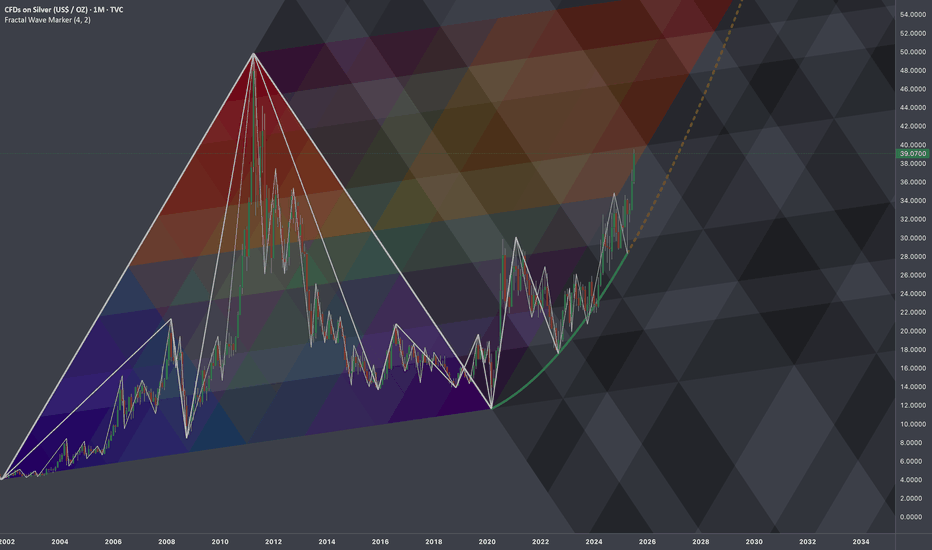

$SILVER: Fractal Geometry (Cycle 2001-2020)Research Notes

Working out probabilistic texture using multiple fibonacci channels on just 3 coordinates of fractal cycle (late 2001 - 2020) on linear scale (on log chart it would still be relevant, so you can switch to view with right click on price scale for selection).

To describe behavior of price and key levels on smaller scale starting from covid we'll use

L-H-L:

Using coordinates to express surface area of broken cycle with fibs mimicking rise, fall and side mapping cycle:

I'd look for patterns of bullish exhaustion only after price crosses the curve.

Fractal

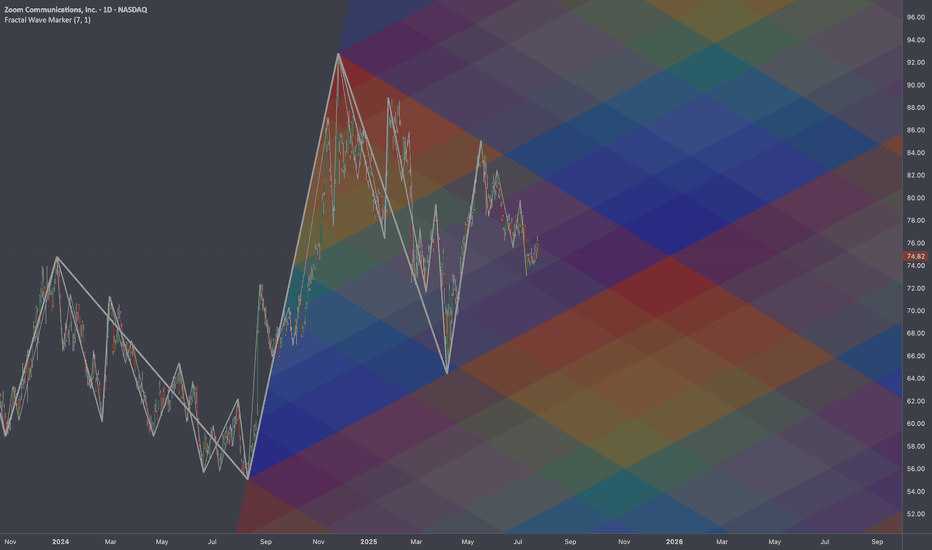

$ZM: Fibonacci Gradient 🏛️ Research Notes

Original Structure

Substitute for projection (TV's drawing tool)

I was thinking if using same 3 coordinates of cycle to cover future 2-polar expansions after breakout. That's why descending fibs would start with coldest (at breakout zone it would be relevant) and vise versa.

Same but with added counter-direction to produce gradient effect of decay.

XLM Explodes +132% — Is the Party Over or Just Starting?XLM has been one of the top movers, sweeping the January 2025 swing high at $0.515 before stalling and moving sideways for the past 4 days.

Is XLM gearing up for another push toward the highs, or is a correction imminent?

Let’s dive into the details.

🧩 Market Structure & Fractal Pattern

XLM skyrocketed +132% in just 13 days, mirroring the explosive move seen back in November 2024.

If we apply the November fractal, the current price action suggests we could be setting up for an ABC corrective move.

📉 Key Levels & Confluences

FVG Zone: ~$0.49–$0.50 — likely to be swept before any major move down.

Monthly Support: $0.4142

Key Level / Liquidity Pool: $0.4056 — likely cluster of stop-losses.

Anchored VWAP (from $0.2228 start of trend): currently near $0.4056, adding strong confluence.

1.0 Trend-Based Fib Extension (ABC projection): If price pushes to ~$0.49 to complete wave B, the projected 1.0 TBFE for wave C lands right on the $0.4056 key level + VWAP, creating a perfect confluence zone.

➡️ Conclusion: The $0.4142–$0.4056 zone is a critical support and liquidity area with multiple confluences lining up.

Trade Setups

🔴 Short Setup:

Entry zone: $0.48–$0.50 (ladder in)

Stop-loss: Above $0.5166 (prior high)

Take-profit: $0.4142–$0.4056 zone

R:R ≈ 1:3

🟢 Long Setup:

Entry zone: $0.4142–$0.4056 (preferably near VWAP)

Stop-loss: Below $0.395

Take-profit: $0.44

⚡ Final Thoughts

Watch for a potential final push toward $0.49–$0.50 before a corrective wave unfolds.

The confluence at the $0.4142–$0.4056 zone — including monthly/weekly levels, VWAP, liquidity pool, and the 1.0 TBFE target — makes it a key area for decision-making.

Stay patient and wait for confirmation at these levels. Will post an update as things unfold!

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

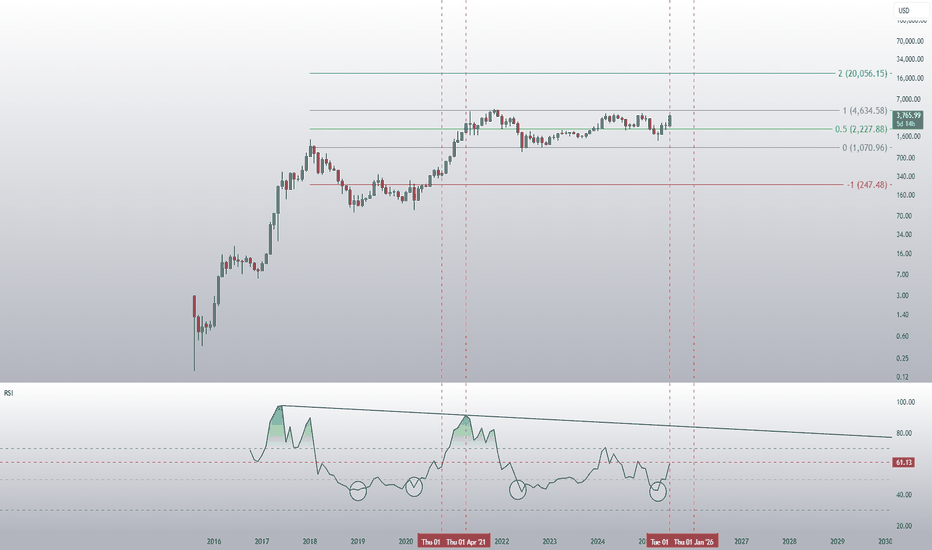

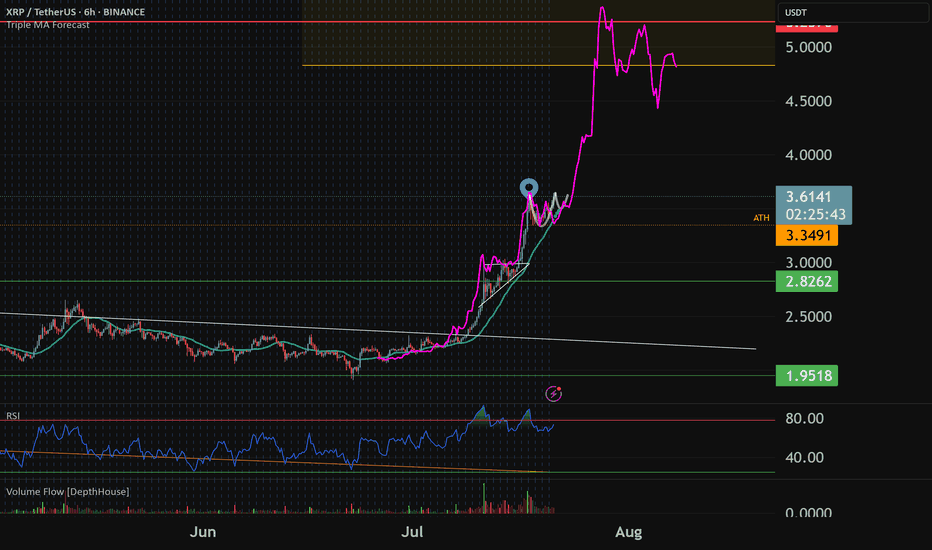

ETH is about to go parabolicDid people realise that Ethereum hit its historical lows on the monthly RSI in April this year? Some people are laughing at the idea of a target of 20k this year, but that would only represent a 20x increase from 2022 to 2025. In contrast, Ethereum achieved a 60x increase from 2018 to 2021.

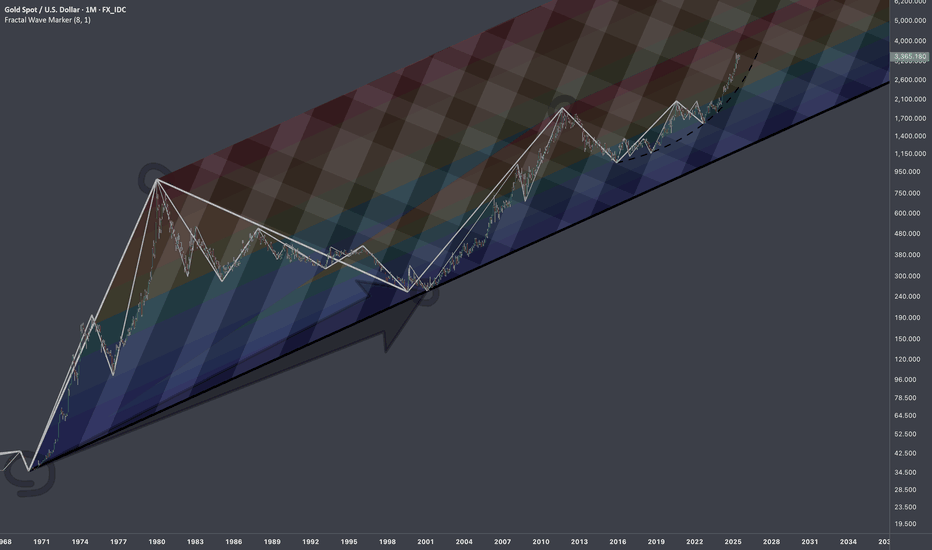

$XAUUSD: Macro InterconnectionsResearch Notes

Linking historic surface area and coordinates of consistent geometric expressions to document and learn more about the "texture" of self-organizing processes. The topology assumes that current price is a result of all history together that took to make the price end up where it is.

The fastest shortcut to figure out fractal hierarchy of waves and general direction is through Fractal wave marker .

Since angle of highs cycle is broken and price stayed above it for long time. That means it would be better to strip the chart starting from the lower levels, in order to get better coordinates for structural basis.

FWM helps to spot that distinctive part of broken waves that enables visual orientation in the rhythm. They manifest in its closest formative across cycles.

The angle that links the pattern through the time can have deterministic property, therefore we can use that direction for fibonacci channels to fill the gaps.

The fact that on log scale the bits from bullish phase of cycles contracted on price scale, I'd orientate with thin fibonacci channels (that is based on angle of lows of macro-cycle applied to previous ATH.

There are some other interconnection that are being tested.

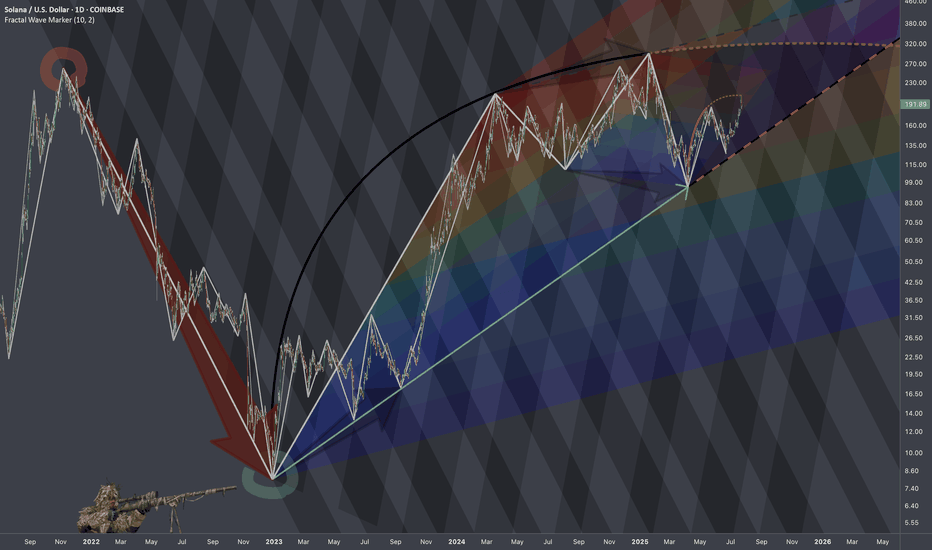

$SOLUSD: Scaling LawsResearch Notes

Progressions here are evident so I'll use the historic bits and organize them into structure that would determine the levels inside dark highlighted zone of the local scope.

If we scale back, it's hard to avoid the massive drop that structurally can serve as reference point.

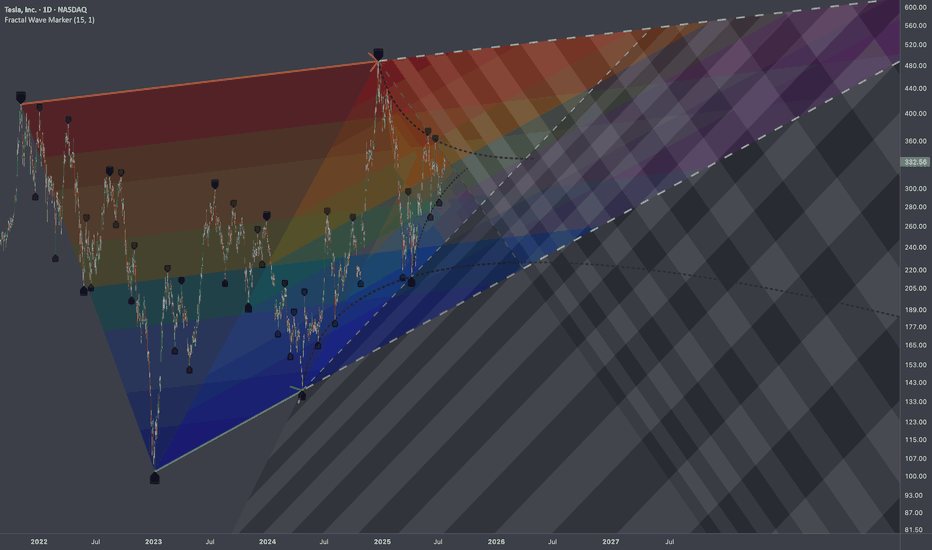

$TSLA: Multi-Scale DensityResearch Notes

Identified structural compressions happening within two periods:

This set has provided a perfect opportunity to study exponential fibs with growth rate starting from phi^1/4 applied to area of expression of squeeze.

Geometrically, gives a better sense of a continuity than regular fibs.

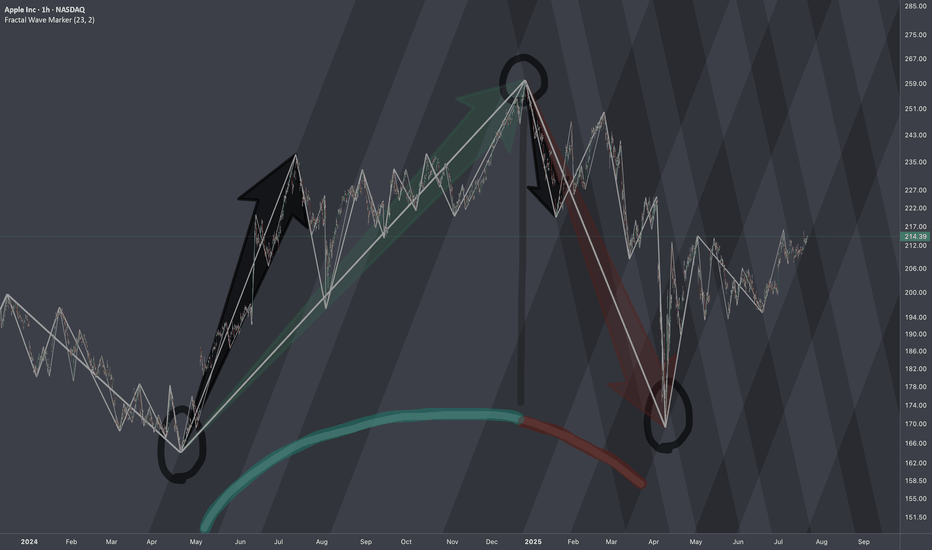

$AAPL: Structure SurgeryResearch Notes

Original Structure:

Altering structure for experimental purposes

Angle of fib channels that rises from cycle low, has been pushed into the past to the top of first major reaction. blue area resembles the change

Reason

The the angle of Fibonacci channels which cover the general decline (from perspective of ATH to end of cycle), are adjusted to the angle of the first bear wave of smaller scale.

Therefore, when it comes to measurements of opposing forces for working out interference pattern, having this symmetric approach of mapping interconnections is fair.

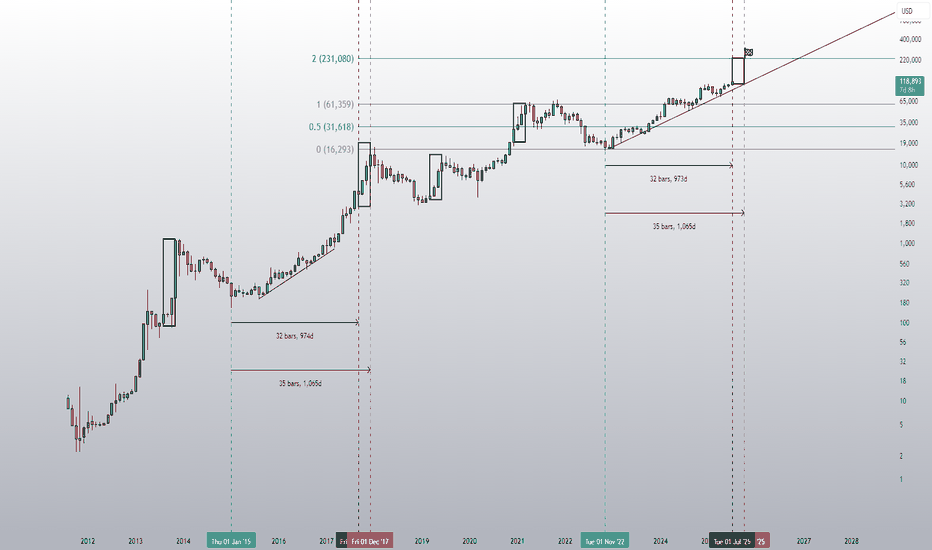

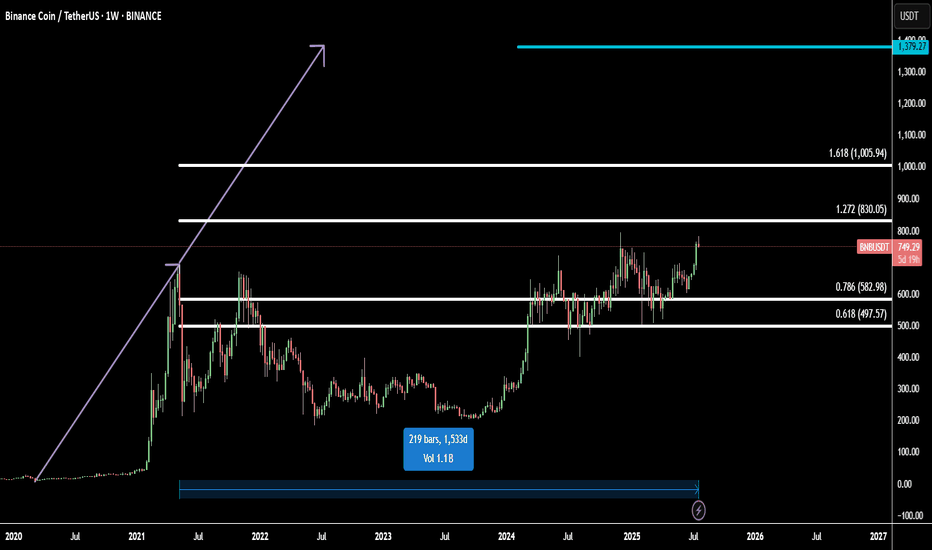

BNB Ready for All-Time High: Fibonacci + 1533-Day FlagBinance Coin (BNBUSD) is setting up for a major breakout, approaching its all-time high with strong momentum.

Technically, BNB has completed a 1533-day flag accumulation — a rare, long-term fractal consolidation that often precedes explosive moves. This massive base acts as a launchpad for the next bullish leg.

Using Fibonacci extensions, we identify two major upside targets:

Target 1: 1.272 Fib – 830.05 - the first resistance and profit zone

Target 2: 1.618 Fib – 1005.94 - key bullish extension from breakout range

Final Target: 1379.27

The final target is projected using fractal symmetry from previous bullish expansions, aligning with the broader market cycle and BNB’s historical price action.

This setup suggests a high-probability move toward new all-time highs and beyond, supported by strong technical structure and breakout energy.

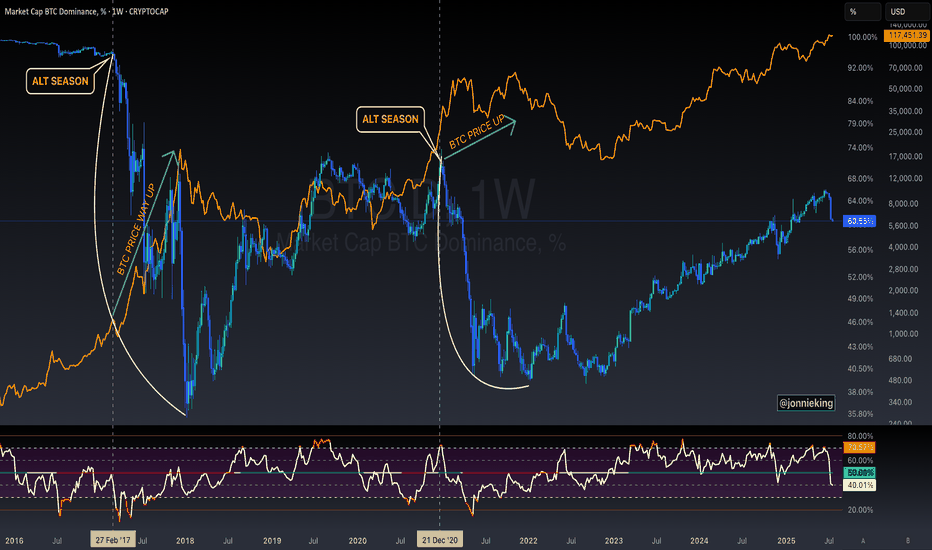

$BTC Will Go Up Alongside Alt SeasonSomeone posted on one of my tweets the following:

" Jonnie my bro, the only problem for me right now is that btc didnt top yet. You also talked how btc shoud top around 200k range. Alt season can only come when btc reach top"

MYTH DEBUNKED ✅

CRYPTOCAP:BTC does NOT need to top in order for Alt Season to commence.

Both can and will occur in tandem 🤝

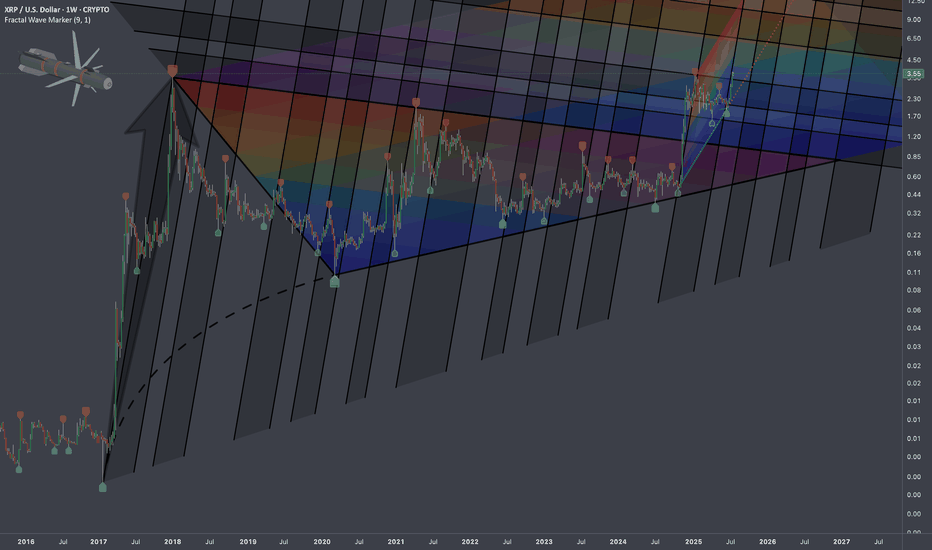

$XRPUSD: Limits of Expansion🏛️ Research Notes

Documenting interconnections where historic area and coordinates of formations are used to express geometry of ongoing cycle.

If we scale out the chart back starting from roughly 2016, we can see more pretext like how the price was wired before decisive breakout from triangle.

Integrating fib channel to the angle of growth phase of the previous super-cycle, so that frequency of reversals match structural narrative.

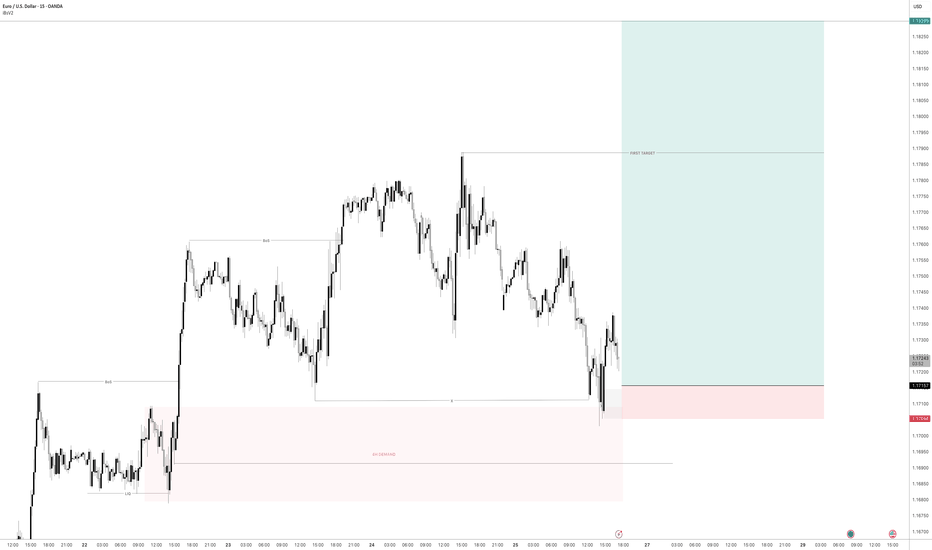

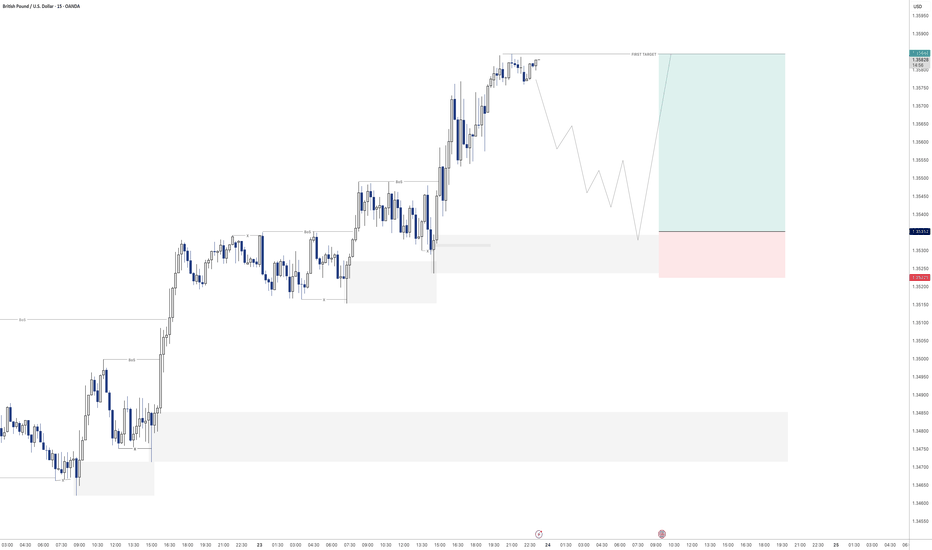

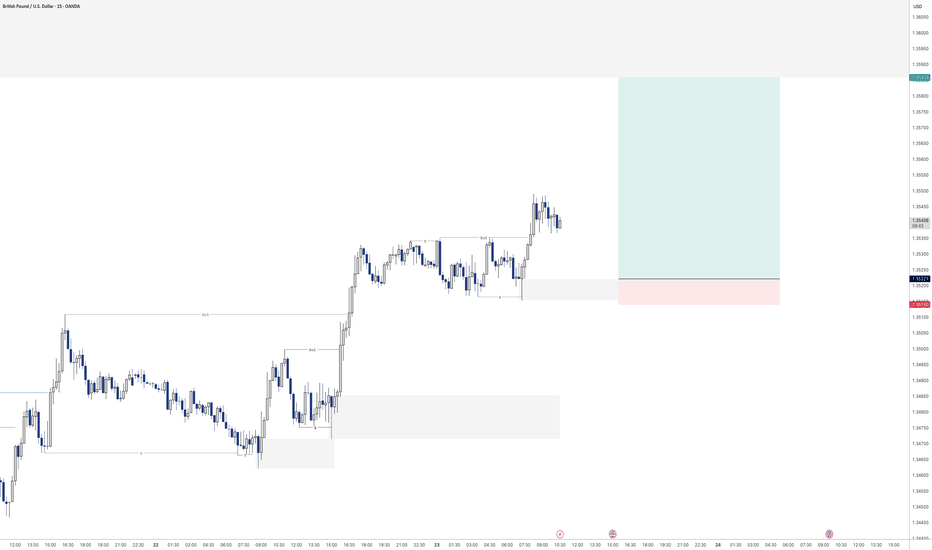

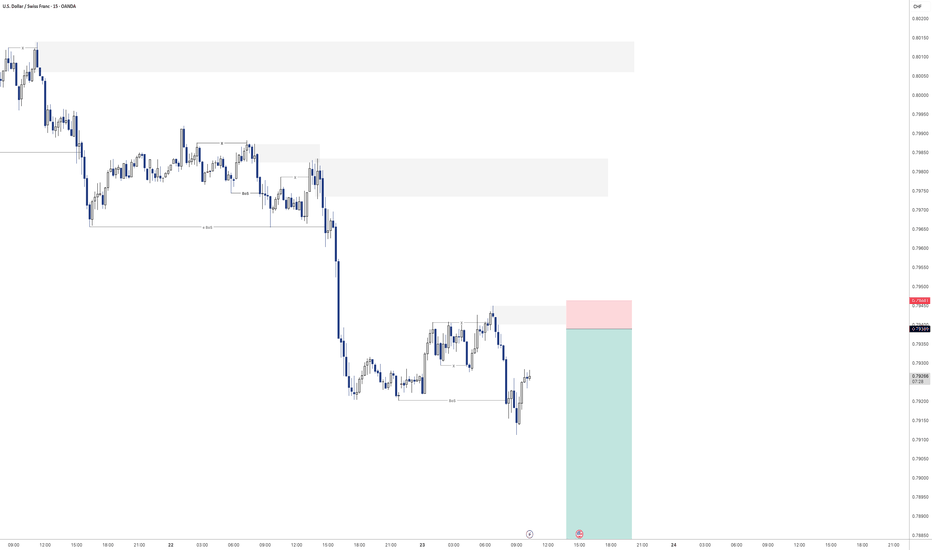

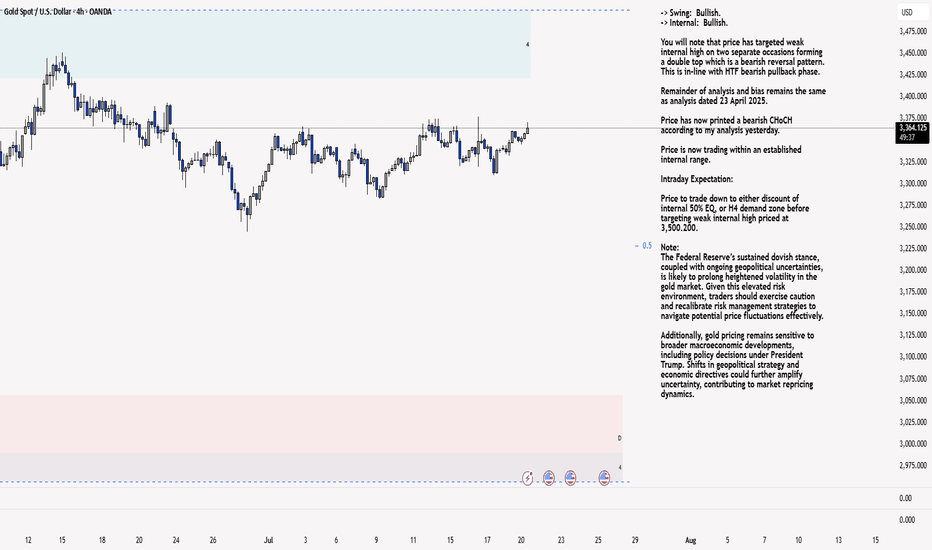

XAU/USD 21 July 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

You will note that price has targeted weak internal high on two separate occasions forming a double top which is a bearish reversal pattern. This is in-line with HTF bearish pullback phase.

Remainder of analysis and bias remains the same as analysis dated 23 April 2025.

Price has now printed a bearish CHoCH according to my analysis yesterday.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,500.200.

Note:

The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively.

Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

H4 Timeframe - Price has failed to target weak internal high, therefore, it would not be unrealistic if price printed a bearish iBOS.

The remainder of my analysis shall remain the same as analysis dated 13 June 2025, apart from target price.

As per my analysis dated 22 May 2025 whereby I mentioned price can be seen to be reacting at discount of 50% EQ on H4 timeframe, therefore, it is a viable alternative that price could potentially print a bullish iBOS on M15 timeframe despite internal structure being bearish.

Price has printed a bullish iBOS followed by a bearish CHoCH, which indicates, but does not confirm, bearish pullback phase initiation. I will however continue to monitor, with respect to depth of pullback.

Intraday Expectation:

Price to continue bearish, react at either M15 supply zone, or discount of 50% internal EQ before targeting weak internal high priced at 3,451.375.

Note:

Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment.

Additionally, President Trump’s recent tariff announcements are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws.

M15 Chart:

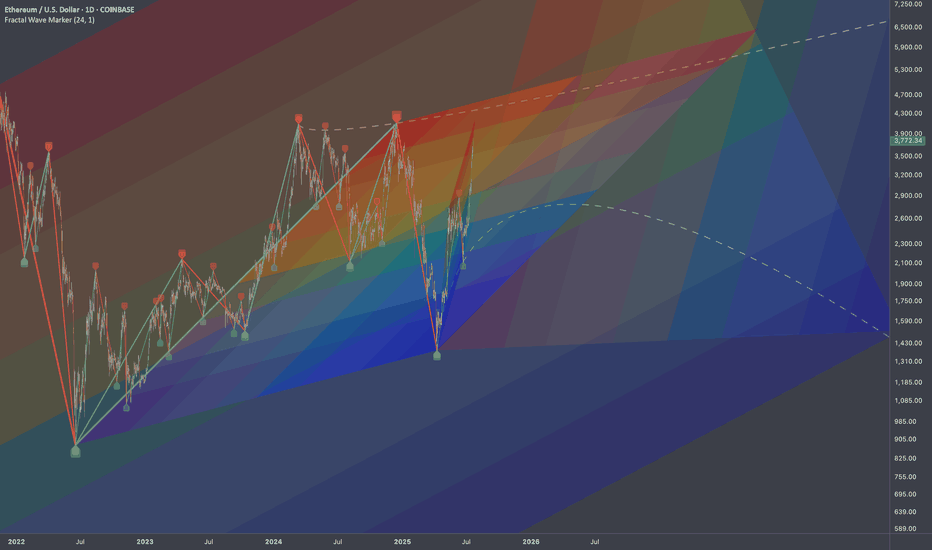

ETHUSD: Multi-Scale LevelsResearch Notes

Price is getting close to connected tops (after which rejections happened).

If we scale out, there is larger narrative Giving vital points of reference.

The dynamics look like part of various progressions at the same time. For example, to answer why price grew from sub-2k levels in the first place, I would pay attention to how it had been falling. Even if price breaks above white line, the ongoings cycle still inherits the prolonged timing.

Interconnection of levels with structural significance:

⬩At smaller scale, fibonacci channel adjusted to the angle of the first small cycle

⬩Scaling out the structure from previous cycle to relate to the levels of local scope.

⬩The final frame of reference covers the case where price expands breaking domestic range.