This chart measures pain.Spoiler alert, there is a lot.

Inspired by a fellow trader, link to his idea. He is the reason I took the stock market seriously.

An easy-to-explain chart.

As NoOneWhoIsSomeone explained better, FEDFUNDS increases when an economy is strong. Therefore it can be a modificator for prices. The FED increases the rate when it smells money, and money smells when there is strength, historically...

Now the FEDFUNDS race now is for inflation (amongst other conspiracy stuff)

Does this chart work??? I don't know...

Orange line: It is SPX in log scale.

Blue line: I tried to add in the equation the FEDFUNDS rate. The price of SPX is divided by M2SL. This takes out of the equation the money printing. Now we multiply by 10-FEDFUNDS rate. I could do many different calculations but this is good enough for my knowledge. I am no trader, I have even managed to forget physics I did one year ago, so you could't possibly call me a genius. So take this with a grain of salt.

What we find out is a new blue line which could be a measure of today's strength of economy.

Throughout history, the two lines followed together, with the blue line surpassing the orange. Therefore the "strength" is higher than the SPX reading. In 2008 the lines followed through in exactly the same fashion. Even in 2000, albeit the blue line being slow, they both reached the same bottom.

What we see now is the incredible. The economy's strength is already in trash. And for quite some time...

It appears that my extreme ideas are not that extreme after all...

Go ahead, post some hate comments below, like some did in the idea I linked.

Tread lightly, for this is hallowed ground.

-Father Grigori

FEDFUNDS

Peak Equities?Happy Dump Year! What a shocking year... equities dropping, bond market failing and energy skyrocketing. Almost a perfect storm ain't it?

But something ain't right... Have we passed the dump year or are we just started? Which number will we be talking about in the future, 22 or 23?

And another question... have equities peaked?

For the past year, bonds have been outperforming equities.

But equities have been holding relatively strong despite the monumental increase in yields.

Now we might have reached the point of diminishing returns.

Every move we make is beginning to turn up against us.

The similarity to the Great Depression is stunning.

Stochastics don't help the situation much. Even if a total crash does not occur, the product looks fated to move horizontally.

The cover chart pinpoints us on a fib retracement, with much resistance above. The drawn levels were respected throughout the last 15 years.

Other equity comparisons follow suit...

The charts above attempt to objectively calculate the price of equities compared to the cost of money.

This chart below attempts to calculate the excess performance SPX has, compared to the performance of an investment in bonds. It is further modified by PPIACO, the producer price cost.

Printed on the chart are some beautiful bull flags, and some very historically-important retracements. Equities will have much trouble gaining traction compared to bonds.

This year, the relative performance of equities compared to bonds, showed a 60% drop.

So 2022 was definitely a Dump Year. This is massive of a figure for the equity market, measured as relative performance. Also the bond market has suffered a lot this year.

If equities have already sustained a massive hit compared to bonds, who will be the next to take the dive? Since their product (their cumulative profit) has just now showed signs of stagnation.

Will equities drop again or bonds, or both? It smells like 2023 will have some sort of dump...

An analysis of equity mutual funds compared to bond-focused mutual funds could have a lot to say... I leave it as an exercise for the TradingView community. Feel free to tag me if you analyze anything regarding it!

PS. Happy Dump Days as of now (The peak of the product chart), for the main indices are:

DJI: Nov. 8, 2022

SPX: Nov. 10, 2022

NDQ: Oct. 25, 2022

Take a look at price action of the indices after that day if you are curious on how real prices translated from that day onwards.

Tread lightly, for this is hallowed ground.

-Father Grigori

Energy ready for prime-time?An updated view

Pattern taken from reverse symmetry.

Elliott Waves

Stochastic RSI Oscillators

The 12 Month oscillator pushes everything upwards. Since the 3M oscillator is at it's top, we expect a short drop until mid 2023. It will be short because of the effect of the 1M oscillator as well as the 12M one.

Oscillators tell us that it is probable for price of energy to drop until Q2 of 2023 and then begin it's rally. Energy could very well increase now. The ABC Elliott wave shown on the main chart is alarming.

An alternate scenario is this.

A 5-step Elliott wave.

Either of them could play out.

Tread lightly, for this is hallowed ground.

-Father Grigori

Financial (in)stability mechanismsI have posted many times regarding volatility, especially the VVIX&VIX relationship.

There are times when mechanisms need to activate to stabilize the economy, the psychology, the society. Recessions, wars, pandemics are periods that may justify such actions.

It is wise for an investor to understand pressures and their direction. The motto "Don't fight the FED" and "Don't go against the trend" should be applied everywhere.

A very rapid growth like in 2016 needed suppression, or else equities would have gone parabolic.

Increasing yields makes growth harder. So the thought process back then was to suppress growth. I have some theories on why they wanted growth suppression. My ideas are extreme as they are, so I will try to put them into the suppressing field.

After this parabolic growth that occured backstage, the recession nobody remembers ocurred.

Yields suppress growth.

Yields as a stability mechanism.

Yield increases however can cause the opposite problem, money scarcity and liquidity problems.

Yields cause recessions.

Yields as an instability mechanism.

_______________________________________________________

Now onto VIX.

This year's recession was a time when financial stability had to occur to calm the markets. Back in 1929 we didn't have such mechanisms. The main chart, VVIX, shows us that there is substantial volatility management backstage.

While I don't know the mechanisms for SPX and VIX stabilization, I have some theories. There are now massive hedge funds that can easily stabilize the equity/derivative market. VIX is a traded index, so hoarding contracts could in theory artificially change the VIX value. That is why I advised on volatility analysis by comparing VIX with volatility indicators.

Hedge Funds (amongst other mechanisms) suppress volatility.

Smart Money as a stability mechanism.

I have posted before about the VVIX/VIX chart and how it can help us analyze SPX growth stability.

So the question arises, how much and for how long have markets been manipulated? Surely in 1929 there was nothing one could do to stabilize the markets. That is why the recession was so deep and painful. We had no brakes.

Manipulation/stabilization works in a consistent manner, when VIX peaks we suppress it. Suppression works by making VIX more predictable and less spiky. So inherently VIX manipulation decreases VVIX. With these charts we can see the stabilization mechanism in action.

In the middle of the 2008 recession, in May-June we had this period when psychology briefly changed from pessimism to optimism.

It is the denial phase of psychology. More about that in the "VIX | The effect on SPX" idea linked below.

It is this vicious cycle during the VIX manipulation period that drags us further down inside the recession.

VIX suppression cycle pulls economy into a vicious cycle.

Stability mechanisms as instability mechanisms.

_______________________________________________________

Onto some speculation:

Perhaps we are in a long-term recession, since 2018. Again, look into "The Cake is a Lie" idea.

Back in 2018 we were in a recession while equities were rapidly increasing. Now we are growing with equities dropping. This is nuts!!!

Look at this VVIX/VIX chart comparison.

In this chart I have hidden the price of VVIX/VIX and left just the EMA Ribbon. That is what we live through now. I drew a retracement from this specific point in time so as to better pinpoint the possible targets for VVIX/VIX.

This chart suggests that we have never went through the crisis since 2018. I know this is crazy to say, but look at this chart below.

RSI divergence confirms that. Perhaps the RSI of SPX correlates better to the VVIX/VIX chart.

_______________________________________________________

Conclusion:

So where does this leaves us? The fact that we have passed through two periods of upside down phenomena (2018 and 2021), when equities were increasing in a recession, and vice versa. This troubles me, as to how much is hidden. How big of a problem are we in and we have just not realized it yet. Moral of the story again? Don't believe what you are told and what you are shown. Don't listen to me as well. Do your own research.

There may still be massive volatility ahead of us. VVIX is suppressed by more than 30%. If VVIX returns to normal levels ~120 and the VVIX/VIX targets are correct, this means that VIX will increase 3.5x from what it is now. As a number it makes sense because it takes us to the peak of the 2020 Black Swan. VIX has every possibility to go incredibly high.

QE and Stabilization Mechanisms themselves have caused this fog. In our attempt to stabilize the economy, we have clouded our vision.

The suppressing field will be shut off, on the day we have mastered ourselves. On the day we can prove, we no longer need it. And that day of transformation, I have it on good authority, is close at hand.

-Dr. Breen

Money Supply Bull Flag ???Maybe this is a massive money supply flag. We have support on the ribbon. Stochastic RSI confirms it.

I don't know if this even makes sense, since CURRCIR is a subset of M2SL.

On the other hand, who would have thought that in 1990s currency in circulation would increase by 50% in less than a decade.

Or is there a ceiling prohibiting more increase?

Also look at the ratio between Europe's money supply and US.

And my favorite, the most accurate retracement ever.

Total "purchasing power" of Europe vs US. Just recently we have reached a perfect golden ratio. 1 in 10.000 accuracy.

Maybe this is a harmonic pattern. Feel free to guide me as to what this might be. And how price might continue in the following months/years.

A closeup view.

Maybe Europe will print so much money that it diminishes its currency. This chart suggests that EURUSD is in reality much weaker than it seems. A lot of Euro is printed compared to Dollars.

Maybe they get more hawkish than the US and increase rates to >5%. I am not sure...

Prepare for unforeseen consequences I guess?

- G-Man, Half-Life 2

M2SL | Duplex Megaprinter 8000 ™Back in the 80s, we thought that by 2020 we would have an automated oven and flying cars. All we got is a money printer, and we liked it. We played with it a lot. And this year for Christmas, who wouldn't like some more printer ammo?

Since high inflation cannot ensure social stability, we have only one option. Lower inflation. That is the motto of the FED, the hope of every investor, a lower inflation figure. The consumer is overwhelmed from the increasing cost to survive . The inflation war is nowhere near it's end. We have gone from commodity inflation to services inflation, to the everything inflation. We haven't managed to stop it. What if there was another way?

Actually there is another way. If you break the oath of "never read the news" and actually read the news, you will realize that the average consumer is getting the help they need from grants. Governments throughout the world have found the way for social stability. They simply buy us off.

Record high electricity bill? No problem, here is a grant, the government is paying a percentage of the bill as a help.

Expensive fuel? Here are 100€ in fuel discount to go to work.

It is like the best Christmas ever. Businesses get to enjoy 100% of the earnings they want, consumers consume, and governments have social and financial stability. They just have to keep the game going, keep the printer full of ink. Everyone is happy. One could say that this perfect scenario we are in cannot fail. And even if it breaks, we keep the printer rolling.

Sometime in the not-so-distant-future of course, something could break. We have just moved the problem from the consumer to the investor/corporation/government. We have gained some time. It is just incredibly difficult for me to understand what could break if this game goes on and who will take the dive. At what point will this printer stop helping us?

Right now it helps many. Also go out and talk with people, almost nobody talks about inflation as a problem that could completely destabilize the global economy. They just care about the immediate issue, that everything is expensive.

We are humans, and not a very wise kind. We are an infant species (like Dr. Breen said). Even now that we realize what we have created, and try to solve it, we do it in a fashion that will ultimately turn against us. We buy out everyone and everything, we have made humans more dependent. With all that technology around us, I realize that we are incredibly fragile. We haven't managed to be empowered from technology, we are swallowed in it. And we hate the word Plan B, imagine how trapped we are in when we don't cover our bases.

We buy out our problems because we search for the easy way out. That's the reason we made the printer in the first place. We needed to solve one issue, ignoring the future repercussions.

After all that epilogue, I will now add the prologue. This idea is upside down, like everything around us these days.

On the main chart, we see that we have found support on the weekly ribbon.

The 1M (and 2M) chart suggests that we are heavily supported from below.

Do note that dropping oscillator on money supply does not mean significant price drop. Since money supply increases exponentially, a bearish oscillator suggests that we are on the upper side of the trend.

This chart shows us the Reverse Repurchase Aggreements.

We have RSI divergence, and stochastics dont help the situation. RRPONTTLD dropping is signaling QE.

As SPY_Master stated in this idea, this chart shows us the effort the FED does to fight inflation.

Yields show a similar picture. We are under significant resistance from the 200EMA in the 2M chart. Stochastics print a bearish signal.

CURRCIR/M2SL may be printing a bull flag.

What will be the effect if currency-in-circulation increases compared to money supply? How will prices and inflation react? We have already had significant increase in the past year in the ratio.

US money supply is showing signs of increasing, or at least stagnating. This chart comparing US and EU is alarming...

Tread lightly, for this is hallowed ground.

-Father Grigori

VIX | The effect on SPXI would like to do some qualitative analysis on VVIX/VIX, and it's behavior/effect on markets. We will try to pinpoint some "wave types".

A. The most consistent/stable growth for SPX occurs in times of stable VIX and stable VVIX. Their ratio remains the same.

B. At times of decreasing VIX and increasing VVIX, we have an unstable, impulsive upwards wave. This occurs after a VIX peak. While everyone expects a lower VIX, as time passes markets get increasingly indecisive about the future of VIX. Therefore VVIX increases. VIX measures the sentiment of SPX, while VVIX the sentiment of VIX.

C. A period of unusually low VIX leads to speculative growth. This growth in the end, traps both the VVIX/VIX chart, and the price chart.

D. In the above waves, VVIX/VIX is either trending up or horizontally for prolonged periods. A variation from it is a period of prolonged VVIX/VIX drop. During this period, sentiment is homogenous, everyone believes that VIX will increase. A consistent belief in the VIX fate, is pushing VVIX lower. An unusually low VVIX describes a period like now, or 2008. Everyone is preparing for the drop.

Some examples will follow:

D WAVE (2008-2009)

I have highlighted two very important points during this drop.

First, the small circles. This is the point of a rapid sentiment change. Curiously, this point is many months after the FED is done with rate hikes. It is actually when it begins to drop rates.

The big circles are in a period of denial, a period during which everyone believes that the bottom is in. VVIX/VIX attempts to escape the descending channel.

B WAVE (2009-2011)

A WAVE (2012-2015)

C WAVE (2016-2018)

I find very interesting the retracements that occured after this rapid growth.

C WAVE (2020-2021)

D WAVE (2022)

Just like 2008, the shift in sentiment in September 2021 is very apparent. Likewise, now we are witnessing the period of denial.

As a final thought, what we are witnessing with the D waves is not the effect of FED, it is the effect of sentiment on it's own.

We witness the specific points of sentiment change, which don't depend (?) on the FED hike schedule. And curiously, they are in identical spots as in 2008. One before the peak, one in the point of denial.

Perhaps what everyone fears is the terminal rate. Or we fear the drop, we fear of losing. I don't know...

Inflation!Oh yeah, inflation... Just how much though???

One of the main "benefactors" for inflation is money supply. Printing money fast and not managing it to create growth, is bad... unsurprisingly. For the last 2 years, an astronomical amount of money was printed. But have we seen it's effect?

To figure out these HOT questions, we use charts. Opinions don't do us any good for important issues, facts do.

First: M2SL (Money Supply)

Specifically the rate of change. We use the ROC indicator, set in 24 months.

This chart above, the ROC is looking familiar...

It looks like the rate of change in money supply, follows the inflation rate. So we might have something.

I hear you say, on the far right we see an explosion in money supply ROC, and we witness the explosive inflation rate we had this year. Thankfully, ROC is now almost turning negative, and inflation is showing signs of slowing down.

Not so fast.

Look at the following chart.

In this chart we have 3 lines, blue is money supply ROC, orange is time-synced inflation rate, and the faint white line is inflation moved 2 years earlier. I tried to match the money supply ROC peaks with the inflation peaks of 1970s.

Do note that the M2SL ROC for a specific date, takes the average ROC for the past 24 months (2 years). So the delay between money printing and inflation showing it is at least 2 years . The ROC chart is delayed by itself, and it shows inflation change 2 years before the official inflation rate changes.

Alarmingly, the chart above shows us that we are in the middle of inflation explosion.

A magnified view.

I hear you say again, but inflation is rapidly dropping, so it is peaked. This chart above does have an indication of scale as well as timing. It is obvious that the rate of change stood much higher for long, more than any other time in history. So inflation should be quite substantial. Perhaps more than 15% we had in 1970s. We need to prove that it is higher though...

Second: Total money printed

I tried comparing the cumulative money printed in the decade before the inflation peak, this led me to a dead end. Percentages are identical.

It looks like an inflationary shock today, too much was printed too fast.

This is a key difference between the two periods.

Third: What is the "fair" amount of money we should have printed?

So what if, we try comparing money supply with the total GDP. The ratio M2SL/GDP. If you saw my previous idea, I learned that the GDP/M2SL ratio is basically the money velocity.

The idea behind the M2SL/GDP (which is 1/M2V) is simple, just how much excess money have we printed for the gross domestic product we have? I hastily explained in my previous idea, and I will try to explain it again, comparing these two different periods.

During the period of stagflation (1970s) we had money velocity in a slow but steady growth.

Now we have the complete opposite.

We have too much money printed for how much we produce. I don't have the knowledge to pinpoint how much of an increase this could cause to inflation though. I tried some things in my previous idea.

And finally, fourth: Yields

This are disappointing. Markets don't want high yields, and they refuse to price-in higher yields.

It could take many months before this barrier is broken. This is a 3M chart, so timeframes are quite long.

Market's yield is preceding FEDFUNDS. While I am not experienced on the mechanics of how the FED and the market are reading/predicting/using yield rates, this chart shows us that FEDFUNDS always follows US02Y.

Keltner channels show us the opposite side of the EMA Ribbon. If we trust the one, we trust the other.

We are almost inside the top Keltner channel, a bearish phenomenon.

Unfortunately for the low-inflation-dream, we might have reached a top for now. FEDFUNDS is poised to grow a little more, and US02Y shows signs of weakness.

Like 2008 (and every other rate-hike-era), we may have reached a top.

And an extra: Inflation predictions for other countries

I talk about the US, but I am from Greece. Right now, we are voting for next years budget. This budget is presented as a great one (let's not get into politics). Everything is good regarding it. Curiously, on the first paragraph basically, it states that "this budget is made considering an average inflation rate for 2023, 5 points higher than this year.

(I am paraphrasing, I don't present an official transcript)

Inflation reached a high of 12%, a 30 year record. Europe countries like mine, are bracing for higher inflation for next year. The problem is nowhere near to a solution.

Tread lightly, for this is hallowed ground.

-Father Grigori

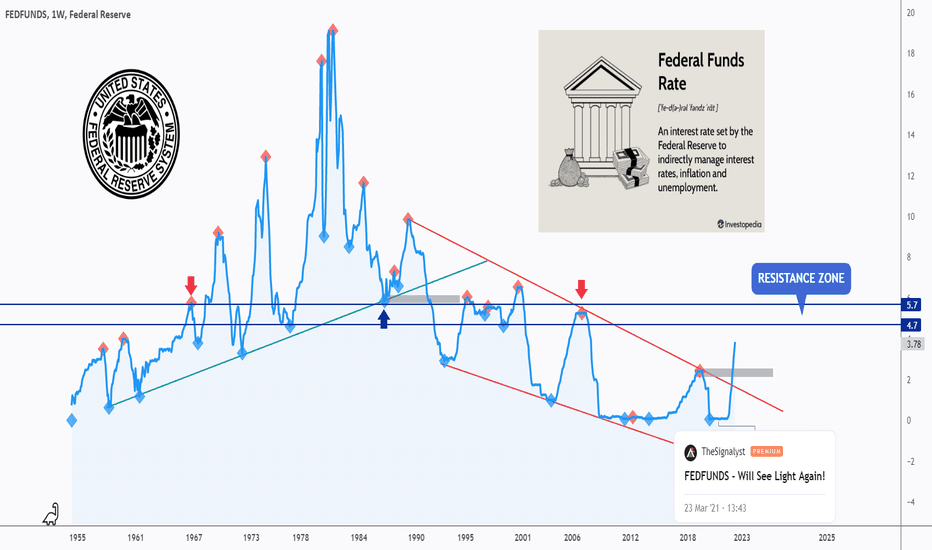

All Eyes On Fed Funds Rate 🏛Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

I am not a fundamental expert (nor an economist) but I found FEDFUNDS chart really interesting!

I never thought that basic technical analysis tools can also be applied to such economic instruments!

As per my last analysis (attached on the chart) FEDFUNDS traded higher and broke the red wedge pattern upward.

Now we are technically bullish, expecting big impulse movements to push price higher, and small bearish correction movements.

We all know that Federal Reserve will most probably increase the interest rates by another 50 basis points (0.5%) next week (on Wednesday)

By adding another 0.5% , FEDFUNDS will be approaching a strong resistance zone in blue (4.7% - 5.7%) which might hold the price down for a bearish correction to start and push price lower till the previous high in gray again.

It would be interesting to hear your thoughts on this one.

Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

The Fed Conundrum and the Housing Market CollapseThe Fed money tightening policies are using interest-rates as a lever to fix a balance sheet problem.

Higher rates feed right back into the CPI, initiating the doom loop.

After the financial crisis of 2008, The Fed employed a policy action to reduce the federal funds rate to a range of 0-0.25% for seven-(7) years, during which time the CPI fell.

Post-pandemic (COVID), the CPI is 97% correlated to the Fed balance sheet.

Looking historically, in 1980's, the Fed Rate was ~19% (real rate was 8%). Compared to today, the Fed Rate is under 3% and Real Fed Rate is at -6%.

Folks already crying about a 3% Fed Rate.

A colossal policy error in the making, or is everything going "according to plan"?

Terminal rates - How FX traders can benefit on TradingViewOne of the more watched interest rate settings in markets is the so-called ‘terminal’ interest rate – the point in the interest rate futures curve that reflects the highest point of future rate expectations – said differently, where the market feels a central bank could take its key policy rate by a specific date.

For those who really want to understand fed funds futures far better, this research piece from the St. Louis Fed is good - files.stlouisfed.org

As an FX trader, I am not too concerned as to the exact pricing in the rates market, a basis point here or there is no great issue - I loosely want to know what is priced by way of future expectations. This lends itself to more fundamental, tactical or thematic trading strategies and obviously day traders won’t pay too close attention, although, it’s worth considering that when rates are on the move you do see higher intraday volatility and that is a factor they have to operate in – where one of the core considerations for any day trader is ‘environment recognition’ and the assessment of whether we’re seeing in a trending or mean reversion (convergence) day.

We also see terminal pricing correlated with FX and equity markets – certain if we look at the relationship between fed funds futures April contract and USDJPY we can see the correlation.

Some will just use the US 2-year Treasury, as this is the point on the US Treasury curve that is most sensitive to rate pricing. The good thing about the fed fund's future though is we can see quantitatively the degree of rate hikes being priced for a set date.

Using the logic expressed in the St Louis Fed research piece we can see that the market sees the highest level where the Fed hike rates is March – subsequently, this is priced off the April contract, and currently, this sits at 4.90%.

Using 4.9% as our yardstick, interest rate traders would make a call if the expected fed funds effective rate was either priced too high, or indeed too low and could push above 5% - if new economic data emerged that suggested the Fed needed to go even harder on hiking than what is priced, and the terminal rate moves above 5% then the USD will find a new leg higher. Conversely, if the market started to trade this down to say 4.70% to 4.5% then the USD will find sellers – and notably USDJPY is the cleanest expression of interest rate differentials.

For TradingView users we can use this code in the finder box - (100-ZQJ2023). I put these codes into a watchlist and add a section' for heightened display. Again, this tells me where the peak pricing/expectations are in the interest rate curve. You can see the corresponding codes needed for each contract.

Terminal rates matter – if we're to see this trending lower, most likely in 2023, then it may be one of the clear release valves the equity market needs – for those looking for the Fed to pivot – the terminal rate will be one way to visualise it

Interest Rate Jargons and Fed Funds TrajectoryCBOT:ZQ1!

We are in a rising interest rate environment. But wait, which rate are you talking about?

All eyes are on the Federal Reserve. But could you really borrow money at the Fed Funds rate? If not, why is it a big deal? Most of us deal with different types of interest rates, such as those for bank deposit, mortgage loan, home equity loan, auto loan, credit card debt, student loan and business loan.

How are these rates determined? How are they related to the Fed Funds rate? Before you take out a loan or make an investment, it’s a good idea to gain some understanding of these questions. Our discussions mainly focus on US dollar interest rates.

Breaking Down an Interest Rate

According to Bankrate.com, the national average of 30-year fixed mortgage rate on October 8th is 6.89%. How is this rate calculated?

While all lenders employ elaborate methods to price an interest rate, I would like to introduce a simple formular to break down the rate into different components.

R(e) = R(rf) + D(p) + R(p) + L(p) , where:

• R(e) is the effective interest rate

• R(rf) is the risk-free interest rate

• D(p) is a duration premium

• R(p) is the risk premium

• L(p) is the liquidity premium

Risk-free Interest Rate

Generally, we consider short-term U.S. government debts to carry zero default risk. Target Fed Funds rate is currently in the range of 3.00%-3.25%.

Duration Premium

US treasury debts have different durations, or the number of days till their maturity.

* Treasury bills (T-bills) are discount instruments maturing in one year or less from their issue date. T-bills are issued for terms of 4, 8, 13, 26, and 52 weeks.

* Treasury notes (T-notes) are interest-bearing securities that have a maturity between 1 and 10 years. T-notes are issued in 2, 3, 5, 7, and 10-year maturities.

* Treasury bonds (T-bonds) are long-term treasury securities issued with a 30-year maturity. Outstanding T-bonds have terms from 10 to 30 years.

While all Treasury instruments are free of default risk, longer-term notes and bonds carry a duration premium. The longer the term, the higher the rate.

We are in an inverted yield curve environment. US Treasuries are quoted and priced in yields. On October 7th, 2-Year T-Note is quoted at 4.312% while 10-Year T-note at 3.888%. The easiest explanation is that investors expect a recession on the horizon and interest rates to fall in the future.

Risk Premium

When a lender evaluates the default risk of a loan, they examine the borrower’s Character, Capacity, Capital, Collateral, and Conditions . These are called the “5 Cs” of credit.

In mortgage lending, 5Cs generally refer to the credit history, income, down payment, value of the house, and current housing market conditions, respectively.

The bigger the risk premium, the higher the interest rate. A subprime borrower with a 600 FICO score would pay higher rate than one with an 800 FICO. Someone who could put up a 25% down payment would get a lower rate than those with 10% down only.

In a booming housing market, a bank is willing to accept a lower risk premium. In the event of the borrower default, it could resell the house and likely get paid back in full.

Liquidity Premium

In the old days, when you got a 30-year mortgage from a savings-and-loans, it had to carry it on the book for the entire term. Since the loan was so illiquid, the lender had to charge a high premium to compensate for all the risks it took.

With the invention of the mortgage-backed securities (MBS), lenders could package hundreds of loans into MBS. As they recoup most of the capital quickly, they could make more loans and generate more fees. Readers who are interested in the history of MBS may check out Michael Lewis’ classic, Liar’s Poker: Rising through the Wreckage on Wall Street.

Mortgage loan applicants may find that Federal Housing Administration (FHA) loans carry a lower rate. If your loan meets FHA’s requirements, it would be guaranteed by the government agency. Therefore, it carries a lower risk for the lender. Additionally, FHA-conformed loans can be easily packaged into MBS, enhancing their liquidity.

The Importance of Reference Rates

When a lender prices an interest rate, it usually employs one or more reference rates. If you carry a credit card balance, you may notice that interest charges vary monthly.

Look up the Customer Agreement with the credit card issuer, you would likely find them defining the Annual Percentage Rate (APR) as “prime rate + xx%”.

Typically, the mark-up portion on the right is fixed for contract terms. However, prime rate is usually defined as “Fed Funds + x%” and may be updated monthly or weekly.

If your credit card says APR = prime rate + 12% and Prime Rate = Fed Funds + 3%, you will be paying 18.25% (= 3.25+3.00+12.00) on outstanding balance, accrued daily. If the Fed raises rate by 75 bp next month, you will find the APR jumping to 19%.

Most lenders use reference rates. With Fed Funds being the root of rate calculation, every Fed rate decision would cause a repricing of the entire credit market. Fed Funds rate is the most important interest rate benchmark in the world. This is why we call it the “Mother of All Reference Rates”.

If you do not wish to iterate rate calculations step-by-step, other references may provide easy solutions. For example, a small-town savings-and-loans could set its deposit rate at the Secured Overnight Financing Rate (SOFR) CME:SR11! , and mortgage rates at 5 basis points over the national average rates published by Mortgage Bankers Association.

Rate Trajectory Projected by Fed Funds Futures

CME 30-day Fed Funds Futures ( CBOT:ZQ1! ) are directly linked to Fed Funds rates. Keeping up with T-bill market conventions, they are quoted like a discount instrument, 100 – R. Interest rate of 3.25% will be converted to a market quote of 96.75 (=100 – 3.25). If you ever wonder why, this is because short-term rate products do not make periodic coupon payments. Instead, you buy at a discount and get the par value back at maturity.

ZQ has monthly contracts going out for five years, with good liquidity for the first 1-1/2 years. It is a reliable measure of what investors think the Fed Funds rates would be in the future. Based on ZQ settlement prices as of October 7th, we get forward Fed Funds Rates implied by the futures market as follows:

• OCT 2022: 3.080%

• NOV 2022: 3.755% (+67.5 bp)

• DEC 2022: 4.110% (+35.5 bp)

• MAR 2023: 4.610% (+55.0 bp)

• JUN 2023: 4.635% (+2.5 bp)

• SEP 2023: 4.580% (-5.5 bp)

• DEC 2023: 4.435% (-14.5 bp)

• FEB 2024: 4.365% (-7.0 bp)

The above quotes show where futures market expects rate hikes to end in Mid-2023. They also expect Fed Fund rate to go down immediately afterwards.

Last Wednesday, in an interview with Bloomberg TV, San Francisco Federal Reserve Bank President Mary Daly called out such projections as inaccurate. She said that the Fed would like the rate to be restrictive enough (4.5%?) and to stay there for a while until inflation is back to the 2% policy target.

Mispricing in the outer months may be a good trading opportunity. Just remember, if you think the implied rate in December 2023 is too low, you would short ZQ futures. This is because of the 100 – R pricing convention. A bigger R would result in a smaller 100 – R.

Financial market is extremely volatile this year. Getting an information edge increases your odds of success in managing risk. I suggest leveraging real-time market data for a better gauge of market situation. TradingView users already have access to delayed data. A Pro user could upgrade to real-time CME market data for only $4 a month, a huge discount at the time of high inflation.

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

Global Recession / Depression of 2022-2023Bears and Bulls await for the "Great Reset" (or as the Fed might state: "financial accident") that will lead to the Fed Pivot.

The question is where (and when) will the pivot occur?

"Watch your step while peering into the abyss. The cliff edge is crumbling faster and is closer than we realize..."

FED Funds Interest Rates Pushed Past Trend ChannelThe Federal reserve stepped in to control inflation by increasing interest rates.

It looks like the decades long trend channel has been broken upwards.

Fed reserve is definitely going above parameters, I bet even they didnt expect to go above.

Im guessing deflation is coming followed by stagnation, I hope i'm wrong.

We're entering uncharted terrritory with debt and interestWe're about to make history y'all! But not for a good reason... We're breaking out of the interest rate bear trend we've been in for over 35 years.

We used to raise interest rates to help control the debt; but after we abandoned the gold standard it didn't work so well. Going forward the economy could handle less and less rate hikes, while debt sky-rocketed. You'll also notice in vertical red, are market peaks before big crashes. For the last 20 years, a crash always follows the hike. Then the government uses it as an excuse to take on more debt.

Something else unique about this hike is that the yield curve inverted from the beginning of the hikes, when in the past it only inverted near the end of several hikes. You can see that in the link below.

The Real Cost of Fed Rate HikesCBOT_MINI:10Y1! CBOT_MINI:2YY1!

The Federal Open Market Committee (FOMC) is scheduled to meet on July 26-27. Market widely expects a 75-basis-points (bps) Fed Funds rate increase, from current target of 1.50%-1.75% to 2.25%-2.50%. The call for a 100-point hike, while still feasible, is weakened after U.S. gasoline price dropped 70 cents per gallon in the past month. New data hints that the runaway inflation may be contained.

Federal funds Rate is the interest rate that banks charge each other to borrow or lend excess reserves overnight. It is the most important global interest rate benchmark, as it directly or indirectly influences the borrowing cost for governments, corporations, and households. By the end of July, Fed Funds would have gone up by 2.25% (assuming 75 bps hike in July) from zero before March. The Fed is not afraid of raising rate even higher until inflation moves back to its 2% policy target.

How much will a higher interest rate cost for government, business, or household? I will illustrate the impact of 100bps rate increase in this analysis. All data comes from either the Fed or USdebtclock.org, unless otherwise noted.

Total Debt : By the end of Q1 2022, the total debt outstanding in the U.S. by both public and private sectors is $90.1 trillion. Mind-boggling. What does the number mean?

• U.S. GDP was $23.0 trillion in 2021. Debt-to-GDP ratio is 3.92. It would take all Americans four years to pay off their debt, without spending or paying interest.

• US population is 332,403,650 as of January 2022 per US Census Bureau. Debt per capita is $270,949. Each time a baby is born, he or she already owes more than a quarter million dollar.

US National Debt : $30.6 trillion based on USdebtclock.org real-time calculation. This is just the debt owed by Federal government and various federal agencies.

• National Debt to GDP ratio: 133%.

• Federal tax revenue is estimated at $4.4 trillion in 2022. If our government just levies taxes and does nothing else, it will take seven years to pay off the debt.

• Federal budget is $6.0 trillion in 2022, with budget deficit running at $1.6 trillion. Interest on debt is $440 billion, the fourth largest budget item. If interest rate goes up 100 bps across the yield curve, federal government will have to come up with $306 billion extra to service the debt.

• Federal budget in 2022: $6.0 trillion

o budget deficit $1.6 trillion

o Interest on debt $440 billion (4th largest budget item)

o Remark: $306 billion extra to service the debt, if interest rate goes up by 100bps

• When all the rate hikes are over, annual debt interest payment could be over $1.0 trillion. It would become the 3rd largest budget item, behind Medicare ($1.4 trillion), Social Security ($1.0 trillion) and ahead of Defense ($751 billion)!

State and Local Government debt : $3.3 trillion, of which $2.1 trillion from state governments and $1.2 trillion from local governments.

• If interest rate goes up by 100 bps, state and local governments will have to come up with $33 billion extra to service their debt.

• We may expect tax hikes from state and local governments, while public services may be cut back at the same time.

US Corporate Debt : $11 trillion, which includes all debt issued by non-financial corporations domiciled in the U.S.

• If interest rate goes up by 100 bps, American businesses will have to come up with $110 billion extra to service their debt.

• We may expect higher prices for goods and services, as businesses pass on the interest cost to consumers.

• Companies with high debt ratio may increase the chance of delinquency.

US Household Debt : $23.5 trillion. This includes mortgage, auto loan, credit card loan and student loan, etc.

• Personal debt per citizen is $70,304. If interest rate goes up by 100 bps, each person will have to come up with $703 extra a year to service their debt.

• American families are fighting with a higher cost-of-living on multiple fronts. If the U.S. falls into a recession, their financial situation will worsen significantly.

• Mortgage delinquency is expected to rise significantly.

The remainder, approximately $21 trillion, is outstanding balance of credit instruments issued by banks and other financial institutions.

Believe it or not, we have only just scrubbed the surface of our mounting debt problem. Most government liabilities are unfunded or underfunded. Each year, the Federal Government borrows new money to pay off the maturing debt.

Medicare, Medicaid, and Social Security are pay-as-you-go programs. Government taxes current workers to pay for the benefits of retirees, without any money saving up for current workers. No one has a crystal ball if the benefits are still there when they reach retirement.

With such a depressing future ahead of us, are there any trading opportunities? The answer is yes. I am counting on the inverted yield curve to return to historical normal.

Yield curve plots the interest rates on government bonds with different maturity dates, notably three-month Treasury Bills, two-year and 10-year Treasury Notes, 15-year and 30-year Treasury Bonds. Bond investors expect to be paid more for locking up their money for a long stretch, so interest rates on long-term debt are higher than those on short-term. Plotted out on a chart, the various yields for bonds create an upward sloping line.

Sometimes short-term rates rise above long-term ones. That negative relationship is called yield curve inversion. An inversion has preceded every U.S. recession for the past half century, so it’s seen as a leading indicator of economic downturn.

On July 21st, the yield on two-year Treasury notes stood at 3.00 percent, above the 2.91 percent yield on 10-year notes. By comparison, two-year yields were one percentage point lower than the 10-year yields a year ago.

Why are we seeing yield curve inversion now? Short-term yield directly responded to Fed rate hikes. It has gone up 225 bps in five months. Longer term yields are determined by credit market supply and demand. The prospect of an upcoming recession held off lending by businesses and households alike, keeping the yields relatively stable.

In my opinion, yield curve inversion could not sustain for long. Borrowers would flock to lower rate debt, pushing up demand for longer term credit. Market force would revert the yield curve to a normal one with interest rates on long-term debts higher than those on short-term ones.

Are there any instruments we could leverage to trade the reversal of yield curve inversion? Long the Spread of CBOT Micro 10-Year Yield (10Y) and 2-Year Yield (2YY) .

Traditional Treasury Futures are quoted in Treasury Notes price, which can be viewed as the present value of future payments that bondholder will receive – interest payment every six months and the return of principal at par value at maturity.

Micro Yield Futures are more intuitive. They are quoted in yield directly. On July 22nd, August 10Y Yield Futures (10YQ2) was settled at 2.819. August 2Y Yield Futures (2YYQ2) was settled at 3.06. The 10Y-2Y spread is -0.241.

The 10Y-2Y spread has been positive in recent years. It turned negative in the beginning of July as we experienced the inverted yield curve. I expect the spread to return to historic normal - a positive number, in the coming months.

To trade Micro Yield futures, margins are $240 for 10Y and $330 for 2YY. A long spread can be constructed by a Long 10Y and a Short 2YY positions.

The great thing about a spread trade lies with the fact that you don’t have to be right in predicting the direction of interest rates. Spread will be widened if 10Y rises faster than 2YY. Even in a falling rate environment, if 10Y fell less than 2YY, the spread will be enlarged too.

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

how to profit from higher yieldsthis chart shows, how the moneyallocation rises while the fed highers yields.

The setup in RSI and the actual chartpattern has high similarities to the copper chart 2006, when Copper broke through a resistance and made exponential returns.

Now copper is again at a resistance, if it breaks through, we might see some crazy gains again.

Past Rate Hikes suggest an initial sell offInterest rates scale is on the left, plotted in orange.

The last time we started hiking rates from zero, we saw a decent sell-off with the first hike. Then things became bullish with subsequent hikes, until it neared 2% where markets got volatile; and then at 2.5% where we see another sell-off. If history, that could put QQQ near -40% from ATHs. I'll be watching closely next week for bearishness.