.55-$0.60: Main demand zone and invalidation point for the setup

• $1.00-$1.20: High Volume Node and key S/R dating back to June 2023.*

• $2.50-$2.80: High Volume Node and wedge high point.*

• $4.00-$4.80: Main supply zone.

* These could offer resistance and represent good levels for partial TPs.

Stellar (XLM) Falling Wedge + Inverse Head & ShouldersBINANCE:XLMUSDT has recently broken out of two major bullish patterns:

• Falling Wedge: The breakout above the descending resistance (orange) confirms the wedge setup, with a measured target around $0.70.

• Inverse Head & Shoulders: Breakout confirmed with a measured target around $0.40.

Key Levels to Watch

• $0.30 – 0.618 Fib level. IH&S neckline and current support. A break below it would invalidate the IH&S setup and potentially lead to a retest of the wedge's resistance as support.

• $0.36 – 0.5 Fib level and previous S/R.

• $0.40 – IH&S measured move target.

• $0.50 – 0.236 Fib level and previous resistance / swing high.

• $0.70 – Wedge measured move target.

Volume Analysis

Breakout volume is not as strong as expected, suggesting the need for further confirmation. A continuation with increasing volume would strengthen the bullish case.

XRP Potential Falling Wedge / Bull PennantBINANCE:XRPUSDT is consolidating within a structure that could be interpreted as either a Falling Wedge or a Pennant — both typically bullish in the current context.

Dual Scenario Setup

• Falling Wedge – A classic bullish continuation structure. Breakout target: ~$4.00.*

• Bull Pennant – A high-conviction continuation pattern. Breakout target: ~$5.30.*

* Both targets are measured from the presumed breakout point and are only valid if price breaks out in the near term.

Key Technical Levels

• Resistance: ~$2.40 – The descending trendline capping price since January.

• Support: ~$1.60 – Confluence of support support trendline + 0.618 Fib retracement of the rally + 1-Year EMA.

• Supply Zone: ~$3.40

• A break below ~$1.60 would invalidate both patterns and shift bias to bearish.

Volume Note: Gradual decline during consolidation supports both wedge and pennant interpretations. A spike in volume post-breakout would confirm strength.

Until a confirmed breakout above ~$2.40 resistance, this remains in a No-Trade Zone for me — but one worth watching closely.

POL (MATIC) Falling Channel BreakoutBINANCE:POLUSDT is attempting a breakout from a nearly 6-months long falling channel. A daily close above the resistance would offer confirmation.

Watch for a potential retest of the resistance as support, as the overbought Daily RSI could signal an imminent pullback.

Key Levels

Aside from the support, these are all good candidates for partial TPs.

• $0.15-$0.17: Bull order block and current support

• $0.30: Previous S/R, 0.236 fib of the move down, and HVN. Will likely offer resistance.

• $0.53: Previous S/R, and 0.618 fib of the move down.

• $0.66-$0.77: Main supply zone, and December 2024 high.

MKR Falling Wedge Breakout + Target & Key LevelsBINANCE:MKRUSDT just broke out of a 1-year long falling wedge, see 1D zoom below.

Further confirmation would be either:

• Daily retest of the resistance as support

• Weekly close above the resistance

Key Levels to Watch

Aside from the demand zone, these are all potential resistances and good candidates for partial TPs.

• $520-$720: Key demand zone. A break below it would invalidate any bullish setup.

• $1600-$1800: Daily sell order block, and the first resistance to overcome.

• ~$2000: 0.382 fib of the move down, and HVN*.

• $2300-$2400: 0.5 fib of the move down, daily sell order block and previous support

• ~$2800: 0.618 fib of the move down, and HVN*.

• $3800-$4000: Daily sell order block, and 2024 high.

The falling wedge measured target is $3700 .

* HVN = High Volume Node

HBAR Falling Wedge / Bull Pennant + RSI breakout (1D)BINANCE:HBARUSDT has spent months correcting after a strong rally and is now compressing within a falling wedge — which could also be interpreted as a bull pennant.

Two Potential Scenarios

• Falling Wedge – A classic reversal setup with bullish RSI divergence and declining volume. Measured target: ~$0.335.*

• Bull Pennant – A continuation pattern formed after the late-2024 impulse. Measured target: ~$0.525.*

Early Bullish Signs

• Declining volume as the pattern developed could signal waning seller strength.

• RSI breaking out of a multi-month downtrend, and retesting the resistance as support, can be a leading signal of a subsequent price breakout.

Key Levels

• $0.050 – Multi-year demand zone.

• $0.120 – Current support + HVN* + previous S/R + 0.786 Fib.

• $0.180 – Resistance + HVN + previous S/R + 0.618 Fib.

• $0.280 – HVN + prior swing high + likely resistance.

• $0.320–$0.460 – Monthly supply zone (in place since March 2021).

• $0.335 – Falling wedge measured target (depending on breakout timing)**.

• $0.360–$0.400 – Daily sell-side order block, expect resistance.

• $0.525 – Bull pennant target (depending on breakout timing)**.

* Wedge and pennant targets are measured from the breakout point, so the actual target will vary the longer we spend within the pattern.

** HVN: High Volume Node — zones of concentrated past trading activity, reinforcing S/R relevance.

⚠️ Until a clean breakout occurs, CRYPTOCAP:HBAR remains in a compression phase and a No-Trade Zone.

LINK Potential Falling Channel Reversal + RSI SignalsBINANCE:LINKUSDT has been in a downtrend since December, grinding inside a falling channel for 2 months, and it's now sitting right above the key ~$10.00 demand zone.

Price Action

• Price is respecting both bounds of a well-defined falling channel.

• Currently consolidating just above the demand area, early signs of potential strength.

RSI Insights

• Clear bullish divergence at demand zone retest.

• RSI could be approaching a breakout of its multi-month downtrend — worth watching closely.

Key Zones

• Support: $9.5–$10.5 is critical. It held last time and could fuel a reversal. If broken, it would invalidate the setup.

• Resistance: Falling channel upper boundary.

• Confirmation: RSI breakout + channel breakout = potential confirmation of trend reversal.

Also watch $15.5-$16 (previous S/R) and the whole $18-$20 area, which previously acted as support and has a high volume traded. Both could be good levels to take profits, together with the main supply zone in the $25-$27 area.

Still in a No-Trade Zone until a breakout is confirmed.

Bitcoin Bull Pennant / Falling Wedge BreakoutBINANCE:BTCUSDT recently broke out of a Bull Pennant / Falling Wedge, and seems to be retesting the resistance as support.

This follows two leading RSI signals:

• RSI downtrend breakout

• RSI bull divergence

Breakout Targets

• $115K — Falling Wedge measured move

• $130K — Pennant projection

Key Levels to Watch

• $72K — Main support + invalidation (former resistance + 0.618 Fib from 49K–109K)

• $91.5K — Prior support, now a key resistance to reclaim

• $109.5K — All-Time High

JASMY Falling Channel BreakoutBINANCE:JASMYUSDT just broke out of its falling channel, with strong volume despite it being a weekend move, and is attempting to reclaim the previous support zone around $0.016.

Observations

• Second clear breakout from a descending structure in the last year.

• Good volume spike backing the move — first meaningful demand since the December peak.

• Attempt to reclaim the $0.016 support zone, which had acted as a base throughout 2024.

Key levels

• A daily close above the resistance would confirm the breakout.

• Holding above ~$0.016 would be an even stronger bullish sign.

• Next major resistance at $0.041-$0.045 from the previous supply zone.

• Watch the 1-year EMA above $0.021 as a potential shorter-term resistance.

If momentum continues, this could be the start of a larger trend reversal, with $0.041 as the first upside target.

ONDO Falling Wedge + Bullish DivergenceBITGET:ONDOUSDT is compressing inside a falling wedge, now trading near key support. Signs of potential reversal are building.

🔹 Key Observations

• Pattern: Falling wedge (bullish bias)

• Support: Price is holding just above the ~$0.68–$0.75 demand zone

• Volume: Declining throughout the wedge – typical pre-breakout behavior

• RSI: Bullish divergence forming + compression under 50, often seen before breakouts

🔸 What to Watch

• Breakout trigger: Daily close above wedge resistance (orange trendline), ideally with volume

• Target zones: $1.30 to $1.60, then $1.90 to $2.10 (prior S/R levels)

• Invalidation: Breakdown below the green demand zone ($0.68)

⚠️ As always, confirmation matters – no breakout yet. But the setup is clean and worth watching closely.

Bitcoin RED Trendline still is dumping price soon 72K$As we can see on chart too Red trendline resistance is now one of the major resistances for Bitcoin and the other one is 93K$ so until these resistances are still holding and are valid price can fall more and see more dump to the next target which is 72K$.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

CAT - Falling Wedge PatternKUCOIN:CATUSDT (3D CHART) Technical Analysis Update

CAT is currently trading at $0.000008225 and showing overall bullish sentiment

Price has broken out from the falling wedge pattern and we are seeing beginning of the bullish trend. Expecting this trend to continue until the price hits the resistance zone.

Entry level: $0.000008225

Stop Loss Level: $0.000004602

TakeProfit 1: $0.000011536

TakeProfit 2: $0.000011536

TakeProfit 3: $0.000034238

TakeProfit 4: $0.000065098

Max Leverage: 2x

Position Size: 1% of capital

Remember to set your stop loss.

Follow our TradingView account for more technical analysis updates. | Like, share, and comment your thoughts.

Cheers

GreenCrypto

BERA Defies Market Trends, Eyes 160% Surge Amid Bullish MomentumIn a market facing significant volatility, BIST:BERA has emerged as a top-performing Layer 1 (L1) blockchain coin, surging 13% in 24 hours and inching closer to its all-time high (ATH) of $15.20. With a resurgence in buying pressure, increased spot inflows, and a strong technical outlook, BIST:BERA is positioning itself for a remarkable recovery.

Why is BIST:BERA Pumping?

- Strong Buying Pressure: The Chaikin Money Flow (CMF) indicator stands at 0.04, signaling bullish inflows.

- Capital Movement: After witnessing $2.6 million in outflows, BIST:BERA has now recorded $316K in fresh spot inflows, indicating renewed investor interest.

- Investor Sentiment: Holders are choosing to accumulate rather than sell, reinforcing long-term confidence in the asset’s value.

Moby Expands to Berachain, Strengthening Its DeFi Ecosystem

A pivotal development for the Berachain ecosystem is the launch of Moby, the No.1 options protocol on Arbitrum, on the Berachain Mainnet. Moby has facilitated over $3.5 billion in total trading volume and is now set to transform on-chain derivatives trading within the Berachain network.

Berachain distinguishes itself as an EVM-identical Layer 1 blockchain that operates on the revolutionary Proof of Liquidity (PoL) consensus mechanism. Unlike traditional Proof-of-Stake (PoS) networks, PoL embeds liquidity provisioning directly into the security model, ensuring that validators, applications, and users benefit from a seamless and capital-efficient ecosystem.

Moby’s selection for Berachain’s prestigious Request for Application (RFA) program signals its critical role in the ecosystem. The protocol has also forged key partnerships with Kodiak, Infrared, PumpBTC, and GMX, further expanding its influence in DeFi.

Technical Outlook: BIST:BERA ’s Bullish Setup

At the time of writing, BIST:BERA is up 4%, ranking among the top-performing altcoins of the week. Despite a 65% decline from its listing price, key indicators suggest that BIST:BERA could be on the verge of a substantial breakout:

- Relative Strength Index (RSI) at 65: Holding strong, indicating sustained momentum without being overbought.

- Falling Wedge Pattern: A classic bullish reversal pattern, hinting at an imminent uptrend.

- Potential 160% Surge: BIST:BERA could aim to reclaim its previous ATH of $15.20, presenting a significant upside opportunity.

Conclusion

With a combination of **strong technical indicators, surging capital inflows, and an expanding DeFi ecosystem**, BIST:BERA is well-positioned for a significant rally. As the asset gains traction, traders and investors should closely monitor its price action, as the next leg up could be the most explosive yet.

Will BIST:BERA reclaim its ATH and set new records? The market is watching, and the momentum is undeniable.

NOTUSDT has formed a Pretty Big falling wedge Pattern!...Notcoin is forming a falling wedge on Daily timeframe , Up we go if we do breakout.

✨Traders, if you liked this idea or have your opinion on it, write in the comments, We will be glad.

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

AVAX - TRADING AT KEY SUPPORT LEVEL#AVAX/USDT #Analysis

Description

---------------------------------------------------------------

+ AVAX is currently trading at a key support level, and holding this level is crucial for maintaining further bullish momentum.

+ A falling wedge formation is also visible, and a breakout from this pattern could drive the price higher.

+ A clear reversal from the support zone is needed to confirm the bullish trend. We can enter a long trade at the current price, with a stop-loss set below the support zone and a target at the local resistance.

---------------------------------------------------------------

VectorAlgo Trade Details

------------------------------

Entry Price: 20.88

Stop Loss: 15.93

------------------------------

Target 1: 28.10

Target 2: 37.44

Target 3: 48.62

Target 4: 62.34

Target 5: 87.40

Target 6: 99.28

Target 7: 133.97

------------------------------

Timeframe: 1W

Capital Risk: 1-2% of trading amount

Leverage: 5-10x

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights.

Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo

gold will sell more and morein my previous analysis i told that we are not changing our trading plan without a good reason.we are facing now good effects of that again hited more than 100+ pips.we are not changing plan yet we are still seller gold is trading below range 2355 we can still sell.

to change the plan the gold has to be broken about 2360 range with a candle close above that range ..i am with breakeven .

I Cannot Short This !!! situation+next targets.Hi.

KUCOIN:GTAIUSDT

➡️ the odds of another bullish Movement is Pretty high because the pattern which GTAI is in, Is a Bullish wedge Pattern! Since The break out has happened.

✅ Due to the Ascending structure of the chart...

🟢 The odds of another Bullish Movement is High!

🟢 Bullish wedge is Visible on The chart!

🟢 Bullish Divergence

🟢 FALLING WEDGE

🟢The break out has happened

✨Targets are:

🎯$2.7060

🎯$3.0200

🎯$3.5000

🎯$4.0165

🎯$4.5580

🎯$5.0490

Previous Analysis:

Stay awesome my friends.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Tron(TRX) is ready to fallTron has reached and reacted to the extreme orderblock of the minor structure in the daily time frame.

We expect it to start downtrend and fall from this point.

The only way to faild this analysis is a candle closes above the extreme order block, which is also very unlikely.

This is my personal analysis and its not a financial advice.