XRPUSDT → The bulls won't hold support. Falling to 1.9BINANCE:XRPUSDT is under pressure despite quite positive news. The coin, being in a downtrend, continues to test the key support. The chance of a breakdown is growing

XRP continues to test a strong support zone on the weekly timeframe, relative to this zone, in the medium term, two scenarios can develop, which depend on the general mood in the market. If the current backdrop persists, the chance of a downside breakdown and further decline is quite high.

At the moment, the focus is on the key support at 2.0637, relative to which the retests continue, and the reaction is getting weaker and weaker, which in general only increases the chances of a further fall to 1.9 - 1.63.

Resistance levels: 2.265, 2.365, 2.509

Support levels: 2.0637, 1.9

The cryptocurrency market is going through bad times (Tariff War, high inflation, stock market decline, disappointment of the crypto community due to expectations) and until the situation starts to change, the technical picture will remain negative. XRP may continue its fall after a small correction.

Regards R. Linda!

Fibonacci Retracement

CADJPY → Consolidation before the news. DowntrendFX:CADJPY continues to forge a downtrend, but within the current movement a symmetrical triangle of accumulative nature is forming

The currency pair may continue its decline due to the strengthening of the Japanese Yen, while the Canadian is consolidating in a narrow range.

The situation may be accelerated by today's news, namely Trump's speech, where he may announce new tariff measures.

Technically, the price is correcting after the false break of 103.56, being below the previously broken upside support. Price is testing key resistance at 104.90, and against 0.5 Fibo is forming a false breakout. A consolidation below 104.69, a break of 104.525 could trigger further decline.

Resistance levels: 104.900, 105.36, 105.74

Support levels: 104.525, 103.56

There are important news ahead, high volatility is possible, especially at the moment of Trump's speech, which may set a medium-term tone in the market.

The currency pair is in consolidation on the background of the downtrend and the priority is to expect a continuation of the fall

Regards R. Linda!

EOSUSDT → False Breakeout of resistance (counter-trend )BINANCE:EOSUSDT.P within the consolidation distribution 0.54 - 0.6 reaches the key resistance and forms a false breakdown without the possibility of continued growth.

The cryptocurrency market is showing weakness, especially after yesterday's Trump speech and the approval of new Tariffs, which creates risks and pressure on the cryptocurrency market. Bitcoin is back in the red zone after rallying, while altcoins will continue to look for a new bottom. EOS stands out in this list, which strengthened quite strongly and the purpose of this maneuver was countertrend accumulation and liquidity capture relative to the range of 0.7 - 0.8. The distribution is tempered by a false breakout of the level 0.82 - 0.86

Resistance levels: 0.82, 0.86

Support levels: 0.793, 0.666

If the bears hold the resistance 0.82 - 0.86 and the consolidation under the level will end with the breakout of the trigger 0.793 and price consolidation in the selling zone, it may provoke a reversal and fall to the zones of interest: fvg, 0.64, 0.541.

Regards R. Linda!

NQ volatility likely to persist until retest of 13k buy zonechart shows it all...expect more volatility this month, likely a retest of 61.8 fib level at 15k & 78.6 fib levels (based on lows from 2023) near 13k before we finally run to the highs again into 2026!

tariffs have similar impact as rate hikes...overall will be digested by markets just fine & we'll head back to the highs as fed sees more freedom to cut given those effects...very incentivized to prevent a "hard landing" economically without also boosting inflation too much, so this is all actually a good thing if you can see it :)

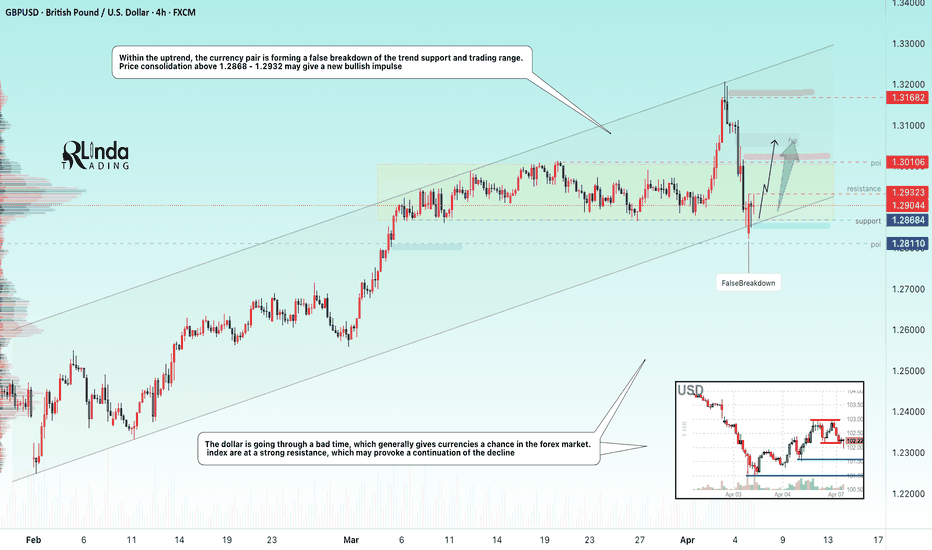

GBPUSD → False break of weekly support + DXY fallFX:GBPUSD is going through a shakeout phase relative to the trading range. Last week was very challenging in terms of unpredictable moves and volatility.

A strong NFP report on Friday allowed the dollar to strengthen, but the reaction from the opening of the new trading week has already exhausted itself as traders are still watching the tariff war, which simply crashed the stock, futures markets.

Technically, the currency pair on this background can win out, as the pound sterling within the ascending trend, the fall of the dollar can continue the growth phase.

On the chart, the price forms a false breakdown of the support conglomerate, which in general may push the price up due to the imbalance of liquidity and interests of money moving away from the dollar

Resistance levels: 1.2932, 1.3010

Support levels: 1.2828, 1.2811

If the bulls will keep the price above 1.2868 and will be able to consolidate above 1.2932, in the short term the market can show growth up to the next target - resistance 1.3010.

Regards R. Linda!

Will ETH finally change direction?ETH is approaching support at $1,559, but here you can see how the price has fallen below the upward trend line, which could have resulted in a stronger rebound. When support is broken, you can still see a strong support level at $997, to which we can see a decline.

Only when the trend changes direction will ETH have to face resistance levels at $1,889, then $2,151, and then $2,560 before we see any major upward movements.

The Stoch RSI indicator shows us moving along a line where we could previously observe strong price rebounds, while the RSI indicator itself, taking into account the interval of one weekend, shows us approaching the level we last touched during the bear market bottom.

BITCOIN → The price is consolidating, but there is a BUT!BINANCE:BTCUSDT is forming a consolidation after a false breakout of trend resistance. Against the backdrop of the global market crash (stock market, futures, forex) bitcoin looks quite strong, but I wouldn't get excited ahead of time

Bitcoin is trading inside a downtrend and also inside a range (global 81200 - 88800 and local 81200 - 85600). As long as the price is inside the local range and below trend resistance it is worth considering selling. There have been periods in history when the price seemed strong in the moment, but then, bitcoin caught up with the fall of indices...

The fundamental background for bitcoin is unstable:

First of all, the price has hardly reacted in any way to the introduction of tariffs, backlash and economic data. The Fed is not giving a clear signal, the market is in uncertainty. Any info noise ( China, Fed rhetoric, company reports ) can cause shake-ups. But at the same time, the same old problems remain: the crypto community is not getting any support. Bitcoin's dominance is growing against the backdrop of its decline. Altcoins continue to storm the bottom.

Technically , the situation is weak, the price cannot update local highs and consolidate above any strong support. It is possible to retest the trend resistance, or the zone of interest 85590 before the reversal and fall. Or, emphasis on the trigger 81187. A breakdown will provoke an impulse.

Resistance levels: trend, 85585, 88840.

Support levels: 81187, 78170, 73500

Buying in the medium term can be considered either after reaching the main target - 73-66K, or after the exit from the descending channel and price fixation above 88840. Now the emphasis is on a possible fall either from the resistance 85580, or when the support 81180 is broken

Regards R. Linda!

LTC Targets $70: A High-Probability Reversal SetupLitecoin (LTC) has just broken below the critical $80 low, signaling that bearish pressure is firmly in control. Currently trading at $79—just beneath the swing low at $80—LTC is also sitting below the monthly open at $82.98. With the bears flexing their dominance, traders are left wondering: Where does the price head next? What’s the target for the bears, and where can bulls find an opportunity to re-enter the market? Let’s dive into the charts, pinpoint the key levels, and craft a plan that could turn this downturn into a golden opportunity.

The Current Market Picture

LTC’s recent breach of $80 confirms the bearish momentum that’s been brewing since its peak at $147.06 on December 5, 2024. Litecoin enjoyed a stellar 122-day bullish run, soaring +195% from $49.80 to high at $147.06. Now, we’re on the 122nd day of a downtrend—a poetic symmetry that hints at a potential turning point. The question is: where will this descent find its floor, and how can we position ourselves for what’s next?

Support Zone: The $70 Fortress

To identify a robust support zone, we need confluence—multiple technical factors aligning to form a level that’s tough to crack. Here’s what the chart reveals:

Fibonacci Retracement: Using the Fib tool from the 2024 low at $49.80 to the high at $147.06, the 0.618 retracement at $86.95 has already been lost, turning our focus to the 0.786 level at $70.61. This deep retracement is a classic spot for reversals, making it a prime candidate for a support zone.

Yearly Level: At $70.14, this pivot is nearly identical to the 0.786 Fib level, adding significant weight to the area.

Volume Profile: The Point of Control (POC) from a 1.5-year trading range sits right around $70, just above the Fib level. This is the price with the highest traded volume over that period—a natural magnet for price action.

Yearly Order Block: Visualized as a green channel, this order block reinforces the $70 zone, suggesting past institutional buying interest or significant support.

Together, these factors create a $70 support zone that’s brimming with confluence. It’s not just a random level—it’s a fortress where bulls could mount a serious stand.

Long Trade Setup:

Entry Strategy: Use a Dollar-Cost Averaging (DCA) approach to build your position. Start with small buys around $75, laddering down to $70, and increase your position size as price nears the core of the support zone. Aim for an average entry of $73/72.

Stop Loss (SL): Set it below $68 to protect against a deeper breakdown while giving the trade room to breathe.

Take Profit (TP): First Target: $80 (the swing low and monthly open not far off). Main Target: $100 (a key psychological and resistance zone).

Risk-to-Reward (R:R): With an average entry at $73 and SL at $68, you’re risking $5 to gain $27 (to $100)—a stellar 5:1 R:R or better. This is a high-probability setup that rewards patience.

Execution Tip: Watch for bullish signals in the $70-$75 range—candlestick pattern, volume spikes, or RSI divergence. This isn’t about chasing; it’s about precision.

Resistance Zone: The $100 Battleground

If bulls reclaim control and push LTC higher, the $100 psychological level looms as a major resistance zone. Here’s why it’s a HOTSPOT:

Yearly Open: At $103.28, this level is close enough to $100 to bolster its significance.

Anchored VWAP: Drawn from the 2024 low at $49.80, the VWAP currently sits around $102.4, adding another layer of resistance.

Historical Context: The $100 mark has been a recurring battleground, with bulls and bears clashing repeatedly. It’s a price that carries weight.

A rally to $100 wouldn’t just be a recovery—it’d be a statement. A clean break above could hint at a broader trend reversal, but until then, it’s a ceiling to respect.

What’s Next? Bears vs. Bulls

For now, the bears are driving LTC lower, with the break below $80 opening the door to the $70 support zone. That’s their likely target—a level where selling pressure could exhaust itself. For bulls, $70 isn’t just a floor; it’s a launchpad. The DCA long setup offers a low-risk, high-reward entry.

Wrapping It Up

Litecoin’s drop from $147.06 to $79 has been brutal, but the chart is screaming opportunity. The $70 zone—backed by Fibonacci, levels, volume, and order blocks—is where bulls could turn the tide. With a DCA entry at around $73/72, SL below $68, and a main target at $100, you’ve got a trade setup that could deliver a 5:1 payoff. Meanwhile, $100 stands as the bears’ next big test if momentum shifts.

So, will you wait for LTC to hit $70 and strike, or watch the action unfold? The levels are clear—now it’s your move. Use this analysis to sharpen your edge, and let’s see where Litecoin takes us in the days, weeks, and months ahead.

________________________________________

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know, I’m here to break down the charts you want to see.

Happy trading =)

MSTR: Mid-term and Macro Price Structure As price holds below $344, odds favor a continuation lower to retest February lows, with later potential bounce and one more push to macro-support levels: 160/150-120 (with a potential extension to 105)

(see. recent idea on BTC price structure)

If BTC and broad market indexes show signs of stabilization and short-term strength over the coming weeks with MSTR price rising above 344, the odds are shifting to a more pronounce bounce to 400-460 resistance levels.

Weekly chart:

From a macro perspective:

as long as price remains below the 460 level, I consider the bullish trend since 2008 lows to have topped in November 2024, with current price action unfolding as part of a larger corrective Wave c.4 structure. Otherwise, If price reclaims ATH the door opens for an extension to 780-1280 resistance levels.

Monthly chart

Recent idea on BTC:

BTC/USD 1W chartHello everyone, I invite you to review the BTC chart to USD at 1W interval. As we can see long -term despite the current correction, the price lasts above the main line of upward trend. Going further we can see how the current correction stopped at strong support at 79221 $, however, if the support is broken, then you can see the second very strong support at $ 72085, which is close to the upward trend line.

In a situation where the trend is reversed, we have visible resistance at $ 89147, then a significant level of $ 96784 and very strong support at the level of the previous ATH. Looking at the RSI, you can see how he begins to change the direction that can change the direction of the price.

NKE: Macro structure [Monthly time frame]Price reached the top of the macro support: 56-27.

The correction from Nov'21 top has a picture perfect three-wave structure that has reached area of an ideal extension to finish itself (60-44 support).

Although, within the context of todays market uncertainty, recovery from this support zone, might still be a larger bounce before one more leg-down deeper into macro support

Best of trading and investing decision and thank you for you attention!

GOLD - Bullish Momentum Continues! Key Levels & Trade SetupCurrent Price Action:

Gold (XAUUSD) is showing strong bullish momentum on the 1-hour chart, with clear support levels forming. The price recently tested 3,108.56 and is holding above key psychological support at 3,100.00.

Key Levels & Trade Setup:

Support Zones:

- FVG (Fair Value Gap) acting as support

- Strong base at 3,108.56 (11:35 candle)

- Major psychological level at 3,100.00

Market Context:

The chart shows liquidity pools with clear buy/sell labels, indicating institutional activity. The price is respecting Fibonacci levels, suggesting a structured uptrend.

Final Thoughts:

Gold remains in a strong uptrend, with clear support levels and Fibonacci confluences providing high-probability trade setups. The 3,100 level is critical—holding above it keeps the bullish bias intact.

Disclaimer: Not financial advice. Always do your own analysis. Trade safe! 💡

BTC - Crawling back up after Trump's tariffs.🚀 BTCUSDT - 4H Chart Analysis 🚀

📊 Market Context:

Bitcoin recently experienced a sharp move, creating a Fair Value Gap (FVG) that price is now retracing into. The large gap in price action was influenced by recent economic uncertainty and speculation around Trump's tariffs.

📌 Technical Insights:

🔹 Price rebounded strongly from the support zone 📈.

🔹 Now approaching the FVG, where sellers may step in.

🔹 A potential lower high formation could lead to a continuation downward.

📉 Trade Expectation:

If price shows signs of rejection within the FVG, we could see a bearish move unfold towards previous support levels. The red arrow highlights the expected move if the resistance holds.

⚠️ Market Caution: Given the macroeconomic impact of recent events, volatility remains high. Always wait for confirmation before making decisions!

📢 Do you think BTC will reject this zone or push higher? Drop your thoughts below! 💬🔥🚀

GOLD → It all depends on NFP and Powell....FX:XAUUSD got shaken by 600 pips on both sides. Technically, after such a move the price may go into consolidation, but the near-term outlook will depend on NFP and Powell.

Gold hit a high of 3168 and went into correction. President Trump's imposed duties on imports from China (up to 54%) and other countries caused a sharp drop in the dollar and bond yields, reinforcing expectations of a Fed rate cut. Traders turned to profit-taking, which led to a correction. Now the market is waiting for the NFP report and Powell's speech. Weak data may return the upward momentum to gold, especially if the dovish rate expectations are confirmed. However, volatility may persist after the publication, given the impact of Friday's flows and Powell's speech

Resistance levels: 3107, 3116, 3135

Support levels: 3086, 3067, 3055

Technically, it is difficult to determine a clear place from where to expect a move as there is news ahead (NFP, Powell's speech). But based on the falling dollar and high economic risks, we can bet on the continuation of the price growth from one of the mentioned support levels: 3086, 3067, 3055.

Exit from the channel and consolidation of the price above 3110 - 3116 will again attract increased interest in buying

Regards R. Linda!

EURGBP → False break of liquidity zone (resistance)FX:EURGBP within the distribution (news background) tests resistance 0.84616 and liquidity zone, but without the possibility of continued growth the price forms a false breakout

The dollar index falls amid Trump's introduction of new tariffs, which generally provokes a rally in the whole market. But before NFP, the market shifts to profit-taking because of the growing risks. There are quite important news ahead, which may provoke high volatility.

Technically, after a strong move, the currency pair forms a false resistance breakout and consolidates in the selling zone. If the bears keep the price below 0.84616, in the short term we should wait for a correction to 0.5 fibo or to the fvg zone.

Resistance levels: 0.84600

Support levels: 0.8427, 0.8396

The situation is quite complicated due to unstable background, but technically we have a classic situation with a false breakout of strong resistance, and as we know, according to statistics, the strongest movements start after it (in relation to the trade of level breakout).

Regards R. Linda!

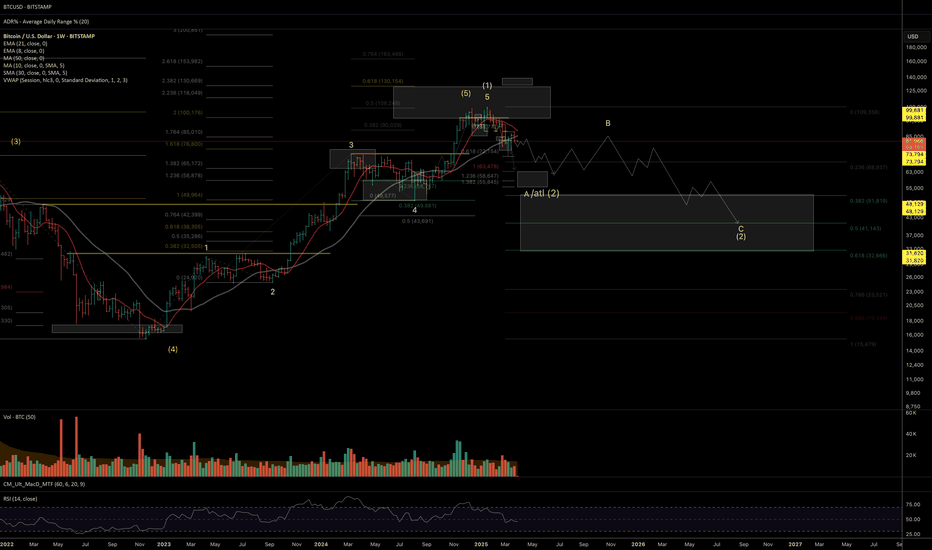

BTC Mid-Term Outlook: Key Levels & Wave StructureAs long as March lows hold, there remains a technical possibility for one more wave up toward the 130K resistance zone. However, given the corrective three-wave structure of the recovery (rather than an impulsive five-wave move), I am now leaning toward the mid-term top being in place at January highs.

If price remains below last week’s high, my operative scenario favors one more leg down to the 64K–55K–51K macro support zone. If the downside scenario unfolds, it would still be technically valid for the entire corrective wave (2) to complete within the support zone mentioned, especially considering the underlying fundamental strength of the asset.

Should price break above last week’s high in the coming weeks, the odds shift in favor of a renewed uptrend, potentially reclaiming ATH and targeting 130K.

The super-macro structure that I'm following as an operative wave count, assumes multi-decades bullish cycle, with the next long-term expansion phase expected once price establishes a firm bottom in the discussed support zone:

Wishing you successful trading & investing decisions. Thank you for your attention!

PS: The wave structure of BTC, proposed in March 2024 idea, has fulfilled itself:

ADA - Bearish Reversal Setup from Fair Value Gap🚀 ADAUSDT - 1H Chart Analysis 🚀

📊 Current Market Structure:

ADA is moving within a rising channel 📈, approaching a key resistance zone where a Fair Value Gap (FVG) is present. This area aligns with a significant Fibonacci retracement zone, making it a strong potential reversal point.

📌 Technical Insights:

🔹 Price is trading inside a well-defined bullish channel.

🔹 Approaching a major supply zone with previous reaction points.

🔹 Bearish rejection is expected in this area, leading to a potential drop.

📉 Trade Expectation:

A reaction from the FVG could lead to a downward move, as highlighted by the red arrows. If price confirms a rejection, a bearish shift in structure could occur, offering short opportunities.

⚠️ Risk Management Tip: Always wait for confirmation before acting on a setup. Managing risk effectively is key to long-term success!

📢 What do you think? Will ADA respect the FVG or push higher? Share your thoughts! 💬📉🚀

GOLD → Correction. Liquidity is the target. News aheadFX:XAUUSD on the background of yesterday's news reaches the target of 3166 and enters the phase of deep correction on the background of profit-taking. The level of economic risks is still high

Despite the pullback, the gold price retains much of its recent record high, thanks to rising risks of a global trade war and a US recession.

Gold corrects from record $3,168 but remains strong amid trade and recession risks. The correction is due to the following nuances: Profit taking ahead of key US jobs data. Waiting for jobless claims and services PMI.

But, Trump's new tariffs, a weaker dollar and lower bond yields are driving gold buying.

Resistance levels: 3116, 3135

Support levels: 3107, 3097

Against the background of high economic risks, falling dollar index, gold still has chances to continue its growth. False breakdown of support may give such a chance.

Regards R. Linda!

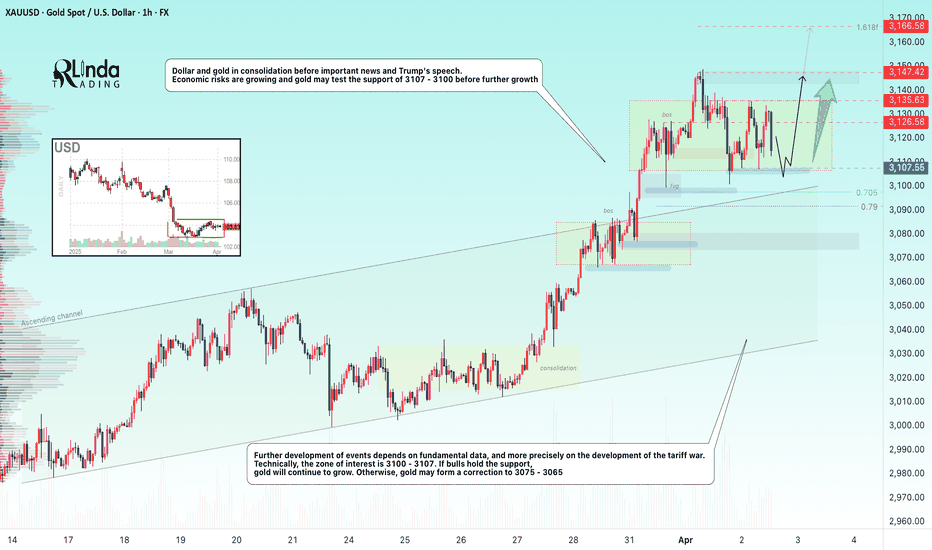

GOLD → Consolidation. News. False breakdown. Growth?FX:XAUUSD and TVC:DXY in consolidation ahead of important news and Trump's speech. Economic risks are rising and the future outlook depends on fundamental data...

Trade tensions support gold demand. Trump may impose global tariffs of up to 20% which will increase risks to the economy. Investors are piling into gold in anticipation, pushing its price to a record $3,150

A key factor is the details of the tariffs. If tariffs are softer than expected, gold could fall to intermediate support zones. If the trade war escalates, the rise could continue beyond 3150

Economic risks are rising and gold may test 3107 - 3100 support before rising further. Technically, 3100 - 3107 is a zone of interest and liquidity. If bulls hold the support, gold will continue to rise. Otherwise, gold may form a correction towards 3075 - 3065

Resistance levels: 3126, 3135, 3147

Support levels: 3107, 3100, 3091

The price is correcting to consolidation support in the moment. A strong and sharp fall is fraught with the risk of a liquidity grab and a false breakdown. In this case, gold may strengthen to one of the key resistances. But the further and medium-term development of events depends on the evening news....

Regards R. Linda!