Forex-aud

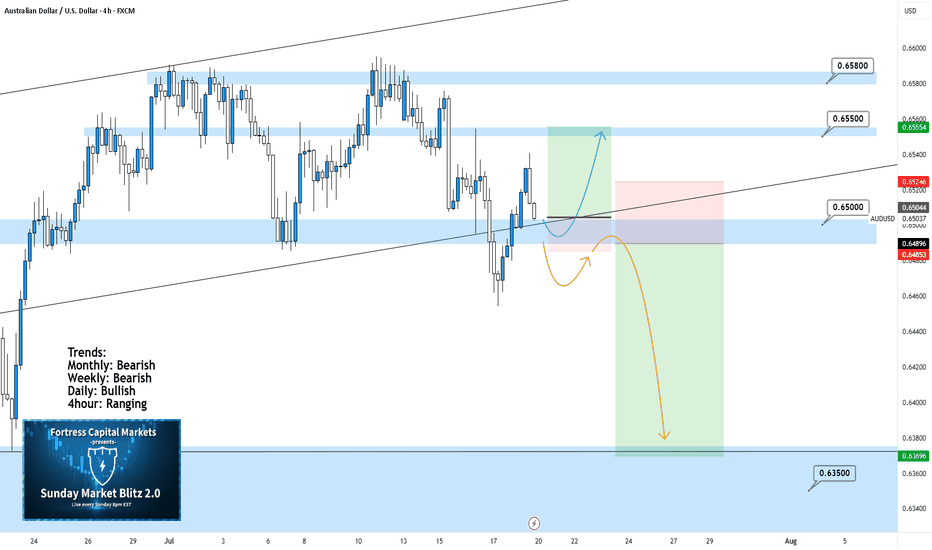

AUDUSD 4Hour TF - July 20th, 2025AUDUSD 7/20/2025

AUDUSD 4hour Neutral idea

Monthly - Bearish

Weekly - Bearish

Dailly - Bullish

4hour - Ranging

We’re looking at a fairly large range here on AU and although the higher timeframe suggests a potential bearish move, I am unsure until we have some clarity around 0.65000. Here are two scenarios that break down what could happen this week and how 0.65000 plays into it:

Range Continuation - Since late June we have seen price action establish this large range and stick to it (0.65800 Resistance & 0.65000 Support).

Currently, we can see price action attempting to break 0.65000 support but it has not done so yet. If we don’t break below 0.65000 early this week it is very likely we will see a rally into the top of the range.

Bearish Breakout - This is the setup we want to see play out this week as it presents a beauty of a trade.

For us to see AU as bearish on the 4hour we need to see a clear break below 0.65000 with a confirmed lower high below. If this happens look to target toward major support levels like 0.63500 area.

AUDJPY – Trade the Range… Until It EndsHello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈AUDJPY has been trading within a big range marked in red.

Moreover, the it is retesting the lower bound of its rising channel marked in blue.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of support and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #AUDJPY approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDCNH SELL 4H

Hello, I am Forex Trader Andrea Russo and today I want to talk to you about an interesting strategy for the AUDCNH currency cross.

Currently, the AUDCNH exchange rate is at a value of 4.61195, and I have identified a selling opportunity based on technical and fundamental analysis. My strategy involves a short entry at this level, with a stop loss (SL) placed at 4.63500, which represents a potential loss of 0.50%. My profit target (TP) is set around 4.55, aiming for a significant bearish movement.

Technical Analysis

The AUDCNH is showing signs of weakness, with a key resistance that has formed near the 4.63500 level. Technical indicators, such as the RSI and the MACD, suggest a possible bearish reversal. Furthermore, the price is below the major moving averages, confirming a bearish trend.

Fundamental Analysis

From a fundamental perspective, the Australian dollar may be under pressure due to weak economic data and a less hawkish monetary policy by the Reserve Bank of Australia (RBA). On the other hand, the Chinese renminbi is benefiting from relative economic stability and targeted stimulus policies.

Trading Strategy

Entry: 4.61195

Stop Loss: 4.63500 (-0.50%)

Take Profit: 4.55 (approximately)

This setup offers an attractive risk/reward ratio, making it a potentially profitable strategy for traders looking for opportunities in the Forex market.

AUDCAD: Bearish Cross kickstarting a decline.AUDCAD is practically neutral on its 1D technical outlook (RSI = 55.879, MACD = 0.001, ADX = 33.394) and got rejected on both the 1D MA100 and MA200 that formed a Bearish Cross. The Channel Down mimics the June 30th 2023 Cross that then pushed the price to the bottom of the Rectangle on the 1.382 Fibonacci extension. Go short, TP = 0.86600.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Mastering AUDUSD: Key Trading Zones Revealed for Optimal EntriesGreetings, traders! Welcome to this AUDUSDmarket analysis, where we focus on identifying higher-probability trading opportunities.

In this video, I start by analyzing the yearly down to the daily charts, highlighting key trading zones, and discussing the confirmations we look for to optimize our swing entries.

If you like the breakdown, boost the idea and follow to receive more ideas.

Trade safely

Trader Leo

AUDCHF: 4H Golden Cross emerging. Buy opportunity.AUDCHF is technically neutral on the 1D (RSI = 49.632, MACD = 0.000, ADX = 25.946) and 4H timeframes alike as the price is consolidating on the HL trendline of a medium term uptrend. That uptrend is technically the bullish wave of the 3 month Channel Up. The pair is about to form a 4H Golden and last time this was formed on the bullish wave prior (Sep 23rd) the wave was only halfway through. The 1D MACD formed the usual Bullish Cross just after the bottom so we have all the technical validations to go long and target the R2 level (TP = 0.58700).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

AUDUSD Channel Down aiming for a bearish break out.AUDUSD is trading inside a Channel Down since September 19th.

The price is currently under the MA50 (4h) and the bullish wave of the Channel Down is about to end.

So far this is similar to the first bullish wave (Megaphone) that made a bearish break out on October 3rd.

Trading Plan:

1. Sell on the current market price.

Targets:

1. 0.64565 (Fibonacci 1.5 extension).

Tips:

1. The RSI (4h) double topped and is trading under its MA. Sell signal as well.

Please like, follow and comment!!

AUDNZD: Bullish extension expected.AUDNZD is bullish on its 1D technical outlook (RSI = 60.156, MACD = 0.002, ADX = 27.433) as it maintained the rebound made on the 4H MA200 and bottom of the Channel Up. According to the 4H RSI, this pattern is similar to the 4H MA200 of April that made one final extension on that rebound to the 1.786 Fibonacci level. Our target is slightly under it (TP = 1.117500).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Euraud likely can see more downsideHello fellow traders , my regular and new friends!

Welcome and thanks for dropping by my post.

Overall a bearish chart on the daily, now with the rejection as last R zone on daily, likely to see more downside on EA.

Do check out my recorded video (in trading ideas) for the week to have more explanation in place.

Do Like and Boost if you have learnt something and enjoyed the content, thank you!

-- Get the right tools and an experienced Guide, you WILL navigate your way out of this "Dangerous Jungle"! --

*********************************************************************

Disclaimers:

The analysis shared through this channel are purely for educational and entertainment purposes only. They are by no means professional advice for individual/s to enter trades for investment or trading purposes.

*********************************************************************

AUDUSD | 15m Trade Plan | Intraday15m: Can observe BoS and Swing Low

The price is now consolidating.

Plan A: As soon as the market takes buy-side liquidity, take a short position, followed by a 15m bearish confirmation.

Plan B: As soon as the market takes sell-side liquidity, take a long position, followed by a 15m bullish confirmation.

Plan C: Take a flip entry accordingly.

Do not deviate from the process; take entries in the 15m kill zones.

AN could be having more upside Hello fellow traders , my regular and new friends!

Welcome and thanks for dropping by my post.

bounced off the lows after daily pullback. currently looks like on track back to an upside.

Do check out my recorded video (in trading ideas) for the week to have more explanation in place.

Do Like and Boost if you have learnt something and enjoyed the content, thank you!

-- Get the right tools and an experienced Guide, you WILL navigate your way out of this "Dangerous Jungle"! --

*********************************************************************

Disclaimers:

The analysis shared through this channel are purely for educational and entertainment purposes only. They are by no means professional advice for individual/s to enter trades for investment or trading purposes.

*********************************************************************

Short on AudCadThe price has formed a lower low, and in the continuation of the downtrend, it is also forming lower highs. The point to note is that we have an engulfing pattern at the bottom, and now we have reached a fresh supply zone where a low-risk short position can be taken with a risk-to-reward ratio of 2.

Trade simple.

AUDNZD Has bias for some more down side...Hello fellow traders , my regular and new friends!

Welcome and thanks for dropping by my post.

I find the long tailing candles of the last 2 weeks disturbing....but still bearish on this cross..watching for short opportunities!

Do check out my recorded video (in trading ideas) for the week to have more explanation in place.

Do Like and Boost if you have learnt something and enjoyed the content, thank you!

-- Get the right tools and an experienced Guide, you WILL navigate your way out of this "Dangerous Jungle"! --

*********************************************************************

Disclaimers:

The analysis shared through this channel are purely for educational and entertainment purposes only. They are by no means professional advice for individual/s to enter trades for investment or trading purposes.

*********************************************************************

AUDUSD Medium-term Sell OpportunityThe AUDUSD pair followed our previous signal with great precision (March 19, see chart below), hitting the 0.63750 Target:

Following that, the price rebounded and has so far been rejected yet again on the 0.5 Fibonacci retracement level. That is the strongest medium-term Resistance and a symmetrical sell level where the similar sequence of June - July 2023 Double Topped and got rejected even below the 1.236 Fibonacci extension.

As a result, we take a similar bearish stance and take this opportunity to sell again and target 0.63450 (1.235 Fib ext).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

AUDCAD - Already Over-Bought 📉Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 AUDCAD has been overall bullish, trading within the rising wedge in red.

At present, AUDCAD is approaching the upper bound of the wedge pattern acting as an over-bought zone.

Moreover, it is retesting a strong resistance zone in blue.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the blue resistance and upper red trendline.

📚 As per my trading style:

As #AUDCAD is hovering around the circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

AUDJPY - Are You Ready⁉️Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 AUDJPY has been overall bullish, trading within the rising wedge pattern in blue.

Currently, AUDJPY is in a correction phase, approaching the lower bound of the wedge.

Moreover , it is retesting a strong demand in green.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of the green demand and lower blue trendline.

📚 As per my trading style:

As #AUDJPY approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

AUDUSD: Wait to buy this dip.AUDUSD is marginally bearish on its 1D technical outlook (RSI = 40.176, MACD = -0.001, ADX = 34.265) as it entered a Channel Down similar to those of August - October 2023 and April - May 2023. That is why we are expecting a bullish reveral the closer we get to the 1.236 Fibonacci extension. As long as the 1D RSI doesn't break into the oversold zone (<30.000), we will buy that dip and target the LH trendline (TP = 0.6700).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

AUDJPY Hit the top of the Channel Up.The AUDJPY pair has recently hit our long-term bullish Target of 99.300, which we set on our last trading idea (December 18 2023, see chart below):

That was at the top (Higher Highs trend-line) and the 1.136 Fibonacci extension of the 9-month Channel Up. We are technically expecting a pull-back now towards the bottom (Higher Lows trend-line) of the Channel Up and our Target is the 0.382 Fibonacci retracement level at 95.600.

If however the price breaks above the Higher High and the Channel Up, we will have a formation bullish break-out and as a result we will take the small loss on the short and go long instead, targeting the 3.0 Fibonacci extension at 102.700. In that case we will be expecting a rally similar to June 2023, which led to the creation of the current Channel Up.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

AUDJPY - Keep It Simple 👌Hello TradingView Family / Fellow Traders,

📈 AUDJPY has demonstrated an overall bullish trend, trading within the rising broadening wedge pattern in blue.

Currently, AUDJPY is sitting around the lower bound of the wedge.

Moreover, the 96.5 serves as a robust demand zone.

🎯 Therefore, the highlighted blue circle signifies a significant zone to consider for potential buy setups . This area is noteworthy as it marks the convergence of the green demand and the lower blue trendline, acting as a non-horizontal support.

📚 In accordance with my trading style:

As AUDJPY is sitting around the blue circle zone, I will actively search for bullish reversal setups to capitalize on the anticipated next bullish impulse movement.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

AUD/USD: Navigating Market Swings Amidst Economic IndicatorsAUD/USD: Navigating Market Swings Amidst Economic Indicators

The Australian Dollar (AUD) has showcased its strength in the aftermath of the US Consumer Price Index (CPI) release. Despite an initial dip yesterday, the AUD demonstrated a robust recovery, maintaining its position within the 50% - 61.8% Fibonacci area. Supported by the 200 Moving Average and the dynamic trendline of a bullish channel, the technical analysis indicates a stable situation, fostering a modest upward movement. As the AUD/USD pair approaches the psychological level at 0.6700, market speculation on potential rate cuts by the US Federal Reserve (Fed) in March and May continues to provide support.

Economic Landscape:

Australia's Monthly Consumer Price Index for October and November revealed a marginal decrease, suggesting that Q4 2023 headline inflation may fall below the Reserve Bank of Australia's (RBA) annual forecast of 4.5%. The Australian Bureau of Statistics (ABS) job vacancies data, reflecting a decline for six consecutive quarters, aligns with the labor market's easing pressures. These factors indicate that the RBA might refrain from further interest rate hikes in February.

Contrasting signals emerge from Australia's economic indicators, with Retail Sales increasing in November and December's Trade Surplus widening. While positive, these signals may not be sufficient to prompt the RBA to implement monetary policy easing, especially given the subdued inflation data.

Forecast:

Amidst these economic dynamics, our forecast maintains a positive outlook for the AUD/USD pair. The technical stability, coupled with market speculation favoring the Australian Dollar, suggests a potential growth in its value. Traders and investors will be keenly observing how the RBA responds to the contrasting economic indicators and whether the central bank decides to adjust its monetary policy stance in the coming months.

Conclusion:

The Australian Dollar's resilience in the face of market fluctuations and economic indicators is noteworthy. While inflationary concerns persist globally, Australia's economic data presents a nuanced picture. The AUD/USD pair's journey toward the 0.6700 level is an intriguing development, and its future trajectory will be shaped by a delicate balance between domestic economic factors and global market sentiment.

Our preference

Looking for a Long positions with target at 0.6940

AUDNZD Bullish set-up.Our last analysis on the AUDNZD pair was on November 16 (see chart below) and so far has hit one of our two targets:

At the moment the price is struggling on the 1D MA50 (blue trend-line) - 1D MA200 (orange trend-line) Zone, where it has failed since Dec 13 and on every single candle to close it above the 1D MA50. If it does, expect the continuation of the uptrend towards the Symmetrical Resistance, in which case our Target will remain 1.9200. If it continues to fail on the 1D MA50 and gets rejected, we will buy again near Support 1 and close everything at 1.08200 (just below the 0.618 Fibonacci retracement level as all previous Lower Highs).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇