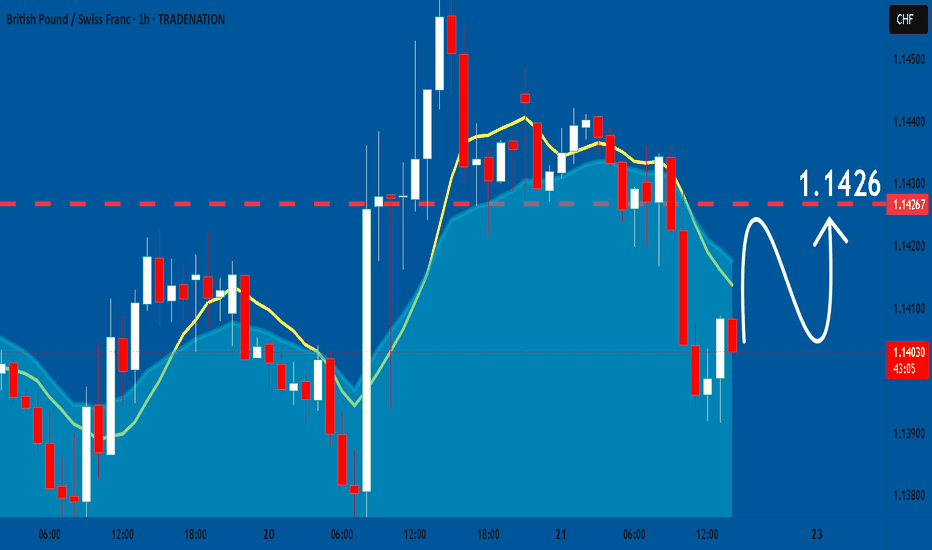

GBPCHF INTRADAY corrective pullback capped at 1.1430Trend Overview

The GBP/CHF currency pair remains in a bearish trend, with current price action reflecting a potential oversold bounce within a broader downtrend.

Key Levels & Scenarios

Resistance: 1.1440 (previous consolidation zone)

A bearish rejection from this level could reinforce downside momentum.

Downside targets: 1.1340, followed by 1.1300 and 1.1200 over a longer timeframe.

Bullish Breakout Scenario:

A daily close above 1.1440 would invalidate the bearish outlook.

Upside targets: 1.1480, followed by 1.1500.

Volume analysis indicates limited buying pressure, keeping the bearish bias intact unless 1.1440 is breached.

Conclusion

As long as 1.1440 holds as resistance, GBP/CHF remains in a bearish structure, targeting 1.1340 and lower levels. A break above 1.1440 would signal a potential shift toward 1.1480 and 1.1500.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPCHF

GBP_CHF LONG FROM RISING SUPPORT|

✅GBP_CHF is trading along the rising support

And as the pair will soon retest it

I am expecting the price to go up

To retest the supply levels above at 1.1413

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPCHF Massive Short! SELL!

My dear subscribers,

GBPCHF looks like it will make a good move, and here are the details:

The market is trading on 1.1428 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.1410

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPCHF: Bears Will Push

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to sell GBPCHF.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPCHF INTRADAY coiling energy build up supported at 1.1366The GBP/CHF currency pair shows a bullish sentiment, supported by the prevailing uptrend. Recent intraday price action indicates a bounce back from the rising trendline support zone.

Bullish Scenario:

The key trading level to watch is 1.1366, representing the previous consolidation range. A corrective pullback to this level, followed by a bullish bounce, would likely target upside resistance at 1.1470. Further bullish momentum could see prices reaching 1.1510 and 1.1570 over the longer timeframe.

Bearish Scenario:

On the other hand, a confirmed loss of the 1.1366 support level, accompanied by a daily close below this point, would invalidate the bullish outlook. This would pave the way for a deeper retracement toward 1.1300, with the next support level at 1.1240.

Conclusion:

The prevailing sentiment remains bullish as long as 1.1366 holds as support. Traders should monitor this level for potential bounce signals to confirm continued upside momentum. A decisive break below 1.1366 would signal a shift to a bearish outlook, targeting lower support zones.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBP_CHF LONG SIGNAL|

✅GBP_CHF is trading in an uptrend

Along the rising support line

Which makes me bullish biased

And the pair is about to retest the rising support

Thus, a rebound and a move up is expected

So we can enter a long trade with

The TP of 1.1410 and SL of 1.1350

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPCHF Will Grow! Long!

Here is our detailed technical review for GBPCHF.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 1.142.

The above observations make me that the market will inevitably achieve 1.150 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPCHF Is Going Up! Buy!

Please, check our technical outlook for GBPCHF.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 1.140.

Considering the today's price action, probabilities will be high to see a movement to 1.151.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBP/CHF BEARS ARE GAINING STRENGTH|SHORT

Hello, Friends!

Previous week’s green candle means that for us the GBP/CHF pair is in the uptrend. And the current movement leg was also up but the resistance line will be hit soon and upper BB band proximity will signal an overbought condition so we will go for a counter-trend short trade with the target being at 1.126.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPCHF: Will Keep Growing! Here is Why:

The price of GBPCHF will most likely increase soon enough, due to the demand beginning to exceed supply which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPCHF INTRADAY bullish continuation supported at 1.1366The GBP/CHF currency pair shows a bullish sentiment, supported by the prevailing uptrend. Recent intraday price action indicates a bounce back from the rising trendline support zone.

Bullish Scenario:

The key trading level to watch is 1.1366, representing the previous consolidation range. A corrective pullback to this level, followed by a bullish bounce, would likely target upside resistance at 1.1470. Further bullish momentum could see prices reaching 1.1510 and 1.1570 over the longer timeframe.

Bearish Scenario:

On the other hand, a confirmed loss of the 1.1366 support level, accompanied by a daily close below this point, would invalidate the bullish outlook. This would pave the way for a deeper retracement toward 1.1300, with the next support level at 1.1240.

Conclusion:

The prevailing sentiment remains bullish as long as 1.1366 holds as support. Traders should monitor this level for potential bounce signals to confirm continued upside momentum. A decisive break below 1.1366 would signal a shift to a bearish outlook, targeting lower support zones.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBP/CHF "Pound vs Swiss" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/JPY "The Guppy" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (1.13700) then make your move - Bullish profits await!"

however I advise to placing the Buy Stop Orders above the breakout MA or placing the Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 1.12700 (swing Trade Basis) Using the 4H period, the recent / Swing Low or High level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.15500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

GBP/CHF "Pound vs Swiss" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

🔶 Fundamental Analysis

The GBP/CHF exchange rate is influenced by the UK's economic growth, inflation, and interest rates, as well as Switzerland's economic performance. Currently, the UK's economy is experiencing moderate growth, with a slight increase in inflation

🔷 Macroeconomic Analysis

The Bank of England has maintained a hawkish stance, with interest rates expected to remain high in the short term. This has led to a strengthening of the British pound. On the other hand, the Swiss National Bank has kept interest rates at historic lows, supporting the economy.

🔶 COT Data Analysis

The Commitments of Traders (COT) report shows that commercial traders are net short, while non-commercial traders are net long. This indicates a potential trend reversal.

💫COT Data Changes (February 4 - February 11, 2025)

Institutional Traders: Increased long positions by 5%, decreased short positions by 3%.

Retail Traders: Increased short positions by 2%, decreased long positions by 1%.

Large Banks: Increased long positions by 4%, decreased short positions by 2%.

💫Upcoming COT Data (February 18, 2025)

Expected Changes: Institutional traders may increase long positions, retail traders may decrease short positions.

Market Sentiment: Bullish sentiment expected to increase.

💫COT Data Trends

Long-term Trend: Institutional traders have maintained a net long position since January 2025.

Short-term Trend: Retail traders have increased short positions over the past two weeks.

🔷 Market Sentimental Analysis

Market sentiment is slightly bullish, with 55% of traders holding long positions. Institutional traders are holding long positions, while hedge funds are holding short positions. Retail traders are also holding long positions.

🔶 Market Sentiment by Trader Type

- Institutional Traders: 60% bullish, 40% bearish

- Hedge Funds: 55% bearish, 45% bullish

- Retail Traders: 55% bullish, 45% bearish

🔷 Positioning Data Analysis

Institutional traders are holding long positions, while corporate traders are holding short positions. Banks are maintaining a bearish stance.

🔶 Overall Outlook

The GBP/CHF exchange rate is expected to remain volatile in the short term, with a slight bullish bias due to the UK's economic growth and inflation. However, the pair's movement will largely depend on the overall performance of the UK and Swiss economies, as well as global economic trends

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBPCHF long – running at +25 pips but looking towards +1600It was in Sep 2022 that this pair made its (ATL) low at 1.01563. Since then, it meandered rather aimlessly (largely consolidating) but made a couple of higher lows. A double top was formed in July 2024, but that ended in a higher low. Here, began an uptrend that I believe is still intact. In Sep 2024 it slipped into a range as shown in the blue rectangle and has recently broken out of it to the upside. Price has been rather consistently above the (daily) 20ema this entire year and is not over-extended either.

PA at this time is not neat, plenty of wicks on both sides (check your daily chart). This is not what trend traders like to see, yet it does seem that the bulls are gaining control. This could be the early phase of a long bull trend or price could hit a resistance and fall down again. I would say that this is a high-risk trade at the moment.

I have taken a (small) long position already but will look to close it just before 1.1640 resistance. If, however, there is break above and pull back to that level, I will conclude that this pair is now firmly bullish and will target 1.3030 with a full position size (or multiple positions). That is a long way away and will be a good test of patience and nerves.

All this can be speculation too, but my risk is extremely limited right now – something well within my comfort zone.

This is not a trade recommendation, merely my own analysis. Trading carries a high level of risk, so only trade with money you can afford to lose and carefully manage your capital and risk. If you like my idea, please give a “boost” and follow me to get even more. Please comment and share your thoughts too!!

It’s not whether you are right or wrong, but how much money you make when you are right and how much you lose when you are wrong – George Soros

GBPCHF Set To Fall! SELL!

My dear friends,

Please, find my technical outlook for GBPCHF below:

The instrument tests an important psychological level 1.1451

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.1386

Recommended Stop Loss - 1.1486

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

———————————

WISH YOU ALL LUCK

GBP/CHF Channel Pattern (13.03.25)The GBP/CHF pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Channel Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 1.1490

2nd Resistance – 1.1540

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

GBP/CHF SHORT FROM RESISTANCE

Hello, Friends!

The BB upper band is nearby so GBP-CHF is in the overbought territory. Thus, despite the uptrend on the 1W timeframe I think that we will see a bearish reaction from the resistance line above and a move down towards the target at around 1.135.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPCHF Will Go Up From Support! Long!

Here is our detailed technical review for GBPCHF.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 1.132.

The above observations make me that the market will inevitably achieve 1.137 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

Bearish drop off pullback resistance?GBP/CHF is reacting off the resistance level which is a pullback resistance that is slightly below the 38.2% Fibonacci retracement and could drop from this level to our take profit.

Entry: 1.1368

Why we like it:

There is a pullback resistance level that is slightly below the 38.2% Fibonacci retracement.

Stop loss: 1.1423

Why we like it:

There is a pullback resistance level that lines up with the 61.8% Fibonacci retracement.

Take profit: 1.1245

Why we like it:

There is a pullback support level that lines up with the 127.2% Fibonacci extension.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.