GBPCHF is in the Selling from ResistanceHello Traders

In This Chart GBPCHF HOURLY Forex Forecast By FOREX PLANET

today GBPCHF analysis 👆

🟢This Chart includes_ (GBPCHF market update)

🟢What is The Next Opportunity on GBPCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Gbpchfsell

GBPCHF Will Keep Falling!

HI,Traders !

#GBPCHF keeps falling down

And the pair made a strong

Bearish breakout of the key

Horizontal key level of 1.07025

And the breakout is confirmed

So we are bearish biased and

We will be expecting a further

Bearish move down on Monday !

Comment and subscribe to help us grow !

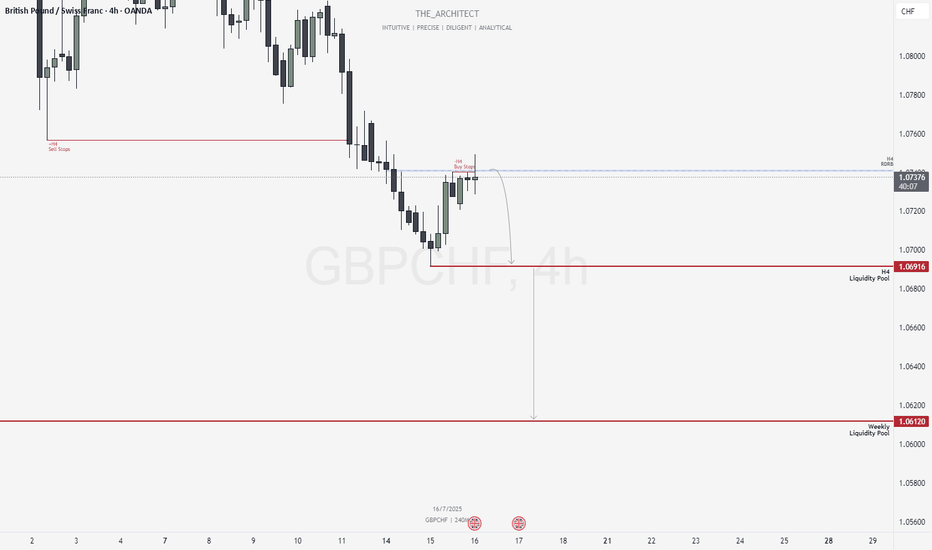

GBPCHF: Bearish Structure Aligns for Potential Sell Setups!Greetings Traders,

In today’s analysis of GBPCHF, we observe that the institutional order flow is currently bearish, and as such, we aim to align with this bias by identifying selling opportunities from key institutional resistance zones.

Higher Timeframe Context:

Weekly TF:

The weekly timeframe, which serves as our macro bias, is firmly bearish. This sentiment is reinforced on the H4 timeframe—our intermediate structure—which is also delivering consistent lower highs and lower lows. The alignment between these two timeframes strengthens our conviction to trade in the direction of institutional bearish order flow.

Key Observations on H4:

Re-delivered & Re-balanced Price Zone: Price has retraced into a previously balanced area that has now been re-delivered into, signaling institutional interest. Rejection from this zone adds to our bearish bias.

Buy Stop Raid: Price action has swept H4 buy stops in this area, providing confirmation that smart money may have used this liquidity for order pairing into short positions.

Entry Zone: The current rejection suggests a high-probability shorting opportunity from this region, provided confirmation on the lower timeframes.

Trading Plan:

Entry Strategy: Await confirmation at the current H4 resistance for short entries.

Targets: First target is the H4 liquidity pool located at discount prices. The longer-term objective is the weekly liquidity pool, which represents the primary draw on liquidity.

Continue to monitor price action closely, maintain patience for confirmation, and manage risk according to your trading plan.

Kind Regards,

The Architect 🏛️📉

GBPCHF – Setting Up for a ShortWe’ve clearly marked our key resistance zone,

and now we’re patiently waiting for price to reach that level.

⚠️ Once we get a valid bearish signal,

I’ll open a short position according to plan.

🔁 If the level breaks cleanly and pulls back,

I’ll flip my bias and go long from the retest —

because I don’t marry levels,

I follow what price tells me.

We’re not here to predict.

We’re here to react, adapt, and manage risk.

The market does what it wants — and I’m ready for every scenario.

GBPCHF is Ready for a breakthroughHello Traders

In This Chart GBPCHF HOURLY Forex Forecast By FOREX PLANET

today GBPCHF analysis 👆

🟢This Chart includes_ (GBPCHF market update)

🟢What is The Next Opportunity on GBPCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPCHF - Looking To Sell Pullbacks In The Short TermM15 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

GBPCHF - Expecting Bearish Continuation In The Short TermH1 - Clean bearish trend with the price creating series of lower highs, lower lows.

No opposite signs.

Expecting further continuation lower until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

#GBPCHF: Major Swing Sell Opportunity! GBPCHF, there are two areas where you can sell it from. The first is the current market, where you can take a risk sell entry. However, if you’re looking for a safer entry, you may want to consider taking a second entry. This will be safer since the price would have filled the liquidity area.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

GBP/CHF Confirmed H&s Reversal Pattern , Time To Enter ?Here is my opinion on GBP/CHF , We have a very clear reversal pattern ( head & shoulders ) and we have a clear closure below the neckline , so i think this pair can give us at least 100 pips , so we can enter a sell trade and targeting at least 100 pips .

GBPCHF - Long active !!Hello traders!

‼️ This is my perspective on GBPCHF.

Technical analysis: Here we are in a bullish market structure from 4H timeframe perspective, so I expect bullish price action after price filled almost all the imbalance and rejected from bullish trendline + institutional big figure 1.13000. Also we have hidden divergence for buy.

Like, comment and subscribe to be in touch with my content!

GBPCHF - Bearish continuation !!Hello traders!

‼️ This is my perspective on GBPCHF.

Technical analysis: Here we are in a bearish market structure from daily timeframe perspective, so I expect price to continue bearish after filling the imbalance and rejecting from bearish OB + level 1.13000. As well we have hidden divergence for sell.

Fundamental news: Tomorrow (GMT+2) we will see results of Interest Rate on GBP, news with high impact on currency

Like, comment and subscribe to be in touch with my content!

GBPCHF - Accumulation phase !!Hello traders!

‼️ This is my perspective on GBPCHF.

Technical analysis: Here we are in accumulation for the last couple of months, so before a distribution in one of the direction I expect to see a manipulation of buy/sell side liquidity.

Like, comment and subscribe to be in touch with my content!

GBPCHF Scenario 2.1.2025On this chart the market created an sfp above the high followed by a decline the price continues to move around the poc at the price level 1.128680 we have two scenarios but both are short first with the first scenario creating an sfp below the low and going for higher prices.

GBP/CHF "Pound Vs Swissy" Forex Market Heist Plan on Bearish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/CHF "Pound Vs Swissy" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 👀 So Be wealthy and safe trade.💪🏆🎉

Entry 📉 : You can enter a Bearish trade at any point.

however I advise placing sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest high level should be in retest.

Stop Loss 🛑: Using the 2h period, the recent / nearest high level.

Goal 🎯: 1.1700 (OR) Before escape in the bank

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

Considering these factors, the GBP/CHF pair may experience a Bearish trend in the short-term, driven by:

Increasing demand for the Swiss franc, driven by its safe-haven status and low-risk profile.

Decreasing demand for the British pound, driven by Brexit uncertainty and weak economic growth.

Potential for a decline in the British pound, driven by a dovish Bank of England and weak economic growth.

Bearish Factors:

Increasing demand for the Swiss franc, driven by its safe-haven status and low-risk profile.

Decreasing demand for the British pound, driven by Brexit uncertainty and weak economic growth.

Potential for a decline in the British pound, driven by a dovish Bank of England and weak economic growth.

Strong Swiss economic growth, driven by strong exports and investment.

Low-risk profile of the Swiss franc, which can attract investors seeking safe-haven assets.

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

GBPCHF - Short position active !!Hello traders!

‼️ This is my perspective on GBPCHF.

Technical analysis: Here we are in a bearish market structure from daily timeframe perspective, so I look for a short. I expect bearish price action after price filled the imbalance and rejected from bearish OB + institutional big figure 1.12000.

Like, comment and subscribe to be in touch with my content!

Scenario GBPCHFHere I see possible preparations for short positions, the analysis solves possible scenarios for the completion of the correction, the first scenario is that the price will reach the upper trendline, the second from the correction will eventually be formed as a head-shoulder formation