Potential bullish rise?GBP/JPY has reacted off the pivot and could rise to the 145% Fibonacci resistance.

Pivot: 194.43

1st Support: 193.80

1st Resistance: 195.61

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Gbp-jpy

GBPJPY LONG FORECAST Q2 W23 D3 Y25GBPJPY LONG FORECAST Q2 W23 D3 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Daily order block

✅15' order block

✅Intraday breaks of structure

✅4H 50 EMA rejection

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPJPY Weekly overview Jun 1, 2025 – Jun 7, 2025BOJ Gov Ueda Speaks could make market move faster in its direction. avoid trading around his speech.

*******************************************************************

The indicated levels are determined based on the most reaction points and the assumption of approximately equal distance between the zones.

Some of these points can also be confirmed by the mathematical intervals of Murray.

You can enter with/without confirmation. IF you want to take confirmation you can use LTF analysis, Spike move confirmation, Trend Strength confirmation and ETC.

SL could be placed below the zone or regarding the LTF swings.

TP is the next zone or the nearest moving S&R, which are median and borders of the drawn channels.

*******************************************************************

Role of different zones:

GREEN: Just long trades allowed on them.

RED: Just Short trades allowed on them.

BLUE: both long and short trades allowed on them.

WHITE: No trades allowed on them! just use them as TP points

GBPJPY - Bearish Control, Again!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📉As per our last GBPJPY analysis (attached on the chart), it rejected the upper red trendline and traded lower.

What's next?

GBPJPY is currently retesting the upper bound of the falling red channel again.

Moreover, the green zone is a strong structure and resistance.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of structure and upper red trendline acting as a non-horizontal resistance.

📚 As per my trading style:

As #GBPJPY is around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

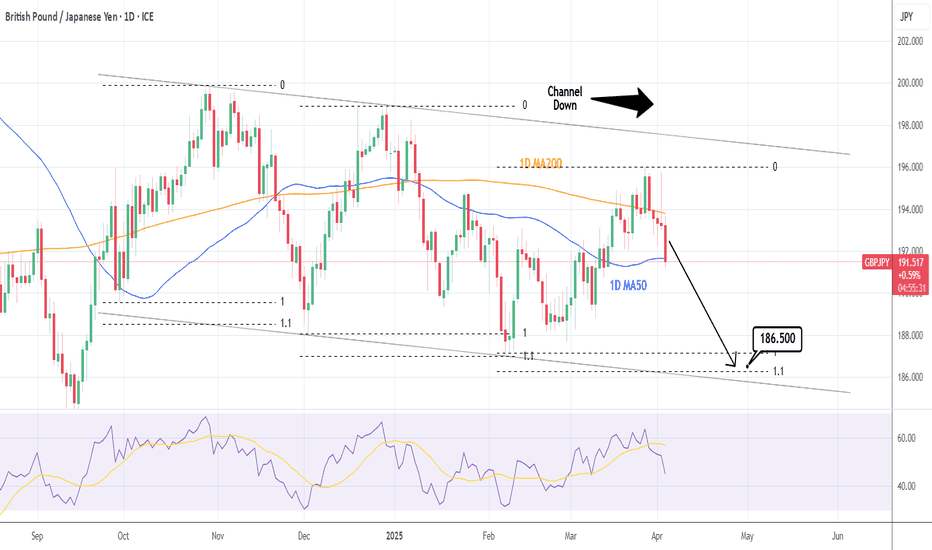

GBPJPY Channel Down making a Lower High rejectionThe GBPJPY pair rose aggressively since the last time we gave our buy signal (April 11, see chart below), quickly hitting our conservative 109.250 Target:

The price has since made a Lower High rejection at the top of the Channel Down but remains supported by the 1D MA50 (blue trend-line). Once broken and it closes a 1D candle below it, we will have bearish break-out signal. Our Targe will be 185.250, which will be the standard -5.85% decline that all 3 previous Bearish Legs had within the Channel Down.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bearish drop off pullback resistance?GBP/JPY is rising towards the pivot and could drop to the 1st support, which is a pullback support.

Pivot: 193.76

1st Support: 191.56

1st Resistance: 194.80

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

GBP/JPY Holds Key Support as Bullish Momentum BuildsA bullish setup has emerged on GBP/JPY, with recent price action suggesting bullish momentum is building. With GBP strengthening against USD, GBP/JPY may present a higher-probability bullish scenario compared to USD/JPY in the near term (though this also looks bullish to my eyes over the near term).

GBP/JPY held above key moving averages midweek. GBP/JPY failed to close below its 200-day SMA on both Wednesday and Thursday, while yesterday’s session also respected support at the 50-day EMA and the 192.00 handle.

Momentum indicators support the bullish case, with the daily RSI trading above 50 after rebounding from its most oversold level in six weeks.

As long as prices hold above Thursday’s low, bulls may look for a retest of the cycle highs near 196.00.

** Please note that Japan's CPI data drops in >30 minutes **

Matt Simpson, Market Analyst at City Index and Forex.com

Falling towards 38.2% Fibonacci support?GBP/JPY is falling towards the pivot and could bounce to the 1st, pullback resistance.

Pivot: 191.56

1st Support: 190.35

1st Resistance: 193.65

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

GBPJPY - Bullish No More!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈As per our last GBPJPY analysis (attached on the chart), it rejected the lower bound of the rising blue channel.

What's next?

GBPJPY is currently approaching the upper bound of its falling trend marked in red.

Moreover, the green zone is a strong structure and resistance.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of structure and upper red trendline acting as a non-horizontal resistance.

📚 As per my trading style:

As #GBPJPY approaches the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPJPY: Entering the most optimal medium-term Sell Zone.The GBPJPY pair is bullish on its 1D technical outlook (RSI = 59.237, MACD = 0.300, ADX = 16.909) as it is expanding the bullish wave of the 6 month Channel Down. The two prior peaked on the 0.786 and 0.9 Fibonacci retracement level respectively. This bullish wave has already reached the 0.786 Fib, so it has entered the most optimal Sell Zone for the medium term. Even if it peaks on the 0.9 Fib, a -5.90% bearish wave (similar with the 3 prior) would test 183.500.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GBPJPY - Crazy Bullish!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPJPY has been overall bullish trading within the rising channel marked in blue.

Moreover, it is retesting a strong demand zone marked in green.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of demand and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #GBPJPY approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP/JPY Bullish Flag (29.04.2025)The GBP/JPY pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 192.18

2nd Resistance – 192.70

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Bearish drop off pullback resistance?GBP/JPY has reacted off the pivot and could drop to the 38.2% Fibonacci support.

Pivot: 191.76

1st Support: 189.40

1st Resistance: 193.84

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Heading into pullback resistance?GBP/JPY is rising towards the resistance level which is a pullback resistance that lines up with the 71% Fibonacci retracement and the 161.8% Fibonacci extension and could reverse from this level to our take profit.

Entry: 192.34

Why we like it:

There is a pullback resistance that lines up with the 161.8% Fibonacci extension and the 71% Fibonacci retracement.

Stop loss: 194.82

Why we like it:

There is a pullback resistance.

Take profit: 189.96

Why we like it:

There is a pullback support level that aligns with the 38.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GBPJPY Potential DownsidesHey Traders, in today's trading session we are monitoring GBPJPY for a selling opportunity around 189.100 zone, GBPJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 189.100 support and resistance area.

Trade safe, Joe.

GBPJPY Potential DownsidesHey Traders, in today's trading session we are monitoring GBPJPY for a selling opportunity around 189.600 zone, GBPJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 189.600 support and resistance area.

Trade safe, Joe.

GBPJPY Channel Down bottom reached. Rebound expected.Last time we looked into the GBPJPY pair (March 20, see chart below) we had a sell signal which dully delivered our 188.550 Target:

This time we have the price at the bottom (Lower Lows trend-line) of the extended Channel Down, with the 1D RSI almost reaching the 30.00 oversold limit. All such bottoms were followed by a rebound that hit at least the 1D MA50 (blue trend-line) before a new Channel Down Lower Low.

As a result, we are going for a short-term buy here, targeting a potential contact with the 1D MA50 at 190.250.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bullish bounce off 61.8% Fibonacci retracement?GBP/JPY has bounced off the support level which is a pullback support that aligns with the 61.8% Fibonacci retracement and could rise from this level to our take profit.

Entry: 186.61

Why we like it:

There is a pullback support level that lines up with the 61.8% Fibonacci retracement.

Stop loss: 184.39

Why we like it:

There is a pullback support level.

Take profit: 189.96

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GBPJPY: Channel Down started its new bearish wave.GBJPY is neutral on its 1D technical outlook (RSI = 45.648, MACD = 0.440, ADX = 26.099) as the price is testing the 1D MA50 again, being already on a 4 red day streak. The recent March 28th high almost touched the top of the 6 month Channel Down, so it can be technically considered a LH. Since the 1D RSI already crossed under its MA, we have a validated sell signal. Both prior bearish waves reached the 1.1 Fibonacci extension. Aim just over it (TP = 186.500).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GBP/JPY SELL SETUP 250 PIPS1️⃣ Macro Fundamental Analysis (GBP vs. JPY)

🔹 Interest Rate Differentials (Carry Trade Impact)

Bank of England (GBP)

The BoE has kept rates high to fight inflation.

Higher GBP rates → capital inflows into GBP assets.

Bullish for GBP/JPY.

Bank of Japan (JPY)

BoJ is still ultra-dovish, keeping negative/low interest rates.

Japan’s government wants a weak yen to support exports.

Bearish for JPY, Bullish for GBP/JPY (carry trade flows into GBP).

📊 Institutional View:

Hedge funds & large investors prefer long GBP/JPY due to high interest rate spreads.

GBP/JPY remains fundamentally bullish due to carry trade inflows.

🔹 Global Risk Sentiment (Risk-On vs. Risk-Off)

GBP/JPY is a "risk-on" pair → it rises when markets are bullish and falls when investors seek safety.

If stock markets are bullish, GBP/JPY tends to rise.

If there’s a global crisis, investors move into JPY (safe-haven), causing GBP/JPY to fall.

Current Market Sentiment:

Stock markets are uncertain, but no full risk-off move yet.

Watch equity markets & US bond yields for risk sentiment confirmation.

📊 Institutional View:

Mild risk-on bias → GBP/JPY has support, but volatility remains high.

🔹 Institutional Positioning (COT Data & Hedge Fund Flows)

Hedge funds have been buying GBP against JPY due to the rate differential.

Commitment of Traders (COT) Report:

Shows institutional investors are still net long GBP/JPY but reducing positions.

Some profit-taking could lead to short-term downside.

📊 Institutional View:

Long-term institutional bias is bullish, but hedge funds may reduce positions if risk-off sentiment increases.

2️⃣ Technical Analysis (ITPM Style) – Multi-Timeframe Breakdown

🔹 GBP/JPY (Daily Timeframe)

📈 Trend: Still in an uptrend, but approaching resistance.

📌 Key Resistance: 195.00 - 196.00

📌 Key Support: 191.00 - 190.00

🔹 Price is struggling at resistance near 194.00.

🔹 Possible pullback to 191.50 - 192.00 before resuming higher.

🔹 GBP/JPY (H4 Timeframe)

📉 Short-Term Weakness, but Still in an Uptrend Channel

📌 Key Level to Watch: 192.50 - 193.00

🔹 Bearish Rejection at 194.00, but still inside an uptrend structure.

🔹 If price breaks below 192.50, a deeper correction to 191.00 is likely.

🔹 GBP/JPY (H1 Timeframe)

📉 Intraday Weakness, Watch 192.50 for Breakdown

📌 Key Levels:

Resistance: 193.50 - 194.00

Support: 192.50 (short-term support), 191.50 (stronger support)

📊 Institutional View:

Intraday traders may take short positions below 192.50, targeting 191.50 - 191.00.

3️⃣ Institutional Trade Setup (ITPM Style)

🔴 Bearish Scenario (Short-Term Correction)

Entry: Sell below 192.50 (Break of key support).

Target: 191.50 → 190.00 (support zone).

Stop-Loss: Above 193.50.

Rationale: Short-term hedge funds taking profits → minor pullback in bullish trend.