AUD/USD Secures Bullish Momentum Above $0.6407FenzoFx—AUD/USD closed above $0.6407 and remains stable, signaling a bullish trend supported by the 50-period simple moving average.

However, indicators like Stochastic and RSI 14 suggest an overbought condition, hinting at a possible correction. Key support lies at $0.6395, with traders watching for bullish signals such as candlestick patterns.

The outlook stays bullish above $0.6276, while dips below this level could trigger extended consolidation.

>>> No Deposit Bonus

>>> %100 Deposit Bonus

>>> Forex Analysis Contest

All at FenzoFx Decentralized Forex Broker

Forexanalysis

USD remains weak across the board. EUR, GBP & JPY Bullish.Not much action due to the extended market break and Easter weekend but I expect more USD selling across the board in the coming weeks ahead.

Long positions are sitting tight but two areas I am keeping an eye on are 1.1200 as a base support and 1.1500 as the resistance hurdle we need to clear in order to open up the gates to 1.2000+

GBP/USD is still a bullish case for me as the short term resistance may be cracking and I'm still expecting for the JPY to advance against the USD.

It's good to get a break from the market volatility but I surely expect it to resume in the coming week!

Good Luck & Trade Safe!

GBP/USD AnalysisFenzoFx—The GBP/USD pair rebounded from $1.3202 support, currently trading around $1.3277 and continuing its bullish trend.

As long as it stays above $1.3144, the next target could be $1.3435. On the flip side, a break below $1.3144 may trigger a bearish move towards $1.3030.

>>> No Deposit Bonus

>>> %100 Deposit Bonus

>>> Forex Analysis Contest

All at F enzo F x Decentralized Forex Broker

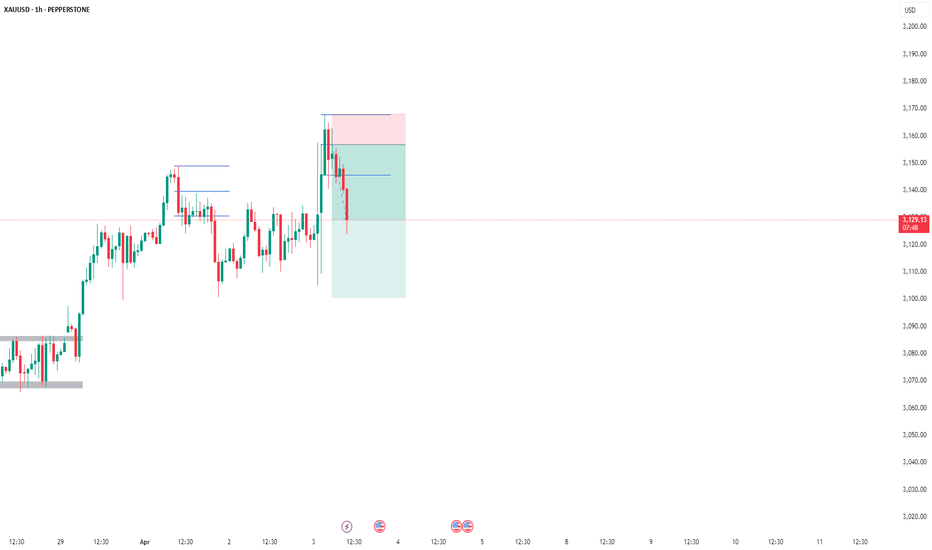

XAU/USD Enters Fourth Wave ConsolidationCurrently, XAU/USD appears to have completed the third wave, and the beginning of the fourth wave seems to be underway, indicating the start of a corrective phase. This correction can potentially extend down to the 3118.486 level. In terms of targets, the key levels to watch are 3166.464 and 3117.451 . Following this correction, there is a possibility that the fifth wave may commence.

Expecting more USD selling overall: Weekly Market PreviewIn this video I go over last week's epic volatility and what I am looking for going forward.

Long positions on EUR/USD at 1.0980 will remain in tact and still eyeing a target of 1.2000 out of the falling wedge displayed on both the monthly and quarterly charts.

I do expect some pullback after a massive move to the upside to end the week however, the bull can become relentless and continue it's strength due to the U.S. Dollar weakness across the board.

USD/JPY is another one I am watching and initiated a short position at 143.31 with a target at 133. If the large weekly broadening pattern runs it's course, I expect for that target to get hit.

Tech may get relief after Trump announced over the weekend that there will be exemptions but the market can remain irrational and continue overall weakness especially since the U.S. economy as a whole is not well.

Hope you enjoy the video and we'll see what we get this upcoming week, especially with Federal Reserve Powell set to speak on Wednesday.

As always, Good Luck & Trade Safe.

Market Analysis: USD/CHF DivesMarket Analysis: USD/CHF Dives

USD/CHF declined and is now struggling below the 0.8615 resistance.

Important Takeaways for USD/CHF Analysis Today

- USD/CHF declined below the 0.8675 and 0.8615 support levels.

- There is a short-term bearish trend line forming with resistance near 0.8550 on the hourly chart at FXOpen.

USD/CHF Technical Analysis

On the hourly chart of USD/CHF at FXOpen, the pair started a fresh decline from well above the 0.8800 zone. The US Dollar dropped below the 0.8675 support to move into a negative zone against the Swiss Franc.

The bears pushed the pair below the 50-hour simple moving average and 0.8615. Finally, the bulls appeared near the 0.8420 level. A low was formed near 0.8421 and the pair is now consolidating losses.

On the upside, the pair could face resistance near the 0.8480 level. It is near the 23.6% Fib retracement level of the downward move from the 0.8674 swing high to the 0.8421 low. The next major resistance is near the 0.8550 level.

There is also a short-term bearish trend line forming with resistance near 0.8550. It coincides with the 50% Fib retracement level of the downward move from the 0.8674 swing high to the 0.8421 low, above which the pair could test the 0.8615 level.

If there is a clear break above the 0.8615 resistance zone, the pair could start another increase. In the stated case, it could even surpass 0.8675.

On the downside, immediate support on the USD/CHF chart is 0.8420. The first major support is near the 0.8400 level. The next major support is near 0.8350. Any more losses may possibly open the doors for a move toward the 0.8220 level in the coming days.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Market Analysis: EUR/USD Resumes IncreaseMarket Analysis: EUR/USD Resumes Increase

EUR/USD started a fresh increase above the 1.0950 resistance.

Important Takeaways for EUR/USD Analysis Today

- The Euro started a decent upward move from the 1.0880 zone against the US Dollar.

- There was a break above a key bearish trend line with resistance at 1.0955 on the hourly chart of EUR/USD at FXOpen.

EUR/USD Technical Analysis

On the hourly chart of EUR/USD at FXOpen, the pair started a fresh increase from the 1.0775 zone. The Euro cleared the 1.0950 resistance to move into a bullish zone against the US Dollar, as mentioned in the last analysis.

The bulls pushed the pair above the 50-hour simple moving average and 1.1000. Finally, the pair tested the 1.1150 resistance. A high was formed near 1.1146 before the pair corrected gains. It dipped below 1.1000 and tested 1.0880.

The pair is again rising from the 1.0880 zone. There was a break above a key bearish trend line with resistance at 1.0955. The pair climbed above the 50% Fib retracement level of the downward move from the 1.1146 swing high to the 1.0880 low.

Immediate resistance on the EUR/USD chart is near the 1.1045 zone and the 61.8% Fib retracement level of the downward move from the 1.1146 swing high to the 1.0880 low.

The first major resistance is near the 1.1080 level. An upside break above the 1.1080 level might send the pair toward the 1.1145 resistance. The next major resistance is near the 1.1165 level. Any more gains might open the doors for a move toward the 1.1200 level.

Immediate support on the downside is near the 1.0955 level. The next major support is the 1.0880 level. A downside break below the 1.0880 support could send the pair toward the 1.0830 level. Any more losses might send the pair into a bearish zone toward 1.0775.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NZD/USD Analysis: Exchange Rate Nears 2025 LowNZD/USD Analysis: Exchange Rate Nears 2025 Low

Less than a month ago, we analysed the NZD/USD chart and:

→ highlighted the key resistance level at 0.5800;

→ outlined a potential scenario involving a decline from that zone.

Now, the NZD/USD pair is trading close to its lowest level of 2025, recorded on 3 February near 0.5525. The latest surge in volatility appears to be driven by President Trump’s widely discussed decision to impose substantial tariffs on trade with multiple countries.

For context, the Australian dollar has fallen to a five-year low amid concerns that retaliatory trade measures could trigger a global recession. The New Zealand dollar, however, has remained somewhat more stable — possibly because traders are anticipating Wednesday’s Reserve Bank of New Zealand (RBNZ) meeting, where the central bank may signal efforts to stabilise the currency. According to Forex Factory, a rate cut from 3.75% to 3.50% is expected.

Technical analysis of NZD/USD chart

Price movements in 2025 have formed an ascending channel (marked in blue), but bears broke through the lower boundary late last week near the 0.5666 level.

This suggests that even if NZD/USD sees a short-term rebound, it may face resistance around that same level — a classic “break-and-retest” pattern often watched by traders.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USD Bear is here: Important Analysis on FX Pairs, Stock MarketIn this video I got over some important outlooks on the EUR/USD, GBP/USD and USD/JPY along with outlook on the stock market.

The U.S. Dollar has been getting absolutely crushed along with the stock market which usually has the opposite effect. Considering we may be into a stagflation scenario, this is not surprising.

Tariffs have spiked volatility and puts the Federal Reserve in a very tight spot of Interest Rate Policy. Interesting times ahead to say the least.

From a pure technical analysis point of view, the USD may be set for much further losses as monthly patterns suggest a big move may be on the horizon. Will be keeping a very close eye on these as we move forward in these stormy waters of the U.S. economy.

As always, Good Luck & Trade Safe.

USD/CHF Falls to Its Lowest Level in Nearly Five MonthsUSD/CHF Falls to Its Lowest Level in Nearly Five Months

Today, the exchange rate of one US dollar against the Swiss franc dropped below 0.87000 francs—its lowest level since early November 2024.

Since the start of 2025, the USD/CHF pair has declined by more than 4%.

Why Is USD/CHF Falling Today?

On one hand, the US dollar is weakening against other currencies due to Trump’s decision to implement the previously announced tariffs on international trade, as mentioned in our previous post.

On the other hand, the Swiss franc is gaining strength due to its appeal as a safe-haven asset. Furthermore, this morning’s release of the Consumer Price Index (CPI) showed that inflation in Switzerland remains at zero, increasing the franc’s value at a time when tariff conflicts pose risks to the global economy.

Technical Analysis of the USD/CHF Chart

Since the start of 2025, the USD/CHF pair has been following a downward trajectory, highlighted by a declining channel (marked in red), with the following key points:

→ The median line has shifted from support to resistance, as indicated by the arrows.

→ The price broke through the March support level around 0.8757, accelerating the decline.

→ The lower boundary of the channel provided support this morning, slowing bearish momentum.

It is possible that the 0.8757 level will act as resistance in April 2025. However, the future direction of USD/CHF will largely depend on news developments, particularly statements from global leaders regarding tariffs in international trade.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NZDJPY Approaching Key Resistance — Potential Sell SetupOANDA:NZDJPY is approaching a key resistance zone, a level where sellers have consistently stepped in, leading to notable bearish reversals in the past. This area is marked by strong selling pressure, increasing the likelihood of a bearish move if sellers regain control.

The current price action suggests that if the pair confirms resistance through signals like bearish engulfing candles, long upper wicks, or increased selling volume, we could see a downward move toward 86.100, which represents a logical target based on previous price behavior and market structure.

However, if the price breaks above this zone and sustains, the bearish outlook may be invalidated, opening the door for further upside.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

Market Analysis: NZD/USD Struggles to Sustain Gains—What’s Next?Market Analysis: NZD/USD Struggles to Sustain Gains—What’s Next?

NZD/USD is also moving lower and might extend losses below 0.5700.

Important Takeaways for NZD/USD Analysis Today

- NZD/USD declined steadily from the 0.5760 resistance zone.

- There is a major bearish trend line forming with resistance at 0.5715 on the hourly chart of NZD/USD at FXOpen.

NZD/USD Technical Analysis

On the hourly chart of NZD/USD on FXOpen, the pair also followed a similar pattern and declined from the 0.5760 zone. The New Zealand Dollar gained bearish momentum and traded below 0.5725 against the US Dollar.

The pair settled below the 0.5720 level and the 50-hour simple moving average. Finally, it tested the 0.5695 zone and is currently consolidating losses.

Immediate resistance on the upside is near the 50% Fib retracement level of the downward move from the 0.5736 swing high to the 0.5693 low at 0.5715. There is also a major bearish trend line forming with resistance at 0.5715.

The next resistance is the 0.5725 level or the 76.4% Fib retracement level of the downward move from the 0.5736 swing high to the 0.5693 low. If there is a move above 0.5725, the pair could rise toward 0.5750.

Any more gains might open the doors for a move toward the 0.5800 resistance zone in the coming days. On the downside, immediate support on the NZD/USD chart is near the 0.5705 level.

The next major support is near the 0.5695 zone. If there is a downside break below 0.5695, the pair could extend its decline toward the 0.5665 level. The next key support is near 0.5640.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Market Analysis: AUD/USD Struggles to Sustain Gains—What’s Next?Market Analysis: AUD/USD Struggles to Sustain Gains—What’s Next?

AUD/USD declined below the 0.6320 and 0.6300 support levels.

Important Takeaways for AUD/USD Analysis Today

- The Aussie Dollar started a fresh decline from well above the 0.6320 level against the US Dollar.

- There is a connecting bearish trend line forming with resistance at 0.6300 on the hourly chart of AUD/USD at FXOpen.

AUD/USD Technical Analysis

On the hourly chart of AUD/USD at FXOpen, the pair struggled to clear the 0.6330 zone. The Aussie Dollar started a fresh decline below the 0.6300 support against the US Dollar, as discussed in the previous analysis.

The pair even settled below 0.6280 and the 50-hour simple moving average. There was a clear move below 0.6270. A low was formed at 0.6269 and the pair is now consolidating losses.

On the upside, an immediate resistance is near the 0.6295 level and the 61.8% Fib retracement level of the downward move from the 0.6312 swing high to the 0.6269 low.

There is also a connecting bearish trend line forming with resistance at 0.6300. It is close to the 76.4% Fib retracement level of the downward move from the 0.6312 swing high to the 0.6269 low. The next major resistance is near the 0.6310 zone, above which the price could rise toward 0.6320.

Any more gains might send the pair toward the 0.6330 resistance. A close above the 0.6330 level could start another steady increase in the near term. The next major resistance on the AUD/USD chart could be 0.6380.

On the downside, initial support is near the 0.6270 zone. The next support sits at 0.6260. If there is a downside break below 0.6260, the pair could extend its decline. The next support could be 0.6200. Any more losses might send the pair toward the 0.6165 support.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

FX Market Preview: NFP week - EUR/USD in focusIn this FX market preview I go into recapping the EUR/USD, GBP/USD and USD/JPY price action last week and what I'm looking at for this week.

I also take a look at ETF's QQQE and Nvidia opportunities.

I continue to hold my EUR/USD short positions while keeping a strong eye on 1.0860 and then 1.0900. I feel these areas are important for the bears to hold the line if we're going to continue the slide down.

NFP in focus this week as well as Trump Tariffs.

As always, Good Luck & Trade Safe.

Strong Confluence Zone – Is EURJPY Ready to Fly?EURJPY is currently respecting a strong ascending trendline that has acted as dynamic support for several years. Price recently rebounded from both the horizontal support zone and the rising trendline, indicating strong buying interest at this confluence area.

Now, the pair is attempting to break above a key resistance zone marked by a descending trendline. A successful breakout above this area could signal a potential continuation of the long-term bullish trend.

The RSI is also showing a bullish divergence, which adds confluence to the bullish bias. However, rejection from resistance could trigger a retest of the support zones.

Found this helpful? Like & follow us for more high-quality market insights.

Market Analysis: USD/JPY Eyes Fresh SurgeMarket Analysis: USD/JPY Eyes Fresh Surge

USD/JPY is rising and might gain pace above the 151.00 resistance.

Important Takeaways for USD/JPY Analysis Today

- USD/JPY climbed higher above the 149.55 and 150.00 levels.

- There is a connecting bullish trend line forming with support at 150.30 on the hourly chart at FXOpen.

USD/JPY Technical Analysis

On the hourly chart of USD/JPY at FXOpen, the pair started a fresh upward move from the 148.20 zone. The US Dollar gained bullish momentum above 148.80 against the Japanese Yen.

It even cleared the 50-hour simple moving average and 149.55. The pair climbed above 150.00 and traded as high as 150.94. It is now consolidating gains and there was a move below the 23.6% Fib retracement level of the upward move from the 148.18 swing low to the 150.94 high.

The current price action above the 150.00 level is positive. Immediate resistance on the USD/JPY chart is near 150.95. The first major resistance is near 151.20. If there is a close above the 151.20 level and the RSI moves above 70, the pair could rise toward 152.50.

The next major resistance is near 153.20, above which the pair could test 155.00 in the coming days. On the downside, the first major support is 150.30 and a bullish trend line, below which the bears could gain strength.

The next major support is visible near the 149.55 level and the 50% Fib retracement level of the upward move from the 148.18 swing low to the 150.94 high.

If there is a close below 149.55, the pair could decline steadily. In the stated case, the pair might drop toward the 148.40 support zone. The next stop for the bears may perhaps be near the 147.50 region.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Market Analysis: EUR/USD RetreatsMarket Analysis: EUR/USD Retreats

EUR/USD declined from the 1.0950 resistance and traded below 1.0850.

Important Takeaways for EUR/USD Analysis Today

- The Euro started a fresh decline below the 1.0850 support zone.

- There is a key bearish trend line forming with resistance at 1.0820 on the hourly chart of EUR/USD at FXOpen.

EUR/USD Technical Analysis

On the hourly chart of EUR/USD at FXOpen, the pair struggled to clear the 1.0950 resistance zone. The Euro started a fresh decline and traded below the 1.0850 support zone against the US Dollar.

The pair declined below 1.0820 and tested the 1.0775 zone. A low was formed near 1.0776 and the pair started a consolidation phase. There was a minor recovery wave above the 1.0800 level. The pair tested the 23.6% Fib retracement level of the downward move from the 1.0954 swing high to the 1.0776 low.

The pair is now trading below 1.0820 and the 50-hour simple moving average. On the upside, the pair is now facing resistance near the 1.0820 level. There is also a key bearish trend line forming with resistance at 1.0820.

The next key resistance is at 1.0850. The main resistance is near the 1.0865 level or the 50% Fib retracement level of the downward move from the 1.0954 swing high to the 1.0776 low.

A clear move above the 1.0865 level could send the pair toward the 1.0910 resistance. An upside break above 1.0910 could set the pace for another increase. In the stated case, the pair might rise toward 1.0950.

If not, the pair might resume its decline. The first major support on the EUR/USD chart is near 1.0775. The next key support is at 1.0750. If there is a downside break below 1.0725, the pair could drop toward 1.0700. The next support is near 1.0650, below which the pair could start a major decline.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

AUDCAD Approaching Key Support - Rebound Towards 0.90150?OANDA:AUDCAD is approaching a significant support zone, highlighted by previous price reactions and strong buying interest. This area has previously acted as a key demand zone, increasing the likelihood of a bounce if buyers step in.

The current market structure suggests that if the price confirms support within this zone, we could see a bullish reversal. A successful rebound could push the pair toward the 0.90150 level, a logical target based on previous price behavior and current market structure.

However, if the price fails to hold this support and breaks below the zone with momentum, the bullish outlook may be invalidated, potentially opening the door for further downside continuation. Monitoring price action and volume in this area will be crucial to confirm a valid setup.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!