XAUUSDHello Traders! 👋

What are your thoughts on GOLD?

Gold remains trapped below the key $3,390–$3,400 resistance zone, which has rejected price multiple times in recent sessions.

A short-term pullback toward the marked support level is likely.

From that zone, we expect buyers to step in, leading to another bullish push toward the resistance, and this time, a potential breakout above the $3,400 level.

As long as the price stays above support, the bullish outlook remains intact.

A confirmed break above $3,400 could open the path toward new highs.

Don’t forget to like and share your thoughts in the comments! ❤️

Forextrading

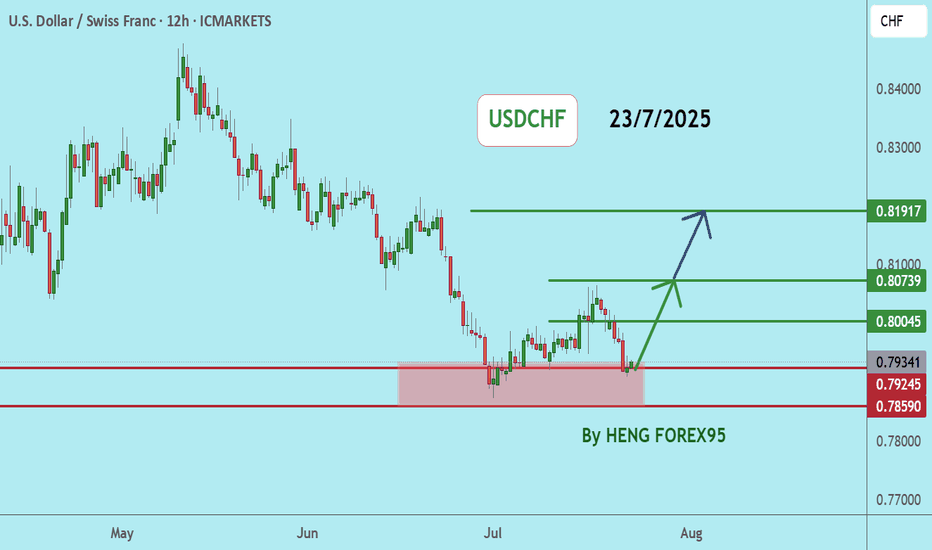

Target Locked: USDCHF Buy Trade with High ConvictionHey Guys,

I'm planning a buy trade on USDCHF from the pullback zone between 0.80028 and 0.80625. My target level is 0.83390.

I'm quite optimistic about this setup. But remember—forex markets do what they want; we simply make educated guesses.

That’s why risk management is key. Protect your capital.

And one more thing: every single like from you is my biggest motivation to keep sharing analysis. Huge thanks to everyone supporting me!

USOILUSOIL price is now testing the support zone of 64.72-63.88. If the price cannot break through the 63.88 level, it is expected that the price will rebound. Consider buying in the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

USD increased slightly and JPY decreased deeplyThe world USD price increased slightly. The USD-Index reached 98.79 points, 0.08 points higher than yesterday. According to CNBC, the USD increased in value compared to most currencies as the market focused on President Donald Trump's personnel nomination for the US Federal Reserve (Fed). Yesterday, President Donald Trump said he would soon announce decisions on replacing Governor Adriana Kugler, who resigned last Friday, including choosing the next Fed chair. Fed Chair Jerome Powell's term will end in May 2026.

Yesterday's report from the Institute for Supply Management said that the US non-manufacturing purchasing managers' index (PMI) in July fell to 50.1 from 50.8 in June. Economists polled by Reuters had forecast the services PMI would increase to 51.5. A PMI reading above 50 indicates growth in the services sector, which accounts for more than two-thirds of the economy. Investors are pricing in a high probability that the Fed will cut interest rates at its September meeting. Investment bank Goldman Sachs expects the Fed to deliver three consecutive 0.25% rate cuts starting in September...

Market Analysis: EUR/GBP Loses MomentumMarket Analysis: EUR/GBP Loses Momentum

EUR/GBP is consolidating and might aim for a fresh increase above 0.8700.

Important Takeaways for EUR/GBP Analysis Today

- EUR/GBP is trading in a positive zone above the 0.8665 pivot level.

- There is a short-term declining channel forming with resistance near 0.8705 on the hourly chart.

EUR/GBP Technical Analysis

On the hourly chart of EUR/GBP, the pair started a consolidation phase after it failed to surpass 0.8730. The Euro traded below the 0.8710 and 0.8700 support levels against the British Pound.

The EUR/GBP chart suggests that the pair even declined below the 23.6% Fib retracement level of the upward move from the 0.8605 swing low to the 0.8729 high. It is now consolidating losses and trading below the 50-hour simple moving average.

The pair is now facing resistance near the 0.8705 level. There is also a short-term declining channel forming with resistance near 0.8705.

The next major resistance could be 0.8730. The main resistance is near the 0.8750 zone. A close above the 0.8750 level might accelerate gains. In the stated case, the bulls may perhaps aim for a test of 0.8780. Any more gains might send the pair toward the 0.8800 level.

Immediate support sits near 0.8680. The next major support is near 0.8665 or the 50% Fib retracement level of the upward move from the 0.8605 swing low to the 0.8729 high.

A downside break below 0.8665 might call for more downsides. In the stated case, the pair could drop toward 0.8635.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USD may weaken in the futureExperts say the USD is still under pressure after the US economy announced a "shocking" non-farm payrolls report for July and revised the May and June figures down sharply compared to forecasts and previous figures.

Experts say the rapidly weakening job market is fueling speculation that the US Federal Reserve (Fed) will soon cut interest rates in September.

However, in the last session, the USD basically stopped falling sharply, when data on the US service and aggregate purchasing managers' indexes increased quite well in July. This has helped the USD not to fall too much.

The USD is expected to remain volatile when the US announces weekly employment on Thursday. Next week is the July consumer price index (CPI). This is an important indicator for the Fed to make a decision on interest rate policy at its meeting in September. This index will strongly affect the trend of the USD.

gold trading strategy for todayThe price is 3,400 USD/ounce. The main reason is believed to be due to the weaker-than-expected US labor market, increasing the possibility of the US Federal Reserve (FED) cutting interest rates, thereby promoting the increase of this precious metal as investors seek gold as a safe haven.

Some analysts note that, since reaching a historical peak of 3,500 USD on April 22, 2025, the gold price has fluctuated in a narrow range from 3,180 to 3,400 USD/ounce. Based on macro assumptions, analysts predict that the gold price may reach 3,850 USD/ounce in the second quarter of 2026 and the current period is like "compressing the spring" - preparing for a strong increase in gold prices in the near future.

Meanwhile, Citigroup (a US multinational financial group) has just raised its forecast for world gold prices to $3,500/ounce in the next 3 months, $3,300/ounce for 6-2025, $3,300 - $3,600/ounce. The main reasons include concerns about US economic growth, high inflation due to US President Donald Trump's tariff policy and a weakening USD.

Gold Price Setup – Potential Rejection & Long ScenariosPrice is currently consolidating below the H4 Supply Zone after rejecting the ascending trendline twice.

Two key scenarios are in focus:

✅ Scenario 1 – Deeper Pullback to Demand Zone

A retracement into the 1H + 30M Order Block (OB) and liquidity zone near 3,341–3,355 (marked with $$$) could attract buyers.

If bullish momentum confirms, look for a continuation toward 3,388 and possibly the upper trendline near 3,400+.

✅ Scenario 2 – Immediate Push Higher

If price holds above the moving average and fails to break below 3,355, bulls could step in earlier, driving price back to test the trendline resistance.

Breakout of the trendline could target the higher supply region.

🔍 Key Levels to Watch:

H4 Supply Zone (3,440 area) for potential reversal.

3,341 OB Zone for liquidity sweep and reaction.

Trendline Resistance capping the upside.

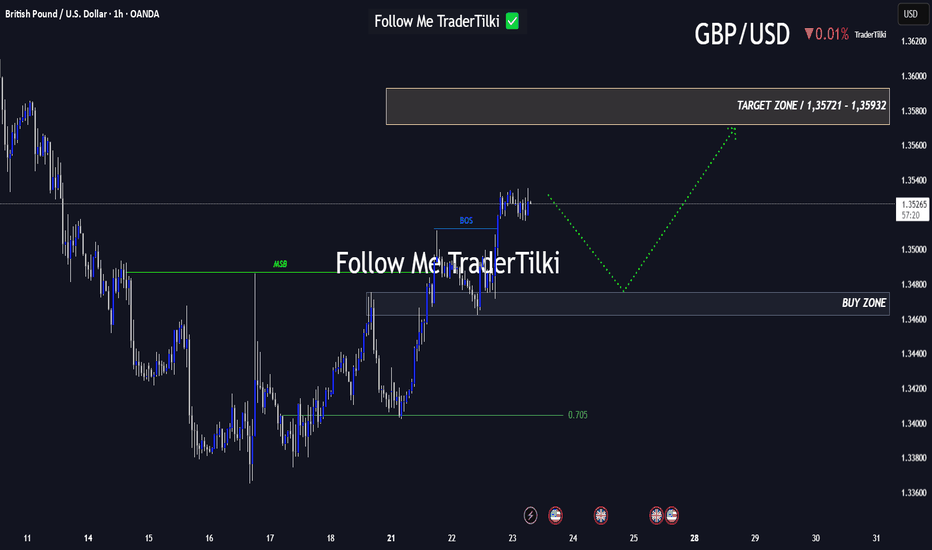

Every Like Is a Boost: This GBPUSD Analysis Is Just for You!Good morning, friends 🌞

Due to the recent shift in GBPUSD’s market structure, I plan to enter a buy position when price reaches the 1.34753 – 1.34623 range.

Target levels: 1.35721 and 1.35932 📈

Every like you send fuels my motivation to share fresh analyses. Thank you to everyone who’s supporting this journey ❤️

AUDUSD BUY

AUD/USD rises to near 0.6480 as accelerating Fed dovish bets weigh on US Dollar

The AUD/USD pair moves higher to near 0.6480 during the European trading session on Monday. The Aussie pair gains as demand for risk-perceived assets has increased, following an increase in market expectations that the Fed could resume its monetary expansion cycle in the September meeting

The AUD/USD currency pair, commonly known as the “Aussie”, represents how many US dollars (the quote currency) are needed to purchase one Australian dollar (the base currency). Alongside the New Zealand Dollar (NZD) and the Canadian Dollar (CAD), the AUD is considered a commodity currency due to Australia’s significant exports of raw materials such as precious metals, Oil, and agricultural products.

The Reserve Bank of Australia (RBA) has historically maintained higher interest rates compared to other industrialized nations. Combined with the relatively high liquidity of the AUD, this has made the AUD attractive for carry traders looking for higher yields.

SUPPORT 0.64852

SUPPORT 0.65074

SUPPORT 0.65285

RESISTANCE 0.64498

GBPUSD SELLGBP/USD holds steady above 1.3250 as investors brace for US ISM Services PMI release

The GBP/USD pair trades on a flat note near 1.3280 during the Asian trading hours on Tuesday. Nonetheless, rising odds of Federal Reserve rate cuts could weigh on the US Dollar against the Cable. Investors will keep an eye on the US ISM Services Purchasing Managers Index data, which is due later on Tuesday.

The broad-based selling pressure surrounding the US Dollar (USD) helped GBP/USD gain traction and allowed the pair to snap a six-day losing streak.

The monthly data published by the US Bureau of Labor Statistics (BLS) showed that Nonfarm Payrolls (NFP) rose by 73,000 in July, missing analysts' estimate of 110,000, while the Unemployment Rate edged higher to 4.2% from 4.1%, as expected. More importantly, the BLS announced that it revised down May and June NFP increases, noting that NFP growth in this two-month period combined was 258,000 lower than previously reported.

The probability of a 25 basis points Federal Reserve (Fed) rate cut in September jumped above 70% from about 30% before the data, as per CME FedWatch Tool. In turn, the USD weakened sharply against its peers.

The economic calendar will not feature any high-tier macroeconomic data releases on Monday. Later in the week, the Bank of England (BoE) will announce monetary policy decisions.

In the meantime, market participants will keep a close eye on US politics. Following the dismal employment report, US President Donald Trump fired BLS Chief Erika McEntarfer, accusing her of manipulating the numbers for political purposes. Additionally, Fed Governor Adriana Kugler, whose term was scheduled to end on January 31, 2026, announced her resignation.

Investors could opt to stay away from the USD in case political developments feed into concerns over the Fed or the BLS losing independence.

SUPPORT 1.32382

SUPPORT 1.31758

SUPPORT 1.32382

RESISTANCE 1.33086

RESISTANCE 1.33375

MarketBreakdown | EURCHF, WTI CRUDE OIL, GBPNZD, DXY

Here are the updates & outlook for multiple instruments in my watch list.

1️⃣ #EURCHF daily time frame 🇪🇺🇨🇭

The market is testing a strong supply area

based on a solid falling trend line and a horizontal resistance.

Probabilities will be high that the price will retrace from that.

2️⃣ CRUDE OIL #WTI daily time frame 🛢️

The price is very close to a significant demand zone

based on a horizontal support cluster and a rising trend line.

I will expect a bullish reaction to that.

3️⃣ #GBPJPY daily time frame 🇬🇧🇳🇿

The market is trading within a contracting triangle.

The price nicely respected its support line and goes up steadily.

I think that bullish momentum will remain strong and the market

will go up to the resistance line of a triangle.

4️⃣ DOLLAR INDEX #DXY daily time frame 💵

The market is consolidating on a key daily support cluster.

Probabilities will be high that the price will bounce from that.

Today's fundamental news can be a trigger.

Do you agree with my market breakdown?

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold Trend Analysis August 7, 2025Market Overview

- Gold prices rose slightly in the first trading session of the week due to geopolitical concerns in the Middle East and weak US employment data

- However, selling pressure returned in the early morning today as the USD recovered and US bond yields rose slightly again

- The market is waiting for the speech of the Fed officials later today, which is expected to be hawkish

Factors that pressured gold down

- DXY index rose again, putting pressure on gold prices, which are priced in USD

- US 10-year bond yields increased

- FED said it was not in a hurry to cut interest rates

- Money flows shifted to stocks

gold price forecast today short term increase forecastmarket overview

Gold prices had a correction around 2325 yesterday, after recovering from a low of 2,290 USD. In the context of investors expecting the Fed to cut interest rates soon, gold is being strongly supported by the prospect of loose monetary policy and the weak USD.

Factors supporting gold prices

Weaker-than-expected US labor data

The non-farm payrolls report released on Friday showed the number of new jobs reaching only 142,000 - much lower than the expected level of 180,000. This increased expectations that the Fed will cut interest rates as early as September, strongly supporting gold prices

GOLD (XAUUSD) - Potential Bullish Reversal from Demand ZonePrice is currently trading around the 3,368–3,370 area after a steady decline. I’m watching two key zones for a potential reaction:

✅ Demand Zone (15M + 5M OB) – This confluence zone sits near 3,360–3,364. If price taps into this area and shows bullish rejection, I expect a bounce in line with the 1H Trendline support.

📈 Scenario:

A liquidity sweep into the 15M/5M Order Block zone followed by a bullish reaction.

Continuation to the upside targeting the 5M and 30M Order Blocks around 3,380.

⚠️ Invalidation:

If price closes strongly below the demand zone, this bullish setup will be invalidated and further downside could follow.

180 Pips Secured on GOLD! | Sniper Strategy in Action📈 Tired of Gold Trades Going Against You? This Sniper Strategy Just Bagged +180 Pips!

Hello Traders,

Struggling with XAUUSD’s volatility?

Taking small wins but suffering big losses?

You’re not alone — and we’ve built something just for you.

🔥 Introducing GOLD SNIPER — a high-probability strategy engineered for serious Gold traders.

With a consistent 1:2 risk-reward and precision entry logic, it’s designed to help you ride big moves and avoid common traps in XAUUSD.

🚀 Today’s Live Trade Recap:

Signal 1

🟢 Buy @ 3355.91

🔴 SL @ 3349.91

🟢 TP @ 3367.91

✅ Result: +120 Pips

Signal 2

🟢 Buy @ 3368.32

🔴 SL @ 3362.32

🟢 TP @ 3380.32

❌ Result: -60 Pips

Signal 3

🟢 Buy @ 3373.29

🔴 SL @ 3367.29

🟢 TP @ 3385.29

✅ Result: +120 Pips

📊 Total Profit Today: +180 Pips

✅ What Makes Gold Sniper So Effective?

✔️ Catches real momentum, not noise

✔️ Keeps entries & exits disciplined and mechanical

✔️ Aims for high-reward trades, not scalp scraps

🎯 Want better entries and more consistent wins on XAUUSD?

📩 DM us now to get instant access and start using Gold Sniper on your TradingView chart.

If this helped you, like the idea and drop a comment — let’s grow together!

Happy Trading,

InvestPro India

EURUSD SELLEUR/USD appears offered around 1.1550

After failing to break above the 1.1600 barrier, EUR/USD is currently under renewed selling pressure and is testing the mid-1.1500s again on Monday. The US Dollar, on the other hand, rises slightly across the board as investors absorb Friday's big drop after the US employment data and turn their focus to trade.

The daily chart for the EUR/USD pair shows the pair met buyers just ahead of a bullish 100 Simple Moving Average (SMA) currently at around 1.1370. A flat 20 SMA, in the meantime, provides resistance at around 1.1640, the level to overcome to turn bullish. Finally, technical indicators corrected oversold conditions, but lost their upward strength just below their midlines, suggesting buyers are still on the sidelines.

In the 4-hour chart, the EUR/USD pair is range-bound, although there are no signs of a potential slide. The 20 SMA lost its bearish strength and turned flat in the 1.1480 area, while technical indicators remain directionless well above their midlines. The pair flirted with the 1.1600 level during Asian trading hours, with gains beyond the level turning the risk towards the upside in the near term.

SUPPORT 1.15387

SUPPORT 1.14950

SUPPORT 1.14520

RESISTANCE 1.16032

RESISTANCE 1.15832

XAUUSDHello Traders! 👋

What are your thoughts on GOLD?

Gold saw a strong rally on Friday following the U.S. Non-Farm Payrolls (NFP) report and is now trading near a key resistance zone.

At this resistance, a short-term pullback is likely as traders lock in profits.

We expect the correction to be contained within key support levels, and if price holds in that zone, the uptrend is likely to resume, targeting new highs.

Will gold resume its rally after the correction? Share your view below! 👇

Don’t forget to like and share your thoughts in the comments! ❤️

USDCHFUSDCHF price is near the main support zone 0.79245-0.78590. If the price cannot break through the 0.78590 level, it is expected that the price will rebound. Consider buying the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

GBPJPYGBPJPY price is near the main resistance zone 200.168. If the price cannot break through the 200.186 level, it is expected that the price will go down. Consider selling the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

XAUUSDUpdate:

Gold Price Trend: As per our previous analysis on July 28, 2025, the price has now tested the support at 3,269. We expect that if the gold price can hold above 3,249, the gold price trend will remain bullish. We recommend considering buying in the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!