NATGAS Resistance Ahead! Sell!

Hello,Traders!

NATGAS is growing sharply

But the price is nearing a

Strong horizontal resistance

Around 3.80$ so after the

Retest on Monday we will be

Expecting a local bearish

Correction as Gas is already

Locally overbought

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GAS

Potential Decline of Natural Gas Prices to $2.43–$2.74Brief Overview of Events and News Explaining the Potential Decline of Natural Gas Prices to $2.43–$2.74.

➖ Weather Forecast and Reduced Demand

On April 23, 2025, the U.S. National Weather Service forecasted milder-than-average weather across the U.S. for late spring and early summer 2025, particularly in key gas-consuming regions like the Northeast and Midwest.

Warmer weather reduces the demand for heating, a primary driver of natural gas consumption. This led to a 2.5% decline in Henry Hub natural gas futures, settling at $3.05 per MMBtu on April 24, 2025.

Source: Reuters

➖ High U.S. Natural Gas Inventories

The U.S. Energy Information Administration (EIA) reported on April 17, 2025, that natural gas inventories increased by 75 billion cubic feet (Bcf) for the week ending April 11, 2025, significantly exceeding the five-year average build of 50 Bcf. Total U.S. inventories are now 20% above the five-year average, indicating an oversupply that pressures prices downward.

Source: EIA, "Weekly Natural Gas Storage Report," April 17, 2025

➖ Weak Global LNG Demand

On April 22, 2025, Bloomberg reported a decline in demand for liquefied natural gas (LNG) in Asia, particularly in China, due to an economic slowdown and a shift to cheaper coal alternatives. China’s LNG imports in Q1 2025 dropped 10% year-over-year, reducing export opportunities for U.S. gas producers and adding pressure on domestic prices.

Source: Bloomberg, "China’s LNG Imports Fall as Coal Use Rises," April 22, 2025

Technical Analysis

Natural gas futures (NYMEX) are currently around $3.15 per MMBtu as of April 28, 2025, following a recent decline from a peak of approximately $4.90 in 2025.

Fibonacci retracement levels indicate correction targets at 38.2% ($2.74) and 50% ($2.43).

Fundamental factors, such as oversupply and reduced demand, support a bearish scenario that could drive prices to these levels in the near term.

Nearest Entry Point Target:

• $2.74

Growth Potential:

Long-term:

• $10

Screenshot:

Very likely x's on alpacaAlong with the pda and vin, alpaca may show good growth in the upcoming bullish cycle. This month, the token was not included in the delisting announcement, and an active set of positions began because it is in an extremely oversold position. Previously, many signals were left with attempts to return to 0.15, and this month there is a possibility of working out this goal under an optimistic scenario. At the moment, the main goal is an attempt to consolidate above 0.075, from where an increase in volatility is likely. When a new week or the second half of the month opens above the level, the reaction will not take long. I would like to draw your attention to the fact that, unlike vib and pda, this token has already changed the trend on the daily chart, which can lead to fairly stable growth.

NeoGas: The Altcoins Market Bull Market Is Here Pt.2The dynamics here are the same as with STRAXUSDT. A very strong bullish bias is developing. NeoGas is growing and has grown by 142% since 7-April. The bottom is in, this means that only higher prices are possible now and long-term. This is the meaning of the bottom, it cannot go any lower.

The pattern that came up as the bottom is the classic rounded bottom, it is very easy to spot on the chart. After the bottom was established, the action quickly followed to move above long-term support, which is above the July and August 2024 lows.

Trading volume is high. Signals are bullish all across. This is only the start.

The bottom is set and a bullish breakout takes place. This bullish breakout leads to the development of an uptrend. This uptrend can least 3 months just as it can last 6 months, 12 months, 18 months or more. It can for years for all we know.

Once the bottom is in... Leave a comment and follow.

The only place left to go now is up!

» The Altcoins market Bull Market is here, it is still early though. These pairs have the potential to grow by 1,000% or more.

Namaste.

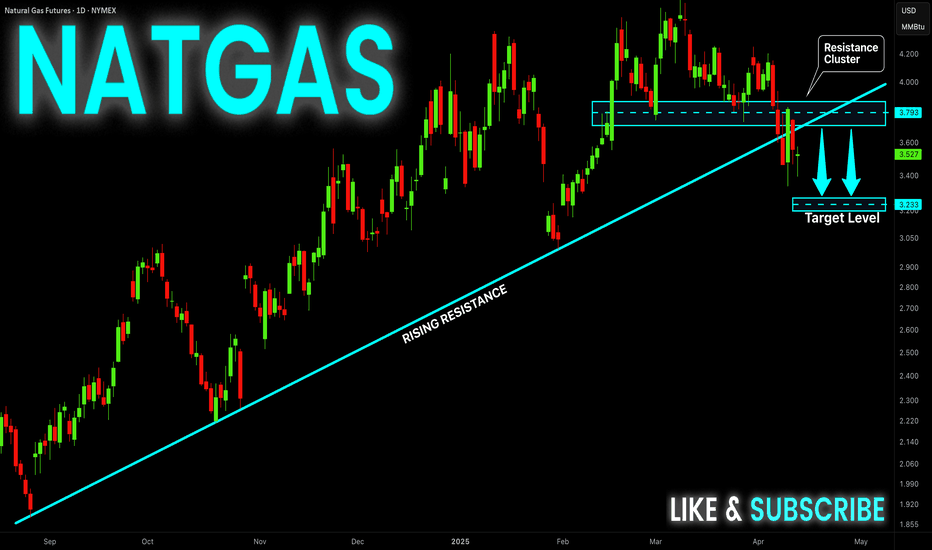

NATGAS Resistance Cluster Above! Sell!

Hello,Traders!

NATGAS made a bearish

Breakout of the support

Cluster of the rising and

Horizontal support levels

Which is now a resistance

Cluster round 3.717$ then

Went down and made a local

Pullback on Thursday and

Friday but we are bearish

Biased mid-term so we

Will be expecting a further

Bearish move down this week

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATGAS Local Bearish Pullback Expected! Sell!

Hello,Traders!

NATGAS is about to hit

A strong horizontal resistance

Level of 3.880$ after a sharp

Push upwards by the bulls

So a local correction is needed

From the resistance with the

Expected target being the

Local level below at 3.655$

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATGAS Bearish Breakout! Sell!

Hello,Traders!

NATGAS made a bearish

Breakout of the key horizontal

Resistance of 3.626$ and the

Breakout is confirmed so we

Are bearish biased and we will

Be expecting a further

Bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATGAS BEARISH BREAKOUT|SHORT|

✅NATGAS formed a head

And shoulders pattern then

Made a bearish breakout of

The neckline which is now

A resistance of 3.850$

And the breakout is confirmed

So we are bearish biased and

We will be expecting a

Further bearish move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

TLT - Monthly Targets (Long Term)Markets are currently tight squeezing due to Trumps terrifs etc, something has to give in, based on this chart:

- TLT has found a bid at .963 Fibonacci level @ $82.42 (EXTREME RETRACE)

- Dec 2, 2024 = the 369 ratio in time for $82.42 (time & price 📐)

NEXT TARGET PROJECTION IS 50% OF THE MAX TARGET ANGLE = ($121)

(BETWEEN 2025 - 2029)

MAX TARGET = $183 - $212

(BETWEEN 2025 - 2034)

NATGAS SUPPORT AHEAD|LONG|

✅NATGAS will soon retest a key support level of 3.728$

So I think that the pair will make a rebound

And go up to retest the supply level above at 3.887

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NATGAS Free Signal! Buy!

Hello,Traders!

NATGAS went down again

But will soon hit a horizontal

Support level around 3.784$

So after the retest we can go

Long on Gas with the Take

Profit of 3.907$ and the

Stop Loss of 3.725$

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Agape ATP's $24 Billion Breakthrough! In a market landscape clouded by macroeconomic uncertainty and weakening sentiment, Agape ATP Corporation (NASDAQ: ATPC) has emerged as a countercyclical outlier with its recent announcement of two landmark Sales and Purchase Agreements (SPAs) worth approximately USD 24 billion. Signed with Swiss One Oil & Gas AG, these agreements mark a bold step forward for ATPC, setting the stage for an ambitious entry into the refined fuels distribution market on a global scale.

The SPAs follow a successful Initial Corporate Purchase Order (ICPO) completed in February 2025, which served as a proving ground for initial trial shipments. Under the terms of the agreements, ATPC will initially supply 200,000 metric tonnes of EN590 10PPM diesel and 2 million barrels of Jet Fuel A1 in March 2025. Following successful execution of this validation phase, the contracts are structured to scale rapidly to weekly deliveries of 500,000 metric tonnes of diesel and 2 million barrels of Jet Fuel A1 — an exponential increase that underscores the strategic ambition of both parties.

All deliveries will be conducted using Free on Board (FOB) procedures at major international ports, with product quality certified by SGS or equivalent agencies in accordance with ASTM/IP standards. This not only enhances transparency and credibility but also signals ATPC's commitment to international compliance and operational rigour.

What makes this deal truly transformative is the sheer scale of the undertaking. If executed to full potential, weekly deliveries of 2 million barrels of jet fuel would translate into an annual supply of roughly 104 million barrels — equivalent to around 2% of total annual U.S. jet fuel consumption. Such volume would position ATPC as a serious contender within the global energy trade ecosystem, shifting its profile from a relatively obscure player to a recognisable force in refined fuel logistics and supply.

The structural staging of the agreement — trial, validation, then full-scale execution — reveals a commercially astute strategy. It reduces upfront risk and capital exposure while providing room for operational ramp-up and systems optimisation. However, the magnitude of the weekly delivery requirements suggests that ATPC must urgently enhance its logistical capabilities, secure dependable supply sources, and establish robust quality assurance and compliance frameworks.

From a financial standpoint, the implications are staggering. The USD 24 billion value of the agreements stands in stark contrast to ATPC's current market capitalisation of just USD 5.17 million — a disconnect representing a multiple of over 4,600 times. While such disparity is not uncommon in early-stage high-growth stories, it highlights the importance of scrutinising the company’s readiness to scale operationally and financially.

Under FOB terms, ATPC will bear the cost of acquiring and transporting the fuel to the port of loading, thereby requiring significant working capital. Timely financing and cash flow management will be paramount, especially as delivery volume scales. Questions surrounding margin structure, procurement reliability, and commodity price hedging strategies will need to be addressed to fully appreciate the risk-return profile of this venture.

Yet, amid broader market softness and investor caution, ATPC’s bold strategic execution stands out. If the company successfully navigates the complex logistics, financial demands, and operational scale-up, this agreement has the potential to redefine its financial trajectory and long-term shareholder value.

In an era where execution is everything, Agape ATP’s audacious move could very well prove prescient. Investors will be watching closely — not just for signs of progress, but for proof of delivery.

Article inspired by Stock Titan.

NATGAS Growth Ahead! Buy!

Hello,Traders!

NATGAS made a retest

Of the horizontal support

Level of 3.720$ and we are

Seeing a nice strong bullish

Rebound so we are bullish

Biased and we will be

Expecting a further bullish

Move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Natural Gas still coiling! breakdown or breakout?Hello Traders

In This Chart NATGAS HOURLY Forex Forecast By FOREX PLANET

today NATGAS analysis 👆

🟢This Chart includes_ (NATGAS market update)

🟢What is The Next Opportunity on NATGAS Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

OXY: Bullish Breakout PotentialA break above the 50.80 level could confirm the stock is ready to clear its descending channel and shift momentum in favor of the bulls. This price has acted as a pivotal zone in recent sessions, and a decisive close above it would suggest the downtrend may be reversing. A surge in volume above 50.80 would further strengthen the long setup, potentially targeting the high 50s or low 60s if buyers follow through. The RSI on this 2W chart is hovering near the middle (accumulation) range. It’s neither showing an extreme overbought nor deeply oversold condition. That gives price room to run in either direction.

Disclaimer:

This analysis is for educational purposes only and should not be considered financial advice. Trading and investing involve risk, and independent research or consultation with a professional is recommended before making any financial decisions.

Short Term Pain for Long Term GainAfter an amazing and wild week last week, I believe tomorrow will be the start of an even crazier one. Trump Tariffs, Oil and Gas up along with the US Dollar, while tech is on the verge of another break down. Will Bitcoin finally break below 89k, while Gold and Silver possibly break to the upside? Exciting times if you're ready for it.

Will Oil jump against Trump's requests?On a technical perspective, Oil could reverse from the current price and start to climb again targeting buyside, as we have seen a divergence between Brent and WTI. However, it looks like Brent is weaker and might not be able to validate higher prices.

Next week's OPEC meeting could clarify the direction, as I do not believe they will succumb to President Trump's requests of lowering Oil prices massively, and we could be looking for a volatile month.

NATGAS Swing Long! Buy!

Hello,Traders!

NATGAS has lost almost

30% from the local highs

In no time so It is oversold

And as the Gas is about to

Retest the horizontal support

Of 2.948$ we will be expecting

A local bullish rebound

And a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!