EURUSD: Bears Will Push Lower

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the EURUSD pair which is likely to be pushed down by the bears so we will sell!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Forex

BTCUSD: Long Signal with Entry/SL/TP

BTCUSD

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy BTCUSD

Entry Level - 11326

Sl - 11231

Tp - 11516

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

USOIL Technical Analysis! BUY!

My dear followers,

I analysed this chart on USOIL and concluded the following:

The market is trading on 67.25 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 68.74

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

SILVER My Opinion! SELL!

My dear friends,

Please, find my technical outlook for SILVER below:

The price is coiling around a solid key level - 37.026

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 36.725

Safe Stop Loss - 37.189

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

AUDJPY; Heikin Ashi Trade IdeaIn this post, I’ll be sharing my analysis of AUDJPY with my unique Heikin Ashi strategy.Picture tells more than 1000 words, no BS. I highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

AUDJPY: goodbye uptrend?On the 4H chart, AUDJPY has printed a textbook double top pattern, breaking the rising trendline and diving below the 95.6–95.78 support zone - now acting as resistance. The pair is currently retesting this zone from below, which often provides a clean re-entry point for bears.

This area also aligns with the 0.705–0.79 Fibonacci retracement, reinforcing it as a key resistance. If the price rejects this zone, the next target is 93.85 (1.618 Fibo projection), followed by 93.25 and potentially 91.71 if momentum strengthens.

Fundamentally, the yen gains strength on risk-off flows and diverging rate expectations, while the Australian dollar is pressured by falling commodity prices and a likely pause from the RBA. This widens the rate differential and weakens AUD.

As long as price remains below 95.78, sellers are in control. Watch for a rejection from this retest zone.

EUR/USD Daily Chart Analysis For Week of August 1, 2025Technical Analysis and Outlook:

In this week's trading session, the Euro experienced a significant drop, reaching the 1.139 level, and completing what is referred to as the Inner Currency Dip. As a result of the completion, the currency reversed direction and made a strong rebound, hitting the Mean Resistance level at 1.160. Recent analyses suggest that the Euro is likely to enter a sustained downward move after retesting the Mean Resistance at 1.160, with the target set to revisit the completed Inner Currency Dip at 1.139. However, it is essential to consider the possibility of continued upward momentum towards the Mean Resistance level of 1.177. Such a movement could trigger a significant rebound and lead to the completion of the Outer Currency Rally at 1.187.

EURAUD Ready to Bounce? Key Support & Fundamentals Aligned!Today I want to share a Long position idea on EURAUD ( OANDA:EURAUD ) with you.

From a fundamental perspective , both the Euro (EUR) and Australian Dollar (AUD) are currently under pressure. However, the Aussie appears fundamentally weaker in the short term, making the EURAUD Long setup more favorable at this stage.

AUD Weakness :

The Reserve Bank of Australia (RBA) has held rates steady at 3.85%, but recent inflation data has dropped to 2.7%, the lowest in over 3 years.

Most economists now expect the RBA to cut rates in its next meeting in August, possibly by 25 basis points.

Slowing economic growth and dovish forward guidance from the central bank are weighing heavily on AUD sentiment.

EUR Outlook :

The European Central Bank (ECB) is also facing weak economic data, but is taking a more cautious approach toward cutting rates.

Despite softer PMIs and sluggish growth in countries like Germany and France, the ECB has not confirmed a near-term rate cut, keeping EUR relatively stable.

This divergence between the RBA’s dovish stance and the ECB’s pause is supportive of EUR strength against AUD.

Summary :

With the RBA likely to ease policy soon and the ECB holding ground for now, the interest rate differential favors EURAUD upside. Fundamentals point toward further weakness in AUD, making the EURAUD Long a strategically sound trade idea for the coming days.

-------------------------------------------

Now let's analyze the conditions of the EURAUD chart on the 4-hour time frame .

EURAUD is currently trading near the Support zone(1.772 AUD-1.763 AUD) , Potential Reversal Zone(PRZ) , and near the lower line of the descending channel .

According to Elliott Wave theory , EURAUD appears to have completed a Zigzag Correction(ABC/5-3-5) .

Also, we can see the Regular Divergence(RD+) between Consecutive Valleys .

I expect EURAUD to rise to at least 1.784 AUD .

Second Target: 1.792 AUD

Note: Stop Loss(SL): 1.762 AUD

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/Australian Dollar Analyze (EURAUD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

AUDNZD Technical + Fundamental Align for DownsideToday I want to analyze a short position on the AUDNZD ( OANDA:AUDNZD ) pair, first, let's look at it from a fundamental analysis perspective .

Fundamental View on AUDNZD

Key reasons to short AUDNZD:

Australian weakness:

Recent data show weakening consumer sentiment and declining building approvals. The RBA seems hesitant to hike further, putting pressure on the Aussie.

New Zealand resilience:

The RBNZ maintains a relatively hawkish stance. Inflation is still a concern, and the central bank is committed to keeping rates high, supporting NZD strength.

Monetary policy divergence:

The divergence between RBA’s dovish stance and RBNZ’s hawkish approach supports further downside in AUDNZD.

----------------------

Now let's take a look at AUDNZD from a technical analysis perspective on the 4-hour timeframe .

AUDNZD is currently trading in a Heavy Resistance zone(1.0963 NZD-1.0870 NZD) near the upper line of the Range Channel , Potential Reversal Zone(PRZ) and Yearly Pivot Point .

In terms of Elliott Wave theory , AUDNZD appears to be completing microwave B of microwave Y of the main wave 4 .

I expect AUDNZD to drop to at least 1.0904 NZD(First Target) based on the above explanation .

Second Target: 1.0886 NZD

Note: Stop Loss(SL): 1.0963 NZD

Please respect each other's ideas and express them politely if you agree or disagree.

Australian Dollar/New Zealand Dollar Analyze (AUDNZD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

BITCOIN Will Go Lower! Sell!

Please, check our technical outlook for BITCOIN.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 113,260.21.

The above observations make me that the market will inevitably achieve 107,826.27 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

NZDJPY Will Go Up! Buy!

Here is our detailed technical review for NZDJPY.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 87.264.

Taking into consideration the structure & trend analysis, I believe that the market will reach 88.444 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPJPY Will Move Higher! Long!

Take a look at our analysis for GBPJPY.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 195.702.

Considering the today's price action, probabilities will be high to see a movement to 197.050.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

NASDAQ at Key Turning Point 🔍Technical Context

After testing the 23,600–23,800 supply zone, price printed a strong bearish rejection with a weekly engulfing candle.

The RSI broke decisively below the midline, signaling a clear loss of momentum.

Price is now trading back within the weekly demand zone between 22,800 and 22,950.

If a pullback toward 23,200 occurs, it could offer a fresh short opportunity, with downside targets around 22,600.

🪙 COT Report – July 29

Non-Commercials (speculators):

Long: +8,581

Short: +4,355

Commercials (hedging):

Long: +4,955

Short: +8,556

The market remains net long, but commercials are increasingly hedging with shorts.

The current imbalance — 88.6% long vs 11.3% short — suggests excessive bullish positioning, raising the risk of a correction.

🗓️ Seasonality – August

August is historically strong for the NASDAQ:

+222 pts (10Y)

+400 pts (5Y)

+912 pts (2Y)

While the trend is clearly bullish seasonally, caution is warranted:

Tops are often formed during the first half of August, followed by more pronounced corrections in September.

📉 Operational Summary

Primary scenario:

Wait for a retest of the 23,200–23,250 area

Look for rejection signals → enter short

Target 1: 22,800

Target 2: 22,600

Alternatively:

If 22,800 breaks on a strong weekly close, deeper downside scenarios may unfold.

USDJPY Is Very Bearish! Sell!

Here is our detailed technical review for USDJPY.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 150.492.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 148.583 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USOIL BULLS ARE STRONG HERE|LONG

USOIL SIGNAL

Trade Direction: short

Entry Level: 67.26

Target Level: 68.46

Stop Loss: 66.46

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/CHF SHORT FROM RESISTANCE

Hello, Friends!

EUR/CHF pair is in the uptrend because previous week’s candle is green, while the price is obviously rising on the 5H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 0.926 because the pair overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/NZD BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

EUR/NZD pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 12H timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 1.929 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GOLD BEST PLACE TO SELL FROM|SHORT

GOLD SIGNAL

Trade Direction: short

Entry Level: 3,309.55

Target Level: 3,288.24

Stop Loss: 3,323.69

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 45m

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZD-JPY Local Long! Buy!

Hello,Traders!

NZD-JPY is retsting a

Strong horizontal support

Level around 87.044 and

As the pair is locally

Oversold we will be expecting

A local rebound and a move

Up on Monday!

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_USD POTENTIAL SHORT|

✅EUR_USD has been growing recently

And the pair seems locally overbought

So as the pair is approaching

A horizontal resistance of 1.1632

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

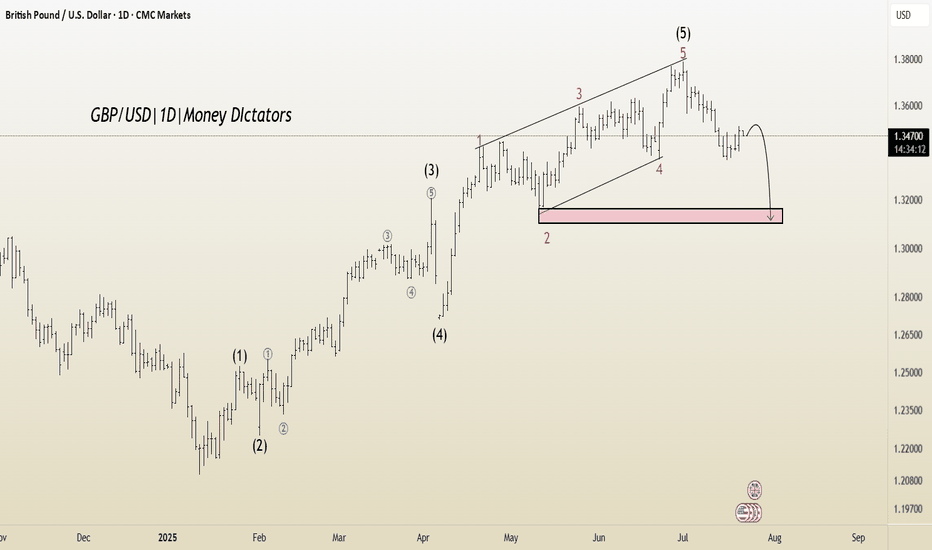

GBP/USD: Post-Impulse Sell Setup from Ending DiagonalThe chart depicts a completed 5-wave impulsive structure, culminating at the top of wave (5). The internal wave structure of the final fifth wave forms a classic ending diagonal pattern, typically signaling a trend reversal or deep correction.

After this extended fifth wave, the price has started rolling over, confirming the start of a corrective decline. The wave count now expects an ABC correction targeting the previous wave 4/2 demand zone, highlighted in red.

Target 1 (T1): 1.33608

Target 2 (T2): 1.32436

Stop Loss (SL): 1.35988

Ending diagonal at the top of wave (5) signals exhaustion of bullish momentum.

Clear bearish divergence (not shown here) is commonly seen with this pattern.

The price has broken the short-term structure and is now forming lower highs.

Target zone aligns with previous wave 2 consolidation – a typical retracement zone for post-impulse corrections.

CAD_JPY BEARISH BREKAOUT|SHORT|

✅CAD_JPY broke the key structure level of 107.400

While trading in an local downtrend

Which makes me bearish

And I think that after the retest of the broken level is complete

A rebound and bearish continuation will follow

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-JPY Risky Long! Buy!

Hello,Traders!

GBP-JPY collapsed on Friday

And the pair's final move

Was absorbed by the horizontal

Support of 195.400 so as the

Pair is oversold we will be

Expecting a local rebound

And a correction on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.