BTC - About to TankBitcoin is holding below these bearish trendlines pointed out on previous posts.

Here we can see liquidation levels on the HTF.

I see two potential moves:

Scenario A)

115,000 to 17,000-20,000 range

Scenario B)

3 Wave Corrective Pattern

115,000 to 35,000

35,000 to 83,000

83,000 to 8,000-10,000

DXY is retesting a major bearish breakdown on the weekly / monthly time frame. This is why we have been seeing the recent drop, and preparation for a mass liquidation / flash crash.

The above stated is my own personal views and is not intended as financial advice. Please trade responsibly.

Futurestrading

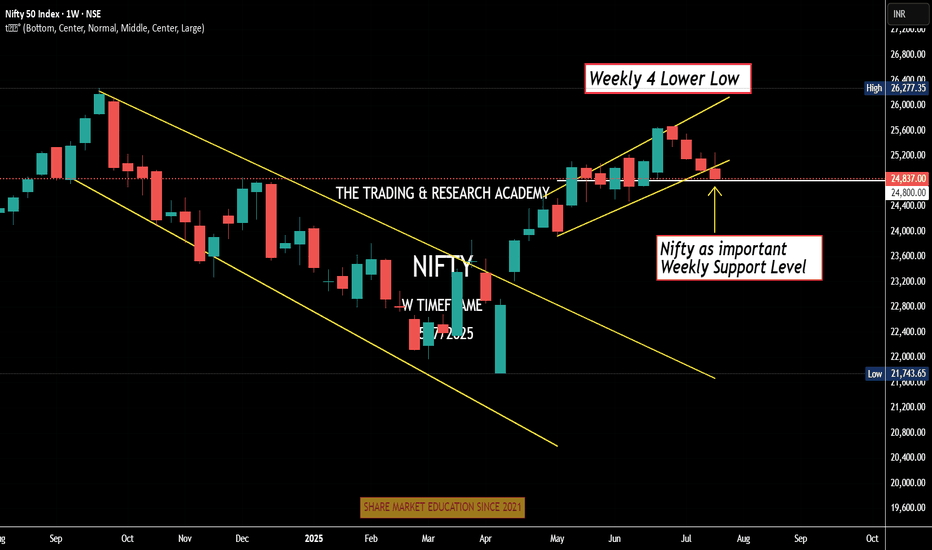

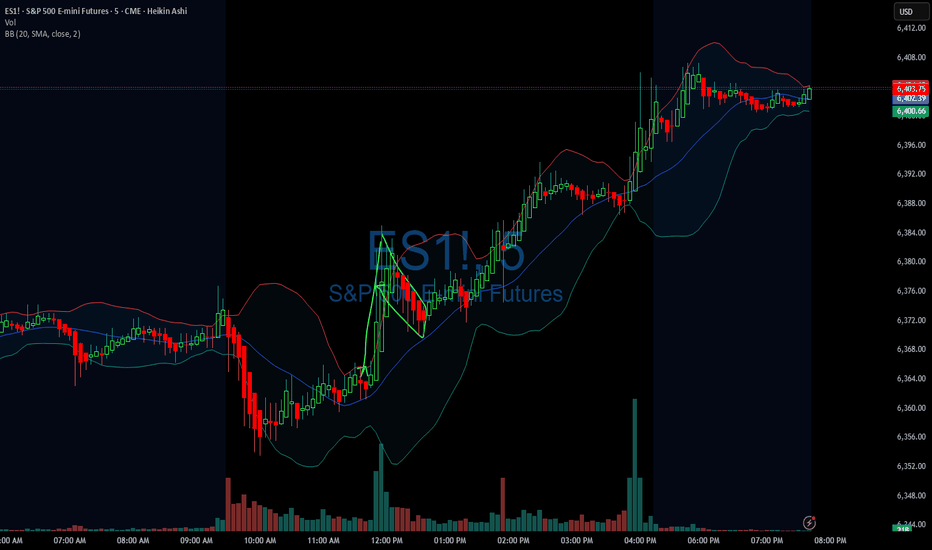

Day 1 Trading Only S&P Futures — Starting with $200 Profit

Day 1 — Trading Only S&P Futures

Daily P/L:+ 204 :moneybag:

Sleep: 8 hours

Emotions: Tired and sored from muay thai.

:thought_balloon: Today’s Trade thoughts:

I was leaning bearish in the market because we had such strong selling pressure on Friday butonce we broke over the level i posted last week at 6330, I gave up on my bias and I just followed the signals and traded the the X1dd buy signal with @gohawks14 and shorted the Max gamma resistance around 6352 and called a day when i made $200.

I think for this week as we start the trading challenge, I want to have one account where i just make $200 and call it a day so this way i can build consistency and get my trading % up.

:bell:News Highlights:

DOW REBOUNDS NEARLY 600 POINTS, VIX PLUNGES AS U.S. STOCKS END SHARPLY HIGHER ON RATE-CUT OPTIMISM

:bar_chart: VX Algo Signals (9:30am – 2pm EST):

9:00 AM Market Structure flipped bullish on VX Algo X3!

10:10 AM VXAlgo NQ X1 Sell Signal

10:40 AM VXAlgo ES X1 Sell Signal

11:40 AM VXAlgo NQ X1DD Buy Signal (Double buy signal)

11:40 AM VXAlgo ES X1 Buy signal

12:40 PM VXAlgo NQ X1 Sell Signal

1:21 PM VXAlgo ES X1 Sell Signal

2:00 PM VXAlgo ES X3 Sell Signal

:chart_with_upwards_trend: Key Levels for Tomorrow:

Above 6332 = Bullish

Below 6300 = Bearish

:link: Recap & Charts: www.tradingview.com

Corrective Dip or New Downtrend on the S&P 500 Futures?🟣 1. Impulses vs. Corrections – The Classical View

When price trends, it doesn't move in a straight line. Instead, it alternates between directional movements called impulses and counter-directional pauses or retracements known as corrections. Most analysts define an impulse as a sharp, dominant move in the direction of the trend—typically accompanied by rising volume and momentum indicators. Corrections, on the other hand, tend to be slower, overlapping, and often occur with declining volume.

Common methods to identify impulses vs. corrections include:

Swing structure: Higher highs and higher lows suggest impulse; overlapping lows suggest correction.

Fibonacci retracements: Corrections often retrace up to 61.8% of a prior impulse.

Moving averages: Price above a rising MA is often viewed as impulse territory.

Volume analysis and oscillators such as RSI or MACD are used to confirm price behavior.

Despite the abundance of methods, the distinction between impulses and corrections often remains subjective. That’s where the Directional Movement Index (DMI) provides an objective lens—especially when paired with price action.

🟣 2. Rethinking Impulses with the DMI Indicator

The Directional Movement Index (DMI), developed by J. Welles Wilder, offers a quantitative way to assess the strength and direction of price movement. It breaks down market activity into three components:

+DMI (Positive Directional Movement Index): Measures the strength of upward movements.

−DMI (Negative Directional Movement Index): Measures the strength of downward movements.

ADX (Average Directional Index): Quantifies overall trend strength but is optional in this discussion.

The key to applying DMI lies in the crossover between +DMI and -DMI:

When +DMI > -DMI, upward price moves dominate—suggesting bullish impulses.

When −DMI > +DMI, downward moves dominate—suggesting bearish impulses.

Calculation is based on a comparison of successive highs and lows over a specific lookback period—commonly set to 14 or 20 periods.

While EMAs track trend direction and momentum, DMI helps dissect who’s in control. This makes it a powerful filter when evaluating whether a breakdown or breakout is likely to become an impulsive trend—or just another correction in disguise.

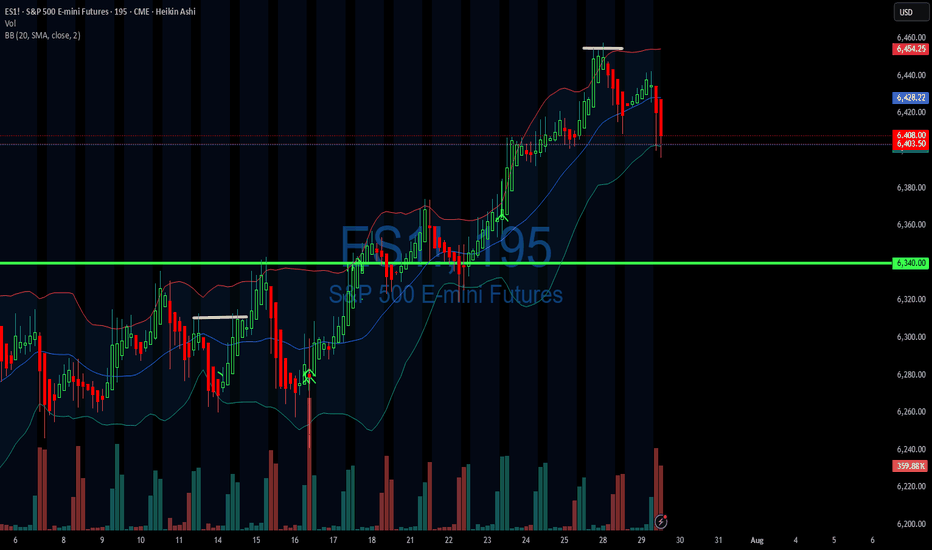

🟣 3. Case Study – Two Breakdowns, Two Outcomes

Let’s apply this logic to two recent moments on the E-mini S&P 500 Futures (ES) daily chart.

🔹 Feb 21, 2025 Breakdown

Price broke sharply below the 20-period EMA. At first glance, this looked like a potential trend reversal. The DMI confirmed this suspicion: −DMI surged above +DMI, signaling downside impulses were in control. The market followed through with a clear downtrend, confirming the move was not just a pullback—it was a shift in market structure.

🔹 Aug 1, 2025 Breakdown

A similar sharp break below the 20 EMA just occurred again. However, this time +DMI remains above −DMI, despite the bearish price action. This divergence tells a different story: the breakdown may not be impulsive in nature. Instead, it's likely a corrective dip within a broader uptrend, where buyers are still the dominant force.

This is a textbook example of how a moving average crossover without DMI confirmation can mislead traders. By combining these tools, we’re able to make more informed decisions about whether price action is signaling a true shift—or just a pause.

🟣 4. CME Product Specs – ES vs. MES

Traders can express directional views on the S&P 500 using two primary CME futures contracts: the E-mini S&P 500 Futures (ES) and the Micro E-mini S&P 500 Futures (MES). Both track the same underlying index but differ in size, capital requirement, and tick value.

✅ E-mini S&P 500 Futures (ES)

Symbol: ES

Contract Size: $50 x S&P 500 Index

Tick Size: 0.25 index points

Tick Value: $12.50

Initial Margin: Approximately $21,000 (varies by broker and through time)

Market Hours: Nearly 24/6

✅ Micro E-mini S&P 500 Futures (MES)

Symbol: MES

Contract Size: $5 x S&P 500 Index

Tick Size: 0.25 index points

Tick Value: $1.25

Initial Margin: Approximately $2,100 (varies by broker and through time)

The Micro contract provides access to the same market structure, liquidity, and price movement as the E-mini, but with a fraction of the exposure—making it ideal for smaller accounts or more precise position sizing.

🟣 5. Risk Management Matters

Understanding whether a market move is impulsive or corrective isn’t just academic—it’s the difference between positioning with the dominant flow or fighting it. Traders often get trapped by sharp moves that appear trend-defining but are simply noise or temporary pullbacks.

Using tools like DMI to confirm whether directional strength supports price action provides a layer of risk filtration. It prevents overreaction to every EMA crossover or sudden price drop.

Stop-loss orders become vital in both impulsive and corrective conditions. In impulsive environments, stops help lock in profits while protecting from reversals. In corrective phases, they act as circuit breakers against breakouts that fail.

Moreover, knowing the product you're trading is critical:

A single ES contract controls ~$320,000 of notional value.

An MES contract controls ~$32,000.

This disparity means poor sizing on ES can magnify errors, while proper sizing on MES can offer flexibility to test, scale, and hedge with tighter capital control.

Whether you're reacting to price or preparing for continuation, risk management is the only constant. It’s what turns analysis into disciplined execution.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

XRP ANALYSIS🔮 #XRP Analysis - Update 🚀🚀

💲 We can see that there is a formation of Falling Wedge Wedge Pattern in #XRP and we can see a bullish movement after a good breakout. Before that we would see a little retest and and then a bullish movement.

💸Current Price -- $2.9130

📈Target Price -- $3.1290

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀💸

#XRP #Cryptocurrency #Breakout #DYOR

CORN; Heikin Ashi Trade Idea📈 Hey Traders!

Here’s a fresh outlook from my trading desk. If you’ve been following me for a while, you already know my approach:

🧩 I trade Supply & Demand zones using Heikin Ashi chart on the 4H timeframe.

🧠 I keep it mechanical and clean — no messy charts, no guessing games.

❌ No trendlines, no fixed sessions, no patterns, no indicator overload.

❌ No overanalyzing market structure or imbalances.

❌ No scalping, and no need to be glued to the screen.

✅ I trade exclusively with limit orders, so it’s more of a set-and-forget style.

✅ This means more freedom, less screen time, and a focus on quality setups.

✅ Just a simplified, structured plan and a calm mindset.

💬 Let’s Talk:

💡Do you trade supply & demand too ?

💡What’s your go-to timeframe ?

💡Ever tried Heikin Ashi ?

📩 Got questions about my strategy or setup? Drop them below — ask me anything, I’m here to share.

Let’s grow together and keep it simple. 👊

SOYBEAN; Heikin Ashi Trade Idea📈 Hey Traders!

Here’s a fresh outlook from my trading desk. If you’ve been following me for a while, you already know my approach:

🧩 I trade Supply & Demand zones using Heikin Ashi chart on the 4H timeframe.

🧠 I keep it mechanical and clean — no messy charts, no guessing games.

❌ No trendlines, no fixed sessions, no patterns, no indicator overload.

❌ No overanalyzing market structure or imbalances.

❌ No scalping, and no need to be glued to the screen.

✅ I trade exclusively with limit orders, so it’s more of a set-and-forget style.

✅ This means more freedom, less screen time, and a focus on quality setups.

✅ Just a simplified, structured plan and a calm mindset.

💬 Let’s Talk:

💡Do you trade supply & demand too ?

💡What’s your go-to timeframe ?

💡Ever tried Heikin Ashi ?

📩 Got questions about my strategy or setup? Drop them below — ask me anything, I’m here to share.

Let’s grow together and keep it simple. 👊

How to Use Engulfing Candles in TradingViewEngulfing patterns are among the most powerful candlestick formations because they signal strong momentum shifts and can help you spot dramatic trend reversal opportunities.

What You'll Learn:

• How to identify valid engulfing formations where one candle completely covers another's body

• The two types: bullish engulfing (green candle engulfs red) and bearish engulfing (red candle engulfs green)

• Psychology behind engulfing patterns: when one side completely overwhelms the other

• Using volume analysis to confirm engulfing pattern validity

• Finding meaningful engulfing patterns at trend highs and lows for reversal setups

• Timeframe considerations for engulfing analysis on any chart period

• Step-by-step trading strategy for engulfing reversal setups

• Setting proper stop losses above engulfing candle highs

• Determining profit targets below engulfing candle lows

• Managing wide-range drawdowns common with strong momentum shifts

• Advanced entry technique: waiting for retracements to improve risk-reward ratios

This tutorial may help futures traders and technical analysts who want to use powerful candlestick patterns to identify significant momentum changes.

The strategies covered could assist you in creating effective reversal setups when strong buying or selling pressure appears at key price levels.

Learn more about futures trading with Tradingview: optimusfutures.com

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only. Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools—not forecasting instruments. Market conditions are constantly evolving, and all trading decisions should be made independently, with careful consideration of individual risk tolerance and financial objectives.

NFP Miss Implications: Recession Signal or Rate Cut CatalystCME_MINI:NQ1! CME_MINI:ES1! CME_MINI:MNQ1!

Happy Friday, folks!

Today is the first Friday of August, and that means the highly anticipated Non-Farm Payroll (NFP) numbers came in at 7.30 am CT.

US Non-Farm Payrolls (Jul) 73.0k vs. Exp. 110.0k (Prev. 147.0k, Rev. 14k); two-month net revisions: -258k (prev. +16k).

Other key labor market indicators were as follows:

• US Unemployment Rate (Jul) 4.2% vs. Exp. 4.2% (Prev. 4.1%)

• US Average Earnings MM (Jul) 0.3% vs. Exp. 0.3% (Prev. 0.2%)

• US Average Earnings YY (Jul) 3.9% vs. Exp. 3.8% (Prev. 3.7%, Rev. 3.8%)

• US Labor Force Particle (Jul) 62.2% (Prev. 62.3%)

Data and Key Events Recap:

What a year this week has been! It's been packed with high-impact economic data and pivotal central bank decisions, especially from the Federal Reserve. On top of that, trade and tariff announcements have dominated the headline.

U.S. economic data this week was broadly strong. Second-quarter GDP came in at 3.0%, beating expectations and signaling solid growth. The ADP employment report also surprised to the upside, printing 104K vs. the 77K forecast. Consumer confidence showed resilience as well, with the Conference Board’s reading rising to 97.2.

Inflation data was mixed but mostly in line. Core PCE for June rose 0.3% MoM, while the YoY reading ticked up to 2.8%, slightly above the expected 2.7%. The broader PCE Price Index also came in at 0.3% MoM, with a YoY print of 2.6%, slightly higher than forecast.

The Federal Open Market Committee (FOMC) voted to keep the federal funds rate target range unchanged at 4.25% – 4.50%. Notably, Governors Waller and Bowman dissented, favoring a 25-basis-point rate cut as expected, however, marking the first dual dissent by governors since 1993.

Changes to the FOMC Statement included a downgraded assessment of economic growth, reflecting slower real consumer spending. The Committee reiterated that uncertainty around the economic outlook remains elevated. It maintained its view of the labor market as "solid" and inflation as "somewhat elevated." Forward guidance remained unchanged, emphasizing the Fed’s readiness to adjust policy as necessary while continuing to monitor risks to both sides of its dual mandate.

Here’s a summary of key points from the FOMC press conference:

• On current policy stance:

“We decided to leave our policy rate where it’s been, which I would characterize as modestly restrictive. Inflation is running a bit above 2%... even excluding tariff effects. The labor market is solid, financial conditions are accommodative, and the economy is not performing as if restrictive policy is holding it back.”

Chair Powell commented on the need to see more data to help inform Fed’s assessment of the balance of risks and appropriate Fed Funds rate.

• On labor market risks:

“By many statistics, the labor market is still in balance... You do see a slowing in job creation, but also a slowing in the supply of workers. That’s why the unemployment rate has remained roughly stable.”

• On inflation and tariffs:

“It’s possible that tariff-related inflationary effects could be short-lived, but they may also prove persistent. We’re seeing substantial tariff revenue—around $30 billion a month—starting to show up in consumer prices. Companies intend to pass it on to consumers, but many may not be able to. We’ll need to watch and learn how this unfolds over time.”

Trade Headlines:

US President Trump announced tariffs on countries ranging from 10%-41%. Average US tariff rate now at 15.2% (prev. 13.3%; 2.3% pre-Trump), according to Bloomberg. US officials said that if the US has a surplus with a country, the tariff rate is 10% and small deficit nations have a 15% tariff, US officials said they are still working out technicalities of rules of origin terms for transshipment and will implement rules of origin details in the coming weeks. No details on Russian oil import penalty. Sectoral Tariffs White House said new reciprocal tariff rates take effect on Friday. Although Canada’s tariffs were increased to 35%, excluding USMCA goods, the effective rate is only 5%.

The economic data is showing strength, on the contrary, tariffs announcements for most countries have now been announced. Investors need to consider that tariffs are not just a tool to reduce trade deficit, it is also a geopolitical tool presently being used to shape alliances. The US wants to soften BRICS, China and Russian influence on the world stage.

Key to note is that these tariffs are substantially lower than what was announced on April 2nd, 2025.

The key question now remains, do participants buy the dip or ‘sell the fact’ is the current playbook?

Market Implications

Given the prior revisions in NFP data of -258K, July’s payroll came in at 73K, missing forecasts of 110K. What does this mean for markets? Markets are now pricing in 75% chance of a September rate cut. Prior revisions along with the current job market slowing down imply that risks to the downside are substantially increasing. Fed’s current policy is not just moderately restrictive but rather it may likely tip the US into a recession if Fed Funds rates remain elevated. The Chair asked to see more data, and here it is but I do wonder why they did not take this data into account for the July meeting. Surely, it would have been available to them.

Another question to ask would be, is it due to defiance of rate cut calls by the US administration? Is the Fed already behind the curve?

Fed’s dual mandate targets inflation and maximum employment. While inflation is sticky, the Fed may need to abandon their 2% mandate in favor of average inflation of 2.5% to 3%. A less restrictive policy will provide needed stimulus along with the fiscal stimulus provided via the BBB bill.

This drastically changes, in our analysis, how investors position themselves heading into the remainder of the year.

Markets (equities) may retrace slightly but the dip in our opinion will still be the play given weaker labor market data and increased rate cut bets. The bad news here means that the Fed has the data it wants to see to start cutting. Market pricing in 2 cuts seems to be the way forward for now.

Tactical Short Setup on EURThe September 2025 Euro FX futures contract (E6U25) is currently trading around 1.1440 after topping out near 1.19 the 1st of July. This decline reflects a broader market repricing, driven by evolving expectations around monetary policy from the Federal Reserve and the European Central Bank, softening Eurozone growth prospects, and a technical backdrop that has turned decisively bearish. Coupled with shifts in sentiment and options market positioning, the current setup presents an opportunity to initiate a tactical short with an attractive risk-reward profile.

Fundamental Analysis – Central banks and diverging momentums

Monetary policies on either side of the Atlantic appear to diverge. The Federal Reserve has kept its federal funds rate steady in the 4.25%–4.50% range since December 2024, resisting political pressure to ease. In contrast, the European Central Bank has gradually lowered its deposit rate from 4% to 2.00% since mid-2024 and maintained that level in July, considering inflation is now back to its 2% target. This has widened the yield differential in favor of the U.S. dollar.

Forward guidance from both central banks suggests a cautious stance. The Fed’s June 2025 dot plot anticipates a modest rate cut by year-end, though FOMC members remain divided. Meanwhile, the ECB projects subdued inflation and modest growth, implying no urgency for further easing.

On the macro front, U.S. GDP rebounded sharply in Q2 (+3.0% annualized), though driven largely by a collapse in imports. Domestic demand and job creation have slowed, and tariffs may push core inflation above 3% again. In the eurozone, Q2 GDP barely expanded (+0.1%), with uneven performance across member states. Inflation is stable at 2%, with core pressures easing. Altogether, the dollar retains a slight edge amid firmer data and a more hawkish Fed.

Technical Outlook – Bearish shift with volume confirmation

From a technical standpoint, the E6U25 contract has clearly broken down from its prior range. The area around 1.1775, which previously served as a high-volume node and resistance, was breached with strong downside momentum. The price action has since carved out a clean pattern of lower highs and lower lows, and volume has notably increased on bearish sessions, confirming the shift in control.

The current structure suggests a vacuum between 1.1775 and 1.1500, with only minor resistance expected around 1.1545, where some residual volume lies. There is little to no support before the 1.1280–1.1300 area, which aligns with a lower volume shelf on the visible range volume profile (VRVP). If price retraces to retest the 1.1525–1.1575 zone, that area is likely to act as a tactical selling opportunity before potentially resuming the downtrend.

Sentiment Analysis

CFTC data as of late July shows asset managers holding a substantial long position in EUR/USD, though these are beginning to unwind. The positioning profile leaves the euro vulnerable to further long liquidation if the selloff deepens.

Retail sentiment reinforces this view, as most retail traders are caught on the wrong side of the move. Open interest is stable but elevated, and trading activity has begun to rise slightly, hinting at retail dip-buying that may lack conviction. No major retail capitulation has occurred yet.

Broad market volatility remains subdued, and EUR/USD-specific indicators show a similar picture. The CME CVOL Index for EUR/USD remains around 8, a level considered moderately low by historical standards, reflecting a calm, non-disruptive market environment that favors technical trading, including respect for resistance levels and trend-following strategies.

Options Analysis

According to the CME FX Options Vol Converter, the landscape for EUR/USD still exhibits a modest downside bias. Risk reversals across one to three months tenors remain slightly negative, reflecting moderate demand for euro puts.

In listed markets, CME data for August expiries shows notable open interest concentration in puts at the 1.1450 and 1.1500 strikes, with deltas indicating directional positioning rather than purely hedging activity. On the call side, interest is more dispersed but visible above 1.1650, particularly at 1.1700 and 1.1750, suggesting some appetite for upside. However, the deltas are lower.

Trade Idea

A tactical short trade is favored in the 1.1525–1.1575 zone, which coincides with a potential pullback level within a well-established downtrend. This level also aligns with a minor volume shelf, providing a natural resistance area where sellers are likely to re-enter the market.

The suggested stop level is 1.1650, just above the recent short-term swing highs, which would invalidate the current bearish structure. The target lies around 1.1290, near the next major support zone and volume cluster.

Final thoughts

The EUR/USD rally in May/June was primarily fueled by expectations of synchronized easing and softer U.S. data. However, the Fed’s reluctance to commit to a cut, combined with a relatively more aggressive ECB stance, has shifted the narrative back in favor of the dollar. With asset managers showing signs of willingness to further unwind their exposure, combined with sentiment indicators pointing to complacency, a deeper retracement remains plausible.

The technical breakdown, lack of implied vol support for a rebound, and fresh open interest on euro puts collectively argue for tactical downside continuation. The proposed trade seeks to capture that move with a controlled stop and a realistic price target. Unless EUR/USD can reclaim the 1.1650–1.1700 zone decisively, the path of least resistance remains downward.

---

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.com/cme/ .

This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

MNQ Short @robby.tradez price looking to fill imbalance from yesterdays late New York session

- what inspired the trade?

I run a checklist of confluences when trading this asset, it is either I compare it with CME_MINI:MES1! or DXY

as of now MNQ is below my daily open so it lets me know sellers are in control as well as using the volume profile gives me more confirmation, also pairing it with DXY then we have more reason why I took the trade \\

RR 1:4 I generally aim for 4% on a trade like this because it passes as a high probability trade A SETUP

07/30/25 Trade Journal, and ES_F Stock Market analysis EOD accountability report: +960

Sleep: 5 hours

Overall health: still struggling with sleep due to heat waves

VX Algo System Signals from (9:30am to 2pm)

— 8:30 AM Market Structure flipped bearish on VX Algo X3!✅

— 9:45 AM Market Structure flipped bullish on VX Algo X3! ✅

— 10:30 AM Market Structure flipped bullish on VX Algo X3!❌

— 11:30 AM Market Structure flipped bearish on VX Algo X3!❌

— 12:00 PM VXAlgo NQ X1DD Buy Signal, ✅

— 12:30 PM Market Structure flipped bullish on VX Algo X3!✅

What’s are some news or takeaway from today? and What major news or event impacted the market today?

I have started to noticed that the last 3 days, we have been getting false triggers on market structure signals and it almost feels MM are trying to do it to break people's algo that trade on that.

This is a good reminder that no matter how successful the signal has been for the last 30 days, you still need to have risk management. additionally, it's also a good way to test people's faith and trick new traders in going back to doing random things because it makes them think market can behave randomly and nothing works.

this is why i always tell people to religiously test out a system for 30 days before giving up.

News

*FEDERAL RESERVE SKIPS RATE CUT, KEEPS FED FUNDS RATE AT 4.50%

What are the critical support levels to watch?

--> Above 6410= Bullish, Under 6400= Bearish

BTC ANALYSIS🔮 #BTC Analysis 💰💰

🌟🚀As we said #BTC performed same. Now, In daily chart we can see a formation "Rising Wedge Pattern in #BTC. There is a strong resistance zone and we could see a rejection from that level but if the price breaks the resistance zone then we would see a bullish move 💲💲

🔖 Current Price: $1,18,590

⁉️ What to do?

- We have marked some crucial levels in the chart. We can trade according to the chart and make some profits in #BTC. 🚀💸

#BTC #Cryptocurrency #DYOR #PotentialBreakout

Implied volatility, one more tool in our arsenalWHAT IS IMPLIED VOLATILITY?

Implied volatility (IV) refers to the market’s expectations of future volatility for a given asset, derived from option prices. Unlike historical volatility, which measures past price fluctuations, IV is forward-looking and reflects what traders believe will happen in the near future, typically over a 1 to 3 month horizon. IV is not directly observable; it is inferred from option prices using models like Black-Scholes. When option premiums rise even though the underlying asset remains flat, this often signals a rise in implied volatility: investors are preparing for more pronounced future price moves.

IMPLIED VOLATILITY IN FX

In FX markets, as in equities or commodities, implied volatility serves as a risk gauge and a proxy for uncertainty. It plays a critical role in portfolio management, hedging, and strategy timing.

High implied volatility on a currency pair indicates market expectations for increased future movement. This can stem from upcoming economic data, central bank decisions, geopolitical risk, or broader market instability. For example, rising IV on EUR/USD ahead of a major Fed or ECB meeting may signal increased demand for options as market participants hedge against potential surprises. Conversely, sustained low IV often reflects calm market conditions or, at times, a strong directional trend.

Implied volatility can act as a market condition filter for trading strategies. To simplify, we can, for example, divide the CVOL level into four distinct categories.

Abnormally low IV (well below average): Reflects extreme complacency or post-event calm.

Moderately low IV (below average): Indicates orderly, technical markets.

Moderately high IV (above average): Suggests elevated uncertainty.

Abnormally high IV (well above average): Signals market stress or panic.

In spot FX, where retail traders rarely engage in options directly, implied volatility serves best as a macro signal, helping inform position sizing, stop placement, or overall risk exposure based on the current volatility regime.

One advanced use of IV is to compare it against realized (historical) volatility. When implied volatility is much higher than realized volatility, it often means options are expensive, and vice versa. This comparison proves especially valuable in FX markets, as it helps traders identify situations where risk premia may be overpriced, revealing potential misalignments between implied and realized volatility. It also offers a forward-looking perspective by highlighting upcoming catalysts that are not yet fully priced into the spot market.

INTRODUCING THE CME CVOL INDEX

To make volatility data more accessible and comparable across asset classes, CME Group introduced the CVOL index family in 2023, a set of standardized implied volatility indexes derived from listed futures options.

How CVOL is calculated?

CVOL indexes are built using vanilla options on futures. They estimate 30-day forward implied volatility, using a basket of out-of-the-money options across various strikes and near-term expirations. The methodology is comparable to that of the VIX in equities, but adapted for the structure of futures markets. Each CVOL index is expressed as an annualized percentage, which can be interpreted as the expected one-standard-deviation move over the next 30 days.

CVOL indexes in FX

Several major currency pairs now have their own dedicated CVOL indexes, offering a real-time measure of implied volatility based on options pricing from CME Group futures contracts. Each index reflects the market’s expectations of future volatility for a given pair:

EUVL for EUR/USD (based on 6E futures)

JPVL for USD/JPY (6J futures)

GBPVL for GBP/USD (6B futures)

CAVL for USD/CAD (6C futures)

ADVL for AUD/USD (6A futures)

In addition to individual pair indexes, the G5 CVOL Index provides a broader view by aggregating the implied volatility of the five major currency pairs, offering a high-level snapshot of volatility across the G5 FX complex. This makes it a valuable tool for macro-focused traders monitoring global risk appetite, cross-asset volatility regimes, or portfolio-level currency exposure.

HOW TO USE CVOL IN PRACTICE

Detecting shifts in risk perception

A sudden spike in CVOL, without a move in the underlying, suggests that institutional players are actively hedging. This can act as an early warning signal for market-moving events or shifts in sentiment. Example: before an ECB decision, a jump in EUVL from 7% to 10% annualized while EUR/USD remains flat may suggest that traders are bracing for a policy surprise.

Adjusting position sizing

When CVOL moves beyond predefined thresholds, traders often respond by reducing leverage, widening stop-loss and take-profit levels, and avoiding overly aggressive directional exposure, in contrast with periods where CVOL fluctuates near its historical average and market conditions appear more stable.

Quant strategy filters

CVOL can also act as a regime filter within systematic trading strategies. For example, when implied volatility on EUR/USD, as measured by EUVL, reaches extreme levels, certain algorithms may shift into breakout mode, anticipating strong directional moves in a high-volatility environment. Conversely, when the index shows no abnormal reading, it may reflect a well-balanced market backdrop, offering more orderly conditions where structured strategies such as range trading tend to perform better.

As historical data on CVOL indexes are available, quant traders can easily backtest and validate ideas that incorporate volatility-based signals or regime filters. More experienced participants often go further, combining FX implied volatility with other volatility indicators, such as CVOL indexes on interest rate futures, to build multi-asset strategies and monitor cross-asset shifts in risk appetite with greater precision.

FINAL THOUGHTS

Implied volatility is a powerful lens into market expectations and potential price swings. In FX, although not always directly accessible to retail traders via options, IV data provides essential context for positioning, timing, and risk management.

With the advent of CME’s CVOL indexes, traders now have a standardized and transparent way to track and compare implied volatility across currencies. Whether you are a macro trader, hedge fund manager, or informed retail participant, monitoring CVOL brings a distinct informational edge, especially when used to anticipate shifts in sentiment and volatility regimes.

And perhaps most importantly: IV doesn’t tell you what happened, but what might happen next, making it an invaluable tool for anyone navigating fast-moving global FX markets.

---

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.com/cme/ .

This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

07/29/25 Trade Journal, and ES_F Stock Market analysis EOD accountability report: +734

Sleep: 5 hours

Overall health: Been struggling with sleep due to heat waves

VX Algo System Signals from (9:30am to 2pm)

— 8:00 AM Market Structure flipped bearish✅

— 9:30 AM VXAlgo NQ X3 Buy Signal✅

— 9:36 AM Market Structure flipped bullish on VX Algo X3! ❌

— 11:49 AM VXAlgo ES X1 Buy signal✅

— 11:59 AM VXAlgo NQ X1 Buy Signal❌

What’s are some news or takeaway from today? and What major news or event impacted the market today?

Today was one of the few short the resistance day and refreshing to see after we been grinding ATH (all time highs)

News

— 1:30 PM

🇺🇸🇨🇳 *CHINA SAYS IT AGREES WITH US TO EXTEND TARIFF TRUCE

What are the critical support levels to watch?

--> Above 6395= Bullish, Under 6374= Bearish

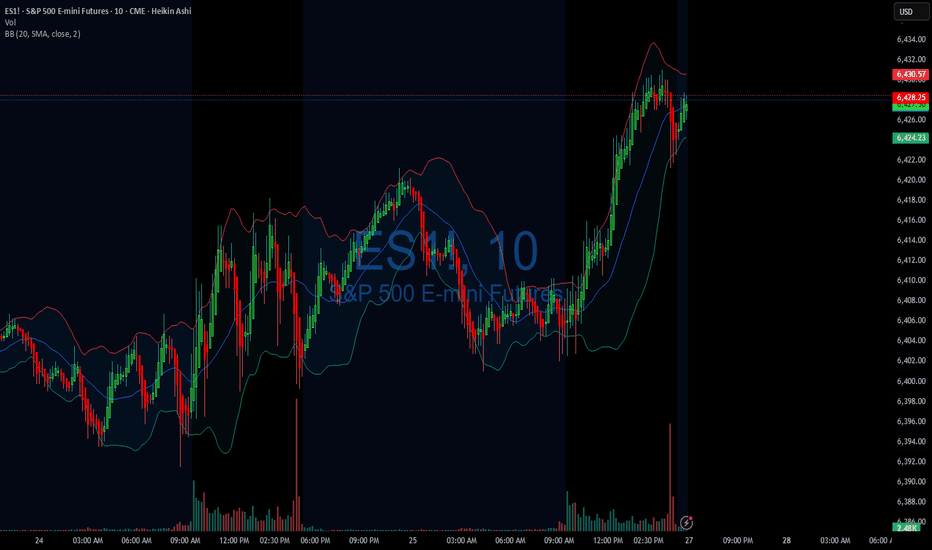

07/28/25 Trade Journal, and ES_F Stock Market analysis EOD accountability report: +405

Sleep: 5 hours

Overall health: meh

VX Algo System Signals from (9:30am to 2pm)

— 9:00 AM Market Structure flipped bullish❌

— 10:04 AM VXAlgo ES X1 Buy signal! ✅

— 11:21 AM Under 6424, the structure is bearish. Don't avg down! ✅

— 11:40 AMVXAlgo NQ X1 Buy Signal! ✅

— 12:40 PM VXAlgo NQ X1DD Sell Signal! ✅

— 1:30 PM VXAlgo ES X3DD Sell Signal! ✅

What’s are some news or takeaway from today? and What major news or event impacted the market today?

Today was one of the few short the resistance day and refreshing to see after we been grinding ATH (all time highs)

News

Eu trade deal over the weekend,

& china tariff extension.

What are the critical support levels to watch?

--> Above 6395= Bullish, Under 6374= Bearish

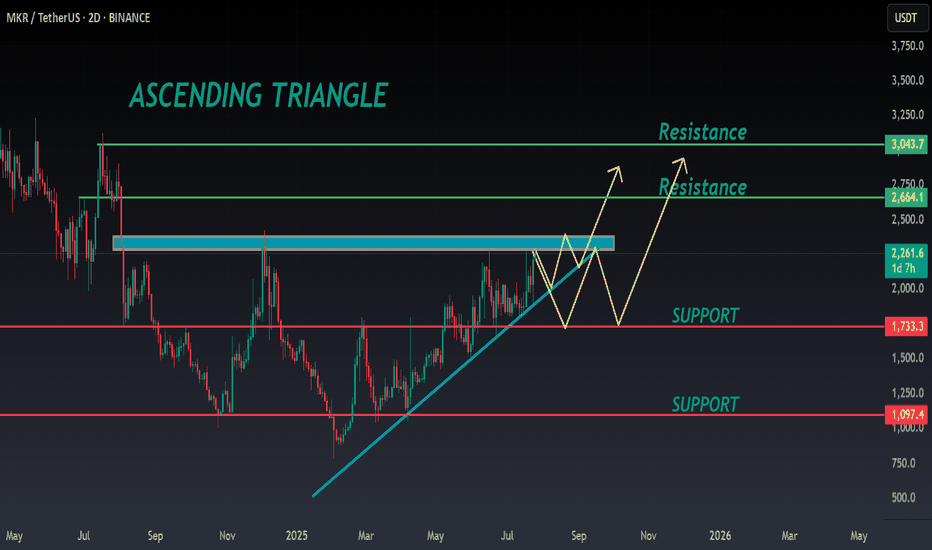

Bias is still Bullish However its month end Overall bias is still strong bullish, do note that its coming to end of month, either we pull back a bit or continues higher till end of month then pullback. Losing 23350 and 23300, probabilities of moving lower will higher since we had short squeeze move last Friday. Max Pain is 23020 can be use as a guide off futures movement.

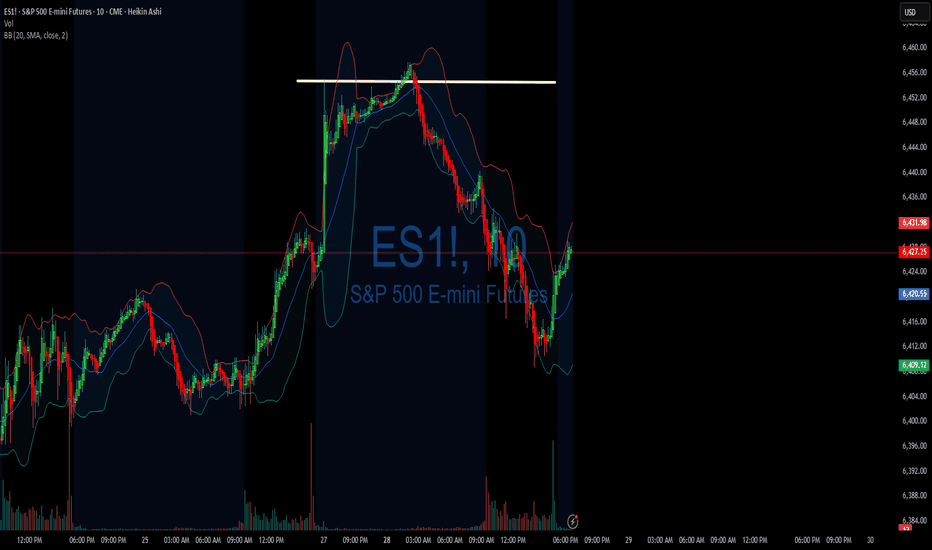

MKR ANALYSIS🔮 #MKR Analysis

🌟🚀 As we said earlier #MKR moved around 48%. Right now #MKR is trading in an Ascending Triangle Pattern and here we can see that #MKR moving again towards its neckline. We see see more bullish move in upcoming days

🔖 Current Price: $2260

⏳ Target Price: $2664

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀

#MKR #Cryptocurrency #Breakout #DYOR

07/25/25 Trade Journal, and ES_F Stock Market analysis

EOD accountability report: +228

Sleep: 5 hours

Overall health: Still struggling to catch up on sleep. gonna take gg sleeping pills today

** VX Algo System Signals from (9:30am to 2pm) **

— 9:07 AMMarket Structure flipped bearish on VX Algo X3! :white_check_mark:

— 9:53 AM Market Structure flipped bullish on VX Algo X3! :white_check_mark:

— 10:30 AM Market Structure flipped bullish on VX Algo X3! :white_check_mark:

— 11:00 AM VXAlgo ES X1 Sell Signal :x:

**What’s are some news or takeaway from today? and What major news or event impacted the market today? **

Market structure algo was flipping a lot today, even in premarket, which tells me that MM was changing position a lot and things could be unreliable so i decided to end the trading day early at $200 and closed up shop on my main acccount.

**News**

*S&P 500 ENDS AT A NEW RECORD HIGH

**What are the critical support levels to watch?**

--> Above 6395= Bullish, Under 6372= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

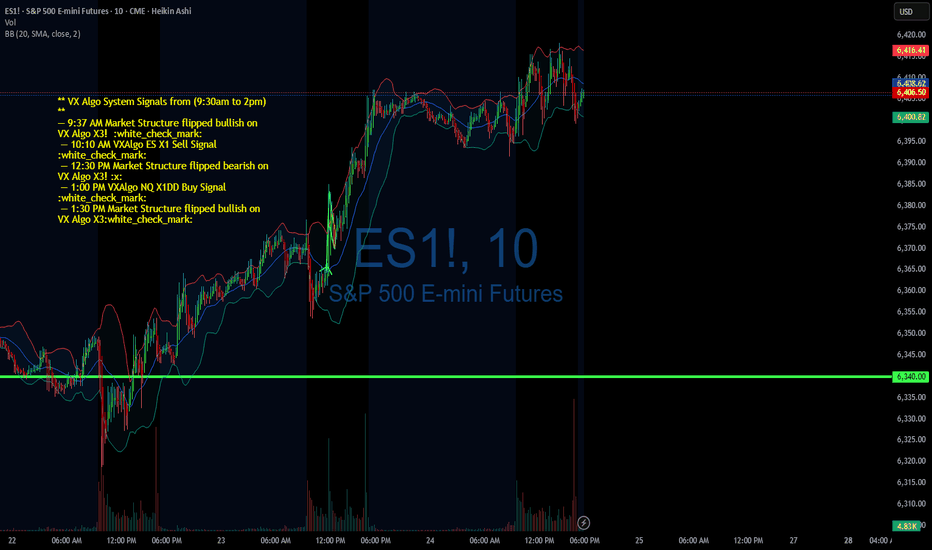

07/24/25 Trade Journal, and ES_F Stock Market analysis EOD accountability report: +1452

Sleep: 4 hours

Overall health: need to catch up on sleep

** VX Algo System Signals from (9:30am to 2pm) **

— 9:37 AM Market Structure flipped bullish on VX Algo X3! :white_check_mark:

— 10:10 AM VXAlgo ES X1 Sell Signal :white_check_mark:

— 12:30 PM Market Structure flipped bearish on VX Algo X3! :x:

— 1:00 PM VXAlgo NQ X1DD Buy Signal :white_check_mark:

— 1:30 PM Market Structure flipped bullish on VX Algo X3:white_check_mark:

**What’s are some news or takeaway from today? and What major news or event impacted the market today? **

Today's market was a bit wild in the morning with a lot of big moves, sot here was opportunity to money if followed the signals.

I mostly finished trading by 12:30 because there was so many big moves.

**News**

(US) Pres Trump: Regarding firing Powell, would be a big move, it's not necessary; No pressure for Powell to resign; Have 1-3 names in mind for Fed Chair position

**What are the critical support levels to watch?**

--> Above 6370= Bullish, Under 6355= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

07/23/25 Trade Journal, and ES_F Stock Market analysis EOD accountability report: -1243

Sleep: 4 hours

Overall health: having issues with sleep the last 2 nights

VX Algo System Signals from (9:30am to 2pm)

9:23 AM Market Structure flipped bullish on VX Algo X3!

9:34 AM Market Structure flipped bearish on VX Algo X3!

11:47 AM Market Structure flipped bullish on VX Algo X3!

12:17 PM NQ X1 Sell Signal (triple sell)

What’s are some news or takeaway from today? and What major news or event impacted the market today?

After going on a long green streak, I got a bit greedy and wanted to make a big profit and went a bit risky dicky at the end of the session, having been able to read everything pretty well, I was pretty sure $6400 was going to be a pretty tight resistance between reading the gammabot data and options data, it showed that we would stall at $6400 on ES so i decided to put a few big ES short positions there with a tight stoploss at 6405 thinking, it surely can't go wrong with only a few minutes left in the session.

and surely it did, it went completely wrong and i went from being positive for the day to negative and throwing my profits away.

News

*STOCKS SURGE AFTER US-JAPAN TRADE DEAL AS S&P 500 AND NASDAQ CLINCH FRESH RECORDS

What are the critical support levels to watch?

--> Above 6339= Bullish, Under 6320= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts