CADJPY: Intraday Bearish Reversal?! 🇨🇦🇯🇵

There is a high chance that CADJPY will retraced from the

underlined blue resistance.

I see strong bearish confirmation on an hourly time frame:

a formation of a bearish imbalance and a change of character.

I expect a bearish move to 105.05

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Freeforexsignals

AUDCAD: Bearish Move From Resistance 🇦🇺🇨🇦

There is a high chance that AUDCAD will retrace from the intraday resistance.

A bearish movement after an extended consolidation on an hourly time frame

provides a reliable bearish signal.

I expect a down movement at least to 0.901

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPJPY: Pullback From Resistance 🇬🇧🇯🇵

There is a high chance that GBPJPY will retrace from the underlined

resistance zone.

A formation of a bearish engulfing candle indicates a strong

bearish pressure.

With a high probability, the price will drop to 194.0 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CADCHF: Very Bearish Candlestick 🇨🇦🇨🇭

CADCHF formed the insidebar pattern after a test of a strong resistance cluster.

Bearish breakout of its range is a strong intraday bearish signal.

I expect a retracement from the underlined area at least to 0.514 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDJPY: Time For Pullback 🇳🇿🇯🇵

I see a nice opportunity to buy NZDJPY after a test of a key daily support.

As a confirmation, I spotted the insidebar pattern with a breakout

of the upper boundary of its range.

I expect a bullish movement at least to 85.75

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

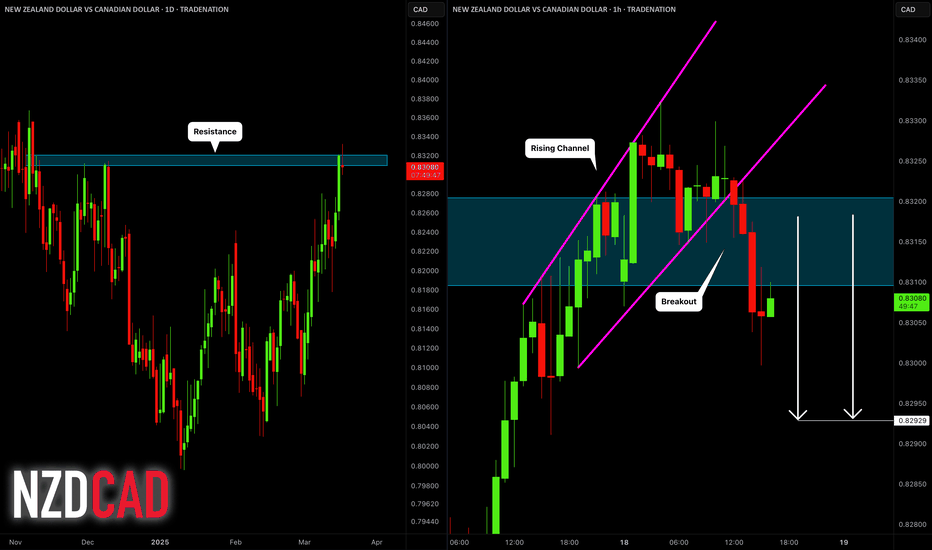

NZDCAD: Bearish After the News?! 🇳🇿🇨🇦

NZDCAD turned bearish after a release of Canadian Inflation data.

The price retraced from a key daily resistance and broke

a support line of a rising parallel channel on an hourly time frame.

The market may drop at least to 0.8293

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD_NZD LONG SIGNAL|

✅AUD_NZD is going down to retest

A strong horizontal support of 1.0947

And the pair is clearly oversold

So after the price hits the support

We can go long on the pair expecting

A bullish correction with the

Take Profit of 1.0965 and

Stop Loss of 1.0939

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDCAD: Strong Bullish Signals 🇳🇿🇨🇦

I see 2 strong price action confirmations on NZDCAD:

the price broke a resistance line of a bullish flag

and then formed a confirmed change of character CHoCH on a 4H.

I think that the market will continue a bullish rally.

Next resistance - 0.83

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

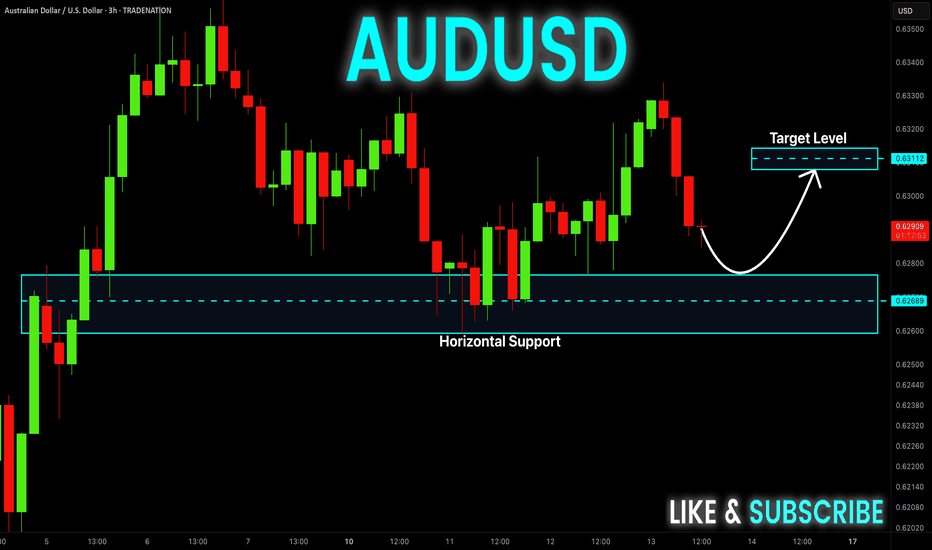

AUD-USD Support Ahead! Buy!

Hello,Traders!

AUD-USD is going down

And will soon retest a

Horizontal demand level

Of 0.6260 from where we

Will be expecting a local

Rebound and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURCHF: Correctional Movement Started 🇪🇺🇨🇭

EURCHF started a correctional movement after a test of a key daily resistance.

Inverted cup & handle pattern on an hourly time frame on that

provides a strong intraday bearish confirmation.

We can expect a bearish continuation at least to 0.96 today.

❤️Please, support my work with like, thank you!❤️

GBPCHF: Pullback From Support 🇬🇧🇨🇭

There is a high chance that GBPCHF will pullback from the

underlined blue intraday support.

As a confirmation, I see a cup and handle pattern on that

and a breakout of its neckline.

Goal - 1.1367

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPCAD: One More Wave Ahead?! 🇬🇧🇨🇦

GBPCAD is positioned to continue rising to new highs.

A bullish breakout of a neckline of the ascending triangle

pattern on a 4H time frame provides a strong trend-following bullish signal.

With a high probability, the price will reach 1.868 level soon.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURCHF: Rise After the News 🇪🇺🇨🇭

Looks like EURCHF may continue growing after the release of US news today.

A breakout of the resistance of the range on an hourly time frame

provides a strong technical confirmation.

Goal - 0.959

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURJPY: Bullish Move From Support 🇪🇺🇯🇵

EURJPY looks bullish after a completion

of a consolidation on a key daily/intraday support.

A formation of a bullish imbalance candle provides a strong bullish confirmation.

I think that the price will go up and hit at least 160.33 level.

❤️Please, support my work with like, thank you!❤️

EURGBP: Bearish Chart Pattern?! 🇪🇺🇬🇧

EURGBP broke a support line of a symmetrical triangle pattern

after a test of key daily resistance.

I think that the pair may retrace at least to 0.836

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDCAD: Bearish Triangle 🇳🇿🇨🇦

I see a descending triangle pattern on NZDCAD after a test of key resistance.

Its neckline breakout is a strong intraday bearish signal.

Goal - 0.8103

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURJPY: Gap is Going to Close 🇪🇺🇯🇵

There is a nice gap up opening on EURJPY.

The formation of a bearish engulfing candle

after a test of the underlined resistance indicates

that the gap is going to be filled soon.

Goal - 156.3

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.