Forensicforex

DXY Full Trading DayHello Traders!

Here we can see the DXY fall lower for the day.

However, by using the Asian Session we are able to have greater chance of knowing where the the market will.

We know the 3 main sessions all have different characteristics.

London will be keying off the Asian session.

Notice how they trap traders during London Session.

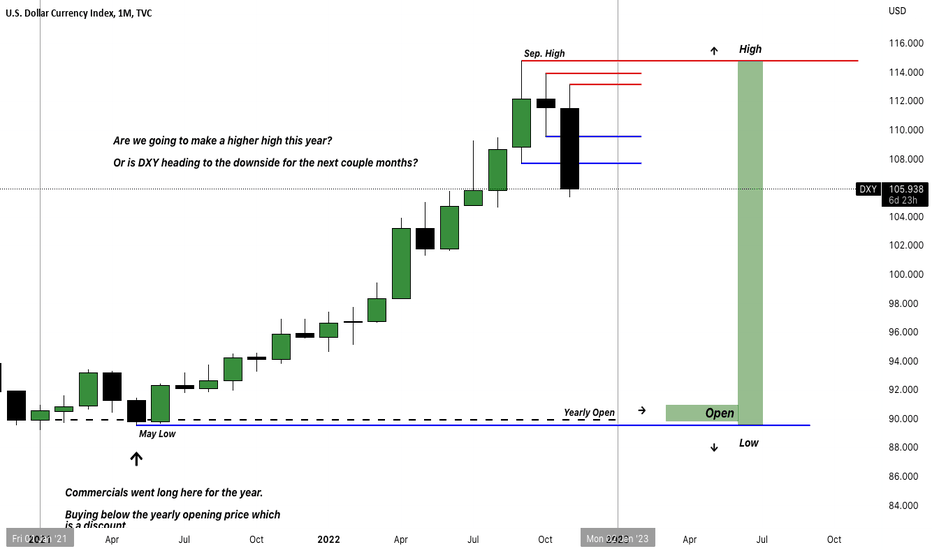

DXY Yearly Bar Candle Hello Traders!

Here this is the DXY yearly range on the monthly time frame.

I do not think we are going to see another rally in the dollar during this year.

We have failed to break a previous monthly high and took out the pervious monthly low.

According to the yearly open we are in a premium range.

You can see how earlier in the year the discount range is where the commercials executed their net longs for the year.

This yearly candle is a large range candle as well.

DXY Weekly Range Thursday IdeasHello Traders!

Here we can see the DXY made the high of the week on Monday.

We are now crossing over Sundays opening price after rallying up into a discount or overbought range for the weekly range.

Price is falling fast.

What are the odds of price rallying back up and taking out the pervious daily high?

I will favor sell side liquidity targeted going into Thursday.

Thursday can also make the low of the week with Friday moving counter to the weekly range expansion to the downside.

The weekly candle has opened, rallied up and now has fell below it's open! Sellers are in strong.

I do not want to see price come back to the sundays opening price. If it does I want to see a dynamic reaction away from it back to the discount range.

Going into thursday I would seek selling above M.O.P and above 2:00 Am European open.

DXY Weekly Range in a PremiumHello Traders!

We can see that the dollar index was in a consolidation last week.

This week we can see dollar run into a premium above Sunday's Opening Price.

Currently Monday holds the high of the week.

Today Tuesdays daily range broke the daily low formed on monday and not its high.

Are we seeking a selling opportunity Wednesday? Preferably. Failed to break pervious daily high but we were successful in breaking the pervious daily low,

Still have that 4h breaker that I am eyeing. We do not have to trade back to it but I looking at it as a opportunity commercials would sell again.

GBP/USD Intraday StudyHello Traders!

Here we can see the classic AMD but with more time specific regions.

I have a time window of 1am to 3 am to hunt a opportunity to go long on a bullish day.

This is how I filter trades.

We can also see the Asian session standard deviations.

GBP/JPY and GBP/AUD did not give dynamic moves like GU during London.

DXY Consolidations TipsHello Traders!

Here i'm showing you how to filter through pairs when the DXY is moving sideways.

DXY in consolidation = EU, GU, NU, AU in consolidation

This makes the crosses highly more manipulated.

You want to find the strongest and weakest and match it up to make a currency pair to trade.

Relative Strength DXY vs Futures FXHello Traders!

Here we are looking at the Dollar Index compared to the FX Futures (Continuous Chart).

All the signs:

6B1! = British Pound Dollar

6N1! = New Zealand Dollar

6C1! = Canadian Dollar

6J1! = Japanese Yen Dollar

6S1! = Swiss Franc Dollar

6A1! = Australian Dollar

6E1! European Dollar

I have everything on the same % scale.

I am simply looking at who is the weakest out all the pairs to make a dynamic move with the dollar in consolidation last week and now in a this week breakout.

From the 1H it looks like Australian Dollar was the weakest. As DXY went sideways it declined the most out the others.

From the 1H it looks like British PounD dollar was the strongest. As DXY went sideways it increased the most out of the others.

From the 1H it looks like Swiss Franc Dollar moved sideways as the DXY went sideways.

Now I'm speculating AUD weak and GBP Strong. Which means I should look at the currency pair GBP/AUD.

I should look for signs of GBP/AUD going long. Check to see if a HTF discount PD array has been respected and gave a nice dynamic rally away from it. Check to see where it stands in its IPDA ranges for the month of November so far.

When the DXY goes sideway is will be a change for the commercials to manipulate the crosses like EUR/GBP, EUR/YEN, EUR/NZD, EUR/AUD etc...

DXY 4H Bearish BreakerHello traders!

Here we can see retail traders are trapped above that swing high.

How do we know this? Simply see how quick price distributes after the buy stops are taken.

That move to the downside is attractive to any trader, however, this is how they entice retail traders to chase price and sell late!

By the time retail is all shorting the commercials are already going to pull price back up to the breaker to another short opportunity.

DXY Momentum Shift.Hello Traders!

Here we can see DXY is clearly not breaking swing highs.

It not looking to seek buy side liquidity above swings highs.

Instead we can see price seek sell side liquidity below swing lows.

We also can see here on the daily a swing low is broken and price follows with a lower swing high forming

(High probability scalp model in play).

I would like to see price seek equilibrium of its monthly range it is trading in currently.

Swing highs are broken are going to be seen as turtle soup situations.

DXY Monthly Chart Premium vs DiscountHello Traders!

Here we can see the DXY is overpriced and overvalued.

It is currently sitting within a premium range.

When I see premium I think of commercials seeking short opportunities typically back down into equilibrium of the range.

In order for price to seek higher price it will need to see at least equilibrium or discount for commercials to load longs.

Distribution needs to occur in my opinion and has already started.

USD/CAD November IPDAHello Traders!

Here we can see UCAD has broke the 20 look back low.

We could see retail traders get trapped below this low and commercials increase longs.

If we look at the CAD futures contract we see the opposite. Price breaks the 20 day look back high.

I would favor this pair this month as the seasonal charts and liquidity low looks to match up.

DXY November IPDAHello Traders!

Here we can see DXY may be coming back down into a discounted market to rally higher.

Another way to get retail traders on the wrong side thinking dollar is going to fall again.

I would like to see price run the 20 day low(sell side) and rally higher.

Seasonally chart shows DXY is bullish this month.