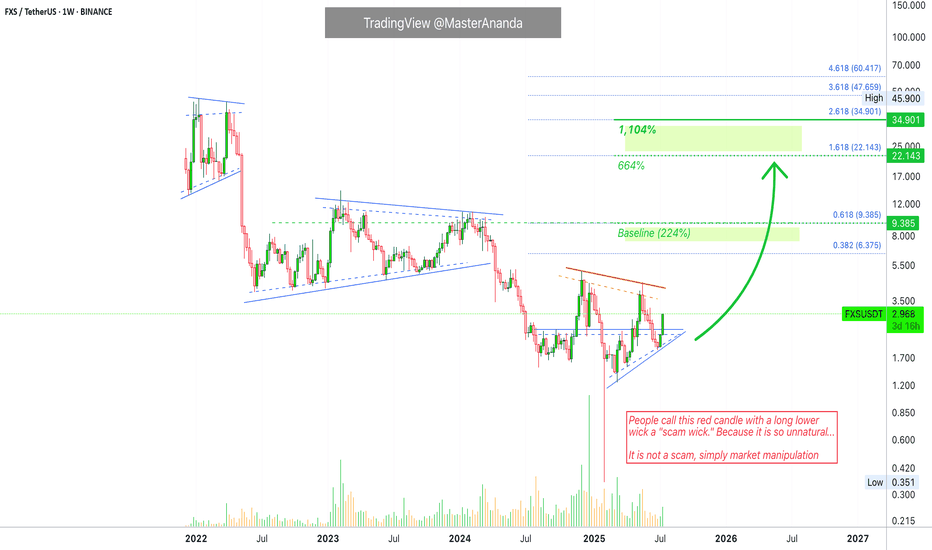

Frax Share 1,104% Target Explained · Scam Wick & MoreFrax Share is starting to recover with strong bullish momentum. The low for this pair was set 3-February with what many people call a "scam wick." Higher lows since. A higher low in March then again in April and June. Only a few pairs completed their lows in February and this is good.

The scam wick was so strong that you can be certain there is no need for prices to go lower again. From now on, we can witness sustained long-term growth.

The "back to baseline" level opens up an easy 224% potential profits. This is the level where you can say, "Ok, I want to triple this Bitcoin with very low risk." And it works like a charm because the action will end up much higher. This is the kind of move that cannot fail. We use spot of course as the whole strategy becomes a simple wait —buy and hold.

The next target gives us 664% and requires the highest prices since May 2022, more than three years. This one is good but some resistance will need to be conquered to get there.

The final target that is mapped on this chart opens 1,104%. This is a strong target but is also do-able. When all is set and done, we can end up with an even higher target. These are only conservative projections and hard to miss. I cannot say with a high level of certainty how far up Frax Share will go, the chart is a bit strange, but I can say with 100% level of certainty that we are entering a major bullish wave. 500% to 1,000% growth is an easy guess. Anything extra is welcomed and accepted.

Thank you for reading.

Namaste.

Fxsusdt

FXS/USDT – Long-Term Accumulation Base Ready for Takeoff🧠 Overview:

Frax Share (FXS) has been consolidating in a long-term accumulation phase, forming a strong base in the $1.24 – $2.54 zone for over a year. This prolonged sideways movement suggests institutional accumulation and a potential macro reversal, especially as the price is tightening near a major descending trendline that has acted as dynamic resistance since early 2022.

The chart is setting up for what could be a massive bullish breakout, with multiple confluences aligning technically and psychologically.

🧱 Technical Structure & Pattern Analysis:

Pattern: The chart shows signs of a falling wedge combined with a horizontal accumulation base, which is typically a bullish reversal structure.

Descending Trendline: The yellow diagonal trendline has been respected for over 2 years. Price is now coiling below it, hinting at a potential volatility expansion.

Accumulation Range: Price has consistently respected the $1.24 – $2.54 support range (highlighted in yellow), forming a multi-touch base, which strengthens the validity of this demand zone.

Volume: While volume isn't shown, such long consolidations often coincide with volume contraction, followed by explosive moves when volume returns.

🟢 Bullish Scenario (High Probability):

1. Breakout Above $2.54 confirms exit from the accumulation range.

2. Initial targets:

$4.16 – Previous resistance + psychological round level

$7.46 – Major horizontal S/R flip

$10.39 – Weekly supply zone

3. Mid to Long-Term Targets:

$17.40 – Pre-breakdown support from 2022

$38.35 and even $46.00 – Full bullish cycle potential (ATH zone)

📌 Catalyst: A weekly candle close above $2.54 with increased volume could trigger a cascade of bullish momentum and possibly attract large buyers or breakout traders.

🔴 Bearish Scenario (Low Probability but Must Consider):

1. Breakdown below $1.24 would invalidate the base and potentially lead to:

Retesting uncharted lows near $1.00 or lower

Loss of investor confidence in the short to mid term

2. Such a move could suggest distribution rather than accumulation, but this currently lacks confirmation from price action.

🧠 Strategic Insight:

This chart is a textbook example of “High Risk, High Reward”. Smart traders and swing investors often hunt for assets in deep accumulation zones with favorable reward-to-risk setups — and FXS fits this criterion perfectly.

Entering on retests above $2.54 or accumulating in the current zone with tight stop-losses below $1.24 offers compelling upside with controlled downside.

📊 Key Technical Levels to Watch:

Level Description

$1.24 - $2.54 Demand Zone / Accumulation Base

$2.54 Breakout Confirmation Level

$4.16 First Key Resistance

$7.46 Major Resistance

$10.39 Mid-Term Bull Target

$17.40 Pre-breakdown Zone

$38.35 - $46 Long-Term Bull Cycle Target

🧭 Conclusion:

FXS is quietly preparing for a major breakout move, and the current chart setup indicates that patient accumulation might soon pay off. Whether you're a technical trader, long-term investor, or a crypto strategist, FXS deserves a spot on your watchlist right now.

This could be one of those “before the hype” moments — don’t miss it.

#FXS #FXSUSDT #CryptoBreakout #AltcoinSetup #TechnicalAnalysis #Accumulation #FallingWedge #BullishCrypto #CryptoChart #FXSTechnical #SwingTrade

$FXS Setup Heating Up CRYPTOCAP:FXS Setup Heating Up 🔥

CRYPTO:FXSUSD is holding strong above the breakout zone near $3 after a clean retest.

As long as it stays above this support, the setup looks bullish with a potential 100% move toward $6.20.

Momentum is building, one to keep an eye on!

DYRO, NFA

#FXS/USDT#FXS

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 3.70.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 3.75

First target: 3.96

Second target: 4.13

Third target: 4.37

Frax Share On The Way Up (PP: 270%)The low here happened 11-March rather than 7-April, 7-April was a higher low. The action is strongly bullish and the rising channel has been broken, the upper boundary. From this we can deduct that the next higher high will be a really strong one.

Frax Share is on the way up.

The $11.33 target with 270% potential on the chart gives 809% potential when taken from the 11-March low. This is the projected size of this first 2025 bull market advance. Of course it can happen that the peak reaches $7.47.

The first peak can be $7.47 or $11.33 doesn't matter. After the higher high is in, we are likely to experience a retrace or correction followed by additional growth. This "additional growth" will result in something really huge. It will be awesome.

Prepare now, many Altcoins are still trading at bottom prices.

Plan before buying. When will you sell if prices start to rise after you bought?

How much will you sell?

If you don't sell everything, what will you do with the remaining tokens?

If you sell everything, what will you do with the free capital? Use a portion to enter a new trade while securing some profits? Go all in a new trade or split between multiple pairs?

Plan for all scenarios.

Create your own scenarios. This way you can win big.

Namaste.

Can #FXS Bulls Make a Comeback? Key Levels to Watch Yello Paradisers! Is #FXS gearing up for a massive breakout? Or will the bears take full control? Here’s what’s happening right now with #FraxShare (FXSUSDT) and why this next move could be crucial:

💎#FXSUSDT has been stuck in a descending triangle pattern, consistently rejecting off its downward resistance line. This structure suggests a squeeze is coming, and a decisive break will set the tone for the next big move. Currently, #FXS is hovering near a strong support zone at $1.53, where buyers are stepping in.

💎A bullish divergence on the histogram is forming, hinting at a potential momentum shift. But for bulls to take charge, #FXSUSD must break above the descending resistance and reclaim $3.32. If this level is flipped into support, we could see a strong rally toward the $5.32 resistance zone, where heavy selling pressure might re-emerge.

💎However, if #FXS fails to hold above $1.53, the bullish setup will weaken, increasing the risk of further downside. A breakdown below this level would expose the next major support at $0.36—a level where panic could set in, leading to a sharp sell-off.

💎The battle between bulls and bears will reach a climax at $0.36 because if it fails, the bears will be in total control, invalidating the bullish setup.

Stay focused, patient, and disciplined, Paradisers🥂

MyCryptoParadise

iFeel the success🌴

Frax Share (FXS)FXS Analysis 📈🔥

Introduction

FXS (Frax Share) is one of the key cryptocurrencies in the DeFi space, offering a cohesive ecosystem with innovative decentralized finance (DeFi) mechanisms and a robust tokenomics structure. It has secured a prominent place among similar projects. Currently, FXS is trading within a descending channel and is approaching a significant PRZ zone (green zone). If this zone is broken, we could expect a strong upward movement. Let’s dive deeper into the technical analysis of FXS’s price action 🚀📊.

Technical Analysis (TA)

Key Supports:

FXS is currently within a descending channel, nearing its upper boundary. The green zone, which includes both weekly resistance and the top of the descending channel, is a crucial PRZ (Price Reversal Zone). This zone is significant due to the confluence of several key technical levels, such as weekly resistance and the channel's upper boundary.

If the price breaks through this zone 💥, we could see strong buying pressure enter the market, triggering a notable upward move. However, if the price gets rejected from this zone 🚫, we may see a continuation of the bearish trend or a deeper correction. Thus, this zone represents a critical turning point for determining the price’s direction.

Key Resistances:

If the green zone is broken, the following Fibonacci target levels could be reached:

1.272: (between 10.058 and 11.770)

1.618: (between 17.252 and 20.414)

2.272: (between 38.696 and 46.175)

These levels are considered potential targets for the next upward move 🚀. It's essential to pay attention to trading volume in this zone, as an increase in volume would confirm the strength of the buying pressure and a possible breakout. A significant volume surge, especially above the average daily volume, can be indicative of the start of a larger upward trend.

Predicted Critical Scenarios:

1. If the price is rejected from the PRZ zone:

In the event of a rejection from the green zone 🚫, we could see a deeper correction toward the gray zone (between 1.541 and 1.813). If this area fails to hold, there is a risk of further correction toward the lower boundary of the descending channel ⚠️. In this scenario, it’s important to watch for reversal signals at these levels.

RSI Indicator:

The RSI is currently moving within a descending channel with a mild slope 📉. A breakout from this channel to the upside 💥 could indicate a move into the overbought (Overbuy) territory, potentially accelerating the upward movement of the price 🚀. However, if the RSI continues its downward trend, we may need to watch for lower support zones.

Investment Strategy:

Step-by-Step Entry:

The best strategy in this situation is to enter gradually 🪜. You can start entering around support zones with reasonable volume and strengthen your position once the green zone breaks. This strategy allows you to manage risk more effectively and take advantage of any price rallies.

Risk Management:

To manage risk 🛡️, it’s advisable to set your stop-loss in lower support areas such as 1.541 – 1.813. This helps mitigate potential losses in case negative scenarios unfold.

Volume Analysis:

Trading volume is a key factor for confirming breakouts or trend continuations. If we see an increase in volume within the PRZ zone 📈, the likelihood of a breakout and a subsequent upward move increases. Any unexpected volume spike should be carefully monitored.

Conclusion:

FXS is at a crucial point in its price action. Given the technical analysis and current conditions, employing a step-by-step entry strategy and managing risk can help you take full advantage of this opportunity 💡. Additionally, paying attention to the PRZ zones, volume analysis, and RSI is essential for navigating this trade. These key points can guide you in making well-informed decisions for the future 🚀.

Are We on the Verge of a Major FXSUSDT Shift? - Frax Share◳◱ On the BINANCE:FXSUSDT chart, the Bband Breakout pattern suggests a consolidation phase that could precede a trend continuation or reversal. Traders might observe resistance around 3.366 | 4.186 | 5.572 and support near 1.98 | 1.414 | 0.028. Entering trades at 3.383 could be strategic, aiming for the next resistance level.

◰◲ General Information :

▣ Name: Frax Share

▣ Rank: 275

▣ Exchanges: Binance, Kucoin, Huobipro, Gateio, Mexc, Hitbtc

▣ Category / Sector: Financial - Stablecoins

▣ Overview: Frax attempts to be the first fractional-algorithmic stablecoin protocol to implement design principles of both collateralized and algorithmic stablecoins. The Frax protocol is a two token system - the stablecoin FRAX, and Frax Shares (FXS), which are used to stablise the system, accrue seigniorage revenue and fees, as well as provide governance rights. The degree to which FRAX is collateralized is determined by market forces, with the collateral ratio determining the proportion of FRAX outstanding to be backed by collateral, with the remainder in FXS.

◰◲ Technical Metrics :

▣ Current Price: 3.383 ₮

▣ 24H Volume: 47,158,096.844 ₮

▣ 24H Change: 34.299%

▣ Weekly Change: 0.52%%

▣ Monthly Change: 29.85%%

▣ Quarterly Change: 71.48%%

◲◰ Pivot Points :

▣ Resistance Level: 3.366 | 4.186 | 5.572

▣ Support Level: 1.98 | 1.414 | 0.028

◱◳ Indicator Recommendations :

▣ Oscillators: BUY

▣ Moving Averages: STRONG_BUY

◰◲ Summary of Technical Indicators : BUY

◲◰ Sharpe Ratios :

▣ Last 30 Days: 1.04

▣ Last 90 Days: 1.40

▣ Last Year: -0.92

▣ Last 3 Years: -0.04

◲◰ Volatility Analysis :

▣ Last 30 Days: 1.45

▣ Last 90 Days: 1.10

▣ Last Year: 0.96

▣ Last 3 Years: 1.13

◳◰ Market Sentiment :

▣ News Sentiment: N/A

▣ Twitter Sentiment: N/A

▣ Reddit Sentiment: N/A

▣ In-depth BINANCE:FXSUSDT analysis available at TradingView TA Page

▣ Your thoughts matter! What do you think of this analysis? Share your insights in the comments below. Your like, follow, and support are greatly valued and help sustain high-quality content.

◲ Disclaimer : Disclaimer

The content provided is for informational purposes only and does not constitute financial, investment, or trading advice. Always conduct your own research and consult a qualified professional before making any financial decisions. Use of the information is solely at your own risk.

▣ Explore the Power of Charting with TradingView

Unlock a wide range of financial analysis tools, data, and features to elevate your trading experience. Take a tour and see the possibilities. If you decide to upgrade your plan, you can receive up to $30 back. Discover more here - affiliate link -

TradeCityPro | FXS : Signs of a Bullish Momentum Surge👋 Welcome to TradeCityPro!

In this analysis, I will evaluate the FXS token. This token belongs to the Frax project, which is considered one of the most comprehensive protocols in DeFi. It could be a strong investment for a bullish market portfolio.

📅 Weekly Timeframe: Early Signs of Bullish Momentum

On the weekly timeframe, we observe significant selling pressure right from the beginning of the chart. This selling pressure has driven the price down twice: once from the 38.917 resistance to the 4.468 support, and again from 11.859 to 1.613. Notably, this is one of the few coins that has yet to revisit the lows it formed in early 2023.

📊 Despite the significant decline, market volume has consistently increased, and overall, buying volume has been greater than selling volume.

📈 Currently, in line with Bitcoin’s upward movement, FXS has also rebounded from its 1.613 low and climbed to the 4.468 zone. This upward movement occurred after breaking the 34.90 resistance on the RSI, which introduced considerable bullish momentum into the market.

✅ If the 4.468 resistance is broken, the next targets are 7.515 and 11.859. These two resistances mark the goals for the next upward movement if it continues, with 11.859 being a key critical resistance for this coin.

🚀 Breaking the 11.859 resistance will be challenging. However, if the market gains substantial momentum, FXS could break through all resistances with a large bullish candle and head towards higher targets. On the other hand, a gradual and steady approach towards this level would make breaking it significantly harder.

🔼 If this resistance is broken, additional bullish momentum could enter the market, enabling the price to move towards the 38.917 zone and potentially reach new all-time highs (ATH).

🔍 To explore more scenarios, let’s examine the daily timeframe for detailed insights.

📅 Daily Timeframe: Struggling Against Key Resistance

In the daily timeframe, the latest upward movement in price is visible in more detail. As seen, after the last touch at 1.613, there was a massive and notable increase in buying volume. However, upon reaching the 4.819 resistance, a Blow Off candle was formed, marking the end of this trend’s upward leg.

📉 Currently, the price is in a corrective phase and has fallen below the 3.97 zone. If the correction continues, there is a significant resistance zone close to the 2.346 support level that I’ve highlighted. Should the RSI stabilize below the 53.46 support level, the likelihood of a deeper correction will increase.

🧩 Conversely, if the 4.819 resistance is broken, we could expect another rally for the price. The targets for this rally have been identified in the weekly timeframe analysis

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️ above.

#FXSUSDT: Will This Be the Breakout We've Been Waiting For?Yello, Paradisers! Will this be the breakout of #FXSUSDT that investors have been waiting for? Let's discuss the latest analysis of $FraxShare:

💎After 4-5 months of a slow and steady downtrend, #FXS is finally approaching a critical turning point. The price is now testing the upper boundary of a Descending Channel, thanks to a strong bounce from the major demand zone at $1.86. But the question is—can the bulls sustain the momentum and spark a true rally?

💎To ignite this breakout, #FraxShare needs to clear a key hurdle at $2.69. This level, which previously acted as strong support on two occasions, has now turned into a resistance that must be overcome. If we see a breakout above this zone, confirmed by increasing trading volume and the 20 EMA, it could signal that the bulls are ready to take control and push higher. If this happens, get ready for a potential surge toward the next major resistance level.

💎However, if momentum falters, we might see a pullback toward the crucial support zone around $1.86, potentially retesting the breakout level. Should the price fail to hold here, trouble could be brewing, with #FXSUSDT possibly sliding back down to test the $1.50 support level.

💎The real risk lies in a break below $1.50. If this support gives way, the bears will likely seize control, leading to a deeper correction and dashing any hopes for a short-term bullish recovery.

Stay focused, patient, and disciplined, Paradisers🥂

MyCryptoParadise

iFeel the success🌴

FXS- BULLISH MOMENTUMClear Path for Long Positions Until January 20th

We have a green light to focus on long setups leading up to January 20th, but emotional Discipline is critical—avoid letting euphoria or emotional demons dictate your decisions.

BINANCE:FXSUSDT is a standout candidate for a strong rally based on my criteria:

Monthly and Weekly Structure supported by FVG (Fair Value Gaps).

PMH and PML (Previous Monthly High/Low) being disrespected.

PWH and PWL (Previous Weekly High/Low) being disrespected.

PDH and PDL (Previous Daily High/Low) being disrespected.

4H Swing Highs and Lows also being disrespected.

At this moment, I see no valid reasons to adopt a bearish stance. The primary risk lies in potential liquidity spikes. To mitigate this, a solid Stop Loss is essential to safeguard your position and allow for re-entry if price action justifies it.

Risk-to-Reward Ratio: 9.53

Stay focused and protect your trades.

#FXS/USDT#FXS

The price is moving in an ascending channel on a 1-day frame and sticking to it well

We have a bounce from the lower limit of the descending channel and we are now touching this support at a price of 1.80

We have an upward trend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 2.11

First target 2.50

Second target 2.82

Third target 3.21

#FXS (SPOT) entry range( 1.600- 2.050) T.(6.440) SL(1.501)entry range ( 1.600- 2.050)

Target1 (2.870) - Target2 (3.440)- Target3 (5.190)- Target4 (6.440)

2 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

SL .1D close below (1.501)

*** collect the coin slowly in the entry range ***

*** No FOMO - No Rush , it is a long journey ***

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS ****

FXS ANALYSIS🚀#FXS Analysis : What Next ??💲💲

✅As we can see that there was a formation of "DESCENDING CHANNEL PATTERN" in #FXS and given a breakout. Right now #FXS is trading in a parallel channel. We are expecting around 80-100% bullish move after a good breakout📈

🔰Current Price: $4.642

🎯 Target Price: $9.600

⚡️What to do ?

👀Keep an eye on #FXS price action. We can trade according to the chart and make some profits. Stay tuned for further analysis and stay updated with market sentiments and news.⚡️⚡️

#FXS #Cryptocurrency #TechnicalAnalysis #DYOR

🚀FXS: A Potential Skyrocket Waiting to Launch 🌕📈 FXS has been in an accumulation phase since June 2022, consolidating within a green rectangle range. With a tiny circulating supply of just 78,825,942 FXS, this crypto could be primed for a massive upside move.

💣 Once FXS breaks out from this accumulation range, it could potentially explode to new heights, with targets of $22-$24 in sight. However, the timing of this breakout remains uncertain, so patience is key. ⏳

🚀🚀 Red Lines and White trends are our targets.🚀🚀

✨ While the upside potential is enticing, it's crucial to do your own research (DYOR) and manage your risk accordingly. Dollar-cost averaging (DCA) into FXS could be a wise strategy for those willing to hold through the volatility.

🎰 Good luck to those who decide to take a chance on this potential crypto gem! May the odds be ever in your favor. 🍀

In summary, FXS presents an exciting opportunity for patient investors willing to weather the accumulation phase. With its tiny supply and potential for a massive breakout, FXS could be a rocket ship waiting for liftoff. 🚀 DYOR, DCA, and buckle up for a thrilling ride!

FXS Expanding T-Pattern Analysis: Potential Breakout and Grow?!🍣📈This analysis examines the expanding triangle pattern formation and assesses the potential for a breakout and subsequent price growth.

📈Expanding Triangle Pattern:

An expanding triangle pattern has been identified, characterized by rising highs and falling lows.

This pattern indicates a buildup of market indecision and uncertainty.

📉🔺Breakout and Resistance Levels:

A breakout above the daily resistance level could signal a bullish trend reversal and potential for further price appreciation.

The next daily resistance level would then become the target for the upward movement.

📊🔺RSI Confirmation and Volume:

A break above the RSI trendline would provide additional confirmation of the bullish breakout.

Increasing trading volume alongside the breakout would indicate strong momentum and support the upward trend.

⛔Important Considerations:

False breakouts are a possibility with expanding triangle patterns, and traders should exercise caution.

🔽Additional technical indicators and market sentiment analysis can help validate the breakout and provide trade entry and exit signals.

🚫This analysis is for educational purposes only and should not be construed as financial advice. Always conduct your own research and employ sound risk management practices before trading.🚫

#Fxs#Fxs

The price has broken the descending blue resistance line on the screen

The price has always rebounded over the course of the year

Now the price is heading upward after retesting the trend

On the MACD indicator, we see saturation and a breach of the zero line

Buying areas are at the area marked in blue, in the price range of 5.05 to 5.30

The goals will be $10 to $11 $

FXS has broken above the channel bandFXS has broken above the channel band, it will continue to go up

🔵Entry Zone 9.100 - 9.583

🔴SL 7.998

🟢TP1 10.680

🟢TP2 11.868

🟢TP3 15.280

🟢TP4 17.298

Risk Warning

Trading Forex, CFDs, Crypto, Futures, and Stocks involve a risk of loss. Please consider carefully if such trading is appropriate for you. Past performance is not indicative of future results.

If you liked our ideas, please support us with your likes 👍 and comments.