BTCUSD - Bitcoin resistance and bullish divergence 20110410Bitcoin didn't break to the upside according to the previous target but it's still contained between the upward sloping lines of the ascending channel. The price suffered some pressure and broke to the lower part of the channel (below the median line).

However, the chart shows a bullish divergence which demonstrates that bears are losing power and that bulls can be ready to control, confirm the bullish divergence with the price and RSI oscillations in the chart. The price should pass the median line of the ascending channel, approximately around $43,500, to enforce the narrative that the bulls are taking control.

There's some resistance at around $45,600 and $46,900 so the price may struggle to break these levels, something to watch closely.

If the price breaks above $43,500 it can go to around $45,600. If the price doesn't break above $43,500 it can go sideways or to the lower trend line of the ascending channel around $40,000.

FLAG

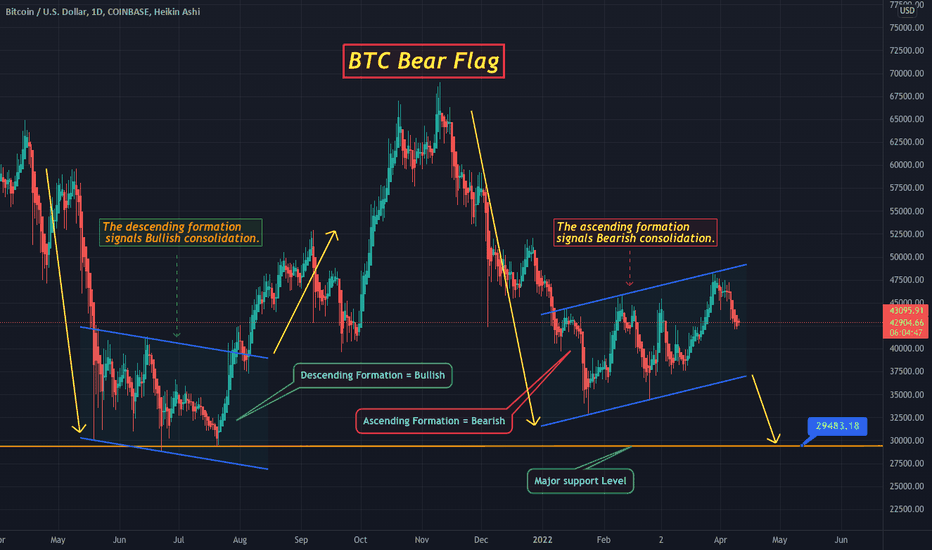

Bitcoin Bear Flag - What this means for Bitcoin's Future...Hello Traders,

Today I will be discussing the formation of a Bear Flag and what this means for Bitcoin.

- As you can see on the chart BTC has been consolidating in an "Ascending" parallel channel since January.

1) An ascending formation is typically a Bearish signal.

2) In conjunction with the downtrend from the highs at $69K in November, this creates a bear flag.

- Now I'm sure some of you may be wondering... Well BTC consolidated last year in a channel before the massive pump to $69K, so won't Bitcoin do the same this time? - The answer is no.

- Last year Bitcoin consolidated in a "Descending" channel which is typically Bullish.

- As expected BTC pumped coming out of that Bullish consolidation.

- This time BTC has created a Bear Flag and has a much higher probability of continuing lower before hitting previous ATH's.

So what does this mean for BTC? Here are the 3 possibilities I see playing out..

1) (Highest Probability) BTC retests the $36K support level

2) (Medium Probability) BTC retests the $29K support level

3) (Lowest Probability) BTC retest the $20K support level.

I want to emphasize... Patterns have a certain probability of playing out. Bear flags have a relatively high probability of playing out and BTC has formed a textbook Bear Flag. This means the probability of BTC breaking down and even hitting $20K are still relatively high. Sometimes you have to zoom out and look at the bigger picture. I'm sure a lot of you will be discouraged by this, but think of how incredible it would be to accumulate BTC back at $20K!?

Good luck everyone and happy trading!

LRC shortPrice in range on daily chart, had fake out but broke back into range. Price formed head and shoulders type pattern, broke support and retested support turned resistance and 4h 20 day ema. Had a high volume breakout of trend line on 30 min chart, bears currently following thru.

Stop loss: Above chop, above resistance

Take profit: Above highest volitility level of total range, just above a daily resistance level near mid point of range

APE bear flagPrice in mid term down trend, retested previous breakout area as resistance. Had a 50% retracement, rejecting at resistance / 50% fib level. Began to see wicks at upper bb band, price over extended - ma crossing bearish on stoch. Closed with a bearish engulfing on 15 min.

Stop loss: Placed above resistance - past high wick

Take profit: At support low - half order. Second half to hold on to break of flag - fib extension levels

Corn - Bullish Flag Corn is trading inside a bullish flag on Daily/Weekly charts. I'm looking for either a breakout or buy from the bottom of the flag (in case we see a bounce here rather than a breakout).

Targets at 800 and 880.

Invalidation - breakout below the flag structure.

BTCUSD - Bitcoin uptrend 20220406Bitcoin broke the downtrend and build up with higher highs and higher lows. It seems to be forming an ascending channel with a settlement in the upper part of the channel, denoting an indication to break to the upside. It's also testing the 200 MA which is working as a mediator between trends.

In the last few days, it seems to be forming a bull flag, if it breaks to the upside the target can be around USD $53,500, if it breaks to the downside the target can be around USD $40,000.

EURUSD BEARISH FLAG BREAKOUTMarket moving down formed a bearish flag and just broke out, we are looking for a candle to close below the pattern and that should be our sign to entry.

Entry: 10.094 (Now or when candle closes below flag pattern)

Invalidation 1.09904 (above recent LH)

Target: 1.07343 (Strong institutional zone)

SOL flag breakoutPrice broke and held weekly zone. Formed consolidation flag, had a 61.8% retracement before breaking flag with bb break - high volume on 30 min chart. Need 1h bb break to confirm trade.

Take profit: 150 (psychological level), also at 0.272 extention level - just below daily resistance.

Stop loss: Within channel, below s/r level, below previous structure

AXS flag breakoutPrice had nice daily close, wicking down to 20 day ema, closing with a moderate bullish spread. Price made impulsive move up followed by a very clean flag - channel printed on the 4 hour. Price broke out on the 30 min time frame with ultra high volume to the upside.

Stop loss: Just below daily s/r and vpvr level, inside of previous channel, and in trough of volatility zone measured thru out channel

Take profit: At next daily zone, aligning with the 0.272 fib extension level of flag

SLP flag and ab=cd pattern#SLP/USDT

$SLP is inside a parallel channel that can act as flag pattern.

🐮 price can drop to support zone around $0.017 that is the same with lower line of channel and then head up to break out upper line.

breaking out of flag can increase price to resistance zones and if price going to complete AB=CD pattern it will reach $0.05.

weekly time frame shows price can increase to $0.07 and $0.12 or even more

Just a "classic" Ethereum (ETC) bull flag chartHey everyone,

Nothing special here, maybe a little as I just wanted to share that view on ETC and usually its Ethereum not the "classic" one, because it looks like very nice bull flag with break out and retest played out & it feels to me like a very nice R:R entry.

but there is something furthermore going on behind with ETH & ETC in next months, so I would pay attention to ETC this year.

Trade safe and keep your mind focused

Cheers

ChaChain

-------------

Disclaimer:

I´m not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature, and therefore I´m unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis of making investment decisions, and it is for entertainment purposes only.

KEYWORDS

R:R, money management, risk, reward, technique, style, trading, bitcoin , bitcointrading, profitable trading, profittrading, profit trading, secret, divergence, bull divergence, bear divergence, divergencetrading, divergence trading, trading strategy, how to trade bitcoin , bitcoin trades, bitcoin trading, make profit, take profit, trading strategy, trading technique, successful, successful trader, successful technique, successful strategy, successful secret, how to trade, trend analysis, technical analysis , indicators, rsi , relative strenght index, let it rain, successful life, easy strategy, easy trading, easy technique, make money, crypto investing, investing, crypto, cryptocurrency, cryptocurrencies, mentoring, money, chartart, beyond technical analysis

Continuation of bear flagNear perfect rejection at the top of the trend. I'm not a fan of the lower time frames as I'm not a daily trader. The monthly Macd just crossed huge bearish signal. The Daily momentum is failing. My view has been and still is we see 20k.

Comment: **disclaimer- anything mentioned in this forum is for information & educational purposes only and does not constitute investment advice. please talk to your investment advisor and do additional research and due diligence on your own before investing and making important investment decisions.- disclaimer**

AVGO - Underrated titan in vulnerable spot

Three lower lows and lower highs ---

below VWMA (early) -

Decreasing volume --

Bearflag setup on daily ---

Good volume in the demand zone ++

IF market shows strengths next week, possible that it tests 625 zone, where it runs into big supply. Breakdown there could slide this to recent low near 500.

What is Flag pattern and how to trade with that?Flag Pattern (Bullish)

* One of the most common patterns of price trend continuation is the FLAG pattern. How to identify this pattern? How to use it in trading most effectively?I will cover it all through this post.

* The Flag pattern is a type of price pattern in bullish trends. This pattern consists of a strong increase (called a flagpole), followed by a countertrend with two levels of Resistance and Support (called flags). The price forms this pattern after a strong increase. It then breaks out of the Resistance and continues rising, marking the end of the pattern. This is a very common behavior of prices during an uptrend.

* After breaking out of the Resistance, the price can retest this new Support.

How to open an order :

Entry Point : Right after the candlestick breaks out of the Resistance.

Stop-Loss : At the bottom of the price channel (the lowest point of the support).

Target : At the price whose, from the entry point, the length is equal to the length of the flagpole.

* In the future, we will publish other patterns such as Triangle, head and shoulders, wedge and other educational materials 📚 . Please follow our page to be informed as soon as the materials are published.

Thank you all for supporting our activity with Likes 👍 and Comments ❤️

MATIC/USDT ??Bearish Flag??hello everyone,

as it currently looks, the Cryptocurrency Polygon is well on the way to forming a Bearish Flag.

I drew a entry line for short.

have a nice day to all of you!

OGN pullbackGauging my skills at spotting Pullbacks.

Target #1 0.3239

Target #2 0.2907

This is my Thesis, targets are purely hypothetical based on my analysis.

This is NOT Investment and/or Trading Advice.

Happy Trades!

❤️ If you enjoy my ideas, Please like/comment, it means a lot, Thank You! ❤️

BINANCE:OGNUSDTPERP

COINBASE:OGNUSD