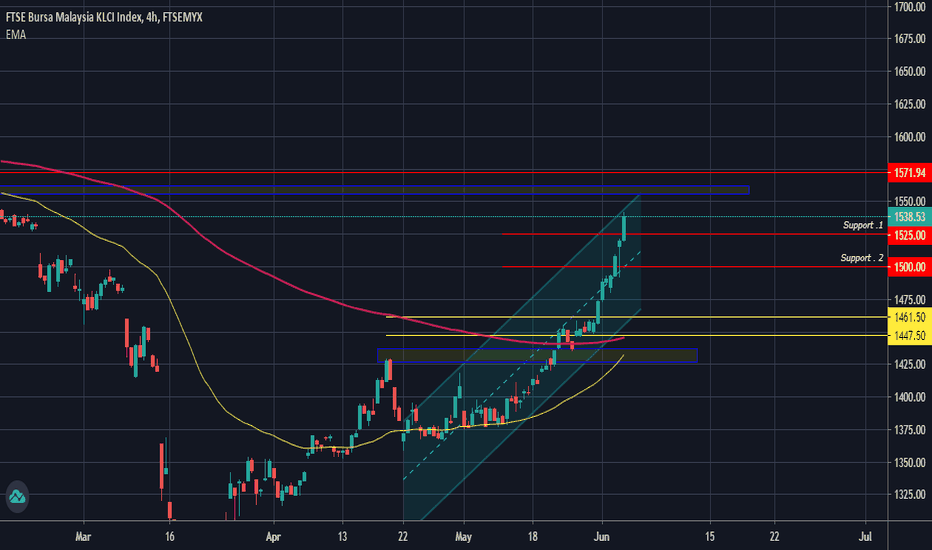

The "marubozu" Candlestick is roaring..Overall momentum remains strong, underpinned by “marubozu” candlestick pattern. Expected the index will test the psychological resistance in the near term.

Due to Malaysia Government is struggling to fight back the economy, in Q3 is seen a little bit of hope to recover back for a short period.

Fkli

FKLI - Bullish BatFKLI has fallen over 423 points (16th Apr 2018 - 24th Feb 2020)

A bullish bat pattern formed at 1524.00

Currently the price is hover in the PRZ Zone & there is a lower gap between 1515 - 1503. We are waiting for the price moving back upwards and above 1524 then we could looking for a high probability long trade.

PRZ: 1524.00

SL: 1421.5

TP1: 1666.00

TP2: 1753.5

Ideally looking for RSI bounce back out of the oversold zone and climbing towards the PRZ.

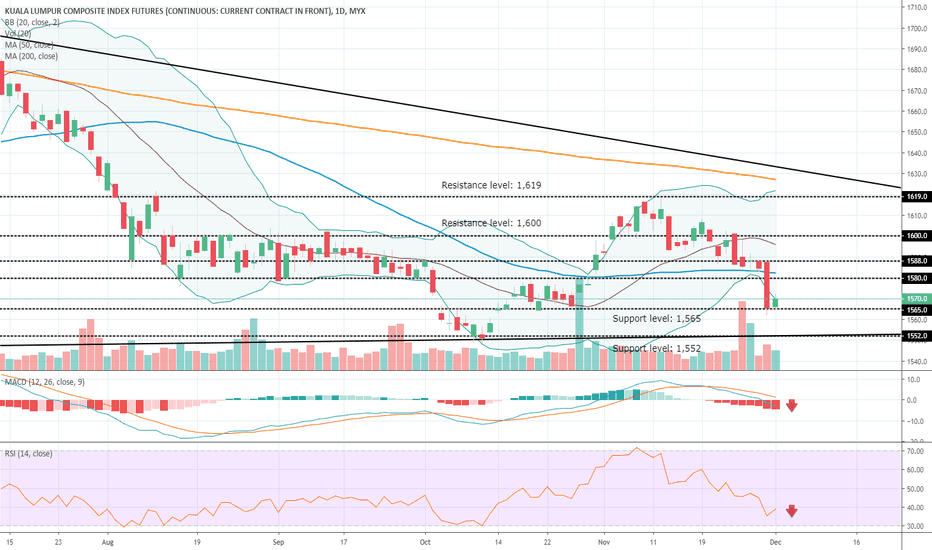

FKLI - All Way DownFKLI

Trend: Bearish

Rst: 1,500

Spp: 1,468

Technically in recession as our index plunges more than 20% from its peak over extended period of time.

Current progress - weekly chart telling the index has arrived Fibo Retracement 61.8%, if it fails to grip its support here, next will be 50%.

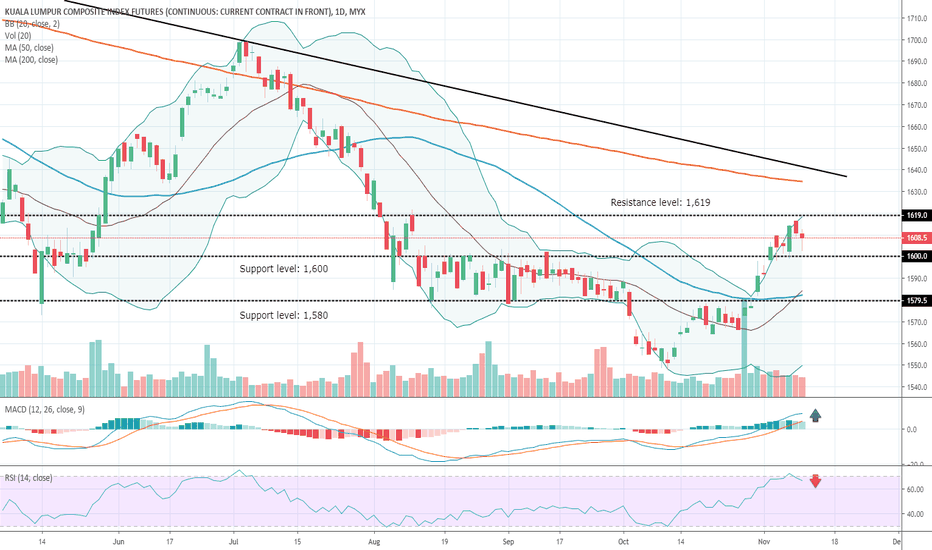

FKLI (Weekly Chart) - Bearishness PersistsFKLI

Trend: Bearish

Rst: 1,535

Spp: 1,515

Since our index has fallen like nobody business, we have to turn our view into broader one - weekly chart. This week candle formed at lower BB, means further downside cannot be escaped next week. MACD casting bearish crossover as well, more downside.