GBPCHF Will Collapse! SELL!

My dear followers,

I analysed this chart on GBPCHF and concluded the following:

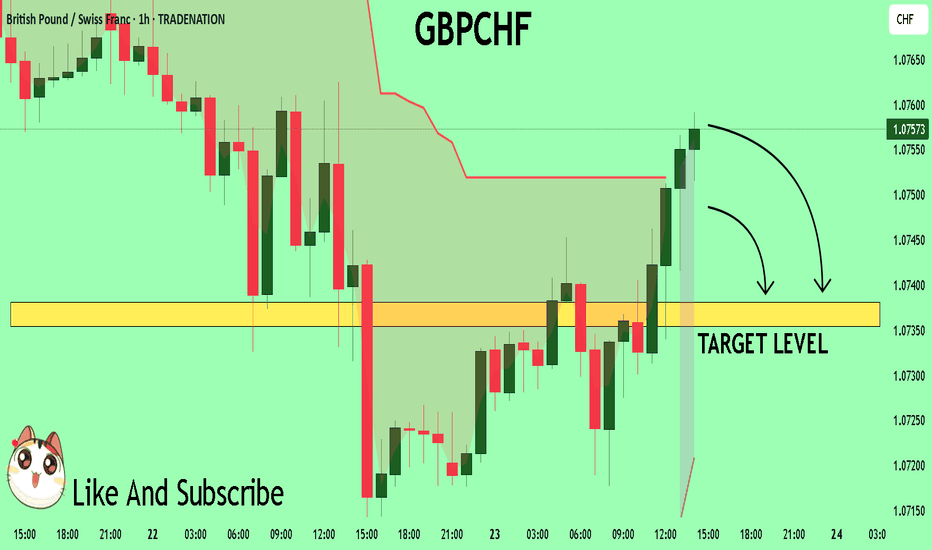

The market is trading on 1.0756 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.0731

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPCHF

GBPCHF: Short Signal with Entry/SL/TP

GBPCHF

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short GBPCHF

Entry Point - 1.0741

Stop Loss - 1.0754

Take Profit - 1.0714

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBP/CHF BEST PLACE TO BUY FROM|LONG

Hello, Friends!

GBP/CHF pair is in the uptrend because previous week’s candle is green, while the price is clearly falling on the 2H timeframe. And after the retest of the support line below I believe we will see a move up towards the target above at 1.073 because the pair is oversold due to its proximity to the lower BB band and a bullish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Technical Analysis: GBP/CHF (British Pound / Swiss Franc)Timeframe: Hourly (H1) – *Data as of Aug 01, 2025, 14:33 UTC+4*

Source: OANDA via TradingView

1. Key Price Levels

Current Price (C): 1.07357 (+0.09% from previous close).

High/Low (H/L): 1.07386 / 1.07308 (narrow range, indicating consolidation).

Resistance Levels:

R1: 1.07514 (near-term resistance).

R2: 1.08208 (stronger resistance).

Pivot Point (P): 1.07723 (intraday benchmark).

2. Price Action & Trends

Short-Term Trend: Slightly bullish (+0.09% gain), but trading near the day’s low (1.07308).

Volatility: Low (tight range between 1.07308–1.07386).

Support Zone: 1.07200–1.07335 (critical for bearish reversals).

3. Technical Indicators (Implied)

Pivot Points (PVC): Price is below the pivot (1.07723), suggesting bearish pressure unless it breaks above.

Resistance/Support:

Bulls need to push above R1 (1.07514) to target R2 (1.08208).

Bears aim for S1 (1.07335) or lower (1.07200).

4. Trading Signals

Bullish Scenario: Break above 1.07514 (R1) could signal upward momentum toward 1.07723 (Pivot).

Bearish Scenario: Drop below 1.07308 (today’s low) may extend losses to 1.07200.

Neutral Zone: Price oscillating between 1.07308–1.07386 suggests indecision.

5. Risk Management

Stop-Loss (S/L): Below 1.07200 for longs; above 1.07514 for shorts.

Take-Profit (T/P):

Longs: 1.07723 (Pivot) or 1.08000 (psychological level).

Shorts: 1.07200 or 1.07000.

6. Conclusion

Current Bias: Neutral-to-slightly bullish, but lacks strong momentum.

Watch For: Breakout from the 1.07308–1.07514 range for directional clarity.

Caution: Low volatility may lead to false breakouts; confirm with volume/RSI if available.

Recommendation: Wait for a confirmed breakout with volume before entering trades.

GBPCHF Trading Opportunity! BUY!

My dear followers,

This is my opinion on the GBPCHF next move:

The asset is approaching an important pivot point 1.0737

Bias - Bullish

Safe Stop Loss - 1.0728

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.0756

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPCHF meets strong support: A reversal here is high probabilityLooking at GBPCHF and how it fits within my approach to structure-based trading, this one is really speaking my language.

Price has come down into a key higher-timeframe support zone: a zone that’s proven itself multiple times in the past. Now, price has shown some initial rejection there, making my long position towards 1.1000 a clear, rational target.

What makes this setup different could be the patience behind it. As we let the market complete its downward leg, waited for price to revisit a reliable zone, and now anticipating a bounce back. It’s a move that I’ve captured across my previous charts again and again.

Let me know in the comments what you think

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPCHF oversold bounce backs capped at 1.0826The GBPCHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend.

Key resistance is located at 1.0826, a prior consolidation zone. This level will be critical in determining the next directional move.

A bearish rejection from 1.0826 could confirm the resumption of the downtrend, targeting the next support levels at 1.0653, followed by 1.0607 and 1.0545 over a longer timeframe.

Conversely, a decisive breakout and daily close above 1.0826 would invalidate the current bearish setup, shifting sentiment to bullish and potentially triggering a move towards 1.0870, then 1.0936.

Conclusion:

The short-term outlook remains bearish unless the pair breaks and holds above 1.0826 Traders should watch for price action signals around this key level to confirm direction. A rejection favours fresh downside continuation, while a breakout signals a potential trend reversal or deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPCHF: Short Signal with Entry/SL/TP

GBPCHF

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short GBPCHF

Entry Point - 1.0754

Stop Loss - 1.0768

Take Profit - 1.0732

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPCHF Will Keep Falling!

HI,Traders !

#GBPCHF keeps falling down

And the pair made a strong

Bearish breakout of the key

Horizontal key level of 1.07025

And the breakout is confirmed

So we are bearish biased and

We will be expecting a further

Bearish move down on Monday !

Comment and subscribe to help us grow !

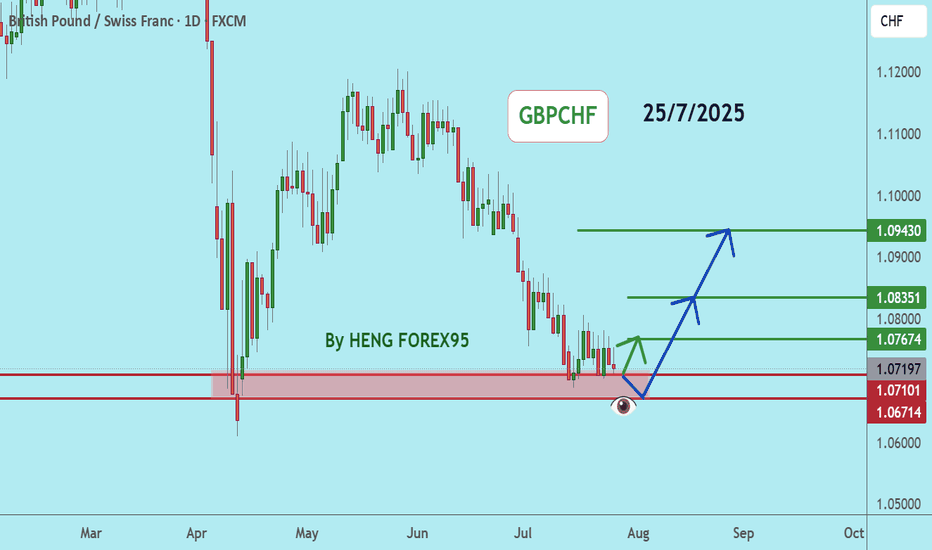

GBPCHFGBPCHF price is near the main support zone 1.07101-1.06714. If the price cannot break through the 1.06714 level, it is expected that the price will rebound. Consider buying the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

GBPCHF My Opinion! SELL!

My dear followers,

I analysed this chart on GBPCHFand concluded the following:

The market is trading on 1.0756 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.0738

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Could the price bounce from here?The GBP/CHF is falling towards the pivot and could bounce to the 1st resistance, which serves as a pullback resistance.

Pivot: 1.0777

1st Support: 1.0739

1st Resistance: 1.0837

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

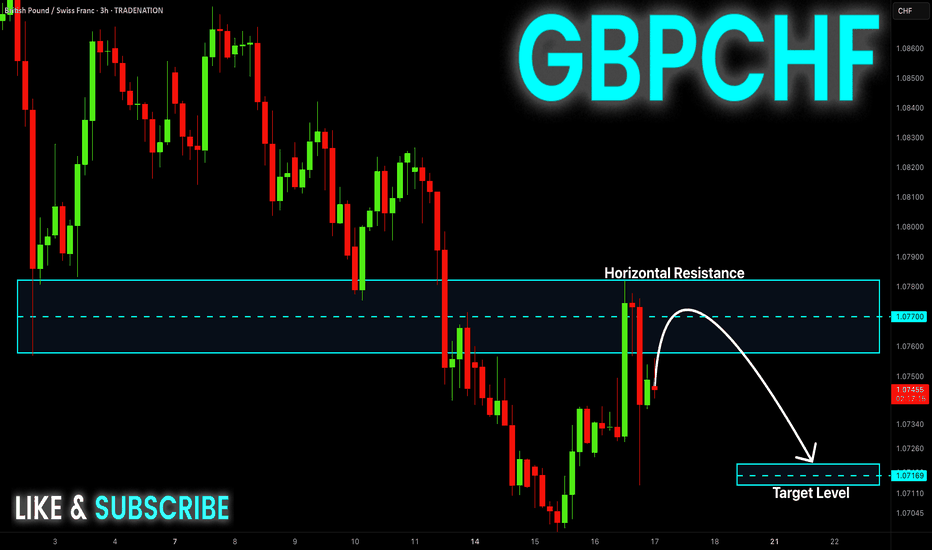

GBP-CHF Local Short! Sell!

Hello,Traders!

GBP-CHF made a retest of

The wide horizontal resistance

Of 1.0780 and we are already

Seeing a bearish pullback

So as the pair is trading in a

Downtrend we will be expecting

A further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

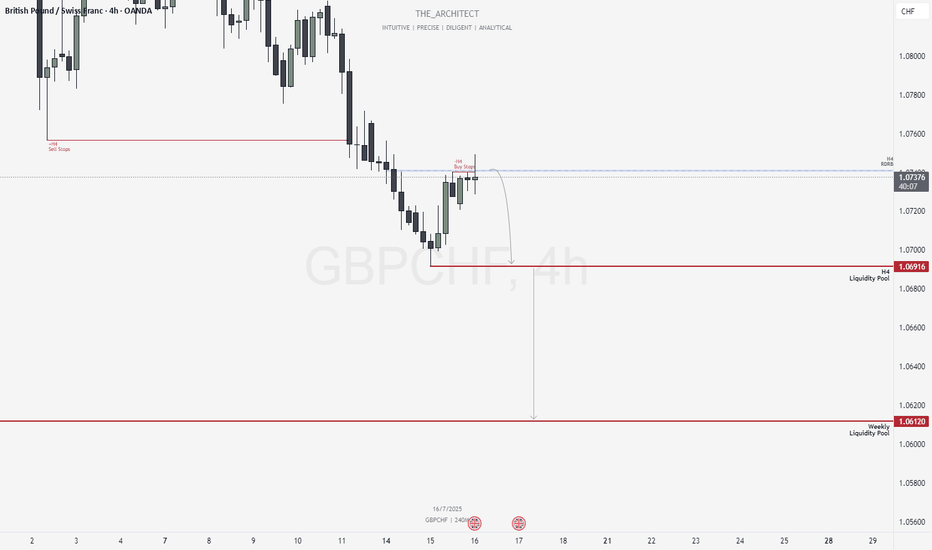

GBPCHF: Bearish Structure Aligns for Potential Sell Setups!Greetings Traders,

In today’s analysis of GBPCHF, we observe that the institutional order flow is currently bearish, and as such, we aim to align with this bias by identifying selling opportunities from key institutional resistance zones.

Higher Timeframe Context:

Weekly TF:

The weekly timeframe, which serves as our macro bias, is firmly bearish. This sentiment is reinforced on the H4 timeframe—our intermediate structure—which is also delivering consistent lower highs and lower lows. The alignment between these two timeframes strengthens our conviction to trade in the direction of institutional bearish order flow.

Key Observations on H4:

Re-delivered & Re-balanced Price Zone: Price has retraced into a previously balanced area that has now been re-delivered into, signaling institutional interest. Rejection from this zone adds to our bearish bias.

Buy Stop Raid: Price action has swept H4 buy stops in this area, providing confirmation that smart money may have used this liquidity for order pairing into short positions.

Entry Zone: The current rejection suggests a high-probability shorting opportunity from this region, provided confirmation on the lower timeframes.

Trading Plan:

Entry Strategy: Await confirmation at the current H4 resistance for short entries.

Targets: First target is the H4 liquidity pool located at discount prices. The longer-term objective is the weekly liquidity pool, which represents the primary draw on liquidity.

Continue to monitor price action closely, maintain patience for confirmation, and manage risk according to your trading plan.

Kind Regards,

The Architect 🏛️📉

GBP/CHF BULLS WILL DOMINATE THE MARKET|LONG

GBP/CHF SIGNAL

Trade Direction: long

Entry Level: 1.070

Target Level: 1.088

Stop Loss: 1.058

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP_CHF SWING LONG|

✅GBP_CHF is set to retest a

Strong support level below at 1.0650

After trading in a strong downtrend for some time

Which makes a bullish rebound a likely scenario

With the target being a local resistance above at 1.0750

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPCHF Technical Analysis! BUY!

My dear followers,

I analysed this chart on GBPCHF and concluded the following:

The market is trading on 1.0733 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.0775

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPCHF – Setting Up for a ShortWe’ve clearly marked our key resistance zone,

and now we’re patiently waiting for price to reach that level.

⚠️ Once we get a valid bearish signal,

I’ll open a short position according to plan.

🔁 If the level breaks cleanly and pulls back,

I’ll flip my bias and go long from the retest —

because I don’t marry levels,

I follow what price tells me.

We’re not here to predict.

We’re here to react, adapt, and manage risk.

The market does what it wants — and I’m ready for every scenario.

GBPCHF is Ready for a breakthroughHello Traders

In This Chart GBPCHF HOURLY Forex Forecast By FOREX PLANET

today GBPCHF analysis 👆

🟢This Chart includes_ (GBPCHF market update)

🟢What is The Next Opportunity on GBPCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBP-CHF Bearish Breakout! Sell!

Hello,Traders!

GBP-CHF is trading in a strong

Downtrend and the pair

Broke the key horizontal

Level around 1.0780 which

Reinforces our bearish

Bias and we will be

Expecting a further

Bearish move down

On Monday!

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.