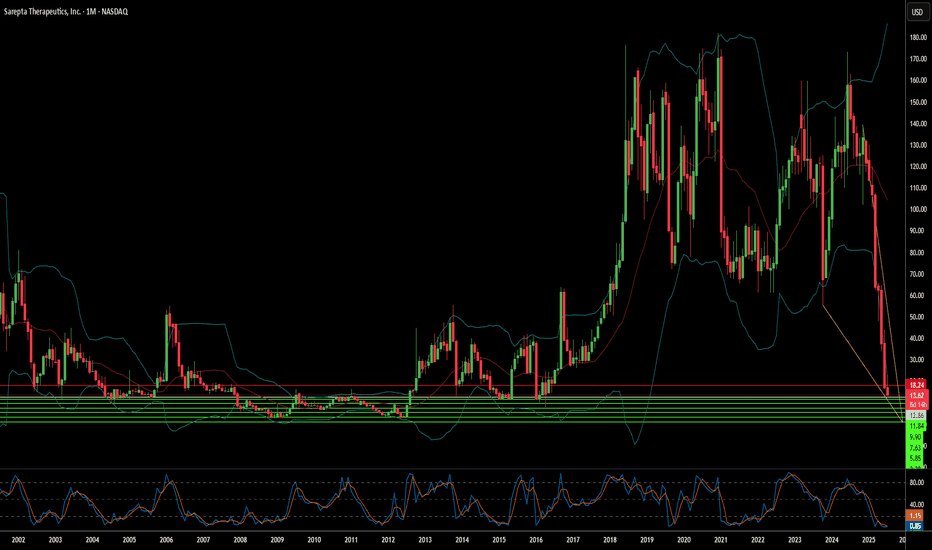

Sarepta's Plunge: A Confluence of Challenges?Sarepta Therapeutics (SRPT) faces significant market headwinds. The company's stock has seen a notable decline. This stems from multiple, interconnected factors. Its flagship gene therapy, ELEVIDYS, is central to these challenges. Recent patient deaths linked to similar gene technology raised safety concerns. The FDA requested a voluntary pause in Elevidys shipments. This followed a "black box warning" for liver injury. The confirmatory EMBARK trial for Elevidys also missed its primary endpoint. These clinical and regulatory setbacks significantly impacted investor confidence.

Beyond specific drug issues, broader industry dynamics affect Sarepta. Macroeconomic pressures, like rising interest rates, reduce biotech valuations. Geopolitical tensions disrupt global supply chains. They also hinder international scientific collaboration. The intellectual property landscape is increasingly complex. Patent challenges and expirations threaten revenue streams. Cybersecurity risks also loom large for pharmaceutical companies. Data breaches could compromise sensitive R&D and patient information.

The regulatory environment is evolving. The FDA demands more robust confirmatory data for gene therapies. This creates prolonged uncertainty for accelerated approvals. Government initiatives, like the Inflation Reduction Act, aim to control drug costs. These policies could reduce future revenue projections. Sarepta's reliance on AAV technology also presents inherent risks. Next-generation gene editing technologies could disrupt its current pipeline. All these factors combine to amplify each negative impact.

Sarepta's recovery depends on strategic navigation. Securing full FDA approval for Elevidys is crucial. Expanding its label and maximizing commercial potential are key. Diversifying its pipeline beyond a single asset could de-risk the company. Disciplined cost management is essential in this challenging economic climate. Collaborations could provide financial support and expertise. Sarepta's journey offers insights into the broader gene therapy sector's maturity.

Fda

KALV FDA approval rallyKALV received FDA approval this week for a new drug, has $220mln in cash, and just bounced off the daily 21EMA (overlayed on this 4H chart).

Recently rejected off the monthly 100ema two times (overlayed on this 4H chart). Breakout beyond the monthly 100ema and first target is $20. Numerous price target increases, most notably, one at $27 and another increased from $32 to $40.

Can a Single Onion Slice Reshape the Future of Fast Food?In a dramatic turn of events that has sent ripples through the quick-service restaurant industry, McDonald's Corporation faces a watershed moment that transcends mere food safety concerns. The recent E. coli outbreak linked to Quarter Pounder burgers, resulting in 49 reported cases across 10 states, serves as a powerful reminder of how seemingly minor supply chain decisions can cascade into significant corporate challenges. With shares plummeting 7% in after-hours trading, this crisis presents a compelling case study in crisis management, operational resilience, and the delicate balance between efficiency and safety in modern food service operations.

The revelation that slivered onions from a single supplier could potentially trigger such widespread impact challenges conventional wisdom about supply chain diversification in the fast-food industry. McDonald's swift response - removing Quarter Pounders from menus across several Western states and implementing immediate supply chain modifications - demonstrates the complex interplay between brand protection and operational agility. This situation raises profound questions about the industry's approach to supplier relationships and the potential vulnerabilities created by centralized sourcing strategies in pursuit of consistency and cost efficiency.

Beyond the immediate health concerns and financial implications, this crisis illuminates a broader narrative about consumer trust and corporate responsibility in the modern food service landscape. As McDonald's navigates this challenge, their response may well set new standards for crisis management and transparency in the industry. The incident serves as a catalyst for reimagining food safety protocols and supply chain resilience, potentially ushering in a new era where consumer safety and operational efficiency are not just balanced but fundamentally integrated into the fabric of fast-food operations.

MGNX a biotechnology penny stock LONGMacrogenenics sold-off 75% from a moderately bad earnings miss 2 weeks ago. It will be a slow

and gradual recovery in the 10 -12 weeks until the next earnings unless a favorable catalyst

appears. 5 patients died in a clinical study about the same time as earnings were due. This was

a news catalyst amplifying the earnings miss. What is unclear is the total number of patients

being studied, how many who died got the developmental drug and how many got the placebo.

Two deaths were deemed to be unrelated to that drug possibly because they did not receive

it. No matter, the investigation continues. I suspect the clinical trial is at least suspended

and could get terminated. MGNX has six other drugs in development. None are past Phase 3

and so none are revenue producing. MGRX could fail financially or clinical but then again it

could recover. If fialing it could sell-off its intellectual property and clinical trials data or

look for a rich uncle looking to get in to the cancer drug market. Only time will tell.

I see this as a very risky long trade targeting fib levels. I will devote a small capital position

here anticipating anything from a 200-250% return to hitting a 25% stop loss and calling it

finished. IF MGNX can move up I will make sure the stop loss is raised and diminshed a bit.

Those without risk appetite and a pinch of greed should take a pass on this one. Another piece

of bad news could be catastrophic while on the other hand clearance of liability by the FDA and

resumption of the clinical trial would be quite uplifting. It could be a coin flip.

$PCYG from micro to small-cap as USA rolls out food traceabilityFSMA Rule 204 is coming into effect after the State of California won a lawsuit against the US Federal Government to enforce the law that was passed but sitting idle since the Obama Admin. Park City Group, Inc. owns the software Repositrak that has the most accreditation from the food safety industry. CEO has the pep in his step as the demand for food traceability solutions will be huge in the years to come as 204 gets rolled out. Read this to learn more about it www.qualityassurancemag.com

RZLT Biotechnology Penny Stock Reports in the next day LONGRZLT is a biotechnology company which has products in clinical development. Many are aware that means rigorous clinical trials before an FDA approval and a product line that generates earnings. Stock price is more about growth and potential more than anything else. That

said the chart looks good and I sense there is momentum heading into earnings in the next day

so this is a buy for me. I can see that price broke above a recent supply/resistance zone. This

penny stock likely cannot be shorted so there is no selling pressure to be exerted until present

longs have found their target. This can add to the momentum without the drag of that short selling. A penny here and a penny there it all adds up over time especially with compounding in active trading with penny stocks that have great range.

$CING - Cingulate ADHD 1 Dose Medicine, MICRO FLOAT, ROCKET SHIP937K shares, 2.2M marketcap micro float. ADHD 1 dose medicine advancing through trials with FDA guidance. I wouldn't be surprised to see NASDAQ:ARCT , NASDAQ:DRRX , or NASDAQ:NLSP buy them up! Do your own due diligence. Do not take this as financial advice. I own shares in this company.

EBS a biotech company focused on vaccinesEBS is a small biotechnology company whose forte is the clean processing and manufacturing

facility that the FDA requires for certain bioprocessing to be certified for delivery of products

to end-user patients. It is not a research facility like the one in China that accidentally released

COVID and the global impact will be likely felt for another decade. EBS does depend on

federal support and income from contract work from vaccine manufacturers. There is

reasonable expectation or persistent and consistent revenues ongoing without fail unless

the FDA decertified the facilities. On the chart, EBS is in a flat bottom triangle on its base.

It is presently rising out of the triangle and towards the mean anchored VWAP It is just above

The POC line which functions as dynamic support in the demand zone. I see a long trade

with the stop loss below the POC line, the first target the blue line representing one standard

deviation above the mean VWAP at about 9.4 while the second target is the redline two

standard deviations above the mean VWAP at about 10.05 while the final target contemplates

that EBS will challenge the high in May of 10.75.

EVFM 53X Upside potential according to Morgan Stanley !EVFM Evofem Biosciences has a big upcoming catalyst:

Its Phase 3 clinical trial evaluating Phexxi for the prevention of chlamydia and gonorrhea in women is on track to report top-line data from this landmark trial in mid-October, so we are one week away from results!

Positive study outcomes would enable potential U.S. approval for prevention of these sexually transmitted infections in 2023.

Evofem`s Phexxi whas already approved in Nigeria, the most populous country in Africa and the seventh largest country in the world, 3 days ago.

On 4/12/2022 Jeffrey Hung from Morgan Stanley Boosted the Price Target for EVFM to Underweight, from $7.95 to $8.55.

On 8/15/2022 HC Wainwright Boosted the Price Target to $4.00, giving a Buy Rating.

Now the stock is trading at all time low, $0.16, while 4 months ago it was trading 10X higher.

In my opinion this is a premium call and a great buy opportunity ahead of a Big upcoming catalyst for EVFM Evofem Biosciences.

Looking forward to read your opinion about it.

$EVFM Only FDA Approved Hormone-Free Contraceptive on the Market$EVFM produces the only FDA approved hormone-free contraceptive & developing products preventing STIs & HIV. Phase 3 trial results coming later this year. High demand for contraceptives after Roe v. Wade was overturned.

www.cnn.com

CRXT 900% Upside Potential According to this analyst Clarus Therapeutics Holdings, Inc. (CRXT) Announced Initiation of Phase 4 Clinical Trial of JATENZO, the first and only FDA-approved oral softgel for testosterone replacement therapy in adult male.

On 3/31/2022 Serge Belanger from Needham & Company LLC brokerage set a Buy Rating for CRXT and a Price Target of $8.00, which is 9 times higher than the current price.

I think it can easily double.

Looking forward to read your opinion about it.

AYTU All Time Low | Fast Track Designation form FDA todayAYTU Aytu BioPharma announced today that the FDA has granted Fast Track designation to AR101, a protein kinase inhibitor, for the treatment of patients with Vascular Ehlers-Danlos Syndrome.

After the bullish news, AYTU stock hit the all time low level.

52 Week Range 0.76 - 7.20

LADENBURG THALM has a price target of $14.50 for the stock.

I think a reversal is imminent.

My price target is $5.25.

Looking forward to read your opinion about it.

ARDS first Investor call of 2022. Phase 3 news ???Aridis Pharmaceuticals announced first Investor call of 2022 for today, after the closing bell.

Exiting pipeline with 2 phase 3 drugs and their monoclonal antibody cocktail.

AstraZeneca PLC (AZN) has a stake in this company.

CEO has co-developed several drug which have been sold to Astra Zeneca, Megabits and MedImmune.

Aridis Pharmaceuticals can be a potential buyout for AZN.

Analyst Vernon Bernardino from H.C. Wainwright reiterated a buy rating and $19 price target on ARDS: "the cocktail binds to the S2 spike protein subunit, which mediates viral cell membrane fusion in SARS-CoV-2 variants and also binds to the omicron variant with no loss in affinity compared to the original Wuhan strain."

Aridis Pharmaceuticals Inc 's monoclonal Covid-19 Antibody Cocktail is potentially First-in-Class treatment!

Cantor Fitzgerald also said last week that Aridis' pipeline is "underappreciated."

ARDS Pan-Coronavirus Monoclonal Antibody Cocktail Retains Effectiveness Against the Omicron variant, other COVID-19 Variants, SARS, MERS , and the Common Cold Human Coronaviruses.

It provides relevant drug levels for up to 1 year from prophylactic or therapeutic treatment.

Market Cap of only 22.48Mil

52 Week Range 1.13 - 8.4

MBRX Annamycin Fast Track and Orphan Drug Designation from FDAMoleculin Biotech`s Annamycin has Fast Track Status and Orphan Drug Designation from FDA for the treatment of soft tissue sarcoma lung metastases.

the FDA agreed with Moleculin Biotech`s Investigational New Drug (IND) application to study WP1122 for the treatment of Glioblastoma Multiforme (GBM) to go forward.

This should be an interesting year for MBRX, which is at all time low now.

52 Week Range 1.64 - 8.78

My price target is $3.8

AEZS European approval to market MacrillenAEterna has a variety of new products in its pipeline.

Macrilen, for example, is the first and only FDA-approved oral test for the diagnosis of Adult Growth Hormone Deficiency.

AEterna received European approval to market Macrillen.

Dr. Christian Strasburger: "Clinical studies have demonstrated that macimorelin is safer and much simpler to administer than the current methods of testing for insulin-induced hypoglycemia, and is well-tolerated by patients and reliable in diagnosing the condition.”

I think AEZS is a sleeping giant.

My price target is $1.25.

QNRX first FDA-approved treatment for Netherton SyndromeQuoin Pharmaceuticals (NASDAQ: QNRX ) is positioned to deliver the first FDA-approved treatment for Netherton Syndrome, a devastating disorder which affects 1 in every 200,000 people worldwide.

This month, QNRX Signed Multiple Exclusive Distribution Agreements for in various regions of the globe for its Lead Asset, QRX003, for Netherton Syndrome.

JMP Securities Initiated Coverage on Quoin Pharmaceuticals, Ltd. ( QNRX ) with a Market Outperform rating and a price target of 8usd.

QNRX is massively oversold having a bullish divergence chart formation and fundamentals that can skyrocket the price to 12 usd in my opinion!

Could be a Great buy opportunity at $1.91 today!

SESN Price TargetOn 8/17/2021 Canaccord Genuity brokerage Lower Price Target for SESN giving a Buy rating from $7.00 to $3.00.

Sesen Bio (SESN) flagship drug candidate Vicineum, failed to obtain FDA approval, but they will try a second time to get the regulatory go-ahead for the bladder cancer treatment.

buying long term calls could be a strategy for this one. volatility is likely after they announce the second FDA submission.

MRK has a lot of headline potential from hereHeadline Potential

Merck has three drugs currently under priority FDA review, one of them a Covid-19 drug:

Molnupiravir, an antiviral for Covid-19 which has received a positive opinion from the advisory board and which Merck's CEO says should work against any variant

Vaxneuvance, a pneumococcal vaccine

Lynparza, a breast cancer drug

Merck also continues to make strong headway with Keytruda, an immunotherapy, which recently picked up another approval in Japan.

All of this means that Merck has a lot of headline potential in coming weeks, especially at a time when a new Covid-19 variant is spreading across the world. There's quite a bit of options activity in Merck today as traders place bets ahead of the news.

Technicals and Sentiment

Merck is currently near support from a long-term trend line and from the 200-day EMA. It has 26% upside to the average analyst price target and a bullish put/call ratio of .43. It has an average analyst rating of 9.3/10, which is very high. It gets an above average ESG score of 2.25/3.

Value

S&P Global gives Merck's fundamentals an average score of 90/100. IIt's currently trading -1.4 standard deviations below where it usually trades in relation to its major moving averages. Forward dividend yield is about 3.7%, forward P/E just over 11, forward P/S about 3.4. The price to free cash flow ratio is fairly high, at over 20, but that has to be interpreted in light of the other multiples. estimate that Merck has about 18% upside to its average price multiple of the last 3 years. Its earnings outlook is highly positive; I score its growth forecast a 5/6.

QNRX Market Outperform Price Target !!Yesterday, JMP Securities Initiated Coverage on Quoin Pharmaceuticals, Ltd. (QNRX) with a Market Outperform rating and a price target of 8usd.

Quoin Pharmaceuticals (NASDAQ: QNRX) is positioned to deliver the first FDA-approved treatment for Netherton Syndrome, a devastating disorder which affects 1 in every 200,000 people worldwide.

This month, QNRX Signed Multiple Exclusive Distribution Agreements for in various regions of the globe for its Lead Asset, QRX003, for Netherton Syndrome.

My price target is the 12usd resistance.

ARDX 500mil Revenue Forecasts for a Penny Stock | The 10X call??Ardelyx, Inc. ARDX yesterday had one of the the highest the out of the money call options, due to the fact they plan to launch IBSRELA, the company's FDA approved treatment for irritable bowel syndrome with constipation (IBS-C) in adults, in the second quarter of 2022, that has a potential peak in revenue greater than 500mil per year.

Since ARDX’s Market Cap is only 191.663Mil, it has still a big upside potential. A decent 9X revenue means a potential 4.5 Billion market cap.

That`s why in the last 2 days we saw volumes higher than 100Mil.

Recently, on 11/30/2021, Yigal Nochomovitz from Citigroup Boosted the Price Target from Positive to Buy increasing the price target from $7.00 to $13.00.

The price of the stock is now 1.7usd.

My valuation is much higher!

I look forward to read your opinion about it.