Falling

Breakout of falling wedge $TSLATSLA has been trading in a falling wedge since the middle of december 2018.

It perfectly touched the upper and lower trendline a few times and now broke out above the upper trendline.

Entry for this is anywhere around 292$-295$

Target = 372$

Stop loss = 235$

Risk/Reward ~ 1.4 - 1.5

EURUSD Falling WedgeA bullish wedge is what we can see here on the lower timeframe (1hr), I'm trading this as shown on the chart.

We see the price closing in what means the bears are losing control pushing the price down over the buying up from the bulls.

This can be traded on the breakout, but with a narrow wedge like this there is more chance missing the entry.

You could also watch for a price lower, the RSI is not oversold yet but that is just an indicator that would conform your entry on a support or resistance.

Notice that I'm regularly trading on closing wedges rather then breakout since I'm not a fulltime trader and can't watch over the markets all day everyday.

Also this would not be my trading style because I don't want to get emotional involved with the markets, my way of doing this is just to spot a pattern and stick to the plan.

Thanks for reading and have a good day!

Wesley

Are you prepared for the next 30 plus percent off???We are in the end of this bear trend, but we will fall a little bit more one more time.

Be prepared to the fast fall!

If you are longing with leverage, don't forget to set your stops to prevent liquidations.

In my opinion, in the next weeks, we will fall to USD 2750, maybe with a leg touching the USD 2400 or something like that, and then Bitcoin we will rise up slowly back to USD 3400/4500 level for a few months.

But, this will be the cheapest price we could see bitcoin ever again, so don't think this will be the end! Believe, this will be the begin of the preparation time that market needs to next and biggest Bull rally!

Total Marketcap Weekly 200ma vs 20ma continues. At crucial pointWe can now see on the Total Marketcap's weekly chart we have managed to inch our way above the weekly 20ma's strong support. We need to of course close 2 consecutive weekly candles above this MA in order to confirm we have flipped it from strong resistance to support however and we can see the weekly stoch rsi is currently overextended and could potentially see a bearish cross here in the near future. For that reason, I'm not yet sure that the bulls will win the battle between the 200ma support and the 20ma resistance...If we do dip back below the 20ma before closing 2 weekly candles above it, my guess is we will be dropping back down to at the very least retest the weekly 200ma's support and possibly even break through it. I think if this occurs it will probably result in capitulation and even though we ma break under the 200 weekly I think on the weekly chart we will still ultimately find support there with maybe a huge wick to the downside dipping below it as capitulation. From there hopefully we would see a big bounce again provided by the 200 weekly ma that could have enough momentum to finally break us firmly above the 20 ma..and finally be done with the bear market. Of course if we see 2 weekly candle closes above this 20 MA I will instead be confident that probability strongly favors the bottom is already in and we should then see a corresponding significant bullish surge to go with it that takes us towards the breakout target of the larger falling wedge. We will likely find out in the next week which way we will be heading.

GOLD COMEX: Drop in the value of gold. What to expect next?COMEX:GC1!

On the chart, we see that we started the downward movement, as you can see, a “falling star” reversal candle was formed earlier, which directly signaled the impending fall. As it seems to me, the fall will continue further if we do not restore the price and break up the blue line.

I wish you good luck, do not forget about the stop order.

BitcoinBitfinex 1D chart

What happened today is of course this manipulation, the index of greed is off-scale, so this fall has happened.

Can we think for a long time why this happened?

But the fact remains.

what's next?

This is what I showed on the chart.

Here showed a grid of levels and lines of supports and resistances and possible options for continuing the movement.

We still continue to move in the upstream channel, we are near the support line and it is likely that after this impulse I expect a slight correction in black or in a large yellow triangle. With the continuation of the movement

An exciting updated look @ the weekly total crypto market chart!An update to the weekly falling wedge we've been keeping track of on the total crypto market cap chart. We currently are breaking up from the 1 day yellow falling wedge. If we can maintain above the 1 day 50ma(not shown here) which we likely will, we will also trigger breakout of this larger 1 week red falling wedge! If we trigger the red falling wedge the entire market could triple to quadruple in value! We can see that much like bitcoin's chart, the weekly 200 ma (shown here in blue) has provided tremendous support. If we do indeed triple the market value from a validated bullish breakout of this wedge, I would be very confident that the bear market would officially be over at that point. Always potential for fakeouts of course though so I will remain vigilant for any bearish turnarounds but as for now probability is heavily favoring a triggered breakout of the red falling wedge within the next two weeks. We may very well be witnessing the start of it.

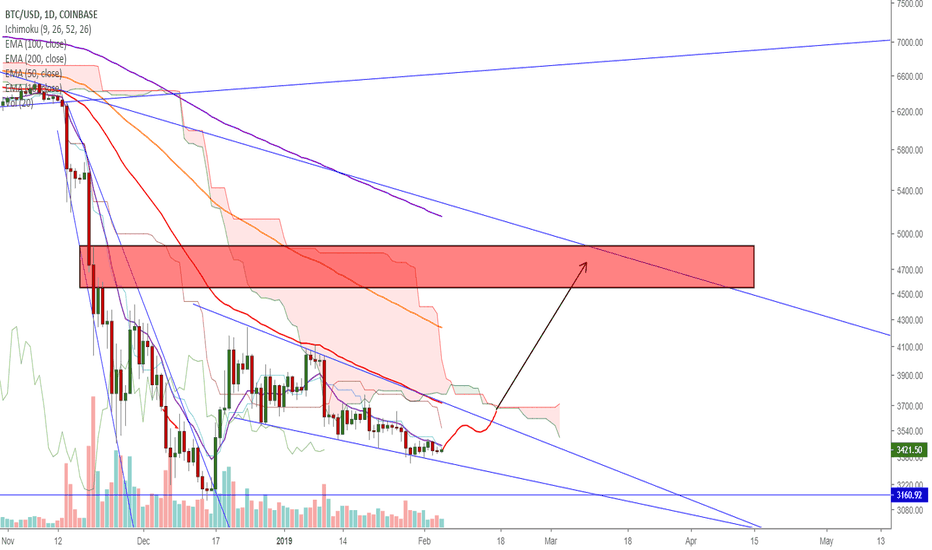

Bitcoin 1D chart falling wedge. (Read comment!)I have been waiting for days for a clear pattern and here it is a falling wedge. I am expecting Bitcoin to break up this falling wedge in the 3rd week of february. If that happens the breakout will be followed by strong volume bringing us to test again the resistance line that has been dominating the market in this bear trend. The resistance will be strong and not sure if it BItcoin will be able to break it but the ride to this resistance(4600-5000) can already be very profitable in many ways.

I am not going to open new trades before it breaks up this falling wedge . Chances of breaking up are around 68% for a falling wedge and a pullback happens 50% of the times so I am going to wait for the pull back when/if it breaks up and then will open a long position on Bitmex and will buy some altcoins . When Bitcoin reaches the resistance area I will start closing my trades and will wait for a new pattern and more data.

Until the breakout more accumulation and sideways is expected as we saw in the last weeks. I am expecting considering my chart 9-12 days more of accumulation and sideways before the breakout. So right now I will just be patient and watch how this pattern is going to play out.

BTC 4hr 50ma trying to lift price action out of fallingwedge It's come down to the strong support of the 4hr 50 ma vs. the strong resistance of the 1 day 50ma...who will win? We can see here on the 4hr chart that the 4hr 50ma is doing its best currently to hoist the price action up out of the falling wedge for a breakout but each and every time it tries to breakout the 1day charts 4hr 50ma gives it a strong rejection back down into the wedge. For now I'm bullish until both moving averages get slightly closer to eachother once price action is finally getting squeezed between the 2 like a pair of chopsticks I will be more neutral, however, btc may have gained enough bull momentum from the breakout of the wedge to help the 4hr 50ma muster the strength to overcome that resistance and actually solidify it as support for once. I've been consistently saying this whole time that we need to solidify the 1 day 50ma as support in order to sustain any further bullish upside. That remains true...so in the short term until we get back up to the 1 day 50ma I'm bullish then when we get there I'm neutral until I see it flip to solidified support...if it can do that then I'm definitely long. Mainly for the immediate future I think the 4hr 50ma is powerful enough to at least reach the 1 day 50ma before potentially solidifying as any kind of resistance.

Siamese Falling Wedges & a 4 Hour Golden CrossWe can see we will likely be getting a 4hr golden cros on the 4hr chart roughly 2 hours from now on Bitstamp(shown here). A quick look on the Bitfinex chart(not shown here) shows me a 4hr golden cross has already occurred on that exchange which could be why we are already seeing 3 nice green candles in a row here.Of coure it could also be in anticipation for the golden cross as well. Other bullish elements include the current falling wedge we are in(in yellow). It is nearing its apex and we can also see that it is overlapping with another falling wedge(in white). This overlapping wedge effect I haven't seen talked about before but the term I'm coming up with for it is siamese falling wedge because they are kind of fused together. Currently the most valid of the 2 wedges I believe is the yellow wedge and it is exciting to see price action trying to break above it...unfortunately right at the top trendline of the yellow wedge we currently have the historically strong teal horizontal teal line overlapping the trendline and creating a double reinforced resistance. Ultimately the kind of patterns eventually resolve bullishly so I anticipate we will inevitably break upward here...the 4hr stochrsi ah plenty of room to go up. However, I now think the breakout target is gonna be more for the wedge than it is any kind of long poled bull flag so I don't believe we will be breaking out of the bigger wedge above it necessarily but I do believe we will at least test it and we will hopefully finally break above the 1 day charts 50 ma for a bit which has been incredibly powerful resistance for a long time. Whether or not we will be able to sustain priceaction above the 1 day 50ma and flip it to solidified support I will have to wait and see how things look once we get there. For now I am at least in the immediate and semi short term long. Just my position though not financial advice by anymeans. Thanks for reading!

Possible falling wedge breakout on ZCash.Nice volume so far here but remember this is a 1 day chart pattern so there is still 7 hours left in the 1 day candle for a fakeout to occur...so far probability is favoring the breakout however. The 4hr stochrsi is definitely overextended for now though but it may ignore that and keep bullishly breaking upward.

USOIL Falling WedgeUSOIL seems to be in a falling wedge.

This pattern seems to be formed but not ready to break yet, think the black gold will drop a little more before make some gains.

Will update later on if this wedge is holding or broke, if it closes in like expected this could be a good trade opportunity.

Thanks for reading and I would appreciate some feedback!

Total Crypto Market Cap Weekly Chart Update.Things are getting exciting here as Crypto may have now closed 2 weekly candles above the weekly falling wedge pattern and could b poised for a breakout at anytime...however where the latest weekly candle has closed has also opened the door for the ossibility of the top trendline of the wedge to be considerably higher than originally thought (shown here with the dotted green hypothetical trendline)..either way we also have a smaller 1 day chart falling wedge(shown here in red) that price has currently been consolidating in as well and that pattern has already cleared the solid green top trendline of the wedge...it should clear the hypothetical dotted green top trendline too by the beginning of March. If the solid green topt rendline is the legitimate trendline we should see a significant breakout upwards sometime within the next couple weeks...if not and the dotted trendline is the valid one we should see a significant break out upward around the first 2 weeks of March...either way you lice it though I'm confident we will be breaking out soon....and if not until march the price target will be even bigger than if we break out in the next week or 2 so it really is a win win situation no matter which top trendline is most valid. Just my opinion though of course and not financial advice. Thanks for reading!

BTC breaks up & closes candle @ exact target of projected brkoutAlthough the falling wedge lost its 4hr chart validity when the red candle closed green giving it only two wick touches on each trendline, the break upward that has occured has conveniently closed its breakout candle at the exact breakout target the wedge would have had. I've yet to see a wedge this long breakout this prematurely so I think it may more likely be simply an inverted bart that has occurred shortly after a bearflag breakdown fakeout but the confluence of the breakout target of the inv bart with the wedge target is very synchonicious. Very curious to see how often a falling wedge has broken up this early on other charts on the past.

Potential 4hr chart falling wedge confluence w/ h&s drop targetThe current price action is starting to form a potential falling wedge on the 4hr chart...interestingly enough the apex of that potential falling wedge is at the exact same point as the drop target from the 4 hour chart head and shoulders pattern we recently broke down from. I find that confluence very interesting and something that gives more credence to this four hour wedge being legitimate. However with such a big support line as the weekly 200ma just below I'm not gonna be trying to do any limit sells or even shorts here because that support could easily bust us up out of this pattern logn before it reaches the wedge apex/h&s drop target. For this reason this idea will be left neutral.

AUD/USD - All eyes on SHORT!Hello traders,

We are looking at AUD/USD 4HR chart, where we can see price just broke out of a Rising Wedge Pattern.

Overall the trend is still Bearish so looking for continuation and for a sell opportunity on the Wedge Re-Test.

Wait for Re-test and then a Bearish Candle confirmation and we can enter this trade with great risk-reward.

I will update this trade soon, when we reach 5 comments!

If you like my work be sure to leave a LIKE or comment below!!

See you soon,

Rodrigo FAC TEAM

XRP falling wedge longer than originally thought…no breakout yetWhat started as a 4hour falling wedge that appeared to breakout but hit nowhere near its projected target is now seeming more and more valid as a considerably longer 1 day falling wedge instead of which we have not broken out of yet. If this is indeed the case then it's possible that we may not see xrp break up from this wedge until we revisit 28 cents r possibly even as low as 23 cents which would be a zone that could provide a massive double bottom along side the falling wedge breakout. we will have to wait and see but at this current time it does appear the adjusted trendlines here for the longer wedge are now more valid than the previous wedge. Of course we also currently have a potential Inverted head and shoulder on the 4hour chart that could play out as well as a descending triangle on the 4hour that comes just after a nice bullish green candle making that pattern bullish....both of these patterns could potential send us upward and nullify the chances of a longer falling wedge but the 1 day stochrsi suggest we will be headed slightly further south still and this new longer wedge does seem to line up with btcs falling wedge timeframe a lot better too.