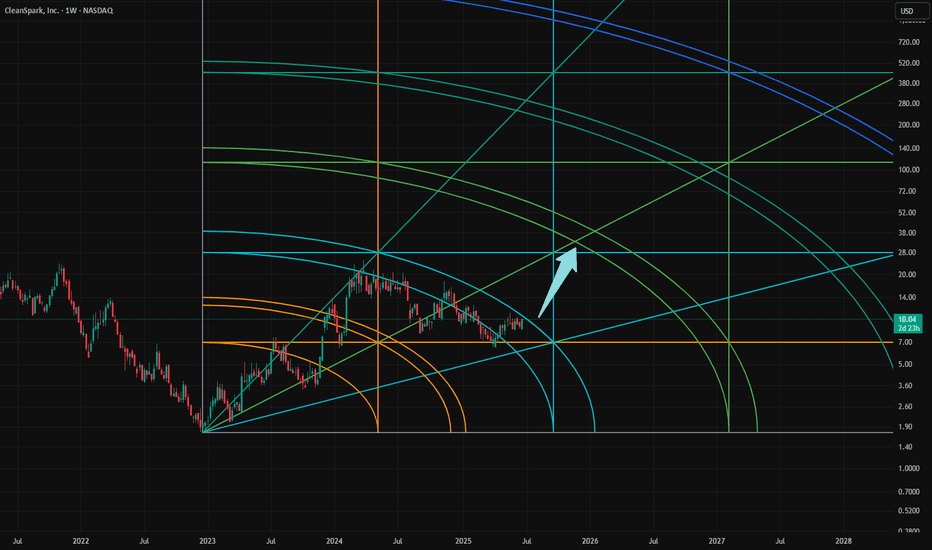

Gann

#MYRIA/USDT#MYRIA

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.0010770, acting as strong support from which the price can rebound.

Entry price: 0.0011480

First target: 0.0012075

Second target: 0.0012700

Third target: 0.0013400

US30: The Market Is Looking Up! Long!

My dear friends,

Today we will analyse US30 together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 43,045.6 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 43,152.9.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

SILVER: Strong Bullish Sentiment! Long!

My dear friends,

Today we will analyse SILVER together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 35.758 will confirm the new direction upwards with the target being the next key level of 36.094 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

EURUSD: Bears Are Winning! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 1.16242 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

EUR/USD Ready to Explode or Collapse? All Eyes on June 26 🔺 Gann Trend Analysis

The red upward sloping line is a long-term Gann trendline connecting major swing lows since late May.

According to Gann principles, trendlines from major pivots are often tested again before a major reversal.

The annotation “a trend should be tested again” aligns with the Gann philosophy: after price rallies away, it often returns to test the base trendline.

The cluster of vertical blue time cycle lines (June 26) implies an important Gann time window, potentially a reversal point.

📐 Channel & Price Structure

A small ascending wedge/channel is drawn in red, signaling rising but weakening momentum.

Price is now approaching key resistance zones marked in yellow and green (1.1640, 1.1650, 1.1660, 1.1683).

These resistance zones suggest potential exhaustion, making the upper boundary of the channel a sell zone.

🔻 Bearish Scenario & Projections

Blue arrows indicate the expected bearish path after hitting resistance.

The reversal target is the Gann trendline retest zone around 1.1500–1.1520.

A break below this Gann trendline could trigger deeper drops in alignment with time-based cycles.

⚠️ Conclusion

This setup implies:

Bearish divergence between price action and time cycles.

Resistance clusters = likely reversal point.

Retest of the long-term Gann trendline is highly probable.

AMC Bullish Cycle Alert – Gann Analysis Signals a 60%+ Move!📊 Key Insight:

According to our proprietary Gann time cycle and technical analysis, AMC is entering a strong bullish window, with a minimum expected upside of 60%.

🟢 Bullish Case Highlights:

✅ W–X–Y–X–Z corrective structure potentially completed.

🔁 Multiple bullish divergence signals across the recent lows.

📅 Time Cycle Tops: 21st July – 2nd September 2025.

🎯 Minimum Price Target: $4.90 – $5.30

💥 Extended Fibonacci Target: $11.88

🔴 Invalidation Level: A weekly close below $2.67 invalidates this setup.

📌 Strategy:

Early accumulation within the $2.80–$3.20 range may provide strong risk-reward setups for swing traders. Watch for volume and momentum confirmation during July.

🔍 Vital Direction View:

This setup combines Elliott Wave structure, Fibonacci symmetry, and Gann time analysis, forming a high-probability inflection zone. If confirmed, this could mark the start of a new bullish cycle for AMC.

GOLD: Next Move Is Down! Short!

My dear friends,

Today we will analyse GOLD together☺️

The market is at an inflection zone and price has now reached an area around 3,303.99 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 3,285.33..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

COIN- Cup and Handle FormationThere is more to this, but the basic formation is here. Other systems seem to also support the formation (such as Gann, and Harmonics).

There are a few 6 month candles overlaid in the entry to this that I was creating- illustrating the 6 month gains to form the cup. The handle portion did catch me off guard as we are typically use to seeing a cup form at the initial correction, but this one seems to have formed inside of the down move (very interesting).

Lets see how it works out. If true- its 50% gain on the bone here.

XAUUSD: Market strategy and analysis on June 24Gold technical analysis

Daily chart resistance 3400, support 3286

4-hour chart resistance 3345, support 3304

1-hour chart resistance 3335, support 3315

B2 bombing was carried out over the weekend, the scale of the war expanded, and the ceasefire was directly stopped on Monday. The news is changing at any time. Now the market risk aversion has subsided, and the gold price has fallen rapidly!

The 3400 mark has been under pressure for many times and failed to break through. With the news of the ceasefire agreement, the short-term correction pressure has increased.

Today, gold directly fell below the 3340 support. The loss here means that the shorts will further develop momentum downward. Next, gold will focus on the second highest point of the 1-hour line rebound 3357 as a defense point. If it continues to fall and test the 3300 integer mark, you can try to buy.

SELL:3340near

BUY:3300near

USDCHF LONG FORECAST Q2 W26 D24 Y25 14:00GMTUSDCHF LONG FORECAST Q2 W26 D24 Y25 1400GMT

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Daily order block

✅15' order block

✅Intraday breaks of structure

✅4H Order block

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

Technical Analysis of SOL/USDT (Weekly Chart)

The chart shows a Falling Wedge pattern – a typically bullish reversal formation.

A breakout to the upside from the wedge has occurred, signaling the potential start of an upward trend.

📉 Entry Zone (LONG HERE):

Clearly marked around the Fibonacci support levels:

0.618 (~130 USDT)

0.786 (~115 USDT)

This support zone is strong and ideal for long positions.

📊 Fibonacci Retracement Levels:

0.382 – First resistance

0.5 – Mid-level resistance

0.618 – Strong retracement support that price bounced from

🎯 Target Projections:

204.31 USDT – First target; a strong historical resistance.

229.01 USDT – Second target; a breakout above this would confirm bullish strength.

258.45 USDT – Final target if the bullish momentum continues.

AVAAIUSDT.P – Long Setup at Key Fibonacci Support (61.8–78.6%)AVAAIUSDT.P has pulled back into a strong Fibonacci retracement zone after a sharp bullish impulse. The current zone (61.8%–78.6%) aligns with previous price structure, offering a solid risk-to-reward setup for a long entry.

Monitoring MACD for confirmation of a bullish crossover or histogram shift. Targeting a move back toward the recent high near 0.03050.

#AVAAIUSDT #Bybit #CryptoTrading #FibonacciLevels #LongSetup #CopyTrading #MACD #TechnicalAnalysis #TradeWithConfidence