Fundamental Market Analysis for March 24, 2025 GBPUSDThe GBP/USD pair continues to hold below the round 1.2900 mark and is attracting buyers in the Asian session on Monday.

The US Dollar (USD) started the new week on a weak note and halted its three-day recovery from multi-month lows, which in turn is seen as a key factor acting as a tailwind for the GBP/USD pair. Despite the Federal Reserve (Fed) raising its inflation forecast, investors seem convinced that a tariff-induced slowdown in the US economy could force the central bank to resume its rate-cutting cycle in the near future.

In fact, the UK central bank has cautioned against assumptions of rate cuts and has also raised its forecast for inflation to peak this year. This suggests that the Bank of England will reduce borrowing costs more slowly than other central banks, including the Fed, which lends further support to the GBP/USD pair.

Moving forward, traders are awaiting the release of flash PMI indices from the UK and the US for meaningful momentum. In addition, speeches from influential FOMC members will stimulate demand for the dollar, which, along with comments from Bank of England Governor Andrew Bailey, should create short-term trading opportunities for the GBP/USD pair.

Trading recommendation: BUY 1.2930, SL 1.2850, TP 1.3060

Fundamental-analysis

USD/CAD Triangle Pattern (24.03.2025)The USD/CAD pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Triangle Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 1.4403

2nd Resistance – 1.4435

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

xAUUSD Structure, Sentiment & Strategic Patience📊 XAUUSD WEEKLY INSIGHT | Structure, Sentiment & Strategic Patience

As we close out a volatile trading week, let’s zoom out and assess what’s really happening with gold. The recent price action on the higher timeframes is revealing important signals — and it’s time to take a strategic pause before the next move.

🔍 WEEKLY SNAPSHOT:

Gold experienced a sharp correction of over $50, followed by a late-session recovery into the weekend. The result?

✅ Long upper wicks on both the W1 and D1 candles,

✅ Signs of rejection from all-time highs,

✅ Yet price still managed to close above the 50% candle body range — momentum is cooling, but not reversing (yet).

The big question now is:

Is this a healthy pullback within the uptrend… or the beginning of something deeper?

📐 Key Takeaways:

Structure on higher timeframes remains bullish – price is still moving within the primary ascending channel

Short-term retracement has reached the 0.5–0.618 Fibonacci zone on H1 and H2 – a potential decision area

End-of-week buying indicates positioning by informed participants, not random volatility

No confirmation of a major reversal yet – but conditions are developing

📌 Key Levels to Watch:

Resistance Zones: 3025 – 3033 – 3040 – 3046 – 3056

Support Zones: 3014 – 3005 – 3000 – 2993 – 2986

🧠 Mindset Going Into Next Week:

Don’t rush it.

Let Monday’s open reveal the volume story — whether through gaps, spikes, or clean structure. The best setups form after the market shows its hand, not before.

This is where strategic patience beats emotional trading.

📣 Final Note:

Stay focused on structure. Respect your levels. Watch how price reacts — not just where it goes.

And remember: sometimes no trade is a powerful trade when the market is indecisive.

More insights coming soon on market psychology and execution discipline.

💬 Feel free to leave a comment, follow for updates, or share your own views below.

Wishing everyone a strong and clear start to the new week,

— AD | Money Market Flow

Fundamental Market Analysis for March 21, 2025 EURUSDFederal Reserve (Fed) Chairman Jerome Powell downplayed the danger to the economy from US President Donald Trump's tariff threats, which seem to exist in a quantum state where they both exist and don't exist at the same time. According to Fed Chairman Powell, downside risks have certainly increased thanks to repeated tariff threats, but Fed policymakers continue to insist that US economic data remains strong, albeit off recent highs.

The Federal Reserve Bank of Philadelphia's (Fed) manufacturing activity survey for March fell to 12.5 m/m, down from the previous reading of 18.1 and down for the second month in a row, but held the brakes and fell less than the median market forecast of 8.5. US weekly initial jobless claims also rose less than expected at 223,000 new jobless claimants, up from 220,000 the previous week. Investors had expected the figure to be 224k. Sales of existing homes in the US also rose by almost a third of a million transactions more than expected, rising to 4.26 million units in February from a revised January figure of 4.09 million. Market watchers had expected a slight slowdown to 3.95 million.

With little in the way of economic data on Friday, investors will have a week's worth of events to digest. Traders will also keep an eye on any social media developments from President Trump.

Trade recommendation: SELL 1.0850, SL 1.0930, TP 1.0760

GOLD (XAU/USD) Trading Plan: Can Gold Surge Past $3100?🚀Published by MMFlowTrading on 20 March 2025

📊 Market Snapshot

Gold (XAU/USD) is riding a strong uptrend on the H1 chart, moving within a clear ascending channel 📈. After breaking the $3000 psychological barrier, bullish momentum remains intact 💪. However, with key resistance ahead and US economic data on the horizon, volatility could spike. Let’s break down the setup for today’s trading session! 🧠

🔍 Technical Analysis

Ascending Channel:

Gold is trading in a well-defined ascending channel (highlighted in orange on the chart) 📉📈. The price has respected both the upper and lower boundaries, confirming a solid uptrend. It’s currently testing the upper channel resistance at $3070.612 🚧

Key Resistance Levels:

Immediate resistance at $3070.612, a high-volume area (VPOC) where sellers may step in 🛑

A break above could target $3081.053, then $3097.774, with $3100 as the next psychological level 🎯

Key Support Levels:

Nearest support at $3031.774, aligning with the channel’s lower boundary and a prior VPOC 🛡️.

A deeper pullback might test $3024.254 or $3017.197, where buyers previously defended (marked by yellow circles) 📍

Additional Levels to Watch:

Resistance: $3054 - $3061 - $3070 🚧

Support: $3044 - $3038 - $3031 - $3026 🛡️

🌍 Fundamental Insights

US Dollar Dynamics:

Gold often moves inversely to the USD 💱. Today, 20 March 2025, markets are focused on the US Jobless Claims data (due at 13:30 GMT) and Fed speeches, which could sway the Dollar 📅. A weaker-than-expected US report may weaken the USD, boosting Gold towards $3100 🚀.

Safe-Haven Demand:

Geopolitical tensions (e.g., Middle East unrest, US-China trade talks) continue to support Gold as a safe-haven asset 🛡️. This underpins the bullish outlook for now.

Interest Rate Environment:

The Fed’s dovish tone in early 2025 has lowered the opportunity cost of holding Gold, supporting its upward trajectory 📉. Meanwhile, keep an eye on UK inflation data this week, as it could impact GBP and indirectly influence Gold.

📝 Trading Plan

Buy Opportunity (Buy Zone: $3032 - $3030) 🟢

Stop Loss (SL): $3026 ⛔

Take Profit (TP): $3038 - $3042 - $3046 - $3050 - $3060 💵

Sell Opportunity (Sell Zone: $3069 - $3071) 🔴

Stop Loss (SL): $3075 ⛔

Take Profit (TP): $3065 - $3060 - $3055 - $3050 💵

⚠️ Market Alert

Gold has been hitting all-time highs following the FOMC meeting earlier today 🌪️. With US data due during the London session, expect volatility—stick to your TP/SL to safeguard your account! 🛡️💡

Fundamental Market Analysis for March 20, 2025 USDJPYThe Japanese yen (JPY) attracted buyers for the second consecutive day and strengthened to a new one-week high against its US counterpart during the Asian session on Thursday. Expectations that strong wage growth could boost consumer spending and contribute to higher inflation give the Bank of Japan (BoJ) room to raise interest rates further. This has led to a recent sharp narrowing of the rate differential between Japan and other countries, which continues to support the low-yielding yen.

In addition, uncertainty over US President Donald Trump's trade policy and its impact on the global economy, as well as geopolitical risks and the political crisis in Turkey, are contributing to inflows into the Yen. The US Dollar (USD), on the other hand, is struggling to gain meaningful momentum amid increased economic uncertainty amid US President Donald Trump's trade tariffs. This, in turn, is weighing on the USD/JPY pair and contributing to the intraday decline.

However, interest rate differentials, the Bank of Japan's loose monetary policy, the trade balance differential and global market sentiment put pressure on the Japanese yen. The further direction of the USD/JPY pair lies on the upside.

Trading recommendation: BUY 148.400, SL 147.600, TP 150.100

Sharp reversal in US marketsAmid market volatility and uncertainty, US stock indices experienced a sharp decline last week. The Dow Jones Index (#DJI30) fell by 3.5%, the S&P 500 (#SP500) dropped by 4.1%, and the Nasdaq-100 (#NQ100) lost 5.5%.

Investors reacted nervously to new economic data, including rising inflation and expectations of interest rate hikes, leading to a sell-off in stocks and a decline in key indices. The drop was particularly significant in the technology and consumer sectors, where companies like Apple and Tesla lost around 6-7% of their value.

However, starting March 13, 2025, the indices began to recover: #DJI30 gained 2.3%, #SP500 rose by 2.5%, and #NQ100 increased by 3.1%.

The recent rebound in US stock indices has been driven by several factors that restored investor confidence. Let’s take a closer look at the main reasons:

• Improvement in unemployment data: Labor market statistics played a crucial role in the market recovery. The US unemployment rate fell to 3.4% in February 2025, marking a record low in recent decades. This indicates strong employment levels and economic resilience, boosting investor optimism and supporting stock market growth.

• Stabilization of inflation and interest rate expectations: Although inflation in the US remains high, recent data showed a slowdown in its growth. Reduced inflationary pressure gave investors hope that the Federal Reserve (Fed) might slow down the pace of interest rate hikes. This was perceived as a sign of potential economic stabilization, positively impacting stock indices.

• Growth in consumer spending: One of the key drivers of the recent market recovery has been the increase in consumer spending. In Q1 2025, consumer demand in the US showed strong performance, serving as an essential indicator of economic activity. Increased spending on goods and services supports business stability and enhances corporate revenues, which, in turn, stimulates stock growth.

• Absence of new geopolitical risks: In recent weeks, there have been no major geopolitical crises or new threats on the international stage. This helped financial markets stabilize, as investors could focus on economic data and corporate earnings reports, contributing to stock index growth.

• Positive corporate earnings reports:

• #Microsoft (MSFT): Microsoft shares rose by 4.2% after reporting strong quarterly results, driven by growth in cloud services and software revenue.

• #Google (GOOGL): Alphabet’s stock increased by 3.7% due to higher advertising revenue and improved forecasts for upcoming quarters.

• #Apple (AAPL): Apple shares climbed 2.9%, supported by strong sales of new products and rising revenue from services.

• #Tesla (TSLA): Tesla stock surged 5.6%, fueled by strong electric vehicle sales growth and optimistic profit projections for the next quarter.

These companies demonstrated significant growth on the back of improved financial performance, strengthening investor confidence and aiding the stock market’s recovery amid volatility.

So despite last week’s market downturn, the current situation in the US stock market signals a potential recovery and a more positive trend in the coming weeks.

CAD/JPY Triangle (BoJ Interest Rate- Today) 19.03.2025The CAD/JPY pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Triangle Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 105.50

2nd Resistance – 106.06

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

NZD/JPY Trendline Breakout (19.3.2025)The NZD/JPY Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Trendline Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 85.83

2nd Support – 85.10

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

XAUUSD- Gold will continue the Bullish upward (Read caption) XAU/USD is expected to maintain its bullish momentum in the upcoming week, driven by sustained investor demand, a weakening U.S. dollar, and ongoing geopolitical uncertainties that continue to support safe-haven assets. Technical indicators suggest that gold may test key resistance levels, with buyers looking to push prices higher amid strong market sentiment. Traders should keep an eye on economic data releases and Federal Reserve commentary, as any dovish signals could further fuel the rally. As long as gold remains above crucial support zones, the bullish trend is likely to persist, with the potential for new highs in the near term.

WELCOME 3000 GOLD WILL GOLD MARK NEW ATH AGAIN!🔥 Attention Traders! 🔥

XAUUSD is heating up! Here's the latest analysis:

🔻 Bearish Setup: Watch for a potential decline if the price breaks below 2979-3003. Key targets: 2960 & 2945.

🔺 Bullish Setup: A breakout above 2911 could signal buying opportunities! Keep an eye on these targets: 3015 & 3030.

📉 Risk Management: Always protect your capital by setting stop-losses and adjusting position sizes based on your risk tolerance. Trading with discipline is key to success!

📊 Stay Engaged: Share your thoughts and strategies as we navigate through this volatile market. Let’s aim for new highs while managing risk effectively! 💵🚀

Fundamental Market Analysis for March 18, 2025 EURUSDThe escalating trade war with further tariffs on European Union goods by US President Donald Trump is having a negative impact on the Euro (EUR).

The US has imposed tariffs on steel and aluminium, the EU has drawn up plans to retaliate, and Trump has promised to impose retaliatory 200% tariffs on European wines and spirits. Any signs of an escalation in the tariff war between the US and EU could put pressure on the euro.

German Chancellor Friedrich Merz has agreed to a €500bn infrastructure fund and radical changes to borrowing rules, or stretching the so-called ‘debt brake’. That should ensure the package is approved in Germany's lower house of parliament on Tuesday and in the upper house on Friday. This, in turn, could boost the common currency against the US dollar (USD) in the near term.

In addition, weaker-than-expected US retail sales data has heightened concerns about a slowdown in consumer spending. This report could put pressure on the USD and serve as a tailwind for the major pair. US retail sales rose 0.2% month-on-month in February, compared to a 1.2% drop (revised from -0.9%) in January, the US Census Bureau reported on Monday. The figure was weaker than market expectations, which had expected a 0.7% rise. On a year-over-year basis, retail sales rose 3.1% compared to 3.9% (revised from 4.2%) previously.

Trade recommendation: BUY 1.0920, SL 1.0840, TP 1.1040

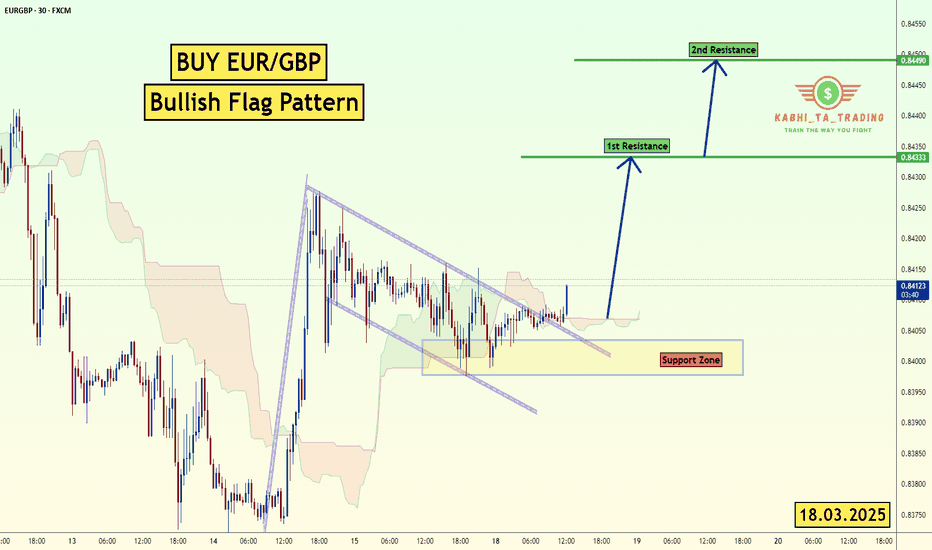

EUR/GBP Bullish Flag (18.3.25)The EUR/GBP pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Bullish Flag Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 0.8433

2nd Resistance – 0.8448

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

XAG/USD Breakout (17.3.2025)The XAG/USD pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 34.31

2nd Resistance – 34.66

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Fundamental Market Analysis for March 17, 2025 USDJPYThe Japanese yen (JPY) fluctuated between moderate gains and minor losses against its US counterpart during Monday's Asian session amid mixed fundamentals. Optimism driven by China's stimulus measures announced over the weekend is evident in the overall positive tone in Asian stock markets. This, in turn, is seen as a key factor undermining the safe-haven yen.

Nevertheless, a significant yen depreciation remains elusive amid diverging policy expectations between the Federal Reserve (Fed) and the Bank of Japan (BoJ). In addition, geopolitical risks and concerns over the economic impact of US President Donald Trump's tariffs are supporting the yen. In addition, bearish sentiment around the US Dollar (USD) should restrain the USD/JPY pair.

Traders may also refrain from aggressive directional bets and prefer to step aside ahead of this week's key central bank events - the Bank of Japan and Fed decisions on Wednesday. This calls for caution from the yen bears and positioning for a continuation of the recent rebound in the USD/JPY pair from the multi-month low around 146.550-146.500 reached last Tuesday.

Trading recommendation: BUY 148.900, SL 148.400, TP 150.100

Fundamental Market Analysis for March 14, 2025 GBPUSDThe GBP/USD pair continues to decline for the second consecutive session, trading near 1.29400 during the Asian session on Friday. The pair faces challenges as the Pound Sterling (GBP) struggles amid weakening risk sentiment, exacerbated by concerns over global trade after US President Donald Trump threatened to impose 200% tariffs on European wines and champagne, which worried markets.

Traders are now awaiting the UK's monthly gross domestic product (GDP) and factory data for January, which will be released on Friday. Investors will be keeping a close eye on the UK GDP data as the Bank of England (BoE) has expressed concerns about the outlook for the economy. At its February meeting, the Bank of England revised its GDP growth forecast for the year to 0.75%, up from the 1.5% projected in November.

The US Dollar (USD) is appreciating amid growing concerns about a slowdown in the global economy, with traders' attention focused on Friday's Michigan Consumer Sentiment Index data. The US Dollar Index (DXY), which tracks the dollar against six major currencies, strengthened after Thursday's positive jobless claims report and weaker-than-expected Producer Price Index (PPI) data. At the time of writing, the DXY is trading near 104.00.

U.S. initial jobless claims for the week ended March 7 came in at 220,000, below the 225,000 expected. Jobless claims fell to 1.87 million, below the forecast of 1.90 million, indicating a resilient U.S. labor market.

Inflationary pressures in the US showed signs of easing. The producer price index rose 3.2% year-on-year in February, down from 3.7% in January and below the market forecast of 3.3%. The core producer price index, which excludes food and energy, rose 3.4% on a year-over-year basis, up from 3.8% in January. On a monthly basis, the core price index was unchanged, while the underlying price index declined 0.1%.

Trading recommendation: SELL 1.29400, SL 1.29900, TP 1.28600

GBP/USD Channel Breakout (14.03.2025)The GBP/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Channel Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 1.2890

2nd Support – 1.2862

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

GBP/CHF Channel Pattern (13.03.25)The GBP/CHF pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Channel Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 1.1490

2nd Resistance – 1.1540

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

EUR/USD Triangle Pattern (13.3.25)The EUR/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 1.0805

2nd Support – 1.0771

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

XAG/USD (Silver) Wedge Pattern (13.03.2025)The XAG/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Wedge Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 32.45

2nd Support – 32.00

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

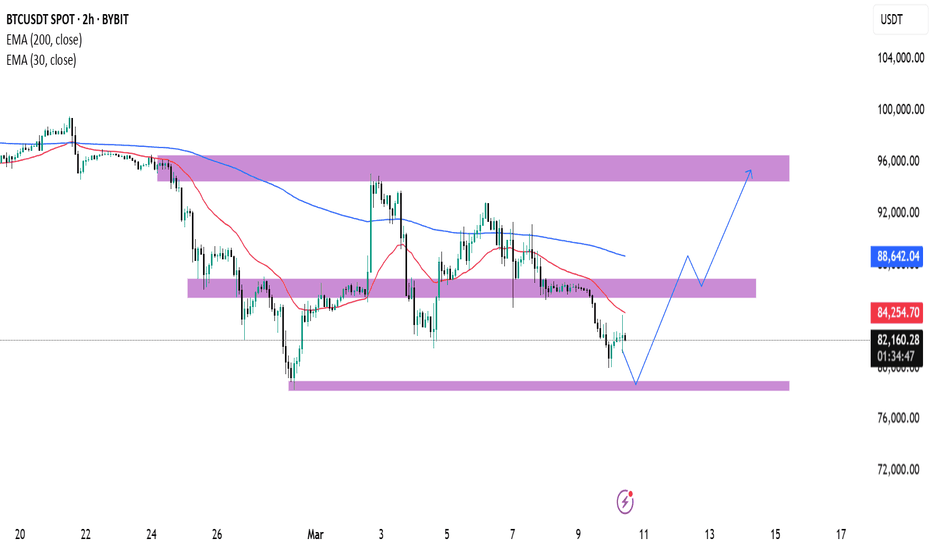

BTC/USDT Price Analysis: Reversal or More Downside?:

📊 BTC/USDT 2-Hour Chart Analysis

🔻 Current Trend:

BTC is in a downtrend 📉, trading below the 30 EMA (🔴 84,270 USDT) and 200 EMA (🔵 88,644 USDT).

The price is currently 82,406 USDT and approaching a key support zone (🟣 ~80,000 USDT).

Support & Resistance Levels

🟣 Support Zone (~80,000 USDT) – Possible bounce area ⬆️

🟣 Mid-Resistance (~86,000–88,000 USDT) – First hurdle 🚧

🟣 Major Resistance (~96,000 USDT) – Final target 🎯

Possible Price Movement (🔵 Blue Line Projection)

✅ Bullish Case:

If BTC bounces off support 🏋️, it could move towards 88,000 USDT 🚀 and then 96,000 USDT 🎯.

❌ Bearish Case:

If BTC breaks below 80,000 USDT, we might see more downside ⚠️.

💡 Trading Tip:

Watch price action 📊 at support & resistance.

Look for confirmation signals ✅ before entering trades.

🚀 Are you bullish or bearish on BTC? 🔥