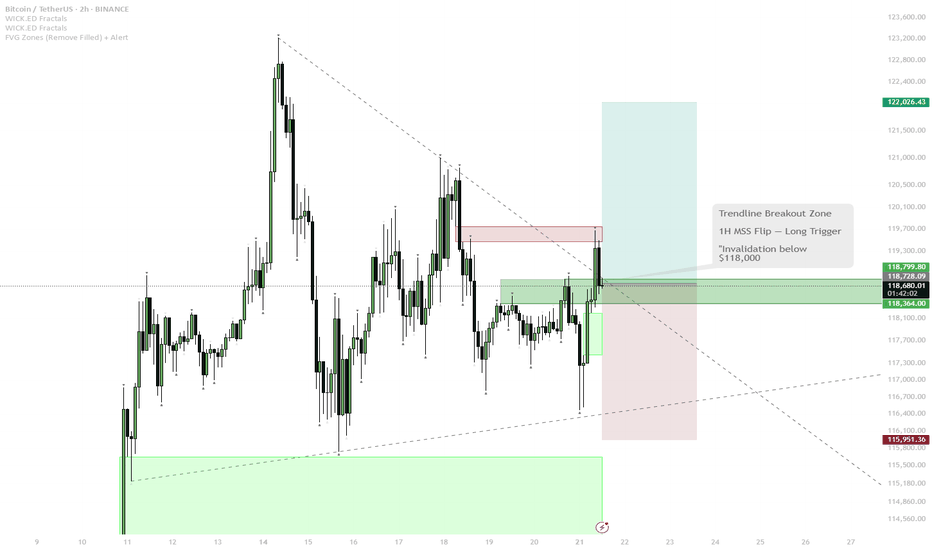

BTC Reloading for Breakout — Watching for 1H MSS Flip

BTC has bounced from local support (green zone) and is challenging the descending trendline.

The price is now testing the red resistance zone and the upper boundary of the 1H MSS (market structure shift) box.

Scenario A (Bullish):

— If BTC cleanly breaks the trendline and flips the 1H MSS box into support (with a strong close above), this is a trigger for a scalp long.

— Target for the move is the upper green box/previous high area near $122,000.

Scenario B (Bearish/Invalidation):

— If price is rejected at the red resistance and falls back below the green support box, risk of deeper pullback toward $116,000 increases.

BTC has shown resilience by quickly reclaiming support after a sweep lower, indicating strong demand. The market looks to be reloading for another push, with liquidity building up just below resistance. The setup favors a breakout if NY Open brings momentum. The flip of the 1H MSS box would confirm bullish intent. However, caution if the breakout fails — structure remains choppy and a failed breakout can trap late buyers.

Flip

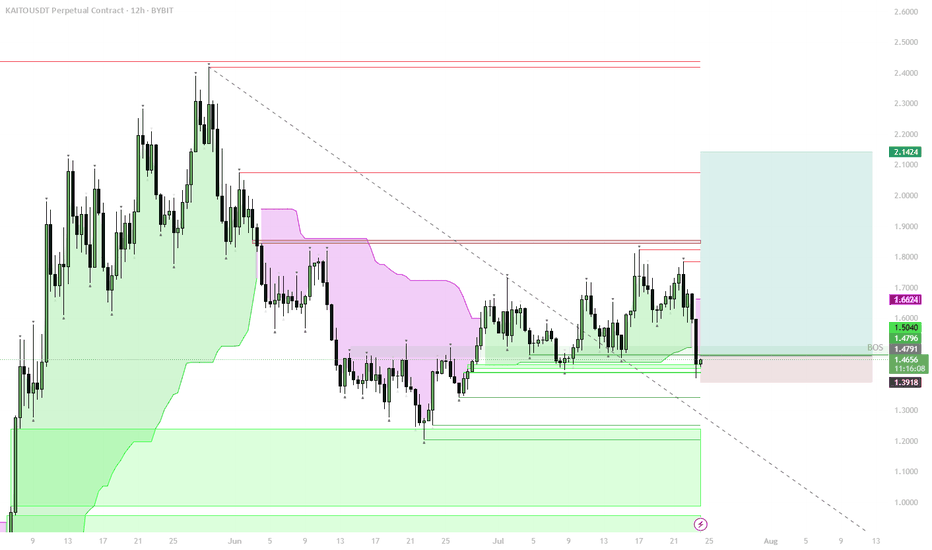

KAITO – Structural Flip, Bullish Accumulation ZoneStructural Shift:

Price reclaimed the key 1D S/R + BOS (Break of Structure) level, signaling a major trend change from bearish to bullish.

Trend Confirmation:

The move above $1.48–$1.50 zone confirms a bullish market structure. This level is now strong support.

Accumulation Opportunity:

The area between $1.65–$1.50 is ideal for spot accumulation, as it aligns with the reclaimed BOS and the lower edge of the bullish structure.

Upside Targets:

If the bullish structure holds, price could target $1.66 (local resistance), with the next targets at $1.85, $2.14, and potentially higher if momentum continues.

Invalidation:

A break and close below $1.48 would invalidate this bullish scenario and signal a return to the previous range.

The reclaim of the BOS level, with a shift above 1D S/R, marks a clear bullish structural flip on the chart. Historically, such shifts create strong accumulation zones just above the reclaimed level, where risk/reward is best for spot buys. Buying into the $1.65–$1.50 range aligns with both trend-following and classic Smart Money concepts: enter after the structural confirmation, not before. Invalidation is clear below $1.48, where structure would flip bearish again.

GIGA | Watch for 1D MSS Flip & Long TriggerBUY ZONE $0.0175–0.0192 — wait for pullback, enter on bullish signal.

TRIGGER: Flip and hold above 1D MSS zone.

STOP: Close below $0.0171 = exit.

TP: $0.025 / $0.03 — take profit on move up.

Wait for the break and flip above 1D MSS, then enter long on confirmation. Avoid early entry — only buy after a clear signal. Fix part of profit at resistance.

LINK Potential Falling Channel Reversal + RSI SignalsBINANCE:LINKUSDT has been in a downtrend since December, grinding inside a falling channel for 2 months, and it's now sitting right above the key ~$10.00 demand zone.

Price Action

• Price is respecting both bounds of a well-defined falling channel.

• Currently consolidating just above the demand area, early signs of potential strength.

RSI Insights

• Clear bullish divergence at demand zone retest.

• RSI could be approaching a breakout of its multi-month downtrend — worth watching closely.

Key Zones

• Support: $9.5–$10.5 is critical. It held last time and could fuel a reversal. If broken, it would invalidate the setup.

• Resistance: Falling channel upper boundary.

• Confirmation: RSI breakout + channel breakout = potential confirmation of trend reversal.

Also watch $15.5-$16 (previous S/R) and the whole $18-$20 area, which previously acted as support and has a high volume traded. Both could be good levels to take profits, together with the main supply zone in the $25-$27 area.

Still in a No-Trade Zone until a breakout is confirmed.

NULS buy setupFlip structure looks bullish on hourly time frames.

We have a bullish iCH on the chart and the trigger line is broken.

By maintaining the demand, it can move towards the targets.

Closing a 4-hour candle below the invalidation level will invalidate the analysis

Note that the financial market is risky, so:

Do not enter any position without confirmation and trigger.

Do not enter a position without setting a stop.

Do not enter a position without capital management.

When we reach the first TP, save some profit and try to move the stop continuously in the direction of your profit.

If you have any comments please post them, comments will help us improve our performance

Thanks

CHAINFLIP (FLIP)

FLIP is an innovative digital currency that promises to revolutionize online gaming economies through its decentralized platform. Positioned as a virtual gaming marketplace, FLIPusdt allows gamers and developers to trade assets securely and efficiently. The platform's backbone is its native token, USDT, which is used to facilitate transactions and incentivize the network’s participants.

In a significant development, Twitch has adopted FLIP to facilitate in-stream purchases, heralding positive news for USDT stakeholders.

Future price milestones for USDT are projected at $6, $8, and $9.

flipusdt → a quick and requested analysishello guys...

this coin broke down the last trendline and I think it is a bearish trend now!

target1= 4.7

target2= 4.05

___________________________

✓✓✓ always do your research.

❒❒❒ If you have any questions, you can write them in the comments below, and I will answer them.

❤︎ ❤︎ ❤︎And please don't forget to support this idea with your likes and comment

$QOMUSDT - Shiba Predator, the coin whose goal is to FLIP shibaOKX:QOMUSDT Its been months now that i had my eye out on $QOM, ive researched alot about them and found all top wallets holding shiba are also in $QOM. If the goal is to flip the market cap to $QOM and the top holders of QOM are also the top holders of SHIBA then that only makes it make sense, its a matter of time. OKX:QOMUSDT

Dow Jones analysis... #us30hello guys...

who trades Dow Jones? lucky you :)

us30 hunted the last higher high very well and confirmed it was just a hunt, not a breaking out! (just check the weekly time frame)

so you can get a short position on Dow Jones. the first target is $32400 and the second one is $30500

in the range between $30500-$29700, we should be waiting for a long position...

I'll update this analysis later...

always do your research.

If you have any questions, you can write them in the comments below, and I will answer them.

And please don't forget to support this idea with your likes and comment

"THE FLIPPENING" : When ETH flips BTC in dominanceThe flippening, or when ETH exceeds BTC in dominance, aka flipping dominance, will happen on May 2023 according to this chart.

By charting the ratio of ETH dominance, ETH.d, to BTC dominance, BTC.d, the flippening occurs when the ratio exceeds 1.

ETH.d to BTC.d ratio has printed a cup and handle pattern on the higher time frame. This pattern's measured move, if the ratio breaks out of it, exceeds 1 meaning that ETH would have flipped BTC in dominance.

By projecting a rising channel from the handle, the intersection of the measured move is around May 2023.

At the moment it seems inconceivable that crypto will rise, but drops of 80% to 90% are common in alts in bear seasons, bull seasons will be in the multi Xs gains for alts.

BTC is facing many problems, the largest of which is energy consumption, currently turning a profit mining BTC is in the red as energy prices have risen and BTC price has dropped. Another problem is that BTC transaction time is exceedingly slow and BTC lacks smart contracts.

ETH merger has addressed the problem of energy consumption in mining and theoretically transaction fees which have been astronomical since ETH price has risen.

ETH technically is a better contender as a BTC replacement. Also, ETH holders from March 2019 covid dump have outperformed BTC holders. Microstrategy would have been in better shape if it held ETH.

In an old idea below, I predicted that ETH will reach the neckline of the cup and handle around 25% of the market cap.

position for BTCHELLO guys...

Bitcoin has experienced a lot of DUMP

and I think this bearish movement will continue and the best positions are short positions. But in this direction, there are opportunities for those who are interested in long positions. I think we will have an upward consolidation in the next day or two.

But it reached the range of the last box I drew and it was in direction with the downward trendline, I suggest a short position there.

always do your own research.

If you have any questions, you can write it in comments below, and I will answer them.

And please don't forget to support this idea with your like and comment.

XRP analysis... short positionhello guys...

as you can see in my cryptocurrency charts i believe this market is bearish so far and continue downward movement until forming a strong and powerful reversal setup in high time frame like weekly or monthly!

this crypto currency (xrp or ripple) formed a ascending triangle and break bottom line strong and continue downward movement until reach to its target (i showed as green area) this green area is on MPL...

always do your own research.

If you have any questions, you can write it in comments below, and I will answer them.

And please don't forget to support this idea with your like and comment.

JICPT| NQ touching nearest demand zone on the dailyHello everyone. NQ has been retreated from key fib level of around 13744 last Wednesday.

Now, it's approaching the nearest demand zone on the daily(12740-12930). That's a 210 points wide range, coincided with flip level.

I would like to see if the zone will the respected. If so, Previous high around 13744 would be the short-term target.

It'll be a volatile week as Fed chair Jerome Powell would comment on inflation at the Central bank's annual Jackson Hole economic symposium. Investors will digest what he says and bet on how much Fed will hike the interest rate. Would it be 75bps or 50bps?

What if the zone gets violated? 12150-12038 would be served as the second defense zone. What do you think? Give me a like if you're with me.

JICPT| NQ may test 10000 level for 1st time since June 2020Hello everyone. From the crypto currency to bond market, global market got great hit by unexpected surging inflation and rate hikes followed. Even gold dropped, the safe heaven asset faces selling pressure as well. It seems only the USD got attraction.

So, what about NQ? My last published idea titled 'NQ may drop further to 11500!' worked. It bounced back from 11500 until the flip level marked on the daily chart.

By using the fib extension tool, I found a relative stable demand level around 10000 which is also a key whole figure. I mean, price may retest the level amid more aggressive rate hikes concerns. That'll be a 40% drop from the high created in Nov of last year.

But based on my historic annual return analysis, if NQ achieve negative return this year, the next 2 years will be fantastic for bullish buyers. The worse the better.

What do you think? Give me a like if you're with me.

JICPT|BTC is expected to rise after massive sell-offHello everyone. BTC has been down by over 60% from the historic high created in early Nov. last year. The massive volume got my attention with small base formation.

From the volume spread analysis, it is a sign that sellers may be tired with buyers coming in. The nearest trouble level is $32543(flip), however the key supply zone is $35000 to $36480.

What do you think? Give me a like if you're with me.

USDJPY - range ideas for next weekOn this pair we can see that it is currently range bound and coming to a close for the trading week. We can see on multiple timeframes that the range is respected as of now, with the major support levels around the 127.6 region, and minor resistance around the 128.1 region. The idea for this trade is a simple break and buy concept during the Asian or the NY session, alongside potential scalps within the range itself when price fails to break the range. For the buy this could signal the potential end of the retracement from the top to continue going higher for a potential 70 pip range with minor traffic at TP1. For the sell this could continue the move down to the major support and retest the lows for a potential 40 pip range with minor traffic at TP1. For the better entry confirmation, a retest of the previous support/resistance would be ideal or a break and close on a higher timeframe such as the hourly. Now should the price fail to break the range support or resistance, this can potentially lead to some scalp opportunities by trading from support to resistance or from resistance to support, which I potentially might do with the range being 50 pips.

Trade ideas are considered with a 10 pip stop loss for the example, and would likely change due to candle structure and entry.

JICPT| surging US10Y yield triggered sell-offHello everyone. The surging US10Y yield above 3% trigger sell-off, with the tech-heavy index suffered the most pain. The index has been down by over 500 points.

Look at the US 10Y yield monthly chart, I think it's coming into the solid supply zone(3.07%-3.26%). I think the possibility of penetrating the zone with the first test is very low. It may consolidate around 3% for a while before taking the next step.

VIX chart: it seems to get support on the flip level around 25. 40 is definitely hard to break.

NQ: It's hard to guess how low it might go down. By applying anchored vwap, price might test the level of 12300 . The violation of previous low is a sign.

On the macro and micro level, we do need some good data and better-than-expected earning reports to get buyers coming in. Until the CPI gets controlled, market will be volatile is likely to go further down amid high inflation(crude oil ) and conflicts in Europe. Obviously, 2022 will be a tough year to make money.

What do you think? Give me a like if you are with me.