It's about to GO DOWN... British Pound {FOREX Scenario}I am looking for shorts these week at/near the 1.306 price

Minimum of 5:1 Reward to Risk on this tentative setup.

Trading involves risk, allow price to come to an area you feel comfortable with if you plan to take any positions.

Let the institutions show you their true intentions and be patient!

Will be trading this pair this week as I am expecting volatility.

Gapfill

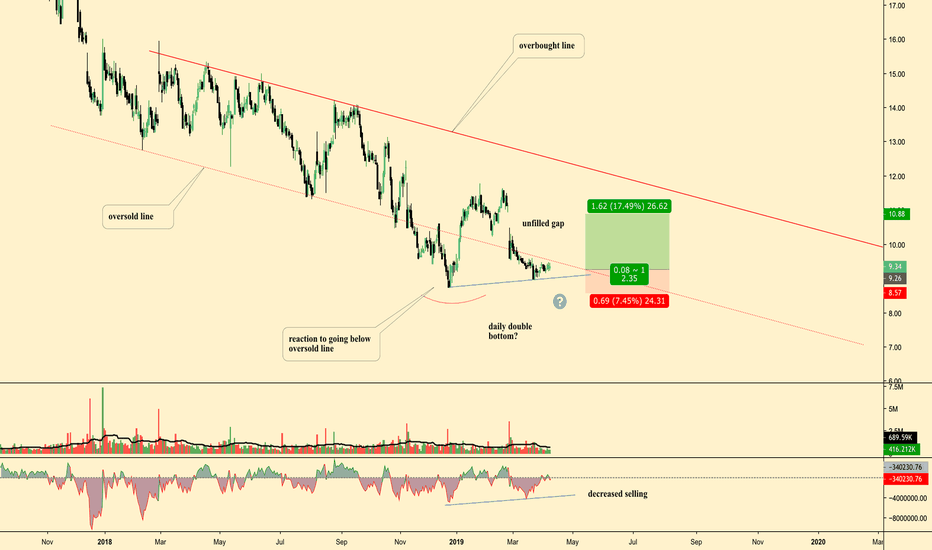

TIVO Long OppAnnotations and Ideas provided on chart

General Idea:

Possible Double Bottom, w/ second bottom forming higher low

decreased selling on second bottom

Price trading in oversold territory (below the channel)

Unfilled Gap that also coincides w/ local HVN (not marked)

NTAP: Filling gap, solid candlestick patterns ahead of earningsNTAP has moved into the gap area, and is now poised to challenge the next resistance level. This stock has had recent HFT activity and is likely to have more HFT attention on the day of its earnings release. The candlestick patterns are solid ahead of earnings. Watch for pro traders setting up for a pre-earnings run.

LYFT - $65 and the GAP Continuing with the IPO week for LYFT, here are a couple of new scenarios that may play out ...

Its my belief based on the chart / price action, that this recent LO will determine what happens at the GAP, should price reach it:

Either:

A. The current LO is in place, then a revisit to the GAP (and fill) may show as a pivotal resistance point, temporarily. And then make a valid attempt at the IPO day HI.

Or

B. A new LO ($65 or less) would have the GAP play out (if it tests it) as resistance, before seeing declines to prices of $60 and $50.

NVDA: Filled gap down, watch for pro trader pre-earnings runNVDA has filled the gap down from the negative earnings reaction in November 2018. The stock is likely to consolidate or shift sideways at this resistance level if it is to build energy to move higher. There is some Dark Pool accumulation in the bottoming pattern. HFTs have gapped this stock on earnings news in the past. Earnings will be reported May 9th. A month out is a good time to start watching for the pro trader patterns that lead to momentum in a pre-earnings run.

BTC Overview April 2019Looking at heavy resistance at the $6,000-$6500 range after the most recent run. Expecting a pull back to reset RSI levels before a continued rise. Not much resistance until around $6,000-$6,500 as BTC looks to gap fill the area marked. Gaps will always fill at some point in a healthy market, whether up or down. In this case BTC is Bullish and trying to fill a large gap back up to the 6k+ range. Playing this gap fill for the short term would be considered a lower risk trade. However, a full bull market could be a ways away and this move could be the formation of another equilibrium pattern (a lower high forms at or around 6k) that could send us sideways for a few months. Major resistance at the $4,200 level (before recent breakout) was broken and now has turned into a nice support level, making $4,200 a good place to accumulate around. Took around 6 tries to break $4,200, making it very strong Support now. Playing for short term gains here is the best option until we get to a full bull run. The potential to drop is always lurking, although I do not see us breaking down below $4,200 support again. If it does then look for the mother of all double bottoms at the $3,200 level and major reversal. Being patient and accumulating are the name of the game.

EURUSD Quick Short Trade *LEARN TO TRADE MARKET GAPS*I have recently had a lot of success trading the weekend market gaps forming on a few major FX currency pairs so I thought I would show you another example and explain it in more detail.

Market gaps most commonly occur when price moves quicker than the market or, in the case of weekends, when the market is closed. Things happen in the market over the weekend so when Sunday evening trading opens, price has normally moved or "gapped" away from the close price on Friday.

I don't trade every gap I see in the market and that is because of how the gap forms as part of the prevailing trend that is showing. I always try to trade with the trend and use market gaps as a discounted way of entering into a normal trend following trade.

This example is on EURUSD.

The market gaps upon opening and is now around 20 pips higher than the close price on Friday. This is good because the price has gapped up when I have the bearish trend marked on the chart with the lower highs and bearish TL. A gap up means I can enter short and be onside with the current bearish trend. This seriously helps with profitability and success in the long term.

My confluences for taking this trade are:

- RSI showing over bought.

- Price is around daily pivot level.

- Bearish trendline

- Lower highs and lows.

I always place my Stoploss 10 pips above the current high when taking my pivot trades and I have used this same method for these quick gap trades.

Profit Targets:

My TP1 is always set to the Friday close price. This means the gap has been fulfilled.

TP2 is set at the daily S1 level. This is taken from my day trading strategy because if there is a lot of momentum then it makes sense to ride it out for more profit.

TP3 is set at the daily S2 level if there is still enough bearish momentum to make it there.

R:R Ratios:

- If price makes it to TP1 then that is a very simple 2:1 trade.

- TP2 would make the trade a 4:1 trade.

- TP3 would make this trade over 6:1 R:R which is crazy but sometimes possible if there enough momentum in the markets.

Thanks for reading and I hope this helps at least a few of you to start spotting and trading market gaps. They really are very good to help you get a head start on the week ahead and lock in a few % profit before Monday has even began!

AUD/USD Weekly Outlook and IdeasPretty sizable gap away from the base of a triple bottom (yellow rectangle)...how to interpret this??

Someone or something with deep pockets is eyeing the .707 area, perhaps a barrier option slightly below at the .706 demand level?

Either way let's map out the possibilities...

If this gap closes down, I think it could spell trouble for buyers who bought heavily @ .707..how many more touches can this level take before capitulation?

Now the .706 level is not a significant level @ this point, its well within the ATR range of the yellow rectangle. Meaning if we do close the gap, the possibility this drops further increases.

If the current gap level holds and we see upside, the .714 area is the one to watch for resistance. Any move above that, and we may have an uptrend.

RBA rate decision on Monday is going to be the key driver for direction this week, so hold on!

This could be a BIG MOVE!NASDAQ:YNDX has a big gap to fill above. Definitely keep this one on your watchlist.