EURUSD: Long Signal with Entry/SL/TP

EURUSD

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy EURUSD

Entry - 1.1724

Stop - 1.1714

Take - 1.1743

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Forex

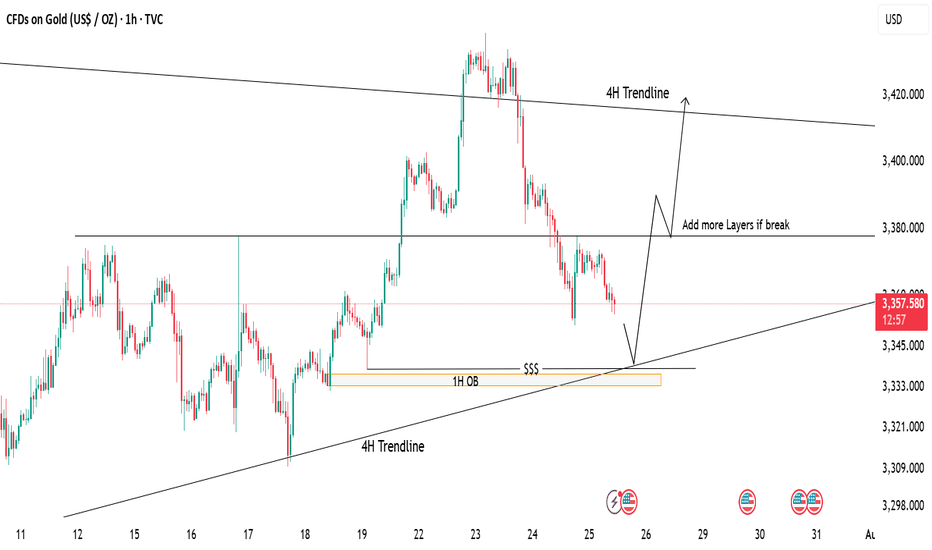

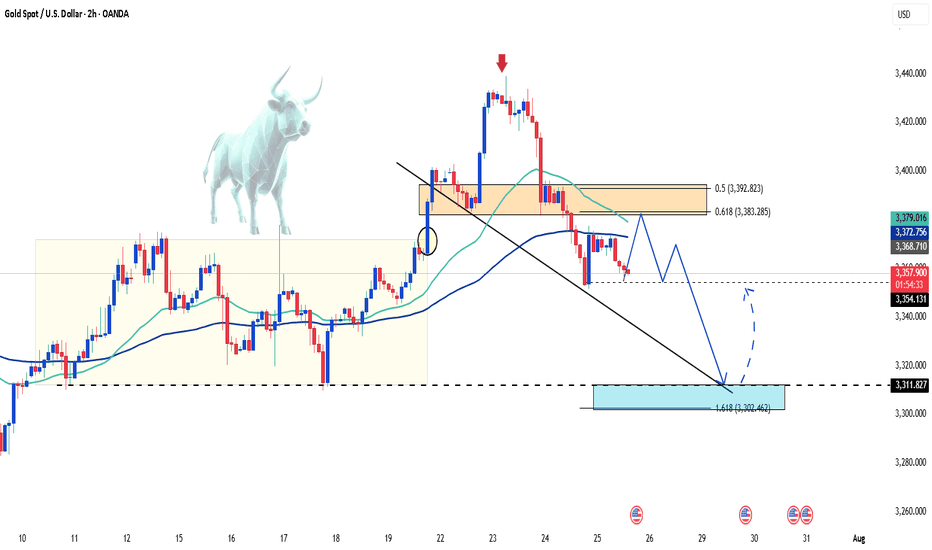

Gold Tapping Into Major Support – Eyes on Bullish ReversalPrice is currently retracing after a strong drop from recent highs. We're now approaching a key demand zone, aligning with:

📍 1H Order Block (OB)

📍 4H Trendline Support

📍 Liquidity Zone ($$$)

📉 If price taps into this area, it may offer a high-probability long setup.

📈 First target: 3380 (mid-range resistance)

🧱 If this breaks, we can look to scale in/add more positions, targeting the 4H trendline zone near 3420.

⚠️ Waiting for price reaction at support – patience is key!

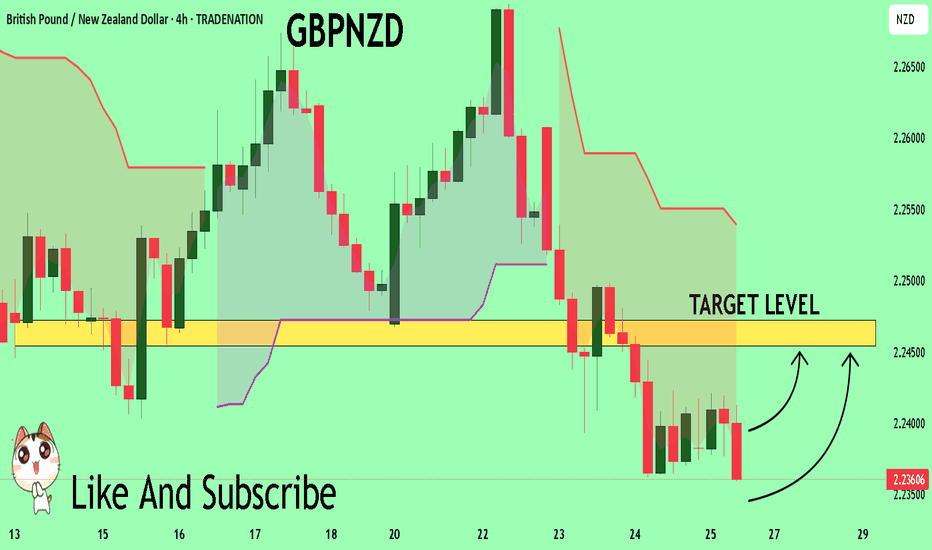

GBPNZD Will Explode! BUY!

My dear friends,

My technical analysis for GBPNZD is below:

The market is trading on 2.2361 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 2.2454

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

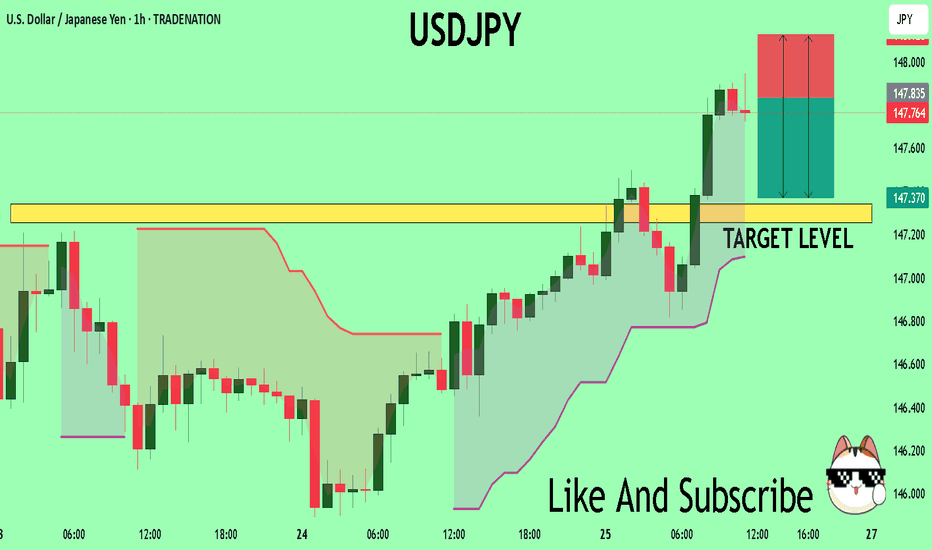

USDJPY Under Pressure! SELL!

My dear subscribers,

My technical analysis for USDJPY is below:

The price is coiling around a solid key level - 147.83

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 147.34

My Stop Loss - 148.12

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

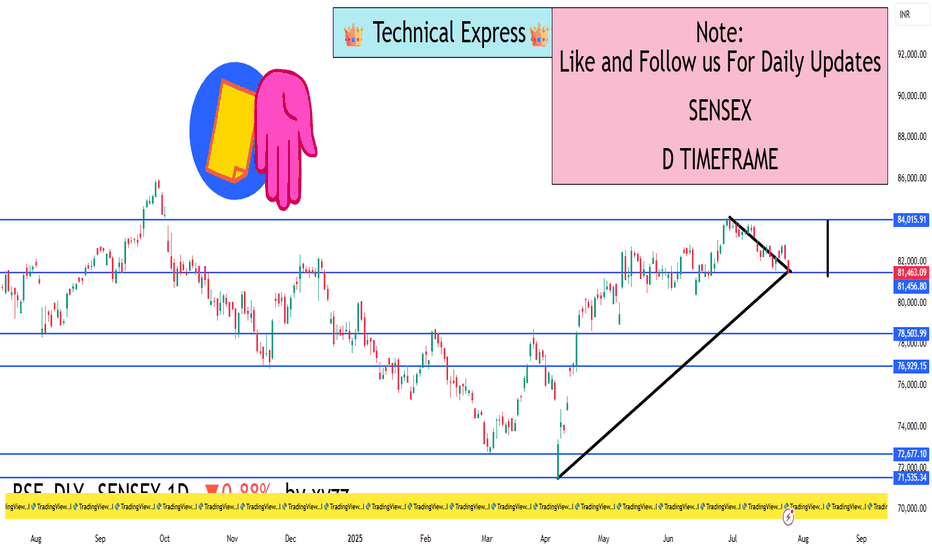

SENSEX 1D Timeframe📉 SENSEX Daily Overview (as of July 25, 2025)

Current Price: Around 81,460

Daily Change: Down by approximately 720 points (–0.9%)

Day’s High: About 82,070

Day’s Low: About 81,400

Previous Close: Around 82,184

📊 1-Day Candlestick Analysis

The candle for today is bearish, indicating strong selling pressure.

The price opened near previous levels but faced resistance at around 82,000.

Sellers dominated most of the day, pushing the index toward the 81,400 support zone.

🔍 Key Support and Resistance Levels

Level Type Price Range

Resistance 82,000 – 82,200

Support 81,400 – 81,000

If Sensex breaks below 81,400, the next target could be around 80,500 or 79,900.

If it holds above support and bounces, it could retest 82,200.

🧠 Technical Trend Analysis

Short-Term Trend: Bearish

Medium-Term Trend: Neutral to mildly bullish (as long as above 80,000)

Market Structure: Lower highs forming, suggesting pressure building on bulls

Indicators (assumed):

RSI may be approaching oversold

MACD likely showing bearish crossover

Volume increasing on red candles—indicating strong sell interest

📌 Sentiment & Market Context

Financial stocks (like banking, NBFCs) are under pressure.

Global cues (such as interest rate uncertainty and geopolitical concerns) are impacting investor confidence.

FII outflows and weak earnings in key sectors are adding to bearish momentum.

The broader trend remains range-bound, but with short-term downside bias.

✅ Strategy Suggestions (For Traders & Investors)

Swing Traders: Wait for a reversal candle (like a bullish engulfing or hammer) before considering long positions.

Breakout Traders: Watch for breakdown below 81,000 for continuation of the fall.

Positional Traders: Can wait to enter near 80,000–79,500 if the market holds that key level.

🔄 Summary

SENSEX is under pressure with a drop of 720+ points.

Technical structure suggests caution, especially if 81,000 breaks.

Support: 81,000 – 80,500

Resistance: 82,000 – 82,200

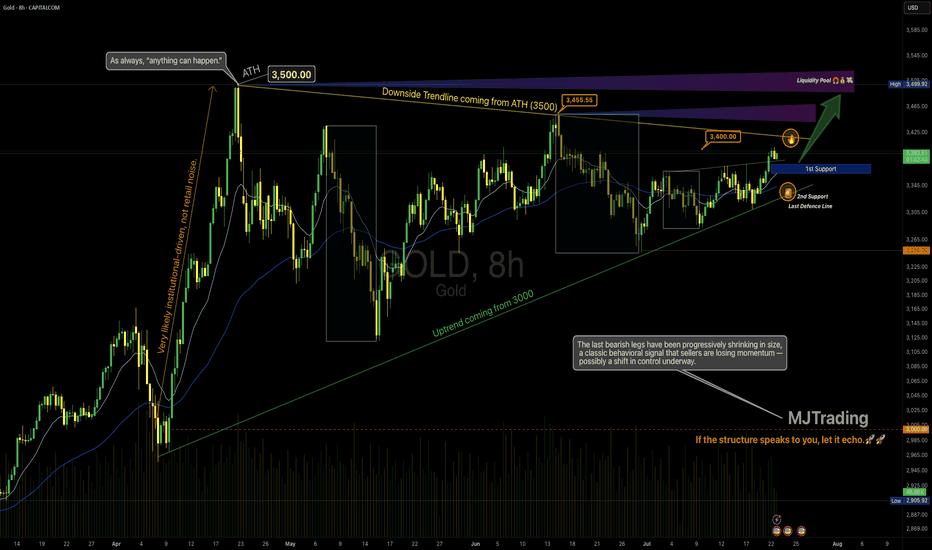

Gold – Bear-to-Bull Transition in Motion?🧠 MJTrading:

TVC:GOLD – 8H Chart: Bulls, It’s Your Move.

📸 Viewing Tip:

🛠️ Some layout elements may shift depending on your screen size.

🔗 View the fixed high-resolution chart here:

The impulsive move from 3000 to 3500 wasn’t just a trend — it was a statement of strength.

That rally carved the ATH, then left behind weeks of digestion and structural compression.

Now, the market may be setting up for its next decision.

Notice how each bearish leg has been shrinking — a classic behavioral signal that sellers are losing momentum — possibly a shift in control underway.

We’re also pressing above the downtrend line from the ATH (3500), while the uptrend from 3000 remains clean and respected.

We’re now testing the 3400 zone — a key battleground.

📍 If bulls want to reclaim the momentum and show dominance, this is the moment to act.

🔹 1st Support: 3363–3377

🔹 2nd Support: Rising trendline

🎯 Target Zone: 3455–3500+ (Liquidity Pool & ATH proximity)

⚠️ Break back inside the triangle could delay the breakout narrative.

⚠️ If momentum fails to increase from here, and bulls can’t break out with conviction, the market is likely to remain range-bound for longer — extending the sideways phase between 3250–3500.

💭 If you’re watching for a new ATH… stay sharp, stay structured — the market rewards patience and readiness.

“If the structure speaks to you, let it echo, boost it.”

📐 MJTrading 🚀

What do you think?

#GoldAnalysis #XAUUSD #MarketStructure #LiquiditySweep #AnythingCanHappen

#MJTrading

#ChartDesigner

Psychology Always Matters:

Click on them for the caption...

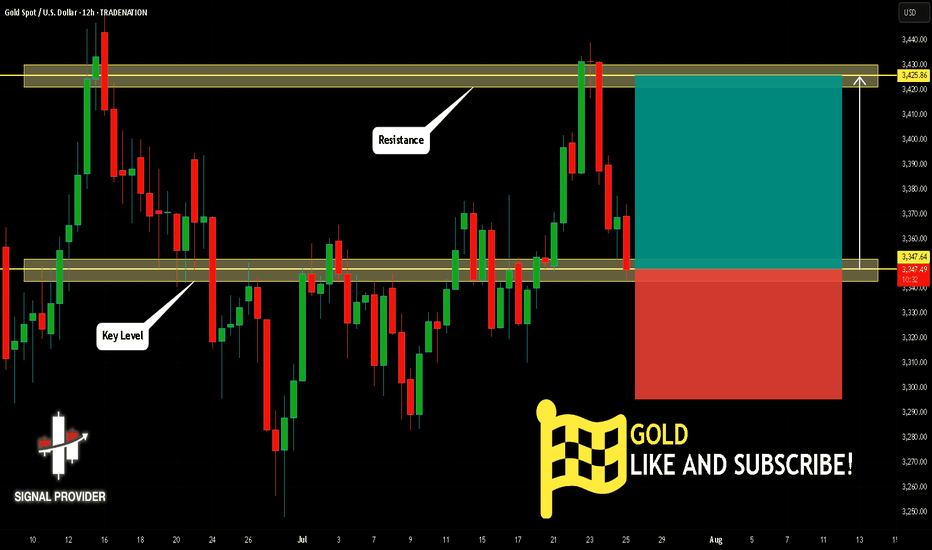

GOLD Will Move Higher! Buy!

Here is our detailed technical review for GOLD.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 3,347.64.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 3,425.86 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

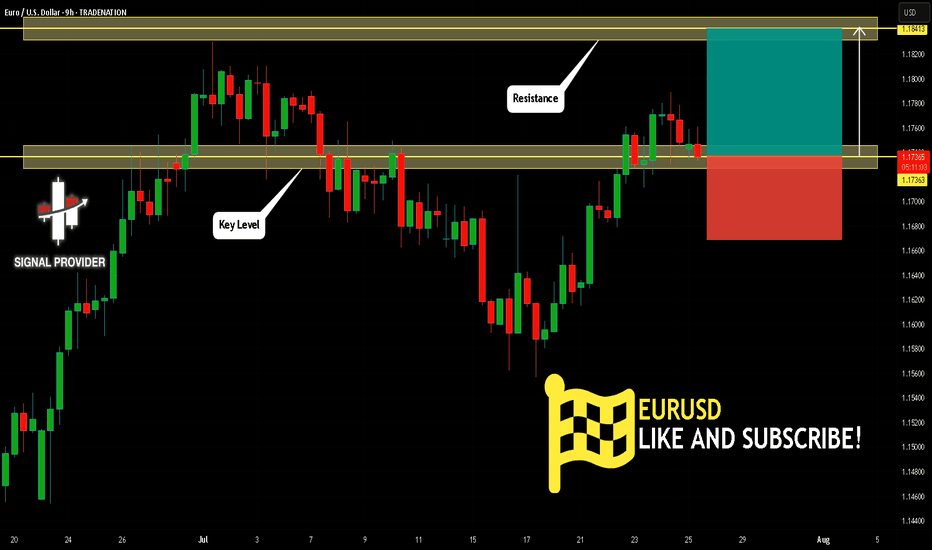

EURUSD Is Bullish! Long!

Take a look at our analysis for EURUSD.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 1.173.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 1.184 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

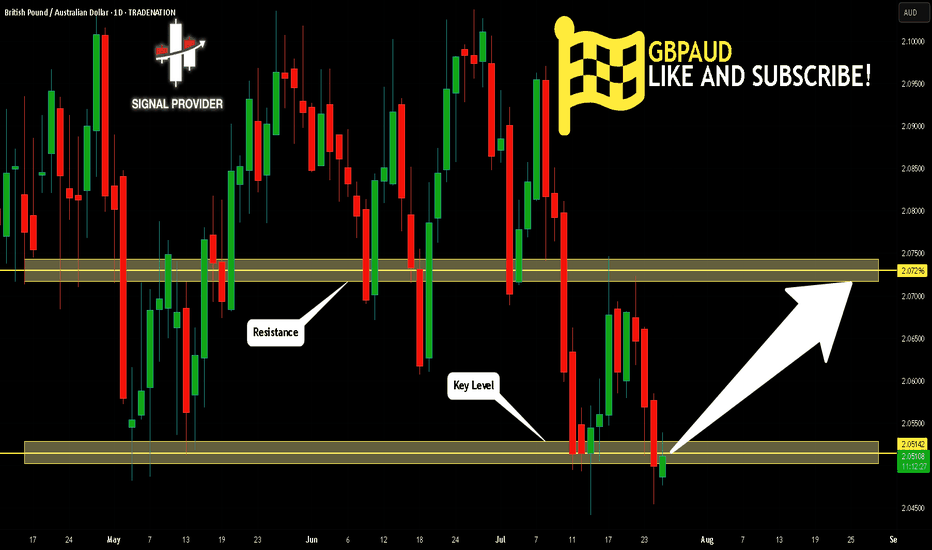

GBPAUD Is Going Up! Buy!

Here is our detailed technical review for GBPAUD.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 2.051.

Taking into consideration the structure & trend analysis, I believe that the market will reach 2.072 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

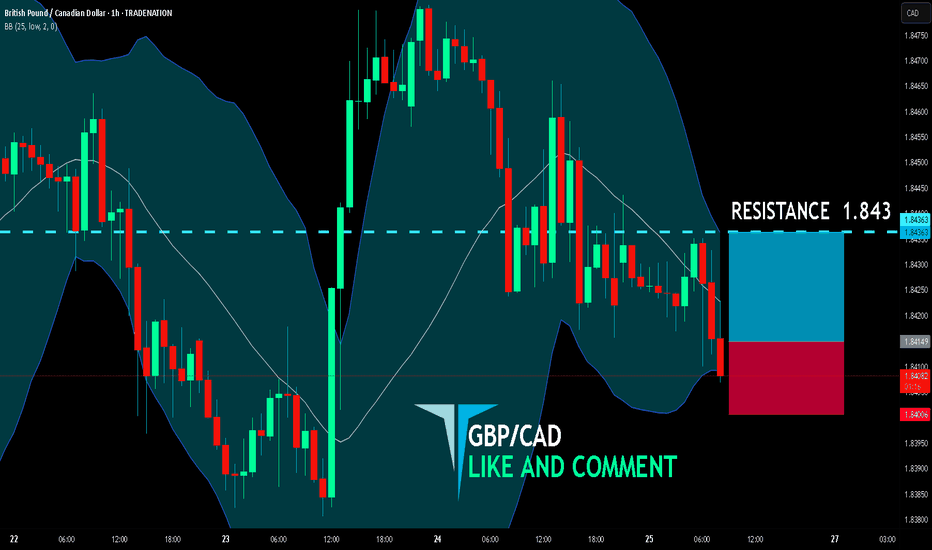

GBP/CAD BUYERS WILL DOMINATE THE MARKET|LONG

GBP/CAD SIGNAL

Trade Direction: long

Entry Level: 1.841

Target Level: 1.843

Stop Loss: 1.840

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

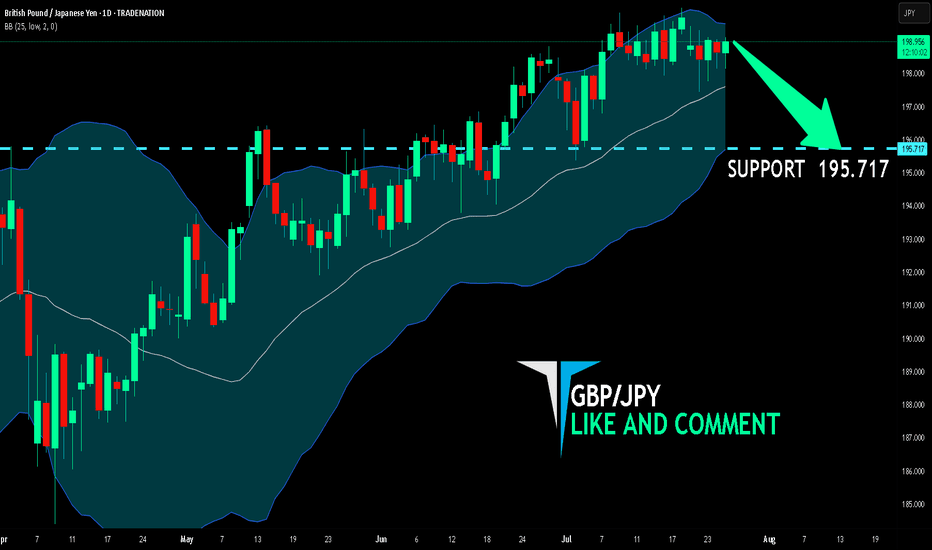

GBP/JPY BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

GBP/JPY pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 1D timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 195.717 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

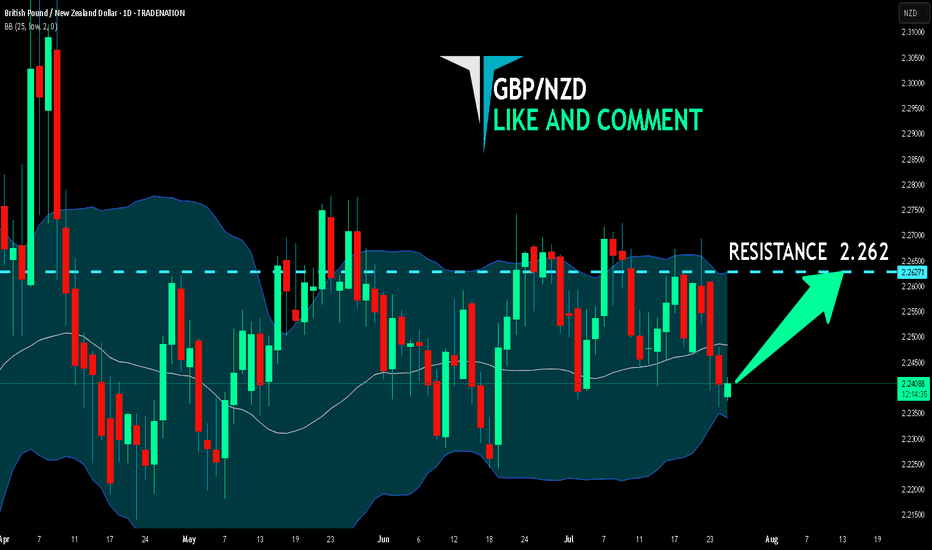

GBP/NZD BEST PLACE TO BUY FROM|LONG

Hello, Friends!

We are going long on the GBP/NZD with the target of 2.262 level, because the pair is oversold and will soon hit the support line below. We deduced the oversold condition from the price being near to the lower BB band. However, we should use low risk here because the 1W TF is red and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURGBP: Bearish Forecast & Outlook

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the EURGBP pair price action which suggests a high likelihood of a coming move down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

BTCUSD 4HOUR TIME FRAME ANALYSISCurrently bearish on the 4-hour chart with lower highs and lower lows forming consistently.

Price Action: BTCUSD recently broke below a key support zone around 116,000, turning it into a fresh resistance. The market shows bearish momentum as price fails to reclaim above that zone.

Candlestick Patterns: Multiple bearish engulfing candles confirm selling pressure near the 115,500–116,000 area.

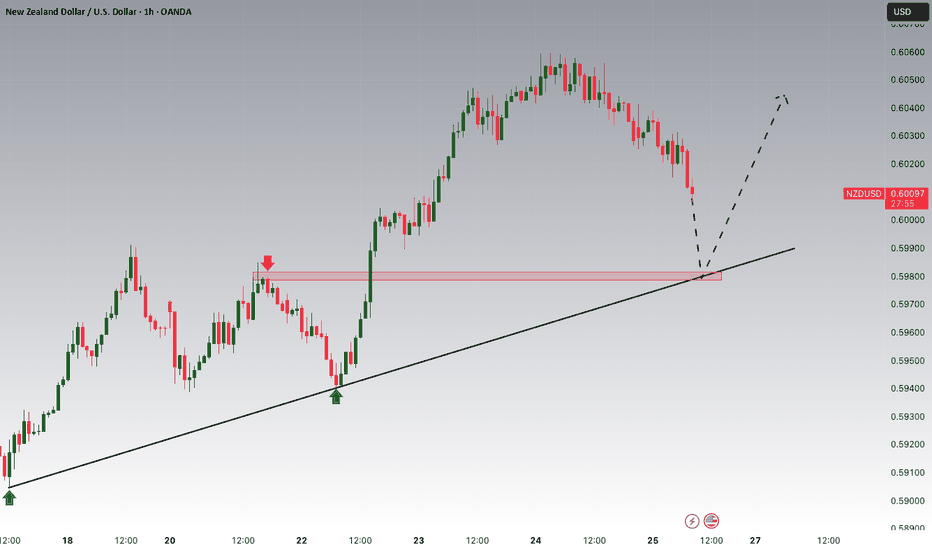

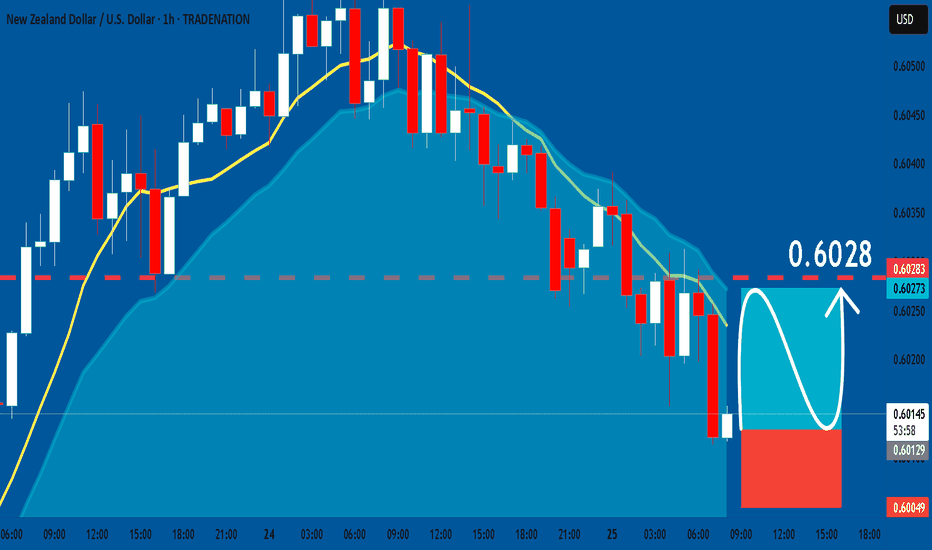

NZDUSD: Free Trading Signal

NZDUSD

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long NZDUSD

Entry Point - 0.6013

Stop Loss - 0.6004

Take Profit - 0.6028

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

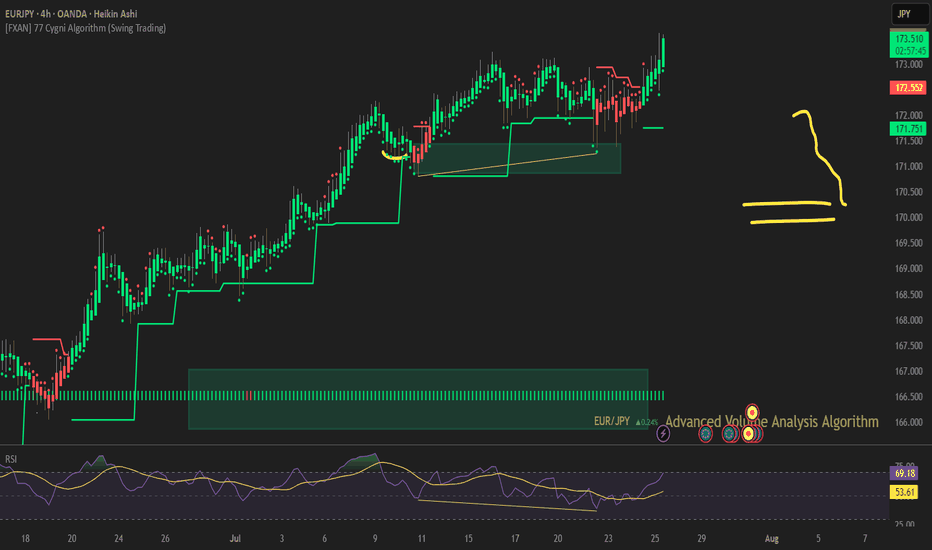

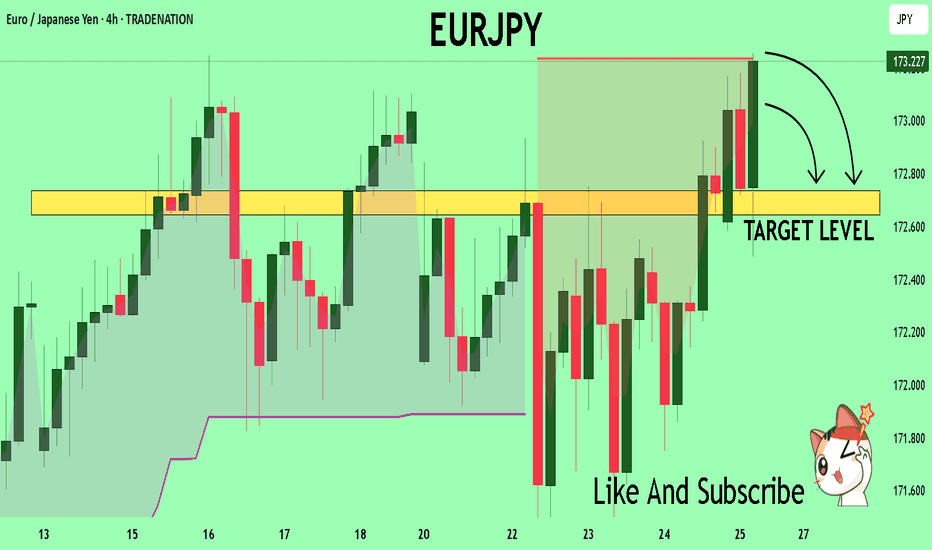

EURJPY Technical Analysis! SELL!

My dear subscribers,

EURJPY looks like it will make a good move, and here are the details:

The market is trading on 173.19 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 172.73

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

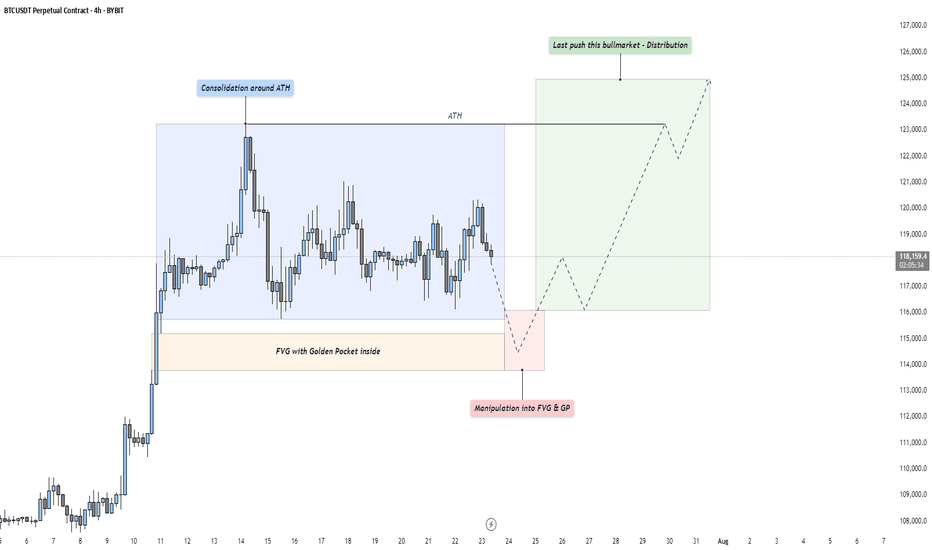

BTC - Last Push: Consolidation, Manipulation & DistributionMarket Context

After a strong upward impulse, Bitcoin has entered a mid-term consolidation phase just below its all-time high. This kind of price action is typical as the market digests recent gains and larger participants prepare for the next move. These pauses in momentum often precede either trend continuation or a reversal — and the structure here suggests we might be witnessing the former, but not without a final shakeout.

Phase 1: Consolidation Around the All-Time High

The first phase is defined by a tight range just beneath the all-time high, where price moves sideways in a balanced struggle between buyers and sellers. This is often where retail participants become overly bullish, anticipating a breakout. However, the lack of a sustained move higher indicates that smart money may be waiting for better entries — or preparing to engineer liquidity to fuel the next move.

Phase 2: Manipulation Into the Fair Value Gap and Golden Pocket

Directly below the range lies a clean Fair Value Gap, with a Golden Pocket retracement nestled inside it. This zone represents a strong area of interest. A sharp move into this area would likely sweep late long positions and trigger stop-losses from range traders — a classic manipulation pattern. This phase serves two purposes: collect liquidity and offer favorable pricing for larger players looking to position themselves before expansion. Watch for signs of absorption or reversal as price enters this zone.

Phase 3: Expansion – The Last Push of the Bull Market?

Following the liquidity sweep and reaction from the Fair Value Gap and Golden Pocket zone, we could see a renewed expansion toward higher highs. This is the phase where volume returns, sentiment shifts, and price accelerates. If this plays out, it could mark the final leg of this bull cycle — potentially driving Bitcoin to new all-time highs with strength.

Execution Thoughts

If you're looking to participate, it's wise to wait for a confirmation signal on a lower timeframe — like the 5-minute or 15-minute chart — once price enters the Fair Value Gap and Golden Pocket zone. Watch for a strong bullish reaction, break of structure, or shift in order flow to signal that buyers are stepping back in.

Final Thoughts

Let the market come to your level and don’t chase moves without context. These three phases — consolidation, manipulation, and expansion — are timeless patterns seen across all markets. Stay patient, stay objective, and react with clarity.

If this breakdown helped you see the setup more clearly, a like would mean a lot — and I’d love to hear your thoughts in the comments! Are you watching the same zone, or do you see something different?

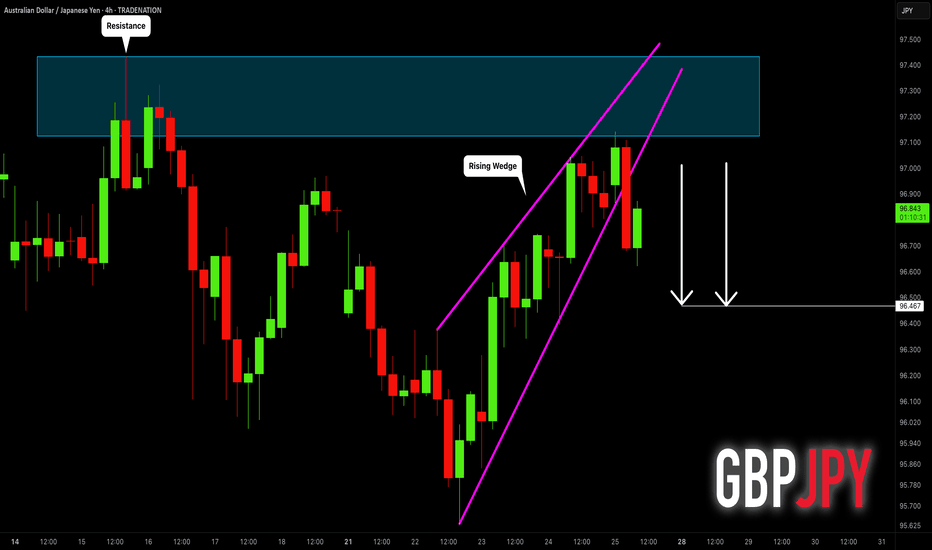

AUDJPY: Strong Bearish Signal?! 🇦🇺🇯🇵

AUDJPY may retrace from a key daily resistance.

As a confirmation, I see a bearish breakout of a support line of a rising

wedge pattern with a high momentum bearish candle.

Goal - 96.47

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

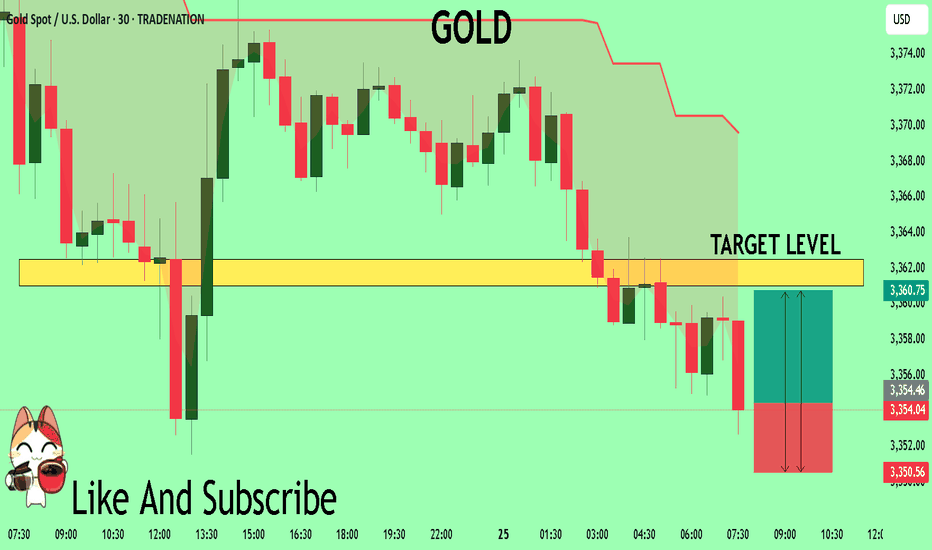

GOLD The Target Is UP! BUY!

My dear followers,

I analysed this chart on GOLD and concluded the following:

The market is trading on 3354.1 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 3361.01

Safe Stop Loss - 3350.5

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Gold dips on profit-taking, long-term outlook still bullishGold prices continued to decline this morning as investors locked in profits following the precious metal’s recent rally above $3,400.

In the short term, further downside is possible if profit-taking persists and capital flows shift toward equities, especially as U.S. stock markets hover near record highs. However, gold remains a favored safe-haven asset for the long run amid ongoing global economic and geopolitical uncertainties.

Markets are also turning their focus to the upcoming Federal Reserve policy meeting on July 29–30. While the Fed is expected to hold interest rates steady this time, many investors still anticipate a potential rate cut in September. A low interest rate environment typically supports non-yielding assets like gold.