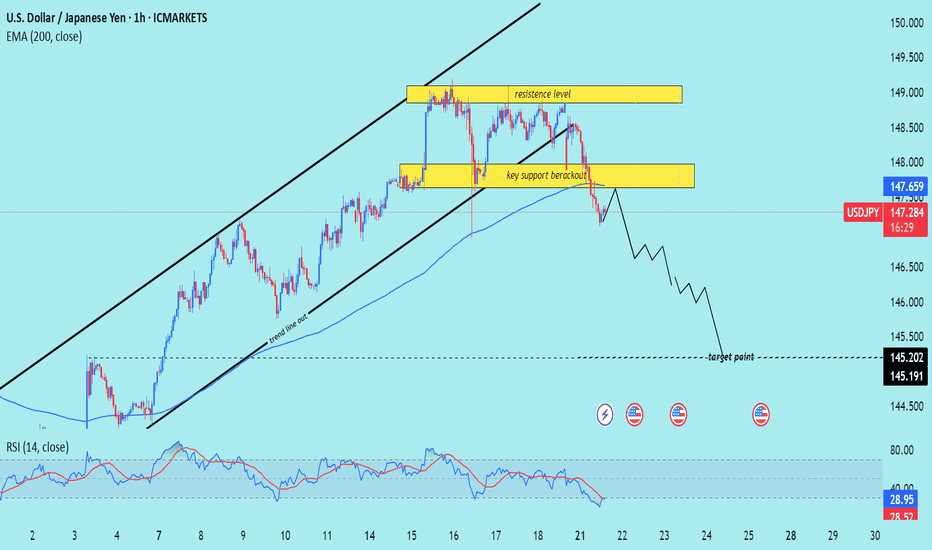

USD/JPY) bearish Trend Read The captionSMC Trading point update

Technical analysis of USD/JPY on the 1-hour timeframe, signaling a potential drop toward the 145.200 – 145.191 target zone. Here's the detailed breakdown:

---

Technical Analysis – USD/JPY (1H)

1. Rising Channel Breakdown

Price has broken below an ascending channel, confirming a trend line breakout and signaling a trend shift from bullish to bearish.

The trend line cut and rejection from the upper resistance zone support the bearish reversal.

2. Key Support Breakout

A crucial horizontal support zone around 147.80–148.00 was broken.

The break-and-retest of this area (yellow box) acts as a confirmation of bearish momentum continuation.

3. Bearish Momentum Below EMA

Price is trading below the 200 EMA (147.659) — a strong signal of downward bias on this timeframe.

The EMA has flipped from dynamic support to resistance.

4. RSI Oversold but Bearish

RSI is at 29.41, in oversold territory, which may hint at a short-term bounce.

However, the broader structure suggests more downside potential before a deeper retracement.

5. Target Projection

Projected target zone is between 145.200–145.191, aligning with previous structure lows and likely liquidity zone.

Mr SMC Trading point

Summary

Bias: Bearish

Current Price: 147.307

Key Resistance: 147.80–148.60 zone

Structure: Rising channel break + key support breakout

200 EMA: Above price (bearish signal)

RSI: 29.41 – oversold but momentum remains bearish

Target: 145.200–145.191

Please support boost 🚀 this analysis)

Foryourpage

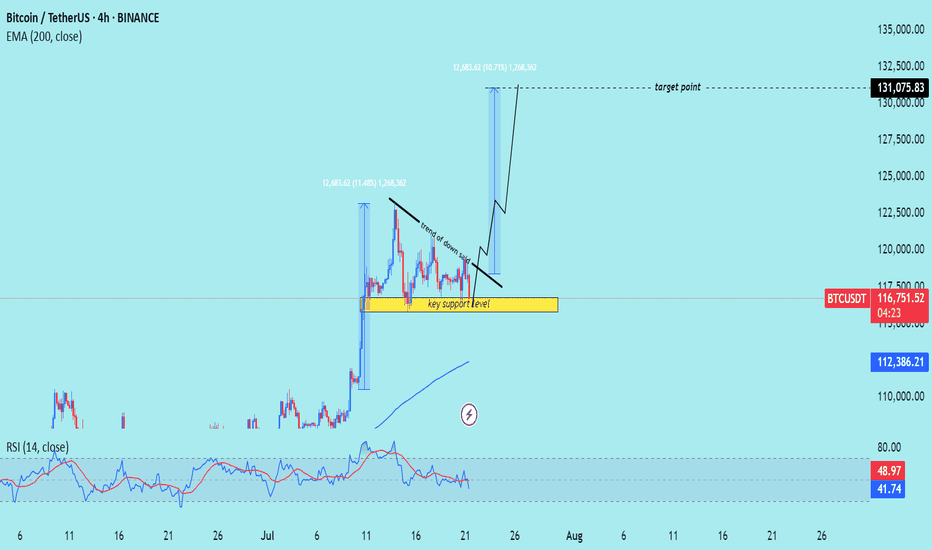

BTC/USD) Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of Bitcoin (BTC/USDT) on the 4-hour timeframe, indicating a potential upward continuation after a period of consolidation above a key support level.

---

Analysis Summary

Pair: BTC/USDT

Timeframe: 4H

Current Price: 116,810.90

Bias: Bullish breakout continuation

---

Key Technical Insights

1. Key Support Zone:

The yellow box marks a strong support level, where price has bounced multiple times.

Acts as a launchpad for the next move higher.

2. Descending Trendline:

A trend of lower highs suggests short-term selling pressure.

Break above this trendline would signal a bullish breakout.

3. Projected Move:

If the breakout occurs, the projected target is around 131,075.83, representing a ~12% gain.

Similar move structure as the previous breakout earlier this month.

4. EMA 200 (Supportive):

Price remains above the 200 EMA at 112,386.80, affirming bullish trend bias.

5. RSI (14):

RSI hovering around 42–49, slightly oversold area, suggesting upside potential remains.

---

Target Point

Target: 131,075.83 USDT

Stop-Loss Suggestion: Below key support zone (~114,000)

---

Trade Idea

Direction Entry Stop-Loss Target

Buy Break above 118,000 Below 114,000 131,000–132,000

Mr SMC Trading point

---

Summary

Bitcoin is consolidating above a strong support zone and under a descending trendline. A confirmed breakout from this pattern could lead to a bullish rally toward 131,000+.

-

Please support boost 🚀 this analysis)

XAU/USD) Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of XAU/USD (Gold) on the 1-hour timeframe. Here’s a breakdown

---

Technical Analysis Summary

Descending Channel Breakout

Price action previously formed a descending wedge/channel, shown by the two black trendlines.

A bullish breakout occurred above the trendline, signaling a shift in momentum from bearish to bullish.

Key Support Zone

The yellow highlighted zone (around $3,338–$3,340) is marked as the “new key support level”.

Price is expected to retest this area (confluence with 200 EMA), which aligns with standard bullish breakout behavior.

The green arrow indicates potential bounce confirmation.

Bullish Projection

After the retest, price is projected to climb steadily toward the target point at $3,394.52.

The setup anticipates around 56.27 points upside, or roughly +1.69% gain from the support zone.

---

Target

$3,394.52 – defined using the previous range breakout height and horizontal resistance.

---

Trade Idea

Entry: On bullish confirmation near $3,338 support zone.

Stop Loss: Just below the yellow zone (e.g., under $3,330).

Take Profit: Near $3,394.

Mr SMC Trading point

---

Conclusion

This is a classic breakout-retest-play, supported by trendline structure, a key horizontal support zone, and RSI strength. As long as price respects the highlighted support, the bullish outlook remains valid.

Please support boost 🚀 this analysis)

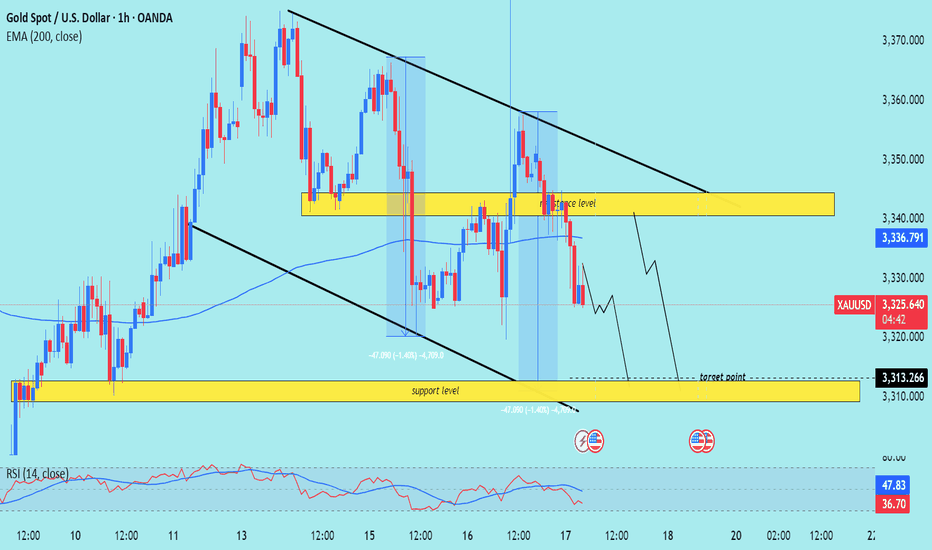

XAU/USD) bearish Trend Read The captionSMC trading point update

Technical analysis of XAU/USD (Gold Spot vs US Dollar) on the 1-hour timeframe. Here's a breakdown

---

Technical Breakdown:

1. Descending Channel:

Price is trading within a clearly defined downward-sloping channel (black trendlines).

This suggests a short-term bearish trend.

2. Resistance Zone (Yellow Box at 3,335–3,340):

Price recently rejected from this resistance area.

This zone aligns with both the 200 EMA and previous structure, strengthening its validity.

3. EMA Confluence:

The 200 EMA (3,336.798) is acting as dynamic resistance.

Price is currently below the EMA, confirming the bearish bias.

4. Support/Target Zone:

The projected target zone is around 3,313.266, labeled as a support level.

This level has acted as previous structure support, increasing its significance.

5. RSI Analysis:

RSI is at 37.18, close to the oversold region, but not yet fully exhausted.

Suggests there’s still room for a downside move before any potential bounce.

Mr SMC Trading point

---

Trade Idea Summary:

Bias: Bearish

Entry: Below the resistance zone (~3,335–3,340)

Target: 3,313 (support zone)

Invalidation: Break and hold above 3,340–3,345

Risk Note: Watch for potential consolidation or fakeouts before continuation.

Please support boost 🚀 this analysis)

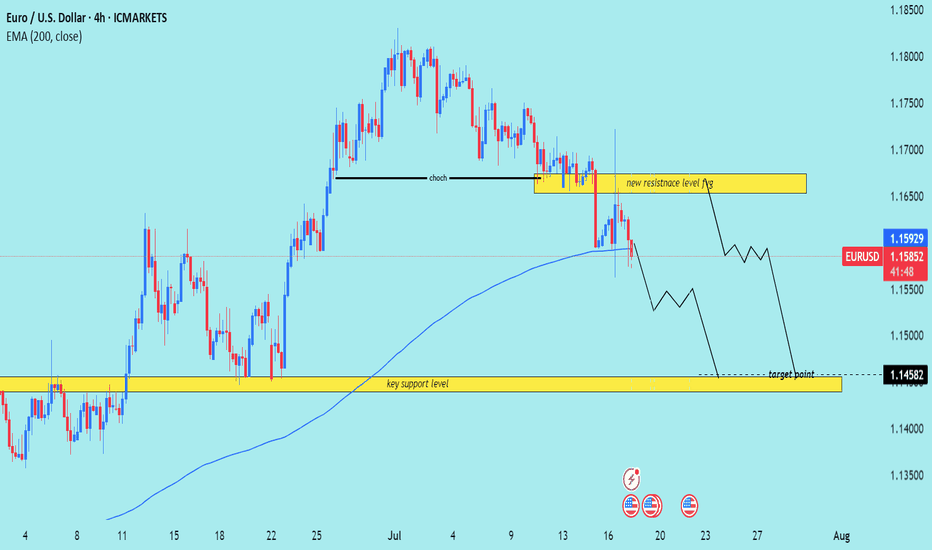

EUR/USD) bearish chochy Trend Read The captionSMC trading point update

Technical analysis of EUR/USD (Euro vs. U.S. Dollar) on the 4-hour timeframe. Here’s the breakdown

---

Technical Breakdown:

1. Market Structure Shift (CHOCH):

The chart highlights a Change of Character (CHOCH), signaling a bearish reversal after a previous uptrend.

This is confirmed by lower highs and lower lows forming after the CHOCH point.

2. New Resistance Zone:

The previous support (yellow box) has now turned into a new resistance level around 1.16400–1.16700.

Price has rejected this area after the breakdown, validating the resistance flip.

3. 200 EMA Breakdown:

Price is now trading below the 200 EMA (1.15928), which reinforces bearish sentiment.

The EMA may act as dynamic resistance on any pullbacks.

4. Target Zone:

The projected target is the key support zone around 1.14582, where price consolidated before the last major bullish move.

This level has historical significance and aligns with a clean support demand zone.

5. RSI Indicator:

RSI is not yet oversold, sitting in a neutral-to-bearish range, indicating further downside potential.

Mr SMC Trading point

---

Trade Idea Summary:

Bias: Bearish

Entry Zone: On breakdown and rejection from the new resistance area (~1.16400–1.16700)

Target Zone: 1.14582 (key support)

Invalidation: A break and close above the resistance zone

Confluence: CHOCH confirmation + support-turned-resistance + 200 EMA breakdown

---

Please support boost 🚀 this analysis)

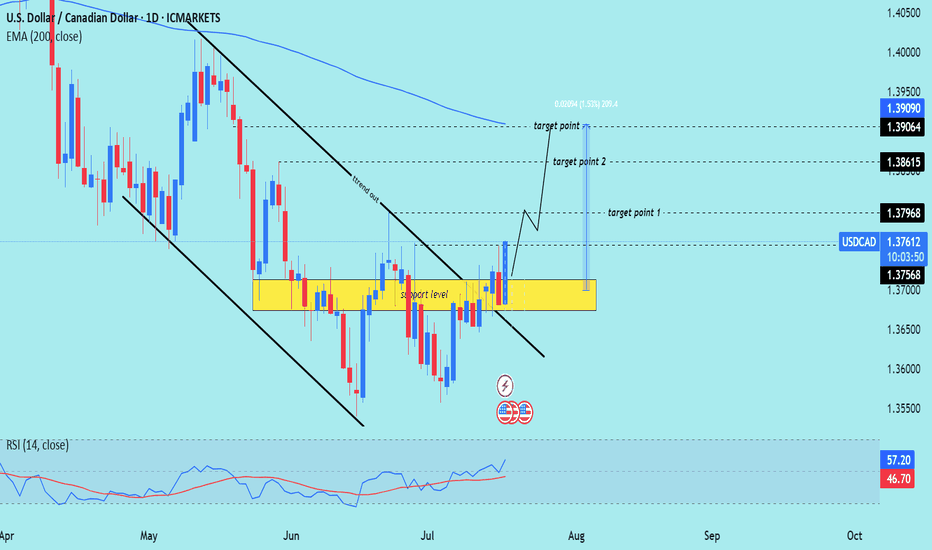

USD/CAD) strong bullish trend Read The captionSMC trading point update

Technical analysis of USD/CAD (U.S. Dollar vs Canadian Dollar) on the daily timeframe. Here's a breakdown of the trade

---

Technical Breakdown:

1. Breakout from Descending Channel:

Price has broken out above a descending trend channel (marked with black lines).

This breakout suggests a potential trend reversal or at least a bullish correction phase.

2. Key Support Zone (Yellow Box):

The yellow zone marked as “support level” was a strong consolidation area.

Price has bounced off this zone multiple times, forming a solid base for further upside.

3. Bullish Price Action:

Price has closed above the previous resistance (now support), signaling bullish intent.

Current candle structure confirms strength with bullish continuation patterns.

4. RSI Indicator:

RSI is at 56.38, indicating bullish momentum without being overbought.

Suggests there is room for further upside before exhaustion.

---

Target Levels:

Target Point 1: 1.37968 (near-term resistance)

Target Point 2: 1.38615 (intermediate target)

Target Point 3: 1.39064–1.39090 (longer-term resistance near the 200 EMA)

Mr SMC Trading point

---

Trade Idea Summary:

Bias: Bullish

Entry Zone: Break and retest of the yellow support area (~1.368–1.371)

Target Zone: 1.379 – 1.390

Invalidation: Break below the yellow support zone

Confluence: RSI strength + breakout of downtrend channel + structural support

plesse support boost 🚀 this analysis)

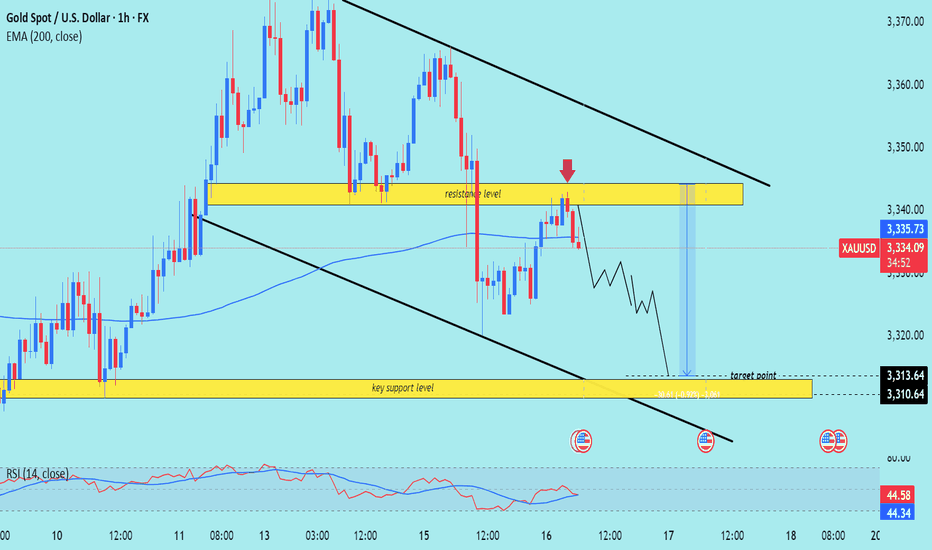

XUA/USD) Bearish Analysis Read The captionSMC trading point update

Technical analysis of XAU/USD (Gold vs USD) on the 1-hour timeframe. Here's a breakdown

Technical Analysis Summary

1. Descending Channel:

The price is moving within a clear descending channel, indicating a bearish market structure.

Recent price action rejected the upper boundary of the channel, strengthening the downtrend bias.

2. Resistance Rejection:

A key resistance level around 3,340–3,345 was retested (marked with a red arrow) and rejected.

Price has already shown early bearish candles post-rejection, suggesting weakness at that level.

3. 200 EMA (Exponential Moving Average):

Price is currently hovering around the 200 EMA, and a clean break below it could accelerate the bearish move.

4. RSI Indicator:

RSI is around 46, below neutral 50, showing bearish momentum is building but not yet oversold.

No divergence is present, supporting the idea of continuation.

---

Bearish Playbook

Entry Idea: After the rejection at the resistance zone and confirmation of lower highs.

Target: 3,313 – 3,310 zone (marked as the “key support level” and “target point”).

Risk Management: A stop loss above 3,345 (above the resistance zone) would be a prudent protection level.

---

Confluences Supporting the Short Setup:

Rejection at horizontal resistance.

Alignment with the descending trendline/channel.

Price trading near or below the 200 EMA.

RSI slightly bearish.

Caution:

Watch out for any macroeconomic news or high-impact events (highlighted with the economic event icons) that could inject volatility.

A strong break back above the resistance could invalidate this bearish setup.

Mr SMC Trading point

Conclusion:

This setup anticipates a bearish continuation targeting the 3,310 support zone. Ideal for short-term traders looking for downside opportunities, provided price respects the trend and fails to reclaim the resistance.

Please support boost 🚀 this analysis)

(ETH/USD) Bullish Setup: Entry at $2,422 with Target at $2,521 a1. Entry Point: ~2,422.2

This is the suggested buy area based on a recent bounce from the support zone

2. Support Zone (Purple Box):

Bottom boundary: ~2,392.4

Top boundary: ~2,408.4

Price has bounced multiple times here, showing strong buying interest.

3. Resistance Point: ~2,463.9

A clear horizontal resistance line, previously tested.

4. EA Target Point: ~2,522.1

A bullish target if the price breaks above the resistance level.

🔶 Highlighted Patterns / Markers

Orange Circles: Indicate key swing highs and lows — possibly used to identify double tops/bottoms or rejection/wick zones.

Blue Arrows: Illustrate the anticipated move from:

Entry (2,408.1) → Resistance (2,463.9) → Target (2,521.2)

Target gain = +111.7 USD (+4.64%)

🔻 Stop Loss Level

Set just below the support box at ~2,392.4

Protects from false breakouts or deeper pullbacks.

📈 Strategy Outlook

Bullish Bias: The setup expects a breakout from the current price range.

Risk-Reward Ratio: Appears favorable — tight stop and wide target.

Confirmation Needed: A solid breakout and hold above 2,423–2,425 may be the early confirmation signal.

📌 Summary

Element Value

Entry Point ~2,422.2

Stop Loss ~2,392.4

Resistance ~2,463.9

Target (TP) ~2,521.2

R:R Ratio Approx. 3:1

Bias Bullish

Silver (XAG/USD) Bullish Trade Setup from Key Support ZoneXAG/USD (Silver) Trade Analysis – 2H Chart (July 2, 2025)

🔹 Trade Setup Overview:

Entry Point: 35.84299

Target (TP): 37.32540

Stop Loss (SL): 35.59483

Current Price: 36.36350

Risk/Reward Ratio: ~5.9:1 (Very favorable)

🔹 Technical Insights:

Support Zone:

Price recently tested and respected a strong demand zone between 35.60 – 35.84, which has now acted as a bounce level.

Multiple wicks and rejections at this zone highlight buyer interest.

Moving Averages:

50 EMA (red) is starting to flatten, possibly hinting at momentum reversal.

200 EMA (blue) held as dynamic support during the last dip — a bullish signal.

Breakout Potential:

Price has bounced off the entry zone and is approaching minor resistance near 36.40–36.60.

A clean break above this area can trigger momentum toward the 37.30s.

Volume & Momentum:

The latest candle shows strong bullish momentum, validating the bounce setup.

No sign of exhaustion yet.

🔹 Strategy Suggestion:

Entry has already occurred or is slightly above entry zone — ideal for aggressive traders to ride the momentum.

Conservative traders may wait for a pullback near 36.00–36.10 before entering.

SL is well-placed below previous lows and structure — reasonable protection.

🔹 Conclusion:

This setup reflects a bullish continuation trade from a strong support zone. Given the risk/reward profile and recent bullish action, this trade is technically sound as long as price stays above 35.84. A close below this level could invalidate the setup

USD/JPY) Bullish trend analysis Read The captionSMC trading point update

Technical analysis of USD/JPY on the 4-hour timeframe, signaling a breakout and possible rally toward the 151.016 target zone. Here's the detailed breakdown:

---

Technical Analysis – USD/JPY (4H)

1. Bullish Structure Breakout

Price has broken above a long-term resistance trendline, indicating a bullish breakout from a rising wedge or ascending channel.

The breakout is confirmed by bullish momentum and sustained price action above the previous highs.

2. Trendline + EMA Confluence

Price remains well above the 200 EMA (145.143), reinforcing the bullish bias.

A clear higher low was formed at the inner trendline (support), followed by strong upside moves.

3. RSI Strength

RSI is around 63.16, indicating strong bullish momentum without being overbought yet.

Suggests more upside potential while maintaining healthy trend conditions.

4. Price Target Projection

The chart shows two upward extensions:

First move projected ~+2.20%, indicating a measured move target around 149.7.

Final target point is 151.016, based on previous price action extension and resistance level.

Mr SMC Trading point

---

Summary

Bias: Bullish

Current Price: 147.366

Key Support: Rising trendline + 145.143 EMA

Targets:

Short-term: ~149.7

Final: 151.016

RSI: Strong but not overbought (63.16)

Invalidation: Break below the inner trendline support and EMA (below 145.00)

Please support boost 🚀 this analysis)

XUA/USD) Bullish Analysis Read The captionSMC trading point update

Technical analysis of Gold (XAU/USD) analysis on the 3-hour

---

Gold (XAU/USD) 3H Technical Analysis Summary

Market Structure: Bullish breakout

Price has successfully broken above both the downtrend line and the support zone (highlighted in yellow), signaling a shift in structure from bearish to bullish.

Key Support Zone:

The yellow zone (~3,335–3,355) was previously a resistance area. After the breakout, it is acting as a strong support level and has been retested.

Trendlines:

Downtrend line: Broken and retested.

Uptrend line: Guiding current price action, supporting higher lows and forming an ascending channel.

200 EMA (blue line):

Price is trading above the EMA 200 (~3,331), confirming bullish bias and providing dynamic support.

Momentum (RSI 14):

RSI is around 67.85, showing strong bullish momentum.

Nearing overbought, so a minor pullback or consolidation could occur before continuation.

Volume:

Increase in buying volume near breakout area suggests institutional interest or strong buyer conviction.

Mr SMC trading point

---

Conclusion:

Price has shifted into a bullish continuation pattern.

A successful break and retest of structure and trendlines increases the likelihood of further upside.

As long as price holds above the yellow support zone and the uptrend line, bullish momentum is favored.

Short-term pullbacks may offer new long opportunities.

---

Please support boost 🚀 this analysis)

XAU/USD technical analysis setup Read The captionSMC trading point update

Technical analysis of (XAU/USD) on the 6-hour timeframe, focusing on a key resistance zone that could trigger either a bullish breakout or a bearish reversal.

---

Analysis Summary

Current Price: $3,357.95

Trend Context: Price is testing a strong resistance zone with a possible breakout or rejection in play.

---

Scenario 1 – Bullish Breakout

1. Resistance Zone: $3,357–$3,372

Multiple previous rejections.

A confirmed close above $3,372.77 signals bullish strength.

2. Upside Targets:

Target 1: $3,393.87

Target 2: $3,452.08

3. Indicators:

RSI at 63.74, approaching overbought but still with room to rally.

EMA 200 is trending upward, supporting bullish bias.

---

Scenario 2 – Bearish Rejection

1. If price fails to close above $3,372.77, a rejection from resistance is likely.

2. Downside Targets:

Reversal projected toward the key support zone at $3,246.97

EMA 200 at $3,300.97 may provide temporary support before breakdown.

---

Trade Ideas

Direction Entry Level Stop-Loss Target 1 Target 2

Bullish Close above $3,372 Below $3,346 $3,393.87 $3,452.08

Bearish Rejection from $3,357–$3,372 Above $3,380 $3,300 → $3,246.97

Mr SMC Trading point

---

Summary

This is a critical decision point for Gold. A breakout above resistance can propel price to $3,450, while rejection could drive price back to $3,246. The reaction at the current zone will dictate the next major swing.

Please support boost 🚀 this analysis)

GBP/JPY) Bearish Analysis Read The captionSMC trading point update

Technical analysis of GBP/JPY on the 3-hour timeframe, suggesting a potential short-term pullback within a larger ascending channel.

---

Analysis Summary

Pair: GBP/JPY

Timeframe: 3H

Current Price: 198.883

Bias: Bearish move toward channel support

---

Key Technical Insights

1. Ascending Channel Formation:

Price is moving within an upward-sloping channel.

Current structure suggests price is heading toward the lower trendline support.

2. Support Level & Target Zone:

The yellow zone around 196.355 is a major support area and target point, coinciding with both structural support and the bottom of the channel.

3. EMA (200 Close):

Price is still above the 200 EMA (197.067), so overall trend remains bullish — but current move is a correction.

4. RSI (14):

RSI is neutral near 51.14, allowing room for further downward movement before becoming oversold.

---

Target Point

Target: 196.355 (support zone and bottom of channel)

---

Trade Idea

Direction Entry Stop-Loss Target

Sell 198.80–199.00 Above 199.70 196.35

SMC trading point

---

Summary

GBP/JPY is likely to retrace toward support at 196.35 before possibly bouncing within the larger bullish structure. This offers a short-term selling opportunity, with potential buy setups near the lower trendline later.

Please support boost 🚀 this analysis)

USD/JPY) LOGN TIME Analysis Read The captionSMC trading point update

Technical analysis of USD/JPY on the daily timeframe, highlighting a long-term downtrend reversal with potential for significant upside.

---

Analysis Summary

Pair: USD/JPY

Timeframe: Daily

Current Price: 147.442

Bias: Bullish breakout from a descending wedge structure.

---

Key Technical Insights

1. Descending Trendline Break:

Price has broken above the long-term downtrend line, signaling a reversal.

Breakout area is circled in yellow, confirming bullish intent.

2. Trendline & Structure Support:

Multiple rejections from the ascending support trendline (marked by green arrows) confirm accumulation and higher lows.

3. 200 EMA as Dynamic Resistance/Support:

Price is now above the 200 EMA (147.920) — a bullish signal, turning resistance into support.

4. RSI (14):

RSI at 62.99, approaching overbought territory, but still has room to push further.

---

Target Point

Target: 158.951

Based on measured move from wedge breakout and historical resistance level.

---

Trade Setup Idea

Direction Entry Stop-Loss Target

Buy 147.40–147.60 Below 145.80 158.95

Mr SMC Trading point

---

Summary

This chart signals a major bullish breakout on USD/JPY, with the break of a year-long downtrend structure, reclaiming the 200 EMA. If this breakout sustains, price could aim for 158.95 in the coming weeks.

Please support boost 🚀 this analysis)

(XAU/USD) 3H Chart – Bearish Reversal Setup from Resistance Zon1. Entry Point (Sell):

Marked at 3,335.03

This is a key resistance level where price is expected to reverse downward.

2. Stop Loss:

Placed above at 3,354.88

This acts as a protection level in case the trade goes against the direction.

3. Take Profit Targets (EA Target Points):

TP1 (Downside): 3,245.65

TP2 (Upside - if Stop Loss is hit): 3,455.76 (in case of reversal or long position)

4. Price Action Observation:

Price is currently around 3,320.56, climbing back toward the entry zone.

The red 50-period moving average (EMA) and blue 200-period MA show convergence, often preceding volatility.

---

📉 Bearish Scenario (Main Setup)

Sell Bias is expected from the 3,335 region.

If price respects the resistance zone and breaks down again, the target is 3,245.65, yielding approximately 90-point move.

This is a risk-reward favorable setup, with:

Risk: ~20 points

Reward: ~90 points

RRR ≈ 1:4.5

---

⚠️ Bullish Invalidity (Stop Loss Hit)

If the price breaks and closes above 3,354.88, it invalidates the bearish setup.

Then, the market may shift towards targeting 3,455.76 — about 100 points to the upside.

---

🔧 Technical Factors Supporting the Setup

Supply zone marked by the purple box around the entry.

Trend previously bearish — recent upward move may just be a retracement.

Confluence with MAs: Price is testing MAs — rejection here would add bearish confirmation.

---

✅ Summary of Trade Setup

Element Value

Entry 3,335.03

Stop Loss 3,354.88

Take Profit 3,245.65

Alt Target 3,455.76 (if SL hit)

Risk-Reward ~1:4.5

Bias Bearish (Sell Setup)

XAU/USD) bearish Trand analysis Read The captionSMC trading point update

Technical analysis of (XAU/USD) on the 3-hour timeframe, projecting further downside after rejection from a resistance zone aligned with a descending trendline.

---

Analysis Summary

Trend Bias: Bearish

Current Price: ~$3,301.96

Structure: Price is respecting a descending channel, with multiple rejections from the upper boundary and key resistance zone.

---

Key Technical Insights

1. Resistance Zone & Downtrend Line:

Price was rejected from a resistance block near the EMA 200 (~$3,331) and descending trendline.

This level has repeatedly triggered strong downside moves (highlighted with red arrows).

2. EMA 200 Reaction:

The EMA 200 at $3,331.10 is acting as dynamic resistance.

Each time price reaches or crosses above this line, selling pressure increases.

3. Bearish Price Projection:

After recent rejection, the chart anticipates a pullback to the support zone between $3,248.26 and $3,245.71.

A deeper drop toward $3,159.13 is projected as a next major target, consistent with previous price moves.

4. RSI Indicator:

RSI at 40.24 suggests bearish momentum is still in play but not yet oversold—indicating room for more downside.

---

Bearish Trade Idea

Element Level / Description

Entry Zone Below resistance: $3,310–$3,320

Target 1 $3,248.26–$3,245.71 (support zone)

Target 2 $3,159.13 (channel base / next support)

Stop-Loss Above $3,335 (above resistance zone)

---

Risk Considerations

Fundamental catalysts: Gold is sensitive to USD strength, interest rate decisions, and macroeconomic data.

Invalidation: A strong breakout and close above the descending trendline and EMA 200 would negate the bearish outlook.

---

Summary

This analysis outlines a bearish setup for XAU/USD, supported by trendline resistance, EMA rejection, and RSI momentum. If current structure holds, a move toward the $3,245 and $3,159 levels is likely.

Please support boost 🚀 this analysis)

USD/JPY) back down Trend Read The captionSMC trading point update

Technical analysis of USD/JPY (U.S. Dollar / Japanese Yen) on the 3-hour timeframe, anticipating a rejection from a descending trendline resistance and a move down toward key support levels.

---

Analysis Overview:

Trend Bias: Bearish correction expected

Structure: Price is reacting at a descending trendline, which has held as resistance on multiple occasions.

Indicators:

EMA 200 (144.756): Price is currently above, but projected to break below it.

RSI (14): Overbought at ~74, signaling potential for a reversal.

---

Key Technical Components:

1. Descending Trendline Resistance:

Price is approaching/has touched a well-respected downtrend line, marked by three strong rejections (red arrows).

This trendline has consistently capped bullish moves, indicating strong seller interest.

2. Bearish Reversal Expectation:

The projected path suggests a potential fake breakout or double-top, followed by a steep decline.

A two-stage drop is anticipated, with price first targeting the EMA 200 zone, then extending lower.

3. Target Points:

First target: Around 145.244, near EMA 200.

Final target: 143.048, aligning with the key support zone (highlighted in yellow), where price previously bounced.

4. RSI (14):

Currently overbought (73.29), signaling a likely retracement.

Prior peaks at this level led to notable corrections.

---

Trade Setup Idea:

Parameter Level

Entry Near current price (~146.85) if bearish pattern confirms

Stop-Loss Above trendline (~147.30–147.50)

Target 1 145.24 (EMA 200 zone)

Target 2 143.05 (Support zone)

This setup offers a high-probability short opportunity if resistance holds.

---

Risk Factors:

Upcoming economic events could trigger volatility (news icon marked).

A clean breakout and close above the trendline (~147.50+) would invalidate this bearish thesis.

Mr SMC Trading point

---

Summary:

The analysis suggests a potential USD/JPY reversal from a descending trendline, supported by overbought RSI and prior rejections. The bearish projection targets a move toward 143.048, following a dip below the EMA 200 level at 145.244.

Please support boost 🚀 this analysis)

XAU/USD) order block back up trand Read The captionSMC trading point update

Technical analysis of Gold (XAU/USD) on the 1-hour timeframe, focusing on a potential reversal from a key support/order block zone. Here's a full breakdown

---

Chart Analysis – XAU/USD (1H)

1. Key Zone: Support Level / Order Block (Yellow Box)

The price is currently testing a strong support zone that previously acted as a bullish order block (demand area).

This zone is also near a diagonal trendline and a prior breakout level, adding confluence to the setup.

2. Reversal Anticipation (Black Zigzag Path)

The chart suggests two possible scenarios from the support area:

A bullish bounce leading price up toward:

Target 1: 3,343.05 (near 200 EMA)

Target 2: 3,364.62 (upper resistance)

A break below the yellow support zone, triggering a deeper move toward:

Key support: 3,247.55

3. RSI Oversold Signal

RSI (14) is at 32.66, which is near oversold territory, signaling potential for a bullish reversal if buying pressure steps in.

4. EMA (200 - Blue Line)

EMA at 3,330.95 currently acts as dynamic resistance.

If price bounces from the order block, this EMA may serve as the first reaction level before further upside.

Mr SMC Trading point

---

Summary

Bias: Bullish bounce if price holds above 3,296.04 (order block support).

Entry Zone: Current price near 3,301 or confirmation bounce candle.

Targets:

TP1: 3,343.05

TP2: 3,364.62

Invalidation: Strong break and close below 3,296.04 may open the path to 3,247.55.

RSI: Favoring reversal conditions (near oversold).

---

Please support boost 🚀 this analysis)

XAU/USD) support level back bullish trend Read The captionSMC trading point update

Technical analysis of Gold (XAU/USD) on the 3-hour timeframe, suggesting a long trade idea with a clearly defined support zone and target projection. Here's the detailed breakdown:

---

Chart Breakdown (3H - XAU/USD)

1. Support Zone (Yellow Box):

Price reacted strongly to the 3,244–3,300 area, which is identified as a key support level.

This area has historically seen demand and is now acting as a base for potential bullish continuation.

2. Falling Wedge Breakout:

A falling wedge pattern has been broken to the upside, which is typically a bullish reversal signal.

The breakout indicates a shift from the previous bearish momentum into bullish strength.

3. EMA 200 Confirmation:

Price is now above the 200 EMA (3,333.347), supporting a bullish bias.

This can act as dynamic support going forward.

4. RSI Momentum:

RSI at 62.00, indicating growing bullish momentum without being overbought.

The RSI has also broken above a previous local high, confirming strength.

5. Target Projection:

The projected move (blue arrowed box) suggests a potential rally of +105.305 points (3.20%), targeting the 3,394.503 level.

This level aligns with previous price structure and acts as the next major resistance.

6. Anticipated Price Path (Black Zigzag Line):

Price is expected to pull back slightly, retesting the wedge breakout or support zone.

After this retest, a bullish continuation toward the target point is projected.

Mr SMC Trading point

---

Summary:

Bias: Bullish

Pattern: Falling wedge breakout + support retest

Entry Zone: Around 3,300–3,320 on a retest

Target: 3,394.503

Invalidation: Strong break and close below 3,244.166

Confirmation: Bullish price action near support + sustained RSI strength

Please support boost 🚀 this analysis)

Gold/USD Bullish Breakout Toward Target Zone Gold/USD Bullish Breakout Analysis 🚀🟢

The chart illustrates a strong bullish breakout from a consolidation zone, signaling upward momentum:

🔍 Key Technical Observations:

Support Zone: The price respected the support area around 3,325 – 3,330 USD, forming a solid base for reversal.

Bullish Structure: Series of higher lows and higher highs indicate a bullish trend formation.

Breakout Confirmation: Price broke above short-term resistance with a strong bullish candle, indicating buying pressure.

Trendline Support: The ascending trendline has held well, confirming trend continuation.

Target Point 🎯: Projected target is near 3,365 USD, which aligns with a previous resistance and Fibonacci confluence zone.

✅ Conclusion:

The breakout above resistance, supported by a bullish structure and momentum, suggests further upside potential toward the 3,365 USD target zone. As long as price holds above the breakout level, bullish bias remains valid.

🛑 Watch for invalidation if price falls back

Tesla Bullish Breakout Setup: Entry at $295.54 Targeting $488.87Entry Point (Buy Zone): Around $295.54

Stop Loss: Between $272.94 – $295.54 (lower purple support zone)

Target (TP): $488.87

Current Price: $315.33 (as of the latest candle)

📈 Strategy Summary:

Setup Type: Long (Buy)

Risk-Reward Setup:

Reward: ~$193.33 per share (from $295.54 to $488.87)

Risk: ~$22.60 per share (from $295.54 to $272.94)

Reward:Risk Ratio ≈ 8.6:1 — a high potential payoff if the trade works out.

📊 Technical Context:

Support Zone: Price recently bounced off the support region (marked in purple).

Moving Averages:

Red Line (Short-Term MA): Price just crossed back above.

Blue Line (Long-Term MA): Price reclaimed this level — bullish signal.

Price Action: After a corrective phase, a possible reversal is forming at support, confirming bullish interest.

✅ Bullish Signals:

Bounce from support zone with a strong bullish candle.

Price closing above the 200-day MA (bullish trend resumption).

High reward-to-risk trade setup with clear stop loss.

⚠️ Considerations:

Confirmation with volume or a second bullish candle would add confidence.

Watch for earnings or macro events that could disrupt the trend.

Tight stop is essential to avoid drawdowns if the setup fails.

🔚 Conclusion

This is a well-structured long setup with a high potential reward. If price maintains above the entry zone and breaks recent highs, a push toward the $488.87 target is plausible.

USD/JPY) Back support level Read The captionSMC trading point update

Technical analysis of USD/JPY pair using a combination of price action, resistance/support levels, and indicators. Here's a breakdown of the idea behind the analysis:

---

Chart Breakdown (2H - USD/JPY)

1. Key Zones:

Resistance Level (Yellow Box at Top):

Price has previously been rejected from this zone multiple times.

Recent bearish wicks and aggressive sell-offs are marked by red arrows—showing strong seller interest.

Support Level / Target Point (Bottom Yellow Box):

Price has found strong buying interest around 142.142.

This zone is the anticipated downside target if the bearish scenario plays out.

2. Bearish Bias Justification:

Liquidity Grab / Fakeout (labeled “fug”):

The price briefly broke above the smaller resistance block but quickly reversed.

This "fake breakout" often traps buyers, strengthening the bearish case.

EMA 200 (Blue Line):

Price is currently near or slightly under the 200 EMA (144.553), suggesting a potential rejection area aligning with resistance.

RSI Indicator:

RSI shows divergence and has not confirmed a bullish breakout.

The values (56.77 and 42.82) indicate loss of bullish momentum.

3. Projection (Black Lines):

The black zig-zag lines represent a forecasted drop to the support level.

Suggests a short setup near 144.50–145.00 with targets near 142.14.

Mr SMC Trading point

---

Summary:

Bias: Bearish

Entry Zone: Near resistance area (144.50–145.00)

Target: 142.142 (support zone)

Invalidation: Strong break above 145.00 and hold

Confirmation: Rejection from resistance with bearish candle pattern

---

Please support boost 🚀 this analysis)

XAU/USD) bearish reversal analysis Read The captionTechnical analysis of (XAU/USD) based on price action and technical indicators on the 15-minute timeframe. Here's a

---

Key Technical Insights:

1. Resistance Level (Highlighted Yellow Zone):

Price is approaching a strong resistance zone (previous rejection marked by red arrows).

This area has historically pushed price downward.

2. Trendline Support (Rising Black Line):

Price has been following a short-term ascending trendline, forming higher lows.

A break below this trendline signals potential bearish reversal.

3. EMA 200 (Blue Line):

Price is currently above the EMA 200, indicating short-term bullish momentum.

However, price is testing resistance — a rejection could flip momentum bearish.

4. Bearish Rejection & Projection:

The chart shows an anticipated rejection from resistance, followed by a break of trendline support.

Target zone is marked near 3,228.098, indicating a drop of ~94 points from the current level.

5. RSI (Relative Strength Index):

RSI is nearing overbought territory (68.79).

A bearish divergence or RSI crossing down may confirm weakening momentum.

Mr SMC Trading point

---

Conclusion / Trading Idea:

Bias: Bearish

Entry Zone: Near the resistance level (~3,322)

Confirmation: Break of trendline support

Target: 3,228

Stop-Loss: Above resistance zone (just over the upper trendline)

---

pelas support boost 🚀 this analysis)