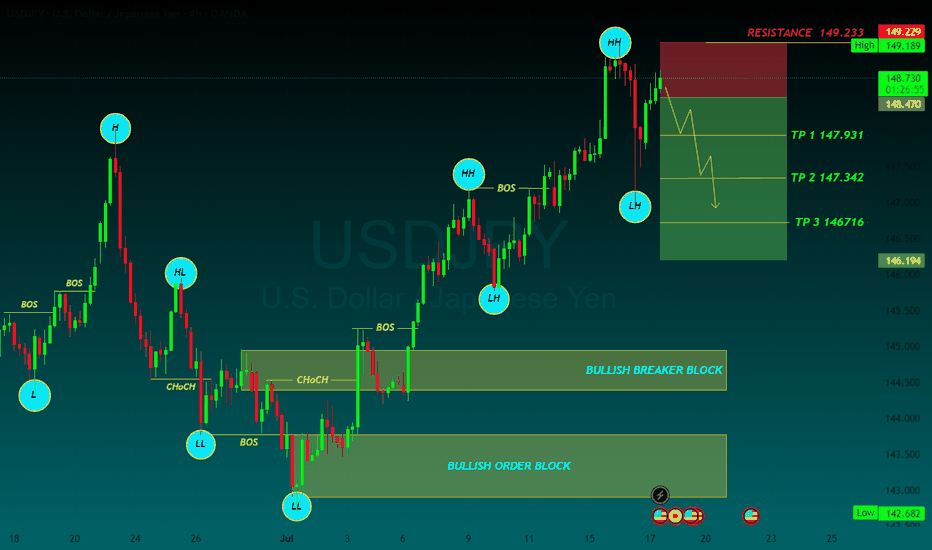

USDJPY SELLJapanese Yen adds to intraday losses; USD/JPY climbs to 148.80 amid broad-based USD strength

The Japanese Yen selling remains unabated through the early European session on Thursday, which along with a goodish pickup in the US Dollar demand, lifts the USD/JPY pair to the 148.80 region in the last hour. Data released earlier today showed that Japan clocked a smaller-than-expected trade surplus in June.

From a technical perspective, the USD/JPY pair showed some resilience below the 100-hour Simple Moving Average (SMA) on Wednesday, and the subsequent move up favors bullish traders. Moreover, oscillators are holding comfortably in positive territory and are still away from being in the overbought zone, suggesting that the path of least resistance for spot prices is to the upside. Hence, some follow-through strength back towards the 149.00 mark, en route to the overnight swing high near the 149.15-149.20 region, looks like a distinct possibility. The upward trajectory could extend further towards reclaiming the 150.00 psychological mark for the first time since late March.

On the flip side, the 148.00 round figure now seems to protect the immediate downside ahead of the Asian session low, around the 147.70 region. The latter nears the 100-hour SMA, below which the USD/JPY pair could retest sub-147.00 levels. Some follow-through selling might shift the bias in favor of bearish trades and drag spot prices to the 146.60 intermediate support en route to the 146.20 area, the 146.00 mark, and the 100-day SMA support, currently pegged near the 145.80 region\

TP 1 147.931

TP 2 147.342

TP 3 146716

RESISTANCE 149.233

Foex

USDCAD BULLISH OR BEARISH DETAILED ANALYSISUSDCAD has just completed a clean falling wedge breakout—a classic bullish reversal pattern often signaling trend exhaustion. After months of consistent lower highs and lower lows within a well-defined wedge, price has now broken decisively above the descending resistance. The current price sits around 1.367, and we are confidently targeting the 1.407 level in the coming weeks. This breakout aligns perfectly with the seasonal USD strength historically seen in Q3, especially following soft Canadian economic data.

From a fundamental perspective, the Canadian dollar is facing downside pressure amid falling crude oil prices and softening domestic data. Canada’s most recent GDP growth came in below expectations, raising concerns around economic resilience. Meanwhile, the Bank of Canada is expected to remain dovish with growing speculation of another rate cut in the next quarter. In contrast, the US dollar has been gaining traction following stronger-than-expected ISM services data and a better-than-anticipated ADP employment report, supporting the Fed’s “higher for longer” stance on interest rates.

Technically, the breakout is further supported by increasing bullish momentum and a break of market structure on lower timeframes. We’re seeing volume confirmation with this push, adding conviction that buyers are stepping in with strength. The risk-to-reward ratio remains highly favorable here, and any pullback into the 1.36 zone would provide an excellent re-entry opportunity for continuation.

With sentiment shifting in favor of USD bulls and oil-related weakness dragging CAD, USDCAD looks primed for a rally. The 1.407 target aligns with both key resistance levels and Fibonacci projections from the breakout structure. Momentum is with the bulls, and this setup has the potential to deliver solid profits as we head deeper into Q3.

US

Bearish drop?EUR/USD has reacted off the resistance level that is a pullback resistance that is slightly below the 100% Fibonacci projection and could drop from this level to our take profit.

Entry: 1.0426

Why we like it:

There is a pullback resistance level that is slightly below the 100% Fibonacci projection.

Stop loss: 1.0467

Why we like it:

There is a pullback resistance level that is slightly above the 61.8% Fibonacci retracement.

Take profit: 1.0343

Why we like it:

There is a pullback support level that aligns with the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

EurGbp will be bearish bias. Should be pullback to shortHello fellow traders , my regular and new friends!

Welcome and thanks for dropping by my post.

Do check out my recorded video (in trading ideas) for the week to have more explanation in place.

Do Like and Boost if you have learnt something and enjoyed the content, thank you!

-- Get the right tools and an experienced Guide, you WILL navigate your way out of this "Dangerous Jungle"! --

*********************************************************************

Disclaimers:

The analysis shared through this channel are purely for educational and entertainment purposes only. They are by no means professional advice for individual/s to enter trades for investment or trading purposes.

*********************************************************************

XAU continues to rise due to the warTechnically, bullish gold futures have a strong typical near-time period technical advantage

Bulls` subsequent upside charge goal is to provide a near for June futures above strong resistance at 2,400

With facts from US commodity charges, it's miles possibly that the USD will preserve to sag and can be susceptible whilst the September assembly approaches.

Gold charges are possibly to weaken this summer, probably into May and June because the Fed delays reducing hobby rates. However, if inflation withinside the US remains managed and americaA economic system suggests symptoms and symptoms of weakening, gold has the possibility to growth its rating following the weakening of the USD.

Cooling inflation will assist the Fed quickly make a choice to decrease hobby rates,

AUDJPY H4 | Rising to resistanceAUDJPY is rising to an overlap resistance, from there it could potentially rise to the take profit level.

Buy entry is at 96.932 which is an overlap resistance that aligns with the 61.8% Fibonacci retracement.

Stop loss is at 96.288 which is a pullback support.

Take profit is at 97.775 which a pullback resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd, previously FXCM EU Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

CHFJPY Price is currently in a 4H Uptrend channelCHFJPY Price is currently in a 4H Uptrend channel. It is hovering near the 170.000 psychological level, as well as the 4H Demand.

I will be looking for entries the moment price taps into the 4H Demand and forms a bullish rejection at 169.300 - 169.600.

I expect price to continue heading its way upwards to the 172.000 psychological level, following the channel.

Bitcoin H4✔️ In the daily time, it hit a very important area and moved up from FVJ. If the daily zone below our FVG is broken and a close is recorded below it, we can expect the price movement to the next daily zones and even a floor break.

✔️ But currently and according to the weekly structure, we can expect correction to even the number of 32 thousand.

✔️ It is definitely best to wait for the necessary confirmations in time for at least one hour for the next decisions so that the assignment of this very important area is determined.

GBPNZD seems bearish to 1.8267 with a warningInverse Cup and Handle has formed on daily with not a great handle (but a Bear Rectangle)

MAs all clustered which signals indecision with which direction it wants to go.

There is clearly strong momentum to the downside and so the target is 1.8267

With the current tax issues in the UK since Liz Truss and the failing economy, investors are more wary with the pound and the direction on where it's going.

The aftermath is showing more downside to come.

Bearish bias

XAUUSDHello traders ,what do you think about GOLD? In this week, we are still bearish on gold and we are looking for a selling position in the resistance areas, so in the resistance areas, we can enter the sell by getting confirmation.

If this post was useful to you, do not forget to like and comment.❤️

CAD/JPY: Change of market structureCanadian Dollar/Yen Japanese could to forming a possible bought continuation, so, as we was in short position, we closed up this trade as we fall it. this movement. But in based my perspective, we don't see short for now and long for now. At the moment, the market it's move to the upside, but in case that CAD get strength, we could see a bought in the following zone that I mark $104.70 JPY and $104.40 JPY, what we need to closed up and keep away of this trade, if I know it, I closed up this short when we see this bullish movement, what I will take this analysis to work better and not focus in H4 becuase the armonic pattern what I show you fall this prediciton what I thinking. But now, analyzing the H1, we found out that CAD/JPY forming a change of market structure like ascending channel and lower high in the price, what mean a possible change of trend.

I hope that this idea support you, at the moment, we would need to wait a little more, in case to short this trade,we would need to break-out of the EMA 200 and 2nd support zone on $104.35 JPY.

I hope that this idea support you!!!

XAUUSD 30 mintHello Traders, here is the full analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

The way I told you, you have to trade like this and you will have more profit always and you will not be a loss.

🎯NZDUSD is a good prospect for building a trading pyramid●● Preferred count

● NZDUSD (IDC): 🕐1 M

As expected back in the distant 2019 , after the completion of the double zigzag , growth followed, presumably within the third wave of the ending diagonal c of (IV) .

_______________________________________

● NZDUSD (SAXO): 🕐 1D

Primary wave ③ is likely to show a double zigzag shape (W) - (X) - (Y) .

In the area indicated by the blue channel, the completion of the correction (X) and the subsequent resumption of growth by the final wave (Y) is expected.

As a local alternative, wave (X) can take the shape of a triangle or a flat correction .

_______________________________________

● NZDUSD (SAXO):🕐 4h

I recommend keeping a part of the short position with an eye to implementing an alternative count.

_______________________________________

_______________________________________

●● Alternative count

● NZDUSD (IDC): 🕐 1M

The alternative wave count has not changed. There is a possibility that the wave Ⓧ of I has assumed the form of a flat .

_______________________________________

● NZDUSD (IDC): 🕐1D

Most likely, wave (C) of Ⓨ will go beyond the top C of (B) , level 0.54720 , reaching the lower border of the 0-Ⓦ-Ⓧ channel. Not a bad prospect for building a short trading pyramid.

_______________________________________

Disclaimer

— The owner of the TradeWaves-EWA © community is not responsible and has no direct or indirect obligations to the User/Customer in connection with any possible losses or financial damages related to any content of this community.