$SNAP Snap stock plunged Friday after the social-networking firm posted disappointing revenue growth and guidance that fell shy of estimates on Thursday.

The parent of Snapchat said its advertising revenue was hurt more than expected by Apple ‘s change in the rules surrounding advertising on mobile apps.

The miss weighed heavy on shares of other major social-media companies.

Snap (ticker: SNAP) stock was down 25% in Friday trading. Facebook (FB) was down 6% on the news, while Twitter (TWTR) was off 5%, Pinterest (PINS) had fallen 4.4%, and Alphabet (GOOGL) had slipped 3.4%. Snap is the first of the companies to report September quarter results.

For the third quarter, Snap posted revenue of $1.067 billion, up 57% from a year ago, and below the company’s guidance range of $1.07 billion to $1.085 billion. Adjusted Ebitda, or earnings before interest, taxes, depreciation, and amortization, was $174 million, well above its guidance range of $110 million to $120 million. On a non-GAAP basis, the company earned 17 cents a share in the quarter, beating the Street consensus of 8 cents a share.

The company said it grew daily average users in the quarter by more than 20% to 306 million.

Gapfill

Potential Conter trend corrective underway in the EUR/NZDGood afternoon folks, Happy Friday!

On our hunt for some potential ideas forming this morning, we came across an opportunity in the EUR/NZD.

At the moment price seems to have formed a nice higher low and has surged to the upside with a particular degree of momentum. Given that we have such a huge gap away from our 8EMA, I would expect the gap close to be well under way before long.

We did see something similar to this counter trend view earlier in the week before we saw another leg down but given where price is in the wider picture, having closed beneath major support, the likelyhood of a deeper corrective certainly seems to be on the cards.

Wait for a potential trigger via the breakout and retest of the 1.62400 zone for a potential window of opportunity to seek longs to approximately 1.63300-400.

Dont rush the process and trade the plan.

Have a lovely weekend!

NVDA: I warned you about the "Gap Reversal Ritual"!Hello traders and investors! As crazy as this sounds, but after almost one month, NVDA did exactly what we expected.

It confirmed our theory about the “ Gap Reversal Ritual ” which we talked about in our last analysis ( link below), and now, it filled all its previous gaps, as we thought (I told you, I’ve never seen this structure failing). It only did one more gap after my previous analysis, which is something acceptable and this didn’t ruin the thesis at all – it just reinforced it .

The reversal pattern that triggered the Gap Reversal Ritual was this Inverted Head and Shoulders , which worked as a confirmation . Now, we are close to the previous resistance at $ 225, and we see a Trap Zone , as the 21 ema is going up, squeezing the price against the resistance. If we are going to lose the 21 ema, or break the resistance, we don’t know yet, but we can work with scenarios in the daily chart.

If we break the resistance, NVDA will probably seek the ATH again, as the momentum would be very strong. If we lose the 21 ema in the 1h chart, we'll probably seek the 21 ema in the daily chart.

Now the situation on NVDA is not as easy to read as it was last month, but we can still work with targets.

If you liked this analysis, remember to follow me to keep in touch with my daily studies on stocks and indices.

Have a good day.

JICPT| Microsoft Daily bullish gap fill trade! Hello everyone. I've published bullish trading ideas on Microsoft with entries of 246-249 and 222-225 respectively. After the recent decline, I think it's probably a good time to consider the bullish entry again!

On the weekly, the stock is testing the short-term MA which sits around 282. I also noted that uptrend line and a solid demand zone marked in yellow colour.

On the daily chart, it's gonna fill the gap created on July 22nd.

So, to sum up, I think it's a good opportunity for bullish buyers. What do you think?

Give me a like if you're with me.

Consolidation breakout CHZConsolidation breakout, came down to fill the gap up, breakout at 17c, next doors at 26 and 32.

$AVID Volume Gap@avi417 Per your request, Avid looks like it wants to fill the gap it left from the beginning of AUG.

No trade for me here, but a break out of the resistance level $31 would have my interest with the volume pocket above. similar to June's price action, would want to see some consolidation then a strong break of $31 to imply a move up to $36 and close the gap.

Initial rejection of the $31 supply zone I see support at $28 .

AUDJPY - Let's see if we can RUN the sell stops...Current weekly bar is an inside bar and being ity appears buy stops have been neutralized there just might be a run for sell stops. Being that the daily is showing no close above a certain threshold, perhaps I have read it right. Half a % on the table.

AAPL Short (PT: $137)- With the current state of the market, AAPL can still see a drop in price. If we look back on the chart, we have a strong support zone of around $137. This zone is also confirmed by a gap up back at the beginning of July. AAPL will have to fill that gap up and it will hold that zone because in the past it was a strong area of resistance. If we don't hold the support then I will be watching 134.40 all the way down to the POC line for the next area of support.

- Another indicator I am using to show AAPL will keep heading down is the gap in the volume profile. On the right of the chart, the level we are at is right above the gap, if we don't hold this level on the next trading week we could see it fall through.

- A counter perspective we could see playout for the next trading week, is AAPL breakout above the trendline it has been following these past few weeks. A point to support this is the RSI divergence seen this last week of trading.

2021.09.29 VWAP + Volume Gap I am not able to conclude anything but

1. there are 3 huge gap/demand in traded BTC volume

- Gap 2,3 are to be filled but no one is going to get hurt

- if Gap 1 is going to be filled, there must be a big dump to reach the level.

2. Bulls that accumulates BTC after 2021.1.1 are at even at this point

3. Bulls that accumulate after 21.7.1 are in deficit

4. Bulls that accumulate from the capitulation are at even

*Please feel free to share your ideas on mine

I see vwap as the avg.price of a trader who start at a certain point of time then participate every transaction as a same portion of his/her fund to the volume traded.

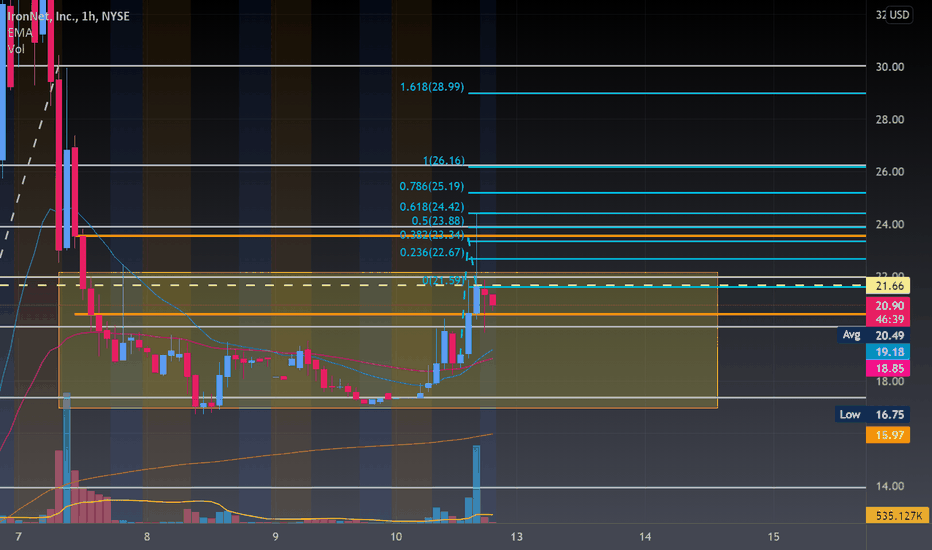

IRNT: RUG PULL OR SQUEEZEIRNT: depending on where IRNT goes in the pre-market can determine which price action

This bearish looking wedge we have formed is on top of a critical support zone.

~If 35 breaks, we can see a dip all the way to 22. Why?

~There is a gap to fill on the down. ranges 21.30-24.50. All previous gaps have fill on the down except this one.

~If IRNT does release a share offering like some are predicting it will, price will inevitably go down and could be another reason for the dip.

~If 44.50 is broken, we could see price action to 55 and maybe even 60

~Note that during hours there were no call contracts past 60 bucks (interesting though may not matter)

~WSB has had huge rallies saying this stock will squeeze like there is no tomorrow. Be ready to go up and up if another squeeze occurs and don't forget to take profit when you wanna screenshot.

DOWN DOWN DOWN (support zones):

~Note that these zone may provide resistance to a rug pull. The italicized zones will give the most fight.

~35 - 37

~30.90 - 32.55

~29.25 - 30.21

~27.20 - 28

Most Confusing Chart- Mixed Indicator Signals- Thoughts?The weekly Mac D & Stoch RSI lead me to think that there isn't much room for us to come back down further before a move upward. However, today's close (evening star candle), the Stoch RSI & Mac D on the 4hr, as well as the 100MA cross on the 4hr, all lead me to believe we are actually heading further down first. I tend to think the weekly indicators reign supreme over the daily, but I also know this chart & have gathered how every possible gap tends to be filled before the next move up, and we certainly are looking at a couple of gaps. Thoughts?

Note- My ultimate targets are the fibonacci extensions of the overall move, at appx $88 and $115, respectively.

AMAT: Trade the wedgeAMAT (swing): (In the process of filling the gap on the down)

~Watch the support zone 135.40-136.50 for a bounce to PT1: 138 / PT2: 140 / PT3: 144

~Monday may see a dip to 133-ish area, if support doesn't hold. I would buy calls at 133. (Price likely will recover 2 bucks after the pullback)

~We are still trading in a missive looking wedge and probably will be for at least another month. Take advantage of using the zone inside the wedge for the time being to make swings. (there is at least 10 bucks between the support and resistance line.)

Refilled... At The IronNetGap retested and filled. Now I know the chart is a little messy but if you look close and do some DD you'll totally get it lol. But if you were to ask me I'd say $24.50 isn't far from reality according to this beautiful collage! Good luck trading.

Like, Follow, Share!

Join the community of Risk Takers with me Riskitpaid!

$ANY MORE???$ANY fresh out of the cup and handle from last week. We gapped back down to the breakout point where we are battling a bit of resistance around $7.07-$7.47. When it breaks the resistance we should see it easily run back up and over the high. Next area of resistance would be around $8.67-$8.75. Remember invest wisely. Follow for more! THIS IS NOT FINANCIAL ADVICE!!!

FEDEX gap upFedex presents a GAP formed on 7/21/21.

The GAP would be filled at around $297.50 which presents a swing idea from the current sock price of 263.64.

Closest support is at 258.43 which if respected would be a good entry price for this play.

I am a beginning trader and I welcome all comments &/or suggestions. This is just my plan from what i've learned

JICPT| Tencent completed retest, ready to challenge gap! Hello everyone. It's a good day for tech bullish buyers, especially Tencent fans.

On the daily chart, I found the retest has been completed with a bullish leg-out candle formed today. Looking above, the next challenge is the gap from HKD513 to HKD528. Also, there is a downtrend line which may weigh on it.

Looking forward, the valuation is attractive and I'm bullish on the stock. Though, it could have a second fall to the level of HKD479 before coming back again.

What's your opinion? Give me a like if you're with me.

$WISH setting up for reversal $WISH PT 1: $9.33 PT 2: $11.64 PT 3: $15.00 NASDAQ:WISH

---> Closing in on gap fill $7.87 - $9.33

---> Testing 5-12 EMA cloud for trend reversal

---> Rounding bottom

---> macD cross August 30th

EASY GAP FILL ON $ZM!! Possible Gap Fill Monday

- Previous THU & FRI were both green days making its way into the gap

-We can see a red open if we do we shall look for a reversal

- If we open green right off the bat we know we are clear all the way until $322.84 first PT then second PT which is the top of the gap fill which is 339.37