FAS

FAZ / FAS a demonstration of ratio-tradingHere on a daily chart the ratio of the Bearish Leveraged Financial ETF to its Bullish counterpart

is showing to be in a descending parallel channel. The chart is marked with comments about

trading considerations of these ratios at a given time. At present, the FAZ is undervalued

and should be bought. On the other hand, Bullish FAS, should be either sold if positions are

held.

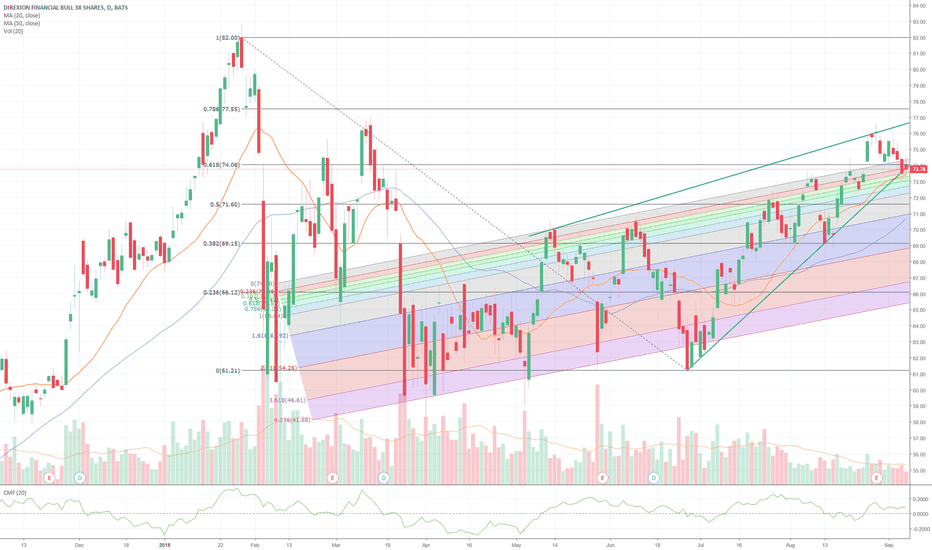

FAS bullish leveraged EFT on the financial sectorFAS is one of the Direxion leveraged ETFs focused on the financial sector. As can be seen on

the 15 minute the price action has had increasing volatility in the past month. Increasing

volatility is the hallmark of the megaphone pattern ( a megaphone is a cone like hand held

plastic device used in the old days before bullhorns and other things to amplify voice for

cheers). FAS may have increasing volatility because of federal actions related to rate hikes,

some bank failures and the banking industry adjusting to the " new normal" as higher rates

become increasingly integrated into the financial system while still remaining viligent

regarding a recession and its own set of complications.

To play a megaphone traders will typically set a plan to buy on the lower support trendline

hold for a short period and then sell at the upper resistance trendline. I will open a long

trade on FAS given that it is presently near to support making for a suitable risk to reward

ratio if putting a stop loss immediately below the support trendline.

FAZ Bear Leveraged Financial Economy ETF LongAs the fed raises rates to try to throttled down inflation, the economy and the financial sector

suffer. FAZ got its catalyst today in the federal news. It is a bearish fund that will go up

while the FAS ETF will go down.

On the 2-hour chart, the price can be seen rising to crossover the VWAP anchored a month back.

It is nearly crossing over the POC line of the intermediate-term volume profile.

These are both bullish moves confirmed by a dramatic increase in trading volumes perhaps

4-5X of the moving average volume.

The overall picture is a long trade setup either with stock or strategic but more risky

call options which could 10X.

Bullish Cypher target $37Looking at this trading range, I've spotted a previous bearish cypher, a current bullish cypher. Price Action has retrace back to the Previous (B) leg of the Bearish Cypher. The Previous resistances, is currently acting as support for the D leg of the present bullish cypher.

We can confirm this w/ the bottom of the Stoch RSI.

I'm looking to buy put options on $faz ( the financial 3x bear ETF ) near the open bell Monday Morning.. I can also buy shares in the premarket of $xlf or call options. It will depend on the price action of both at that time.

jpm $147.50 targetTracking the Money flow and the AD. Its showing me an $147.50 target on jpm via an ascending triangle. It previous broke out of the cup/handle pattern. Which was led by an bullish ABCD Pattern and Bull Flag. D leg should be the retrace leg, the AD could retrace back to the previous breakout handle.. Will re-evaluate at that time.

$FAS Softens on Conference Weight, but Catalysts LoomFAS took a beating on Tuesday during the Barclay's bank conference as players revealed all the nasty writedowns on the way.

But the BofA survey of large fund managers also hit the wires, showing that the most concrete outlook is an expectation of a steepening yield curve once a vaccine is around, which directly translates into rapid growth in bank net margins. Look for dips here to be reversed on squeezes as we push toward an inevitable vaccine.

$RTY_F $rut $spx VIDEO ANALYSIS - Small Caps Mega Breakout!While the large-cap stock indexes like the $SPY $SPX $QQQ $DIA have been running higher, they are now at resistance and should stall out or at least slowdown. Small-cap stocks have been building a base for a mega rally that could make the large-cap run look like chump change!

See more analysis on the small-cap sector: Click Here

European banks turn up as US 30 year treasury bonds fallBanks do better in a high interest rate environment. The US central bank is going to be reducing its balance sheet by selling US bonds. As the yield curve steepens, interest rates rise. If reflation holds (DXY falls, interests rates rise AND it doesn't crash the market), banks could do very well. Watch for upward resistance here. The european banks are up today. To see the intraday STOXX 600 banking prices, go to STOXXdotcom and search sx7p. See the links to the relevant etfs for trading options.

I am only short USB10yUSD via TWO right now. Note the chart shows 1/USB30yUSD, the inverse of the bond price (yield is also inverse to the bond price).

The Financial SectorThe Financial Sector

The following ETFs are related to the Financial Sector. The ETFs track different sections of the financial sector as noted. There are many more ETFs in financial subsections for the USA and international equities. Included for each ETF are the symbol, the total Assets Under Management (AUM), the Number of Shares in circulation (Shares), the Average daily Trading Volume (Avg Volume) for the 3 months prior to 7/12/2017, the Expense Ratio, and the Bull//Bull type as well as the leverage ratio.

I have tried to copy these data carefully but cannot be held responsible for any mistakes made. These data are important because high volume ETFs are liquid which means you can get in and out quickly and there is a smaller spread between the bid and ask price. This affects the actual profitability of the entry and exits trades. The same considerations applies to put and call options. Use the highest volume ETF that you can.

The risk of the 2x and 3x Leveraged ETFs is that the 2x or 3x ration only applies to one trading day. After that, the ratio declines daily due to the rebalancing effect. NEVER hold 2x or 3x ETFs long term as they fall in value over time. For long shorts (in a non margin account or 401k), just buy the 1x Bear ETF. Unfortunately FAZZ is very low volume.

XLF AUM 25.2 Billion, Shares 1,006 M, Avg Volume 73.9 M, Expense Ratio 0.14%, 1x Bull

Broad sector exposure.

VFH AUM 6.0 Billion, Shares 94.7 M, Avg Volume 0.8 M, Expense Ratio 0.10%, 1x Bull

***Note VFH tracks the MSCI US Investable Market Financials 25/50 Index

IYF AUM 1.8 Billion, Shares 16.4 M, Avg Volume 377,765, Expense Ratio 0.44%, 1x Bull

***Note IYF tracks the Dow Jones U.S. Financials Index

UYG AUM 847 Million, Shares 8.0 Million, Avg Volume 46,208, Expense Ratio, 0.95%, 2x Bull Leveraged

***Note UYG tracks the Dow Jones U.S. Financials Index

FAS AUM 1.4 Billion, Shares 29.3 M, Avg Volume 2.7 M , Expense Ratio 1.05%, 3x Bull Leveraged

***Note FAS tracks the Russell 1000 Financial Services Index

FAZ AUM 197 Million, Shares 12 M, Avg Volume 1.7 M, Expense Ratio 1.1%, 3x Bear Leveraged

***Note FAZ tracks the Russell 1000 Financial Services Index

SKF AUM 43.7 Million, Shares 1.7 Million, Avg Volume 38,138, Expense Ratio, 0.95%, 2x Bull Leveraged

***Note UYG tracks the Dow Jones U.S. Financials Index

FINZ AUM 173.0 Million, Shares 0.1 Million, Avg Volume 1,766, Expense Ratio 0.95%, 3x Bear Leveraged

***Note UYG tracks the Dow Jones U.S. Financials Index

FINU AUM 27.1 Million, Shares 0.4 Million, Avg Volume 10,327, Expense Ratio, 0.95%, 3x Bull Leveraged

***Note UYG tracks the Dow Jones U.S. Financials Index

FAZZ AUM 1.7 Million, Shares 0.1 M, Avg Volume 310, Expense Ratio 0.58%, 1x Bear

***Note FAZ tracks the Financial Select Sector Index VERY LOW VOLUME

I put these here for your and my convenience so we can use the elf which fits our needs best. If you know of a higher volume 1x bear etc for this sector, let me know.

For premarket US traders, you can go to STOXXdotcom in the morning and look up symbol SX7P (STOXX® Europe 600 Banks) as a leading indicator of how US banks will be doing.

TRADE IDEA: FAS AUG 18TH 18/28.5 SHORT STRANGLETruth be told, I'm not a huge of fan of leveraged instruments, but when a $23 underlying has the potential to yield a $100 or more worth of credit, I'll briefly overlook the warts these instruments have as an "investment" tool ... .

Here are the metrics for the play:

Probability of Profit: 77%

P50: 81%

Max Profit: $127/contract at the mid (this is off hours pricing; we'll have to see whether that's possible at NY open)

Max Loss/Buying Power Effect: Undefined/$232/contract (estimated/off hours)

Break Evens: 16.73/29.77

Notes: I'll look to get a fill for anything north of $100/contract, given the price of the underlying. As usual, I'll look to take this off at 50% max profit.