XAUUSD Gold price moves closer to three-week peak amid modest USD downtick

Gold price regains positive traction amid a modest USD pullback from a multi-week high. Persistent trade-related uncertainties also lend support to the safe-haven precious metal. Reduced Fed rate cut bets might cap the commodity ahead of the critical US CPI repo

Fundamental Overview

Amid US President Donald Trump’s fresh tariff threats announced late Monday and his latest criticism of Federal Reserve Chairman Jerome Powell, Gold traders resorted to profit-taking after the bright metal hit a three-week high of $3,375 while bracing for the US inflation report for June.

Trump threatened to impose 100% tariffs on Russia if President Vladimir Putin does not agree to a deal to end his invasion of Ukraine in 50 days, per Bloomberg.

Meanwhile, the US President renewed his attacks on Powell, noting that “interest rates should be at 1% or lower, rather than the 4.25% to 4.50% range the Fed has kept the key rate at so far this year.”

Markets now price in 50 basis points of Fed interest rate cuts by year-end, with the first reduction foreseen in September.

However, it remains to be seen if these expectations hold ground following the US CPI data publication.

Economists are expecting the US annual CPI and core CPI to accelerate 2.7% and 3% in June, reflecting the tariff impact feeding through prices. Meanwhile, the monthly CPI and core CPI inflation figures are set to rise to 0.3% in the same period.

Hotter-than-expected US CPI monthly or annual readings could reinforce the Fed’s patient outlook, pushing back against expectations of two Fed rate cuts this year.

This scenario could help the US Dollar (USD) extend its recovery at the expense of the non-yielding Gold price.

Alternatively, if the data come in below forecasts, it could provide a fresh tailwind to the Gold price on renewed bets that the Fed will remain on track for two rate cuts.

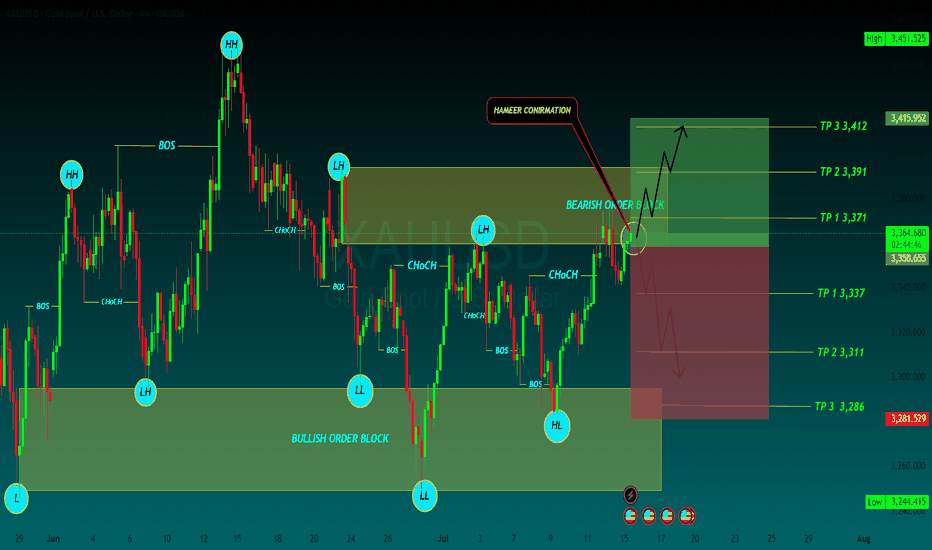

BAY TP

TP 1 3,371

TP 2 3,391

TP 3 3,412

SELL PT

TP 1 3,337

TP 2 3,311

TP 3 3,286

Forexrtrading

XAU/USD Short Trade Setup | Entry 2690.766 | SL 2700 RR: 1:10Executed a short position on XAU/USD with a strategic entry at 2690.766. Using my standard market structure analysis, I identified a solid resistance level and potential downside momentum. Placing a stop loss at 2700 to manage risk and targeting 2593.019 for a solid risk-to-reward ratio. Ensuring a calculated approach with every trade.

Focus on the consumer price index (CPI) reportGold prices are currently at a very high level, up about 36% compared to October 2023, so there is always pressure to take profits after each strong increase.

Investors are closely monitoring the conflict in the Middle East. This is still considered a powder keg that can cause tension in the global financial market.

Investors are also paying attention to the US consumer price index (CPI) report, expected to be announced on August 14. This is considered one of the most important indicators that the Fed monitors to make decisions on monetary policy. If the CPI continues to show a downward trend in inflationary pressure, the possibility of the Fed cutting interest rates in the coming months becomes even clearer.

Gold is forecast to reach $2,500/ounce in the second half of the year. This is easier than ever when the price for December delivery has exceeded this threshold. If tensions escalate uncontrollably in the Middle East, gold prices could climb further.

GBPJPY sell vaild - Show of hands who else is 🙌👍It might be bank holiday here in the UK but our script doesn't stop when markets are open.

First trade alert of the week is a GBPJPY short.

Entry details are shown on the chart.

We're only looking for TP3.

Trade history can be seen below this trade idea too for full transparency.

------------------------------------------

I try and share as many ideas as I can as and when I have time. My trades are automated so I am not sat in front of a screen daily.

Jumping on random trade ideas 'willy-nilly' on Trading View trying to find that one trade that you can retire from is not a sustainable way to trade. You might get lucky, but it will always end one way.

------------------------------------------

Please hit the 👍 LIKE button if you like my ideas🙏

Also follow my profile, then you will receive a notification whenever I post a trading idea - so you don't miss them. 🙌

No one likes missing out, do they?

Also, see my 'related ideas' below to see more just like this.

Interested in access to my strategy so you can be in these trades the moment they're valid? Drop me a DM .

The stats for this pair are shown below too.

Thank you.

Darren

USDNOK READY FOR LAUNCH!Hello traders,

I hope you are all doing great!

The last week finished in deep green territory for us (The Greek Trader community) above 500 pips profit and we are doing the same on this one!

The trade set up we are looking on is the USDNOK and let us tell you what our analysis is showing us:

Technical Observations

1.We have price reaching a daily-weekly and a monthly zone at 8.78-8.80 level.

2.It's a psychological round number!

3.We have with bullish MACD divergence.

4.We have a double top pattern in the daily timeframe and we have reached the targets of the extensions.

5.We have a Fib extension of 2.618 from the last pullback.

6.We have also 5 waves completed on the 4Hour timeframe.

Possible long Trade

ENTRY at 8.8110

STOP LOSS at 8.7658

TP at 8.99340-9.0 LEVEL

RISK/REWARD 4.03

THANK YOU ALL FOR SUPPORT!!

KEEP FOLLOWING AND SUPPORTING MEANS A LOT TO OUR ME!

Happy profits everyone!!

THE GREEK TRADER

NZDJPY approaching resistance, potential drop! NZDJPY is approaching our first resistance at 78.08 (horizontal swing high resistance, 61.8%, 50% Fibonacci retracement, 100% Fibonacci extension, descending channel resistance) where a strong drop might occur below this level pushing price down to our major support at 75.60 (horizontal pullback support, 61.8% Fibonacci extension, 38.2% Fibonacci retracement).

Stochastic (55,5,3) is also approaching resistance and we might see a corresponding rise in price should it react below this level.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.