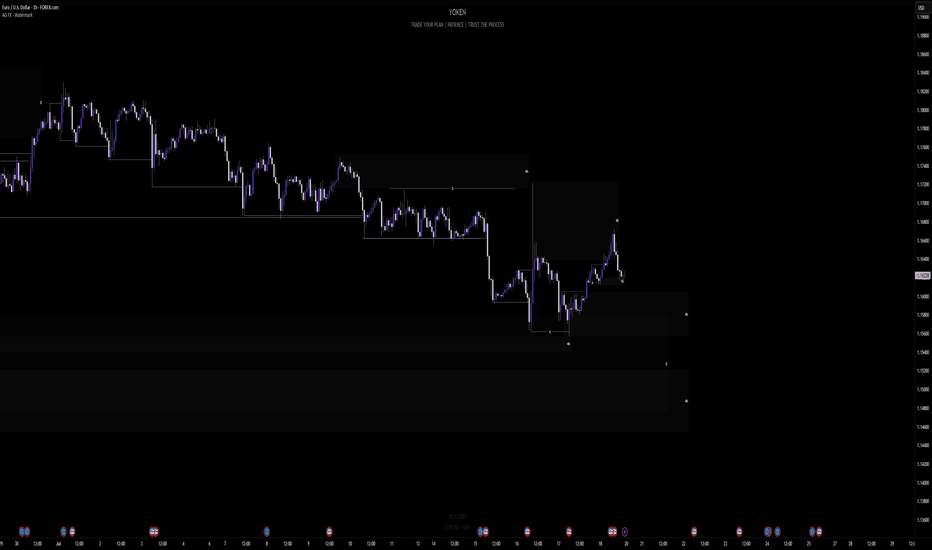

Week of 7/20/25: EURUSD AnalysisLast week's price action was bearish and has finally reached the extreme daily demand level and provided some reaction. Price has swept bulls and bears, so now we follow internal structure and wait to see where price actually wants to go. If internal 1h structure breaks bearish, we have confirmation to trade bearish until price goes deeper into the daily extreme zone.

Forexsignal

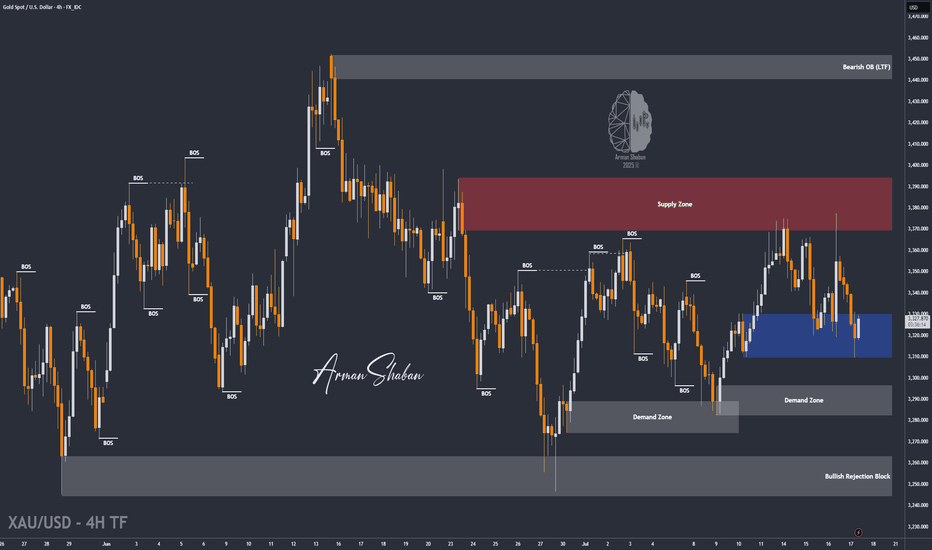

XAU/USD | First LONG to $3345, Then a Potential DROP Below $3300By analyzing the gold chart on the 4-hour timeframe, we can see that last night the price first tapped into the $3340 level, showing an initial push up to $3352. However, the drop intensified soon after, breaking the $3340 resistance and, according to the second scenario, falling to $3310. Upon reaching this key demand level, buying pressure kicked in, pushing the price back up to $3325. Now, the key question is whether gold can hold the $3310 support. If this level holds, we can expect a rise toward $3331 as the first target and $3345 as the second. After this move, a rejection from the $3345 area could trigger another drop, possibly pushing gold below $3300. So, first LONG, then SHORT!

THE LATEST VIDEO ANALYSIS :

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

AUDNZD Breakout: Long Opportunity in Ascending ChannelToday I want to share with you a Long position opportunity in AUDNZD ( OANDA:AUDNZD ).

Let's first take a brief look at the AUDNZD fundamentals .

RBNZ kept rates at 3.25% , signaling likely further cuts in August.

RBA paused at 3.60% , but dovish bias remains; markets expect more easing ahead.

As NZD is more pressured by immediate rate cuts than AUD, the fundamental setup favors a bullish AUDNZD.

Now let's find a long position for AUDNZD using technical analysis .

AUDNZD seems to have managed to break through the Heavy Resistance zone(1.0963 NZD-1.0870 NZD) and is moving near the Support zone(1.0964 NZD-1.0954 NZD) on the 1-hour time frame .

AUDNNZD is also moving in an Ascending Channel .

I expect AUDNZD to rise at least to the Resistance lines , the second target is the Resistance zone(1.103 NZD-1.0993 NZD).

Note: Stop Loss(SL): 1.0944 NZD

Please respect each other's ideas and express them politely if you agree or disagree.

Australian Dollar/New Zealand Dollar Analyze (AUDNZD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

EURUSD Under Pressure After Hot CPI – More Downside Ahead?Today, the US released key inflation figures :

Core CPI m/m: 0.2% (vs 0.3% forecast)

CPI m/m: 0.3% (as expected)

CPI y/y: 2.7% (vs 2.6% forecast, up from 2.4%)

Fundamental Analysis ( EURUSD ):

The slightly lower Core CPI suggests some easing in underlying inflation pressures. However, the headline CPI y/y came in hotter than expected at 2.7%, reinforcing the idea that the Fed is not yet ready to ease policy aggressively.

This combination supports the US dollar, as sticky inflation could delay rate cuts.

EURUSD is likely to remain under pressure in the short term unless the ECB signals a more hawkish stance or US data starts showing broader weakness.

Now let's move on to the technical analysis of EURUSD ( FX:EURUSD ) on the 4-hour timeframe .

EURUSD is trading in a Heavy Resistance zone($1.1802-$1.1602) , having simultaneously managed to break the Support lines and the lower line of the Descending Channel , and is also trying to break the Support zone($1.1642-$1.1578) .

I expect EURUSD to continue its downtrend and decline to the Support zone($1.1549-$1.1520) at the first target .

Second target : $1.15043

Third target : $1.1464

Note: Stop Loss(SL)= $1.1660

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/U.S. Dollar Analyze (EURUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

EUR/USD Retracement Into Demand ZoneHello guys!

EUR/USD is currently undergoing a healthy retracement after an extended bullish trend within the ascending channel. The price is now approaching a key demand zone, which aligns perfectly with the mid-line of the channel structure.

This zone previously acted as a strong resistance area and is now expected to serve as support, confirming a classic flip in market structure. The reaction around the 1.16288 - 1.15774 area will be crucial.

If buyers step in here, the bullish momentum is likely to resume with the next major target being the upper resistance zone near 1.20000 , as projected by the upward arrow. The overall structure remains bullish as long as the price holds above the channel support and doesn't close below the last demand zone.

GBPUSD LONG FORECAST Q3 D16 W29 Y25GBPUSD LONG FORECAST Q3 D16 W29 Y25

Welcome back to the watchlist GBPUSD ! Let's go long ! Alignment across all time frames.

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Daily order block

✅1H Order block

✅Intraday breaks of structure

✅4H Order block

📈 Risk Management Principles

🔑 Core Execution Rules

Max 1% risk per trade

Set alerts — let price come to your levels

Minimum 1:2 RR

Focus on process, not outcomes

🧠 Remember, the strategy works — you just need to let it play out.

🧠 FRGNT Insight of the Day

"The market rewards structure and patience — not emotion or urgency."

Execute like a robot. Manage risk like a pro. Let the chart do the talking.

🏁 Final Words from FRGNT

📌 GBPUSD is offering textbook alignment — structure, order flow, and confirmation all check out.

Let’s approach the trade with clarity, conviction, and risk-managed execution.

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

Could OIL Slide to $60? a 5% Drop Might Be on the Table? Hey Realistic Traders!

Price action is weakening. Will USOIL find support or slide further?

Let’s Break It Down..

On the 4H timeframe, oil has formed a double top pattern followed by a neckline breakout, which is a classic sign of a potential shift from a bullish to a bearish trend.

This breakout was confirmed by a break below the bullish trendline, accompanied by consecutive bearish full-body candlesticks that reinforce the bearish momentum. Afterward, the price formed a bearish continuation pattern known as a rising wedge, which was followed by a breakdown.

The combination of bearish reversal and continuation pattern breakouts signals further downside movement and confirms the shift into a bearish trend.

Therefore, we foresee the price forming lower lows and lower highs toward the first target at 63.21, with a potential extension to the close the gap at 60.73.

The bearish outlook remains valid as long as the price stays below the key stop-loss level at 69.66.

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: This analysis is for educational purposes only and should not be considered a recommendation to take a long or short position on USOIL.

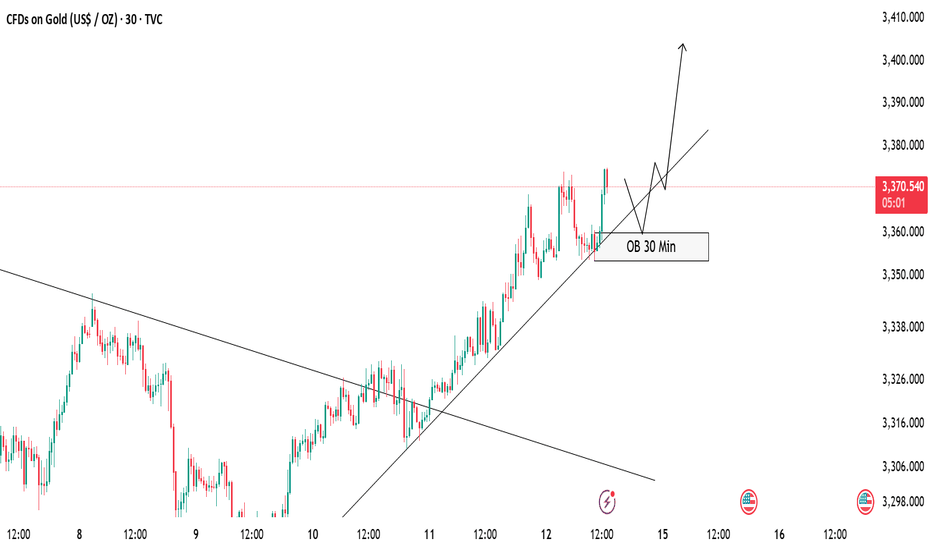

GOLD Buy Setup – OB Zone in FocusCurrently, gold is respecting the ascending trendline and maintaining a bullish structure 🟢. Price hasn’t tapped into the 30 Min Order Block (OB) yet, but we are expecting a potential pullback into this OB zone 📍.

✅ Our Plan:

We will wait patiently for price to mitigate the OB.

After the tap, we will look for bullish confirmation (rejection wick, bullish engulfing, or break of minor structure) before entering a buy position 🚀.

As long as the trendline holds, we remain bullish on gold.

📝 Invalidation:

If price breaks and closes below the trendline and OB zone, we will stay out or re-evaluate the setup ❌.

Stay disciplined and follow the plan! 💪

NZDUSD Pullback in Play – Head & Shoulders Signals More DownsideNZDUSD ( OANDA:NZDUSD ) is currently trading near the Resistance zone($0.612-$0.605) and has also managed to break the Support zone($0.604-$0.602) . We consider the Support zone as the neckline of the Head and Shoulders Pattern .

In terms of classic technical analysis , NZDUSD has managed to form a Head and Shoulders Pattern .

I expect NZDUSD to decline towards the Support zone($0.5968-$0.5946) after completing the pullback .

Note: Stop Loss(SL): $0.6062

Please respect each other's ideas and express them politely if you agree or disagree.

New Zealand Dollar/ U.S. Dollar Analyze (NZDUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

XAUUSDHello Traders! 👋

What are your thoughts on XAUUSD?

Gold has successfully broken above its descending trendline, signaling a potential shift in market structure and growing bullish momentum.

A pullback toward the broken trendline is now likely, as price may retest the breakout zone.

Once the pullback is completed, we anticipate a bullish continuation and a move toward higher levels.

As long as price holds above the identified support zone, the bullish outlook remains valid.

Will gold resume its rally after the pullback? Share your thoughts in the comments! 🤔👇

Don’t forget to like and share your thoughts in the comments! ❤️

USDJPY LONG & SHORT – WEEKLY FORECAST Q3 | W29 | Y25

💼 USDJPY LONG & SHORT – WEEKLY FORECAST

Q3 | W29 | Y25

📊 MARKET STRUCTURE SNAPSHOT

USDJPY is currently reaching for a key higher time frame supply zone, looking for price action to show weakness at premium levels. Structure and momentum are now aligning for a short opportunity backed by multi-timeframe confluence.

🔍 Confluences to Watch 📝

✅ Daily Order Block (OB)

Looking for Strong reaction and early signs of distribution.

✅ 4H Order Block

Break of internal structure (iBoS) confirms a short-term bearish transition.

✅ 1H Order Block

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

🏁 Final Thoughts from FRGNT

📌 The structure is clear.

The confluences are stacked.

Let execution follow discipline, not emotion.

EURGBP SHORT – WEEKLY FORECAST Q3 | W29 | Y25💼 EURGBP SHORT – WEEKLY FORECAST

Q3 | W29 | Y25

📊 MARKET STRUCTURE SNAPSHOT

EURGBP is currently reacting from a key higher time frame supply zone, with price action showing weakness at premium levels. Momentum has slowed, and early signs of distribution are appearing. With structure aligning bearishly across multiple timeframes, the pair presents a short bias opportunity.

🔍 Confluences to Watch 📝

✅ Daily Order Block (OB)

Price reacted from a high-probability bearish OB.

Rejection wicks and a shift in candle body control point to supply dominance.

Momentum is fading, confirming the presence of smart money sellers.

✅ 4H Order Block

Clear mitigation of 4H OB followed by an internal break of structure (iBoS).

Price is respecting the OB zone, printing lower highs beneath key supply.

Perfect mid-timeframe confirmation of trend transition.

✅ 1H Order Block

1H structure shifted bearish, validating LTF trend alignment.

Price building supply chain with continued lower highs and bearish engulfing patterns.

Ideal zone for entry on pullback or liquidity sweep.

📈 Risk Management Protocols

🔑 Core Principles:

💰 Max 1% risk per trade

📍 Only execute at pre-identified zones

⏰ Set alerts — avoid impulsive trades

📉 Respect RR — minimum 1:2 per position

🧠 You're not paid for frequency. You're paid for discipline and execution quality.

🧠 Weekly FRGNT Insight

“Trade what the market gives, not what your ego wants.”

Stay mechanical, stay focused, and allow the probabilities to play out. Your job is to control risk — not the outcome.

🏁 Final Thoughts from FRGNT

📌 The structure is clear.

📌 The confluences are stacked.

📌 The bias is confirmed.

Let your execution reflect your discipline, not your emotions.

❤️ Good luck this week, and as always – I’ll see you at the very top.

XAUUSD- Bearish AB=CD pattern at resistance zone!Timeframe:2H|Pattern: AB=CD| Bias: Bearish Reversal!

Gold (XAUUSD) has completed a precise AB=CD pattern aligning perfectly with a strong resistance zone near 3340-3350 the symmetry of the harmonic pattern combined with historical rejection levels gives a strong signal for a potential downside move

Trade setup idea:

Sell entry: 3340-3350

target:1: 3300

target:2: 3260

risk reward: Favorable setup with harmonic confirmation.

GBPCAD LONG FORECAST Q3 D11 W28 Y25GBPCAD LONG FORECAST Q3 D11 W28 Y25

It’s Fun Coupon Friday! 💸🔥

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURGBP SHORT DAILY FORECAST Q3 D11 W28 Y25EURGBP SHORT DAILY FORECAST Q3 D11 W28 Y25

It’s Fun Coupon Friday! 💸🔥

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPCAD LONG FORECAST Q3 D10 W28 Y25GBPCAD LONG FORECAST Q3 D10 W28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURJPY SHORT DAILY FORECAST Q3 D10 W28 Y25EURJPY SHORT DAILY FORECAST Q3 D10 W28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDUSD SHORT FORECAST Q3 D10 W28 Y25AUDUSD SHORT FORECAST Q3 D10 W28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURUSDHello Traders! 👋

What are your thoughts on EURUSD?

Following its recent rally, EURUSD has reached a key resistance zone, which also aligns with a trendline. The pair failed to break above this area and has been rejected.

Given the weak momentum and bearish reaction, we do not expect a breakout at this stage.

Instead, we anticipate some consolidation around the resistance, followed by a downward move toward the specified support level.

Don’t forget to like and share your thoughts in the comments! ❤️

XAUUSD setup selling ideas h4Disruptive Gold Analysis – 4H Chart Perspective

Symbol: XAU/USD 🥇 | Timeframe: 4H

Date: July 9, 2025

⸻

🔁 Scenario Disruption: Potential Bullish Reversal

✅ While the original analysis shows a bearish continuation setup with consolidation under resistance and breakdown towards multiple downside targets, a disruptive view considers a false breakdown or support flip scenario.

⸻

🔁 Alternative Viewpoint:

📍 Current Price Action:

Price is testing the support zone (~3,280–3,290) which has held multiple times in the past.

🟢 Disruption Possibility:

1. Bullish Fakeout Trap Setup:

• Price may create a false breakdown below support to trap sellers.

• A quick recovery and breakout above the consolidation highs (~3,310–3,320) would invalidate the bearish continuation.

2. Resistance Flip Setup:

• If the market reclaims above 3,320, we may see a bullish push towards the key resistance zone at 3,360–3,380.

• This could evolve into a range breakout bullish trend continuation toward previous highs.

⸻

🔄 Disruption Targets:

• 📈 Immediate Upside Target: 3,320

• 📈 Breakout Target: 3,360

• 📈 Extended Bullish Target: 3,400+

⸻

⚠️ Invalidation Level:

If price closes below 3,270, then the original bearish scenario remains intact, with continuation toward 3,240 → 3,200 → 3,140.

USDCAD LONG DAILY FORECAST Q3 D8 W28 Y25USDCAD LONG DAILY FORECAST Q3 D8 W28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDJPY SHORT FORECAST Q3 D8 W28 Y25AUDJPY SHORT FORECAST Q3 D8 W28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X