GBPJPY H4 | Bearish Drop Based on the H4 chart, the price is rising toward our sell entry level at 191.02, a pullback resistance that aligns with the 50% Fibo retracement.

Our take profit is set at 187.32, a multi-swing low support.

The stop loss is set at 193.72, a pullback resistance that aligns with the 78.6% Fibo retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (fxcm.com/uk):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

Stratos Global LLC (fxcm.com/markets):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

GBPJPY

GBP/JPY: Yen Strength Pushes Price Toward Key SupportGBP/JPY has posted a decline of more than 3% over the last four trading sessions, with bearish momentum growing as the market increasingly favors the Japanese yen in the short term. Demand for the yen has risen sharply since last week, when Donald Trump announced a minimum 10% tariff on all imports into the United States. This was further reinforced today by new comments proposing additional 50% tariffs on China, following Beijing’s announcement of countermeasures against the U.S.

The yen is historically considered one of the safest currencies, and the recent surge in uncertainty has helped it hold strong against the British pound.

Wide Sideways Range

The pair remains within a broad long-term range, bounded by a ceiling near 198.676 and a floor around 186.932. Although recent selling has brought the pair close to the lower boundary, price action has not yet been strong enough to break this level, keeping the sideways channel as the dominant technical formation to watch for now.

MACD

The MACD indicator has started to show a shift in market momentum, with the histogram oscillating below the zero line. This reflects ongoing bearish pressure based on recent moving average behavior, and as long as this pattern persists, selling momentum in GBP/JPY may become increasingly relevant in the coming sessions.

RSI

The RSI also reflects a bearish tone, with the line currently holding below the 50 level. However, the indicator is gradually approaching the oversold zone near the 30 level, which is typically where selling pressure may begin to ease, potentially opening the door for short-term bullish corrections.

Key Levels:

192.493 – Key resistance: Located in the middle of the broader range and roughly aligned with the 200-period moving average. Persistent price action near this level may signal the beginning of a bullish bias in the short term.

190.144 – Tentative zone: This level may act as a potential area for short-term bullish corrections.

186.932 – Current support: Positioned at the bottom of the broader range. If price action breaks below this level, it could pave the way for a much more significant downtrend in the sessions ahead.

By Julian Pineda, CFA – Market Analyst

GBP/JPY SELLERS WILL DOMINATE THE MARKET|SHORT

GBP/JPY SIGNAL

Trade Direction: short

Entry Level: 193.172

Target Level: 187.511

Stop Loss: 196.946

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

LONG ON GBP/JPYGJ has Taken a dive since last week.

The Jpy Index is now over brought and should begin falling.

This will cause most of the XXX/JPY pairs to rise.

EJ, NJ, and GJ all look great for a buying opp.

GJ has a morning star on the 15min TF, I am waiting for price to pullback to the FVG or demand area on the 15min TF before entering long.

This is a sell limit order risking 65 pips to make over 300 pips.

See you at the top.

ICPUSDT READY TO FLY AGAIN ?? ICPUSDT is currently forming a classic falling wedge pattern on the chart, which is widely recognized as a bullish reversal signal. The price has been compressing within this narrowing range and is now approaching a key point where a breakout is highly likely. With strong support being respected and buyers gradually stepping in, the setup is aligning well for a potential upside move.

Volume levels have been steadily increasing, confirming growing investor interest in Internet Computer (ICP). This increasing participation from traders and investors alike can often serve as a reliable indicator that a breakout may occur soon. Technical indicators such as RSI and MACD are also hinting at a momentum shift that aligns with a bullish scenario.

Given the strength of this chart formation and the positive volume dynamics, ICPUSDT could potentially see a price gain in the range of 90% to 100%+ from current levels. The risk-to-reward ratio is favorable, especially for those who are entering early before the breakout confirms with stronger candles above resistance. A retest of the wedge breakout, if it happens, could also provide a second opportunity to enter.

ICP is also gaining traction among long-term investors due to its unique blockchain technology aimed at decentralizing the internet. The ongoing development and community support around the project adds more fundamental strength to this setup. Keep an eye on it for confirmation of the breakout!

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

GBP/JPY "The Dragon" Forex Bank Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the GBP/JPY "The Dragon" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (190.000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 199.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

GBP/JPY "The Dragon" Forex Bank Heist Plan (Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental analysis, Macro Economics, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Positioning and future trend...

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GBPJPY Will Fall! Short!

Take a look at our analysis for GBPJPY.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 189.486.

Taking into consideration the structure & trend analysis, I believe that the market will reach 183.143 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPJPYHello Traders! 👋

What are your thoughts on GBPJPY?

On the daily chart of GBPJPY, a Rising Wedge pattern has formed. After a bullish move, the price has entered a resistance zone.

If the wedge breaks down and price confirms below the 192.000 level, a short position could offer a favorable risk-to-reward setup.

Don’t forget to like and share your thoughts in the comments! ❤️

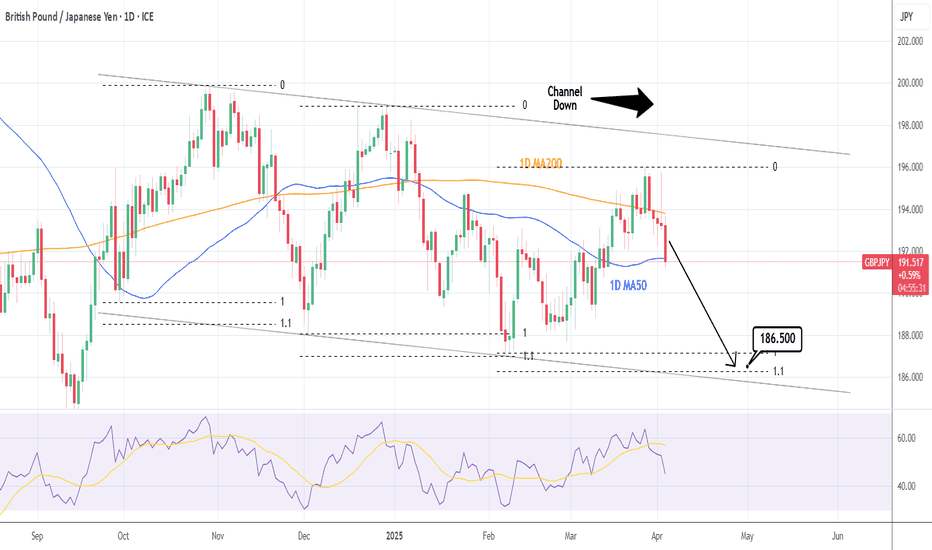

GBPJPY: Channel Down started its new bearish wave.GBJPY is neutral on its 1D technical outlook (RSI = 45.648, MACD = 0.440, ADX = 26.099) as the price is testing the 1D MA50 again, being already on a 4 red day streak. The recent March 28th high almost touched the top of the 6 month Channel Down, so it can be technically considered a LH. Since the 1D RSI already crossed under its MA, we have a validated sell signal. Both prior bearish waves reached the 1.1 Fibonacci extension. Aim just over it (TP = 186.500).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

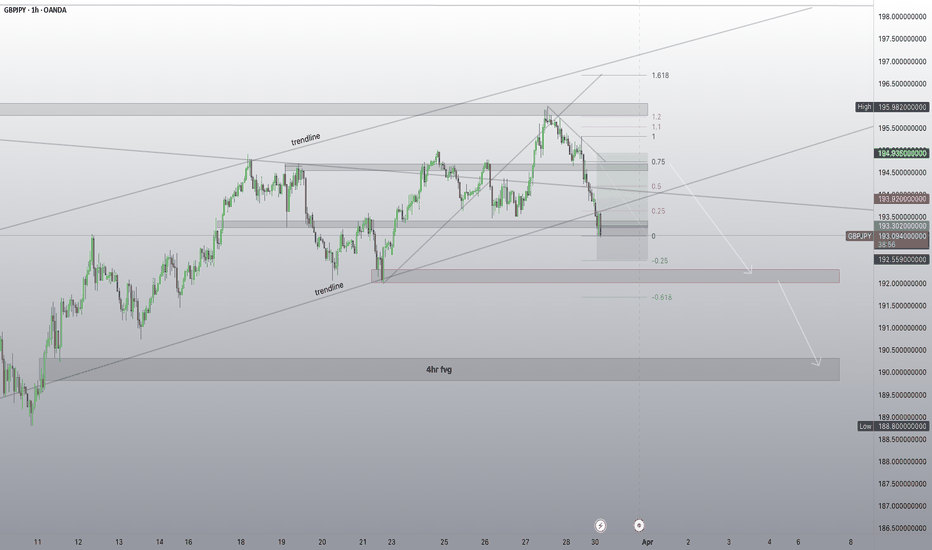

Going long now until we hit around the 75% fib zoneGoing long before a potential big sale off to close the 4HR FVG. We have broken the support trend line so we will probably see a retracement before continuing downward.

If we keep going down we will drop to the next zone before we retrace. I will be entering more buys if so.

*I also notice that we are very low compared to previous years so there could be a huge bull coming through. just something to keep in mind!*

📈📉📈

GBPJPY: Bullish Continuation is Highly Probable! Here is Why:

The analysis of the GBPJPY chart clearly shows us that the pair is finally about to go up due to the rising pressure from the buyers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️Please, support our work with like & comment!❤️

GBPJPY INTRADAY support retest at 191.70The GBP/JPY pair is in an overall uptrend, though currently experiencing a short-term pullback.

• Key Support: 191.70 – A bounce from this level could push prices higher.

• Upside Targets: 194.00, 195.50, and 195.70 if the bullish trend continues.

• Bearish Scenario: A break below 191.70 could lead to further declines toward 190.90, 190.00, and 189.00.

Conclusion: The trend remains bullish unless GBP/JPY drops below 191.70, which would signal further downside risk.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

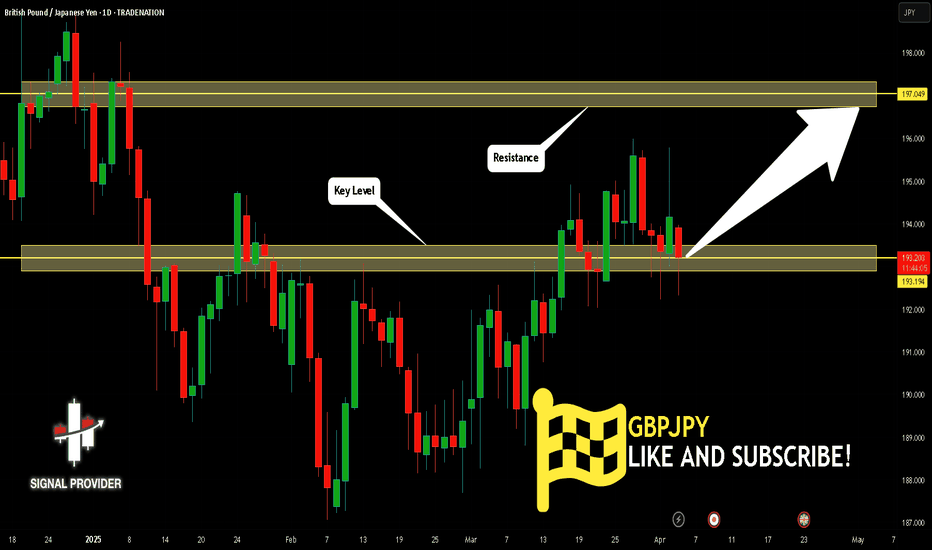

GBPJPY Will Grow! Long!

Here is our detailed technical review for GBPJPY.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 193.194.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 197.049 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

#GBPJPY: +250 Pips From Last Idea Expecting A Strong Bulls! The GBPJPY currency pair experienced a decline to the 190 area, which represents a discounted price range. Subsequently, the price reversed positively by approximately 250 pips. Our market analysis remains unchanged, and we anticipate that the price will continue to exert dominance.

It is possible that the price may experience a correction or a downward movement, as we anticipate the release of strong economic data this week. This data is likely to influence the future trajectory of the currency pair.

We encourage you to like and comment for further insights. Your support has been invaluable throughout our journey, and we sincerely hope that you achieve success in your own market endeavours.

Team Setupsfx_

❤️🚀

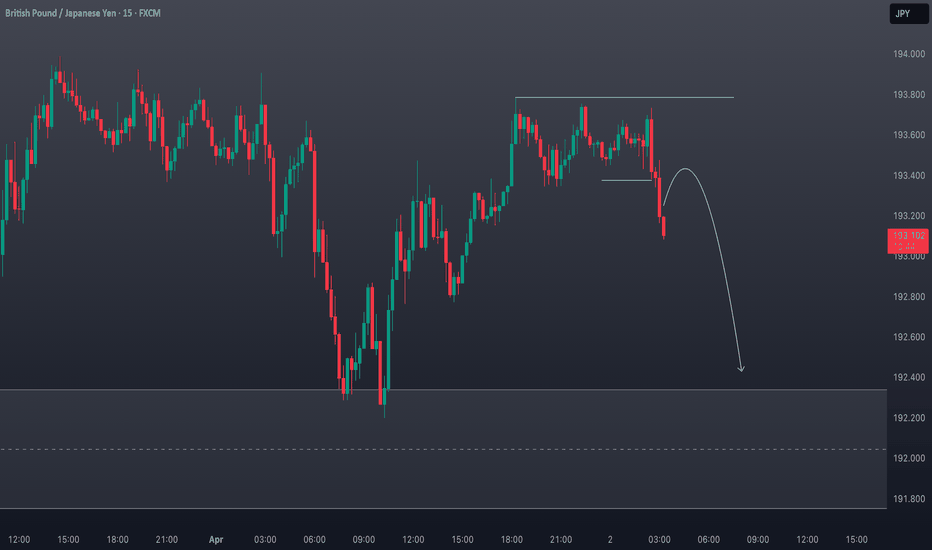

GBP/JPY Bearish Rejection – Short Trade Setup!🔹 Trendline Rejection ❌📈

Price tested the descending trendline and got rejected.

Bearish pressure increasing! 🚨

🔹 Resistance Zone (📍193.6 - 194.0) 🔵

Strong selling zone 📉

Stop Loss placed at 194.013 🚫

🔹 Support Zone (📍193.0) 🟦

Price might bounce here temporarily 🤔

If it breaks below, expect further drop 🚀📉

🔹 Target Level (📍192.311) 🎯

Bearish Target ✅

Ideal Take Profit 🏆

Trade Setup 💼

🔸 Entry: 📍193.5 - 193.6 📉

🔸 Stop Loss: ❌ 194.0 🚫

🔸 Take Profit: ✅ 192.3 🎯

Final Verdict: Sell Setup Active! 📉🔥

Watch for confirmation before entering! 👀🚀

GBPJPY Under Pressure: Potential Sell Opportunity.The GBPJPY pair has recently broken structure to the downside on the 4-hour timeframe, signaling bearish momentum. The pair is currently under significant selling pressure, with price action suggesting a potential continuation of the downtrend. Here's a deeper analysis of the situation:

Market Structure: The recent break of structure to the downside indicates that sellers are in control. The pair has failed to reclaim previous highs, reinforcing the bearish sentiment.

Key Levels:

Range High: The stop-loss level should be placed above the recent range high to manage risk effectively. This level acts as a key invalidation point for the bearish setup. 🚫

Range Low: The target is the previous range low, which aligns with a strong support zone. This level could act as a magnet for price, given the current bearish momentum. 🎯

Bearish Pressure: The pair is trading below key moving averages (e.g., 50 EMA and 200 EMA on the 4-hour chart), further confirming the bearish bias. Additionally, momentum indicators like RSI and MACD may show bearish divergence or oversold conditions, which could provide further confluence for the trade idea. 📊

Risk Management: As always, proper risk management is crucial. Ensure that the position size aligns with your trading plan, and avoid over-leveraging. 🔒

Fundamental Context: Keep an eye on any GBP or JPY-related news that could impact the pair, such as central bank decisions, economic data releases, or geopolitical developments. These factors could either accelerate or invalidate the current technical setup. 📰

Disclaimer ⚠️

This analysis is for educational and informational purposes only and does not constitute financial advice. Trading involves significant risk, and you should only trade with capital you can afford to lose. Always conduct your own research and consult with a financial professional before making any trading decisions. 📢