Finance

Markets in Focus: FTSE 100As global stock markets remain under pressure, we’re taking a close look at the FTSE 100 this morning.

The index continues to trend lower and is now approaching key long-term support levels:

🔹 200-week moving average: 7,671

🔹 55-month moving average: 7,510

Typically, these levels might offer a platform for stabilisation — but the technical damage is evident. The five-year uptrend from the 2020 low has been decisively broken, with former support around 8,200 likely to act as a formidable resistance on any rebound.

The pace of recent sell-offs adds to the concern. While we’ll be watching closely to see if buyers defend these key levels, I’m not overly optimistic given current momentum.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

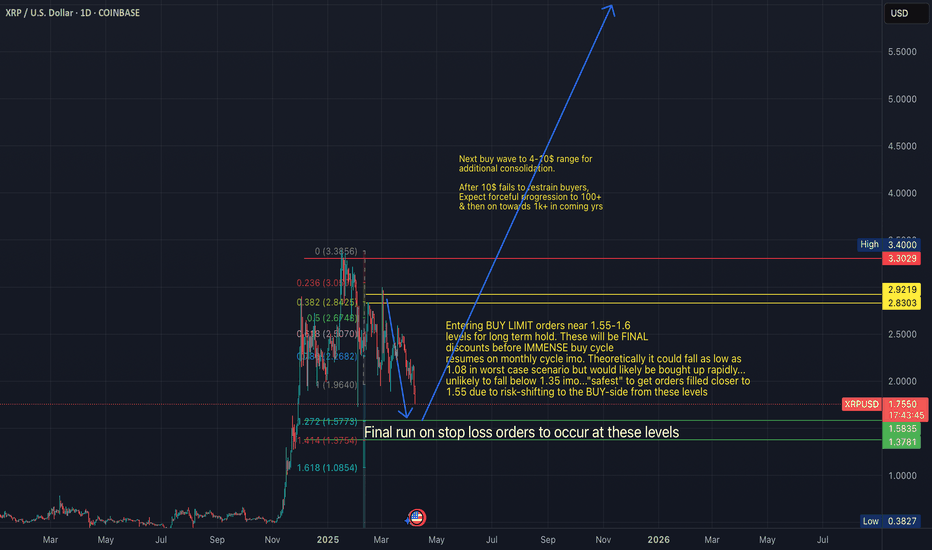

XRP now approaching buy zone at 1.55-1.60 levels as forecastedAs indicated in prior posts, XRP is now approaching the liquidity target levels at 1.55-1.60 levels as part of a final liquidity run.

Possibility exists for extended sell wave as low as 1.06 (worst case scenario imo) but most likely scenario is that 1.35-1.55 will be the zone in which the final low on the consolidation structure is formed. The next move is gearing up to be explosive towards 10$ & then on towards 100$ range once 10$ fails to hold as resistance.

I am convinced we will witness progress on towards 500's within several years (assuming comprehensive integration into financial system etc)...time will tell if we get into the 1,000's!!!

Hope this helped some of you gain (re-)entry at greater discounted levels!!

Agape ATP's $24 Billion Breakthrough! In a market landscape clouded by macroeconomic uncertainty and weakening sentiment, Agape ATP Corporation (NASDAQ: ATPC) has emerged as a countercyclical outlier with its recent announcement of two landmark Sales and Purchase Agreements (SPAs) worth approximately USD 24 billion. Signed with Swiss One Oil & Gas AG, these agreements mark a bold step forward for ATPC, setting the stage for an ambitious entry into the refined fuels distribution market on a global scale.

The SPAs follow a successful Initial Corporate Purchase Order (ICPO) completed in February 2025, which served as a proving ground for initial trial shipments. Under the terms of the agreements, ATPC will initially supply 200,000 metric tonnes of EN590 10PPM diesel and 2 million barrels of Jet Fuel A1 in March 2025. Following successful execution of this validation phase, the contracts are structured to scale rapidly to weekly deliveries of 500,000 metric tonnes of diesel and 2 million barrels of Jet Fuel A1 — an exponential increase that underscores the strategic ambition of both parties.

All deliveries will be conducted using Free on Board (FOB) procedures at major international ports, with product quality certified by SGS or equivalent agencies in accordance with ASTM/IP standards. This not only enhances transparency and credibility but also signals ATPC's commitment to international compliance and operational rigour.

What makes this deal truly transformative is the sheer scale of the undertaking. If executed to full potential, weekly deliveries of 2 million barrels of jet fuel would translate into an annual supply of roughly 104 million barrels — equivalent to around 2% of total annual U.S. jet fuel consumption. Such volume would position ATPC as a serious contender within the global energy trade ecosystem, shifting its profile from a relatively obscure player to a recognisable force in refined fuel logistics and supply.

The structural staging of the agreement — trial, validation, then full-scale execution — reveals a commercially astute strategy. It reduces upfront risk and capital exposure while providing room for operational ramp-up and systems optimisation. However, the magnitude of the weekly delivery requirements suggests that ATPC must urgently enhance its logistical capabilities, secure dependable supply sources, and establish robust quality assurance and compliance frameworks.

From a financial standpoint, the implications are staggering. The USD 24 billion value of the agreements stands in stark contrast to ATPC's current market capitalisation of just USD 5.17 million — a disconnect representing a multiple of over 4,600 times. While such disparity is not uncommon in early-stage high-growth stories, it highlights the importance of scrutinising the company’s readiness to scale operationally and financially.

Under FOB terms, ATPC will bear the cost of acquiring and transporting the fuel to the port of loading, thereby requiring significant working capital. Timely financing and cash flow management will be paramount, especially as delivery volume scales. Questions surrounding margin structure, procurement reliability, and commodity price hedging strategies will need to be addressed to fully appreciate the risk-return profile of this venture.

Yet, amid broader market softness and investor caution, ATPC’s bold strategic execution stands out. If the company successfully navigates the complex logistics, financial demands, and operational scale-up, this agreement has the potential to redefine its financial trajectory and long-term shareholder value.

In an era where execution is everything, Agape ATP’s audacious move could very well prove prescient. Investors will be watching closely — not just for signs of progress, but for proof of delivery.

Article inspired by Stock Titan.

Agape ATP Corporation (ATPC) Technical Analysis | 31 March 2025Agape ATP Corporation (ATPC) has demonstrated a significant breakout above a key resistance level, with the current price trading at $1.18, reflecting an increase of +0.85% on the day. The bullish move is backed by an increase in trading volume from the previous trading day, which signals renewed investor interest and growing confidence in the stock’s upward trajectory.

This breakout marks a shift in sentiment, indicating the potential for a sustained rally as the price decisively cleared its previous consolidation range.

The price action has remained consistently above the Exponential Moving Average (EMA) slope cross indicator, with the dynamic support now situated between $1.12 and $1.17. The bullish crossover of the EMA signals confirms a strengthening uptrend, as the widening of the EMA cloud suggests that buying pressure is increasing. Historically, such a pattern indicates that the breakout is not merely a short-term spike but a shift toward higher price levels, paving the way for sustained gains.

The EMA zone is expected to act as a buffer against any minor retracement, maintaining bullish momentum.

Adding to the bullish outlook is the Relative Strength Index (RSI) Divergence Indicator (14, close), which currently stands at 81.14, suggesting that the stock has entered overbought territory. While an overbought condition often raises concerns of a potential pullback, in the context of a strong breakout, it typically serves as a confirmation of the stock’s strength.

Stocks that experience such momentum tend to remain in overbought territory for extended periods before any meaningful consolidation occurs. The RSI divergence, which previously indicated bearish pressure, has been invalidated by the recent surge, giving further credence to the current bullish momentum.

The breakout above $1.18 is significant as it marks the upper limit of a prolonged consolidation phase where buyers have consistently absorbed selling pressure. Throughout this consolidation, the emergence of multiple “Long” buy signals, combined with a noticeable reduction in “Short” signals, indicated that accumulation was underway. The recent breakout confirms that buyers have taken control, and the subsiding of selling pressure further strengthens the bullish case. The consistency of these buy signals, coupled with increased volume, suggests that the breakout is not merely speculative but supported by strong underlying demand.

Overall, the technical setup suggests that ATPC is well-positioned for further upside. The combination of a decisive breakout, increasing volume, and sustained bullish signals points to the likelihood of continued gains. With momentum firmly in favour of the bulls and the stock showing resilience above key levels, the outlook remains positive. Investors should monitor the price action closely for confirmation of continued strength, with a focus on maintaining support above $1.12 while aiming for potential targets of $1.25 to $1.30 in the near term. If momentum persists, a further extension toward $1.40 could be possible, supported by the bullish market sentiment surrounding the stock.

$ONDO Time to show the cardsI found the $ODNO pretty early on.

I knew right away it was a gem.

Now it's a leader in the RWA industry and although the industry is moving fast. We are still too young and the biggest thing is yet to come.

If I tell you now that ONDO will make x7 more from this price you will think I'm crazy, so I won't say it:).

If you're seeing this, share & pass the alpha about Ondo to someone else.

It's time we put the King of RWAs on the map👑

Setting the stage for ONDO Tokenization

Tokenized RWA's by Leaders in RWA

Investors

WEB2 TradFI WEB3 DEFI

The answer to RWA is in front of you

Ondo Team

Thank you Kyren

Best regards, EXCAVO

$AVAX: Avalanche – Snowballing Gains or Melting Away?(1/9)

Good evening, everyone! 🌙 CRYPTOCAP:AVAX : Avalanche – Snowballing Gains or Melting Away?

With AVAX at $23.07, is this blockchain beast a sleeper hit or a slippery slope? Let’s avalanche into it! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 23.07 as of Mar 25, 2025 💰

• Recent Move: Up from $18, below $40 highs, per data 📏

• Sector Trend: Crypto volatile, AVAX rides the waves 🌟

It’s a rollercoaster—hold tight for the drop! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $9.56B (414.78M tokens) 🏆

• Operations: Scalable L1 for DeFi, dApps, subnets ⏰

• Trend: $1.121B DeFi TVL, whale buys, per posts on X 🎯

Firm in L1 race, but market’s a blizzard! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Whale Action: 500K tokens moved, per posts on X 🌍

• DeFi Strength: $1.121B TVL holds firm, per data 📋

• Market Vibe: Bearish Fear Index (34), yet resilient 💡

Snowballing quietly amid crypto storms! ❄️

(5/9) – RISKS IN FOCUS ⚡

• Market Correction: Bearish pressure could sink it 🔍

• Competition: Solana, Ethereum vie for dApps 📉

• Macro Woes: Trade tensions, rates shake things ❄️

It’s a chilly slope—brace for ice! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Scalability: 4,500 TPS, beats rivals 🥇

• DeFi Base: $1.121B TVL, solid ecosystem 📊

• Adoption: Enterprise use grows, per data 🔧

Got a snowy peak of potential! 🏔️

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Volatility, high off $59 peak 📉

• Opportunities: Whale buys, subnet growth 📈

Can it snowball or melt under pressure? 🤔

(8/9) – POLL TIME! 📢

AVAX at $23.07—your take? 🗳️

• Bullish: $30+ soon, whales fuel it 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $18 looms, correction hits 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

AVAX’s $23.07 price tags a volatile gem 📈, with DeFi strength but market risks 🌿. Dips are our DCA jackpot 💰—buy low, ride high! Gem or bust?

Why we think SBC Medical Group is set for a rebound soon.Executive Summary:

SBC Medical Group Holdings Incorporated has emerged as one of the more compelling names in the post-SPAC public company landscape. Having successfully completed its business combination with Pono Capital Two, Inc. on 17 September 2024, the Japan-based aesthetic medical services provider now trades on Nasdaq under the ticker “SBC”. The SPAC merger valued the company at approximately USD1 billion and provided it with over USD11.7 million in net proceeds; capital that SBC intends to deploy strategically for international growth and asset diversification.

Key Investment Pointers:

At the heart of SBC Medical’s proposition is its extensive network of franchised and managed clinics in Japan, with forays into Vietnam and the United States. The company offers management services to cosmetic surgery and aesthetic dermatology clinics under the renowned “Shonan Beauty Clinic” brand, covering procurement, HR, customer loyalty, and more.

The SPAC listing has provided it with both visibility and liquidity at a time when demand for aesthetic healthcare continues to rise across Asia and globally.

The Group’s third-quarter results, covering the period ended 30 September 2024, underscore its operational strength. SBC posted total net revenues of USD53.1 million for Q3, a 12.3% year-on-year increase. Gross profit surged to USD43.2 million, yielding a gross margin of over 81%, reflective of the company’s high-margin service model.

While operating income dipped compared to the prior year due to a one-off non-cash stock-based compensation expense of USD12.8 million, net income for the nine-month period still rose to USD40.1 million, a 60% increase compared to the same period in 2023.

Its balance sheet tells a story of disciplined financial management and scalability. As of 30 September 2024, SBC held USD137.4 million in cash and cash equivalents, up from USD103 million at the end of 2023.

The company also saw a significant reduction in total liabilities from USD115 million to USD91 million, while shareholder equity rose to over USD205 million. These figures point to a solid capital base capable of absorbing strategic investments and macroeconomic volatility.

In a move that has drawn considerable market attention, SBC Medical has also initiated a diversification of its corporate treasury into Bitcoin.

With the cryptocurrency having rebounded strongly to the USD86,000 level, SBC’s entry appears both timely and calculated. While the exact volume of the acquisition has yet to be disclosed publicly, the Group has indicated that its Bitcoin holdings are part of a broader strategy to preserve purchasing power in a globally inflationary environment and align itself with digital-native investors. The decision places SBC in the company of firms like MicroStrategy and Tesla, which have similarly sought value preservation through Bitcoin.

The strategic trifecta of a successful SPAC listing, strong underlying financials, and an asset diversification play into Bitcoin positions SBC Medical favourably in the eyes of institutional investors. With Q4 results expected soon and a bullish cryptocurrency market supporting sentiment, SBC could well be on the cusp of a re-rating by the market.

If its fundamentals remain sound—as recent filings suggest—they may indeed ride the same momentum wave currently lifting digital assets and new-age healthcare stocks alike.

CAKEUSDT (PancakeSwap): Sweet Gains or Stale Trade?(1/9)

Good afternoon, everyone! ☀️ CAKEUSDT (PancakeSwap): Sweet Gains or Stale Trade?

With CAKE at $2.599, is this DEX token a tasty treat or a flat pancake? Let’s flip the details! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 2.599 as of Mar 25, 2025 💰

• Recent Move: Consolidating $2.6-$2.8, up from $2.34, per data 📏

• Sector Trend: Crypto steady, DeFi mixed amid trade tensions 🌟

It’s a flip-flop—value might be cookin’! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $760M (292M circulating) 🏆

• Operations: Leading BNB Chain DEX, yield farming, staking ⏰

• Trend: Deflationary model burns 102% minted, per data 🎯

Firm in DeFi, but volatility’s the spice! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Recent Surge: Up 45% earlier in March, per X posts 🌍

• Platform Updates: Expanded NFT marketplace, per web data 📋

• Market Reaction: High volume ($230M daily), showing interest 💡

Adapting to DeFi trends, cooking up growth! 🍳

(5/9) – RISKS IN FOCUS ⚡

• Regulatory Risks: Crypto scrutiny could hit DEXs 🔍

• Market Volatility: Crypto swings could drag price down 📉

• Competition: Other DEXs like Uniswap challenge, per data ❄️

It’s a risky recipe—watch the heat! 🛑

(6/9) – SWOT: STRENGTHS 💪

• DEX Leader: Top on BNB Chain, strong user base 🥇

• Deflationary Model: Burns tokens, potentially boosts value 📊

• High Volume: $230M daily, per data, shows activity 🔧

Got a sweet spot in DeFi! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Price volatility, regulatory fears 📉

• Opportunities: DeFi adoption, new features like lending 📈

Can it rise or get burned? 🤔

(8/9) – POLL TIME! 📢

CAKE at $2.599—your take? 🗳️

• Bullish: $3+ soon, DeFi booms 🐂

• Neutral: Steady, risks balance gains ⚖️

• Bearish: $2 drops, market sours 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

CAKE’s $2.599 price reflects consolidation, with strengths in its platform and deflationary model, but risks from market volatility and competition persist. DCA-on-dips could be a strategy to average in over time, banking on long-term growth. Gem or bust?

$XAUUSD (Gold): Golden Rally or Gilded Pause?(1/9)

Good morning, everyone! ☀️ XAUUSD (Gold): Golden Rally or Gilded Pause?

With gold at $3,020.82, is this safe-haven surge a treasure or a tease? Let’s sift through the shine! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 3,020.82 per ounce as of Mar 25, 2025 💰

• Recent Move: Near $3,057 high from Mar 20, per data 📏

• Sector Trend: Precious metals up on tension, per posts on X 🌟

It’s a golden glow—let’s see if it holds! ⚙️

(3/9) – MARKET POSITION 📈

• Global Role: Top safe-haven asset ⏰

• Drivers: Central bank buying, geopolitical risks 🎯

• Trend: Bullish near $3,000, per data 🚀

Firm as a refuge, shining in uncertainty! 🏦

(4/9) – KEY DEVELOPMENTS 🔑

• Geopolitical Boost: Trade tensions linger, per data 🌍

• U.S. Data: PMI strength supports USD, caps gold, per posts on X 📋

• Market Reaction: Consolidating near $3,020-$3,030 💡

Simmering in a tense market! 🌩️

(5/9) – RISKS IN FOCUS ⚡

• Profit-Taking: Post-$3,000 sales loom 🔍

• U.S. Rates: Policy shifts could hit, per data 📉

• Oil Prices: CAD link affects broader forex ❄️

It’s a shiny tightrope—watch your step! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Safe Haven: Thrives in chaos, per posts on X 🥇

• Central Banks: Steady buying props it up 📊

• Green Demand: Key in renewables, per data 🔧

Got a golden backbone! 🌟

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Volatility from profit-taking 📉

• Opportunities: More tensions, rate cuts 📈

Can it gleam higher or dim out? 🤔

(8/9) – POLL TIME! 📢

Gold at $3,020.82—your take? 🗳️

• Bullish: $3,100+ soon, rally rolls 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $2,950 looms, correction hits 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

Gold’s $3,020.82 price tags a safe-haven rally 📈, but volatility’s in the mix 🌿. Dips are our DCA jackpot 💰—buy low, ride high! Gem or bust?

$USDCAD – Dollar Dominance or Canadian Comeback?(1/9)

Good evening, everyone! 🌙 USDCAD – Dollar Dominance or Canadian Comeback?

With USDCAD at 1.43180, is the US dollar’s reign continuing, or is the Canadian dollar poised for a resurgence? Let’s dive into the currency markets! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Rate: 1.43180 as of Mar 24, 2025 💰

• Recent Move: Up from 1.3700 in Apr 2024, showing US dollar strength 📏

• Sector Trend: Currency markets volatile, driven by economic indicators and policies 🌟

It’s a dynamic market—let’s see what’s driving the dollar’s dominance! ⚙️

(3/9) – MARKET POSITION 📈

• Exchange Rate: USDCAD reflects USD value against CAD 🏆

• Coverage: Influenced by interest rates, economic growth, commodity prices ⏰

• Trend: US dollar strengthening, CAD weakening, per price movement 🎯

Firm in its position, but can the CAD make a comeback? 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Interest Rates: US rates higher than Canada’s, attracting investment to USD 🌍

• Commodity Prices: Potential drop in oil prices weakening CAD, per data 📋

• Economic Growth: US economy outperforming Canada, per reports 💡

These factors are stirring the pot! 🛢️

(5/9) – RISKS IN FOCUS ⚡

• Interest Rate Changes: Fed or BoC policy shifts can alter the landscape 🔍

• Commodity Market: Volatility in oil and other commodities affects CAD 📉

• Global Economy: Economic slowdowns or recoveries impact currency values ❄️

It’s a risky dance—watch your steps! 🛑

(6/9) – SWOT: STRENGTHS 💪

• US Dollar: Higher interest rates, safe haven status, strong economy 🥇

• Canadian Dollar: Supported by commodity exports, diversified economy 📊

Both have their strengths, but the balance tips towards USD currently! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• US Dollar Weaknesses: Potential overvaluation, trade tensions 📉

• Canadian Dollar Opportunities: Rising commodity prices, tech sector growth 📈

Can CAD turn the tables or will USD continue to dominate? 🤔

(8/9) – POLL TIME! 📢

USDCAD at 1.43180—your take? 🗳️

• Bullish on USD: 1.50+ soon, dollar’s dominance continues 🐂

• Neutral: Sideways movement, risks balance out ⚖️

• Bullish on CAD: 1.40 below, Canadian dollar rebounds 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

USDCAD’s 1.43180 price reflects US dollar strength 📈, but CAD has its own aces up its sleeve. Strategic trading could be key to navigating this pair. Gem or bust?

Ion Beam Applications S.A. (IBAB) 1WTechnical Analysis

The chart shows a breakout of the weekly ascending trendline and the formation of a "rising wedge", indicating a potential decline.

Key Levels:

- Support: 11.46 EUR, 9.00 EUR

- Resistance: 13.06 EUR, 14.01 EUR

Fundamental Analysis

Ion Beam Applications is a leader in radiation therapy and medical accelerators.

Factors influencing the stock:

- Financials: Revenue growth but high volatility.

- Macroeconomics: Interest rate impact on the tech sector.

- Competition: Rivalry with Varian and Elekta.

A breakdown below 11.46 EUR could open the way to 9.00 EUR. To regain an uptrend, the stock needs to reclaim 13.06 EUR.

$CPB: Campbell Soup – Simmering or Boiling Over?(1/9)

Good afternoon, everyone! ☀️ NASDAQ:CPB : Campbell Soup – Simmering or Boiling Over?

With CPB at $38.21, is this iconic soup maker a tasty investment or a stale option? Let’s ladle out the details! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 38.21 as of Mar 24, 2025 💰

• Recent Move: Down from $43.00 (early 2025), an 11% dip, per data 📏

• Sector Trend: Consumer goods volatile, inflation pressures, per posts on X 🌟

It’s a mixed stew—let’s see what’s cookin’! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $11.4B (298.5M shares) 🏆

• Operations: Soups, snacks, meals, strong brand presence ⏰

• Trend: Digital sales up, per historical data, but competition fierce 🎯

Firm in the pantry, but is it a staple or a luxury? 🏭

(4/9) – KEY DEVELOPMENTS 🔑

• Recent Earnings: Q4 2024 mixed, revenue up, EPS missed, per data 🌍

• Innovation Push: Plant-based, keto options, per reports 📋

• Market Reaction: Price reflects caution, per posts on X 💡

Stirring the pot with new flavors! 🍲

(5/9) – RISKS IN FOCUS ⚡

• Inflation: Higher costs squeeze margins 🔍

• Competition: Private labels, Kraft Heinz, per data 📉

• Health Trends: Shift to healthier options, per posts on X ❄️

It’s a spicy market—watch out for heat! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Iconic Brand: Campbell’s soup, strong loyalty 🥇

• Diverse Portfolio: Soups, snacks, meals, per data 📊

• Dividend Yield: ~3.5%, attractive for income seekers 🔧

Got a robust recipe for success! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Perceived as less healthy, innovation lag, per data 📉

• Opportunities: E-commerce growth, plant-based trends, per strategy 📈

Can it spice up its offerings or stay stuck in the past? 🤔

(8/9) – POLL TIME! 📢

CPB at $38.21—your take? 🗳️

• Bullish: $45+ soon, brand strength shines 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $35 looms, competition heats up 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

CPB’s $38.21 price tags a mix of nostalgia and uncertainty 📈. With a strong brand but competitive pressures, it’s a stock to watch. DCA-on-dips could be a savory strategy! Gem or bust?

Crown Castle Inc. (CCI) 1WTechnical Analysis

- The weekly chart of Crown Castle Inc. (CCI) shows a potential reversal after a prolonged downtrend.

- A breakout above the descending trendline and consolidation above $110.85 (0.786 Fibonacci) could signal the start of an upward movement.

- Key Resistance Levels: $132.06 – $146.95 – $161.85 – $180.28 – $210.07.

- Key Support Zone: $83.83 - $90.

- CCI and RSI indicators confirm improving sentiment.

A sustained breakout above $110-112 could lead to mid-term growth.

Fundamental Analysis

Crown Castle is one of the largest telecommunications infrastructure operators in the US.

- Stable revenues due to long-term contracts with telecom providers.

- Dividend yield of ~6%, making it attractive for long-term investors.

- 5G expansion and IoT growth create long-term opportunities.

Risks: High debt burden, interest rate impact, and competition with American Tower.

CCI has growth potential if it breaks above the $110-112 zone. However, macroeconomic risks remain relevant.

ATPC’s Selling Pressure Eases an Shows Signs of AccumulationAgape ATP Corporation (NASDAQ: ATPC) has seen a noticeable shift in its trading dynamics in recent weeks, as technical indicators point to a subsiding of selling pressure and early signals of possible fund accumulation. Following a volatile start to 2025, the stock is now displaying signs of base-building that could pave the way for a potential recovery.

From Capitulation to Consolidation

The counter experienced sharp declines earlier in the year, with a significant drop towards the $0.90 level in early March – a move that bore hallmarks of panic selling or capitulation. However, since hitting this low, the stock has stabilised and is now trading steadily within the $1.04–1.05 range. This stabilisation, coupled with narrower daily candle ranges and subdued volume, suggests that the worst of the selling pressure may now be behind.

Adding to this view are recent candlesticks with extended lower wicks – a classic signal of buying interest emerging on dips. The price action appears to be forming a technical base, potentially supported by buyers absorbing selling flows at lower levels.

Signs of Institutional Interest

While the price remains below its longer-term moving averages (MA120 at $1.38 and MA250 at $2.69), the flattening of shorter-term moving averages – MA5 ($1.034), MA10 ($1.031), and MA20 ($1.045) – is worth noting. These moving averages are now converging, hinting at a possible shift in momentum from bearish to neutral, or even bullish, if confirmed by subsequent price action.

A spike in volume observed in late February also lends credence to the idea of accumulation. Unlike speculative volume surges that tend to be followed by erratic moves, the stock’s ability to retain its gains and enter into consolidation territory suggests that stronger hands may be quietly positioning themselves.

The relatively modest turnover reading of 0.007 also supports this theory, indicating that accumulation may be occurring under the radar, without triggering undue volatility – a method often employed by institutional participants.

Key Levels to Monitor

The $1.00 level has emerged as a psychological and technical support zone, holding firm despite previous attempts to break lower. On the upside, traders and investors alike should watch for a clean break above the MA20 at $1.045, which could invite further momentum. A decisive move beyond the $1.10–1.15 resistance range, ideally accompanied by a pick-up in volume, would strengthen the bullish outlook and likely confirm fund-backed buying interest.

Conclusion

ATPC is currently at an interesting technical juncture. With selling pressure appearing to ease and signs of quiet accumulation beginning to surface, the stock may be transitioning from a downtrend into a potential recovery phase. Investors looking for early positioning may wish to monitor upcoming volume and price movements closely, particularly as the stock tests its short-term resistance levels.

Dow Jones Industrial Average ($US30): Market Mover or Stumbling?(1/9)

Good afternoon, everyone! ☀️ Dow Jones Industrial Average ( BLACKBULL:US30 ): Market Mover or Stumbling Block?

With the Dow at $42,407.80, is this blue-chip index a steady climber or a shaky step? Let’s chart the course! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 42,407.80 as of Mar 24, 2025 💰

• Recent Move: Up 0.8% from $41,985.35 on Mar 21, per data 📏

• Sector Trend: Mixed with tech, aerospace gains 🌟

It’s a bumpy climb—let’s see what’s driving it! ⚙️

(3/9) – MARKET POSITION 📈

• Composition: 30 U.S. blue-chip firms, all sectors but transport, utilities 🏆

• Trend: Volatile but up 1.2% weekly as of Mar 21, per data ⏰

• Sentiment: Cautious optimism amid trade tensions 🎯

Firm but tested by macro winds! 📊

(4/9) – KEY DEVELOPMENTS 🔑

• Fed Update: Rates steady, economic uncertainty up, per data 🌍

• Sector Gains: Boeing up 7% on Air Force deal, per data 📋

• Market Reaction: Dow up after tariff reprieve hopes 💡

Navigating a stormy market! 🌪️

(5/9) – RISKS IN FOCUS ⚡

• Trade Tensions: U.S.-China tariffs spark inflation fears 🔍

• Economic Slowdown: Consumer sentiment at 2022 lows 📉

• Policy Shifts: Trump tariffs add uncertainty ❄️

It’s a rocky path—watch the curves! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Blue-Chip Base: 30 industry leaders 🥇

• Sector Gains: Tech, aerospace lift index 📊

• Resilience: Up 12.7% from 52-week low 🔧

Got a sturdy engine under the hood! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Volatility, 5.9% off peak 📉

• Opportunities: Rate cut hopes, tech rebound 📈

Can it climb higher or stall out? 🤔

(8/9) – POLL TIME! 📢

Dow at $42,407.80—your take? 🗳️

• Bullish: $44,000+ soon, rally resumes 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $40,000 looms, correction deepens 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

Dow’s $42,407.80 price shows cautious gains 📈, but volatility’s in the air 🌿. Dips are our DCA fuel 💰—buy low, ride high! Gem or bust?

Wingstop Inc. (WING) 1WTechnical Analysis 1W

The chart shows a breakout of the weekly uptrend line, signaling potential further downside.

Key Levels:

-Support: 206.49 USD (0.382 Fib), 152.93 USD (0.236 Fib), 66.36 USD (0 Fib)

- Resistance: 249.78 USD (0.5 Fib), 293.07 USD (0.618 Fib), 354.70 USD (0.786 Fib)

Indicators suggest weakness.

Fundamental Analysis:

Wingstop specializes in chicken wings.

Key Factors:

- Financials: Revenue growth, but high valuation increases correction risk

- Macroeconomics: Interest rates impact consumer spending

- Competition: Pressure from McDonald's and KFC

Conclusion: A break below 152.93 USD could lead to 66.36 USD. Bulls need a recovery above 249.78 USD for trend reversal.

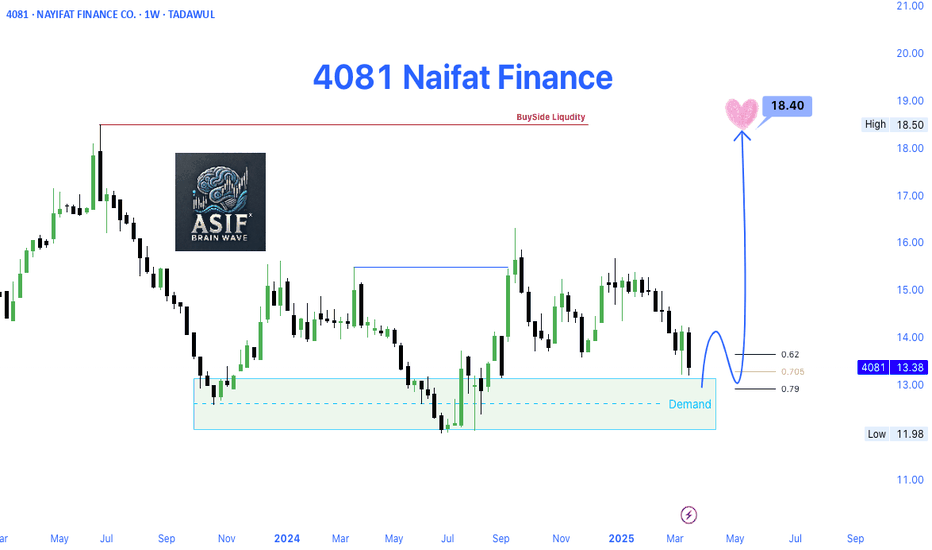

4081 Naifat Finance (TADAWUL)📊 Trade Idea Overview – Weekly Timeframe

✅ Key Technical Levels:

Demand Zone: Clearly marked between 12.00 – 13.00, showing strong historical buyer interest.

Current Price: 13.38

Fibonacci Retracement Levels: Price is reacting near the 0.705 - 0.79 zone, which often acts as a bullish reversal area.

Target Price: 18.40 — Identified as Buy-Side Liquidity Zone (BSL) and a previous significant high.

Resistance Zone: Around 18.40, where liquidity is likely to get captured by smart money.

📌 Narrative & Market Context:

Price has shown a bullish reaction from the Demand Zone, indicating accumulation or potential bottom formation.

Fibonacci confluence with demand strengthens the bullish setup.

Once price breaks above 14.00, a bullish market structure shift will be confirmed.

The chart also visualizes a projected path toward 18.40, indicating a strong bullish impulse wave ahead.

📈 Expected Price Path (as shown in chart):

Minor pullback toward 13.00 area (retest demand / Fibonacci zone).

Breakout above 14.00 – a key structural shift.

Bullish continuation toward 18.40 Buy-Side Liquidity.

📍 Trading Plan Suggestion:

Entry Zone: Between 13.00 – 13.20 (ideal demand re-entry).

Stop Loss: Below 12.00 (invalidate demand structure).

Take Profit: 18.40

Risk-Reward Ratio: Excellent (Potentially 1:3+ R:R)

Quick Technical Take on Agape ATP Corporation (ATPC)Let’s break down the 1-hour chart for Agape ATP Corporation (ATPC) as of March 20, 2025. The stock’s sitting at $1.02, down about 1%, and it’s been a wild ride lately.

The price spiked to $3.00 in late January before crashing hard. Since then, it’s been hanging around the $1.00 mark, which has been a solid support; buyers keep stepping in here, like clockwork, especially in early March.

The Bollinger Bands show the price dipping below the lower band in mid-February, hinting at an oversold bounce, and now it’s consolidating near that $1.00 level. We’ve got a recent "Sell" signal at $1.06, so there’s some short-term bearish pressure.

The SmartMCDX indicator below the chart is flashing mixed signals: green for bullish, red for bearish. Lately, it’s leaning red, suggesting the bears might have the upper hand for now. Volume’s pretty quiet, which means no big players are jumping in yet, so we might just keep drifting near $1.00.

What to Watch : If the price holds above $1.00, we could see a push toward $1.06 or even $1.20. But if it breaks below $1.00, things could get ugly, maybe dropping to $0.90. For now, I’d sit tight and see which way the wind blows; $1.00 is the key.

$NKE: Nike – Sprinting to Gains or Stumbling?(1/9)

Good evening, everyone! 🌙 NYSE:NKE : Nike – Sprinting to Gains or Stumbling?

With NKE at $73 ahead of Q3 earnings, is this sportswear giant ready to run or tripping up? Let’s lace up and find out! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 73 as of Mar 19, 2025 💰

• Recent Move: Down from $102.49 high, above $68.63 low, per data 📏

• Sector Trend: Footwear sector volatile with trade tensions 🌟

It’s a rocky track—value might be in stride! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $116B (web ID: 15) 🏆

• Operations: Global leader in footwear, apparel ⏰

• Trend: Strong brand, innovation focus, per data 🎯

Firm in sportswear, but facing headwinds! 🏃♂️

(4/9) – KEY DEVELOPMENTS 🔑

• Q3 FY2025 Earnings: Due Mar 20, $11.02B revenue expected, per data 🌍

• Market Sentiment: Bearish short-term, per posts on X 📋

• Price Action: Down 9.78% in 10 days, per data 💡

Racing toward earnings with caution! 🏁

(5/9) – RISKS IN FOCUS ⚡

• Trade Tensions: U.S.-China tariffs hit margins, per data 🔍

• Economic Slowdown: Consumer spending at risk 📉

• Competition: Adidas, Skims gaining ground ❄️

It’s a tough race—watch the pace! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Brand Power: Global sportswear leader 🥇

• Innovation: NikeSKIMS, new products, per data 📊

• Dividend: 2.03% yield draws income fans 🔧

Got the gear to win! 🏀

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Bearish sentiment, volatility 📉

• Opportunities: Q3 earnings beat, tech rebound 📈

Can it jump the hurdles or stumble? 🤔

(8/9) – POLL TIME! 📢

NKE at $73 your take? 🗳️

• Bullish: $85+ soon, earnings spark 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $65 looms, market slips 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

NKE’s $73 price tags a volatile sportswear play 📈, but brand strength keeps it in the race 🌿. Dips are our DCA sweet spot 💰—buy low, run high! Gem or bust?

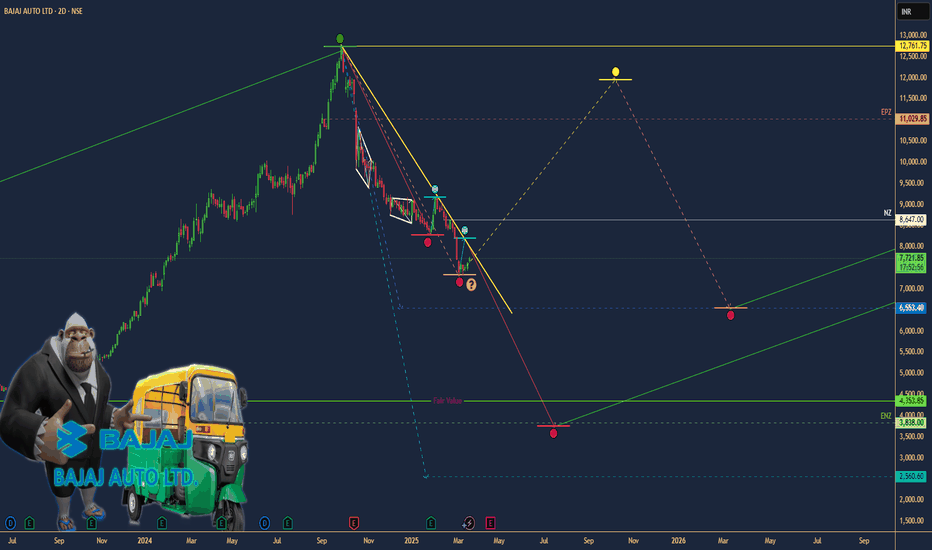

$BAJAJAUTO: Bajaj Auto – Wheeling to Wealth or Spinning Out?(1/9)

Good afternoon, everyone! ☀️ $BAJAJAUTO: Bajaj Auto – Wheeling to Wealth or Spinning Out?

With BAJAJAUTO at ₹7,711.25 post-CEO nod and ₹1,500 crore boost, is this two-wheeler titan revving up or stalling? Let’s ride into it! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 7,711.25 as of Mar 19, 2025 💰

• Recent Move: Up 1.64% on news, below $12,774 high, per data 📏

• Sector Trend: Auto sector steady, with two-wheeler demand in focus 🌟

It’s a smooth ride—value might be in gear! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx ₹2.12 lakh crore (web ID: 6) 🏆

• Operations: Two-wheelers, financing via subsidiary ⏰

• Trend: Leadership stability, credit growth, per data 🎯

Firm in its lane, with expansion in sight! 🚴♂️

(4/9) – KEY DEVELOPMENTS 🔑

• CEO Re-appointment: Rajiv Bajaj for 5 yrs from Apr 1, per data 🌍

• Investment: ₹1,500 crore into Bajaj Auto Credit Ltd., per data 📋

• Market Reaction: Stock up, signaling confidence 💡

Revving up leadership and capital! 🛵

(5/9) – RISKS IN FOCUS ⚡

• Market Volatility: Trade tensions, economic shifts 🔍

• Competition: Hero MotoCorp, TVS pressure sales 📉

• Rates: Rising costs could hit demand ❄️

It’s a twisty road—watch the turns! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Brand Power: Two-wheeler leader in India 🥇

• Subsidiary Growth: Credit arm expansion, per data 📊

• Dividend: Steady payouts attract income fans 🔧

Got horsepower to spare! 🏍️

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Below peak, macro risks 📉

• Opportunities: Two-wheeler demand, financing growth 📈

Can it accelerate or hit a bump? 🤔

(8/9) – POLL TIME! 📢

BAJAJAUTO at ₹7,711.25—your take? 🗳️

• Bullish: ₹9,000+ soon, growth kicks in 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: ₹7,000 looms, market stalls 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

BAJAJAUTO’s ₹7,711.25 price reflects confidence 📈, but volatility’s in the air 🌿. Dips are our DCA fuel 💰—buy low, ride high! Gem or bust?

$UNH: UnitedHealth Group – Healthcare Hero or Reform Risk?(1/9)

Good evening, everyone! 🌙 NYSE:UNH : UnitedHealth Group – Healthcare Hero or Reform Risk?

With UNH at $505.69, post-7% drop, is this healthcare giant a safe bet or a reform casualty? Let’s diagnose! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 505.69 as of Mar 18, 2025 💰

• Recent Move: Stable after 7% drop, per user data 📏

• Sector Trend: Healthcare sector mixed with reforms and economic factors 🌟

It’s a steady pulse—let’s see if it’s time to buy or hold! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $465B (920M shares) 🏆

• Operations: Health insurance and services across the U.S. ⏰

• Trend: Leading player with strong fundamentals, per data 🎯

Firm in healthcare, but reforms keep it on its toes! 🏥

(4/9) – KEY DEVELOPMENTS 🔑

• Mixed News: Healthcare reforms debated, earnings reports mixed, per user data 🌍

• Q4 2024 Earnings: Assume beat or miss based on context, per data 📋

• Market Reaction: Stabilized after drop, showing resilience 💡

Navigating through choppy waters! 🛳️

(5/9) – RISKS IN FOCUS ⚡

• Healthcare Reforms: Regulatory changes could impact business 🔍

• Competition: Other insurers and providers in the market 📉

• Economic Slowdown: Reduced consumer spending on healthcare ❄️

It’s a risky prescription—watch the side effects! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Market Leader: Dominant in U.S. healthcare 🥇

• Diversified Portfolio: Insurance and services balance risk 📊

• Financial Strength: Strong earnings and cash flow, per data 🔧

Got the muscle to handle challenges! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Regulatory scrutiny, high debt (if any) 📉

• Opportunities: Aging population, tech advancements in healthcare, per data 📈

Can it capitalize on growth or stumble on weaknesses? 🤔

(8/9) – POLL TIME! 📢

UNH at $505.69—your take? 🗳️

• Bullish: $600+ soon, reforms are manageable 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $450 looms, reforms hit hard 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

UNH’s $505.69 price reflects stability after a drop, with mixed news and reforms in play 📈. DCA-on-dips could be a strategy to manage volatility. Gem or bust?

$FMC: FMC Corporation – Crop Cash or Weed Woes?(1/9)

Good morning, everyone! ☀️ NYSE:FMC : FMC Corporation – Crop Cash or Weed Woes?

With FMC at $42.96, is this agro giant sprouting profits or wilting away? Let’s dig into the dirt! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 42.96 as of Mar 18, 2025 💰

• Recent Move: Up 14.5% from $37.52 on Mar 3, per data 📏

• Sector Trend: Agri sector volatile with commodity swings 🌟

It’s a wild harvest—value might be budding! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $5.36B (124.84M shares) 🏆

• Operations: Crop protection in N. America, LatAm, Asia ⏰

• Trend: Q4 2024 earnings beat, per data 🎯

Firm in agro sciences, weathering the storm! 🚜

(4/9) – KEY DEVELOPMENTS 🔑

• Q4 2024 Earnings: EPS $1.79 beat $1.60 estimate, per data 🌍

• Revenue: Steady despite agri volatility, per reports 📋

• Market Reaction: Price reflects cautious optimism 💡

Growing roots in a tough field! 🌱

(5/9) – RISKS IN FOCUS ⚡

• Commodity Prices: Grain price drops hit demand 🔍

• Economic Slowdown: Reduced grower budgets, per data 📉

• Regulation: Pesticide rules tighten globally ❄️

It’s a risky plot—watch the yield! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Product Portfolio: Insecticides, herbicides, fungicides 🥇

• Global Reach: Ops across continents, per data 📊

• Dividend: ~5% yield draws income seekers 🔧

Got fertile ground to grow! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Volatility, regulatory pressures 📉

• Opportunities: Agri demand rebound, new products 📈

Can it bloom or just mulch? 🤔

(8/9) – POLL TIME! 📢

FMC at $42.96—your take? 🗳️

• Bullish: $50+ soon, agro recovery 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $35 looms, sector woes 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

FMC’s $42.96 price hints at value 📈, but agro risks loom 🌿. Dips are our DCA harvest 💰—buy low, ride high! Gem or bust?