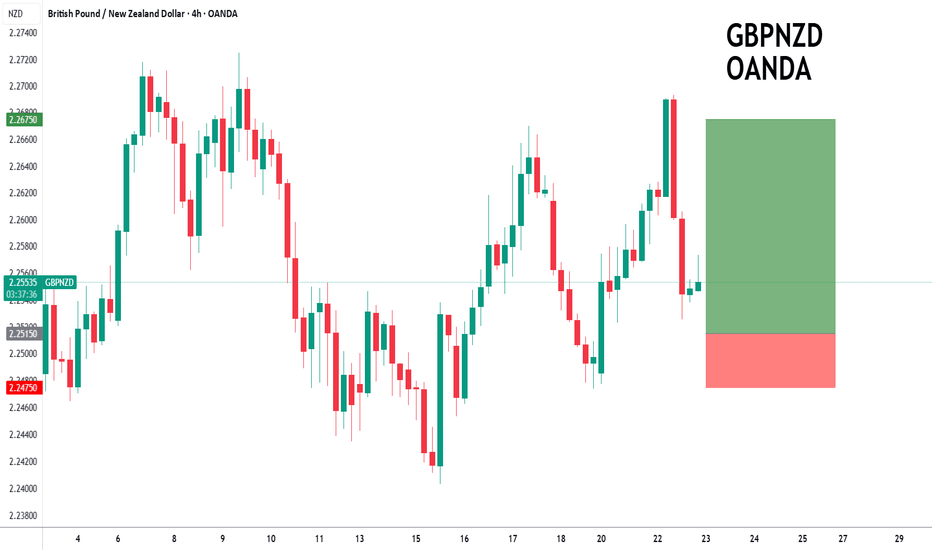

GBPNZD to form a higher low?GBPNZD - 24H expiry

The medium term bias remains bullish.

Price action looks to be forming a bottom.

Preferred trade is to buy on dips.

Bespoke support is located at 2.2515.

Risk/Reward would be poor to call a buy from current levels.

We look to Buy at 2.2515 (stop at 2.2475)

Our profit targets will be 2.2675 and 2.2710

Resistance: 2.2660 / 2.2720 / 2.2770

Support: 2.2510 / 2.2420 / 2.2375

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Gbp-nzd

GBPNZD to find buyers at current market price?GBPNZD - 24h expiry

The medium term bias remains bullish.

We look for a temporary move lower. Preferred trade is to buy on dips.

Bespoke support is located at 2.2485.

Risk/Reward is ample to buy at market.

We look to Buy at 2.2485 (stop at 2.2430)

Our profit targets will be 2.2705 and 2.2730

Resistance: 2.2650 / 2.2740 / 2.2790

Support: 2.2500 / 2.2450 / 2.2410

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

GBPNZD | Potential Buy opportunityHey Traders!

We’re taking a shot on GBPNZD — it looks like a solid setup for a move to the upside. Price is currently sitting right on the 4H 50MA, and the 1H 200MA is also aligned at the exact same level, giving this zone even more weight. Our stop loss is tight, risking just a 1:1 minimum, so the downside is limited. On top of that, the Fib is drawn from top to bottom and the 0.5 level lines up perfectly with this area, which adds another layer of confidence. If this zone holds, there’s a good chance we’ll see price continue pushing up.

GBP/NZD - Triangle Breakout (05.06.2025)The GBP/NZD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 2.2345

2nd Support – 2.2285

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Potentially bullish rise?GBP/NZD has reacted off the support level which is a pullback support and could rise from this level to our take profit.

Entry: 2.2393

Why we like it:

There is a pullback support level.

Stop loss: 2.2190

Why we like it:

There is a pullback support level.

Take profit: 2.2722

Why we like it:

There is a pullback resistance level that aligns with the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GBPNZD Sell Limit: Shorting from Key Resistance at 2.2590📉 GBPNZD: Sell Limit Trade Idea (Intraday)

Published: 27/03/2025 16:06 | Expires: 28/03/2025 15:00

Overview

Trading Bias: Mixed and volatile, with a preference to sell into rallies.

Market Context: GBPNZD has been showing short-term volatility, with the RSI trending higher, indicating potential for a temporary move upward before resuming the downtrend.

Trade Details

Entry (Sell Limit): 2.2590

Stop Loss: 2.2650 (-60 pips)

Take Profit: 2.2350 (+240 pips)

Risk/Reward Ratio: 4:1

Key Levels

Resistance Levels:

R1: 2.2590 (Bespoke resistance, preferred entry point)

R2: 2.2620

R3: 2.2680

Support Levels:

S1: 2.2450

S2: 2.2400

S3: 2.2330

Rationale

Preferred Setup: We expect a temporary rally into resistance at 2.2590, providing a favorable entry point to initiate short positions.

Momentum: While RSI indicates higher momentum in the short term, this aligns with a corrective rally rather than a sustained bullish move.

Volatility Risks: Key UK economic events (retail sales figures and national accounts) on 28/03/2025 at 07:00 GMT could trigger significant price swings. Traders should closely monitor these data points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP/NZD Rounded Top (06.03.25)The GBP/NZD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Rounded Top Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 2.2362

2nd Support – 2.2266

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

GBPNZD Ascending TrapPrice is currently trading along an ascending trendline, making higher lows in the process. This suggests short-term bullish momentum. However, the overall structure resembles a consolidation or a potential “rising wedge” setup.

The market is hovering just above the trendline, and sellers seem to be testing buyers’ resolve at this level.

The candlesticks near the trendline show some indecision (small-bodied candles or wicks on both ends), hinting that bullish momentum could weaken.

If the price breaks convincingly below the trendline, it would signal a shift from short-term bullishness to a possible bearish phase.

GBP/NZD Trendline Breakout (10.2.25)The GBP/NZD pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Trendline Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 2.2053

2nd Resistance – 2.2141

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

GBPNZD Technical buy opportunity below the 1D MA50.Last time we looked into the GBPNZD pair (October 02 2024, see chart below), we issued a clear buy signal at the bottom of the long-term Channel Up, that easily hit the 2.1900 Target:

Yet again, the price got rejected at the top of the Channel Up and pulled-back where it is consolidating below the 1D MA50 (blue trend-line). In the 12 months of this pattern, this has always been an excellent technical buy opportunity, with the minimum immediate rally being +4.15%.

As a result, we feel confident buying this pair and target 2.2550.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bearish drop?GBP/NZD is rising towards the resistance level which is an overlap resistance that aligns with the 38.2% Fibonacci retracement and could drop from this level to our take profit.

Entry: 2.1897

Why we like it:

There is an overlap resistance level that lines up with the 38.2% Fibonacci retracement.

Stop loss: 2.2076

Why we like it:

There is an overlap resistance level that is slightly above the 50% Fibonacci retracement.

Take profit: 2.1671

Why we like it:

There is an overlap support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish reversal off overlap resistance?GBP/NZD is rising towards the resistance level which is an overlap resistance that aligns with the 38.2% Fibonacci retracement and could drop from this level to our take profit.

Entry: 2.1897

Why we like it:

There is an overlap resistance level that aligns with the 38.2% Fibonacci retracement.

Stop loss: 2.1966

Why we like it:

There is a pullback resistance level that lines up with the 38.2% Fibonacci retracement.

Take profit: 2.1671

Why we like it:

There is an overlap support level that lines up with the 127.2% Fibonacci extension.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish drop?GBP/NZD is reacting off the resistance level which is an overlap resistance and could drop from this level to our take profit.

Entry: 2.2060

Why we like it:

There is an overlap resistance level.

Stop loss: 2.2191

Why we like it:

There is an overlap resistance level.

Take profit: 2.1898

Why we like it:

There is an overlap support level that aligns with the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Sell GBP/NZD Bearish FlagThe GBP/NZD pair on the M30 timeframe presents a potential selling opportunity due to a recent downward breakout from a well-defined Bearish Flag pattern. This suggests a shift in momentum towards the downside in the coming Hours.

Key Points:

Sell Entry: Consider entering a short position around close to the breakout level. This offers an entry point near the perceived shift in momentum.

Target Levels:

1st Support – 2.1994

2nd Support – 2.1920

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI FOREX TRADING

Thank you.

Buy GBP/NZD Channel BreakoutThe GBP/NZD pair on the M30 timeframe presents a potential Buying opportunity due to a recent downward breakout from a well-defined Channel pattern. This suggests a shift in momentum towards the upside in the coming Hours.

Key Points:

Buy Entry: Consider entering a Long position around close to the breakout level. This offers an entry point near the perceived shift in momentum.

Target Levels:

1st Support – 2.2053

2nd Support – 2.2132

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI FOREX TRADING

Thank you.

Falling towards 50% Fibonacci support?GBP/NZD is falling towards the support level which is a pullback support that lines up with the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 2.1903

Why we like it:

There is a pullback suppor tlevel that lines up with the 50% Fibonacci retraecment.

Stop loss: 2.1720

Why we like it:

There is an overlap support level that aligns with the 50% Fibonacci retracement.

Take profit: 2.2098

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GBPNZD - The pound, in relative peace!The GBPNZD currency pair is located between EMA200 and EMA50 in the 4H timeframe and has left its downward channel. In case of a downward correction, we can see demand zone and buy this currency pair in that zone with a suitable risk reward.

According to recent data, the UK’s economic indicators have shown various changes. M4 money supply, a key economic measure, has declined by 0.1%, compared to the previous figure of 0.6%. This drop may reflect reduced liquidity in the economy.

In the area of consumer credit, the Bank of England reported that this metric reached £1.098 billion, lower than the forecast of £1.3 billion and the previous figure of £1.231 billion. This may indicate a decline in consumer demand for credit.

Meanwhile, significant growth has been observed in the mortgage sector. Mortgage lending rose to £3.435 billion, surpassing the forecast of £2.7 billion and the previous figure of £2.541 billion. This increase suggests an improvement in the housing market and growing demand for mortgages.

Additionally, the number of approved mortgages reached 68,303, exceeding the forecast of 64,500 and the previous figure of 65,647. This growth further highlights increased confidence and momentum in the housing market.

Andrew Bailey, the Governor of the Bank of England, has addressed the financial and economic state of the UK, highlighting key concerns. He warned that price corrections could disrupt financing but expressed confidence that households and businesses would remain resilient against economic challenges.

He also predicted that the UK’s economic growth would continue “sustainably.” Bailey pointed to heightened global risks and uncertainties while emphasizing that there is no conflict between financial stability and economic growth. Additionally, he noted that geopolitical risks remain elevated.

According to Bloomberg and a CBI survey, tax pressures on UK businesses have caused a significant decline in the private sector. For the first time in two years, the budget has been identified as the main reason for reduced business activity.

Companies have warned that hiring plans are at their weakest level since the COVID pandemic. Business activity in the UK has been declining for the first time in over two years as firms reduced jobs and limited investments following the October budget. According to the Confederation of British Industry’s (CBI) monthly growth index, a £26 billion ($33 billion) increase in payroll taxes and prolonged uncertainty caused by a three-month wait for the next budget after the Labour Party’s decisive victory in the July 4 election have significantly impacted private sector sentiment.

The UK plans to review the design of its new labor survey in the spring. The Office for National Statistics (ONS) reported that overall employment levels are now 313,000 higher than before the COVID pandemic. The economic inactivity rate has decreased by 0.1% to 22.1%, while the unemployment rate has remained steady at around 4.2%. Employment rates for the period from April to June 2024 increased by 0.1%, reaching 74.6%.

GBPNZD: Turning bearish if the 1D MA50 breaks.GBPNZD is neutral on its 1D technical outlook (RSI = 48.440, MACD = 0.004, ADX = 26.806), trading right over its 1D MA50. If broken, it will be the validation of the new bearish wave of the 1 year Channel Down. The 1D RSI is forming the very same Arc pattern as the May bearish wave. Upon validation, we will get short and aim for the 1D MA200, over the 0.786 Fibonacci level (TP = 2.12500).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GBPNZD - How will the BOE decision affect the pound?The GBPNZD currency pair is above the EMA200 and EMA50 in the 4H timeframe and is moving in its medium-term bullish channel. In case of downward correction, we can see the demand zones and buy this currency pair within those zones with appropriate risk reward.

The Bank of England has lowered its interest rate by 0.25%, bringing it to 4.75%. According to the Bank’s monetary statement, GDP is projected to grow by 0.2% in Q3 2024 compared to the previous quarter (September forecast: 0.3%) and increase by 0.3% in Q4 this year. The goal is to keep the interest rate restrictive enough until the risks of inflation persistently returning to the 2% target diminish.

Andrew Bailey, the Bank of England’s governor, noted that the rate of inflation decline has been faster than expected. However, further reduction in service price inflation is still needed to maintain the consumer price index at the 2% target level, and sufficient spare capacity will be essential to reach this goal in the medium term.

The rise in the employer’s national insurance contribution, included in the budget, is expected to have a slightly inflationary effect on prices and a marginally negative impact on wages and corporate profitability. The combined effect of increased employer national insurance and minimum wage is likely to raise hiring costs, with the net impact on inflation yet to be determined.

Adrian Orr, the Reserve Bank of New Zealand’s governor, highlighted geopolitical tensions as a significant risk to the economy, expressing concern over the economy lagging behind the interest rate cuts.

Orr also emphasized that climate change poses an existential threat to New Zealand, calling for serious attention to this issue. This view reflects deep economic and environmental concerns in the country.

The Reserve Bank of New Zealand’s Financial Stability Report indicates that the financial system remains resilient despite the economic downturn, with risks under control. Banks anticipate a slight increase in non-performing loans, although this level remains below what was experienced during previous economic recessions. Debt servicing costs have peaked and are now declining, with mortgage interest rates dropping over the past six months. Although many households and businesses are under financial pressure and some borrowers face challenges with rising unemployment, domestic economic challenges persist.

GBPNZD Potential DownsidesHey Traders, in tomorrow's trading session we are monitoring GBPNZD for a selling opportunity around 2.17 zone, GBPNZD is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 2.17 support and resistance area.

Trade safe, Joe.

Buy GBP/NZD BreakoutThe GBP/NZD pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent breakout from a Triangle Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position Above The Broken Trendline Of The Triangle After Confirmation. Ideally, This Would Be Around 2.1480

Target Levels:

1st Resistance – 2.1600

2nd Resistance – 2.1675

Stop-Loss: To manage risk, place a stop-loss order below 2.1385. This helps limit potential losses if the price falls back unexpectedly.

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI FOREX TRADING

Thank you.

GBPNZD Strong buy signal at the bottom of the Channel Up.The GBPNZD pair has been trading within an 11-month Channel Up and since its break below the 1D MA50 (blue trend-line) on August 28, it has been forming the new bottom. Monday saw it approaching the Higher Lows trend-line and with the 1D MA200 (orange trend-line) just below it as a Support, we believe that we've seen the new Low.

In fact, as the 1D RSI made a Double Bottom, it resembles the Channel's last bottom formation on June 06. The final confirmation of the bullish break-out will be when a 1D candle closes above the 1D MA50. We expect at least a +4.45% rise, thus targeting 2.19000 on the medium-term.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇