Fcpo!

Crude Oil Palm Continues to Ride the downward Coaster. Hello dear Malaysian traders,

Hoping express that everyone is in good health.

The global supply chain is infected, by this pandemic Covid. Every body was asked to stay at home, the workers are stopping from work. And there is no logistics can be done. The crude oil palm demand is also falling.

The best is, continue Short / sell with strength of downward pattern.

If you find my analysis is useful and helping you out, please do like, follow, and comment.

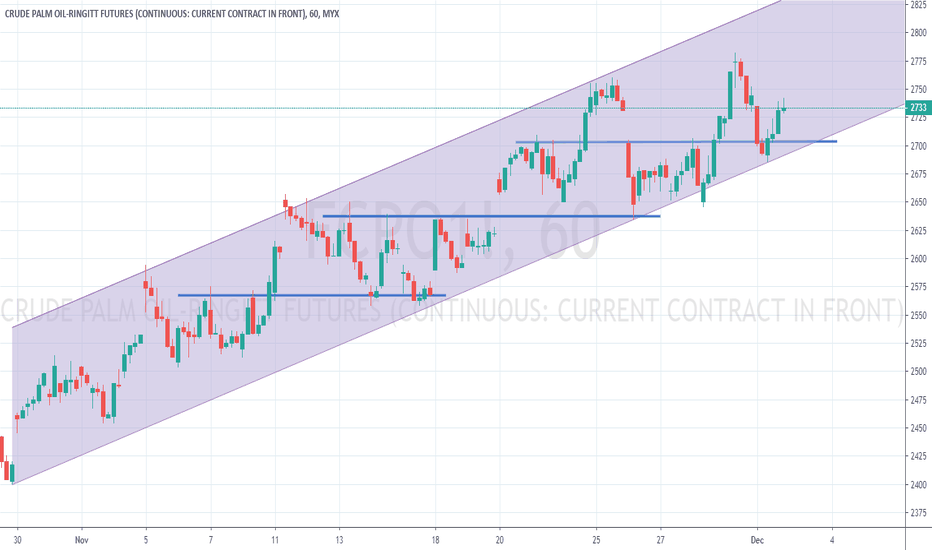

FCPO - Bullish AB=CDFCPO price has been fallen 862 points from peak of 3150 to 2288 (10/01/2020 - 28/02/2020).

In the daily time frame, a bullish AB=CD pattern has completed in the at the price of 2288 and start climbed to 2383. We expect the price would retest the potential reversal zone at range of 2288 - 2176 to find a support before it's continue rising north again.

PRZ = 2288

HOP = 2176

TP1 = 2617

TP2 = 2821

Waiting for the RSI to complete oversold in the HOP and enter order at the PRZ.

FCPO 26/2/2020 Trading Ideas, Rebound Day?Yesterday's CPO has dropped due to the drop on the sales result. Expect to rebound today.

Current: Still under downtrend

Expect to rebound and continue to drop

Long - at market open, TP before 2550(wait for retrace if manage to TP), CL 2430

Short - if break blue trend line

*This are my own trading plan, no intention to ask reader to buy/sell. Share with me if you have different ideas. Thanks.

what a year for fcpoI would like to wish all of traders a happy new year and happy trading in year of 2020. CPO is one of performing commodity. Bullish trend since Oct 2019. May year 2020 will bring a lot of profits. Do not give up in trading. Find a method that suit your personality. Feel free to message if you have any difficulties in trading.