Gasoline Down + Oil Extends Losses in Asia With Crude DownHeadlines:

• Crude Extends its Losses in Asia With NYMEX Crude Down -3.16% + RBOB Gasoline Down -3.29%

• UN Secretary General Calls for Immediate Ceasefire After 33 Turkish Soldiers Killed in Idlib

• Asian Equities Feel Full Force of Sell Pressure with Nikkei225 Down -4.60%

Gasoline

Crude Shrugs off Larger than Expected Build with Futures up +3%Headlines:

- Oil Futures shrugged off larger than expected EIA Build up +3%

- OPEC expects global demand to drop after release of monthly report showing revision down

- Gasoline & Heating Oil both push higher breaking away from weeks lows

Gasoline Futures Finish The Week FlatGasoline prices finished relatively flat after recovering mid-week from falls of around -4% to finishing the week at 1.5041. Data released by EIA did show slightly better than expected build data lower than analyst expectations. This did have a slight impact on pricing which did assist in this pullback we did see. Saying this though, this is the 12 weeks straight of build data which has been released to markets. Build data has increased from the beginning of the November market of last year.

Gasoline Long small position 1/2 sizestop @ 1.5850 target 1.8120 the reason I say small position is because its a cheap asset making any size move larger in percentage. should the trade move against us I will be taking 3 other positions small as well.

2nd 1.67, 3rd 1.66, 4th @ 1.6480

Another reason why I love this position is because the roll over on the buy side pays 26% interest annualy so holding it is worth while.

RBOB Gasoline Futures (Jan 2020) - Rectangle in formationNYMEX:RBF2020

Clear rectangle on the January Futures of the RBOB Gasoline.

A breakout could lead to an interesting trend to ride.

When trading commodities and futures contracts you should always take into account the specifications of each contract to calculate exactly how many contracts to buy or sell short on the basis of your risk management and position sizing.

www.cmegroup.com

Gasoline: Repeating a 1980s pattern. Major bullish break ahead.We have discovered a 1980s pattern on Gasoline (RB) that is strikingly simalar the recent candle action on 1W. We are rather puzzled though as to which point of the 1980s sequence we are currently at.

In 1980s the Golden Cross (MA50 over MA200) emerged after a Double Bottom. Currently we are past that Golden Cross and the price is approaching the last low on a sequence bearing many similar characteristics with the old pattern. This leads us to believe that the Golden Cross is irrelevant on this pattern and that the price mostly follows the trend of the 1W MA50 into similar benchmarks of the 1980 pattern.

For that reason it may be viable to start taking long positions with a projected Target Zone of 2.5000 - 2.8000.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Gasoline (RB1!): Bullish reversal.Gasoline made two important break outs this week: 1) above the 1D Lower High trend line and 2) the 1.7659 4H Resistance. Trading now on standard bullish set up (RSI = 62.821, MACD = 0.013, Highs/Lows = 0.0339), a Channel Up may emerge if the 1.7868 Resistance is rejected. If broken then the uptrend will most likely continue until it reaches the MA200. It will be extremely positive if the MA50 turns into a support now. The long term TP is 1.9000.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

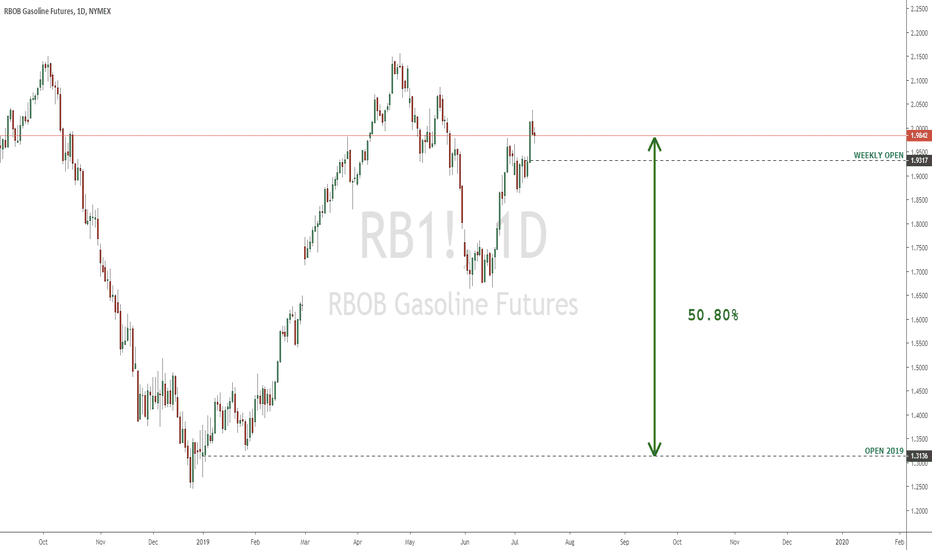

UGA - Adding More Fuel to the FireAs the financial community focuses on the rally in oil, one by-product that has not received much attention but has performed just as well, is gasoline (UGA as a proxy).

Since January 2019, the price of West Texas Intermediate crude oil prices have rallied 37% so far this year to $63 a barrel, with gasoline prices not too far behind, rallying over 29.79% year-to-date.

One reason for this rise in gasoline prices, has been the fact that global demand for crude and crude oil products has been much stronger than expected. Growth projections indicated sluggish demand for fossil fuels in 2019, but instead the global appetite for fossil fuel products has been very strong for the year, especially in emerging markets.

On the supply side, OPEC and its allies have cut oil production output, at the same time US sanctions have been holding back Iranian and Venezuelan oil exports into the international markets.

Lastly, against this global economic backdrop, as drivers are starting to get ready for the seasonal summer driving season, their need for gasoline will be provide a nice support for the commodity, and will only drive the price higher.

Going forward, we believe that this current environment will provide further room for gasoline to move higher until the end of the summer.

We recommend a tactical long position on gasoline (UGA) until then, to profit from this seasonal trend.

Gasoline: How high can it get?This is a long term analysis on Gasoline on the 1W chart. We are trying to determine where this aggressive buying sequence that started at the end of December will stop.

The previous similar sequence stopped just below the 0.618 Fibonacci retracement level. Then it bottomed just under the 0.500 level and consolidated before it resumed the uptrend.

We expect a similar pattern this time as well. The current 0.618 Fibonacci level is at 1.8883, so expect a top around 1.8600. Similarly the 0.500 level is at 1.5543, so this is a projected pull back mark.

This analysis is best suited for long term traders and investors who are looking for a safe and high R/R position for the next bull run.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Hording NEOGAS, speculative asset with towering reward:riskJust a follow up on one of my favorite assets NEOGAS. If you are intrigued by the argument below give us a like/follow!

(CREDIT to Darky999)

A few of us in this sub have been discussing / arguing / debating about the NEO vs GAS price.

It's been a great set of discussions, and I've been deliberately antagonistic to others in order to really get a passionate debate flowing. And we certainly did that! It meant I was able to hear so many different opinions, and also to test ideas and theories.

This culminated in me building a fairly large Excel model to tackle this question I reproduced the 'schedule' of NEO generating GAS - it matches the White Paper's exactly, and I modeled all sorts of scenarios over the next 20-30 years (see below for why).

EDIT: HERE IS LINK TO GOOGLE -0.20% SPREADSHEET: docs.google.com

I want to share some insights from that exercise, as the model itself is not the point here, it's what you learn from building it, and the dependencies that you observe that you simply cannot observe by just using words alone. You really cannot just say things and begin to understand the subtleties of the NEO/GAS dynamics, believe me, it's much more nuanced that you think.

There is no way to model the NEO vs GAS price - lets just be clear on this, right now 99.9% of it is simply speculation. Just like ETH is speculation, hey Crypto is ALL speculation right now.

However, if GAS is worth significantly less than NEO then NEO starts to be worth less and less itself, simply because it generates GAS - and it has actual value due to this GAS.

-------------------------------------------------------------------------

The thread goes on. I recommend you have a read.

More info here

RISING CHANNEL IN GASOLINE (TRAILS CRUDE OIL)No long explanation here, a rising channel in gasoline which will break to the downside so we are not yet cleared for bull trend just yet, same goes for crude oil as gasoline market trails crude, though sometimes ahead of crude in movement.

HELPFUL VIDEOS TO TEACH YOU:

www.youtube.com

www.youtube.com

DISCLAIMER;

Do set stop losses when trading but be generous with how much room you allow for this due to candle wicks and there is also the possibility to hedge yourself, for more confident traders.

All comments and questions welcome, if curious about indicators I use then feel free to inquire. IF YOU SUPPORT MY IDEAS, LIKE, FOLLOW & SHARE. ~ THANKS! ~