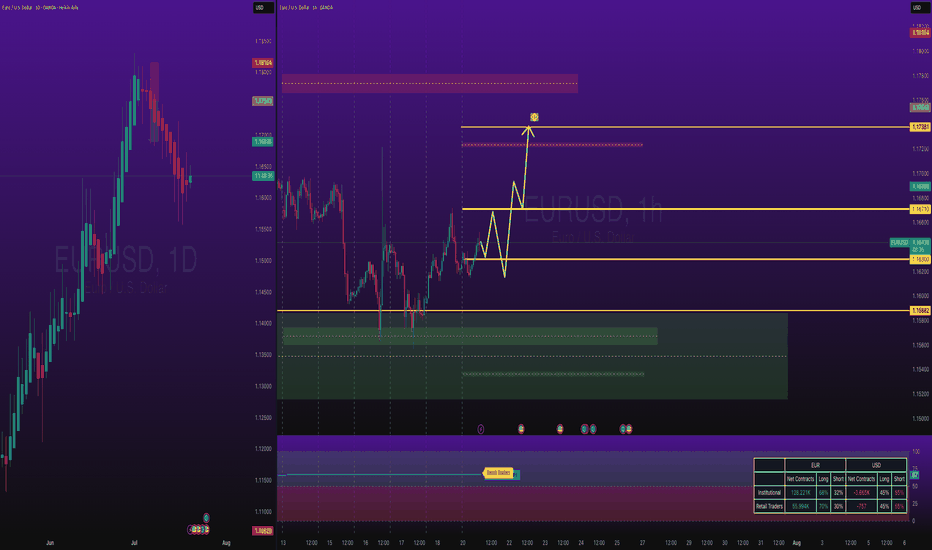

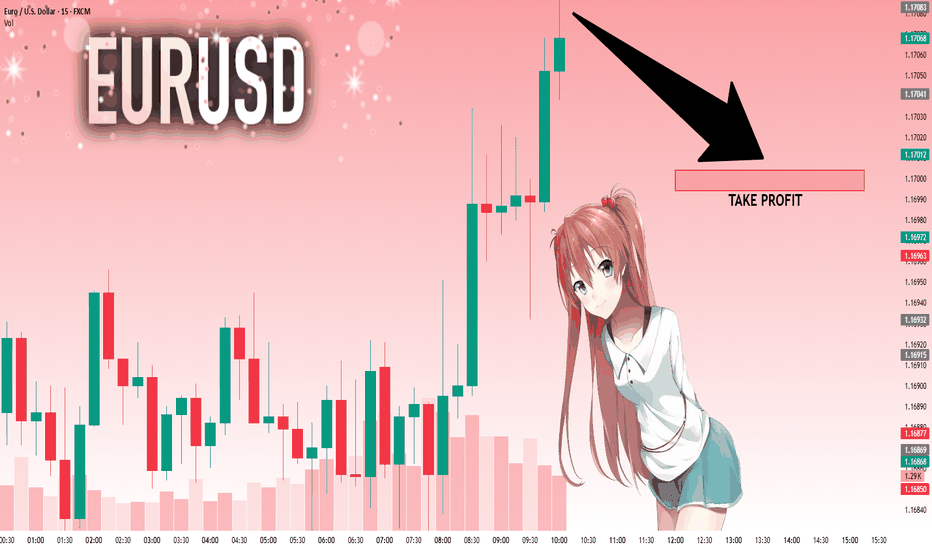

EURUSD Long Swing FX:EURUSD price had stopped falling and I was waiting for bullish volume to kick inn, initial bullish volume started jumping inn, so taking long now.

With my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

I manage trade on daily basis.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

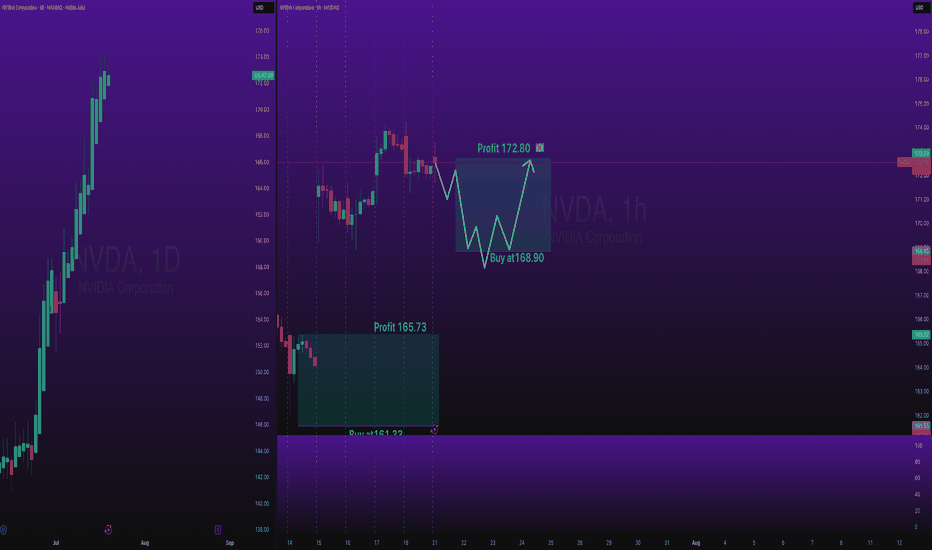

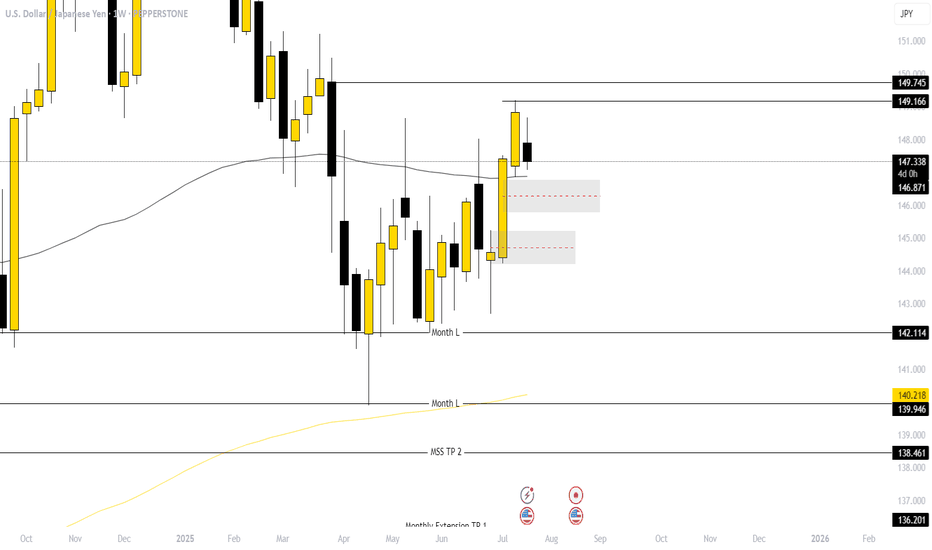

Gann

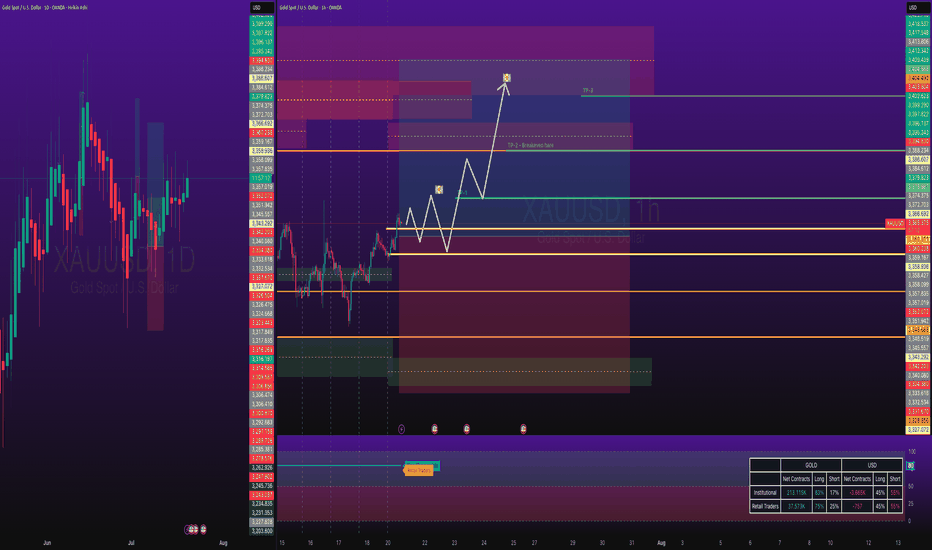

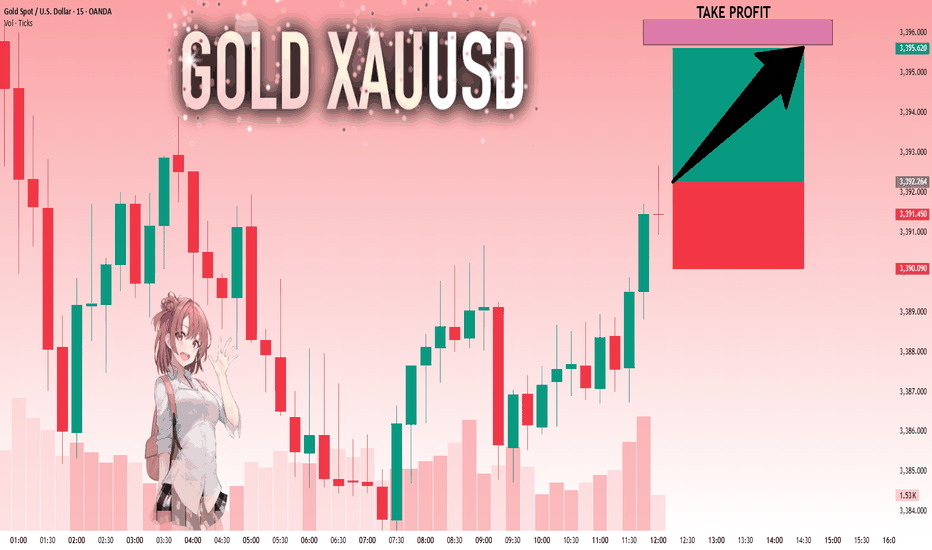

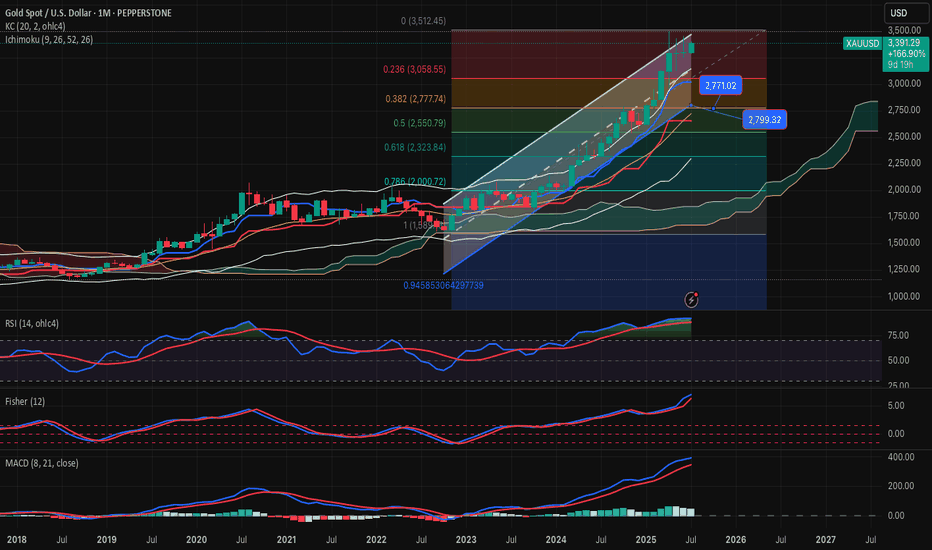

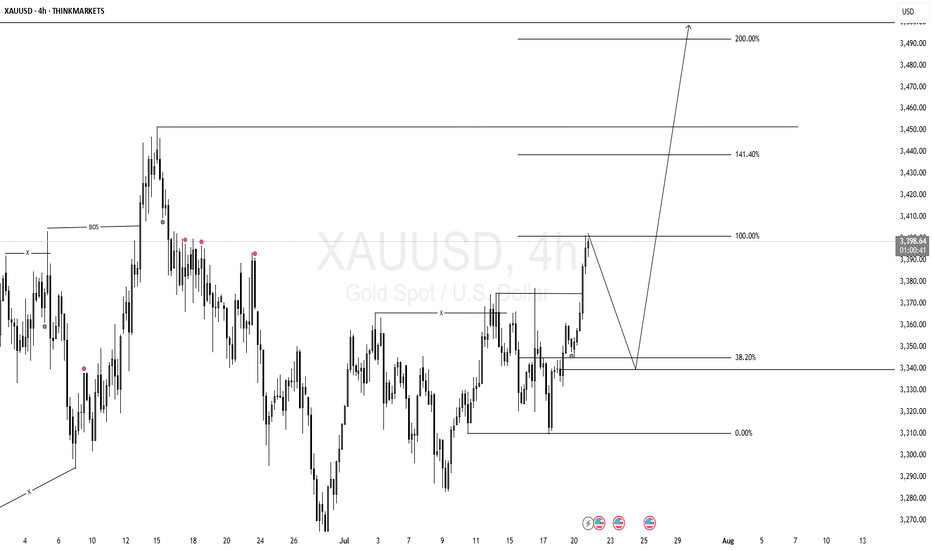

GOLD/XAUUSD maintaining Bullish TrendOANDA:XAUUSD / TVC:GOLD Long Trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

Gold is keeping bullish volume and wants to hit key resistance of July, then to consolidate there and then will see what price does further.

Note: Manage your risk yourself, its risky trade, see how much your can risk yourself on this trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

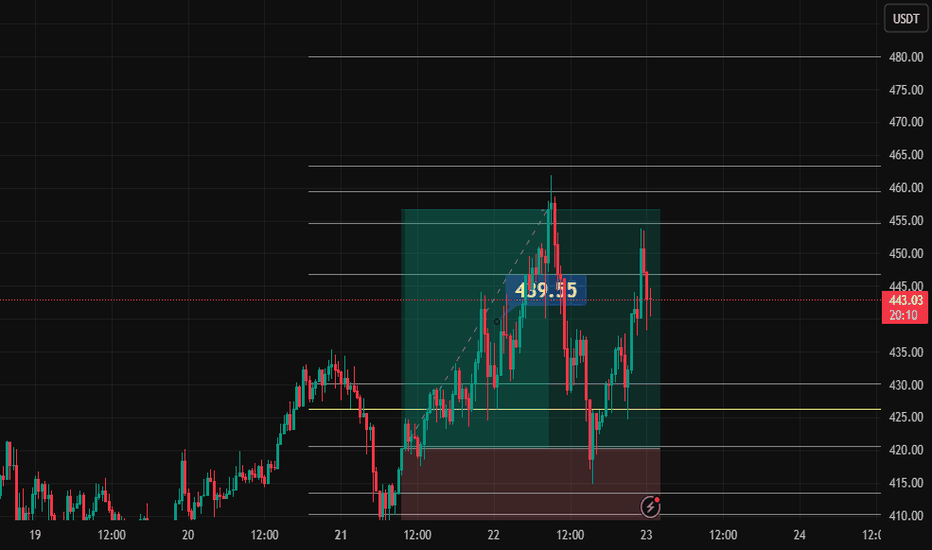

Impatience. Chickening outTrade Journal – TAO, Pengu & the Elusive HYPE

Date 23/7/2025

I don’t trade on Mondays—by design. But today, I honored that discipline *mostly*… with a few strategic pivots.

TAO: First Move, First Lesson

I took TAO on Spot early Monday, planning to hold until weekend highs. My bias? After that weekend pump, I expected Monday’s session to seek out those liquidity-rich levels.

By midmorning, I had early profits—more than I’d normally expect for a Monday. With extra charting time and a shift in schedule, I decided to secure gains around **+3%** and move on.

Right idea… maybe wrong execution.

TAO didn’t just continue—it ripped.

Looked back at me like:

> “The hell were you thinking?”

Fair enough. I responded:

> “Chill. This is the volatility zone. I’ll find another one.”

🐧 Pengu: Redemption in Motion

Scanned. Spotted Pengu .

Took it on Spot again—targeting a clean +5%.

Wasn’t worried about drawdowns; I trust the setup.

Only issue? My exchange doesn’t allow pre-queued sells unless I’m actively in the trade—and sometimes, I forget to prep that.

Fast forward: I checked back, and I’m sitting on +10%++.

No hesitation this time—we sold. Clean.

HYPE: The One That Got Away

Next up was HYPE . I had done the work—clean levels, setup looked solid.

Except… not available on my exchange. Again.

Maybe I just couldn’t find it. Or maybe my exchange was playing games. Either way, that trade left the station without me.

Could’ve transferred funds and chased, but I value precision. Rushed logistics aren’t part of my edge.

Price will always come back.

Final Thought

HYPE’s still on my radar.

If it wants to come home to me and take me to TP—door’s open. Limit set, looking for a 15% within the next 15 days.

Until then, I’m letting the market breathe. Discipline + Setup = Process.

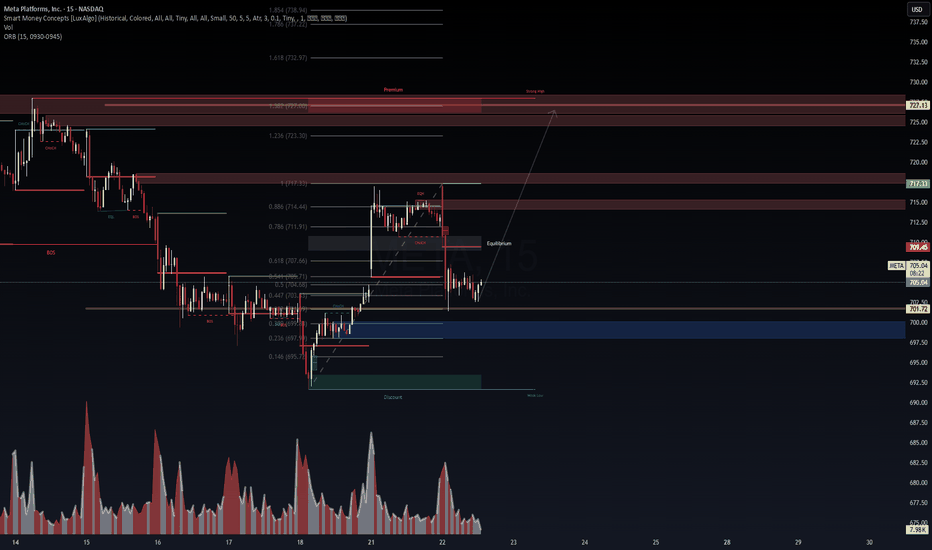

META: That weird drop looks like it was planned :P📊 META (15M) | Smart Money Concepts Setup

🔍 Powered by VolanX Protocol | WaverVanir International LLC

META is showing signs of reclaiming equilibrium after a clear CHoCH -> BOS -> EQH sweep. Price tapped into a premium inefficiency zone and is now consolidating at the equilibrium of the latest impulse leg, suggesting a potential long opportunity.

🧠 Thesis:

Order Block + EQH rejection aligns with a key Fibonacci confluence zone.

Strong demand sits near the 701.72–700.00 area.

Bullish continuation setup toward:

TP1: 717.33 (ORB + EQH target)

TP2: 727.13 (1.382 Fib extension + liquidity sweep zone)

⚠️ Risk Management:

Invalid if price closes below 697.00 (Discount OB)

Ideal entry near 703–705 with confirmation (candle body close over 707.66 Fib)

🛡 VolanX Score: High Confluence | SMC + Fib + Volume Spike

📈 Watching for a bullish engulfing or clean mitigation inside the OB for confirmation.

📎 For educational purposes only – not financial advice.

#VolanX #WaverVanir #META #OptionsFlow #SMC #Fibonacci #SmartMoney #TechStocks #TradingView

NIO Setting Up for a Big Move!🚨 NIO ALERT 🚨

Looks like a buy & fly setup is loading! 📈💥

📊 Technicals aligning beautifully with macro cycle support.

🔥 Volume picking up. The structure looks explosive.

📍 A clean breakout could send this EV beast soaring!

I'm watching closely for confirmation...

This could get FAST. ⚡

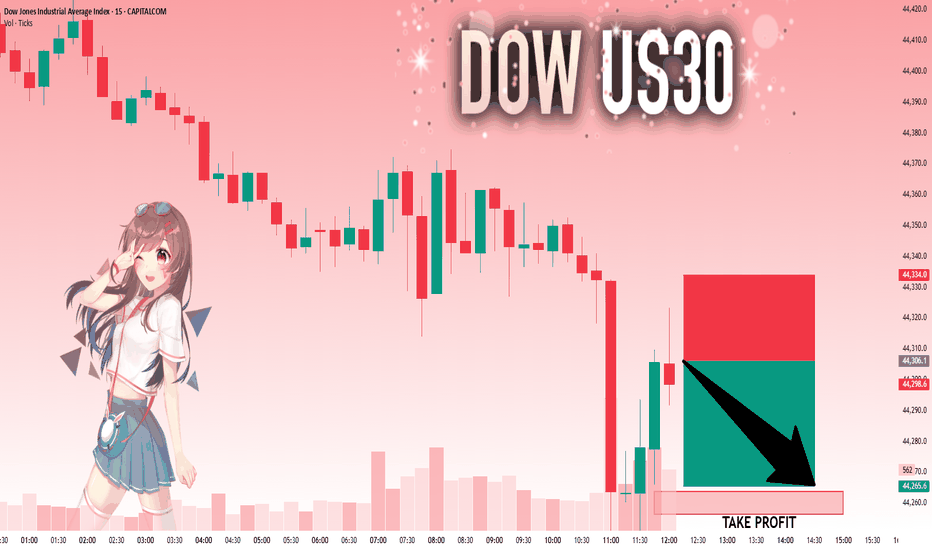

US30: The Market Is Looking Down! Short!

My dear friends,

Today we will analyse US30 together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 44,306.1 will confirm the new direction downwards with the target being the next key level of 44,263.8..and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

GOLD: Strong Bullish Sentiment! Long!

My dear friends,

Today we will analyse GOLD together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 3,392.264 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

EURUSD: Bears Are Winning! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The market is at an inflection zone and price has now reached an area around 1.17083 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 1.17004..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

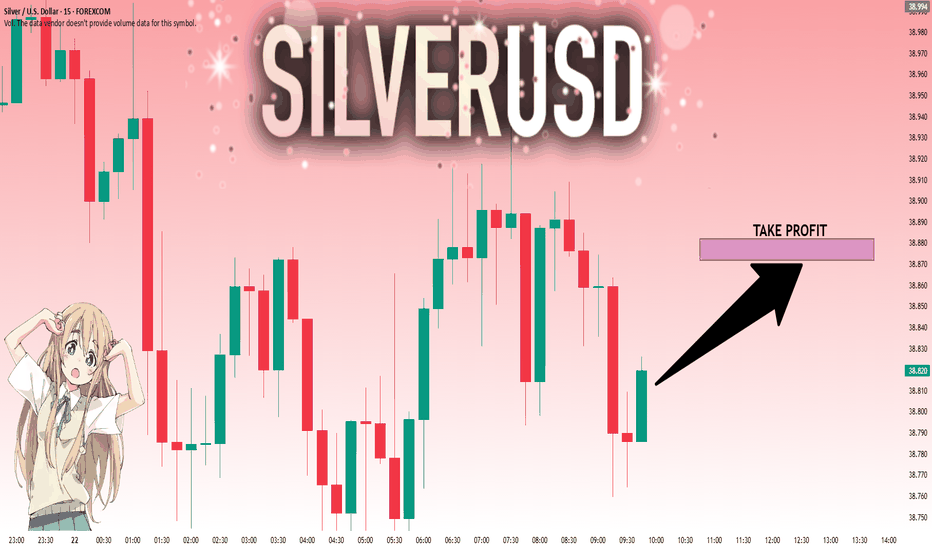

SILVER: Next Move Is Up! Long!

My dear friends,

Today we will analyse SILVER together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 38.823 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 38.872.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

#RLC/USDT#RLC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.995.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading toward stability above the 100 Moving Average.

Entry price: 1.028

First target: 1.063

Second target: 1.102

Third target: 1.152

July 18 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

Bitcoin 30-minute chart.

There is no Nasdaq indicator announcement today.

The mid-term pattern was broken in the morning wave,

but I proceeded as safely as possible.

At the bottom left, I connected the final long position switching section in the analysis article on the 15th with a purple finger.

*When the blue finger moves,

Bidirectional neutral

Short->Long or long waiting strategy

1. Short position entry section of $120,338 / Stop loss price when orange resistance line is broken

2. Long position switching of $118,886.8 / Stop loss price when blue support line is broken

3. Long position 1st target of $121,756.2 -> Target price in the order of Good and Great

If it falls immediately from the current position or

touches the top once and falls, it is a vertical decline condition.

If it falls immediately, it is the final long waiting in section 2.

(When the sky blue support line breaks, the stop loss price is the same)

From the sky blue support line break, the 6+12 section is where the mid-term pattern is restored,

and it is roughly the bottom section.

If the strategy is successful, I have left a simulation with a pink finger on the right,

so please check the switching and profit-taking section,

and operate safely in each position, long, short, and no position, based on whether the purple support line breaks from the current position.

From the green support line break, the low point of today's daily candle is broken,

so it would not be good for a long position, right?

Up to this point, please use my analysis article only for reference and use,

and operate safely with principle trading and stop loss price.

Thank you.

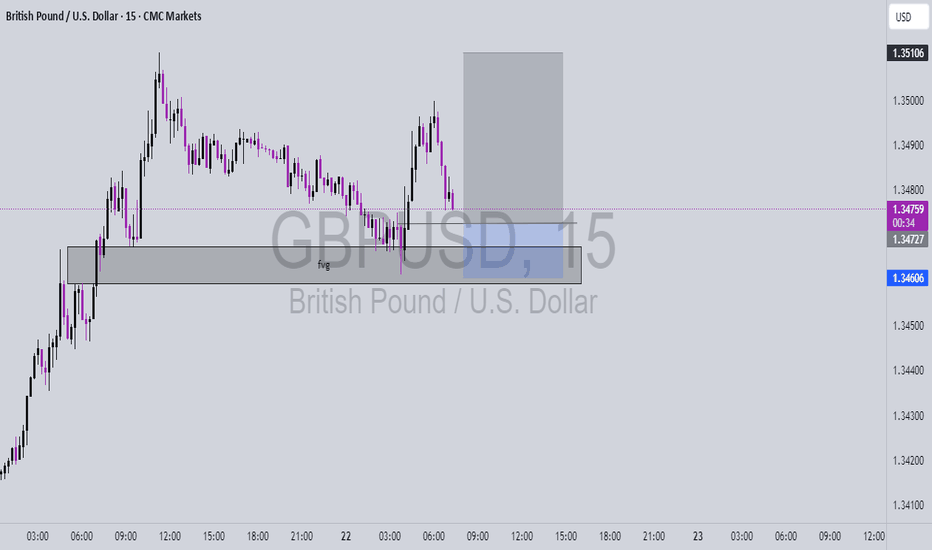

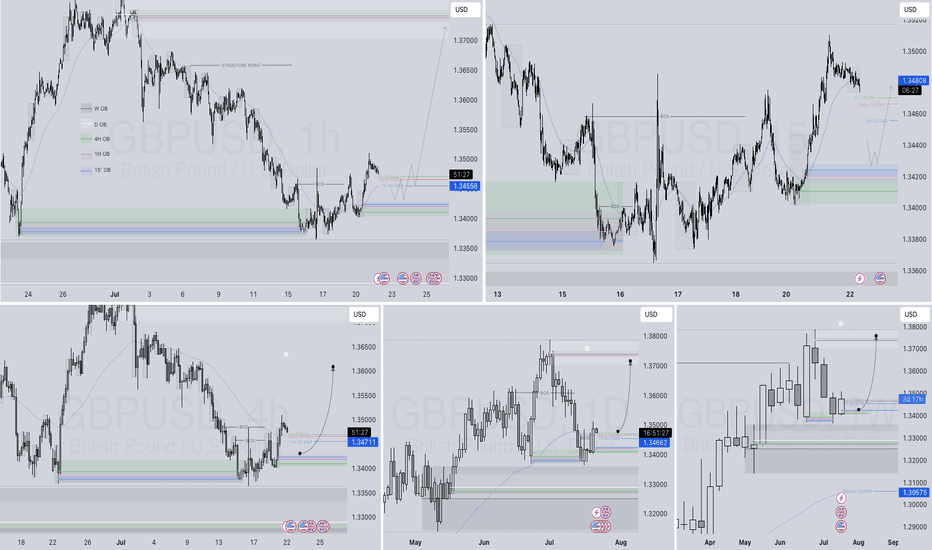

GBPUSD Q3 | D22 | W30 | Y25📊GBPUSD Q3 | D22 | W30 | Y25

Daily Forecast Long 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT

WAIT FOR BREAKOUT AND GO LONG THIS MIGHT BE THE LAST CHANCEThis chart is a technical analysis idea for the OM/USDT pair on the daily timeframe from TradingView. Here's a breakdown of the idea:

🔍 Overview

Pair: OM/USDT

Exchange: Binance

Timeframe: 1D (Daily)

📉 Current Market Context

The price is in a strong downtrend, forming a falling wedge (marked with red trendlines), which is typically a bullish reversal pattern.

Price is currently around $0.2539.

📊 Key Levels (Support Zones in Green)

$0.2539 (Current Price)

$0.2390

$0.2285

$0.2250

$0.2224

$0.2100

$0.1882

$0.1115

$0.1016

These green lines represent support zones—potential reversal areas if price falls further.

🟨 Yellow Boxes

These are higher time frame demand zones or accumulation areas, suggesting stronger possible reversal points if price drops deeper.

Placed between $0.14 - $0.04 zone.

📈 Red Arrows

Indicate possible reversal paths:

A bounce from current levels

A dip into deeper support zones before bouncing

A flush into yellow zones before reversal

🗓️ Time-Based Prediction

The note says:

“19, 21, 23, and 30th June might be positive for OM”

This suggests a time cycle forecast—the analyst expects bullish price action on or around these dates, possibly based on astro-cycles, Gann analysis, or time symmetry.

"Despite expecting lower prices, the setup signals that investors are preparing for accumulation—especially near key dates and support levels."

✅ Summary

Wait for wedge breakout confirmation to go long.

Key bullish reversal dates: June 19, 21, 23, and 30

Multiple layered supports and demand zones to watch.

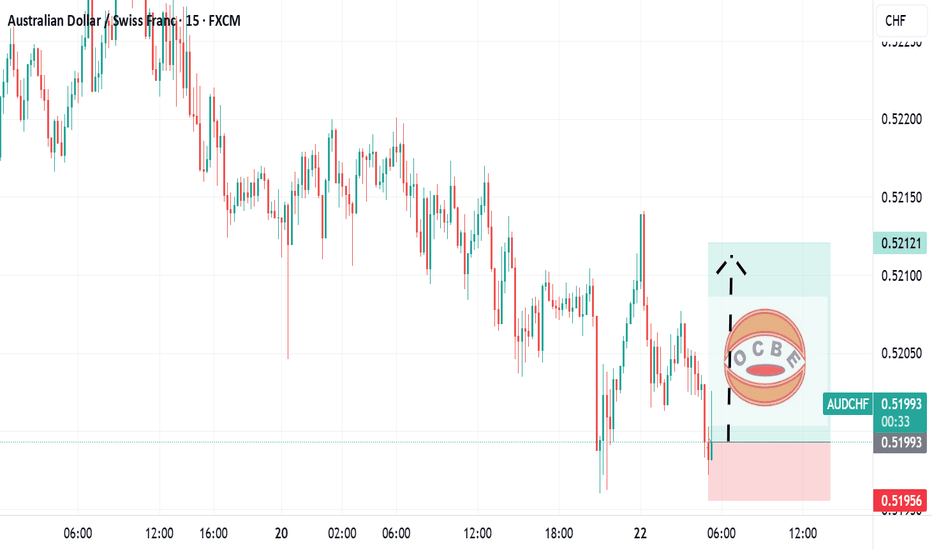

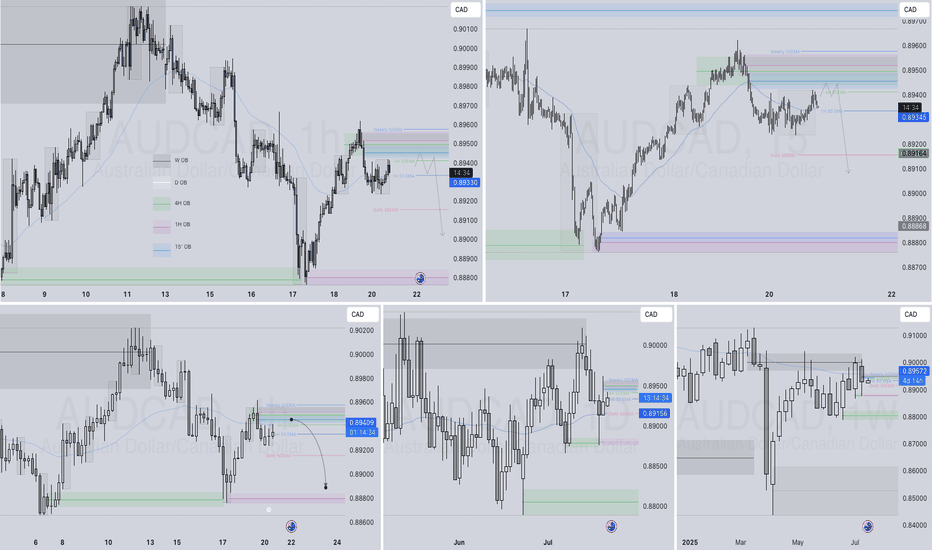

AUDCAD Q3 | D21 | W30 | Y25 📊AUDCAD Q3 | D21 | W30 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT 📊

GOLD-SELL strategy Monthly chart Reg. ChannelGold is very overbought medium-term, and the danger is we may see a large decline. Same as I pointed out today on the shorter time-frame, we are in SELL mode, even though we have been moving higher. Crypto will lead the way.

Strategy SELL @ $ 3,385-3,450 and take profit near $ 2,845 for now.

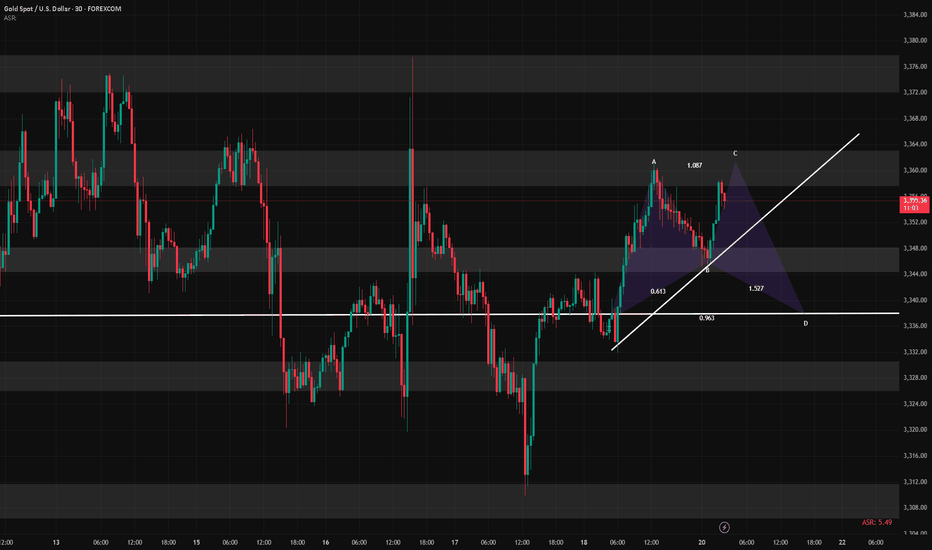

July 21: Key Resistance at 3358–3366, Breakout Targets 3378–3388Good morning, everyone!

Last Friday, gold tested the support around 3332 but did not break below it. The price then rebounded to the 3358 zone, where it encountered selling pressure and pulled back. At today's open, the price retraced to the 3343 level, where support held well, prompting another rally back toward 3358.

It’s important to note that since the 3358 resistance was already tested on Friday, some of the selling pressure has likely been absorbed. As a result, there is a higher probability of a breakout today. If a breakout occurs, the next key resistance lies at 3366/3372–3378. In the case of strong bullish momentum, the price may extend further toward the 3386–3392 resistance zone.

However, if the price continues to be capped below 3358–3366, we may see a consolidation or short-term pullback. In this case, watch support at 3348–3343. Should the price successfully break above 3378, then support on pullbacks will shift higher to 3363 and 3358–3352.

🔺 Key Warning: The 3358 resistance zone is technically crucial. If the price repeatedly fails to break through, watch out for a potential double-top pattern on the 30-minute chart, which could signal a near-term bearish reversal.