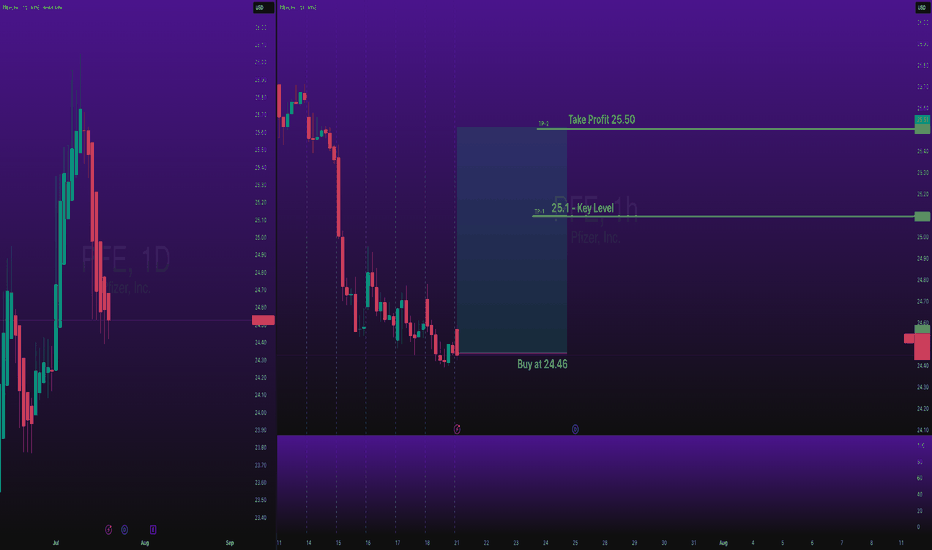

Buy Trade Strategy for UNI: Backing the Leading DeFi DEX UniswapDescription:

This trading idea is centered on UNI, the governance token of Uniswap, the largest decentralized exchange (DEX) on Ethereum. UNI holders play a crucial role in the protocol’s development, and the token benefits directly from Uniswap’s expanding user base, trading volume, and influence in the DeFi space. As decentralized finance continues to evolve, Uniswap remains a foundational pillar for trustless asset swaps, and UNI serves as a strategic asset for exposure to this ecosystem. The platform's commitment to innovation, including cross-chain expansion and layer-2 integrations, further strengthens UNI’s long-term fundamentals.

That said, the crypto market is highly volatile, and **UNI**'s performance is subject to sudden changes due to regulatory shifts, Ethereum network updates, or competitive developments in the DeFi sector. Investors should remain aware of these dynamics and manage their positions responsibly.

Disclaimer:

This trading idea is for educational purposes only and should not be considered financial advice. Cryptocurrencies like UNI carry substantial risk, including the possibility of total capital loss. Always conduct your own research, evaluate your risk tolerance, and consult a qualified financial advisor before making investment decisions. Past performance is not a guarantee of future results.

Gann

DAX: Bulls Are Winning! Long!

My dear friends,

Today we will analyse DAX together☺️

The market is at an inflection zone and price has now reached an area around 23,755.89 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move up so we can enter on confirmation, and target the next key level of 23,976.72.Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

GOLD: Next Move Is Down! Short!

My dear friends,

Today we will analyse GOLD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 3,372.04 Therefore, a strong bearish reaction here could determine the next move down.We will watch for a confirmation candle, and then target the next key level of 3,363.00..Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

EURUSD: Target Is Down! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 1.15671 will confirm the new direction downwards with the target being the next key level of 1.15480.and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

SILVER: Move Up Expected! Long!

My dear friends,

Today we will analyse SILVER together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 37.330 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

#ADA/USDT Trading Strategy ( ADAUSDT ) Buy Trade Setup.#ADA

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.6712.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.6736, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.7395.

First target: 0.7634.

Second target: 0.7943.

Third target: 0.8324.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

XAUUSD: Market Analysis and Strategy for August 4th.Gold Technical Analysis:

Daily Chart Resistance: 3400, Support: 3300

4-Hour Chart Resistance: 3370, Support: 3330

1-Hour Chart Resistance: 3363, Support: 3352.

Last week's NFP data was positive for gold prices, sending gold prices sharply higher. The market trend was much stronger than expected, breaking through the resistance level of 3333 and then rising to around 3360.

The daily chart shows Friday's sharp rise, erasing the losses from the first four days of last week. This signals continued bullishness for this week and the market outlook.

However, for those of us who are day traders, please be cautious about buying at high levels. After all, excessive short-term gains in gold could lead to profit-taking.

Technically, the daily MACD fast and slow lines are about to form a golden cross near the zero axis, indicating that the downward correction is nearing its end. However, the 1-hour RSI indicator shows a strong overbought signal, suggesting continued movement towards the lower support level.

For today's trading, it's best to wait for a pullback before buying. This is both safer and offers greater profit potential. Focus on the lower support level around 3333-3320. Upside targets could be in the 3375-3390 range.

Buy: near 3330

Sell: near 3370

AUDUSD – DAILY FORECAST Q3 | W32 | D4 | Y25📊 AUDUSD – DAILY FORECAST

Q3 | W32 | D4 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:AUDUSD

EURGBP – DAILY FORECAST Q3 | W32 | D4 | Y25📊 EURGBP – DAILY FORECAST

Q3 | W32 | D4 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURGBP

EURUSD – DAILY FORECAST Q3 | W32 | D4 | Y25📊 EURUSD – DAILY FORECAST

Q3 | W32 | D4 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURUSD

GBPUSD – DAILY FORECAST Q3 | W32 | D4 | Y25📊 GBPUSD – DAILY FORECAST

Q3 | W32 | D4 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:GBPUSD

USDZAR-SELL strategy 12 hourly chart Reg.ChannelThe pair has been moving lower, and recovered this morning to 18.1200 area and came down quickly there after. the picture suggest we are negative territory and it feels we may test 17.9500 again going back 17.8150 area.

Strategy SELL @ 18.0500-18.0975 and taker profit near 17.8350 for now.

GBPUSD – WEEKLY FORECAST Q3 | W32 | Y25📊 GBPUSD – WEEKLY FORECAST

Q3 | W32 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT

FX:GBPUSD