Flight

Kuehne + Nagel (logistics): An interesting position as logisticsKuehne + Nagel (logistics): An interesting position as logistics are essential to international trade, but performance is sensitive to global economic cycles.

Rewards

Trading at 46% below estimate of its fair value

Earnings are forecast to grow 4.74% per year

Risk Analysis

Dividend of 4.32% is not well covered by earnings or free cash flows

BO - BULLISH CONTINUATIONA recent Jefferies report notes Boeing's (NYSE: BA) China Southern MAX-8 undergoing a customer acceptance flight, signaling a potential restart of MAX deliveries to China. This specific aircraft, relocated from MWH to BFI in August, has completed five test flights, hinting at a critical step before final delivery. Analysts highlight Boeing's 85 Chinese MAXs in inventory (out of 250) and 118 in unfilled orders, suggesting potential growth, excluding China from the 50/mo rate and $10BB FCF targets in 2025/2026.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

Jet Fuel Takes OffWhen will jet fuel stop making all time highs? I think this speaks volumes about the continued pace of inflation combined with a post-2020 "get me outta here and fly me somewhere" mentality, in addition to other factors. So now people want to fly after not flying for a few years. Why do we have to pay mafia level prices now? I guess now it's time for the propaganda machine to shift the narrative to blaming people for their sudden surge flying habits, which still considerably falls short of pre-2020 levels. Rather than looking at the true source of price inflation: Yes, I mean the mafia overlords themselves at the Federal Reserve, their higher order of archdemon overlords will shift blame to something else. If our eating habits were to become an increasing result of centralized policy, for example, we'd all be forced to eat hot dogs and drink orange juice right about now - the only items in the CPI where it seems inflation is somewhat accurately portrayed.

I can imagine the posters already:

PLEASE refrain from your disgusting urges of flying, LOYAL citizens!

Take this delicious and nutritious diet of HOT DOGS and ORANGE JUICE instead.

Do Uncle Sam PROUD, FIGHT inflation TODAY!

Do your part for OUR NATION!

Oh my...

Seriously though, you gotta give some respect to orange juice , SO FAR:

Good luck and don't forget to hedge your bets! ;)

SPCE (1D) Longterm Target - Wait for DIP Hi Traders,

Hopefully nobody HOLD SPCE Stock right now and you all took profit at last top ?

My expectation is the stock was too much pumped / Hyped by positive news on test flights.

Seems like Major Stockholders - Richard Branson and Chamath were selling huge % of stocks. We can expect continuous drop for next few weeks.

Wait for moment when you will not hear about company anymore / or there will be only bad news (investigation / more selling from Insiders). This could lead to 1:1 extension of corrective waves A:C.

Historic LOW could be good price target to watch. If its going to be supported by RSI and MACD COnvergce at leats at 1D chart. I will notify you about LONG Setup. ;)

Also take deep look into Fundamentals. This company and Space flightscould be good investment long term.

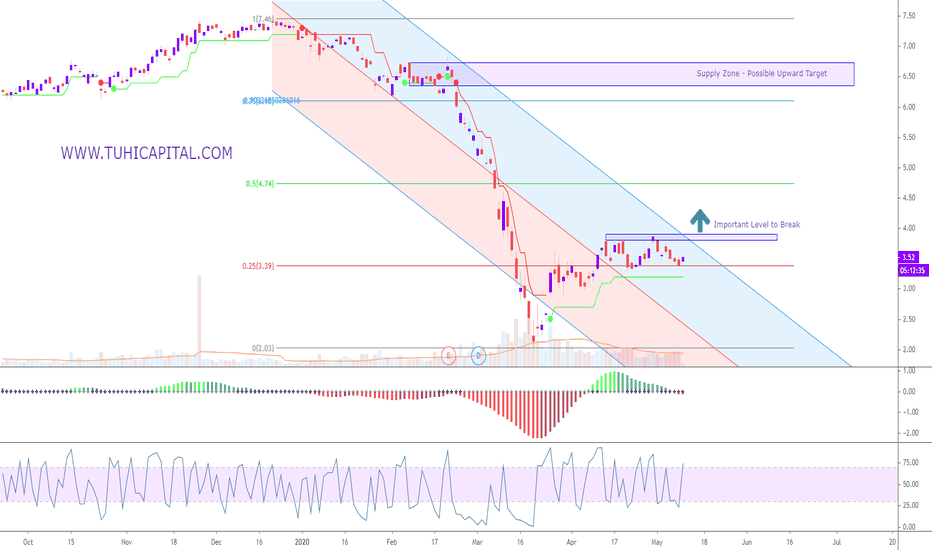

Flight Centre - FLT AnalysisCurrently trading in a descending channel, a healthy retracement following FLT's pump for a few weeks. Could we see a break back to the upside after consolidating to the key level of support (yellow box)?

Ultimately long on FLT from a TA and Fundamental perspective.

Please let me know what you guys think, perhaps you have something else in mind? Any feedback is appreciated greatly.

BA: Watch for the bounce backAs we had more and more bad news and fast-growing covid cases there was a general downtrend beginning from March. Now we are getting to good levels of support to buy.

That’s my trading setup

1. Buy: 204.83

Stop loss: 203.23 (-0.74%)

First Target: 220.69 (+7.68%)

Second Target: 230.49 (+14.49%)

2. Buy: 192.53

Stop loss: 191.07 (-0.70%)

First Target: 204.83 (+7.09%)

Second Target: 220.69 (+15.43%)

I think it is more likely that we see a bounce back at 204$ range. We have the opportunity of a double bottom, have support of the 400 SMA (orange) where we often saw great support (green marked). Daily RSI is oversold (bullish), MACD is pretty neutral.

At the second buy we reach the bottom of the parallel downtrend line to bounce up and double bottom with the strong support of 192.49$.

Time to Buy #SPCE - Ready to Go UpHello Traders,

It's time for this stock to go up, if everything goes well, i expect a short term up at list (if Sir Richard Branson dont use his ATM) (it could go down after, max between 18$ and 20$).

Flight will not start before 2022 but, sales started at a higher price and a test flight (paid) is expected in late september.

- Virgin Galactic reopened ticket sales with prices beginning at $450,000 per seat (before it was 200 000$).

- The space company now targets late September 2021 for the mission called Unity 23 - company’s fifth crewed test flight to the edge of space.

NYSE:SPCE

Jump into the Rocket or Stay on the Ground !

This is a long Term opportunity for the only and the cheapest (near) space travel.

SPCE: A chance that comes once in your lifeExtremely focus on chart details, please. We all can be reach if we dealt with what will happen on the 11th of July wisely

Massive run ahead, be wise, and aware of your resistances, take care!

TP1: All-time highs level (recommend you to hold because it will be weak)

TP2: 65$ (sell 50% then add above 70$)

TP3: 90$ (sell 90% of your shares, and just hold 10% till 100$)

XLM USDT Buy for the real waves, real profits 🌊🌊Right now the candles follow the week of support and below the trend line. Maybe this will be the beard of the daily candle. Plus BTC will go sideways in the 56k -58k zone, BTC Dominance drops, facilitating alt pump before BTC officially creates a new ATH.

Buy the market NOW.

Take profit 1: $ 0.515

Take profit 2: $ 0.570

Take profit 3: $ 0.760

Anything that doesn't make sense, please give me a comment. Please motivate me to develop myself and help someone needed.

Don't forget click like, it's a hug for me. Thanks you!

Airline Companies Preparing For "Takeoff"The aviation industry supports more than 65 million jobs around the world and $2.7 trillion in world economic activity (3.6% of global gross domestic product). By 2036, it is expected that aviation will generate $5.7 trillion in GDP and the number of air travelers is expected to grow to 8.2 billion from 4.4 billion air travelers in 2018. It is clear the importance of aviation in the tourism industry, which is one of the world’s largest industries, but it also provides an immeasurable contribution to global trade, business, and economic development.

Between 2009 and 2017, revenue in the global aviation industry grew at a CAGR (compound annual growth rate) of around 5.9%, reaching $754 billion in 2017. Pre COVID-19, Commercial airlines were expected to generate a combined revenue of $872 billion for 2020.

In early April, worldwide flights were down almost 80%, making the COVID-19 the worst impact in the airline industry. Approximately $50 billion of international passenger revenue was lost from Jan to Apr 2020. According to ICAO, airlines may be faced with 1.5 billion fewer international air travelers this year.

FLT PredictionAs predicted from my last post, FLT took a big dive all the way down to $11.26 last week. If you bought FLT at $11.26 last week you would be up 27%. It has passed previous resistance however last time it reached the resistance line, it bounced up and plummeted down to $11.26. Due to increasing COVID cases in America and Biden's plan to tackle COVID-19 it may begin a downtrend. However, Australia itself has recovered and hopefully positive news for the Australian economy will come out soon. It the meantime, except FLT to begin a downtrend.

Qantas in Talks with the Government- Qantas is in talks with the government to secure an exemption for 1.5m social distancing rules on its its flights.

- If given the green light and the ability to kick off at full capacity for domestic flights / (possibly incl. New Zealand) we expect the stock to move higher - possible to the 50% retracement.

- Technically we are in a downward Channel and we need to break out of the immediate resistance and out of this channel. Our Momentum Squeeze is ON and we are waiting for a breakout.

Australia's Most-Shorted Stock Has Habit of Burning BearsThere’s probably not a lot of people cheering the fact Flight Centre Travel Group Ltd. is Australia’s best-performing equity today.

Getting burnt by the travel retailer is almost a rite of passage for long-short funds Down Under. The market’s most-shorted stock, Flight Centre has a habit of burning bears, with an improved profit outlook in July and this week’s better-than-estimated earnings triggering stock surges.