Can further declines in DXY attract buyers of this commodity?ICEUS:CT1! futures have been on a steady decline for some time now. Could potential further declines in DXY attract buying interest of MARKETSCOM:COTTON ? Let's dig in.

Let us know what you think in the comments below.

Thank you.

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Futures

Gaza conflict and Trump tariffs push GOLD higher againOANDA:XAUUSD rose more than 1% on Tuesday to a new record high and are currently trading around $3,035/oz, close to yesterday's peak. Trade uncertainty due to rising tensions in the Middle East and US President Trump's tariff plans have boosted investor demand for safe-haven assets.

Israeli airstrikes kill more than 400 in Gaza

Early Tuesday morning local time, the Israeli military carried out heavy airstrikes on Gaza City in the northern Gaza Strip, Deir el Balah, the Nusayrat refugee camp in the central Gaza Strip, as well as Khan Yunis and Rafah in the south.

The British news agency Reuters reported that Israeli airstrikes killed more than 400 people in Gaza, threatening a two-month ceasefire.

Israeli Prime Minister Benjamin Netanyahu said the airstrikes were carried out because Hamas has repeatedly refused to release Israeli detainees. Defense Minister Israel Katz warned that if Hamas does not release the detainees, "our attacks will intensify."

Hamas said Israel's move was a unilateral end to the ceasefire, leaving Israelis held in Gaza "to face an unknown fate."

There were unconfirmed reports that an Iranian vessel collecting intelligence during the Gaza offensive was sunk by US forces, escalating tensions in the Middle East.

Saudi media reported on Tuesday that the Iranian Navy's most advanced intelligence ship, the Zagros, was hit by an unidentified missile in the Red Sea on Monday evening local time, causing its hull to be damaged, leaking and sinking.

World Media reported that the US military was then attacking Houthi armed forces in the area outside the Red Sea, while the Israel Defense Forces conducted a large-scale bombing of Gaza, and the origin of the missile that hit the Iranian naval vessel could not be determined.

Trump's Tariffs

Meanwhile, US President Trump has proposed a series of US tariff plans, including a 25% flat tariff on steel and aluminum (which took effect in February), as well as reciprocal tariffs and sectoral tariffs that will be applied on April 2.

Trump said he would impose general reciprocal tariffs on April 2, with additional tariffs targeting specific industries. Trump told reporters on Air Force One on Sunday that both tariffs would be applied to foreign goods imported into the United States “under certain circumstances,” “They tax us, we tax them, and then we’ll tax other industries beyond autos, steel, aluminum.”

Ultimately, Gold is often considered a safe investment in times of economic or geopolitical uncertainty, and in the current environment, it is still fundamentally well supported.

There are also many other supports such as demand from central banks, national reserves, and ETF volumes, the decline of the Dollar, the Fed's monetary policy, etc. Readers can review previous publications for more information.

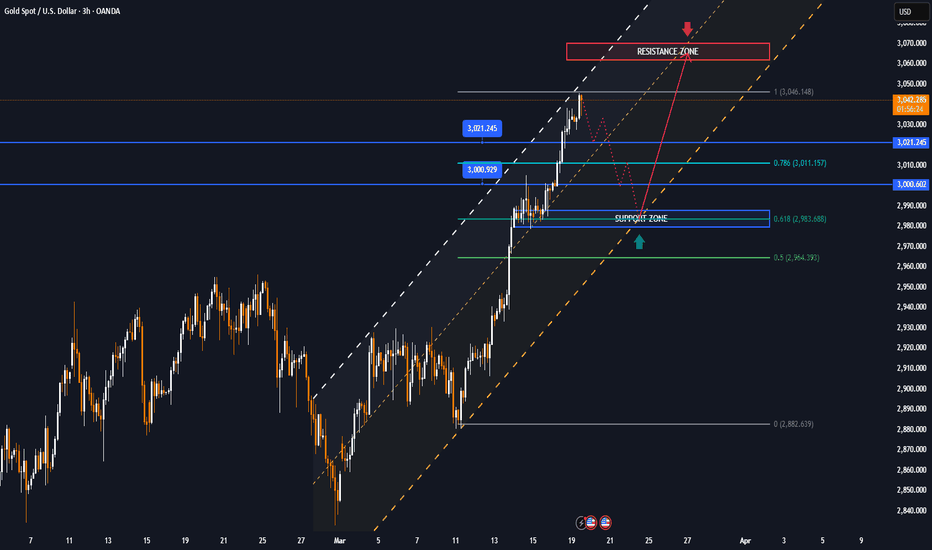

Technical outlook analysis of OANDA:XAUUSD

On the daily chart, although the RSI is operating in the overbought area, it has not shown any signal to indicate a significant downside correction. A signal for a correction is a crossover of the RSI below 80.

Meanwhile, the sustained price action above the 0.50% Fibonacci extension level is a positive signal with the expectation of further upside and the next target is the 0.618% Fibonacci extension position at the price point of $3,065.

Currently, there is no notable resistance ahead, so until the level of 3,065 USD gold can still rise freely.

The intraday uptrend of gold will be noticed again by the following notable positions.

Support: 3,021 – 3,000 USD

Resistance: 3,065 USD

SELL XAUUSD PRICE 3068 - 3066⚡️

↠↠ Stoploss 3072

→Take Profit 1 3060

↨

→Take Profit 2 3054

BUY XAUUSD PRICE 2984 - 2986⚡️

↠↠ Stoploss 2980

→Take Profit 1 2992

↨

→Take Profit 2 2998

S&P 500 E-mini Futures VWAP Breakout Strategy Sharing a solid intraday idea for you all – something I’ve been running on the S&P 500 E-mini Futures (30-min chart) lately, and it’s been delivering clean setups.

VWAP Breakout Play

I’m focusing on simple VWAP-based breakouts. Here’s the breakdown:

The setup:

• Wait for price to break above or below the VWAP with strong momentum (big candles + solid volume).

• I always confirm with a momentum indicator like MACD or RSI to filter out the noise.

Entries:

• Breakout Long: When price pushes above VWAP + momentum aligns.

• Breakout Short: When price dumps below VWAP + momentum confirmation.

Exits & Stops:

• Scale out at session highs/lows or key pivots.

• Stop-loss goes just beyond VWAP to keep the risk tight.

• If momentum fades, I’m out.

Why I like it:

VWAP attracts institutional flow, and combining it with momentum gives this strategy a solid edge, especially around U.S. session opens when volatility kicks in.

Give it a try and tweak it to your liking!

2025-03-18 - priceactiontds - daily update - nasdaqGood Evening and I hope you are well.

comment: Neutral. Today was really bad for the bulls. The rejection from 20000 should not have go so deep. I now think we will likely chop between 19000 - 20000 until Opex. Bulls had the momentum on their side and the breakout above 20100 was strong enough to go higher but here we are. Lows 19346 have to hold or we flush to 19k. Around 19700 I’d rather do jack shit. 50% of this range is Monday’s low at 19755m which was also late resistance today.

current market cycle: strong bear trend but pullback expected

key levels: 19000 - 21000

bull case: Bulls did good and then fumbled it hard. They now need to keep this a higher low above 19346 or we could flush down to 19000. Technically this is a trading range 19300 - 20200 and we could make lower lows and higher highs in this range, give or take. My assumption was stronger buying into opex but for that we needed to stay above 19700ish. Now what could convince me that this could become a strong short squeeze into Friday? Immediate reversal during Globex and a grind up to 20000 before EU opens. Very very unlikely. One last tiny argument bulls could have is the retest one but for that today’s low has to hold and we just have to grind up.

Invalidation is below 19604.

bear case: Bears outdoing themselves currently. Strong surprise today and now I think any upside is likely limited to around 21200. If bears are really strong, we make lower lows tomorrow and then chop into Opex on Friday. I see this as low probability and I would prefer sideways inside the current range.

short term: Neutral around 19700. Bearish around 20000 if bears come around again and bullish if we reverse strongly from either 19600 or 19400.

medium-long term - Update from 2024-03-16: My most bearish target for 2025 was 17500ish, given in my year-end special. We don’t know if we have printed the W1 of the new bear trend or repeat the pattern from 2024, where we sold of very strong to reverse even more strongly and make new all time highs. Market needs a bounce and around 20000/20500 we will see the real battle for the next weeks.

trade of the day: Long during EU session was decent but more so for dax. This short on US open obviously but I don’t think it was easy, given the bullishness before.

GOLD MARKET ANALYSIS AND COMMENTARY - [March 17 - March 21]Last week, the international OANDA:XAUUSD increased sharply, from 2,880 USD/oz to 3,005 USD/oz. Then, profit-taking pressure caused the gold price to drop to 2,978 USD/oz and closed the week at 2,986 USD/oz.

The reason for the sharp increase in gold prices in recent days is that US inflation figures (CPI, PPI) have decreased more sharply than expected, raising expectations that the FED will cut interest rates twice more this year.

In addition, concerns about US public debt have increased as the US Congress is unlikely to pass the Budget Bill, putting the US government at risk of a shutdown.

The FED meeting next week will play an important role in shaping expectations about the FED's interest rate policy. This could be the main driver for gold prices next week, given the inverse correlation between gold and the USD.

However, in recent comments, the FED Chairman has remained cautious about inflationary pressures due to concerns that the Trump administration's tariff policies will fuel inflation in the medium and long term. Therefore, it is possible that the FED Chairman will continue to maintain interest rates at current levels in the next meetings. If so, this will be a shock to gold prices next week, causing gold prices to fall next week.

🕹SOME DATA THAT MAY AFFECT GOLD PRICES NEXT WEEK:

This week is shaping up to be a volatile one for gold, with markets digesting a number of key economic releases.

Central banks continue to dominate the calendar, with the Bank of Japan announcing its interest rate decision on Tuesday, followed by the Federal Reserve on Wednesday and the Swiss National Bank and Bank of England on Thursday.

There are also a number of key US economic data releases, including Retail Sales and the Empire State Manufacturing Index on Monday, Housing Starts and Building Permits on Tuesday. On Thursday, markets will be watching the weekly Unemployment Report, Existing Home Sales and the Philadelphia Fed Manufacturing Survey.

📌Technically, in the short-term perspective on the H1 chart, gold prices next week may maintain their upward momentum to find the 161.8 fibo level around 3035. Or they may temporarily reduce and adjust around the Trendline at 2915.

Notable technical levels are listed below.

Support: 2,977 – 2,956 USD

Resistance: 3,000 – 3,021 USD

SELL XAUUSD PRICE 3036 - 3034⚡️

↠↠ Stoploss 3040

BUY XAUUSD PRICE 2914 - 2916⚡️

↠↠ Stoploss 2910

GOLD surges as geopolitical risks unexpectedly boost gainsOANDA:XAUUSD continued to rise in the short term, with gold prices just hitting a new all-time high of $3,014/oz.

As investors focused on US economic data, which raised concerns about an economic slowdown, and escalating tensions in the Middle East, the precious metal's appeal as a safe haven was highlighted.

Israel Strikes Hamas Targets Across Gaza, Killing Over 200

Israel said it carried out military airstrikes on Hamas targets in the Gaza Strip, a move that risks derailing a fragile ceasefire. Palestinians reported multiple airstrikes by Israel on various areas of the Gaza Strip. Traders were also looking at U.S. retail sales data, which showed a smaller-than-expected increase in February. Falling yields on 10-year U.S. Treasury notes also helped boost non-interest-bearing gold.

Israel has launched a series of airstrikes on the Gaza Strip as a nearly two-month-old ceasefire appeared to be rapidly unraveling, with Prime Minister Benjamin Netanyahu saying his government would “increase its military force” against Hamas.

Palestinians reported Israeli airstrikes in several areas of Gaza on Tuesday morning, and an Israeli statement confirmed the attacks took place across Gaza.

Hamas’ media office said on Tuesday that Israeli airstrikes on the Gaza Strip had killed more than 200 people.

The attack shattered a fragile ceasefire that had been suspended for 15 months in the war ravaging the Gaza Strip. It was the heaviest bombing since a ceasefire brokered by Egypt, Qatar and other countries took effect in January.

Technical Outlook Analysis OANDA:XAUUSD

After reaching and breaking the original price level which is also the bullish price target of 3,000 USD, gold is continuing to aim for the target level behind that, pay attention to readers last week at 3,021 USD in the short term, which is the location of the 0.50% Fibonacci extension level.

Meanwhile, the Relative Strength Index (RSI) is sloping up with a significant slope and has not completely moved above the overbought area, showing that momentum and room for growth is still ahead.

Next, the main trend and outlook remains bullish with price channels and mid- to short-term trend. The main support is seen by the EMA21.

As long as gold remains above the EMA21, it remains technically bullish, the current dips should only be considered as a short-term correction or a buying opportunity.

The following areas of interest will also be noted.

Support: $3,000 – $2,977

Resistance: $3,021 – $3,065

SELL XAUUSD PRICE 3036 - 3034⚡️

↠↠ Stoploss 3040

→Take Profit 1 3028

↨

→Take Profit 2 3022

BUY XAUUSD PRICE 2949 - 2951⚡️

↠↠ Stoploss 2945

→Take Profit 1 2957

↨

→Take Profit 2 2963

Emergence of Bear Flag in Nasdaq The price action seems to be suggesting the formation of Bear Flag Pattern.

The price fell steeply and then gave a pullback, which is getting sold into.

As the channel of flag breaks downwards, the fall may gain momentum.

Further price action will confirm or negate the pattern, it may move cleanly or will have whipsaws.

If the price starts consolidating for long here, rather than breaking downwards, the pattern may fail.

Trade Safe

2025-03-17 - priceactiontds - daily update - dax

Good Evening and I hope you are well.

comment: Weekly outlook gave clear invalidation points and bulls broke above. We have a clear measuring gap down to 22800 now and until that is closed, it’s bullish all the way to new ath and maybe 24k.

current market cycle: trading range but we could see the resumption of the bull trend tomorrow

key levels: 22260 - 24000

bull case: Bulls defended the breakout and had a perfect retest with last weeks close. Every pullback now should stay above 23000 and then we are free to test 23500 and maybe even 24000. Bulls are in full control again.

Invalidation is below 23000.

bear case: Bears failed in breaking below the breakout of 22800ish and they had to give up after we printed 4 consecutive 1h bars with big tails below. 1h 20ema is support and until bears get consecutive closes below it again, they don’t have much. I think most bears will wait how high this one goes and start looking for shorts above 23500.

Invalidation is above 23600.

short term: Bullish for 23500 and maybe 24000. Bearish only below 22900.

medium-long term from 2024-03-16: Germany takes on huge amount of new debt. Dax is rallying hard and broke above multi-year bull trends. This buying is as real as it gets, as unlikely as it is. Market is as expensive as it was during the .com bubble but here we are and marking is pointing up. Clear bull channel and until it’s broken, I can not pound my chest and scream for lower prices. Price is truth. Is the selling around 23000 strong enough that we could form a top? Yes. We have wild 1000 point swings in both directions. Look at the weekly chart. Last time we had this volatility was 2024-07 and volume then was still much lower. We are seeing a shift from US equities to European ones and until market closes consecutive daily bars below 22000, we can’t expecting anything but sideways to up movement.

current swing trade: None

trade of the day: Bullish above invalidation point yesterday given. Hope you made some.

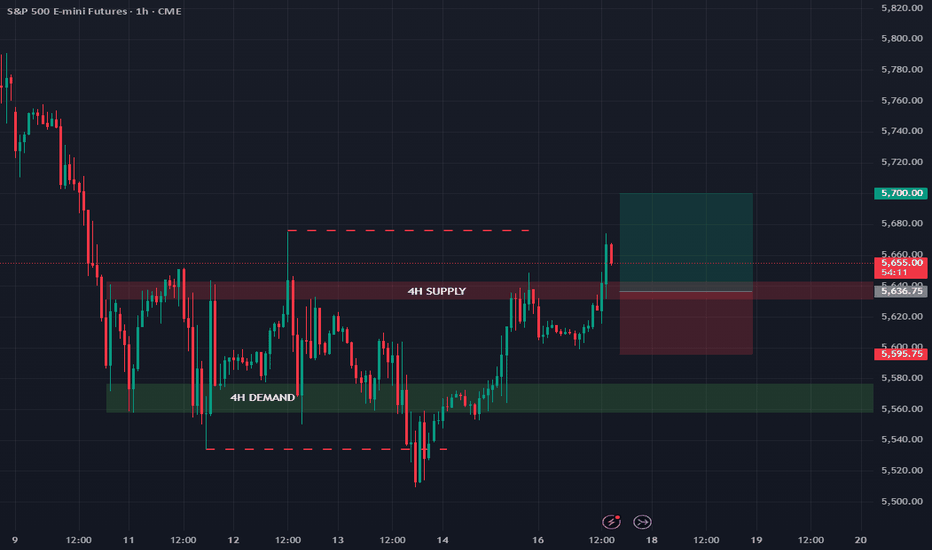

ES futures update 17/03/'25Last week, I mapped out some trading zones that are still valid and unchanged.

The 4H supply zone has broken out, so I will be looking for a long position after a retest of this broken supply zone, which should now act as support.

My last trade was a short from this zone, resulting in a small profit since market closing prevented reaching the full take-profit target.

Let's see if the bullish momentum can hold during the retest entry.

As always, follow for more market updates.

WTI increased slightly and decreased rapidly, downtrend TVC:USOIL prices rose slightly by about 1% in Asian trading on Monday before falling sharply, largely due to the continued US military crackdown on Houthi militias.

US Pete Hegseth said on Sunday that the US military will continue to fight the Houthis until they stop attacking international shipping lanes. The US has previously conducted airstrikes in Yemen, causing casualties among Houthi fighters.

The Houthis have hinted that they could take stronger retaliatory actions, adding to market concerns that the situation in the Red Sea will continue to escalate.

While geopolitical tensions pushed oil prices higher, concerns about global economic growth limited gains.

Goldman Sachs analysts have lowered their oil price forecasts based on the following points:

• The Trump administration’s new tariffs on Mexico and Canada could restrict global trade and lead to lower-than-previously expected US economic growth.

• The slowdown in economic growth will lead to lower oil demand, and Goldman Sachs expects oil demand growth in the coming months to be lower than previously estimated by the market.

• OPEC+ supply could exceed expectations, and while the market is currently focused on the situation in the Middle East, overall supply remains relatively abundant.

• The market expects signs of a slowdown in the US economy to keep oil prices under pressure in the long term, although geopolitical factors could still support prices in the short term. In addition, the market is paying attention to the Federal Reserve's interest rate meeting on March 18-19. The market expects the Fed to keep interest rates unchanged while continuing to assess the impact of the Trump administration's policies on the economy. If the economic outlook continues to deteriorate, the possibility of the Federal Reserve adjusting its policy this year cannot be ruled out.

WTI Crude Oil Technical Outlook Analysis TVC:USOIL

On the daily chart, WTI crude oil is temporarily in the accumulation phase but with the current position and structure, the downtrend is still dominant with the short-term trend being noticed by the price channel, the medium-term by the price channel and the nearest pressure from the EMA21.

The recovery momentum of WTI crude oil is also limited by the 0.50% Fibonacci extension level, and as long as crude oil fails to move above the EMA21 and break above the price channel, it still has a main bearish outlook.

In the short term, the downside target is around $65, the low since September 10, 2024, followed by the 0.786% Fibonacci extension. Notable positions for the WTI crude oil downside trend will be listed again as follows.

Support: $66.63 – $65.33

Resistance: $67.85 – $68.52 – $69.07

#202511 - priceactiontds - weekly update - dax futuresGood Evening and I hope you are well.

comment: Wild week where market reversed the huge selling on Friday and the daily bear bar looks more bullish than bearish. 23k is the battleground right now. If bears keep it a lower high, we could test further down but if they don’t, bulls could try and go for 24k. News certainly help in fueling this right now.

current market cycle: Bull trend until consecutive daily closes below 22000

key levels: 22000 - 24000

bull case: Above 23500 we could go for 24000 next week. This did not change since market went nowhere last week. Bulls defended the gap to 22000 and that is as bullish as it get’s. Plan for bulls is clear, keep market above the adjusted bull trend line around 22500 and make new ath above 23500, likely going for 24000. The channel looks still good, so trade it like it’s valid.

Invalidation is below 22400 because it would invalidate the channel but only a print below 22000 would change the character of this market.

bear case: Bears have shown decent selling pressure for 1200 points but that does not matter if they can not get below 22000 again. I do think it’s not unlikely that the bears have the argument for a head & shoulders, if 23000 proves to be bigger resistance now. I’d still favor the bulls for now but if we fail below 23200 for the next 3-6 days, the bull trend line would be broken and market could test lower, if overall sentiment shifts again after the expected short squeeze. Yes, I do keep in mind that German stocks are likely profiting big time from the spending spree Germany will likely go on but I am a price action daytrader. I read the chart and develop a thesis would could happen and if it does I put on risk. This front-running could very well reverse. Bears only have their confirmation below 22000 and for now market has tested 22147 - 22300 enough that bears gave up.

Invalidation is above 23500.

short term: Neutral around 22800/23200. Above 23200 we will retest 23500 and above that we likely try for 24000. 22400-22800 is the dead zone and only below 21900 bears have good reasons for lower prices. For now I can’t see any reason why this would fall below 22000 next week.

medium-long term from 2024-03-16: Germany takes on huge amount of new debt. Dax is rallying hard and broke above multi-year bull trends. This buying is as real as it gets, as unlikely as it is. Market is as expensive as it was during the .com bubble but here we are and marking is pointing up. Clear bull channel and until it’s broken, I can not pound my chest and scream for lower prices. Price is truth. Is the selling around 23000 strong enough that we could form a top? Yes. We have wild 1000 point swings in both directions. Look at the weekly chart. Last time we had this volatility was 2024-07 and volume then was still much lower. We are seeing a shift from US equities to European ones and until market closes consecutive daily bars below 22000, we can’t expecting anything but sideways to up movement.

current swing trade: None

chart update: Nothing

#202511 - priceactiontds - weekly update - nasdaq e-mini futuresGood Evening and I hope you are well.

comment: Let’s take this from the weekly chart. Market has not dipped below the 2024-09 low but that was way too much to expect for bears. 14% down in 4 weeks straight selling is beyond unsustainable but it’s also very very unlikely that this was it and we just go up again. My thesis is a new bear trend until proven otherwise. How would bulls do that? Anything above 21100 would be too high for a retracement in a strong bear trend and it would likely fit a trading range narrative. Trading range would mean 2024-04 low at 17900 to 2024-12 ath at 22450. Bear trend is drawn on the chart and would lead to at least the 50% retracement of this bull trend since 2022, down to around 17500. When will we know? If market retraces below or to the 50% around 20400 and strongly reverses down again, I see my theory confirmed so far. For next week I can’t see anything but a big short squeeze to trap late bears. 19140 was such a weird place to reverse and I can only see this already being strong bulls buying the dip and trapping everyone who thought we were going for 19000.

current market cycle: strong bear trend but pullback expected

key levels: 19140 - 20500

bull case: Bulls have only going for them that this selling is beyond overdone and climactic and Friday' was a very strong bullish day on huge volume. My bear target was 19600 and we almost printed 19000. 20000 is the first obvious target for a pullback but I think a 50% retracement to 20700 is doable, since the daily 20ema is also at 20400. I expect the market to fight the real battle for either the new bear trend or a multi-year trading range around 20000.

Invalidation is below 19100.

bear case: Bears showed more strength and got below my measured move target of 19600 but failed above the 2024-09 low at 18867. Last time bears made this much money was 2024-07 where we corrected for 16.91% to then rally 25.59% higher over the next 19 weeks. Hand on heart I do think it’s much more likely we will see that pattern from 2024 repeated than a new bear trend. A trading range 19000 - 22450 is much more likely than going down to 16000. As of now. Can this change if the US really goes into a bigger recession? Of course but for now this is front-running the possible risk because we got up so much the past years that funds really need to secure some profits this time. For next week I have absolutely nothing for the bears. This selling is overdone and market is so much more likely to squeeze late bears, that I won’t look for any short trades until we see 20000 or higher.

Invalidation is above 21100.

short term: Heavy bullish bias for 20000 and likely 20400. Above 20500 air would get real thin again, if this was the start of a bear market. For now I think the pattern from 2024-07 is more likely to repeat than the bear trend as drawn on the chart.

medium-long term - Update from 2024-03-16: My most bearish target for 2025 was 17500ish, given in my year-end special. We don’t know if we have printed the W1 of the new bear trend or repeat the pattern from 2024, where we sold of very strong to reverse even more strongly and make new all time highs. Market needs a bounce and around 20000/20500 we will see the real battle for the next weeks.

current swing trade: None

chart update: Updated the possible bear trend and added a bullish alternative to show what we did in 2024. For now the bullish path is more likely.

#202511 - priceactiontds - weekly update - wti crude oil futuresGood Evening and I hope you are well.

comment: Weekly chart. First green week after 7 consecutive bear weeks. Astonishing eh. Weak bull bar anyhow and sideways is more likely than anything above 70, for now at least. We have now seen higher highs but the 2024-04 highs were not broken and market failed below 80. So the multi-year contraction is still valid. Same for the downside. Lows were not broken for now and bears would need to get below the 2024-09 low to make new ones.

current market cycle: trading range

key levels: 65 - 70

bull case: Bulls have nothing. Still. They need a daily close above 70 to start having arguments again. For now they just stopped new lows after 7 weeks and any bounce is likely to get sold again. Daily 20ema at 68.4 is their next target and above that they could try for 70. Since we made higher lows and lower highs last week, we are obviously in a triangle, which could break on Monday.

Invalidation is below 64.

bear case: Bears needed to take profits and reduce risk at these lows that were previous support. For now I see the chance of another leg down as very low so I don’t have many arguments for the bears. If we close strongly below 65, it opens up 64, then 62 but we have so many previous lows (support) down here, it’s just not a good short trade.

Invalidation is above 71.

short term: Neutral again. No shorts for me down here. Want to see either 70 or 63 next week.

medium-long term - Update from 2025-02-23: Bear trend is getting weaker but I still see this going sideways around 70 instead of a range expansion.

current swing trade: None

chart update: Minor adjustments to the trend lines.

US30; Heikin Ashi Trade IdeaPEPPERSTONE:US30

In this video, I’ll be sharing my analysis of US30, using my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

ES futures update 14/03/'25The key trading zones from yesterday's analysis remain unchanged.

Yesterday's plan was to short at the demand zone retest after the breakdown, but the trade was cancelled since price never reached my entry point.

Today, I'll be watching for either a short opportunity at the 4H supply zone or a long position after a breakout and retest of the supply zone.

Follow me for more trading updates.

GOLD nears $3,000 as trade tensions escalateOANDA:XAUUSD have surged to an all-time high, just shy of the key $3,000-an-ounce mark as global trade tensions and expectations of a Federal Reserve rate cut push them closer to a record high. They have risen nearly 14% this year, following a 27% gain in 2024.

WASHINGTON (Reuters) - President Donald Trump on Thursday threatened to impose 200% tariffs on wine, champagne and other alcoholic beverages from France and the rest of the European Union, marking a further escalation in global trade tensions.

Trump tweeted Thursday that he would impose import tariffs if the European Union continues to impose duties on U.S. whiskey exports. The EU's move is in retaliation for Trump's steel and aluminum tariffs that took effect on Wednesday.

Trump also had harsher words for the European Union. The EU has been one of the United States' closest allies for decades. Trump posted on his Truth Social platform: "The European Union is one of the most hostile and abusive tax and tariff organizations in the world, and their sole purpose is to take advantage of the United States. They just put a disgusting 50% tariff on whiskey. If this tariff is not removed immediately, the United States will soon put a 200% tariff on all wine, champagne and spirits coming from France and other EU member states. This will be a tremendous boon to the American wine and champagne industry."

Trump’s trade policy changes have boosted the price of gold, an asset favored by investors during times of geopolitical and economic uncertainty.

In addition, the Wall Street Journal reported that Russian President Vladimir Putin had rejected plans for an immediate ceasefire in Ukraine, which also contributed to the safe-haven buying of gold.

Russian President Vladimir Putin said Thursday that Russia will not agree to an immediate end to fighting in Ukraine and called for further discussions on ending the war permanently, The Wall Street Journal reported. Moscow’s military is now advancing rapidly, aiming to push Ukrainian troops out of the Kursk region. Putin said any ceasefire at this stage would be in Ukraine’s interests because Russia is winning on the battlefield and there are many issues that need to be resolved before a ceasefire can be reached.

SPDR Gold Trust, the world's largest gold ETF, said its holdings rose to 907.82 tonnes on February 25, the highest since August 2023. Meanwhile, data from China's central bank showed China bought gold for a fourth straight month in February.

Over the weekend, data on US consumer confidence and inflation expectations will be less in the spotlight than tariffs and geopolitical headlines.

For economic data, readers can find more details in the signature section through brief comments during the day.

Technical Outlook Analysis OANDA:XAUUSD

On the daily chart, gold is down slightly year-to-date after approaching the important raw price level of $3,000.

The current correction is also not significant as the uptrend will still dominate the chart with the price channel as the nearest support at present, the main support is noted by the EMA21 and the other support is the 0.382% Fibonacci extension level.

Meanwhile, the Relative Strength Index (RSI) has not yet risen above the overbought zone, indicating that there is still room for upside.

Intraday, as long as gold remains above the price channel and the 0.382% Fibonacci extension level, its main short-term outlook remains bullish. Even if gold falls below the aforementioned support area, it remains in an overall bullish trend, so the current declines should be viewed as a short-term correction or a buying opportunity.

Next, the target will be the full price point of $3,000 in the short term and more at the 0.50% Fibonacci extension level.

The notable positions for the day are listed as follows.

Support: $2,977 – $2,956

Resistance: $3,000 – $3,021

SELL XAUUSD PRICE 3037 - 3035⚡️

↠↠ Stoploss 3041

→Take Profit 1 3029

↨

→Take Profit 2 3023

BUY XAUUSD PRICE 2949 - 2951⚡️

↠↠ Stoploss 2945

→Take Profit 1 2957

↨

→Take Profit 2 2963

2025-03-13 - priceactiontds - daily update - nasdaq futuresGood Evening and I hope you are well.

comment: Bulls can’t get anything going that’s not sold heavily. I can’t see this not closing at the lows tomorrow. The target is obvious, 2024-09 low at 18867. The tight bear channel started at 22245. This selling without any meaningful bounce is so weird and overdone, it’s hard to grasp. We went from melting higher on literally any news to not being able to close green on a week where news were all in line or not bad. I can not take this as a W1 of a new bear market where my next target is likely 18000 for W3 and 16000 for W5.

current market cycle: trading range - only daily closes below 20000 mark the end of this bull trend

key levels: 19000 - 21000

bull case: Easy as pie to write. Bulls need anything above 19800. Anything below is much more likely to that we sell hard again, since it’s not stopping. Bulls can not trap any bears and are quick to give up on any selling pressure. Best for bulls would be to stay above today’s low and make another higher low above 19165. Weekly close above 19500 would surprise me big time.

Invalidation is below 19140.

bear case: Bears are really overdoing it. A 5-10% up move is around the corner I think. Next target below is the September 2024 low at 18867, which aligns somewhat with the current bear channel. The channel is the dominant feature right now, so trade it. My base assumption for tomorrow is another try by the bulls and heavy selling into the weekend. Would not be surprised if we close the week below 19000.

Invalidation is above 19600 but bulls need something above 19800 if they want further upside. 19600 is just the break of the bear channel.

short term: Can only be neutral for now. Having a bullish bias but bulls are not doing enough for now. I wait. 20k is my first target. Nothing changed. Selling down here is not for me.

medium-long term - Update from 2024-02-23: Will update this on the weekend. Bear trend has started.

trade of the day: Yeah. Globex printed the high of the day early and market could not get above it or 19600 for that matter. I thought a trading range day was much more likely and we had decent two-sided trading but bulls are running for the exists and just want out. 6 x 1h bars that struggled to stay above 19550 was the cue that we likely test down again.

ES futures trade setup 13/03/'25Hello,

In today's trade analysis, I will review potential setups for this trading day. Since the overall trend is bearish, I favor short positions over long positions.

I have identified two important zones on the 4H timeframe that align well with the 1H timeframe.

4H supply zone: 5,643 - 5,630

4H demand zone: 5,577 - 5,558

We've seen both false breakouts and breakdowns in recent days, indicating choppy market conditions.

My plan is to either go short in the upper 4H supply zone or short a breakdown of the 4H demand zone. For the latter, I'll wait for the candle to close below the zone and set my entry on a retest.

GOLD hits Bullish targets, heading for all-time highAs tariff uncertainty pushed money into safe havens, cooling US inflation kept market expectations of a Fed rate cut intact and optimism over a ceasefire between Russia and Ukraine cooled, OANDA:XAUUSD surged and broke out of its recent sideways consolidation trading range.

OANDA:XAUUSD surged past the $2,942/oz target on safe-haven demand. Weaker US CPI data also supported expectations of a Federal Reserve rate cut, pushing gold higher.

The US consumer price index (CPI) rose 2.8% year-on-year in February, slightly below the 2.9% expected and down from January's 3.0%. The year-on-year increase in the core CPI, which excludes volatile food and energy prices, eased to 3.1% from January's 3.3%.

Recent news of a ceasefire between Russia and Ukraine also cooled earlier optimism.

British news agency Reuters reported on Wednesday that Russian officials were skeptical about the U.S. proposal for a 30-day ceasefire in Ukraine. Kremlin spokesman Dmitry Peskov said on Wednesday that the Kremlin was still waiting for the United States to announce its proposal for a ceasefire in Ukraine. The Kremlin needs to hear the results of the U.S.-Ukraine talks before commenting on whether Russia can accept the ceasefire.

Commenting on a ceasefire proposal that has been accepted by both U.S. and Ukrainian officials, an influential Russian lawmaker insisted on Wednesday that any deal must be reached on Russian terms, not U.S.

A senior Russian source said President Vladimir Putin would be unlikely to agree to a ceasefire proposal without finalizing the terms and receiving some guarantees.

Ukraine accepted a US proposal for a 30-day ceasefire with Russia on Tuesday in exchange for the Trump administration resuming suspended military aid and intelligence sharing. The deal was announced by US and Ukrainian officials after eight hours of talks in Saudi Arabia on Tuesday.

Trump said US officials would meet with their Russian counterparts on Wednesday and he could meet with Russian President Vladimir Putin this week.

The World Gold Council (WGC) revealed that central banks continued to buy gold. The People's Bank of China and the National Bank of Poland added 10 tonnes and 29 tonnes of gold, respectively, in the first two months of 2025.

Traders will next keep a close eye on the release of the US producer price index (PPI) for February, initial jobless claims and the University of Michigan consumer sentiment data.

OANDA:XAUUSD technical outlook analysis

On the daily chart, as of the time of writing, gold has achieved all the bullish targets noted by readers in the weekly publication, along with all the conditions for the possibility of a price increase when there is no more resistance ahead other than the all-time high.

The short-term price channel is noted as the trend at the moment, along with the Relative Strength Index RSI maintaining above 50, surpassing 61, showing that the bullish momentum dominates the market and there is still a lot of room for price increase ahead because it is still quite far from reaching the overbought area.

The most notable supports now are the $2,929 level in the short term, followed by the EMA21 area.

Overall, the uptrend is dominating on the daily chart, with notable price levels listed below.

Support: $2,929 – $2,915

Resistance: $2,956

SELL XAUUSD PRICE 2761 - 2974⚡️

↠↠ Stoploss 2980

→Take Profit 1 2968

↨

→Take Profit 2 2962

BUY XAUUSD PRICE 2904 - 2906⚡️

↠↠ Stoploss 2900

→Take Profit 1 2912

↨

→Take Profit 2 2918

What Are Financial Derivatives and How to Trade Them?What Are Financial Derivatives and How to Trade Them?

Financial derivatives are powerful instruments used by traders to speculate on market movements or manage risk. From futures to CFDs, derivatives offer potential opportunities across global markets. This article examines “What is a derivative in finance?”, delving into the main types of derivatives, how they function, and key considerations for traders.

What Are Derivatives?

A financial derivative is a contract with its value tied to the performance of an underlying asset. These assets can include stocks, commodities, currencies, ETFs, or market indices. Instead of buying the asset itself, traders and investors use derivatives to speculate on price movements or manage financial risk.

Fundamentally, derivatives are contracts made between two parties. They allow one side to take advantage of changes in the asset's price, whether it rises or falls. For example, a futures contract locks in a price for buying or selling an asset on a specific date, while a contract for difference (CFD) helps traders speculate on the price of an asset without owning it.

The flexibility of derivatives is what makes them valuable. They can hedge against potential losses, potentially amplify returns through leverage, or provide access to otherwise difficult-to-trade markets. Derivatives are traded either on regulated exchanges or through over-the-counter (OTC) markets, each with distinct benefits and risks.

Leverage is a very common feature in derivative trading, enabling traders to control larger positions with less capital. However, it’s worth remembering that while this amplifies potential returns, it equally increases the risk of losses.

These instruments play a pivotal role in modern finance, offering tools to navigate market volatility or target specific investment goals. However, their complexity means they require careful understanding and strategic use to potentially avoid unintended risks.

Key Types of Financial Derivatives

There are various types of derivatives, each tailored to different trading strategies and financial needs. Understanding the main type of derivative can help traders navigate their unique features and applications. Below are the most common examples of derivatives:

Futures Contracts

Futures involve a contract to buy or sell an asset at a set price on a specific future date. These contracts are standardised and traded on exchanges, making them transparent and widely accessible. Futures are commonly used in commodities markets—like oil or wheat—but also extend to indices and currencies. Traders commonly utilise this type of derivative to potentially manage risks associated with price fluctuations or to speculate on potential market movements.

Forward Contracts

A forward contract is a financial agreement in which two parties commit to buying or selling an asset at a predetermined price on a specified future date. Unlike standardised futures contracts, forward contracts are customizable and traded privately, typically over-the-counter (OTC). These contracts are commonly used for hedging or speculating on price movements of assets such as commodities, currencies, or financial instruments.

Swaps

Swaps are customised contracts, typically traded over-the-counter (OTC). The most common types are interest rate swaps, where two parties agree to exchange streams of interest payments based on a specified notional amount over a set period, and currency swaps, which involve the exchange of principal and interest payments in different currencies. Swaps are primarily used by institutions to manage long-term exposure to interest rates or currency risks.

Contracts for Difference (CFDs)

CFDs allow traders to speculate on price changes of an underlying asset. They are flexible, covering a wide range of markets such as shares, commodities, and indices. CFDs are particularly attractive as they allow traders to speculate on rising and falling prices of an asset without owning it. Moreover, CFDs provide potential opportunities for short-term trading, which may be unavailable with other financial instruments.

Trading Derivatives: Mechanisms and Strategies

Trading derivatives revolves around two primary methods: exchange-traded and over-the-counter (OTC) markets. Each offers potential opportunities for traders, depending on their goals and risk tolerance.

Exchange-Traded Derivatives

These derivatives, like futures, are standardised and traded on regulated exchanges such as the Chicago Mercantile Exchange (CME). Standardisation ensures transparency, making it potentially easier for traders to open buy or sell positions. For example, a trader might use futures contracts to hedge against potential price movements in commodities or indices.

Over-the-Counter (OTC) Derivatives

OTC derivatives, including swaps and forwards and contracts for difference, are negotiated directly between two parties. These contracts are highly customisable but may carry more counterparty risk, as they aren't cleared through a central exchange. Institutions often use OTC derivatives for tailored solutions, such as managing interest rate fluctuations.

Strategies for Trading Derivatives

Traders typically employ derivatives for speculation or hedging. Speculation involves taking positions based on anticipated market movements, such as buying a CFD if prices are expected to rise. Hedging, on the other hand, can potentially mitigate losses in an existing portfolio by offsetting potential risks, like using currency swaps to protect against foreign exchange volatility.

Risk management plays a crucial role when trading derivatives. Understanding the underlying asset, monitoring market conditions, and using appropriate position sizes are vital to navigating their complexity.

CFD Trading

Contracts for Difference (CFDs) are among the most accessible derivative products for retail traders. They allow for speculation on price movements across a wide range of markets, including stocks, commodities, currencies, and indices, without owning the underlying asset. This flexibility makes CFDs an appealing option for individuals looking to diversify their strategies and explore global markets.

How CFDs Work

CFDs represent an agreement between the trader and the broker to exchange the difference in an asset's price between the opening and closing of a trade. If the price moves in the trader’s favour, the broker pays the difference; if it moves against them, the trader covers the loss. This structure is straightforward, allowing retail traders to trade in both rising and falling markets.

Why Retail Traders Use CFDs

Retail traders often gravitate towards CFDs due to their accessibility and unique features. CFDs allow leverage trading. By depositing a smaller margin, traders can gain exposure to much larger positions, potentially amplifying returns. However, you should remember that this comes with heightened risk, as losses are also magnified.

Markets and Opportunities

CFDs offer exposure to an extensive range of markets, including stocks, forex pairs, commodities, and popular indices like the S&P 500. Retail traders particularly appreciate the ability to trade these markets with minimal upfront capital, as well as the availability of 24/5 trading for many instruments. CFDs also enable traders to access international markets they might otherwise find difficult to trade, such as Asian or European indices.

Traders can explore a variety of CFDs with FXOpen.

Considerations for CFD Trading

While CFDs offer potential opportunities, traders must approach them cautiously. Leverage and high market volatility can lead to significant losses. Effective risk management in derivatives, meaning using stop-loss orders or limiting position sizes, can help traders potentially navigate these risks. Additionally, costs like spreads, commissions, and overnight fees can add up, so understanding the total cost structure is crucial.

Key Considerations When Trading Derivatives

Trading derivatives requires careful analysis and a clear understanding of the associated risks and potential opportunities.

Understanding the Underlying Asset

The value of a derivative depends entirely on its underlying asset, whether it’s a stock, commodity, currency, or index. Analysing the asset’s price behaviour, market trends, and potential volatility is crucial to identifying potential opportunities and risks.

Choosing the Right Derivative Product

Different derivatives serve different purposes. Futures might suit traders looking for exposure to commodities or indices, while CFDs provide accessible and potential opportunities for those seeking short-term price movements. Matching the derivative to your strategy is vital.

Managing Risk Effectively

Risk management plays a significant role in trading derivatives. Leverage can amplify both returns and losses, so traders often set clear limits on position sizes and overall exposure. Stop-loss orders and diversification are common ways to potentially reduce the impact of adverse market moves.

Understanding Costs

Trading derivatives involves costs like spreads, commissions, and potential overnight financing fees. These can eat into potential returns, especially for high-frequency or leveraged trades. A clear understanding of these expenses may help traders evaluate the effectiveness of their strategies.

Monitoring Market Conditions

Derivatives are sensitive to their underlying market changes, from geopolitical events to macroeconomic data. In stock derivatives, this might be company earning reports or sudden shifts in management. Staying informed helps traders adapt to shifting conditions and avoid being caught off guard by sudden price swings.

The Bottom Line

Financial derivatives are versatile tools for trading and hedging, offering potential opportunities to access global markets and diversify strategies. While their complexity demands a solid understanding, they can unlock significant potential for informed traders. Ready to explore derivatives trading? Open an FXOpen account today to trade CFDs on more than 700 assets with competitive costs, fast execution, and advanced trading tools. Good luck!

FAQ

What Is a Derivative?

The derivatives definition refers to a financial contract whose value is based on the performance of an underlying asset, such as stocks, commodities, currencies, or indices. Derivatives are financial instruments used to hedge risk, speculate on price movements, or access specific markets. Examples include futures, forwards, swaps, and contracts for difference (CFDs).

What Are the 4 Main Derivatives?

The primary categories of derivatives are futures, forwards, swaps, and contracts for difference (CFDs). Futures are commonly traded on exchanges, while forwards, swaps and CFDs are usually traded over-the-counter (OTC). Each serves different purposes, from risk management to speculative trading.

What Is the Derivatives Market?

The derivatives market is where financial derivatives are bought and sold. It includes regulated exchanges, like the Chicago Mercantile Exchange, and OTC markets where customised contracts are negotiated directly between parties. This market supports hedging, speculation, and risk transfer across global financial systems.

What Is the Difference Between Derivatives and Equities?

Equities signify ownership in a company, typically in the form of stock shares. Derivatives, on the other hand, are contracts that derive their value from the performance of an underlying asset, which can include equities. Unlike equities, derivatives do not confer ownership.

Is an ETF a Derivative?

No, an exchange-traded fund (ETF) is not a derivative. It is a fund that tracks a basket of assets, such as stocks or bonds, and trades like a stock. However, ETFs can use derivatives, such as futures, to achieve their investment objectives.

Is the S&P 500 a Derivative?

No, the S&P 500 is not a derivative. It is a stock market index that tracks the performance of 500 large companies listed in the US. Derivatives, like futures, can be created based on the S&P 500’s performance.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

GOLD recovers and stays above $2,900, pay attention to CPI dataOANDA:XAUUSD rebounded, driven mainly by safe-haven flows as trade war concerns dampened market risk sentiment and markets focused on US inflation data.

TVC:DXY hit a four-month low, making gold more attractive. Meanwhile, the main event of the week is the US CPI report today (March 12), which could cause major market moves. Positive data could lead to a sharp sell-off in gold, while weak data could give the green light for further gains in gold.

CPI is expected to have risen 0.3% in February, according to a Reuters poll. The New York Federal Reserve's latest consumer expectations survey forecasts inflation at 3.1% over the next year, up slightly from 3% in January. Markets are now expecting the Federal Reserve to cut interest rates in June.

Technical Outlook Analysis OANDA:XAUUSD

On the daily chart, in terms of trend, gold is still in the accumulation phase after recovering from the $2,880 level noted by readers in the previous editions and the break above the $2,900 level provides conditions for further testing of the $2,929 level in the short term.

For now, gold is still trading around the EMA21 and is still in a consolidation state, but in terms of technical conditions, it is more likely to increase in price. With the price channel as a short-term trend, and the RSI activity above 50, quite far from the overbought zone, it shows that the bullish momentum is still ahead.

However, the technical chart still needs a strong impact to break the current accumulation structure. And during the day, the notable positions will be listed as follows.

Support: 2,900 - 2,880 USD

Resistance: 2,929 - 2,942 USD

SELL XAUUSD PRICE 2961 - 2959⚡️

↠↠ Stoploss 2965

→Take Profit 1 2953

↨

→Take Profit 2 2947

BUY XAUUSD PRICE 2899 - 2901⚡️

↠↠ Stoploss 2895

→Take Profit 1 2907

↨

→Take Profit 2 2913

2025-03-11 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: Bears are clearly in control and we have two bear trend lines above us. One around 22600 and the bigger one around 23000. Bulls need to claim 22900 and bears obviously want 22k. Absolutely no idea what we get first. Buying volume increased big time at previous low around 22300 but overall market sentiment has to reverse. I can not see dax rallying 2%+ if us indexes stay at the lows. 22400 is the neutral price, so don’t trade it.

current market cycle: trading range - bull trend clearly broken now

key levels: 22000 - 24000

bull case: Bulls need to get back above 22800 if they want further upside. For now they have buy new lows and scalp. For bulls to reverse this, they would need to print a clear higher low and trapping late bears. Market can not rally, if we make lower lows the whole time. Not much for bulls here and it could be because they expect 22k to be hit and want to buy that.

Invalidation is below 21900.

bear case: Bears want to finally print 22000 again. last time we did was early February. Problem for them is, we are at huge previous support. Should you bet that the breakout will happen? Never. Wait for it to happen and join along and wait for a bounce to sell higher. Any bounce has to stay below 22600 and then we can continue down. Selling below 22400 is bad, no matter what. Bears remain in control until the current bear channel is broken.

Invalidation is above 23600.

short term: Neutral around 22400. Bearish above 22500 if we stall too much and bears come around again. If bulls stay above 22300/22400 and print a lower high, I will join them if us markets do the same. I expect a huge bounce soon.

medium-long term from 2024-02-26: As much as I would love to see this 30% lower, it’s not happening anytime soon. Market will probably has to move sideways for some weeks before this could go down. Daily close below 22000 is needed to turn this neutral and end the bull trend-.

current swing trade: None

trade of the day: Buying during the Globex session was fun and then selling above 22800 again, since it was resistance from yesterday. Where should you have sold? Market hit 22835 and then only printed lower highs for 7 15m bars. That was certainly strong enough to cover longs.