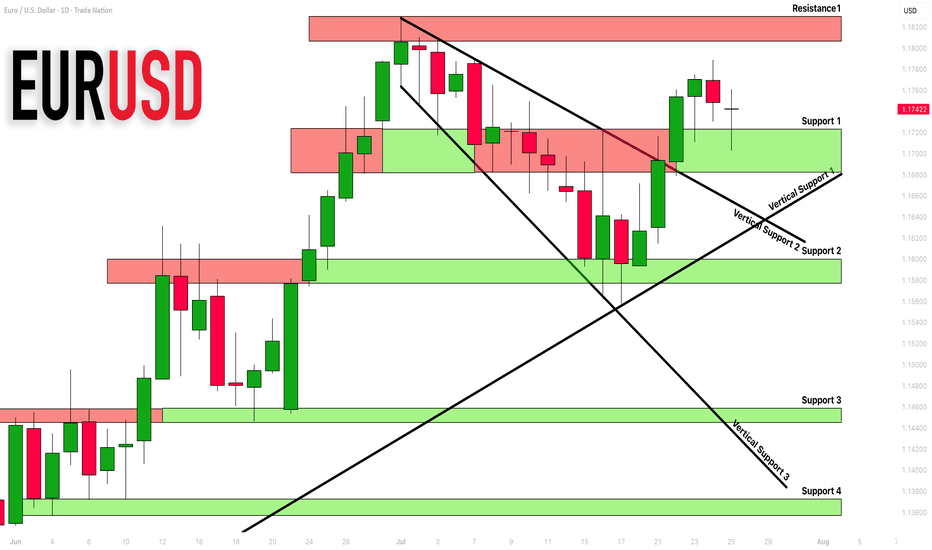

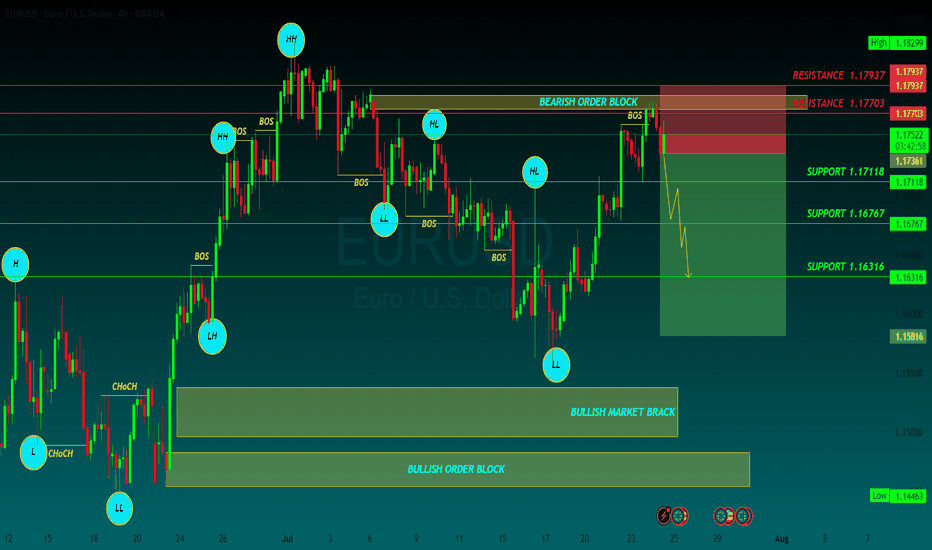

EURUSD: Detailed Support Resistance Analysis For Next Week

Here is my latest support & resistance analysis for EURUSD

for next week.

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Forextrading

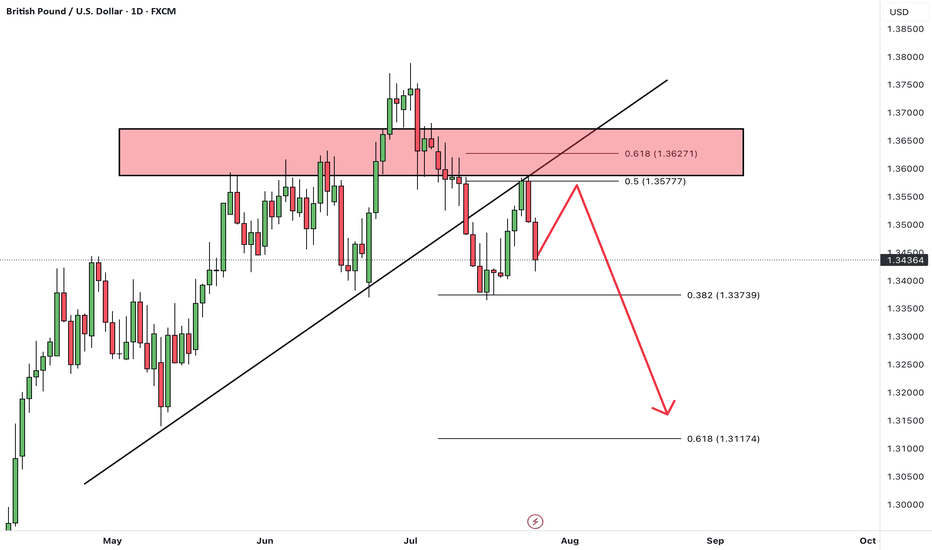

GBPUSDHello Traders! 👋

What are your thoughts on GBPUSD?

GBP/USD has broken below a trendline and has completed a retest (pullback) to the broken level.

The pair is now positioned for a potential downward move.

After some short-term consolidation, we expect price to drop at least toward the next identified support level.

As long as GBP/USD stays below the broken trendline, the bearish bias remains valid, and further downside is likely.

Don’t forget to like and share your thoughts in the comments! ❤️

USDCAD SELLUSD/CAD rallies to 1.3680 as the market focuses on a hawkish Fed

The US Dollar extends its recovery for the second consecutive day, supported by strong US data. Upbeat US business activity and Jobless Claims support the Fed's "wait and see" rhetoric. In Canada, the weak Retail Sales data keep hopes for a BoC rate cut alive.

The year will be politically marked by Trump’s return to the White House. A Republican government is seen as positive for financial markets, but Trump’s pledge to cut taxes and impose tariffs on foreign goods and services may introduce uncertainty to both the political and economic landscape.

Canada’s political crisis peaked in late 2024 with a no-confidence vote against Prime Minister Justin Trudeau, leading to snap elections and a weakened Liberal minority government. Policy uncertainty and economic challenges dominate 2025’s outlook, raising concerns over market stability and investor confidence.

The BoC is set to continue easing interest rates through 2025, at least at a faster pace than the Fed is expected to, which could apply pressure on CAD’s already-rising rate differential.

SUPPORT 1.36991

SUPPORT 1.36739

SUPPORT 1.36495

RESISTANCE 1.37346

RESISTANCE 1.37455

GBPUSD BUYGBP/USD drops to 1.3450 area after weak UK Retail Sales data

GBP/USD continues to push lower after closing in negative territory on Thursday and trades near 1.3450 on Friday. Weaker-than-expected Retail Sales data from the UK and the broad-based US Dollar strength forces the pair to stay on the back foot heading into the weekend

GBP/USD came under bearish pressure on Thursday and lost more than 0.5%, snapping a three-day winning streak in the process. The pair extends its slide on Friday and trades below 1.3500.

The renewed US Dollar (USD) strength weighed on GBP/USD on Thursday. The US Department of Labor reported that the number of first-time applications for unemployment benefits declined to 217,000 in the week ending July 19 from 221,000 in the previous week. This reading came in better than the market expectation of 227,000. Additionally, the S&P Global Composite Purchasing Managers Index (PMI) improved to 54.6 (preliminary) in July from 52.9 in June, reflecting an ongoing expansion in the private sector's business activity, at an accelerating pace.

Meanwhile, the EUR/GBP cross rose more than 0.3% on Thursday as the Euro benefited from the European Central Bank's (ECB) cautious tone on policy-easing. EUR/GBP preserves its bullish momentum and trades at its highest level since early April above 0.8700 on Friday, suggesting that the Euro continues to capture capital outflows out of Pound Sterling.

Early Friday, the UK's Office for National Statistics reported that Retail Sales rose by 0.9% on a monthly basis in June. This reading followed the 2.8% decrease recorded in May but came in worse than the market expectation for an increase of 1.2%, making it difficult for GBP/USD to stage a rebound.

In the second half of the day, Durable Goods Orders data for June will be the only data featured in the US economic calendar. Nevertheless, this data is unlikely to have a long-lasting impact on the USD's valuation.

SUPPORT 1.34550

SUPPORT 1.34982

SUPPORT 1.35421

RESISTANCE 1.33990

RESISTANCE 1.33698

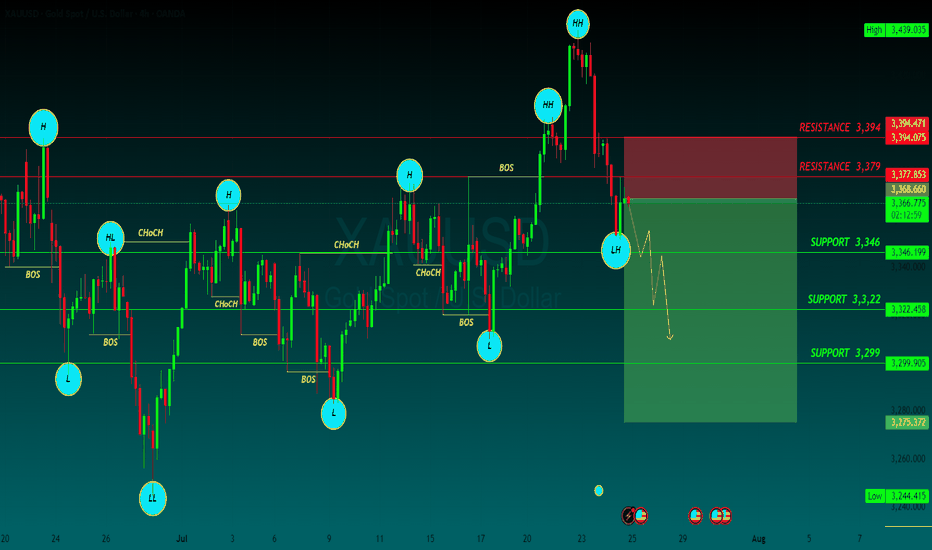

GOLD SELLGold price bears retain control amid fading safe-haven demand, rebounding USD

US President Donald Trump announced late Tuesday that his administration had reached a trade deal with Japan. Furthermore, reports that the US and the European Union are heading towards a 15% trade deal boost investors' confidence and weigh on the safe-haven Gold price for the second straight day on Thursday.

The markets do not expect an interest rate cut from the US Federal Reserve in July despite Trump's continuous push for lower borrowing costs. In fact, Trump has been attacking Fed Chair Jerome Powell personally over his stance on holding rates and repeatedly calling for the central bank chief's resignation.

Moreover, Fed Governor Chris Waller and Trump appointee Vice Chair for Supervision Michelle Bowman have advocated a rate reduction as soon as the next policy meeting on July 30. This keeps the US Dollar depressed near a two-and-a-half-week low and could offer some support to the non-yielding yellow metal.

Traders now look forward to the release of flash PMIs, which would provide a fresh insight into the global economic health and influence the safe-haven commodity. Apart from this, the crucial European Central Bank policy decision might infuse some volatility in the markets and drive the XAU/USD pair.

Meanwhile, the US economic docket features Weekly Initial Jobless Claims and New Home Sales data, which, in turn, would drive the USD and contribute to producing short-term trading opportunities around the commodity. Nevertheless, the fundamental backdrop warrants caution for aggressive traders.

SUPPORT 3,346

SUPPORT 3,322

SUPPORT 3,399

RESISTANCE 3,394

RESISTANCE 3,379

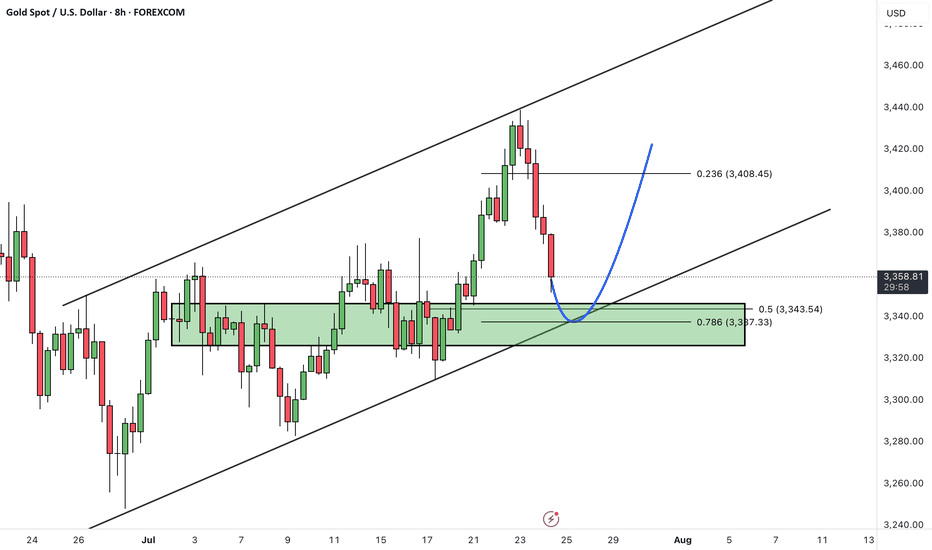

XAUUSDHello Traders! 👋

What are your thoughts on GOLD?

Gold entered a corrective phase after reaching the top of its ascending channel. Price is now approaching the channel bottom, which coincides with a key support zone.

As long as the channel support holds, we expect a bullish reaction from this area, potentially driving price back toward the next target level.

The uptrend remains valid as long as price does not break and close below the lower boundary of the channel.

A rebound from channel support may signal the start of the next upward leg.

Invalidation occurs only if price breaks and holds below the channel.

💡 Will gold bounce from channel support and resume its rally? Share your view in the comments! 🤔👇

Don’t forget to like and share your thoughts in the comments! ❤️

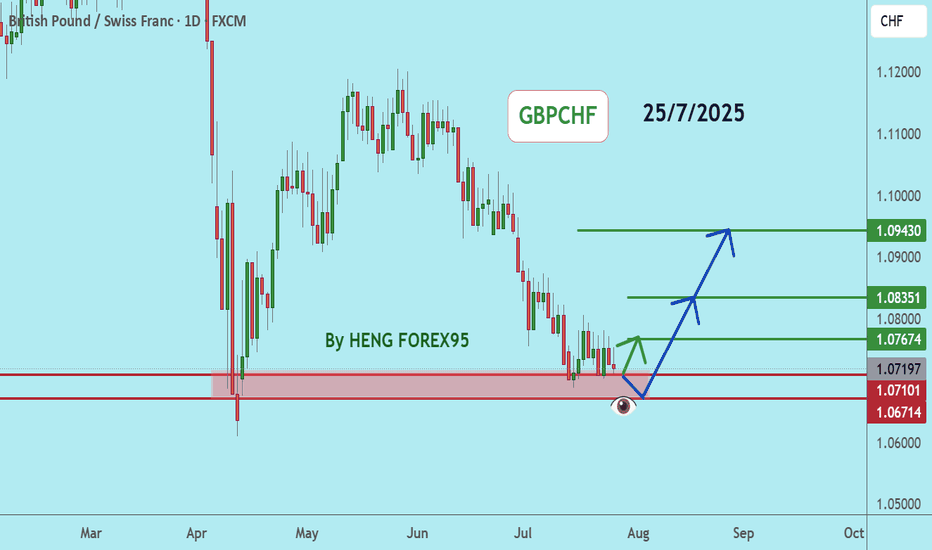

GBPCHFGBPCHF price is near the main support zone 1.07101-1.06714. If the price cannot break through the 1.06714 level, it is expected that the price will rebound. Consider buying the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

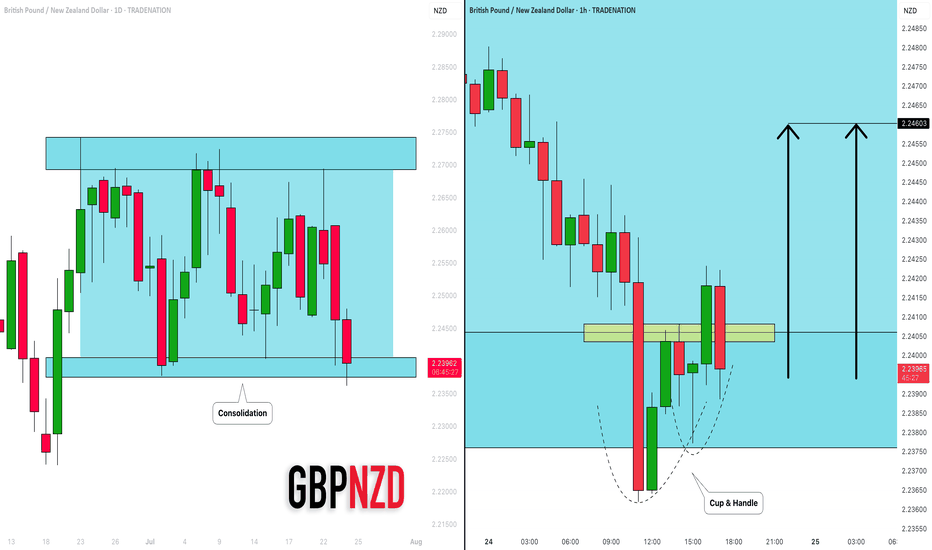

GBPNZD: Bullish Move in a Channel 🇬🇧🇳🇿

I see a horizontal parallel channel on GBPNZD on a daily.

The price is currently testing its support.

On an hourly time frame, a cup & handle pattern was formed on that.

Its neckline was violated with the today's high impact news.

I think that the price may bounce at least to 2.246 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURUSD SELLEUR/USD stays defensive below 1.1800 ahead of ECB decision

EUR/USD remains in a bullish consolidation mode below 1.1800 in European trading on Thursday. Traders refrain from placing fresh bets ahead of the European Central Bank policy announcements and the US preliminary PMI data. Mixed PMI data from Germany and the Eurozone failed to trigger a noticeable reaction.

The EUR/USD pair retreated from a fresh two-week peak at 1.1781 posted during Asian trading hours, hovering around 1.1750 ahead of the European Central Bank (ECB) monetary policy announcement. The US Dollar (USD) edged lower on the back of risk appetite, amid headlines indicating a trade deal between Japan and the United States (US).

US President Donald Trump announced in a post on social media a trade deal with Japan that sets "reciprocal" tariffs at 15% on Tuesday, while Japanese Prime Minister Shigeru Ishiba acknowledged the trade agreement on Wednesday, saying it would benefit both sides. Trump shifted his attention to the European Union (EU), noting that if the Union agrees to open up to US businesses, he will then charge lower levies.

Meanwhile, the Hamburg Commercial Bank (HCOB) published the preliminary estimates of the July Purchasing Managers’ Indexes (PMIs). European growth stands at its highest in almost a year according to the surveys, as the Composite PMI rose to 51.0 in July from 50.6 in Jun,e while beating expectations of 50.8.

As for the ECB, the central bank announced its decision to keep the benchmark rates on hold, as widely anticipated. The interest rate on the main refinancing operations, the interest rates on the marginal lending facility and the deposit facility stood at 2.15%, 2.4% and 2%, respectively. The headline had no impact on EUR/USD, which kept trading at around 1.1750.

Right afterwards, the US released Initial Jobless Claims for the week ended July 19, which improved to 217K from the 221K previously posted and the 227K anticipated. Coming up next is ECB President Christine Lagarde's press conference, and the US S&P Global preliminary July PMIs.

SUPPORT 1.17118

SUPPORT 1.16767

SUPPORT 1.16316

RESISTANCE 1.17937

RESISTANCE 1.17703

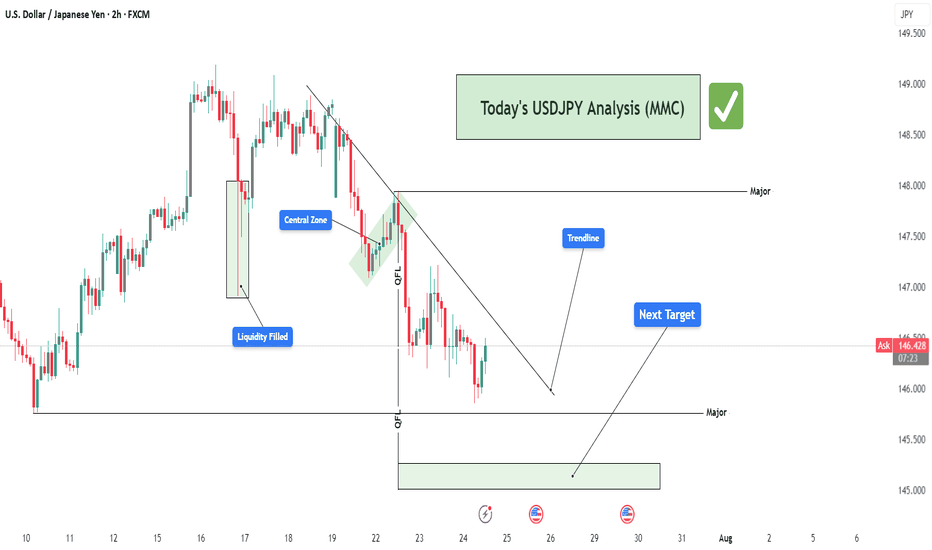

USDJPY Structure Analysis – Liquidity Filled, Rejection + Target🧠 Overview:

This 2-hour chart of USDJPY highlights a clear bearish structure following a smart money-driven move. The price action reflects market maker behavior, liquidity manipulation, trendline rejections, and strategic zone targeting. Let's break down the key elements for today’s USDJPY analysis.

🔍 Key Technical Breakdown:

1. 🏦 Liquidity Grab & Fill (July 17th)

The marked green zone shows an aggressive liquidity sweep where the price dipped sharply into a previous demand zone, triggering stop losses and collecting institutional orders.

This movement represents a classic "liquidity fill", often engineered by market makers to trap retail buyers/sellers.

After sweeping liquidity, price quickly reversed upwards — a signal that large buy orders were triggered and filled.

2. 🎯 Central Zone as a Distribution Region

The market retraced to the "Central Zone", highlighted on the chart, which acted as a distribution area:

Price consolidated and created indecision before rejecting sharply again.

This zone reflects a short-term supply where institutional players may have offloaded positions.

Key clue: This consolidation occurred below the major trendline, increasing its strength as resistance.

3. 🔻 QFL Zones (Quasimodo Failure Levels)

Two QFL levels are marked, which denote structure breaks and retracements in MMC/SMC strategy:

First QFL marks a major support break – a signal of shifting market sentiment from bullish to bearish.

Second QFL confirms continued lower lows formation – solidifying bearish market structure.

These levels are critical in identifying market intent and anticipating future moves.

4. 📉 Descending Trendline Rejection

The descending trendline drawn from recent highs is being respected continuously:

Price tested the trendline multiple times but failed to break above.

These rejections represent seller dominance and validate the trendline as a dynamic resistance.

A break above this line would invalidate the current bearish structure.

5. 🎯 Next Target – Major Demand Zone (145.00–145.20)

Price is heading toward a major demand zone marked in green around 145.000:

This area is a strong buy-side liquidity zone, where institutional buyers may show interest again.

If this zone is tapped, we may see either:

A bounce (bullish reaction), or

A breakdown and continuation lower if bearish momentum continues.

Traders should monitor this area closely for price action signals (engulfing candles, rejection wicks, or bullish divergence).

🧠 Strategic View:

Bias: Bearish, unless trendline breaks with strong volume.

Ideal Entry: Look for short entries on lower timeframe pullbacks into minor resistance (like trendline or last supply zone).

Target Area: 145.00 – ideal zone to book profits or switch bias.

Invalidation: A break and close above the descending trendline + central zone.

🔑 Confluences in This Analysis:

Concept Details

✅ Liquidity Grab Trap & Fill strategy at prior lows

✅ Central Zone Bearish distribution and rejection

✅ Trendline Repeated resistance rejections

✅ Structure Lower lows and QFL confirmations

✅ Target Area Clear next demand zone identified

⚠️ Risk Note:

As always, wait for confirmation before entering trades. The market may fake out near zones. Use proper risk management (1-2% risk per trade) and adjust your strategy as new candles form.

📌 Conclusion:

This chart paints a textbook scenario of how institutional movements and structure-based analysis (MMC/SMC) can offer high-probability setups. We expect further downside toward the 145.00 region before any significant reversal. Keep an eye on reaction from this demand zone for the next play.

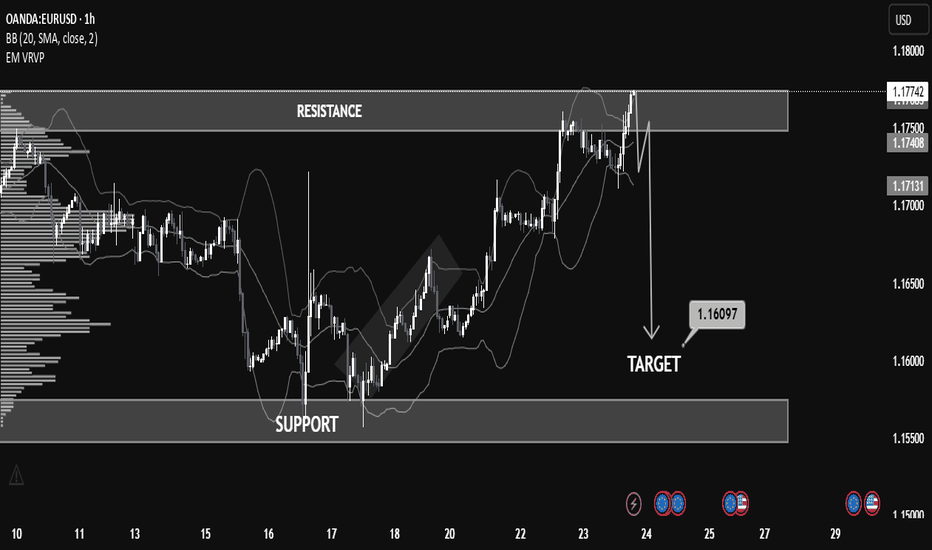

Educational EUR/USD Chart Breakdown – Price Action at Key LevelsEducational EUR/USD Chart Breakdown – Price Action at Key Levels

This EUR/USD (1-hour) chart provides a great example of how support and resistance zones, combined with price action and indicators like Bollinger Bands, can help anticipate market moves.

🔹 Resistance Zone Tested:

The pair recently approached the 1.17500–1.17800 resistance zone. This level had previously acted as a supply zone, and price once again showed rejection here, indicating selling pressure.

🔹 Bollinger Band Overextension:

Notice how the price extended beyond the upper Bollinger Band—this often signals that the market is overbought in the short term, leading to a potential reversal or correction.

🔹 Bearish Reaction & Target:

After rejection from resistance, the chart outlines a bearish move with a target at 1.16097. This level lies just above the next strong support zone (1.15500–1.16100), offering a realistic area for price to stabilize if the downtrend continues.

🔹 What to Learn:

Support & Resistance: Prices often react at key zones; previous resistance can turn into support and vice versa.

Confluence Tools: Use indicators like Bollinger Bands with price structure to increase confidence.

Target Planning: Identify likely reaction zones for risk management and profit-taking.

📚 Summary

This setup is a clean example of trading within a range and using technical confluence to plan entries and exits. If price breaks below 1.17130 with strong momentum, the probability increases for the market to reach the 1.16097 target.

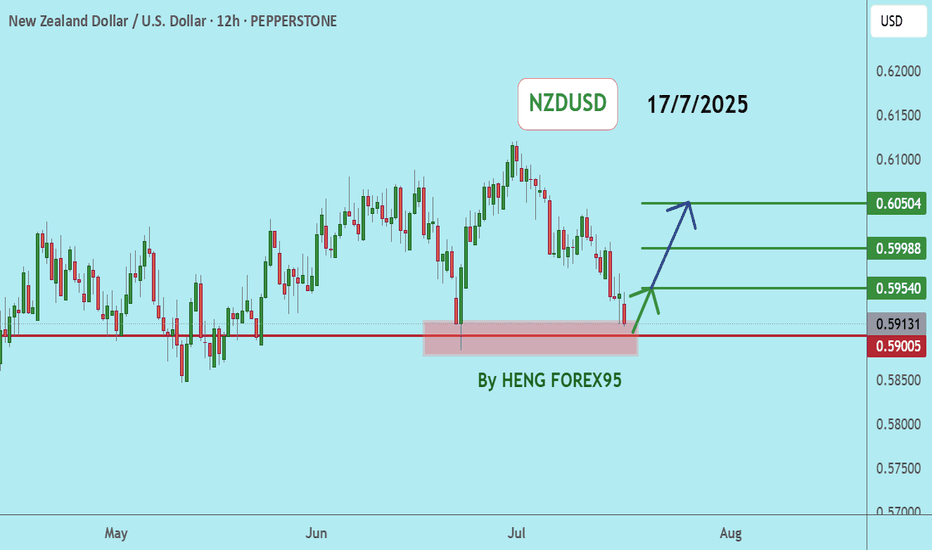

NZDUSDNZDUSD price is near the support zone 0.59197-0.58790. If the price cannot break through the 0.58790 level, it is expected that the price will rebound. Consider buying the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

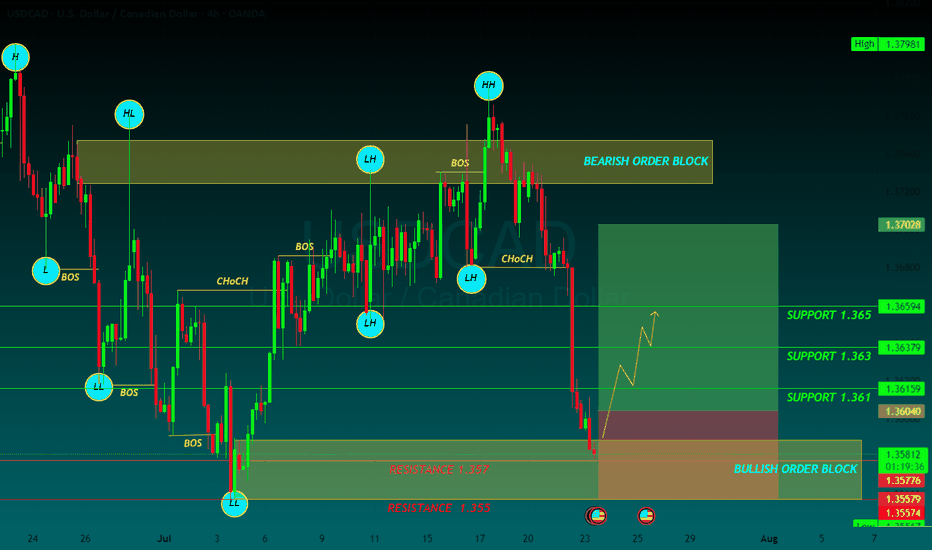

USDCAD BUYUSD/CAD returns below 1.3600, with YTD lows, at 1.3540 coming into view

The US Dollar extends its decline for the fourth consecutive day, with the Canadian Dollar supported by a brighter market mood, as the trade deal between the US and Japan provided some certainty about the outlook of global trade and boosted hopes of more such deals.

In the USD/CAD 2025 Forecast, FXStreet analyst Joshua Gibson suggests uncertainty and risk-off sentiment could strengthen the US Dollar (USD) early in 2025, while the Canadian Dollar (CAD) is expected to weaken in the first quarter. However, CAD investors may reassess prospects as the year progresses, focusing on the Federal Reserve (Fed) - Bank of Canada (BoC) policy dynamics.

From a technical point of view, USD/CAD could face a technical ceiling near the 1.4400 level after the Canadian Dollar's sharp 8.5% decline in 2024 sent the pair to 56-month highs. However, technical indicators like the MACD suggest caution, as short positions may only become viable once clear sell signals emerge, likely during the first quarter.

SUPPORT 1.361

SUPPORT 1.353

SUPPORT 1.361

RESISTANCE 1.357

RESISTANCE 1.355

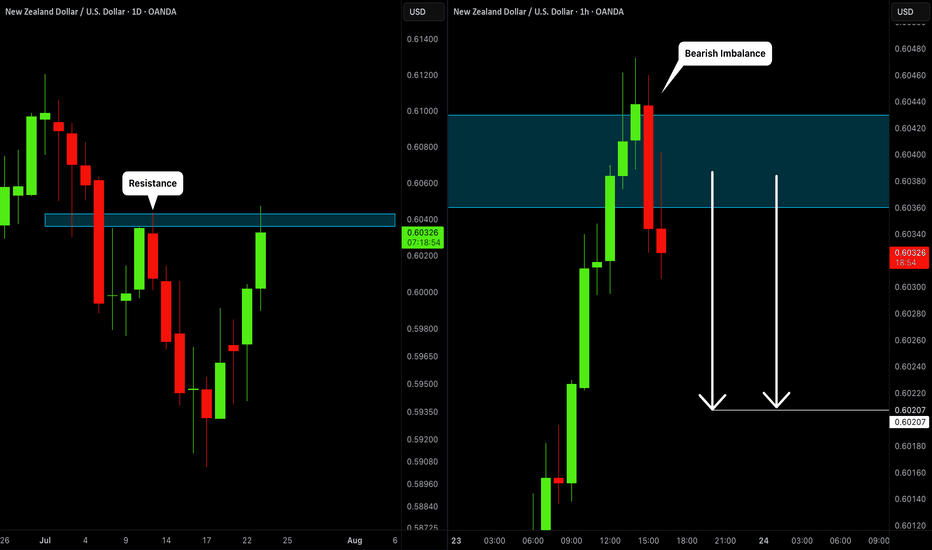

Market Analysis: NZD/USD Climbs as Dollar WeakensMarket Analysis: NZD/USD Climbs as Dollar Weakens

NZD/USD is also rising and might aim for more gains above 0.6000.

Important Takeaways for NZD/USD Analysis Today

- NZD/USD is consolidating gains above the 0.5980 zone.

- There was a break above a major bearish trend line with resistance at 0.5980 on the hourly chart of NZD/USD.

NZD/USD Technical Analysis

On the hourly chart of NZD/USD at FXOpen, the pair started a steady increase from the 0.5910 zone. The New Zealand Dollar broke the 0.5940 resistance to start the recent increase against the US Dollar.

There was a break above a major bearish trend line with resistance at 0.5980. The pair settled above 0.5980 and the 50-hour simple moving average. It tested the 0.6010 zone and is currently consolidating gains.

The NZD/USD chart suggests that the RSI is stable above 60. On the upside, the pair might struggle near 0.6010. The next major resistance is near the 0.6020 level.

A clear move above the 0.6020 level might even push the pair toward the 0.6050 level. Any more gains might clear the path for a move toward the 0.6120 resistance zone in the coming days.

On the downside, immediate support is near the 0.5990 level. It is close to the 23.6% Fib retracement level of the upward move from the 0.5941 swing low to the 0.6008 high.

The first key support is near the 0.5975 level. It is close to the 50% Fib retracement level. The next major support is near the 0.5940 level. If there is a downside break below the 0.5940 support, the pair might slide toward 0.5910. Any more losses could lead NZD/USD in a bearish zone to 0.5850.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Market Analysis: AUD/USD Climbs as Dollar WeakensMarket Analysis: AUD/USD Climbs as Dollar Weakens

AUD/USD started a decent increase above the 0.6520 level.

Important Takeaways for AUD/USD Analysis Today

- The Aussie Dollar rebounded after forming a base above the 0.6450 level against the US Dollar.

- There is a connecting bullish trend line forming with support at 0.6540 on the hourly chart of AUD/USD.

AUD/USD Technical Analysis

On the hourly chart of AUD/USD at FXOpen, the pair started a fresh increase from the 0.6450 support. The Aussie Dollar was able to clear the 0.6500 resistance to move into a positive zone against the US Dollar.

There was a close above the 0.6550 resistance and the 50-hour simple moving average. Finally, the pair tested the 0.6565 zone. A high was formed near 0.6564 and the pair recently started a consolidation phase.

On the downside, initial support is near the 0.6540 level. There is also a connecting bullish trend line forming with support at 0.6540. It is close to the 23.6% Fib retracement level of the upward move from the 0.6454 swing low to the 0.6564 high.

The next major support is near the 0.6495 zone. If there is a downside break below it, the pair could extend its decline toward the 0.6480 level. It is close to the 76.4% Fib retracement level.

Any more losses might signal a move toward 0.6450. On the upside, the AUD/USD chart indicates that the pair is now facing resistance near 0.6565. The first major resistance might be 0.6575. An upside break above the 0.6575 resistance might send the pair further higher.

The next major resistance is near the 0.6600 level. Any more gains could clear the path for a move toward the 0.6650 resistance zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

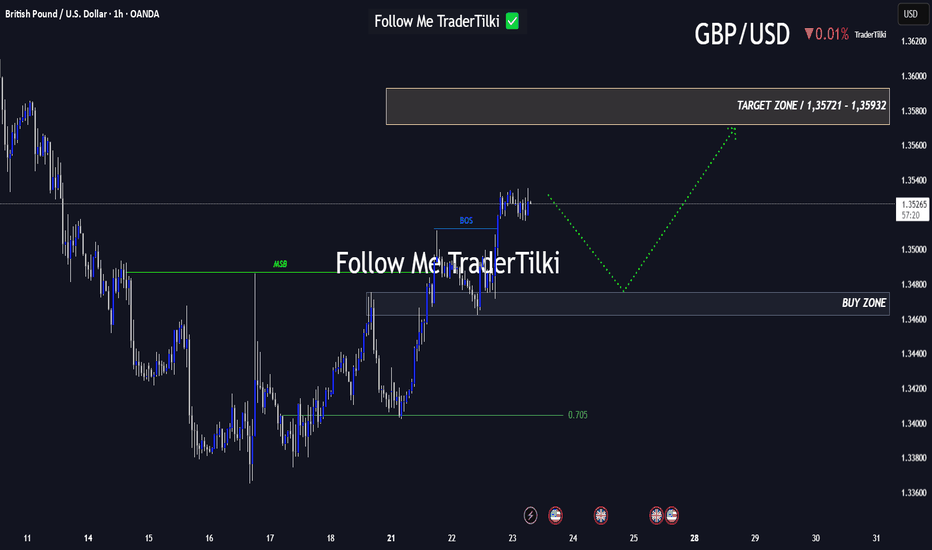

Every Like Is a Boost: This GBPUSD Analysis Is Just for You!Good morning, friends 🌞

Due to the recent shift in GBPUSD’s market structure, I plan to enter a buy position when price reaches the 1.34753 – 1.34623 range.

Target levels: 1.35721 and 1.35932 📈

Every like you send fuels my motivation to share fresh analyses. Thank you to everyone who’s supporting this journey ❤️

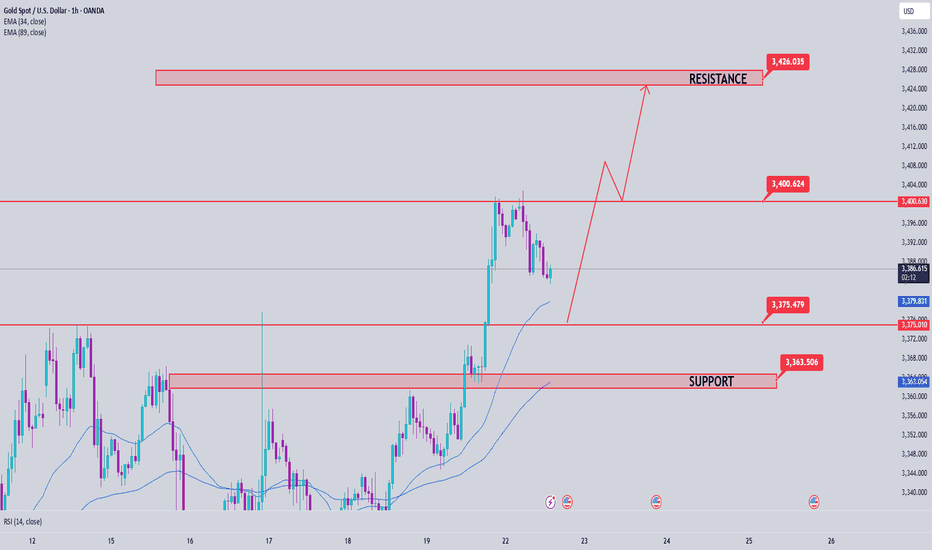

Gold Price Analysis July 22Gold continues to maintain its upward momentum as expected, and yesterday's session reached the target of 3400. This is a signal that the bullish wave structure is still holding. In today's European trading session, the price is likely to make a technical correction to important support zones before continuing the main trend in the US session.

The current trading strategy still prioritizes following the uptrend, focusing on observing price reactions at support zones to find safe entry points. Waiting for buyers to confirm participation is a key factor to avoid FOMO at the wrong time.

🔑 Key Levels

Support: 3375 – 3363

Resistance: 3400 – 3427

✅ Trading Strategy

Buy Trigger #1: Price reacts positively and rejects the support zone at 3375

Buy Trigger #2: Price rebounds strongly from the deeper support zone at 3363

Buy DCA (Moving Average): When price breaks and holds above 3400

🎯 Next Target: 3427

📌 Note: It is necessary to closely monitor price reaction at support zones to determine whether buying power is strong enough. If there is no clear confirmation signal, it is better to stay on the sidelines and observe instead of FOMOing to place orders.

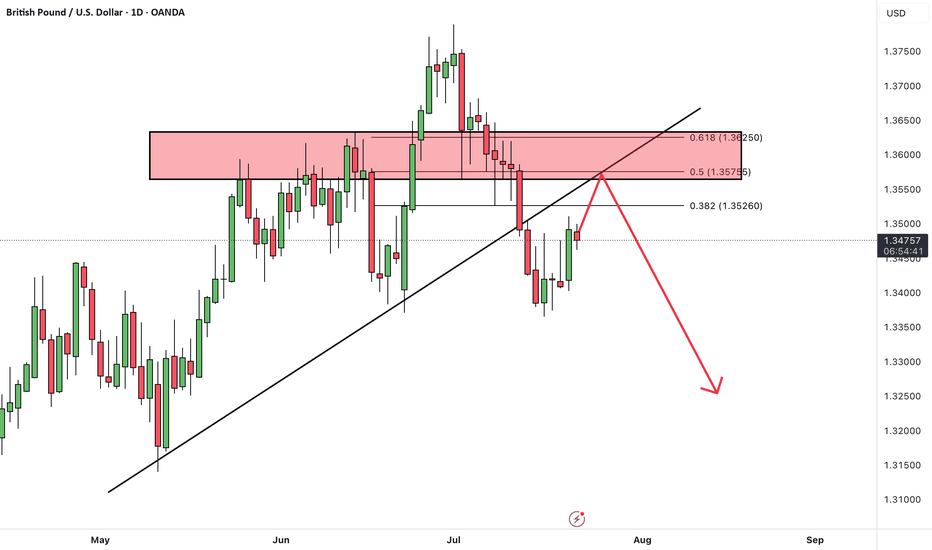

GBPUSDHello Traders! 👋

What are your thoughts on GBPUSD?

GBP/USD has broken support zone and its ascending trendline, indicating a shift in momentum.

The pair is currently in a pullback phase, retesting the broken support zone, which now acts as resistance.

Once the pullback is complete, we expect further downside toward the next identified support level.

As long as the price remains below the broken zone, the bearish outlook remains valid, and rallies may offer sell opportunities.

Don’t forget to like and share your thoughts in the comments! ❤️

GBPJPYGBPJPY price is near the main resistance zone 200.168. If the price cannot break through the 200.186 level, it is expected that the price will go down. Consider selling the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

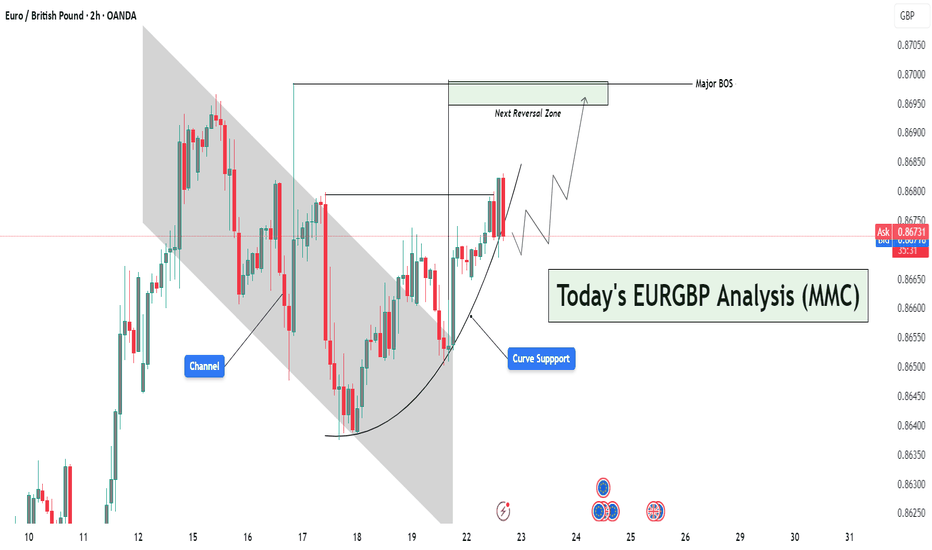

EURGBP Curved Support Breakout – Targeting Reversal Zone🔍 Market Context & Structural Narrative (MMC Style)

The EURGBP pair is currently displaying a textbook MMC structural evolution, transitioning from a bearish trend into a potential bullish leg driven by curve dynamics and trap-break logic.

🔨 Phase 1: Bearish Channel & Trap Formation

The market initially moved within a clearly defined descending channel, which acted as a trap for reactive sellers. Each lower high and lower low within the channel created a perception of sustained bearishness, luring breakout traders and late sellers into short positions.

✅ Key Insight:

This trap zone represents the first step in MMC logic — create a visible structure, generate bias, then prepare for inversion.

🌙 Phase 2: Curve Support – Psychological Accumulation

Around the base of the channel, the market began forming a rounded bottom or curve support. This is a signature MMC accumulation pattern, where market makers gradually absorb sell orders and build long positions without triggering immediate attention.

The curve support has the following implications:

Represents passive accumulation.

Suggests waning bearish pressure.

Builds bullish pressure subtly, often missed by retail traders.

🧠 MMC Mindset Tip:

Curved price action isn't just technical — it's psychological. It represents a controlled shift in sentiment, not an impulsive change, which is what makes it so powerful.

💥 Phase 3: Break of Structure (BOS) – Confirmation of Strength

Price breaks out of both the descending channel and the curved base, leading to a Major Break of Structure (BOS). This BOS is critical, as it confirms the invalidity of the previous bearish narrative and activates a new bullish leg.

📌 This BOS is more than a line — it’s a wall of liquidity getting broken. Price has now closed above key swing highs, which suggests:

Smart money is in control.

Trend shift is validated.

New demand zone created below.

🎯 Projection: The Path to the Next Reversal Zone (NRZ)

Following the breakout, price is projected to:

Possibly retest the breakout level (structure retest) aligned with the curve support — a healthy bullish pullback.

Then move higher towards the Next Reversal Zone (NRZ), which is your defined target area.

📌 NRZ Insight:

This zone is where the market is likely to face:

High liquidity.

Strong previous supply.

Potential profit-taking by early bulls.

Thus, this becomes the make-or-break zone — price either:

Reverses sharply,

Or breaks through and continues the bull rally.

⚠️ Multiple Scenarios Based on MMC Conditions

✅ Scenario 1: Retest & Bounce (Ideal MMC Setup)

Price pulls back to retest the breakout level or the curve support.

Shows bullish confirmation (e.g., pin bar, bullish engulfing).

Targets the NRZ above 0.8700.

❌ Scenario 2: Failed Retest – Fakeout Trap

Price breaks below the curve and structure again.

Suggests that the BOS was a false breakout.

Could re-enter the previous bearish channel structure.

🔄 Scenario 3: Direct Rally Without Retest

Strong momentum buyers push price directly to NRZ.

Wait for reaction at NRZ — could trigger a reversal or continuation depending on price behavior.

🧠 MMC Strategic Takeaways:

Trap → Break → Shift is the psychological framework in play.

The curve is not just support — it's evidence of silent accumulation.

The NRZ isn’t just resistance — it's the battleground where MM logic resolves.

🔐 Trading Insights (Optional Entry Ideas):

Entry: On bullish confirmation near 0.8660–0.8665 (curve/structure support).

SL: Below curve base (e.g., 0.8640).

TP: Near or slightly below NRZ (0.8700–0.8705), partial profits or full exit.

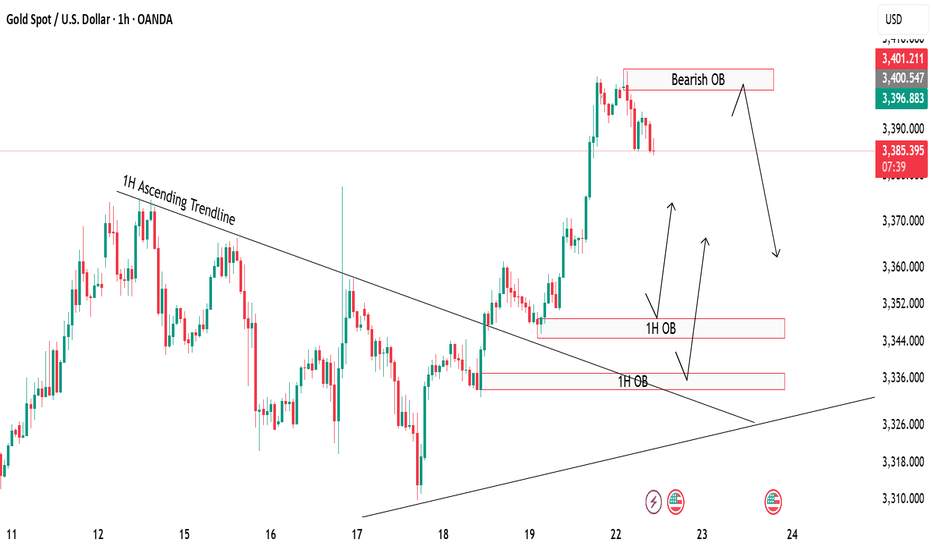

Gold Rejection & Retest Zones AnalysisGold has recently broken out of the 1H ascending trendline with a strong bullish push 🚀. After this breakout, we are now watching key supply and demand zones for the next move.

🔴 Bearish OB (3398-3404):

Price is currently hovering around the bearish order block, which could trigger some short-term rejection or pullback from this zone.

🟢 Bullish OB Zones (3350 & 3330):

If gold decides to correct lower, we have two important bullish OBs below, perfectly lining up with the previous trendline retest ✅. These zones can offer high-probability buy setups if price respects them.

🎯 Focus is on watching for possible rejections from the top OB, or waiting for a deeper retracement towards the bullish zones for buy confirmations

XAUUSDHello Traders! 👋

What are your thoughts on GOLD?

Over the past week, gold has been consolidating within a defined range, fluctuating between two key zones.

A break above the marked resistance zone (around $3380-3390) would confirm the start of the next bullish wave, opening the path toward higher targets.

As long as price remains above the identified support zone, our outlook stays bullish.

Key Levels to Watch:

Resistance: Breakout above $3380 needed to confirm continuation

Support: Holding this zone is essential to maintain the bullish structure

Is gold ready for a breakout after consolidation? Share your thoughts below! 🤔👇

Don’t forget to like and share your thoughts in the comments! ❤️