The December FOMC preview – setting the stage for 2023 Having seen US core CPI come in at 6% the strong reaction in rates, US Treasuries, gold, and the USD makes sense – somewhat more puzzling, after an initial spike of 3% in the US500, we’ve seen a sizeable reversal in US equity markets and perhaps this shows trepidation to hold exposures over the upcoming FOMC meeting.

Certainly, USD pairs are getting a strong showing from clients, with breakouts seen in AUDUSD, NZDUSD, GBPUSD, EURUSD and USDCHF. We’ve also seen XAUUSD close at the highest level since July amid the nirvana backdrop of lower US real rates and USD weakness.

Trading breakouts is defined by strategy – momentum and trend-followers often enter positions on breakouts – other, more non-systematic players, will find it hard to trust the break and refrain from chasing, especially when we have the Fed meeting in play (06:00 AEDT / 1700 GMT), with the ECB, BoE and SNB out not long after.

What could go down?

The Fed will hike by 50bp – I’d be shocked if we saw anything else and this action shouldn’t move markets given it's fully discounted – any move in the USD initially likely comes from algo’s reacting to the fed funds projection (or ‘dot’) for 2023, and perhaps for 2024. The current median projection, set at the September FOMC meeting, is 4.6%, but the debate is whether they lift this to 4.9% or 5.1% - one could easily argue that the Nov CPI print sways it towards 4.9%, which is where market pricing currently sits – subsequently should we see the 2023 ‘dot’ revised to 5.1%, in light of the CPI print, it could be seen driving to USD higher and causing equity and XAU to sell-off.

We can look at the ‘dot’ (or projection for the fed funds rate) for 2024 – currently, at 3.9%, the question whether they leave this unchanged or move this higher. Leaving the projection at 3.9% seems likely but it just validates the market's pricing of increasingly aggressive rate cuts through 2024.

You can see the current projection here - www.federalreserve.gov

The other factor is how open Fed chair Jay Powell – in his press conference - is to take another step down to hikes of 25bp pace at the February meeting – I find it hard to think he wouldn’t strongly open the door as there is so much evidence that US inflation is progressing to target. So, after another fall in the December CPI print on 13 Jan, the Fed should be able to hike by 25bp here – perhaps this will be the last in the series before a pause.

Inflation swaps pricing a strong trend lower in inflation

If I look at the inflation swaps market, I find it interesting that traders are betting that inflation falls below the fed funds rate by March – this is a punchy call, but this is exactly what the Fed want to see, and they have made it clear they want to take fed funds above underlying inflation. We can look further out the inflation swaps curve and see the market pricing headline inflation at 2.37% in late Q4. As I mentioned in the 2023 traders’ outlook, high inflation is likely going to take a backseat to growth concerns, and the Nov CPI print gives that view additional support.

A more dovish Fed in 2024

Another factor which needs to be considered is the rotation in voting FOMC members in 2024 –the way the committee is evolving clearly favours the bond bulls/USD bears. Notably, we see, James Bullard, Esther George, and Loretta Mester – these are 3 of the 6 hawkish Fed members who in September projected a fed funds rate of 4.9% for 2023 and are now calling for well above 5%, are to be replaced by Austan Goolsbee (Chicago Fed), Lorie Logan (Dallas Fed) and Patrick Harker (Philadelphia Fed) – voters who lean more on the dovish side of the ledger.

Economics and markets are dynamic – they evolve – the Fed are still very much reactionary and wants to see strong evidence of inflation headed lower and they should be seeing the evidence build by the day. Market players feel confident Powell won’t want to deviate too greatly from his statement at the Nov FOMC meeting and understand now is not the time for high-fiving and claiming victory on inflation – but he should give them maximum flexibility to take the pace down to 25bp, knowing that growth will likely slow for here and prior rate hikes still need to work their way through the system – Powell will need to hit a home run on his communication – it promises to be very insightful and will set a stage for 2023.

FOMC

XAUUSD - KOG REPORT UPDATE:End of day update from us here at KOG:

We wanted this to go a little lower before the bounce to the upside, however as you can see price reacted aggressively to the news and we went straight up into the KOG Report level we were expecting this week to be completed. It's a difficult market to trade and to be honest we're maintaining the defensive in Camelot so its reduced lots and observation.

Now we would like to see this settle pre-event so expect a range above 1803 and be prepared for FOMC tomorrow.

As always, trade safe.

KOG

GBPUSD H4 - Long SignalGBPUSD H4 - Breakout seen on cable, we covered this in the weekly watchlist video at the start of the week on the Youtube channel, and mentioned we really want to see this break and retest play. Hoping to see a corrective test of 1.23 support for long entries over the next 12-18 hours

DXY H4 - Short Signal ProfitDXY H4 - Really started to make a dent downside and break that consolidation now. Fundamentally we are really starting to align with technicals which is great, another big day tomorrow. Keen to see what unfolds, fairly confident in the interest rate decision of 50bps. But Powel's PC no doubt will be interesting.

DXY Head and Shoulderwhatever comes from this falling wedge, I don't expect DXY above 106 again this year... probably the wedge fails

what I do expect is DXY to break down.. if not immediately following todays economic data (which might be difficult for the market to process) then for the FOMC meeting

TSLA Major Confluence Long Signal!Going to keep this simple. We have a touch on the bottom of the descending parallelly channel, a major horizontal support line, and the golden pocket. This is a very bullish setup for TSLA to bounce. Stops should be placed below golden pock with the right position size and risk management to protect your account incase the bears manage to push the price through this major support.

Love it or hate it, hit that thumbs up and share your thoughts below!

Every day the charts provide new information. You have to adjust or get REKT.

Don't trade with what you're not willing to lose. Safe Trading, Calculate Your Risk/Reward & Collect!

This is not financial advice. This is for educational purposes only.

GBPUSD D1 - Long SignalGBPUSD D1 - Really want to see this upside break and retest before jumping into these longs. ***USD pairs are fast approaching some fairly significant daily resistance zones, lots of data out this week for both the GBP and USD. So this could really catalyse an upside break... We just have to wait and see what releases and what starts to unfold.

The dollar slowly perks up ahead of US CPI and FOMC meetingThe US dollar is trying to form a base following its false break of the August low. Whilst it saw a daily close beneath the key level on Friday 2nd December, a bullish engulfing candle formed the following day. Furthermore, a higher low formed on Friday with a Spinning top Doji and held above the August low, and momentum is pointing higher today. So if this week’s FOMC meeting is more hawkish than currently expected, these levels likely look appealing for bulls after its near-10% retracement. With that said, I suspect volatility will be lower ahead of this week’s US CPI report and FOMC meeting as traders may be wary to front-run these key events.

- The bias is bullish above last week's low (although a more aggressive stop could be used beneath Friday's low)

- Open upside target, given the market has retraced nearly 10% from its highs and the Fed have the potential to deliver a hawkish hike this week

DXY WEEKLY OUTLOOK DXY

2 scenerios for this coming week (very heavy with CPI and FOMC this week)

1) Looking for a continuation melt on the dollar index with a small bear flag on the hourly timeframe. With a break of structure I can see further downside on the dollar which would give rise in the equities market.

2) Looking at the dollar index to form a double top at 106.5 - 107 region for better risk to reward sells which means this will give equites, crypto a short-term downside move as we are currently experiencing now which can serve as manipulation or liquidity grabs to the downside for further upside later in the week or the coming weeks.

Inflations Prints (CPI TUESDAY 9.30 PM SGT)

As per seen from the prints of previous month, inflation is easing. We will be looking for Tuesday's print to be lower than that of previous month of 0.4% to signify a continuation of easing prints for the months ahead. If inflation were to print higher than 0.4%, we can safely gauge that the prints of previous month was a "One Trick-Pony". We will be looking at a continuation of bearish equities market / stocks / crypt and gold and dollar dominance.

Inflation prints is in direct correlation to the FOMC monetary policy. If inflation is easing due to constant aggressive rate hikes, we can be looking at the FEDs to ease rate hikes accordingly as well. The market has been pricing in a Fed pivot Phase 1 and expecting rate hikes to be eased this month printing at 50 BPS. We will be looking at dollar weakness and bullishness across all global markets when this happens.

$BTC - Broke the TrendLINEHello my Fellow TraderZ,

It seems #BTC finally breaking the support of Trendline and currently under the EMA 55and 200 on Hourly.

Currently, the most important levels to keep LONG or SHORT is $15600 & $17400 to get out of the range.

I am assuming that this FOMC would be lenient and price could test the $15800 level before FOMC and could move higher later on. Lets see till then fingers crossed.

Happy Trading. CHEERS!!!

XAUUSD - KOG REPORT!KOG Report:

In last week’s KOG Report we said we didn’t have much confidence in the bullish move from the week before and were expecting a move to the downside. We suggested caution as there was a pattern that suggested a potential break of 1755 so we gave the resistance levels above and illustrated the 1806-10 region to look for a reaction in price and possible rejection. We wanted lower pricing and gave a reaction region of 1760-65 where we were hoping for a tap and bounce back to the upside.

As you can see, it was a perfect point to point, LEVEL TO LEVEL move, resistance held, Excalibur confirmed, and we got the move into the support levels below with then another TAP AND BOUNCE back to where the price is now. A fantastic week in Camelot, not only on Gold with Excalibur hitting and completing numerous targets, but also Silver, US30, GJ and Oil to name a few.

So, what can we expect in the week ahead?

We’re going to start again this week with suggesting caution on the markets! There is a lot of news this week that will cause volatility and choppy price action as well as potential extreme swings. Markets have been lining up for a big move for a few weeks so expect the unexpected in the coming weeks.

For this week we have extended the range we identified in early November which you can see the price has been playing well in. We’ll again prefer to see this tap that high in the early sessions before a potential reaction in price to give us the opportunity to short back down into the support levels below. So the 1806-10 price region is again the key resistance level for price to stay below and for us to see any attempt at the bearish move we’re looking for.

The path shows the support level of 1770-75 as the first key level we would like to see, we will of course be using Excalibur to guide us which will give us more clearer and precise levels to target. This level of 1770-75 is important support this week, price needs to stay above this to the resume the swing to the upside and any attempt to break and hold above 1800!

Now, we have also highlighted a lower level for a potential swoop of liquidity which is sitting just below the 1750 price region, due to the news events this week these extreme levels are very much possible, so please be careful with your entries and be patient. We’re expecting ranging, whipsawing, choppy price action this week so your risk model is really important as well as your lot sizes. They’re going to be grabbing liquidity so spikes up and down are very likely.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

GBPUSD: How to read the fundamentals?GBPUSD is ahead of an important week of CPI meeting in Tuesday and FOMC on Wednesday. if inflation remains under control we can expect fed to slow down the rate hikes more likely 50 bps the coming week and 25 bps early next year which should trigger USD bears and that's what we expect as well based on the last CPI data. Otherwise if CPI is above expectations we can expect the opposite Scenario and more of a strong Dollar and a hawkish FOMC.

when Good fundamentals meet good technicals then there is a good probability for your trade to go in your direction but always keep in mind that trading is a field of probabilities and since everything could happen a proper risk management should be taken in consideration. my recommendation is to risk 1% per trade so that will allow you to stay in the market the longest possible and will help you to compound your account as well. Otherwise if you risk 20% per trade then 5 losing trades in a row will knock you out of the market. And you don't want that to happen so you should stick to proper risk management of always risking small and aiming high.

if you have any question please don't hesitate to ask in the comment section. i'm happy to interact and answer to all!

$AUDUSD - Important data this week, be prepared. $AUDUSD - Get ready...

Another week, another great opportunity for us traders to take advantage of.

This week is a very important week: CPI, FOMC & PMIs.

It was a difficult week, choppy action but that happens when we have important data this week. It's important to reserve your capital gains when market conditions are like this kangaroo or amber mode is way I describe it.

Some are stating the CPI print will be more important than FOMC - I think it will be both very important as we go towards year end we still have plenty of trading opportunities and this week is a great week.

We expect CPI to soften, 7.7% previous to 7.3% - If it comes in softer the rate hikes working, we expect 50 basis point for this meeting and the next and then we expect cuts - Now the market is forward looking we've seen risk play big part DXY declining cuts coming into play, easing less pressure dollar declines: we have Aussie, Gold and crypto escalate higher. What Powell will state will be very important in my humble opinion as we get to year end and positioning for portfolio management I have no set direction on yet to decide the movement for this week, we are within mid ranges of all assets - you could trade the data or wait and trade the after reaction.

Regarding past data on Friday we had PPI: It came stronger than expected however we had minor dip in EUR we still went to rising back, now within the mid ranges. The dollar bears are still out there but will they get hurt this week? Only time will tell.

Technically AUDUSD: We are within ranges a break to either direction, at this current moment of time we arent closing above 200ema if we are to close above bulls could gain further control up we go towards .70 areas easily - if not this rally fails and goes back towards .64 half areas

All the best for this week,

Trade Journal

(FOLLOW YOUR OWN TRADE PLAN - NOT A SIGNAL PROVIDER)

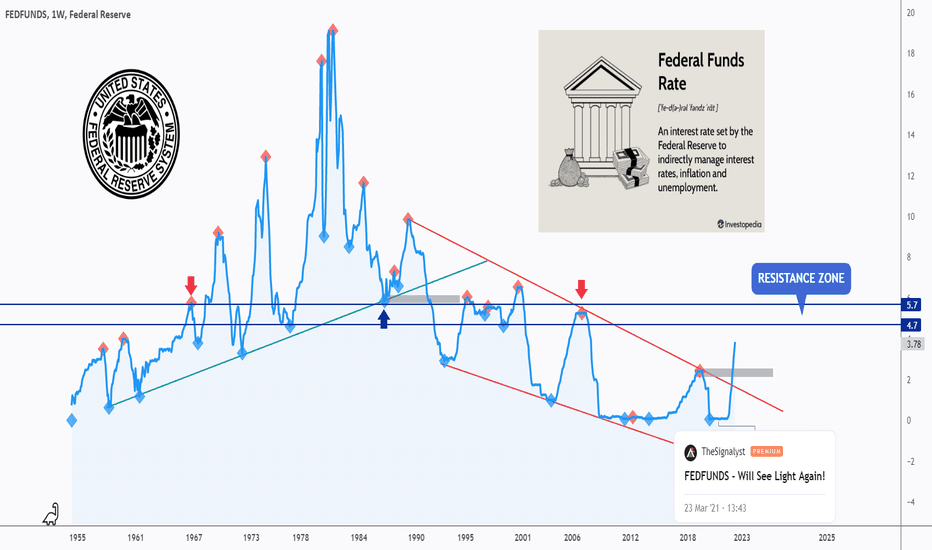

All Eyes On Fed Funds Rate 🏛Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

I am not a fundamental expert (nor an economist) but I found FEDFUNDS chart really interesting!

I never thought that basic technical analysis tools can also be applied to such economic instruments!

As per my last analysis (attached on the chart) FEDFUNDS traded higher and broke the red wedge pattern upward.

Now we are technically bullish, expecting big impulse movements to push price higher, and small bearish correction movements.

We all know that Federal Reserve will most probably increase the interest rates by another 50 basis points (0.5%) next week (on Wednesday)

By adding another 0.5% , FEDFUNDS will be approaching a strong resistance zone in blue (4.7% - 5.7%) which might hold the price down for a bearish correction to start and push price lower till the previous high in gray again.

It would be interesting to hear your thoughts on this one.

Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich