Effort of the Young Green Butterfly to Raise the Siemens Flagthe detail is shown in the above Chart.

I made this Idea based on Candlestick Analysis and Fibonacci Tool .

The Buyers' Crab could reach the highest point at the price of 167 euros.

The Bearish trend started and siemens flag is falling and approaching to the golden level of buyers crab .

The past trend of sellers' candles has formed a motivated green butterfly pattern

So we can expect this young Butterfly to raise the Siemens flag again.

Siemens Is Great .

Good luck.

Flag

BTC Daily AnalysisPrice has been forming a bearish flag pattern and it may bounce around in the parallel channel before making any significant move towards either side. But, based on the bearish momentum over the last couple of weeks and the previous daily, it is increasingly likely that the next move could be downwards at the break of this channel.

US100 BEARISH FLAG|SHORT|

✅US100 is trading in a

Strong downtrend and

The price has formed a

Bearish flag pattern so

And on top of that the

Horizontal resistance

Of 20,000 is ahead so

We are super bearish

Biased and IF we see a

Bearish breakout we

Will be expecting

A further move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold: Key Levels to Watch TodayGold is rising, forming a series of flag-like patterns. Only a few hours remain until the FOMC decision, which could determine the next leg of this move or break the short-term cycle, leading to a retest of the 3000 level. Key levels to watch are 3025 as support and 3045 as resistance.

On the downside, the first target is the 3000–3006 zone, which includes both the psychologically significant 3000 level and the 23.6% Fibonacci retracement level.

On the upside, a breakout could target 3075, aligning with the 61.8% Fibonacci extension level.

EURGBP Bearish Continuation Setup Potential Drop to Key Support📌 Overview:

The EUR/GBP pair is showing signs of bearish continuation after failing to break above key resistance levels. Price action indicates a potential downward move towards a major support zone, aligning with the overall market structure.

🔎 Technical Analysis:

The pair has formed a lower high, indicating weakness in bullish momentum.

A breakdown from the recent consolidation zone suggests sellers are in control.

Price has breached a key support level, turning it into a resistance zone.

The market structure indicates a potential drop towards 0.82773, which aligns with a previous support area.

📊 Key Price Levels:

✔ Resistance: 0.84000 - 0.84200 (previous support turned resistance)

✔ Current Price: 0.83876

✔ Target: 0.82773 (major support and liquidity zone)

✔ Stop Loss: Above 0.84000, invalidating the bearish setup

📉 Trade Plan & Execution:

🔹 Entry Strategy:

Traders can look for a retest of broken support (now resistance) near 0.84000 to confirm selling pressure.

A bearish rejection candle (such as a shooting star, bearish engulfing, or pin bar) could confirm the continuation of the downward trend.

🔹 Profit Target:

The primary target is 0.82773, which acts as a strong demand zone from previous price action.

🔹 Risk Management:

A stop loss should be placed above 0.84000, as a break above this level would invalidate the bearish setup.

Maintaining a favorable risk-to-reward ratio (1:2 or better) is advisable for optimal trade execution.

📢 Market Outlook & Considerations:

✅ Bearish Confirmation: Sustained rejection from resistance and lower highs strengthen the bearish outlook towards 0.82773.

🚨 Bullish Reversal Risk: A break above 0.84000 could invalidate the setup, signaling a potential return to bullish momentum.

📊 Fundamental Factors: Keep an eye on GBP and EUR-related economic data, central bank policies, and risk sentiment, which could impact price movements.

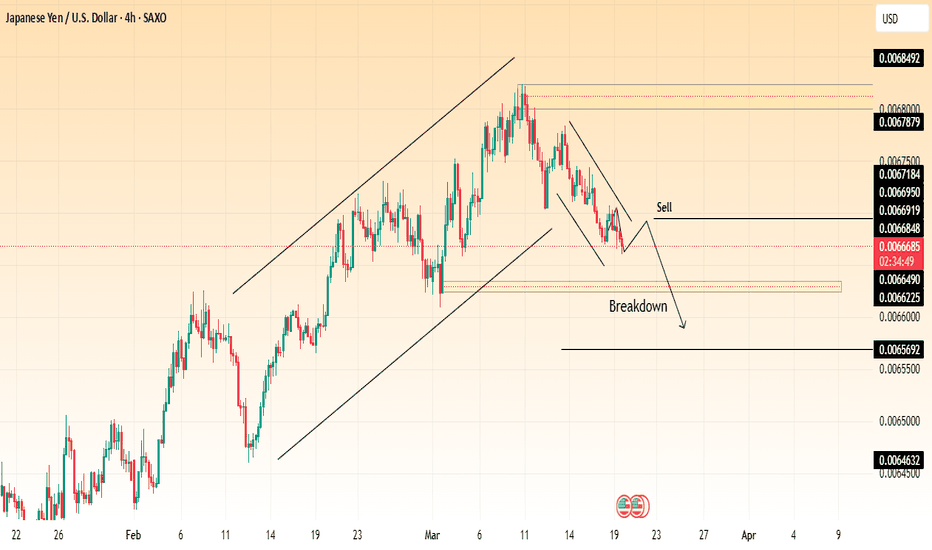

USD/JPY Bearish Continuation📉 Trend Analysis:

The chart shows a breakdown from an ascending channel, indicating a potential bearish reversal after an extended uptrend.

Price has formed a descending channel, reinforcing the short-term bearish structure.

🔍 Key Levels:

Sell Zone: Around 0.0066848 - 0.0066919, acting as resistance.

First Target: Around 0.006490, a strong support area.

Second Target: Around 0.0065692, marking a deeper level of bearish continuation.

Final Target: Around 0.0064632, a critical demand zone.

📌 Trade Plan:

Look for sell entries on a possible pullback to the resistance zone.

Confirmation through rejection candles or continuation patterns could strengthen the bearish case.

⚠ Risk Management:

Stop loss above the previous resistance around 0.0067184.

Take profits gradually at key support zones.

GBP/USD Bullish Channel – Buy Opportunity! Overview:

The British Pound (GBP) against the US Dollar (USD) is currently trading within an ascending channel on the 4-hour timeframe. The price is approaching a key buy zone at the lower trendline, presenting a potential long opportunity if bullish momentum continues.

Key Market Structure Analysis:

🔹 Uptrend in Progress: GBP/USD has been forming higher highs and higher lows inside a well-defined rising channel.

🔹 Support Zone: A potential buy entry is around 1.2925, aligning with the lower boundary of the channel.

🔹 Target Projection: If the price bounces from support, the next key resistance target is 1.3085.

Potential Trade Setup:

✅ Bullish Scenario:

A retest and bounce from 1.2925 could trigger a buy setup.

Upside target:

🎯 1.3085 – Key resistance level within the channel.

⚠️ Bearish Scenario (Invalidation):

A break below 1.2925 could invalidate the bullish setup and signal a deeper retracement.

Below the channel support, price might target the 1.2600 region as the next demand zone.

Final Thoughts:

GBP/USD remains in a strong uptrend, with the lower channel support acting as a key decision point. If bulls defend this level, we could see further upside momentum. However, a breakdown of the structure could shift the sentiment.

Will GBP/USD continue its bullish momentum? Share your thoughts below!

Potential Bearish Flag in Super MicroSuper Micro Computer has bounced since November, but some traders may expect further downside.

The first pattern on today’s chart is the major slide that began last May. SMCI’s spike in February stalled at a 50 percent retracement of that move. The maker of AI servers also tried and failed to clear its 200-day simple moving average (SMA).

Those signals may confirm the longer-term trend is moving lower.

Next, the small rising channel so far in March could be viewed as a bearish flag.

Third, SMCI has tried to hold support at its 50-day SMA but yesterday closed under it.

Fourth, the 8-day exponential moving average (EMA) has remained below the 21-day EMA. MACD is falling as well. Both of those patterns may reflect short-term bearish trends.

Finally, SMCI is one of the most active underliers in the options market. (TradeStation data shows it averaging more than 800,000 contracts per day in the last month.) That could help traders position for moves with calls and puts.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com . Visit www.TradeStation.com for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com .

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

Technical Analysis of Gold Spot (XAU/USD) – March 19, 2025, 15-MTrend Identification:

Gold has been in a strong uptrend, as indicated by the 200-period moving average (blue line) sloping upwards.

However, the price is now rejecting key resistance levels around $3,032–$3,035, signaling possible consolidation or a short-term pullback.

A potential trend shift is forming, with price attempting to break out of its rising channel.

Support & Resistance Levels:

Immediate Resistance: $3,032–$3,035 (recent highs and POC zone).

Major Resistance: $3,050–$3,070 (next psychological and technical resistance).

Immediate Support: $3,020 (lower boundary of the descending channel).

Key Support: $3,010 (previous breakout zone & strong demand area).

Chart Patterns & Market Structure:

The ascending channel broke down, leading to a shift in short-term momentum.

A descending channel (red) is forming, suggesting potential for further downside in the short term.

Volume Profile (VPVR) shows a concentration of liquidity at $3,032–$3,035, indicating a strong supply zone where sellers are active.

Trade Setup & Risk Management:

📈 Bullish Trade Setup (Bounce from Key Support Zone)

Entry: Buy near $3,010–$3,015 if price stabilizes.

Stop-Loss: Below $3,000 (psychological and structural support).

Target 1: $3,032 (POC & resistance).

Target 2: $3,050–$3,070 (major resistance).

Risk-Reward Ratio (RRR): ~1:3

📉 Bearish Trade Setup (Short from Resistance Zone)

Entry: Sell near $3,032–$3,035 if rejection occurs.

Stop-Loss: Above $3,040.

Target 1: $3,020 (mid-level support).

Target 2: $3,010 (key demand zone).

RRR: ~1:2

Risk Management & Position Sizing:

Risk only 1-2% of capital per trade to manage exposure.

Adjust position size based on stop-loss distance to maintain a consistent risk profile.

Watch for volume confirmation before entering trades for better accuracy.

Technical Analysis of DAX Index (March 13, 2025, 15-Minute ChartTrend Identification:

The price action is moving within a rising channel (highlighted in purple), indicating a potential short-term bullish trend.

The 200-period moving average (maroon line) is above the price action, suggesting a larger timeframe bearish bias, but price is attempting to reclaim higher levels.

The Point of Control (POC) at 22,658.69 indicates the area of highest traded volume and a key decision zone.

Support & Resistance Levels:

Immediate Resistance: 22,720 (upper boundary of the rising channel).

Major Resistance: 22,800 (previous swing high).

Immediate Support: 22,560 (lower boundary of the channel).

Key Support: 22,440 (recent swing low and potential reversal area).

Chart Patterns & Market Structure:

The price recently bounced from the lower boundary of the channel, suggesting buying pressure at support.

A Volume Profile (VPVR) shows strong volume concentration around 22,658, reinforcing it as a key pivot zone.

The recent sharp rejection from the lows aligns with potential bullish continuation, targeting the upper channel boundary.

Trade Setup & Risk Management:

📈 Bullish Trade Setup (Trend Continuation)

Entry: Buy near 22,600–22,620 on minor pullbacks.

Stop-Loss: Below 22,540 (previous swing low).

Target 1: 22,720 (upper channel boundary).

Target 2: 22,800 (major resistance zone).

Risk-Reward Ratio (RRR): ~1:2.5

📉 Bearish Trade Setup (Reversal Play)

Entry: Sell near 22,720–22,740 if price rejects resistance with strong bearish candles.

Stop-Loss: Above 22,780.

Target 1: 22,600 (POC and key support).

Target 2: 22,440 (lower channel boundary).

RRR: ~1:2

Risk Management & Position Sizing:

Risk 1-2% of capital per trade to maintain disciplined exposure.

Adjust position size based on stop-loss distance to keep risk consistent.

Monitor volume dynamics for confirmation of trade direction.

Orbs to provide a 20x?Welcome back dearest reader!

Today we will analyse another project called Orbs. Looking at their website the fundamentals look great! But other than that, the chart also looks fantastic!

When looking at past performance its clear orbs has been in a massive flag formation since march 2021, it has broken out in october 2023 and has just now touched a very important support zone! Expecting upside momentum from here untill august.

Target: 0.40$

Stoploss: 0.0145$

SILVER (XAGUSD): Bullish Continuation Ahead

Silver formed a strong bullish pattern on a 4H.

I see a bullish flag with a candle close above its resistance line.

I think that the market is going to continue rising.

Next resistance 34.2

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

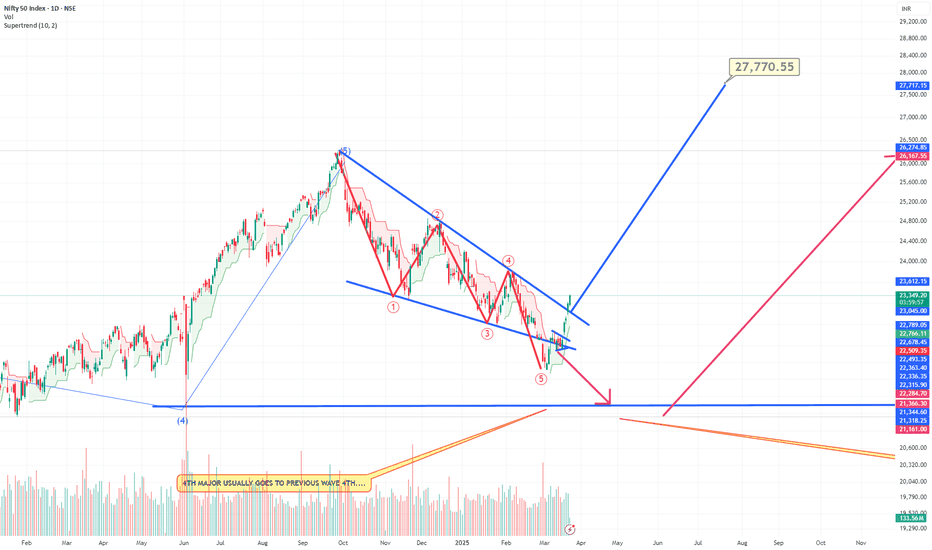

NIFTY Flag BreakoutNIFTY...Finally after a long time has given a good AD ratio...Flat was forming now broke out...see chart...tgt calculated and marked on the chart....Good momentum also exists...Also note if the tgt is achieved ..then on a larger time frame a larger pattern will be broken..But we will come to that once that is achieved..Now we wait for this tgt to be achieved.

The last opportunity If you did not take the January 17th post serious when BABA was 84 dollars, you have to be brave enough to pull the trigger after a 75% move in 2 months.

But most people will sit and wait for a big correction to get involved while they don’t think in the past 4 weeks when market was correcting, BABA stayed flat and as soon as selling pressure decreased, BABA break above the resi.

GBPUSD: UP After the News 🇬🇧🇺🇸

GBPUSD looks bullish after the release of the US news.

I see a bullish breakout of a resistance line of a falling wedge pattern.

The price is going to retest the current high first - 1.2987,

and continue growing to 1.3 level then.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold (XAU) Eyes Breakout from Bull Flag Pattern TechnicalGold (XAU) is consolidating in a tight range (2,900–2,903) following a bullish flag pole formation, signaling potential continuation of the uptrend. Key levels to watch:

- Breakout Resistance: 2,903.31 (flag upper boundary). A close above targets 3,000.00 (psychological resistance).

- Support Zone: 2,900–2,880. A breakdown here may invalidate the pattern.

Technical Rationale: The bull flag pattern suggests accumulation after a sharp rally, with the RSI-neutral price action (+0.03%) indicating balanced momentum. The flag’s proximity to yearly highs reinforces bullish bias if breakout occurs.

Fundamental Catalyst: Macro risks (rate cut expectations, geopolitical tensions) could amplify safe-haven demand, aligning with the technical setup.

Action: Monitor for volume-backed breakout above 2,903.31 for long entries. Tight stop-loss advised below 2,880.

Risk Disclaimer: Trade with managed risk; patterns may fail amid shifting macro drivers.

NZDCAD: Strong Bullish Signals 🇳🇿🇨🇦

I see 2 strong price action confirmations on NZDCAD:

the price broke a resistance line of a bullish flag

and then formed a confirmed change of character CHoCH on a 4H.

I think that the market will continue a bullish rally.

Next resistance - 0.83

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD/CHF: Bearish Trend Pauses, but Breakdown Risks RemainThe strong bearish trend for USD/CHF stalled this week, with buying support emerging beneath .8774, continuing the pattern seen in December. The net result has been a grind higher before running into resistance at .8854, forming what resembles a bear flag on the charts. That should put traders on alert for a potential downside break and resumption of the bearish trend.

Indicators like RSI (14) and MACD are providing mixed signals on price momentum, with the former trending higher while the latter remains below the signal line. However, the modest RSI (14) uptrend looks vulnerable, mirroring the unconvincing price action.

If the price breaks down from the bear flag, immediate levels of note include .8774, .8711, and .8617, the latter being a more substantial support level. On the topside, a break of .8854 would put .8920 and .8966 on the radar for bulls.

The price is hanging around the 200-day moving average like a bad smell this week, but having traded through it on multiple occasions like it didn’t exist, it shouldn’t be a major consideration for traders.

Good luck!

DS