GLD/SPX as a risk-off signal for BTC/SPXFor all the "Bitcoin will follow gold" crowd...

This chart tells a very different story.

Every time we’ve seen GLD/SPX rally sharply, BTC/SPX has underperformed for months afterward.

📉 See the shaded red zones – they highlight periods when:

GLD/SPX (gold line) made strong relative moves,

BTC/SPX (aqua line) lagged or outright dropped.

We're in another one of those zones right now.

Unless you’ve got a strong reason why "this time is different," the base case is clear:

BTC/SPX likely underperforms for another 3–6 months.

If you're positioning long BTC expecting it to mimic gold's run, be aware — that hasn't played out well historically.

🧭 Trade Idea:

Patience: Don't rush the BTC long. Let the GLD/SPX spike play out.

Timeframe: Revisit BTC/SPX for potential re-entry mid-to-late 2025.

Fractal

$ETH = Silver and $BTC = Gold Means WHAT!?They say Ethereum is the Silver to ₿itcoin being Gold.

If that's the case, does that mean that the ceiling for CRYPTOCAP:ETH will forever be stuck at $4,800

just like TVC:SILVER being capped at $48 for the past 45 years?

Does anyone really think ETH will be higher than $4,800 in 45 years???😆

A true store of value 💯

SHORT GBPJPY from 1H supplyThere was a risk entry on the 15M chart which may yet play out but if it breaks to the upside I expect it to return to the 1H supply zone marked ready to take out the remaining imbalance below with the news candle from Weds evening.

We're still in a downtrend but I suspect with the news of tariffs being paused for the next 90 days there may be a rally, would only confirm an uptrend once its broken that upward move from the weds evening.

SPX: Market Reflexivity & Fractal PatternsIn this idea I would like to walk you through some principles which I use to find and relate historical complexities within rhyming cycles.

Market Reflexivity

Market reflexivity is a concept introduced by George Soros that defies the traditional TA notion of efficient markets by revealing that price movements do not merely reflect fundamentals — they actively shape them. As prices rise, optimism fuels further buying, creating a self-reinforcing loop inflating bubbles. Conversely, declining prices trigger fear, accelerating downturns. Reflexivity explains why trends persist and why reversals can be abrupt, as self-sustaining cycles eventually reach a exhaustion point.

To put it simply, there is a feedback loop between market participants’ perceptions and actual market conditions, suggesting that financial markets are not always in equilibrium because collective investor behavior actively drives price movements, which in turn influences future investor behavior.

Feedback Loops

Each massive rally eventually creates conditions that lead to overvaluation, resulting in sharp corrections.

Self-Fulfilling Expectations

Market participants, reacting to past price behavior, reinforce trends until a breaking point.

Structural Adaptation

Every major correction resets valuations, allowing for the next cycle to begin with renewed confidence and capital inflows.

Practical Application of Reflexivity

Compared to many tickers, SPX has exhibited relatively stable growth throughout history. Over the past 70 years, the most significant panic-driven decline occurred after its 2007 peak, with a 57% drop that defined a major cycle. Growth resumed in 2009, making this swing a key reference point for establishing historical relationships.

I see the Dotcom and Housing crisis-induced declines as part of a broader complexity, shaped by prior long-term growth. The two cycles appear as they do because they stem from an extended structural uptrend, not just the 250% surge from 1994 to the bubble top, which lacked a significant preceding decline. Cause-and-effect logic suggests that these crashes were a reaction to a much larger uptrend that began in 1974. A 2447% rally provides a more compelling reason for mass panic and selling, as corrections of such magnitude are rare.

Intuitively, the 2447% long-term upswing should have been preceded by a decline similar to the Dotcom and Housing crashes. This holds true, as the market experienced a nearly 50% drop after peaking in 1973 and 37% in 1968, following the same cyclical pattern of deep corrections leading to extended expansions. These corrections were relatively smaller than the Dotcom and Housing crashes because they are followed by a comparatively smaller 1452% rally from the end of WWII.

Multi-Fractals

Multifractals in market analysis describe the non-linear, self-similar nature of price movements, where volatility and risk vary across different scales. Unlike simple fractals with a constant fractal dimension, multifractals exhibit multiple fractal dimensions, creating varying levels of roughness. Benoit Mandelbrot introduced multifractal Time Series to refine the classic random walk theory, recognizing that price movements occur in bursts of volatility followed by calm periods. Instead of a single Hurst exponent, markets display a spectrum of exponents, reflecting diverse scaling behaviors and explaining why price action appears random at times but reveals structured patterns over different time horizons.

This justifies viewing price action within its structural cause-and-effect framework, where micro and macro cycles are interdependent, while oscillating at different frequencies. Therefore, we will apply the building blocks independently from boundaries of Full Fractal Cycle.

Since volatility varies, this reserves us the right to extract patterns with identical slope and roughness, and by method of exclusion relate to recent cycles starting from covid.

Arbitrum ARB price analysis💰 One can lose count of how many times the “next bottom” from #ARB has been given as "a gift".

⁉️ The only thing that can be assumed is that the behavior of the #Arbitrum price will repeat itself in a fractal fashion and grow to at least $0.57-0.67 by summer.

🪐 And then, if all the stars align with the parade of planets, and the OKX:ARBUSDT price will be able to gain a foothold above the aforementioned zone, it may continue to grow to $1-1.2.

It seems that once upon a time, this was the price at which #ARB was given away for free, and they forgot to think through one nuance: who will be pumping it if they are generously given to everyone)

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

PEG @ 0.22 DEBT/ASSET @ 0.09 NVIDIA LOOKS CHEAP WITH SELL-OFFFundamental metrics favour NVIDIA and with the company's return on equity (ROE) stands above 119%, NVDA stock price looks irresistible below 105.

N.B!

- NVDA price might not follow the drawn lines . Actual price movements may likely differ from the forecast.

- Let emotions and sentiments work for you

- ALWAYS Use Proper Risk Management In Your Trades

#nvda

#nasdaq

#nyse

Xauusd/M15The 4-hour structure of global gold has turned bearish, and after the structural break, as expected, we observed a pullback to higher levels. Currently, the price has entered an important price zone, and if it is not influenced by specific news, we can expect a price reversal from this range and see further decline. Therefore, depending on the trading style you follow, after observing a trigger, you can enter sell trades.

Can $DOGE Still Leapfrog $BTC...?The original thesis has not yet been invalidated, only pushed farther into the future.

The historical pattern is still there, and the reversal is part of it.

Does that mean DOGE will definitely flip BTC to the extreme upside?

Not necessarily.

But the two hypothetical trend lines will not validate/invalidate until DOGE begins to flip BTC more aggressively.

Then we'll know for sure by how much it flips BTC.

DYOR, STFU, Praise the Lord, and Pass the Ammunition.

$75K BIT COIN: ReboundSo, since my last forecast we've finally after a few weeks reached the $75K mark. Is the bloodshed over? No.

Price is respecting areas where pivots happens based on the data thus far it is moving in a sellers market profile since it made its sharp decline on entering February 2025. At the end of February it was confirmed with the selloff that took it down to$78K and has a sharp bounce reaction as the buyers were getting squeezed the pressure was on there was profit taking also causing a selloff ripple effect.

Now finally having just tapped below $75K and briefly bounced, is the nightmare over? Based on the economic outlook my take is, we're not done with down momentum. I would expect price to dabble inside the two black horizontal lines and try to balance itself in this area $70-$65K. But that doesn't mean it cannot continue to bomb dive to a psychological price level $50K which makes total sense after hitting $100K.

Understand that all other coins have lost nearly or more of their value. If you were on the sidelines and cashed out at the highs consider yourself smart or lucky or both-- that was a good move. But are you considering buying at what some consider this to be a 'discount selloff' to buy the dip and HODL once more for a return to ATH?

Crypto tends to do its run during Fall/Winder. Is it smart to buy now or wait more mid-summer to start loading up the boat?

What are your thoughts!

BTCUSDT - The condition for the continuation of the upward trendToday I am here with another analysis. Thank God, so far, about 85% of the analyses I have presented on the Trading View platform have reached their goal, and I expect that with your support and introducing this page to your friends, I will be able to focus on newer analyses with more energy.

So let's move on to Bitcoin analysis.

Before this analysis, I had published several other analyses about Bitcoin, one of which is still open and I am waiting for it to reach its goal, which you can see on the right side of this article.

But this analysis is from another perspective on Bitcoin conditions.

Maybe my opinion is a further decline in price, but this market is a market of possibilities. It is possible that the impact of a piece of news will shock the market so much that the price can move strongly upwards. So, in the current economic conditions and Trump's presidency, everything is possible!

But technically, my view is still more decline, but what technical conditions make us say that Bitcoin will continue its upward trend and will no longer make a new high?

Everything is clearly marked on the chart. For Bitcoin to have a shift structure, it needs to break $94,416.46 on the higher timeframe, even with a shadow. Then we can think about buying with more certainty, but in this situation, I think it is risky to buy blindly and wait for the price to rise immediately.

If you are buying in spot (not futures) and you intend to buy in the medium to long term, I think buying steps can be very good even in this price range and lower. But if you are buying and selling in futures (which I do not recommend at all), you should look for a point with high probability.

My personal opinion and my view is more of a price drop, but this does not mean that the bull cycle is over because we have not yet seen signs of a bear market on higher timeframes such as weekly and monthly.

I hope you enjoyed this analysis

Please support me by following my page

be profitable

2022 NQ Bear Market Fractal scenarios Index has declined more than 20% and we've failed RSI 40 on weekly, indicating a bear market has started. Best case scenario, I could see it bottoming around 16,666/15000 and recovering very quickly with a blow-off top +100% in less than a year, similar to 2000, topping around 30k-33k.

Bear markets typically last 3M-3Y, with most ending in a year or less. This one topped mid Q1, so mid Q2, Mid-May, might be a great time to buy, if only for a few weeks. Bottoming there after 3M would fit close to orange pattern, or stretch it 3M to bottom mid Q3, October.

Green pattern is the only 1:1 with 2022 top to present, with a bottom around 1Yr and then blue and green are steeper variation bottoming a little later, mid 3Y.

Pink is more of a 2000 top with 3Y bear market, but would just be a recession.

Red is worst case scenario; great depression followed by rapid hyperinflation that sends markets screaming with exponential gains just to outrun inflation.

You can stretch the scales on idea to zoom in and out and see the patterns better, or try drawing your own.

Linked are my ideas from 2022 top. There is more confirming TA, but removed for clarity on an already busy chart.

HYPEUSDshort selling set up, cancel trading if break strong high.

DISCLAIMER:

what I share here is just personal research, all based on my hobby and love of speculation intelligence.

The data I share does not come from financial advice.

Use controlled risk, not an invitation to buy and sell certain assets, because it all comes back to each individual.

QQQ: Tariff ReactionNASDAQ:QQQ As China strikes back with a 34% tariff on U.S. goods starting April 10, the global trade landscape could see some serious turbulence. This follows Trump's tariff moves, and the market's already feeling it: QQQ’s daily chart shows capitulation volume on the table, suggesting a potential bounce— IF tariffs ease.

But until these trade tensions subside, it's likely to be a rocky ride. Tariffs push prices up, inflation lingers, and the Fed finds itself boxed in. The outcome? A market crash, recession, and stagflation—yet, there's still hope for a bounce, depending on how these factors play out.

Manage the levels with us at ChartsCoach.

YM / Dow Jones - long term perspectiveOn the CBOT_MINI:YM1! weekly/monthly/quarterly chart, nothing is looking out of the ordinary as of right now.

No matter what timeframe you're looking at, all timeframes have to go through cycles of rise and fall, and this current panic is just a normal red candle on the quarterly/monthly charts.

After this monthly/quarterly pullback, I'm still expecting a push higher to reach at least 48k before any longer term weakness should set in, if at all.

I see $34k-$38k as a mid-term discount zone, with 42-48k as a mid-term premium zone, with 48k as a magnet of sorts for price to draw toward.

I have 2 scenarios I'm currently watching for:

MID-TERM PULLBACK: Bull market stays intact, Trump ISN'T actually Hitler :-), price sweeps under $38k and sets up bounce back toward 48k from there.

LONG-TERM PULLBACK: World falls apart, Trump IS actually Hitler :-), bear market commences, multiple quarterly red candles, price does a deep pullback to $27.5k before rebounding from there.

SCENARIO 1 (seems most likely):

SCENARIO 2 (seems very unlikely):

Mostly, I would just counsel people to have a plan. "If bull market stays intact, do XYZ. If bear market develops, do ABC."

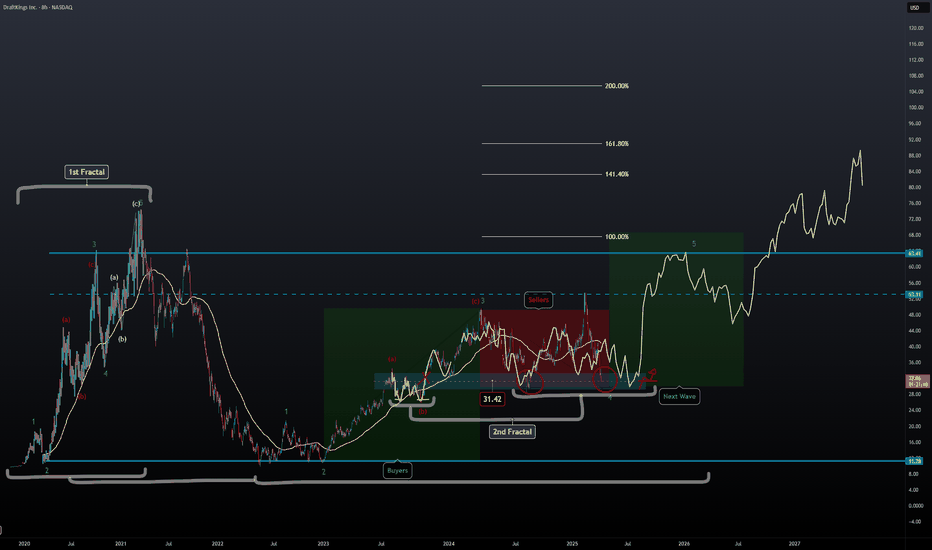

DKNG Update | Second Fractal | Extended TargetsPrice action looks very similar to the '23 Q3 play where we saw a double bottom move taking off from $26 - $49 which is also the ABC move that carried the 3rd impulse wave of the original fractal.

We're still in correction wave 4 and are about to start wave 5 shortly from now to July.

It's possible we could see price action higher than $74 based on the new fractal overlay and with the help of the fib extension.

Tsla Lesson Tesla Stock Always Pay YOURSELFI say this time and time again and this is a PRIME EXAMPLE SO FAR.

🌍Now I suggested THAT IF YOU WERE A TESLA BULL that you might want to start to PAY ATTENTION TO THE STOCK TWO WEEKS AGO.

❓️"OK SO WHAT'S THE LESSON"❓️

I emphasise ALWAYS that TIME TRUMPS PRICE...

TESLA has been rather docile since its initial POP.

But take a look at the HIGHER TIMEFRAME WEEKLY CHART❗️

Whats clear to see is that although the PRICE RANGE hasn't been MASSIVE there has been plenty OF ⏳️TIME TO CAPITALISE AND PAY YOURSELF. £$€¥ 💰

Two 📈HIGHER CLOSES ON THE WEEKLY and the call made whilst the weekly looked EXTREMELY BEARISH📉

EVEN RIGHT NOW we are currently UP ON THE WEEK UNTIL NOW.

ℹ️ If you WERE UNABLE to STRUCTURE A TRADE TO TAKE advantage of this PRICE RANGE whilst DAY TRADING you may need to LOOK BACK and STUDY WHY NOT.

⚠️You could have paid yourself several times over already and even if TESLA was to seek lower prices from here you SHOULD HAVE BACKED SOMETHING ALREADY.

✅️AS ALWAYS TRADE YOUR PLAN & WAIT FOR YOU SIGNAL✅️

xauusd/M15

"In the specified lower range, I expect a buy upon observing a trigger up to the identified supply range. Additionally, I anticipate a breakout above the ceiling from that point. The best range for taking a buy is the identified lower range, where you can proceed with a trigger aligned with your style."