Gold can exit from wedge and drop to support levelHello traders, I want share with you my opinion about Gold. Price action on Gold has shown strong bullish momentum earlier, as it broke out of the previous upward channel and started forming an upward wedge. The rally gained traction once the price left the buyer zone between 3006 - 3025 points, pushing through multiple resistance levels and creating a new structure of higher highs. After the breakout from the wedge’s support line, the price continued to grow and eventually reached the upper boundary of the wedge pattern. Here, we saw a clear reaction and reversal, signaling potential exhaustion among buyers. Currently, the price is trading just below the upper wedge resistance and has already made a pullback after the latest local high. Given this structure and the fact that the wedge pattern is tightening, I expect gold to reverse again and decline toward 3270, which is my first TP. If pressure continues, the price may drop to the 3210 current support level as TP2. The reaction from the upper wedge boundary, combined with weakening momentum and a strong support area below, supports my bearish outlook for now. Please share this idea with your friends and click Boost 🚀

Forex-gold

HelenP. I Gold will make correction movement to support zoneHi folks today I'm prepared for you Gold analytics. After a strong breakout from the ascending structure, price continued its bullish momentum and reached a fresh local high near 3340 points. This impulsive rally was preceded by a steady upward trend inside a rising channel, where the price showed multiple rejections from the lower boundary and the trend line, particularly near the 2970 level, which also matched with the key support zone at 2950 - 2970 points. The upward movement accelerated once Gold broke through the previous resistance zone around 3160 points, which is now acting as support. That level also coincides with the upper edge of the earlier consolidation area, making it a key zone for potential future reactions. At the moment, the Gold is trading far above the trend line and is extended from its last confirmed support structure. Given the sharp vertical impulse and the lack of significant pullbacks, I expect a downward correction toward the 3175 - 3160 support zone, which is my current goal. This area remains critical for evaluating the next buyer reaction and further trend continuation. If you like my analytics you may support me with your like/comment ❤️

XAUUSDXAUUSD is still in an uptrend. The price has a chance to test the 3342 level. If the price cannot break through the 3342 level, it is expected that in the short term, there is a chance that the price will go down. Consider selling the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

HelenP. I Gold may make correction and then continue to growHi folks today I'm prepared for you Gold analytics. Following a deep correction that pushed the price down to the support zone between 2975 and 2950 points, Gold made a strong bullish reversal. This zone had already acted as a key accumulation area in the past, and once again, buyers stepped in aggressively. The reaction from support 2 at 2975 points was sharp, with the price bouncing and forming a clear impulse move. As XAU continued to rise, it broke back above the trend line and retested it, turning former resistance into support. Shortly after, the price pushed above the local support zone between 3165 and 3185 points, confirming the strength of the bullish trend. This zone is now acting as a base for further growth. Currently, Gold is trading above the trend line and support zone, holding near the 3230 area. The recent bullish momentum, strong impulse structure, and consistent reaction to technical levels indicate that buyers remain in control. Given the breakout, successful retest, and strength from key support zones, I expect XAUUSD to continue rising toward my goal at 3300 points. If you like my analytics you may support me with your like/comment ❤️

Are You Taking the Right Risks in Trading? RISK Per Trade Basics

What portion of your equity should you risk for your trading positions?

In the today's article, I will reveal the types of risks related to your position sizing.

Quick note: your risk per trade will be defined by the distance from your entry point to stop loss in pips and the lot size.

🟢Risking 1-2% of your trading account per trade will be considered a low risk.

With such a risk, one can expect low returns but a high level of safety of the total equity.

Such a risk is optimal for conservative and newbie traders.

With limited account drawdowns, one will remain psychologically stable during the negative trading periods.

🟡2-5% risk per trade is a medium risk. With such a risk, one can expect medium returns but a moderate level of safety of the total equity.

Such a risk is suitable for experienced traders who are able to take losses and psychologically resilient to big drawdowns and losing streaks.

🔴5%+ risk per trade is a high risk.

With such a risk, one can expect high returns but a low level of safety of the total equity.

Such a risk is appropriate for rare, "5-star" trading opportunities where all stars align and one is extremely confident in the positive outcome.

That winner alone can bring substantial profits, while just 2 losing trades in a row will burn 10% of the entire capital.

🛑15%+ risk per trade is considered to be a stupid risk.

With such a risk, one can blow the entire trading account with 4-5 trades losing streak.

Taking into consideration the fact that 100% trading setups does not exist, such a risk is too high to be taken.

The problem is that most of the traders does not measure the % risk per trade and use the fixed lot.

Never make such a mistake, and plan your risks according to the scale that I shared with you.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

What Happens to Global Markets When the Ukraine-Russia War Ends?What Happens to Global Markets When the Ukraine-Russia War Ends?

The end of the Ukraine-Russia war will undoubtedly impact major global markets,

here’s what we can expect:

Oil Market : With tensions easing, oil prices could drop as supply concerns lessen and sanctions ease. However, global demand could still keep prices stable or even high.

Gold Market : Gold, a safe-haven asset, might face a decrease in demand as geopolitical uncertainty fades, but if the end of the war leads to global economic instability, gold could remain a strong choice for investors.

Forex Market : The end of the conflict could boost the Euro and USD as stability returns to the market. At the same time, the Russian Ruble might face fluctuations as Russia’s economy adjusts to post-war conditions.

Crypto Market : Cryptocurrencies may see mixed reactions—some may retreat as confidence in traditional markets rises, but others could flow in if economic uncertainty continues to prevail globally.

🔮 The war's end could bring hope, but it also presents new challenges for markets worldwide. Stay tuned to see how it all plays out!

HelenP. I Gold may drop to trend line, breaking support levelHi folks today I'm prepared for you Gold analytics. A few days ago price rebounded from the trend line and started to grow inside the upward channel. In this channel, the price rose to support 2, which coincided with the support zone and soon broke this area. Then it continued to move up and rose to resistance line of channel, but soon it turned around and made small movement below, after which continued to grow near this line little below. Later, Gold made a correction movement to support 2, which coincided with the trend line and then continued to move up inside the channel. In a short time later it reached support 1, which coincided with one more support zone and also broke this level too. Price some time traded near this level and later made impulse up, exiting from channel pattern and then it at once turned around and made correction movement to support 1. Gold even declined a little below this level, but a not long time ago, it backed up. Now, I expect that XAUUSD will start to decline to the trend line, thereby breaking the support level. That's why I set my goal at 2965 points. If you like my analytics you may support me with your like/comment ❤️

Markets On Edge: Gold Soars, Dollar Stumbles, Bitcoin Bounces 🔍 Midweek Market Outlook: What’s Driving DXY, Gold & Bitcoin Right Now?

We’re in the middle of one of the most eventful trading weeks of the year.

The U.S. Dollar is retreating under policy pressure

Gold has officially gone parabolic, smashing through $3,000

Bitcoin is pulling back hard, down nearly 30% from its highs

These aren’t just price moves — they’re reflections of real economic stress and shifting capital flows.

In this week’s outlook, I break down:

📌 The key macro drivers behind these moves

📌 How the latest inflation data, Fed tone, and geopolitics are shaping sentiment

📌 Why gold is rallying like it’s 1980 all over again

📌 And what traders should anticipate next on DXY, XAUUSD, and BTCUSD

If you trade or invest in these markets, this is one of those weeks where fundamentals can’t be ignored.

🧠 Insights. 🎯 Forecasts. 🛠️ Trade Prep.

Check it out — link in the comments.

This EURUSD Range Won’t Hold Much Longer – Expect Fireworks🧠 Current Market Context:

EURUSD is trading in a tight compression zone between 1.0935 support and 1.1000 resistance, following a sharp bullish leg from last week. Price is clearly slowing down, with smaller candles and rejection wicks near key levels — a sign of indecision, but also of an incoming breakout.

⚙️ Price Structure Overview:

The pair is forming higher lows but struggling to break above the psychological barrier at 1.1000, suggesting early signs of bullish exhaustion.

1.0935 has acted as a short-term demand zone, with price reacting to it multiple times, creating a clear price floor.

Buyers and sellers are now locked in a tight range — volatility is shrinking, and volume is likely building behind the scenes.

🧭 Key Levels to Watch:

🔼 Bullish Breakout Scenario:

If EURUSD breaks and closes firmly above 1.1000, we could see bullish continuation toward:

Target 1: 1.1035 – previous price reaction level.

Target 2: 1.1070 – resistance from late March.

A strong 1H close above 1.1000 confirms bulls are in control and may trigger stop orders above the round number.

🔽 Bearish Rejection / Breakdown Scenario:

If price fails to break above 1.1000 and breaks below 1.0935, it opens the door for a short-term correction:

Target 1: 1.0900 – strong structure and psychological zone.

Target 2: 1.0860 – last major higher low and liquidity pocket.

A clean breakdown below 1.0935 with momentum would indicate the bulls are losing control.

⏳ Conclusion:

The market is too quiet right now, and that’s never a good sign — this kind of compression usually ends in a sharp impulsive move. Whether it’s a breakout above 1.1000 or a breakdown under 1.0935, a decision is coming.

This is a textbook case of “don’t predict — prepare”. Smart price action traders are watching... and waiting.

HelenP. I Gold may continue to fall and break support levelHi folks today I'm prepared for you Gold analytics. After failing to hold above the resistance zone between 3140 and 3155 points, Gold made a sharp reversal. The strong bearish reaction from this area marked the end of the previous bullish momentum and triggered an aggressive sell-off. That move broke several minor support levels and pushed the price all the way down to the current support zone between 3010 and 2990 points. Previously, Gold had shown a stable uptrend, consistently bouncing from the trend line and using it as a dynamic support. Each pullback was met with buying pressure, allowing the price to climb higher. However, this time, after reaching the 3140 resistance level, buyers were overwhelmed by strong selling activity. Currently, Gold is trading just above the key support zone and close to the trend line. This area has acted as a pivot level multiple times, but the latest price action shows hesitation from buyers and growing control from sellers. Given the recent sharp decline, the break from the resistance zone, and the pressure near the current support, I expect Gold to continue falling toward 2960 points — my current goal. If you like my analytics you may support me with your like/comment ❤️

SPY’s Epic Crash: Bearish Flag Unleashed!Buckle up, trading fam, because the SPDR S&P 500 ETF Trust (SPY) just pulled a move so wild, it’s giving Keeping Up with the Kardashians a run for its money. We’re talking a bearish flag breakdown on the 4-hour chart that’s got more twists than a Game of Thrones finale, more drama than a Bachelor rose ceremony, and more profit potential than a Shark Tank pitch gone viral. If you’re ready to laugh, learn, and maybe make some cash, then grab your popcorn—this 2,500-word rollercoaster is about to take you on a ride you won’t forget! 🎢

Act 1: SPY’s Golden Era—Living Its Best Barbie Life

Let’s set the scene: it’s late October 2024, and SPY is strutting its stuff like it’s Margot Robbie in Barbie. The price climbs from $570 to a dazzling $607.98 by mid-January 2025—a 6.5% glow-up that’s got traders swooning harder than Ken at a Dreamhouse party. SPY’s basically saying, “I’m not just an ETF—I’m iconic,” as it basks in the glow of a bull market hotter than a Love Island villa.

But here’s the tea: even the shiniest stars can fall. By mid-January, the Stochastic Oscillator at the bottom of the chart is flashing “overbought” signals louder than a Real Housewives reunion meltdown. It’s the first sign of trouble—like when you realize the DJ at the club just played “Sweet Caroline” for the third time, and the vibe’s about to go south. SPY’s living large, but the party’s about to get crashed, Jersey Shore style.

Act 2: The Flagpole Plunge—SPY Sinks Faster Than the Titanic

Cue the dramatic music, because mid-January 2025 is when SPY decides to pull a full-on Titanic. The price plummets from $607.98 to $566.77 in a matter of days—a $41.21 drop, or 6.8%, that’s got traders screaming “I’m not okay!” louder than a Euphoria episode. This sharp decline is the flagpole of our bearish flag pattern, and it’s a doozy. SPY’s sinking faster than Jack and Rose’s ship, and the bulls are left clinging to the wreckage like there’s no room on the door. 🚢

The Stochastic Oscillator dives into oversold territory (below 20), confirming the bearish momentum is stronger than the Hulk after a double espresso. It’s a bloodbath on Wall Street, and SPY’s the main character in this tragic plot twist. But just when you think the drama’s over, SPY decides to play coy—like a Bachelor contestant who says “I’m not here for the right reasons” but sticks around for the drama anyway. Enter the consolidation phase, aka the “flag” part of the bearish flag pattern. Let’s break it down, shall we?

Act 3: The Flag—SPY’s Tease Game Is Stronger Than a Love Island Bombshell

From late January to mid-February 2025, SPY enters a consolidation phase that’s more tantalizing than a Love Island bombshell walking into the villa. The price bounces between $566.77 and $577.74, forming a sneaky little upward-sloping channel. It’s like SPY’s playing hard to get, teasing traders with a “Will I rally? Will I crash?” vibe that’s got everyone on edge. The Stochastic Oscillator hovers below 50, like a villa couple who’s “just talking” but definitely not coupled up yet.

This consolidation is the “flag” in the bearish flag pattern, and it’s a classic setup. Think of it as SPY taking a quick breather after its big fall, sipping a cocktail by the pool before diving back into the drama. Bearish flags are continuation patterns, meaning the price is likely to keep falling after this little flirt-fest. It’s like when you’re watching The Masked Singer—you know the reveal’s coming, but the suspense is what keeps you glued to the screen. And trust me, you won’t want to miss the next act.

Act 4: The Breakout—SPY Says “I’m Out!” Like a RuPaul’s Drag Race Exit

Mid-February 2025 arrives, and SPY decides it’s done with the games. The price breaks below the lower trendline of the flag at $566.77, and it’s like watching a RuPaul’s Drag Race queen sashay away after a lip-sync battle: dramatic, fierce, and leaving the bulls in the dust. The breakout confirms the bearish flag pattern, and the bears are strutting their stuff like they just won the crown. 👑

The price doesn’t just dip—it plunges to $546.33 by late March 2025, a further drop of $20.44 (or 3.6%) from the breakout point. The Stochastic Oscillator dives back into oversold territory, confirming the bearish momentum is back with a vengeance. SPY’s basically telling the bulls, “You better work—because I’m not!” as it leaves them gagging on the runway.

Let’s talk about the measured move—the price target for this bearish flag. We take the length of the flagpole ($41.21) and project it downward from the breakout point ($566.77). That gives us a target of $525.56. SPY doesn’t quite hit that mark—it bottoms out at $546.33—but it gets close enough to make traders sweat harder than a Chopped contestant with 30 seconds left on the clock. It’s a solid performance, even if it didn’t stick the landing perfectly.

Pop Culture Parallels: SPY’s Bearish Flag Is a Reality TV Showdown

Let’s take a step back and look at this chart through a pop culture lens, because SPY’s bearish flag is basically a reality TV showdown. The initial uptrend from October to January is the honeymoon phase—think The Bachelor contestants on their first group date, all smiles and champagne. 🥂

The flagpole drop in mid-January is the drama bomb, like when a contestant gets caught kissing someone else in the hot tub. The consolidation phase is the confessional montage, where everyone’s talking smack and plotting their next move. And the breakout? That’s the rose ceremony—SPY’s handing out its final rose to the bears, and the bulls are sent packing with nothing but a suitcase and some tears.

Trading Tips: How to Slay This Bearish Flag Like a Drag Race Superstar

Now that we’ve had our fun, let’s get down to business. How can you trade this bearish flag like a Drag Race superstar? Here’s the tea, served piping hot:

1. Short the Breakout (Sashay, Don’t Shantay)

When SPY broke below the flag at $566.77, that was your cue to short the stock faster than you can say “Sashay away!” A short position here could’ve netted you a $20.44 gain per share as the price dropped to $546.33—enough to buy yourself a new wig for the next challenge.

2. Set a Stop-Loss (Don’t Get Read for Filth)

To avoid getting read for filth by a fake-out, set a stop-loss above the flag’s upper trendline at $577.74. That way, if the breakout flops harder than a Drag Race comedy challenge, you’re safe.

3. Target the Measured Move (Go for the Crown)

The measured move target of $525.56 was the goal, but SPY stopped at $546.33. That’s still a win—like making it to the top 4 but not snatching the crown. If you’d shorted at the breakout, you’d be serving looks and profits.

4. Watch for a Bounce (Don’t Sleep on the Comeback)

As of late March 2025, SPY’s at $546.33, and the Stochastic is oversold. This could mean a short-term bounce is coming, like a Drag Race queen returning for an All-Stars season. Keep an eye on resistance at $566.77 and $577.74—if SPY breaks above those, the bears might be in for a shady twist.

The Bigger Picture: Is SPY’s Downtrend the New Black?

Let’s zoom out for a hot second. Before this bearish flag, SPY was in a strong uptrend for months, living its best life like a Vogue cover star. This pattern marks a potential trend reversal, like when skinny jeans went out of style and baggy pants became the new black. If the downtrend continues, the next support level could be around $540—or even lower if things get really messy.

But here’s the million-dollar question: is this the start of a bigger bear market, or just a temporary dip? It’s like trying to predict the winner of Survivor—nobody knows, but everyone’s got a theory. The Stochastic being oversold suggests a bounce might be near, but the overall trend is still bearish. So, keep your wits about you, because this market’s shadier than a Real Housewives dinner party.

Why This Chart Is More Addictive Than a Love Is Blind Binge

If you’re still here, you’re officially obsessed—and I don’t blame you! This SPY chart is more addictive than a Love Is Blind binge because it’s got all the elements of a great reality show: drama, suspense, and a cast of characters (the bulls and bears) who can’t stop fighting. The bearish flag is the villain we love to hate, and the price action is the love triangle we can’t stop watching.

Plus, trading is a lot like reality TV. You’ve got your highs (the uptrend), your lows (the flagpole drop), and those messy in-between moments (the consolidation). But when the breakout happens, it’s like the finale episode where someone finally gets engaged—or in this case, the bears get their moment in the spotlight. 💍

Final Thoughts: Don’t Miss the Next Episode of SPY’s Reality Show

SPY’s bearish flag breakdown is a masterclass in technical analysis, wrapped in a package of drama and sass that’d make even the most stoic trader crack a smile. Whether you’re a Wall Street pro or a newbie just here for the tea, this chart has something for everyone.

So, what’s next for SPY? Will it hit that $525.56 target, or will the bulls stage a comeback like a Love Is Blind couple at the altar? Only time will tell, but one thing’s for sure: you won’t want to miss the next episode of this reality show. Keep your eyes on the chart, your finger on the trigger, and your sense of humor intact—because in the world of trading, you’ve got to laugh to keep from crying. 😜

Join the Trading Villa!

If you loved this recap of SPY’s bearish flag drama, don’t ghost me like a Love Island ex! Drop a comment with your thoughts—are you shorting SPY, or are you waiting for a bounce? And if you want more trading tea, puns, and reality TV references, hit that follow button faster than you can say “I’m here to make friends.” Let’s spill the tea and make some money together! 🍵

THE IMPORTANCE of Multiple Time Frame Analysis in Forex Gold

In my daily posts, I quite frequently use multiple time frame analysis.

If you want to enhance your predictions and make more accurate decisions, this is the technique you need to master.

In the today's post, we will discuss the crucial importance of multiple time frames analysis in trading the financial markets and forex gold in particular.

1️⃣ Trading on a single time frame, you may miss the important key levels that can be recognized on other time frames.

Take a look at the chart above. Analyzing a daily time frame, we can spot a confirmed bullish breakout of a key daily resistance.

That looks like a perfect buying opportunity.

However, a weekly time frame analysis changes the entire picture, just a little bit above the daily resistance, there is a solid weekly resistance.

From such a perspective, buying GBPUSD looks very risky.

2️⃣ The market trend on higher and lower time frames can be absolutely different.

In the example above, Gold is trading in a bullish trend on a 4h time frame.

It may appear for a newbie trader that buyers are dominating on the market. While a daily time frame analysis shows a completely different picture: the trend on a daily is bearish, and a bullish movement on a 4H is simply a local correctional move.

3️⃣ It may appear that the market has a big growth potential on one time frame while being heavily over-extended on other time frames.

Take a look at GBPJPY: on a weekly time frame, the market is trading in a strong bullish trend.

Checking a daily time frame, however, we can see that the bullish momentum is weakening: the double top pattern is formed and the market is consolidating.

The sentiment is even changing to a bearish once we analyze a 4H time frame. We can spot a rising wedge pattern there and its support breakout - very bearish signal.

4️⃣ Higher time frame analysis may help you to set a safe stop loss.

In the picture above, you can see that stop loss placement above a key daily resistance could help you to avoid stop hunting shorting the Dollar Index.

Analyzing the market solely on 1H time frame, stop loss would have been placed lower and the position would have closed in a loss.

Always check multiple time frame when you analyze the market.

It is highly recommendable to apply the combination of at least 2 time frames to make your trading safer and more accurate.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold can continue to grow inside upward channelHello traders, I want share with you my opinion about Gold. This chart shows how the price initially rebounded from the support level, which aligned with the buyer zone, but soon reversed and dropped back down to the support line. After hovering near this line, the price entered a triangle pattern, where it bounced off the resistance line and fell to the support line, breaking below the support level. Following that move, the price reversed upward and returned to the buyer zone, where it consolidated briefly before declining again to the support line. From there, it bounced and began to climb. Shortly after, the price broke through the 2915 level and eventually exited the triangle pattern. From that point, the price started trending upward within an ascending channel, reaching the current support level, which overlaps with a key support area, before rising to the resistance line of the channel. Recently, the price pulled back to the support zone once again, and I believe there’s a good chance it will decline a little below from this area and continue its upward move within the channel, aiming for the resistance line. For this scenario, my TP is set at 3080. Please share this idea with your friends and click Boost 🚀

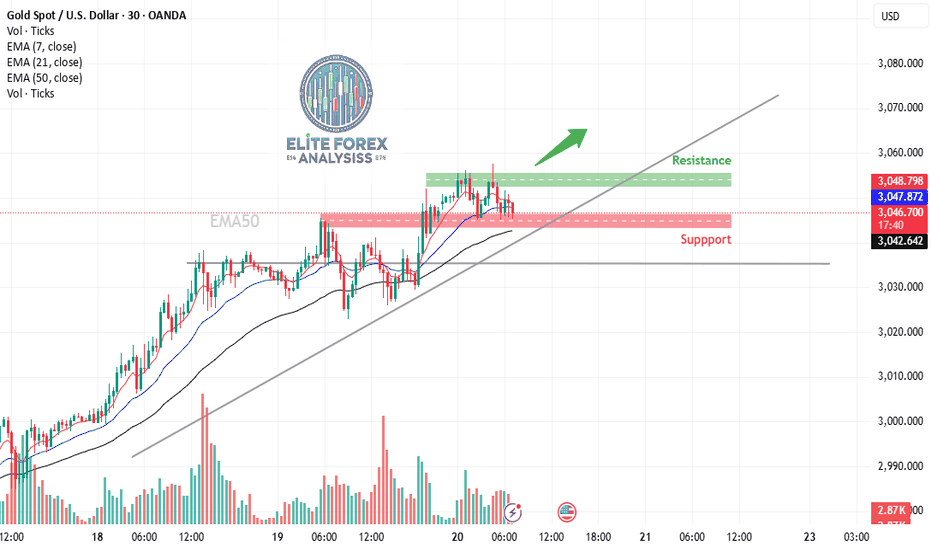

XAUUSD Technical insights and possible trading strategies **1. Trend Analysis (Bullish setup)

- The price is currently in an **uptrend**, confirmed by the **higher highs and higher lows**.

- The **ascending trendline** acts as a dynamic support level.

- The **price is above the 50 EMA**, which usually signals a bullish trend.

- However, it's currently testing support, and a break below could shift momentum.

**2. Key Support & Resistance Levels**

- **Support Zone ($3,042 - $3,046, marked in red)**

- Price has previously bounced from this area.

- The **50 EMA** is also near this support, adding strength.

- If this level holds, it could act as a buying zone.

- **Resistance Zone ($3,050 - $3,060, marked in green)**

- Price faced rejection from this zone earlier.

- A breakout above this resistance could signal further upside.

- If the price fails to break, it may consolidate or retrace.

**3. Moving Averages Analysis**

- **7 EMA ($3,048.844) & 21 EMA ($3,047.889)**

- Short-term EMAs are **very close to price action**, indicating consolidation.

- If the **7 EMA crosses below the 21 EMA**, it could signal short-term weakness.

- **50 EMA ($3,042.649)**

- A **critical dynamic support** level.

- If the price bounces from here, the bullish trend remains intact.

- A breakdown could trigger a deeper pullback.

**4. Possible Trading Strategies**

**📈 Bullish Setup (Buy Scenario)**

- **Entry:** Look for **bullish confirmation (green candle, higher low)** near the support zone ($3,042 - $3,046).

- **Target:** Initial target near resistance at **$3,050 - $3,060**, then **$3,070+**.

- **Stop-Loss:** Below **$3,040** (just under the trendline and 50 EMA).

**📉 Bearish Setup (Sell Scenario)**

- **Entry:** If price **closes below $3,042**, it could indicate a breakdown.

- **Target:** Next support area around **$3,030** or lower.

- **Stop-Loss:** Above **$3,050** (in case of a false breakdown).

**5. Volume Confirmation**

- **Low volume near support** → Risk of breakdown.

- **High volume breakout above resistance** → Strong bullish move.

- **Divergence (price rising but volume dropping)** → Weak trend, possible reversal.

**Conclusion:**

- **Watch price action near $3,046 support**—a bounce could lead to new highs.

- **If support breaks, be ready for a pullback to $3,030 or lower.**

- **Confirm moves with volume before entering trades.**

XAUUSDGold price has retested the resistance zone 2946-2954 again. If the price cannot break through the 2954 level, it is expected that the price will drop. Consider selling in the red zone.

(Very Risky Trade)

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

XAUUSDXAUUSD is still in an uptrend. It is currently in a correction phase. If the price cannot break through 2957, in the short term, there is a chance that the price will drop. Consider selling the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

How to Find Best Supply and Demand Zones/Areas in Forex & Gold

In this article, I will show you the strongest supply and demand zones.

These zones are called confluence zones.

I will teach you to identify these areas properly and explain how to apply it in Forex and Gold trading.

Let's start with a short but important theory.

In technical analysis, there are 2 types of supports and resistances.

Horizontal structures are supports and resistance that are based on horizontal key levels.

Vertical structures are supports and resistance that are based on trend lines.

A confluence supply or demand zone, will be the area of the intersection between a horizontal and vertical structures.

Look at GBPJPY pair. I underlined a significant horizontal support and a rising trend line - a vertical support.

We see a clear crossing of both structures.

The trend line and a horizontal support will compose a narrow, contracting area. It will be a confluence demand zone.

Within, with a high probability, a high volume of buying orders will concentrate, and a strong bullish movement will initiate after its test.

Above is one more example of a powerful demand zone.

It was spotted on a Gold chart.

Now let's discuss the supply zone.

There are 2 strong structures on GBPNZD: a vertical resistance - a falling trend line and a horizontal resistance.

These 2 resistances will constitute a confluence supply zone.

That is a powerful resistance cluster that will concentrate the selling orders. Chances will be high to see a strong bearish movement from that.

There is a strong supply zone on CHFJPY that is based on the intersection of a wide horizontal resistance and a falling trend line.

Supply and demand zones that we discussed are very significant. Very often, strong bullish and bearish waves will initiate from these clusters.

Your ability to recognize these zones will help you to make accurate predictions and identify a safe point to open a trading position from

❤️Please, support my work with like, thank you!❤️

The Main Elements of Profitable Trading Strategy (Forex, Gold)

There are hundreds of different trading strategies based on fundamental and technical analysis.

These strategies combine different tools and trading techniques.

And even though, they are so different, they all have a very similar structure.

In this educational article, we will discuss 4 important elements and components every GOLD, Forex trading strategy should have.

What Do You Trade

1️⃣ The first component of a trading strategy is the list of the instruments that you trade.

You should know in advance what assets should be in your watch list.

For example, if you are a forex trader, your strategy should define the currency pairs that you are trading among the dozens that are available.

How Do You Trade

2️⃣ The second element of any trading strategy is the entry reasons.

Entry reasons define the exact set of market conditions that you look for to execute the trade.

For example, trading key levels with confirmation, you should wait for a test of a key level first and then look for some kind of confirmation like a formation of price action pattern before you open a trade.

Above, is the example how the same Gold XAUUSD chart can be perceived differently with different trading strategies.

3️⃣ The third component of a trading strategy is the position size of your trades.

Your trading strategy should define in advance the rules for calculating the lot of size of your trades.

For example, with my trading strategy, I risk 1% of my trading account per trade. When I am planning the trading position, I calculate a lot size accordingly.

Position Management

4️⃣ The fourth element of any trading strategy is trade management rules.

By trade management, I mean the exact conditions for closing the trade in a loss, taking the profit and trailing stop loss.

Trade management defines your actions when the trading position becomes active.

Make sure that your trading strategy includes these 4 elements.

Of course, your strategy might be more sophisticated and involve more components, but these 4 elements are the core, the foundation of any strategy.

❤️Please, support my work with like, thank you!❤️

XAUUSDXAUUSD is still in an uptrend but there may be a short-term correction.

If the price cannot break through 2848, consider selling the red zone.

Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

ETH/USDT : Get Ready for the next Bullish Move! (READ)By analyzing the weekly (logarithmic) chart of Ethereum, we can see that the price experienced a sharp crash last night, dropping to $2100. After reaching this key demand zone, Ethereum rebounded and is currently trading around $2600.

As long as the $2200 support holds, we can expect further bullish momentum. The mid-term targets for Ethereum are $3900, $4600, $5700, and $7400. 🚀

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban