Decoding Fed Rate Changes via Federal Funds Futures Index◉ What Are Federal Funds Futures?

● Definition: Federal Funds Futures are financial contracts traded on the Chicago Mercantile Exchange (CME) that allow market participants to bet on or hedge against future changes in the federal funds rate (the interest rate at which banks lend to each other overnight).

● Purpose: These futures reflect the market's expectations of where the Fed will set interest rates in the future.

◉ How Federal Funds Futures Work?

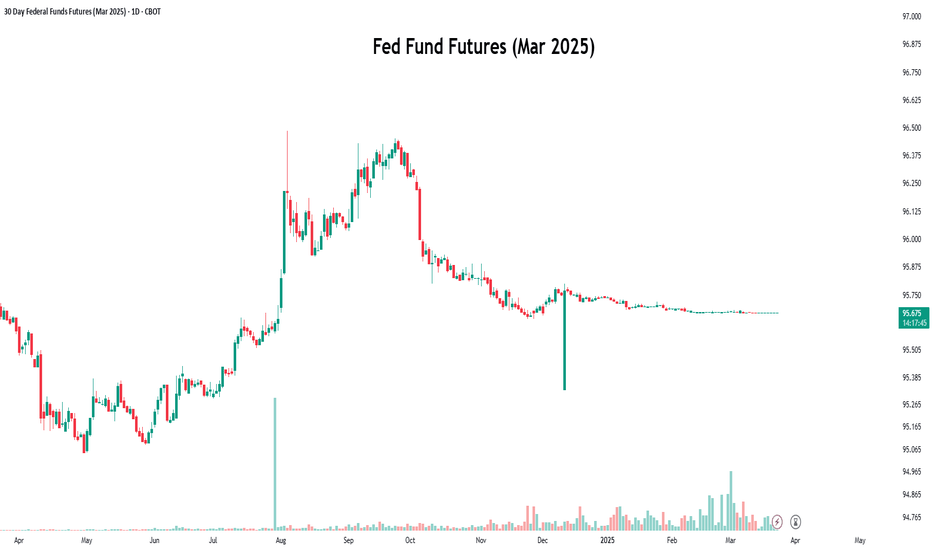

● Pricing: The price of a federal funds futures contract is calculated as 100 minus the expected average federal funds rate for the contract month.

➖ Example: If the futures price is 95.00, it implies an expected federal funds rate of 5.00% (100 - 95 = 5).

● Contract Expiry: Each contract represents the market's expectation of the average federal funds rate for a specific month.

◉ Why Use Federal Funds Futures?

● Predict Fed Policy: Traders and investors use these futures to gauge the likelihood of the Fed raising, cutting, or holding interest rates.

● Hedge Risk: Institutions use them to protect against potential losses caused by interest rate changes.

● Market Sentiment: They provide insight into what the broader market expects from the Fed.

◉ Steps to Analyze Fed Policy Using Federal Funds Futures

● Step 1: Check Current Federal Funds Futures Prices

Look up the prices of federal funds futures contracts for the months you're interested in. These are available on financial platforms like Bloomberg, Reuters, or the CME Group website.

● Step 2: Calculate the Implied Federal Funds Rate

Implied Federal Funds Rate = 100 - Futures Price.

➖ Example: If the futures price for March is 95.5, the implied rate is 4.5% (100 - 95.5 = 4.5).

● Step 3: Compare Implied Rates to the Current Rate

If the implied rate is higher than the current federal funds rate, the market expects the Fed to raise rates. If it's lower, the market expects a rate cut.

● Step 4: Estimate the Probability of Rate Changes

By comparing the implied rates of contracts expiring before and after an FOMC meeting, you can estimate the probability of a rate change.

➖ Example: If the implied rate for March is 4.75% and the current rate is 4.5%, the market is pricing in a 25 basis point (0.25%) hike.

● Step 5: Monitor Changes Over Time

Track how futures prices change over time. Shifts in prices indicate changes in market expectations. For example, if futures prices drop (implying higher rates), it suggests the market is anticipating a more hawkish Fed.

◉ Practical Applications

● Trading: Traders use federal funds futures to speculate on interest rate movements.

● Economic Forecasting: Economists use them to predict the Fed's monetary policy and its impact on the economy.

● Investment Strategy: Investors adjust their portfolios based on expected rate changes (e.g., shifting from bonds to equities if rates are expected to rise).

◉ Limitations of Federal Funds Futures

● Market Sentiment: Futures prices reflect market expectations, which can be influenced by sentiment and may not always accurately predict Fed actions.

● External Shocks: Unexpected events (e.g., geopolitical crisis, pandemics) can disrupt rate expectations.

● Liquidity: Less liquid contracts (further out in time) may not accurately reflect expectations.

◉ Example Analysis

Let’s assume:

➖ Current federal funds rate: 4.5%

➖ March federal funds futures price: 95.5

● Step 1: Calculate the implied rate:

100 − 95.5 = 4.5%.

● Step 2: Compare to the current rate:

The implied rate (4.5%) is equal to the current rate (4.5%), suggesting the market expects no change in rates by March.

● Step 3:

If the futures price drops to 95.25, the implied rate becomes 4.75%, indicating the market now expects a 25 basis point rate hike..

◉ Why This Matters?

● For Traders: Federal funds futures provide a direct way to bet on or hedge against interest rate changes.

● For Investors: Understanding rate expectations helps in making informed decisions about asset allocation.

● For Economists: These futures offer valuable insights into market expectations of monetary policy.

◉ Conclusion

Federal funds futures are a powerful tool for analyzing and predicting the Fed's interest rate decisions. By understanding how to interpret these futures, traders, investors, and economists can gain valuable insights into market expectations and make more informed decisions. However, it's important to consider their limitations and use them in conjunction with other economic indicators for a comprehensive analysis.

Fedratecut

Get Ready for a MASSIVE Week Ahead! Watch now! 🚨 Get Ready for a MASSIVE Week Ahead! 🚨

Don't miss out on preparing for the upcoming week and the year-end Santa Claus Rally! Make sure to watch this entire video to stay ahead of the game.

📊 In this video, we'll cover:

-Major economic news and events

-Market trends for NASDAQ:QQQ , AMEX:SPY , and AMEX:IWM

-Latest updates on all current H5 Trades such as NYSE:HIMS NASDAQ:MBLY NYSE:SQ NASDAQ:MARA NYSE:FUBO & more!

This video is JAM-PACKED with insights and valuable gems you don't want to miss! 💎

Buckle up and check it out now! 👇

Ethereum Surges 9% After Fed Rate CutKey Highlights:

Ethereum saw a 9% price increase, closing the week strong.

The Fed's 0.50% interest rate cut sparked a bullish reaction across the crypto market.

ETH broke through the $2,400 resistance level, which is now a critical support.

Targets and Outlook:

Current targets are $2,600 and $2,900, both of which will serve as key resistance levels.

As long as $2,400 holds, buyers remain in control.

After months of bearish price action, Ethereum is showing signs of recovery.

#Ethereum #ETH #CryptoBull #MarketUpdate #FedRateCut #CryptoRecovery #ETHPriceTargets

Phemex Analysis #23: Can the Fed Rate Cuts Ignite ETH Rally?!The recent Federal Reserve rate cuts sent ripples through the financial markets, sparking a rally in both the US stock market and the cryptocurrency realm. Bitcoin and Ethereum, the two titans of crypto, were among the beneficiaries, experiencing significant price increases.

While many investors approached this bullish surge with caution, a wave of optimism for Ethereum was brewing at the TOKEN 2049 conference. Influencers and experts alike expressed their belief that Ethereum's price could outperform Bitcoin in the next bull market.

Intrigued by this potential, let's explore some possible scenarios for Ethereum's journey and how you might capitalize on them:

Scenario 1: A Bullish Breakaway

If Ethereum's price continues to climb and breaks through the first resistance level of $2,800, we could see a period of accumulation before the next leg up. However, a more explosive move, surpassing the $3,400 mark, would signal a strong bullish reversal and present a prime opportunity to enter Ethereum.

Scenario 2: A Temporary Dip

On the other hand, if the rally loses momentum and Ethereum's price falls below the $2,200 support level, a deeper drop to $1,980 could be on the horizon. However, if the price forms a higher low above $2,200, it would indicate a strengthening of the support level and could offer a lucrative buying opportunity at a discounted price.

As with any investment, it's crucial to conduct thorough research and consider your risk tolerance before making any decisions. The future of Ethereum is filled with uncertainty, but the potential rewards are significant. Stay informed, analyze the market, and seize the opportunities that may arise.

Tips:

Armed Your Trading Arsenal with advanced tools like multiple watchlists, basket orders, and real-time strategy adjustments at Phemex. Our USDT-based scaled orders give you precise control over your risk, while iceberg orders provide stealthy execution.

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

SPY500 $SPY | RALLY AFTER FED RATE CUT - Sep. 19th, 2024SPY AMEX:SPY | RALLY AFTER FED RATE CUT - Sep. 19th, 2024

BUY/LONG ZONE (GREEN): $552.50 - $575.00

WEAKER BULLISH ZONE (PALE GREEN): $552.50 - $540.50

Weekly: Bullish

Daily: Bullish

4H: Bullish

This was my analysis for the end of the day yesterday, forgot to post it. Price has already rallied fairly well today. The Fed cut rates yesterday 50bps, down from 5.50 to 5.00. Here is what I was looking at as the market became volatile when reacting to the news. Despite the market already quickly moving in favor of the bullish zone, I still think we will reach the top of that zone before any form of reversal or significant pullback.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

trendanalysis, trendtrading, priceaction, priceactiontrading, technicalindicators, supportandresistance, rangebreakout, rangebreakdown, rangetrading, chartpatterntrading, chartpatterns, spy, sp500, s&p, AMEX:SPY , fed, federalreserve, fedrate, fedratecut, interestrate, jeromepowell, fedchair, 50bps, volatile, volatility,

USDJPY Analysis: Awaiting Market Confirmation Post Fed Rate CutHi Traders,

Following yesterday's USD news, the Federal Reserve has reduced the interest rate by 0.25%. It seems the market has already absorbed this news, and our attention shifts back to the USDJPY pair.

On Tuesday, my analysis showed a price break above the H4 structure. According to this structure, we can anticipate a continuation of the overall downtrend. However, predicting the exact point where the decline will begin is tricky. We'll need to carefully monitor price movements on smaller timeframes for more clarity.

On the 1-hour (1Hr) chart, we're looking for either a new higher high (HH) or a slightly lower high (LH) to complete the current wave structure. Selling at this stage is premature. Instead, we’re looking to buy on the current swing of the 1Hr chart, waiting for a potential failure to make a new HH.

S&P 500 Faces Key Resistance Ahead of Fed Rate Cut DecisionI don't usually cover US stocks on this platform, but for those following the S&P 500, it had a strong rally over the past few days. However, it’s now facing resistance around $5,650, just shy of the all-time high set back on July 16, 2024. Despite the recent run-up, it couldn’t quite reach the resistance line, and everything now depends on how the market reacts to the Fed's rate cuts on Wednesday.

If the Fed cuts rates by 0.5%, we might see a solid push upward. However, with a 0.25% cut, here are the support levels on the downside. Remember, the market can move either way this is just my take. If you have questions, leave them below, and don’t forget to hit that like button!

02/09/24 Weekly outlookLast weeks high: $64,481.00

Last weeks low: $57,205.43

Midpoint: $60,843.22

As September begins BTC finds itself at the $58,000 mark after selling off for the entire week last week. A historically bad Month for the crypto market is being paired with the first FED rate cut since March 2022.

Conflicting elements with one bearish and one potentially bullish, it will be interesting to see if the final month of Q3 is a slow one or whether this is the month where BTC can break its daily downtrend and continue the Bullrun.

I believe the 25bps vs 50bps rate cut is a huge point of contention, this week we have data releases for unemployment, nonfarm payrolls, jobless claims that could all give clues to the FEDs decision on the 18th September.

BTC finds itself below the 1D & 4H 200EMAs once again after falling short of the $65,ooo breakout. It seems there isn't really any rush to buy before we know of the FEDs decision, chopping and generally delivering max pain to the majority, unless you can be nimble on the LTFs nobody is winning here.

This week the wait continues, we saw a glimpse of hope in the altcoin market recently but that has now been taken away again as BTC struggled. Finding those fundamentally sound projects ready for Q4 and beyond is still a top priority.